Vancouver, British Columbia–(Newsfile Corp. – March 14, 2022) – Provenance Gold Corp. (CSE: PAU) (OTCQB: PVGDF) (the “Company” or “Provenance“) is pleased to announce that it has acquired a large volume of historic data on the Eldorado property that it is digitizing. As a result, the Company has a full historic drill hole data base which it has used to generate cross sections, long sections and horizontal plan sections using the property’s historic 242 drill holes. The Company is very pleased by the information gained from these studies.

Based on the current evaluation work, Provenance has determined that the gold mineralization is locally high-grade within a large volume of lower grade values and is open in all directions and vertically. Additionally, within the larger expanse of the project, numerous undrilled areas could expand the mineralization considerably. Provenance’s review of the cross sections shows that much of the historic drilling was shallow, and stopped above, and even within the mineralization. The following figure shows the distribution of the Eldorado drill holes and the location of the following cross section.

Figure 1. Eldorado Project drill holes and cross section location

Full resolution: https://www.provenancegold.com/images/gallery/PAU_News_130.jpg

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5654/116625_5c9c4d5304d1e9fc_001full.jpg

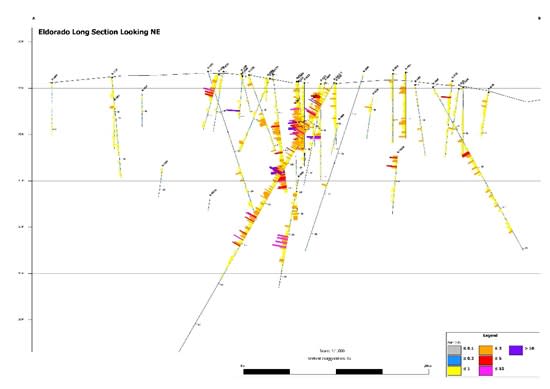

The following drill hole cross section is a northwest trending, 60-meter wideband, which shows all drill holes along this cross section. Note that gold mineralization is at least 200 meters deep along this cross section. A number of high-grade gold samples are found in many of the holes displayed.

Figure 2. Drill hole cross section showing assays and depths of holes

Full resolution: https://www.provenancegold.com/images/gallery/PAU_News_132.jpg

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5654/116625_5c9c4d5304d1e9fc_002full.jpg

The following assay summary table is a 7-hole selection of some of the holes along the cross section. Data is presented in both meters / grams and feet / ounces. The cutoff grade selected was 0.1 g/t and 0.1 ppm. Some selected highlights include R-136 with 134.1 meters of 2.09 g Au, R-001 with 71.6 meters of 0.86 g Au, R96-C1 with sequential intervals of 91.44 meters of 1.4 g Au and 151 meters of 1.2 g Au. Some of the highest grades found in the data include 40.4 g Au in R-90 and 44.19 g Au in R-136 (see table). Note the thicknesses and the longer intervals are centered by much higher grades than the average.

| Hole # | Meters | Meters | Meters | GOLD | Feet | Feet | Feet | GOLD |

| Depth | From/To | Thickness | gm/t | Depth | From/To | Thickness | opt | |

| R-001 | 71.6 | 0-71.6 | 71.6 | 0.86 | 235 | 0-235 | 235 | 0.025 |

| (N, -90) | ||||||||

| R-021 | 103.6 | 0-27.4 | 27.4 | 1.32 | 340 | 0-90 | 90 | 0.038 |

| (N, -90) | 9.1–21.3 | 12.2 | 2.45 | including | 30-70 | 40 | 0.072 | |

| 39.2-65.5 | 25.9 | 1.49 | 130-215 | 85 | 0.043 | |||

| 53.3-59.4 | 6.1 | 5.02 | including | 175-195 | 20 | 0.147 | ||

| 68.6-103.6 | 35 | 0.179 | 225-340 | 115 | 0.005 | |||

| R-31 | 85.3 | 0-85.3 | 85.3 | 1.13 | 280 | 0-280 | 280 | 0.033 |

| (S37W, -60) | 35-85.3 | 50.3 | 1.65 | including | 115-275 | 160 | 0.048 | |

| R-90 | 67.1 | 0-67 | 67 | 3.23 | 220 | 0-220 | 220 | 0.094 |

| (S37W, -60) | 32-67 | 35 | 5.56 | including | 105-220 | 95 | 0.16 | |

| 48.8-65.5 | 16.7 | 9.63 | including | 160-215 | 55 | 0.28 | ||

| 50.3-51.8 | 1.0 | 40.04 | including | 165-170 | 5 | 1.17 | ||

| R-136 | 157 | 0-12.2 | 12.2 | 0.18 | 515 | 0-40 | 40 | 0.005 |

| (W, -55) | 22.9-157 | 134.1 | 2.09 | 75-515 | 440 | 0.061 | ||

| 62.5-91.4 | 28.9 | 1.67 | including | 205-300 | 95 | 0.049 | ||

| 100.6-157 | 56.4 | 3.8 | including | 330-515 | 185 | 0.111 | ||

| 118.9-150.9 | 32 | 5.95 | including | 390-495 | 105 | 0.174 | ||

| 120.4-129.5 | 9.1 | 13.25 | including | 395-425 | 30 | 0.386 | ||

| 128-129.5 | 1.5 | 44.19 | including | 420-425 | 5 | 1.29 | ||

| R-153 | 120.4 | 3-111.2 | 108.2 | 1.0 | 395 | 10-365 | 355 | 0.029 |

| (N51E, -45) | 42.7-97.5 | 54.8 | 1.61 | including | 140-320 | 180 | 0.047 | |

| R-96-C-1 | 369.4 | 7.31-91.44 | 91.44 | 1.408 | 1212 | 24-324 | 300 | 0.041 |

| (N45W, -60) | 26.2-34.1 | 7.9 | 2.3 | including | 86-112 | 26 | 0.067 | |

| Core | 37.8-45.1 | 7.3 | 3.06 | including | 124-128 | 24 | 0.089 | |

| 51.8-83.5 | 31.7 | 1.68 | including | 170-274 | 104 | 0.049 | ||

| 91.4-250.5 | 151.8 | 1.206 | 324-822 | 498 | 0.035 | |||

| 100.6-118 | 17.4 | 3.09 | including | 330-387 | 57 | 0.09 | ||

| 112.5-114.3 | 1.8 | 14.61 | including | 369-375 | 6 | 0.426 | ||

| 136.2-145.4 | 9.2 | 1.702 | including | 447-477 | 30 | 0.05 | ||

| 158.2-176.5 | 18.3 | 2.08 | including | 519-579 | 60 | 0.061 |

Figure 3. Selected drill hole assays of some holes in the cross section

Full resolution: https://www.provenancegold.com/images/gallery/PAU_News_131.jpg

The Eldorado gold mineralization is on BLM land that Provenance controls, but unlike Nevada, Oregon exploration drilling must be permitted by both the BLM and DOGAMI, Oregon’s department of geology. The Company expects to obtain both permits to begin confirmation drilling within the next several months.

The staged work program includes completing compilations from the various historic studies, drilling 20 confirmation holes over a wide area of the property, and planning and permitting a second larger round of drilling into obvious targets and new areas.

As Steven Craig, project manager said, “Holes like R-90 with 67 meters of plus three grams starting at surface are rare. I look forward to starting the confirmation drilling.”

Steven Craig, P. Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical contents of this News Release.

About Provenance Gold Corp.

Provenance Gold Corp. is a precious metals exploration company with a focus on gold and silver mineralization within North America. The Company currently holds interests in four properties, three in Nevada, and one in eastern Oregon, USA. For further information please visit the Company’s website at https://provenancegold.com or contact Rob Clark at rclark@provenancegold.com.

On behalf of the Board,

Provenance Gold Corp.

Rauno Perttu, Chief Executive Officer

Neither the Canadian Securities Exchange, nor its regulation services provider, accepts responsibility for the adequacy or accuracy of this press release. This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/116625