Bob Moriarty is the Man!!!

(Must Read) – Check out all of his books: http://www.321gold.com/ebooks2016/index.html

Source: http://www.321gold.com/

Bob Moriarty is the Man!!!

(Must Read) – Check out all of his books: http://www.321gold.com/ebooks2016/index.html

Source: http://www.321gold.com/

In this interview we sit down with Shawn Khunkhun the CEO of Dolly Varden Silver (TSX.V: DV | OTCQX: DOLLF) to discuss the disconnect with Silver and Silver Equities, the latest news regarding more high-grade Silver results from the Homestake Silver Deposit, and the recent consolidation with addition of the Big Bulk Copper-Gold Porphyry Project.

Longtime readers of 321Gold know I am a giant fan of the Daily Sentiment Indicator put out by Jake Bernstein. The DSI is sending out important signals such as bonds, the dollar, gold, silver, the Euro, the Swiss Franc, British Pound, Yen and the Aussie Dollar. Basically when readings go below 10 you are near a major bottom. When they go above 90 you are near a major top.

As of September 27th close of trading the DSI for treasuries is 10, 93 for the dollar, 8 for gold, 8 for silver, 5 for the Swiss Franc, 7 for the Euro, 10 for the Yen, 9 for the Aussie dollar and 12 for the British pound. To show that it really doesn’t matter what commodity the DSI tracks, the turns it projects says that even boring Orange Juice at 93 is about to tumble.

So in short, the dollar is getting close to a top, gold, silver, bonds and most currencies are near a bottom and about to turn higher. When these moves take place, it will happen all at the same time. Including OJ taking a swan dive.

These numbers are not as extreme as they have been in the past and don’t suggest a turn will happen tomorrow but it will happen soon. That could be as much as a month from now.

There are two kinds of investment information, signal and noise. For some reason many gold bugs are fixated on manipulation and price suppression as being important. I cannot agree. All financial markets are manipulated by everyone involved all of the time. So a sincere belief in manipulation of gold and silver provides no information that would lead to a profitable trade. In other words, if everything is manipulated, and that is true, who cares? You can’t profit. It generates neither a buy signal nor a sell signal. It’s noise, not signal. The DSI on the other hand is the most valuable and consistent signal I know of. In simple terms, you can take it to the bank.

The markets I have identified above are going to reverse direction in the next month. You can write that down on a piece of paper and take it to your local bank and cash it.

For those who are not subscribers to the DSI it seems expensive. Because it is. It is aimed at serious commodity traders who can make all of the cost up in one trade. But if you contact Jake and whine that you can’t afford it, he might give you a break. That’s what I did.

###

Bob Moriarty

President: 321gold

Archives

Bob Moriarty

Archives

Aug 23, 2023

I’ve written about Lion One (LIO-V) probably a dozen times over the last couple of years. They are the only junior in the world with 100% ownership of a major alkaline gold system. Their Tuvatu gold project is located in Fiji on the Pacific Ring of Fire with multiple 20 million ounces high-grade gold mines on the same structure.

With a market cap of only about $171 million CAD the market seems to value the company for only their 2018 43-101 resource estimate of just over 720,000 ounces. But the company is about to be revalued in three different ways.

First of all, the resource does not reflect an accurate count of how much gold they have. The Tuvatu Gold project is similar in size to the Vatukoula Gold Mine in production since 1938 having shipped over seven million ounces of gold. Vatukoula is about 35 km from Tuvatu on the same structure. Vatukoula still reports about 3.8 million ounces in a resource.

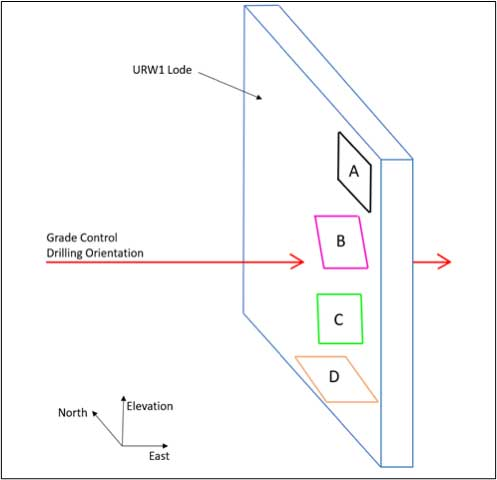

These alkaline gold systems have an unusual form of gold. There will be hundreds of tiny fractures in the rock where flash gold has appeared. The veins may only be a couple of centimeters but are ultra-high grade. Since they vary widely in orientation it is not possible to get a representative assay of the real grade because there is no angle that you can drill that catches all of the tiny veins. Actually in one of the latest press releases the company changed how they sample assays of greater than 10 g/t gold to more accurately reflect the real grade.

What I’m trying to say is that in spite of having spent tens of millions of dollars in drilling, the company still does not know what an accurate grade is for the gold. But the good side of that issue is that no matter how you drill and sample it, you are always showing a lower grade than actually exists. Which means regardless of what they say they have for grade, production will in almost all cases show higher values for gold. It’s a good problem to have.

Lion One reported actually starting to mine in a May press release. The company has been predicting actual milling and gold production in the 4th quarter. Chief Operating Officer Patrick Hickey has been struggling to make the 4th quarter goal. He is so far ahead of schedule that there may be some “TRIAL” gold processing in the 3rd quarter, i.e. in a month.

In that May 18th press release there was a vital visual drawing of why grade control is always inaccurate. No matter how you drill, you miss veins. Here is an image from the press release.

The official first gold pour is scheduled for Fiji Day on October 10th in conjunction with a bunch of officials from the government who are thrilled to see a 2nd gold mine getting into production in Fiji. I know of no other jurisdiction where a junior company was able to go from exploration to production with greater support from the host country.

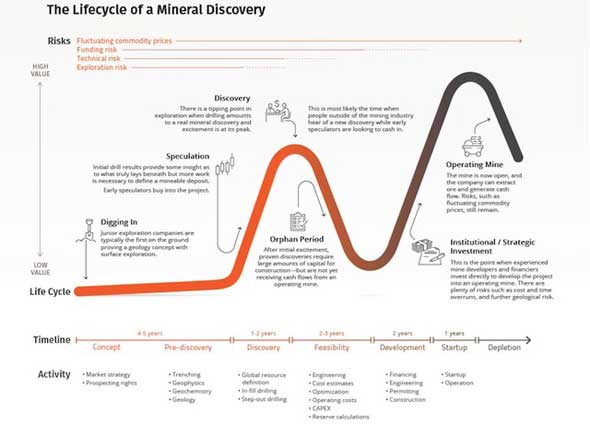

Lion One is on the sweet spot of valuation on the Lassonde Curve as the project begins production. That will give the stock a revaluation based on the risk has been removed from the stock.

The third part of the revaluation will be when gold and gold stocks start their next bull run. I see a general market crash between now and October. It could well take the metals and resource stocks with it. But when the dust settles, gold and gold stocks are going to be the only safe haven in town. The brilliant Bob Hoye is calling for October-November to be a good time to buy shares.

At startup the company is planning on production of 300 tonnes per day. The crushing circuit can do 1,000 TPD but for now the grinding circuit is limited to about 300 TPD. The company has already stockpiled over a two-month supply of material to mill. Plans are in progress to expand production to 500 TPD by September of 2024.

Guess estimates for grade are 6-7 g/t gold for the startup phase but COO Patrick Hickey has his fingers crossed and is hoping for 10 g/t gold. I think I have an understanding of the vein swarms and how they are always undercounted in assays. I’ll climb out on a limb and suggest that they will be doing 13-15 g/t gold a lot sooner than current investors understand.

I’ll make an important comment for investors to know here. I’ve been a small part of this story since Wally brought Quinton Hennigh on board in early 2019. Wally was making progress but it wasn’t visible. Quinton offered a lot of suggestions as to how and where to drill and what changes they needed to make in terms of personnel.

Quinton realized the company needed a professional team on site. He contacted two of the leading guys in mining, Patrick Hickey and Sergio Cattalani and convinced them to come on board. Prior to their entry management was being run out of Perth in Western Australia and frankly that just didn’t work. Investors should read the press release. I am triple impressed with both of them. I shared an hour-long update with Patrick last week. He has things totally under control. He’s the most impressive mine builder I have ever talked to.

Lion One is cashed up to production as a result of the last couple of private placements. Between standard warrants and broker warrants issued with prior placements, there are about 41 million outstanding warrants at prices between $0.77 and $1.49 dated for just over two years. As the warrants are exercised, it will bring in about $53 million. I don’t see cash being a problem for the company. There are about 15 million tradable warrants at $1.25 and I suspect they will add to the liquidity of the company since it allows investors to speculate on the price of the company with a degree of leverage. They expire in November of 2025.

I was in on a call with management of Lion One a week ago after I enquired as to the status of going into production. I was very impressed with the quality of the team and the direction the company is moving. I think the price will soon reflect the quality of management and high-grade of the ore. This should be one of the lowest cost producers in the industry. The government of Fiji is solidly supportive of the company and I see no problems on the horizon at any level.

Lion One has been my largest position for a couple of years now. The company is an advertiser and I couldn’t be more biased. Do your own due diligence.

Lion One Metals

LIO-V $.84 (Aug 22, 2023)

LOMLF OTCQX 206 million shares

Lion One website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd

Order Your Hardcover Here:

I’m a licensed broker for Miles Franklin Precious Metals Investments, The Only Online Dealer that is Licensed and Bonded Period! Where we provide unlimited options to expand your precious metals portfolio, from:

Website| www.provenandprobable.com

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals FAQ – https://www.milesfranklin.com/faq-maurice/

Bob Moriarty

Archives

Nov 21, 2022

As my regular readers fully understand, I am a big fan of measuring sentiment to gauge just where we are in the metals cycle. On September 1st I said we were at a tradable low. That was accurate to the day for silver and gold plodded along for another four weeks before touching the low. I picked that timeframe based mostly on DSI but also use every other way to measure sentiment that I can find including talking to others I have respect for in the industry.

If you are looking for a holiday treat for yourself, the DSI is on sale from now and ending on December 15th at a 60% discount. If you are a serious investor, it is the best tool you will ever find. I know there are half a dozen GURUs out there who claim to be experts who have never made a single accurate call.

I called the top in silver to the day in 2011 and this latest silver bottom to the day. I know of no other writer who can say that. And I am neither a guru nor an expert. I just used the same tools available to all of us.

I have reached out to the people whose judgment I appreciate the most to make sense of what I have seen in the last few months. The sentiment is worse across the board than what I saw back in 2000-2001 when both gold and silver made historic lows. You can see it in the trading volume and absurdly low prices.

It tells me this is your time to make your fortune. I don’t know how many times I have repeated that you have to buy when no one wants to buy and sell when everyone wants to buy. I see dozens of stocks including some real piece of shit stocks with rotten management that have 1000% potential in the near future. Forget reading tealeaves and plucking through chicken entrails and pondering what the Fed might screw up next. Sentiment moves markets but you have to see it. Anyone looking at the DSI and $BPGDM could make the same to the day predictions I have made dozens of times without being a guru.

I’ll say it again. Dolly Varden is silver.

The company has a 163 km land package in the midst of the Golden Triangle in Northern BC, Canada. It consists of two primary parts, the Homestake Ridge with about 20 million ounces of silver with just short of a million ounces of gold. Homestake was bought from Fury for $5 million in cash and 76.5 million DV shares. Fury recently sold 17 million of those shares reducing their overall ownership of Dolly Varden to 26%. The second part would be of course the Dolly Varden property and mine with an additional 44.5 million ounces of silver.

Dolly likes to use both silver and gold equivalent ounces. If using silver Eq, they have a total of 137 million Ag Eq ounces. If using gold it would be 1.83 million Au Eq ounces. With a $133 million CAD market cap and $10 million in cash, Dolly is getting less than $1 CAD an ounce or $.70 USD. Well before the marvelous run up to near $50 an ounce in 2011 silver companies were getting $3 to $5 an ounce USD and it will happen again. Dolly certainly could have a 400-700% move higher when silver investors wake up.

They have not woken up yet. Silver touched a low of $17.56 on September 1st. Last week it hit a high of $22.24 on Wednesday. That is a 26% gain in less than three months. And investors in the resource space have not woken up yet. These subsurface rallies can go higher and faster than you can imagine. It happened in early 2016 and again in 2020 when silver blasted higher from under $12 an ounce to almost $30 in ten months.

Dolly’s 2022 drill program called for 30,000 meters of drilling in 99 holes with four rigs turning. The company is releasing results on a regular basis. Their last press release from November 7, 2022 showed 12.51 meters of 442 g/t Ag. That’s almost $300 rock in USD and highly economic.

One thing that I would like to point out that even I didn’t know, until I poured through their company presentation, is that the ownership is almost totally in the hands of professional investors. Sprott owns 11%, Hecla another 10%, I mentioned Fury with 26% and another 45% in institutional investors. There is a mere 8% in the clutches of retail investors yet they are the people who move the stock. When silver is hot again and it will be, Dolly Varden is going to be the go-to silver stock once again.

Dolly Varden is an advertiser and I participated in their last private placement so I am biased. Please do your own due diligence.

Dolly Varden Silver Corp

DV-V $.58 (Nov 17, 2022)

DOLLF-OTCBB 231 million shares

Dolly Varden Silver website

###

Bob Moriarty

President: 321gold

Archives

Bob Moriarty

Archives

Sep 26, 2022

Regular readers are well aware of how much respect I have for the Daily Sentiment Indicator from Jake Bernstein. It is simply the most valuable tool I have come across in investing. We are at an interesting point where a number of commodities and indexes are showing extremes of emotion normally found only at tops or bottoms. This time may be different but only time will tell.

For anyone who has been awake lately the stock/bond/currency crash many have foreseen is in action right now. There is this simple issue of there being far more debt in the world than can be paid so at some point we need to settle the books. Either the borrowers pay the debt or the lenders. And obviously now it is the lenders. It is probably the worst liquidity event in history.

This is the start of the biggest financial change in five hundred years as the debt based Western financial system collapses and like a dying scorpion stings everything in range as a result. Russia and China are working with the 65% of the rest of the world who do not support either the actions of Nato and the US in Ukraine or sanctions against Russia.

There will be a new financial system. As of now Russia is still saying it will be a basket of currencies but if they have any sense, they will shave off a lot of wasted effort and just go straight to a gold and silver based currency.

The conflict in Ukraine literally is a battle between good and evil with the WEF/NATO/the EU and US on one side and the rest of the world on the other. The EU and NATO are literally committing suicide. That will be as obvious as a pimple on the tip of your nose soon this fall as Europe finds itself in a state of revolution against the massive stupidity of the EU leaders.

In the midst of an energy crisis Belgium voluntarily shut down one of their remaining nuclear power plants on Friday at a time where 64% of Belgians believe they cannot afford to pay their energy bills. That’s not Putin, that’s just basic fucking stupidity. Is it no longer just a requirement for world leaders to be sociopaths but also they must be mental midgets? With perhaps the sole exception of Oban, the rest of the flock are brain dead idiots who couldn’t lead their way out of a wet paper bag.

The dollar index has been flying lately. Readers should understand the dollar index does not have anything to do with measuring the value of the dollar except in terms of other currencies, mainly the Yen, the Euro and the British Pound. On Friday the DSI for the dollar index stood a value of 97. In the 33 years the index has been tracked by the DSI it has hit 98 only once and 97 only three times. In rational times the dollar index would be topping.

As of Friday the DSI for the British Pound was 5 along with the Canadian Dollar and the Australian Dollar. The S&P stood at 5 with the Nasdaq. I suspect the rocket higher in the DXY had more to do with the stupidity of the UK Prime Minister doing her best to destroy the value of the Pound in her rush to the bottom among currencies. There is an excellent chance we will see the continuation of the stock market crash this week, at least through Tuesday.

With the penny juniors in the mining area falling off a cliff on Friday with massive drops across the board, we are starting to see capitulation. While it is painful to watch your investments dropping by double digits daily, this is where wise investors make their fortunes. The market will rocket higher just as soon as those silly investors who used margin finish selling off the last of their investments just to meet a margin call.

These sorts of opportunities only come once in a lifetime. Prepare yourself to rake up the falling fruit. This is a quote from Basic Investing in Resource Stocks.

“Weak hands buy at tops and sell at bottoms. Strong hands buy at bottoms and sell at tops. It’s vital that investors remember that at every top there are 50 reasons to buy, and at every bottom there are 50 reasons to sell. That’s what makes them tops and bottoms.”

The DXY, S&P and Nasdaq are nearing a massive turn soon. Gold and silver will resume their climb and when the capitulation in resource stocks end, they will rocket higher.

###

Bob Moriarty

President: 321gold

Archives

Bob Moriarty

Archives

Aug 19, 2022

Lion One (LIO-V) came out with a press release in early June that shot the shares from $1.04 to $1.67 in less than a week. Obviously the results were excellent. Most of the people who read it appreciated it for what it was. One of the clowns who posts on CEO.CA maintained that the company was only finding high-grade but narrow intercepts and didn’t believe it could be put into production.

So I posted a piece on June 7th and showed Mr. Doom and Gloom a map of Fiji showing the seven million ounces of production from the Vatukoula gold mine only forty km to the North East. The deposits might as well be identical. Same age, same grades and thickness, same type deposit.

The uptick didn’t last long. The shares came off their high and dropped to a low of $1.17 in early July before climbing a little. Gold shares seem to have lost their luster. Right now it really looks like everyone hates gold and gold shares.

That is wonderful news for investors.

But first I want to talk about something that I have been tempted to discuss in one or more of the interviews I have been doing lately. It doesn’t have anything to do with investing but it’s a lifestyle change I learned almost fifty years ago when I worked at Electronic Data Systems. That’s the company that made Ross Perot a billionaire.

EDS made Perot a billionaire within two weeks of the company going public in 1968. He was the first of the billionaires created by taking a company public. When Perot took EDS public only three people made over $1 million. Perot, his secretary and his number 2 man. The company that created the largest number of millionaires was Microsoft. Anyone working there for over five years had picked up enough options by 2000 to be a millionaire. So Perot made the least number of rich employees and Bill Gates made the most.

Perot was a squid; he attended the Naval Academy and served as a line officer in the Navy before leaving the service and going to work with IBM in 1957 selling mainframe computers. In 1962 he formed EDS that made his fortune for him. Perot actually never operated a computer and never wrote a line of code. But he did understand the potential of the machine.

EDS hired me in 1971. We all went through training in Dallas before launching off to whatever contracts EDS had providing computer services. Perot came up with a lot of interesting approaches to life.

The most valuable to me was the concept of how to get a lot of things done. A lot of people who actually believe they are organized will make a list of things they want to do and figure out when it will be convenient to do them.

Don’t ever do things when they are convenient. You will never accomplish very much.

Do things when they are inconvenient.

And the more inconvenient the better. That sounds counter intuitive much like investing in stocks when people hate them but it actually works in real life in both cases.

You see, no matter what you want to do, a lot of the time, in fact most of the time; it’s just inconvenient to do something. There are a lot more inconvenient times to do things than convenient times. So you will accomplish a lot more by doing them when they are a pain in the ass to do. They might never become convenient.

Lion One announced another set of great assays at their Tuvatu Gold mine in Fiji on the 12th of August. Since then the shares have dropped 16%. That’s simply nuts or the assays did nothing more than create a liquidity event. Tuvatu is 100% owned with no NSR.

Lion One came out with a 43-101 back in June of 2014 showing slightly over 910,000 ounces of gold at a 1.0-gram cutoff. They have done a lot of drilling and intercepts since. Remember their neighbor 40 km away has already produced seven million ounces of gold and has another four million identified.

But rich projects require a lot of money and a lot of time to advance. Lion One is drilling for expansion of their resource at the same time they are doing mine planning for their mill scheduled to be into production in Q4 of 2023.

Lion One is my biggest single position. I have an average cost of $1.18 and as of today it trades at $1.16. But I only know half a dozen stocks that have the market cap potential of Lion One and it is by far the cheapest in relative terms. The company has excellent management and technical team. They have their own lab on site supporting the six drill rigs turning.

Lion One is an advertiser. I am a shareholder and just as biased as I can be so do your own due diligence.

Lion One Metals

LIO-V $1.16 (Aug 18, 2022)

LOMLF OTCQX 156.4 million shares

Lion One website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd

Whoa! Joining us for an action packed interview is the legendary Bob Moriarty the founder of http://www.321gold.com/, as we will cover a lot of ground in this interview! Topics ranging from Market Conditions, Bitcoin, the Colorado River, Junior Mining Companies, and Precious Metals. This is an absolute must watch!

Lion One Metals: https://liononemetals.com/

Irving Resources: https://irvresources.com/

Labrador Gold: https://labradorgold.com/

Interview: https://provenandprobable.com/labrador-gold-discovers-54-17-gpt-at-big-vein-on-kingsway-gold-project/

Roogold: https://roogoldinc.com/

Interview: https://provenandprobable.com/roogold-positioned-to-be-the-next-dominant-player-in-the-new-south-whales/

Dolly Varden Silver: https://www.dollyvardensilver.com/

Interview: https://provenandprobable.com/dolly-varden-silver-3-rigs-30000-meter-drill-program-on-the-kitsault-valley-project/

Provenance Gold: https://www.provenancegold.com/

Interview: https://provenandprobable.com/provenance-gold-has-2-gold-projects-that-offer-a-tremendous-opportunity-for-savvy-gold-investors/

Eloro Resources: https://elororesources.com/

NEW YORK, June 10, 2022 (GLOBE NEWSWIRE) — Virtual Investor Conferences, the leading proprietary investor conference series, today announced the agenda for the upcoming OTCQX Best 50 Companies Virtual Investor Conference to be held on June 16 th . Individual investors, institutional investors, advisors, and analysts are invited to attend. The program begins at 9:30 AM ET on Thursday, June 16th.

REGISTER NOW AT: https://bit.ly/3ztPQjz

It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates. There is no cost to log-in, attend live presentations and schedule 1×1 meetings.

“We are delighted to welcome ten of our OTCQX Best 50 companies participating in our upcoming Virtual Investor Conference,” said Jason Paltrowitz, OTC Markets Group EVP of Corporate Services. “We are proud to highlight the impressive efforts of these companies which span a range of industries including Technology, Metals & Mining, Industrial Goods, Financials and more.”

June 16 th Agenda:

| Eastern Time (ET) | Presentation | Ticker(s) |

| 9:30 AM | Global Atomic Corp. | OTCQX: GLATF | TSX: GLO |

| 10:00 AM | IsoEnergy Ltd. | OTCQX: ISENF | TSXV: ISO |

| 10:30 AM | InPlay Oil Corp. | OTCQX: IPOOF | TSX: IPO |

| 11:00 AM | TAAL Distributed Information Technologies Inc. | OTCQX: TAALF | CSE: TAAL |

| 11:30 AM | Labrador Gold Corp. | OTCQX: NKOSF | TSXV: LAB |

| 12:00 PM | Deep Yellow Ltd. | OTCQX: DYLLF | ASX: DYL |

| 1:00 PM | Nanalysis Scientific Corp. | OTCQX: NSCIF | TSXV: NSCI |

| 1:30 PM | Grayscale Investments LLC | OTCQX: GBTC |

| TBD | Novonix Ltd. | OTCQX: NVNXF | ASX: NVX |

| TBD | Thunderbird Entertainment Group Inc. | OTCQX: THBRF | TSXV: TBRD |

To facilitate investor relations scheduling and to view a complete calendar of Virtual Investor Conferences, please visit www.virtualinvestorconferences.com .

About Virtual Investor Conferences ®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly traded companies to seamlessly present directly to investors.

Providing a real-time investor engagement solution, VIC is specifically designed to offer companies more efficient investor access. Replicating the components of an on-site investor conference, VIC offers companies enhanced capabilities to connect with investors, schedule targeted one-on-one meetings and enhance their presentations with dynamic video content. Accelerating the next level of investor engagement, Virtual Investor Conferences delivers leading investor communications to a global network of retail and institutional investors.

Media Contact:

OTC Markets Group Inc. +1 (212) 896-4428, media@otcmarkets.com

Virtual Investor Conferences Contact:

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

(212) 220-2221

johnv@otcmarkets.com