Bob Moriarty

Archives

Aug 23, 2023

I’ve written about Lion One (LIO-V) probably a dozen times over the last couple of years. They are the only junior in the world with 100% ownership of a major alkaline gold system. Their Tuvatu gold project is located in Fiji on the Pacific Ring of Fire with multiple 20 million ounces high-grade gold mines on the same structure.

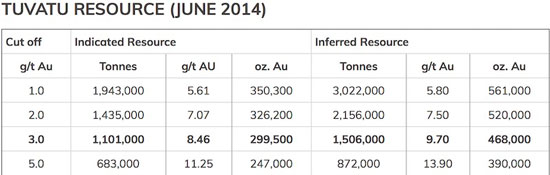

With a market cap of only about $171 million CAD the market seems to value the company for only their 2018 43-101 resource estimate of just over 720,000 ounces. But the company is about to be revalued in three different ways.

First of all, the resource does not reflect an accurate count of how much gold they have. The Tuvatu Gold project is similar in size to the Vatukoula Gold Mine in production since 1938 having shipped over seven million ounces of gold. Vatukoula is about 35 km from Tuvatu on the same structure. Vatukoula still reports about 3.8 million ounces in a resource.

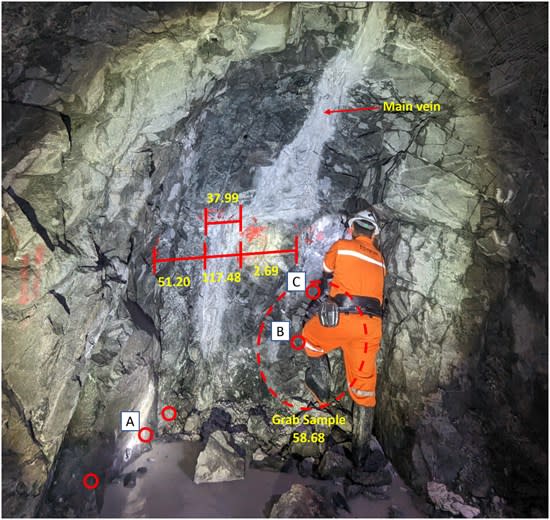

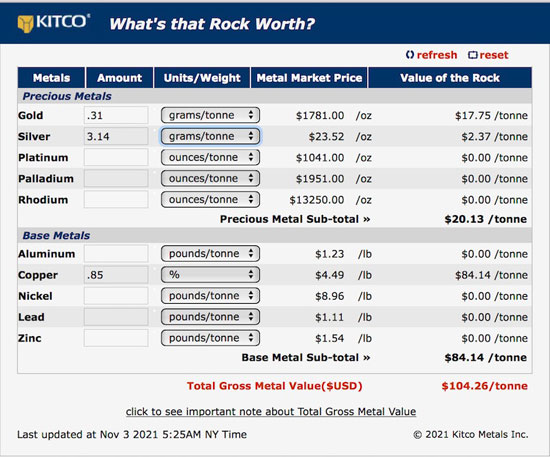

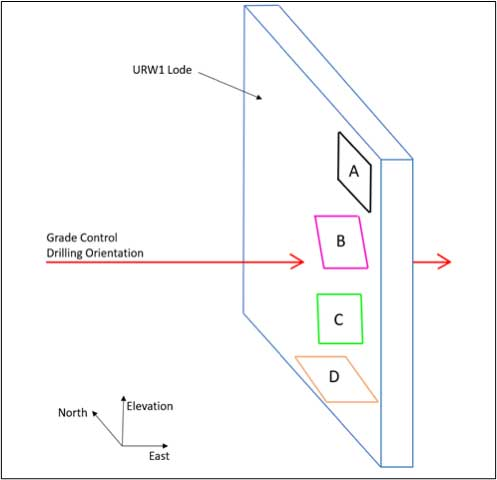

These alkaline gold systems have an unusual form of gold. There will be hundreds of tiny fractures in the rock where flash gold has appeared. The veins may only be a couple of centimeters but are ultra-high grade. Since they vary widely in orientation it is not possible to get a representative assay of the real grade because there is no angle that you can drill that catches all of the tiny veins. Actually in one of the latest press releases the company changed how they sample assays of greater than 10 g/t gold to more accurately reflect the real grade.

What I’m trying to say is that in spite of having spent tens of millions of dollars in drilling, the company still does not know what an accurate grade is for the gold. But the good side of that issue is that no matter how you drill and sample it, you are always showing a lower grade than actually exists. Which means regardless of what they say they have for grade, production will in almost all cases show higher values for gold. It’s a good problem to have.

Lion One reported actually starting to mine in a May press release. The company has been predicting actual milling and gold production in the 4th quarter. Chief Operating Officer Patrick Hickey has been struggling to make the 4th quarter goal. He is so far ahead of schedule that there may be some “TRIAL” gold processing in the 3rd quarter, i.e. in a month.

