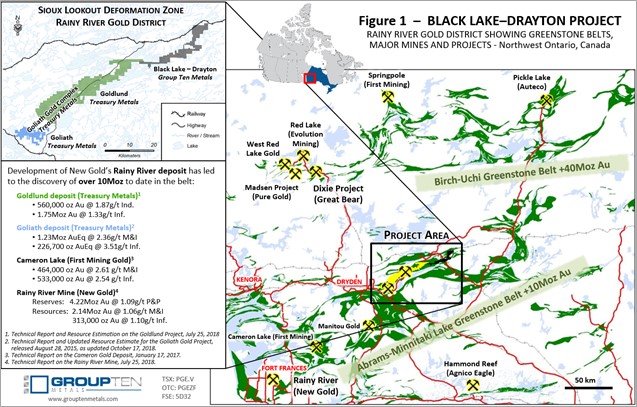

VANCOUVER, BC / ACCESSWIRE / January 19, 2023 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) ( “Granite Creek” or the “Company” ) is pleased to report positive results from its Preliminary Economic Assessment (“PEA”) for the Carmacks Copper-Gold-Silver project (the “Project” or “Carmacks Project”), located in the Yukon, Canada’s Minto Copper District within the traditional territories of Little Salmon/Carmacks First Nation and Selkirk First Nation.

The PEA demonstrates attractive project economics with significant opportunities for additional mine life expansion, reinforcing the potential of the Minto Copper District to become a top-tier global copper district.

Granite Creek Copper will be hosting a live webinar to review the PEA results on January 24th , 2023, at 9:00am PT | 12:00PM ET. To register, click here .

PEA Highlights

- Attractive project economics:

- Base case metal prices of US$3.75/lb Cu, US$1,800/oz Au and US$22/oz Ag:

Pre-tax NPV 5% of C$324 million and 36% IRR

After-tax NPV 5% of C$230 million and 29% IRR - Case 1 metal prices of US$4.25/lb Cu, US$2,000/oz Au and US$25/oz Ag:

Pre-tax NPV 5% of C$475 million and 48% IRR

After-tax NPV 5% of C$330 million and 38% IRR

- Base case metal prices of US$3.75/lb Cu, US$1,800/oz Au and US$22/oz Ag:

- Mine life of nine years at 7,000 tonnes per day with clear exploration potential to extend mine life with four target areas within 1km of the current resource.

- Capital cost of C$220m with payback of 2 years from commencement of production.

- Head grade of 1.10% copper equivalent (“CuEq”) consisting of 0.90% Cu, 0.30 g/t Au and 3.5 g/t Ag.

- Average cash operating costs of US$1.76/lb CuEq and all-in sustaining costs of US$2.57/lb CuEq.

- Option for tailings treatment: PEA study identifies additional potential cash flow through processing of oxide tailings to increase total copper recovery. Recovery sensitivity shows an additional $180M pre-tax NPV based of a 20% increase in recovery rates.

The Company envisions developing the Carmacks Project into a low-carbon source of copper. A critical mineral, as defined by the Canadian government, copper is key to the transition to a zero-carbon economy through the electrification of transportation and other industries, and the development of renewable energy production. The 2023 PEA clearly demonstrates the viability of the Carmacks Deposit as a robust open pit sulphide and oxide copper-gold-silver project with significant potential upside from both resource expansion and secondary processing of oxide material to further improve oxide recoveries. The Project is to be powered by the Yukon’s electrical grid which uses primarily renewable electricity.

“The completion of the PEA is a major accomplishment that doesn’t just advance the Project beyond previous studies but completely re-envisions Carmacks as a high-grade, open pit copper, gold and silver producer with excellent expansion potential in a tier one jurisdiction”, commented Timothy Johnson, President and CEO. “The inclusion of sulphide alongside oxide ore, either as a blend or a straight sulphide feed, has resulted in significant upside on the Project, with further opportunities recognized in both processing and exploration.”

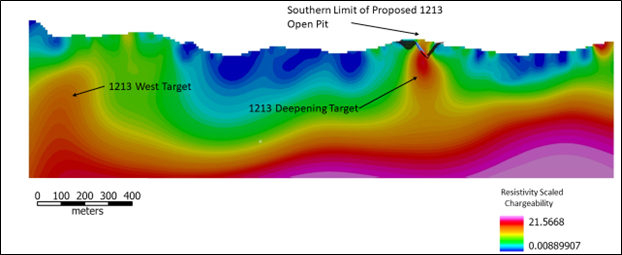

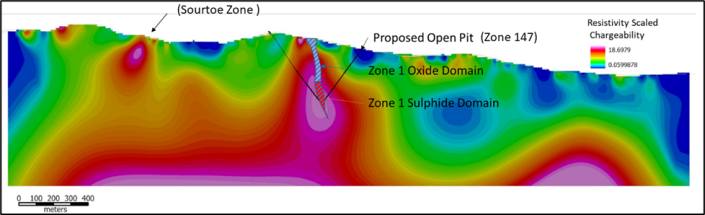

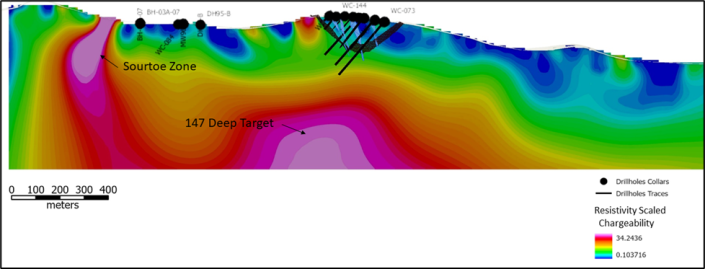

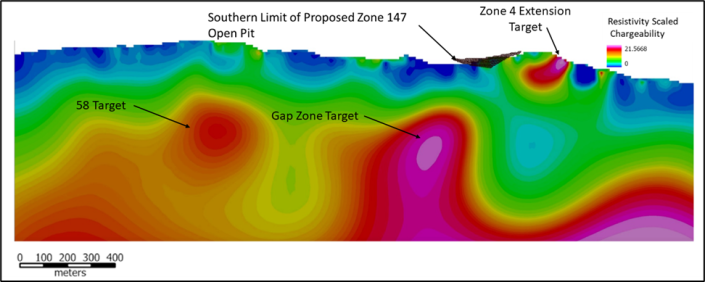

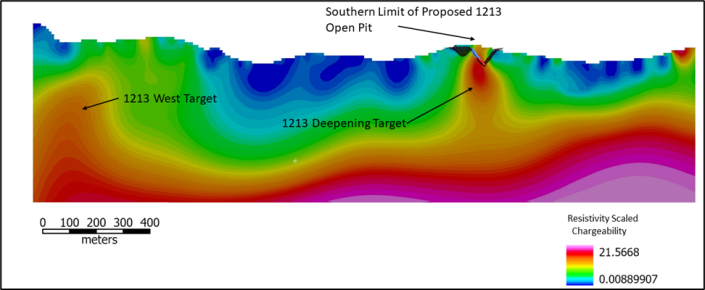

“Potential for near mine resource expansion is demonstrated in new volumetrically significant targets identified by comparison of the geophysical signatures of known mineralization with similar signatures of untested targets near the proposed pits “, continued Mr. Johnson. “These strong geophysical responses have a high correlation with copper sulphide minerals on the Project, giving us high confidence in these new targets, which are a priority for testing in upcoming drill campaigns.”

PEA Study Approach

The PEA contemplates open pit mining using a conventional truck and shovel operation in two separate pits. Mining targets the high-grade, near surface oxide material in the 147 pit, then transitions to target sulphide material in the 1213 pit followed by final mining of the deeper oxide and sulphide material in 147. Mined material would be delivered to a crushing and grinding circuit consisting of a primary crusher, SAG mill and ball mill. Both oxide copper ore and sulphide copper ore would be processed via a simplified flow sheet consisting of well-established flotation technology producing a high-quality copper-gold-silver concentrate. Oxide and sulphide ore would be blended and sequenced to provide optimal cash flow and to minimise the environmental footprint with mined-out pits or portions of pits being reclaimed as mining commences in the next area. Both conceptual pits lie within 2km of the proposed mill site.

Tailings from the flotation circuit would be filtered and water recirculated into the flotation circuit. This would improve water management and limit environmental impact, with final tailings placement on a lined dry stack tailings facility at site.

A high-grade, premium copper, gold and silver concentrate would be shipped via deep seaports in Skagway, Alaska or other nearby facilities. Treatment and refining charges terms are within standard market rates.

Average copper recovery during life of mine (“LOM’) is calculated to be 64% with approximately 2/3 of material processed being oxide ore and 1/3 being sulphide ore. Metallurgical studies returned 93% copper recovery when processing sulphide ore, 40% copper recovery while processing oxide ore and 82% when processing a 50:50 blend. Metallurgical work highlights the opportunity for further optimization of the Project through more detailed mine sequencing or discovery of near mine sulphide or that could be blended with ore from the 147 pit.

Table 1: PEA Key Parameters

| Parameter | Unit | Base Case 1 | Case 1 |

| Metal Prices | |||

| Copper Price | US$/pound | $3.75 | $4.25 |

| Gold Price | US$/troy ounce | $1,800.00 | $2,000 |

| Silver Price | US/troy ounce | $22.00 | $25 |

| Average Recovery to Cu Concentrate 2 | |||

| Copper Recovery | % | 64% | |

| Gold Recovery | % | 58% | |

| Silver Recovery | % | 60% | |

| Concentrate Grade | |||

| Copper | % | 40% | |

| Gold | g/t | 11.0 g/t | |

| Silver | g/t | 134.4 g/t | |

| Production Data | |||

| Resource Tonnes | 21,270,518 | ||

| Copper Equiv. Grade | 1.10% | ||

| Daily Mill Throughput | Tonnes / day | 7,000 t | 7,000 t |

| Annual Processing Rate | Kilo tonnes/ year | 2,495 kt | 2,495 kt |

| LOM Strip ratio | Waste: Ore | 4.6:1 | 4.6:1 |

| Mine Life | Years | 9 years | 9 years |

| Average annual production | |||

| Copper EQ production 6 | Million Pounds / year | 33.9 M | |

| Copper in concentrate | Million Pounds / year | 27 M | |

| Gold in copper concentrate | Troy ounces / year | 12 385 | |

| Silver in copper concentrate | Troy ounces / year | 151 584 | |

| Operating Costs (LOM avg) 2 | |||

| Mining | C$/t mined | $3.16 | |

| Milling | C$/t processed | $18.30 | |

| G&A | C$/t processed | $4.93 | |

| All in Sustaining Costs 4,5 | US$/lb CuEq | $2.57 | |

| Capital Costs | |||

| Initial Capital Cost | C$ | C$220M | |

| LOM Sustaining Capital Cost | C$ | C$130M | |

| Financial Analysis | |||

| Pre-Tax NPV 5% | C$ | C$324M | C$475M |

| Pre-Tax IRR | % | 36% | 48% |

| After Tax NPV 5% | C$ | C$228M | C$330M |

| After Tax IRR | % | 29% | 38% |

| Payback period 7 | Years | 2.0 | 1.5 |

- Base case metal prices based on 36-month trailing average from January 15, 2022.

- Recovery includes both oxide and sulphide ore and is based on mining 2/3 oxide and 1/3 sulphide LOM.

- Total operating costs include mining, processing, tailings, surface infrastructures, transport, and G&A costs.

- AISC includes cash operating costs, sustaining capital expenses to support the on-going operations, concentrate transport and treatment charges, royalties and closure and rehabilitation costs divided by copper equivalent pounds produced.

- AISC is a non-IFRS financial performance measures with no standardized definition under IFRS. Refer to note at end of this news release.

- The copper equivalent grade (CuEq) is determined by (total copper x US$3.75) + (total gold x US$1800) + (total silver x $22)/$3.75)/total resource tonnes.

- Payback period is from commencement of mining.

Capital Cost

The PEA for the Project outlines an initial (pre-production) capital cost estimate of C$220 million and LOM sustaining capital costs of C$130 million, including overall closure costs of C$5 million. Initial capital costs include the construction of milling and processing facilities, lined dry stack tailings and lined waste rock facilities, on-site infrastructure of 15km of access road and facilities for water capture and treatment. Construction of a powerline (12.8 km, 138 kV) from an existing substation is placed under sustaining capital to allow for construction time of the power grid.

Table 2: Capex Estimates 1

| Cost Element | Base Case |

| Mine Costs | C$25M |

| Processing | C$84M |

| Infrastructure | C$27.7M |

| Tailings | C$14.7M |

| EPCM and Indirect Costs | C$34.1M |

| Sub total Capex | C$185 M |

| Sustaining Capital | C$130.M |

| Contingency | C$35.0M |

| Reclamation and Closure | C$5.0M |

1 All values stated are undiscounted.

Operating Costs

Operating costs estimates were developed using first principles methodology, vendor quotes received in Q3 2022, and productivities being derived from benchmarking and industry best practices. Over the LOM, the average operating cost for the Project is estimated at C$3.16/t mined and C$18.30/t processed. Tailings costs are included in processing costs.

The average cash operating costs over the LOM is US$1.76/lb CuEq and the average AISC is US$2.57 /lb CuEq.

Economic Analysis and Sensitivities

The PEA indicates that the potential economic returns from the Project justify advancing to a feasibility study.

The Project generates cumulative cash flow of C$371.2 million on an after-tax basis and C$505.8 million pre-tax at a base case of $3.75/lb Cu based on an average mill throughput of 7,000 t/day over the 9-year life of mine.

Table 3: Summary of Economic Analysis 1,2

| Element | Base Case | Case 1 |

| Metal Price Assumptions (US$) Copper, Gold Silver | $3.75, $1800, $22 | $4.25, $2000, $25 |

| Exchange Rate | 0.75 | 0.75 |

| Average annual cash flow | C$61.8M | C$76.9M |

| Payback Period | 2.5 years | 1.5 years |

| EBITDA | C$505.8M | C$710M |

| LOM Undiscounted Net Cash Flow After Tax | C$371.2M | C$505M |

| NPV (5% discount) After Tax | C$230.5M | C$328M |

| IRR After Tax | 29% | 38% |

1 The analysis assumes that the Project is 100% equity financed (unlevered).

2 Appropriate deductions are applied to the concentrate produced, including treatment, refining, transport and insurance costs.

The PEA is significantly influenced by copper price assumptions. Using the Case 1 metal price scenario consists of near current prices of US$4.25/lb Cu, US$2000/oz Au and US$25/oz silver, the Project generates an after-tax Net Present Value (“NPV”) using an 5% discount rate of $328 million and an after-tax IRR of 38% with a payback period of 1.5 years from the commencement of production. (Table 3), Outlined below in Table 4 is a detailed sensitivity analysis across gold and copper prices with silver kept at $22/ounce. Table 5 below highlights additional sensitivities to foreign exchange, recovery, CAPEX and OPEX.

Table 4: Copper and Gold Metal Price Sensitivity Analysis NPV- Pre-Tax values in Million CDN$

| Copper Price per pound US$ | |||||||||

| Gold price per ounce US$ 1 | 3.25 | 3.50 | 3.75 Base Case | 4.00 | 4.25 Case 1 | 4.50 | $4.75 | $5.00 | $5.25 |

| 1500 | $165.7 | $227.6 | $289.4 | $351.3 | $413.1 | $474.9 | $536.8 | $598.6 | $660.5 |

| 1600 | $177.3 | $239.1 | $301.0 | $362.8 | $424.7 | $486.5 | $548.3 | $610.2 | $672.0 |

| 1700 | $188.9 | $250.7 | $312.5 | $374.4 | $436.2 | $498.0 | $559.9 | $621.7 | $683.6 |

| 1800 Base | $200.4 | $262.2 | $324.1 | $385.9 | $447.8 | $509.6 | $571.4 | $633.3 | $695.1 |

| 1900 | $212.0 | $273.8 | $335.6 | $397.5 | $459.3 | $521.1 | $583.0 | $644.8 | $706.7 |

| 2000 Case 1 | $223.5 | $285.3 | $347.2 | $409.0 | $470.9 | $532.7 | $594.5 | $656.4 | $718.2 |

| 2100 | $235.1 | $296.9 | $358.7 | $420.6 | $482.4 | $544.3 | $606.1 | $667.9 | $729.8 |

| 2200 | $246.6 | $308.4 | $370.3 | $432.1 | $494.0 | $555.8 | $617.6 | $679.5 | $741.3 |

Table 5: Multiple variable sensitivity analysis (all values $CDN)

| Variable | Pre-Tax NPV 5% | After – Tax NPV 5% | ||||

| -20 % | Base | +20% | -20 % | Base | +20% | |

| Copper Price | $138.6M | $324.1M | $509.6M | $88.3M | $230.5M | $361.0M |

| FX Rate | $129.7M | $324.1M | $615.6M | $118.6M | $230.5M | $381.8M |

| Recovery | $138.6M | $324.1M | $509.6M | $88.3M | $230.5M | $361.0M |

| CAPEX | $381.9M | $324.1M | $266.2M | $243.5M | $230.5M | $215.6M |

| OPEX | $452.2M | $324.1M | $196.0M | $318.9M | $230.5M | $131.2M |

Opportunities

- The third conceptual pit, 2000S as identified in the Mineral Resource Estimate (“MRE), could be brought into the mine plan if sufficient additional resources were defined by drilling to offset pre-stripping costs.

- Electrification of the mining fleet. Significant cost saving and reduction in greenhouse gas production may be possible through the sourcing of electric vs. diesel haul trucks for the Project. The PEA envisions using a contract mining fleet for the Project and preference will be given to suppliers that can provide either fully electric or hybrid equipment.

- Further discovery. Exploration conducted in 2022 consisting of geophysics, trenching and soil sampling identified four areas proximal to the proposed mine plan that if successfully drilled could enable longer mine life beyond nine years or provide additional sulphide mill feed earlier in the mine’s life. Four targets on the Property require evaluation, all located within 1km of the current deposits. Two of the targets are located beneath the current resource and there is higher geological certainty that these may contain appreciable copper mineralization.

- Zone 1213 shallow:

Downward continuation of Zone 12 and 13. Estimated dimensions are 360m long, 15 – 40m wide, starting at approximately 65m below the current drilling. - Zone 12 deep:

Downward continuation of Zone 12. Estimated from geophysics to be continuing for an additional 170m below current resource modelling. Approximated to be 580m long and 15-40m wide. - Gap Zone target:

Geophysical anomaly that fits with current geological understanding of the fault offset between 147 and 2000S Zone. Estimated to be 500m long, up to 400m deep, and 30-50m wide. - Sourtoe target:

Estimated from geophysics to be a lensoidal body of similar size to known deposits at 370m long x 370m deep with an estimated width of 15-50m. It has been lightly tested at surface by trenching and is weakly mineralized.

- Zone 1213 shallow:

- In addition, the Carmacks North target area is host to several mineralized zones that have the potential to add resources to the mine plan, all within 15 km of the proposed mill site.

- Additional recovery through metallurgical improvements. The Company has retained Kemetco Laboratories to complete additional leaching and copper precipitating testing to evaluate the processing of tailings. The calculated grade of copper in tailings averages 0.32% with over 140 Mlbs of copper not recovered LOM. Recovery sensitivity show an additional $180M pretax NPV based of a 20% increase in recovery rates. Review of historical metallurgical testing has indicated that copper minerals present in oxidized material respond well to leaching. Once the copper is in solution the copper would be chemically precipitated to produce sulphide minerals that can be added back into the flotation cells.

Mineral Resources

The basis for the PEA uses an updated mineral resource estimate (“MRE”) for the Carmacks deposit (effective date March 30, 2022). The mine plan contemplates processing 62% of resources outlined in the MRE. The MRE includes inferred resources that are too speculative to have economic parameters applied to them. Resources are not reserves and there is no certainty that the resources outlined on the Project can be converted to reserves.

Table 6: Mineral Resource Estimates

| CATEGORY | Cut -Off Cu (%) | Quantity (Mt) | Grade | ||||

| Cu† | Au | Ag | Mo | CuEq | |||

| Total (%) | (g/t) | (g/t) | (%) | Total (%) | |||

| In Pit Oxide | |||||||

| Measured | 0.30 | 11.361 | 0.96 | 0.40 | 4.11 | 0.006 | 1.30 |

| Indicated | 0.30 | 4.330 | 0.91 | 0.28 | 3.37 | 0.007 | 1.16 |

| Measured &Indicated | 0.30 | 15.691 | 0.94 | 0.36 | 3.91 | 0.006 | 1.26 |

| Inferred | 0.30 | 0.216 | 0.52 | 0.09 | 2.44 | 0.006 | 0.63 |

| In Pit Sulphide | |||||||

| Measured | 0.30 | 5.705 | 0.68 | 0.16 | 2.54 | 0.016 | 0.88 |

| Indicated | 0.30 | 13.486 | 0.72 | 0.19 | 2.83 | 0.013 | 0.93 |

| Measured &Indicated | 0.30 | 19.191 | 0.71 | 0.18 | 2.74 | 0.014 | 0.92 |

| Inferred | 0.30 | 1.675 | 0.51 | 0.13 | 2.24 | 0.020 | 0.70 |

| Below Pit Sulphide | |||||||

| Measured | 0.60 | 0.026 | 0.71 | 0.16 | 2.54 | 0.010 | 0.88 |

| Indicated | 0.60 | 1.341 | 0.82 | 0.19 | 2.88 | 0.012 | 1.03 |

| Measured &Indicated | 0.60 | 1.367 | 0.82 | 0.19 | 2.88 | 0.012 | 1.03 |

| Inferred | 0.60 | 0.967 | 0.77 | 0.17 | 2.48 | 0.012 | 0.96 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- The effective date of the Mineral Resources is March 30, 2022.

- Mineral Resources are estimated using an exchange rate of US$0.75/C$1.00.

- Mineral Resources are estimated using a long-term gold price of US$1,800/oz Au with a metallurgical gold recovery of 60%, and a long-term copper price of US$3.75/lb with a metallurgical copper recovery of 95% for sulphide material and 60% for oxide material.

- Mineral Resources are estimated at a cut-off grade of 0.30 copper equivalent.

- Bulk density of 2.83 t/m 3 was used for tonnage calculations.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Numbers may not add up due to rounding.

Mining

The overall mining operation is expected to consist of two open pits completed over three phases. Phase I contemplates development of the 147 zone with low strip ratio. Phase 2 contemplates the mining of 1213 zone with a slightly higher strip ratio. Phase 3 contemplates pushback on the 147 pit to a final LOM strip ratio of 4.6:1, resulting in a total of 9 years of operation, plus one year of pre-stripping. Following this mining period, a low-grade stockpile of 2Mt grading 0.18% Cu, 0.06 g/t Au and 0.8 g/t Ag may be reprocessed once mining operations cease. All waste and tailings will be disposed near the mining infrastructure.

The contract mining operation is planned to be a conventional truck and shovel open pit operation, moving approximately 118Mt of material over the 9-year life of mine. This would provide the floatation processing plant with 21.3Mt of ore at a rate of 7 000 tonnes per day.

Metallurgy and Processing

The processing facilities and saleable mineral products are fundamentally different from the beneficiation procedures that were contemplated in the 2006 Feasibility Study and updated in the 2017 PEA. The processing facilities currently being recommended for the Project would include a simplified flotation circuit, capable of processing three individual types of feed materials, oxide, sulphide, and blended ores, each of which would produce a high grade, premium concentrate.

Metallurgical testing both by Bureau Veritas in 2021 and by SGS Vancouver in preparation for the PEA study support the simplified flotation circuit. Flotation testing of individual oxide copper ores, sulphide copper ores as well as blended ores has been completed in this initial phase of the process investigation.

A test program including mineralogy and flotation was completed on samples from the Carmacks Project. The flotation test program included test work on sulphide, oxide, and blend ores.

- The sulphide ore assayed 0.92% Cu, 0.67% S, and 0.24 g/t Au. Gold and copper head grades calculated from the flotation test assays agreed well with the direct head assays.

- The oxide ore assayed, 0.60% Cu, 0.06% S, and 0.25-0.82 g/t Au, indicating that nugget gold may exist. However, the gold head grade calculated from the flotation tests was consistently between 0.20 g/t to 0.23 g/t with an average of 0.21 g/t.

- Sulphide flotation recovered 93.7% of copper and 69.0% of gold at 42.7 % Cu and 7.7 g/t Au grade (Sulphide F4) while oxide flotation recovered 39.8% of copper and 57.5% of gold at 26.2% Cu and 13.6 g/t Au grade.

- A 50/50 oxide/sulphide blend batch flotation program recovered 75.3% of copper and 65.7% of gold at 40.8 % Cu and 12.4 g/t Au grade (Blend F4).

- Locked cycle flotation on blend sample recovered 82.0% of copper and 70.1% of gold at 40.1% Cu and 10.6 g/t Au grade (Blend LCT1).

- Flotation optimization and an economical evaluation of the target copper grade versus recovery is recommended in future test work.

As mentioned above, the Company has commissioned additional test work to evaluate the potential for further recovery of copper from tailings when material in the mill contains a significant percentage of oxide material. Review of historical metallurgical testing has indicated that copper minerals present in oxidised material respond well to leaching. Once the copper is in solution the copper will be chemically precipitated to produce sulphide minerals that can be added back into the flotation cells.

Infrastructure

The Project lies along the Freegold Road, a Yukon government-maintained gravel road, currently being upgraded as part of the Yukon Resource Gateway Program. The road would ultimately lead to the near by Casino Project and other significant development projects in the area. A 12.8 km transmission line would be constructed to access the 138 kV Carmacks-Stewart transmission at McGregor Creek. Future studies will look at alternate routes for powerlines that could also benefit projects near the proposed Carmacks Project.

Next Steps

Additional Metallurgical work. In addition to the metallurgical work underway to assess further recovery from tailings work will be completed to optimise recoveries of both copper and precious metal. Additional studies will also be completed to identify any metallurgical variability between the two proposed mining areas to assist in further mine plan optimization through sequencing and blending of ore.

Exploration Drilling. Significant resource expansion potential exists within 1 km of the proposed pits. In addition to the new zones identified by 2022 geophysical and geochemical surveys, and trenching, many areas of both the 2000S and 12-13 zones remain open for expansion.

Geotechnical drilling on 1213 pit. In order to advance the Project towards feasibility geotechnical drilling will need to be completed on the proposed 1213 pit. Significant geotechnical drilling in the 147 area dating back to 2006 when a full feasibility study was completed on that portion of the Project will also be reviewed.

Baseline environmental studies. In preparation for advancing the Project towards feasibility existing environmental studies including ongoing water sampling programs will be reviewed and updated.

Continued community engagement. The Company is dedicated to working with communities effected by the Project including Little Salmon Carmacks First Nation and Selkirk First Nation to ensure that the Project advances in a respectful way with maximum benefit to the effected communities.

Technical Report and Qualified Persons

The PEA was prepared by SGS Geological Services. (“SGS”). with several individuals and departments within SGS contributing to sections of the study. William Van Breugel P.Eng., is the lead consultant for this study. SGS Geological Services is known globally as the expert in ore body modelling and resource/reserve evaluation with over 40 years and 1000 consulting projects of experience providing the mining industry with computer-assisted mineral resource estimation services using cutting edge geostatistical techniques. SGS bring the disciplines of geology, geostatistics, and mining engineering together to provide accurate and timely mineral project evaluation solutions.

As part of the larger SGS Natural Resources group, they draw upon their massive network of laboratories, metallurgists, process engineers and other professionals to help bring mineral projects to the next level.

Table 7: Qualified Person

| Department | Area of Responsibility | Qualified Person |

| SGS | Mine Design | Johnny Canosa, P.Eng and William Van Breugel, P.Eng |

| Mine Infrastructure | Johnny Canosa, P.Eng | |

| SGS Tucson | Metallurgy. Processing and process plant operating costs | Joseph Keane PE |

| SGS Tucson | Process plant and infrastructure capital costs | Joseph Keane PE |

| Financial analysis | William Van Breugel, P.Eng |

Note: The Qualified Persons are independent as defined by Canadian Securities Administrators National Instrument 43-101 (“NI 43-101”) “Standards of Disclosure for Mineral Projects”. The Qualified Persons are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the PEA.

The Company cautions that the results of the PEA are preliminary in nature and do not include the calculation of mineral reserves as defined by NI 43-101. There is no certainty that the results of the PEA will be realized.

A NI 43-101 technical report supporting the PEA will be filed on SEDAR within 45 days of this news release and will be available at that time on the Company’s website. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

A presentation summarizing the Project’s PEA results is available on the Company’s website.

Qualified Persons

All scientific and technical data contained in this presentation relating to the PEA has been reviewed and approved by William Van Breugel P.Eng., a Qualified Person for the purposes of NI 43-101. All exploration data including exploration upside potential has been reviewed and approved by Debbie James P.Geo., for the purposes of NI 43-101 The Qualified Persons mentioned above have reviewed and approved their respective technical information contained in this news release.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176-square-kilometer Carmacks Project in the Minto Copper District of Canada’s Yukon Territory. The Project is on trend with the high-grade Minto copper-gold mine, operated by Minto Metals Corp., to the north, and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com .

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Twitter: @yukoncopper

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, potential economic estimates, capital costs, operating costs, potential cash flows, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.