In that May 18th press release there was a vital visual drawing of why grade control is always inaccurate. No matter how you drill, you miss veins. Here is an image from the press release.

The official first gold pour is scheduled for Fiji Day on October 10th in conjunction with a bunch of officials from the government who are thrilled to see a 2nd gold mine getting into production in Fiji. I know of no other jurisdiction where a junior company was able to go from exploration to production with greater support from the host country.

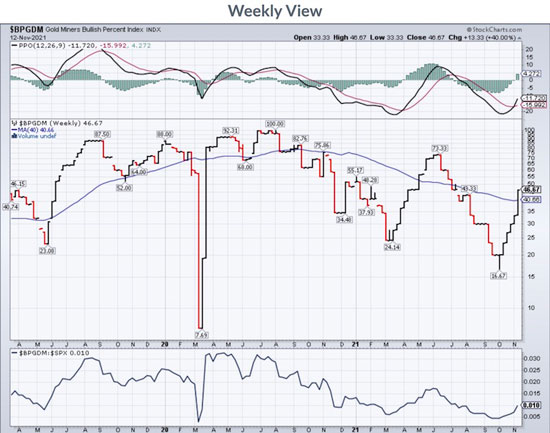

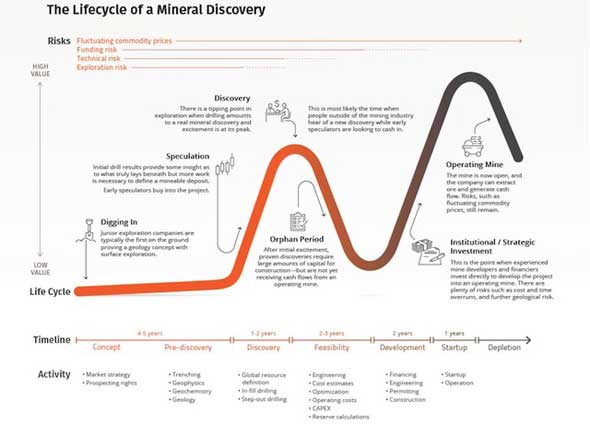

Lion One is on the sweet spot of valuation on the Lassonde Curve as the project begins production. That will give the stock a revaluation based on the risk has been removed from the stock.

The third part of the revaluation will be when gold and gold stocks start their next bull run. I see a general market crash between now and October. It could well take the metals and resource stocks with it. But when the dust settles, gold and gold stocks are going to be the only safe haven in town. The brilliant Bob Hoye is calling for October-November to be a good time to buy shares.

At startup the company is planning on production of 300 tonnes per day. The crushing circuit can do 1,000 TPD but for now the grinding circuit is limited to about 300 TPD. The company has already stockpiled over a two-month supply of material to mill. Plans are in progress to expand production to 500 TPD by September of 2024.

Guess estimates for grade are 6-7 g/t gold for the startup phase but COO Patrick Hickey has his fingers crossed and is hoping for 10 g/t gold. I think I have an understanding of the vein swarms and how they are always undercounted in assays. I’ll climb out on a limb and suggest that they will be doing 13-15 g/t gold a lot sooner than current investors understand.

I’ll make an important comment for investors to know here. I’ve been a small part of this story since Wally brought Quinton Hennigh on board in early 2019. Wally was making progress but it wasn’t visible. Quinton offered a lot of suggestions as to how and where to drill and what changes they needed to make in terms of personnel.

Quinton realized the company needed a professional team on site. He contacted two of the leading guys in mining, Patrick Hickey and Sergio Cattalani and convinced them to come on board. Prior to their entry management was being run out of Perth in Western Australia and frankly that just didn’t work. Investors should read the press release. I am triple impressed with both of them. I shared an hour-long update with Patrick last week. He has things totally under control. He’s the most impressive mine builder I have ever talked to.

Lion One is cashed up to production as a result of the last couple of private placements. Between standard warrants and broker warrants issued with prior placements, there are about 41 million outstanding warrants at prices between $0.77 and $1.49 dated for just over two years. As the warrants are exercised, it will bring in about $53 million. I don’t see cash being a problem for the company. There are about 15 million tradable warrants at $1.25 and I suspect they will add to the liquidity of the company since it allows investors to speculate on the price of the company with a degree of leverage. They expire in November of 2025.

I was in on a call with management of Lion One a week ago after I enquired as to the status of going into production. I was very impressed with the quality of the team and the direction the company is moving. I think the price will soon reflect the quality of management and high-grade of the ore. This should be one of the lowest cost producers in the industry. The government of Fiji is solidly supportive of the company and I see no problems on the horizon at any level.

Lion One has been my largest position for a couple of years now. The company is an advertiser and I couldn’t be more biased. Do your own due diligence.

Lion One Metals

LIO-V $.84 (Aug 22, 2023)

LOMLF OTCQX 206 million shares

Lion One website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd