VANCOUVER, BC / ACCESSWIRE / July 24, 2024 / Rover Critical Minerals Corp. (TSXV:ROVR)(OTCQB:ROVMF)(FSE:4XO) (“Rover” or the “Company“) is pleased to announce that it has entered into a non-binding letter of intent to acquire a 100% interest in the Silicon Valley Silica Project, near Golden, British Columbia (the “Transaction“) Orichalcum Holdings Inc. (the “Vendor“).

The 1,760-hectare (4,349-acre) Silicon Valley Silica Project, located adjacent to the town of Golden, B.C. and the Sinova Quartz silica quarry, hosts approximately 12 kilometers of regionally mapped strike length of the high-purity quartzite beds of the Ordovician Mount Wilson Formation. Sampling in 2017 encountered up to 99.9% SiO2 and an average of 99.6% SiO2 along a traverse of approximately 190 metres, along strike with the adjacent Sinova Quartz silica quarry. Deleterious elements were found to be very low, with an average of 0.03% Fe2O3, 0.02% CaO, 0.02% MgO, 0.01% P2O5, and 0.10% Al2O3. Details of the Project are outlined below.

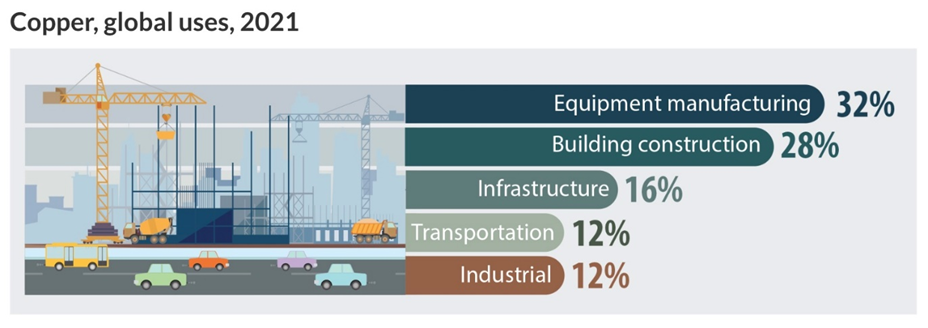

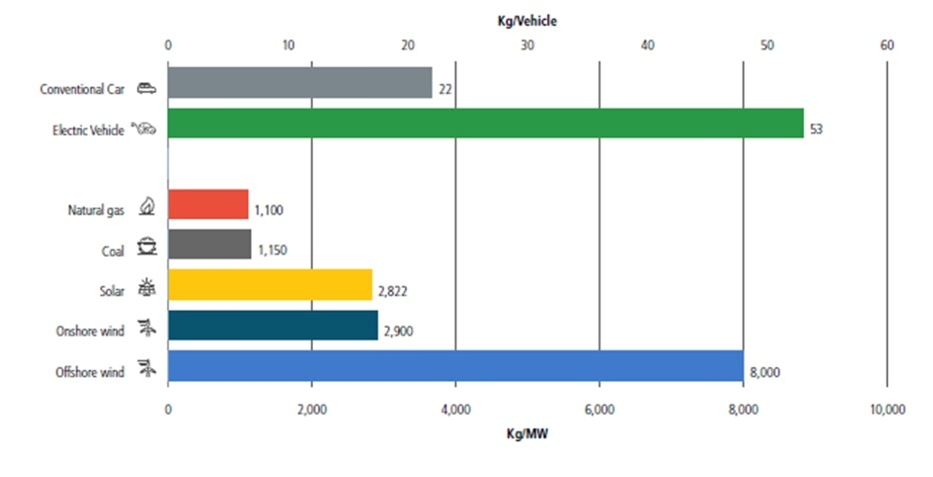

As the demand for renewable energy sources like solar power grows, driven by global initiatives to combat climate change, the market for high-purity silica (also known as high-purity quartz, or HPQ) is poised to expand significantly. With the acquisition of Silicon Valley Silica Project, Rover is poised to gain a strategic position in the rapidly expanding critical minerals market.

Judson Culter, CEO of Rover states, “On June 10th, the Government of Canada announced that silicon metal had been added to Canada’s Critical Minerals List, in addition to announcing additional funding for the semiconductor and chip manufacturing industry. The U.S. Government also has silicon on its critical minerals list, therefore making the project potentially eligible for DoD or DoE funding through the Defense Production Act Investment (DPAI) program. Through this Transaction, Rover is gaining a strategic and timely position in what is becoming one of the most sought-after high-purity silica districts in Canada with a project located adjacent to one of the largest high-purity silica producers in the country. Silica, despite being the second most abundant mineral in the Earth’s crust, is rare in its purest form, and is in increasingly high demand as a crucial element in the production of photovoltaics (PV) and semiconductors. Management closely follows industry trends, evident from companies like Intel, which is on track to build the world’s largest chip-making complex in Ohio, with $20 billion invested by the company to date. Factoring in macro-economic demand for chips in AI applications, along with the geopolitical risks of Taiwan holding current market share of the chip industry, this deal has a bright future.”

Paddy J. Moylan, Rover’s President and Director, comments, “Silicon Valley is a deal we have been working on for some time. Silicon Valley is special. It is transformational for our company and investors. This project has huge potential. We already have boots on the ground within a short walk to a world-class asset, which is exciting! I will be on site as work progresses. Importantly, from an ESG point of view, it ticks many boxes. I look forward to finalising the definitive agreement imminently. Rover has formed a terrific working relationship in the area, and I am thrilled that Case Lewis, will join us as our exploration manager. I have come to know Case well and he will be a strong advocate for Rover and Silicon Valley. We will keep investors informed of progress at all material times as we advance towards positive news flow.”

About High Purity Silica

Silicon, which is derived from high-purity silica, is the primary material in the majority of solar panels, also called photovoltaic (PV) cells. Silicon metal is essential to the manufacture of computer chips and semiconductors, used in almost any and everything electronic. It is also used in aluminum production for aerospace applications, as well as anodes in emergent next-generation lithium-ion batteries. Although silica is abundant in the Earth’s crust, silica deposits with a high degree of purity and volume – those which are in economic demand – particularly in excess of 99% SiO2, are a relatively rare occurrence, especially in Canada and the U.S.

About Canada’s Critical Minerals List June 10 Update

The Critical Minerals List was first released in 2021 and consisted of 31 minerals which were deemed essential to Canada’s green and digital economies. On June 10, 2024, the Government of Canada released an updated Critical Minerals List which increased the number of critical minerals to 34, now including silicon metal.

To be included in the Critical Minerals List, the Government of Canada must consider that: (1) the supply chain of the material is threatened; (2) there is a reasonable chance of the mineral being produced by Canada and; (3) the mineral is considered to be one of the following:

- essential to Canada’s economic or national security; or

- required for the national transition to a sustainable low-carbon and digital economy; or

- positions Canada as a sustainable and strategic partner within global supply chains.

Project Highlights – Silicon Valley Project, Golden, B.C.

- 1,760 hectares (4,349 acres) adjacent to the town of Golden, B.C., and less than 1km from the Canadian Pacific Railway Golden Rail Yard with easy year-round access. (Figure 1)

- High-purity quartzite of the Ordovician Mount Wilson Formation with up to 12 km of regionally mapped strike length on the property and up to 300 metres apparent width at surface. Bedding strikes 120 to 140º and dips from 60 to 75º.

- On the same lithological unit and close to both Sinova Global’s Sinova Quartz quarry pit (500m to south) and the Moberly Silica Mine (9.0 km to north). Sinova Quartz has been permitted for over 1,000,000 tonnes of annual silica production. (1)

- The HCJ MINFILE occurrence on the Project was first reported in 1972 by Dr. L.B. Halferdahl, who characterized the quartzite unit as containing sequences with thicknesses of 30 metres or more of very white to grey high grade silica material, with no impurities being visible with examination even with a 20x hand lens and thus having the potential for ferrosilicon-grade material. The quartzite silica bed at the Silicon Valley Project was mapped to extend at least from the HCJ MINFILE occurrence at the north end of the current Property, to the Sinova Quartz quarry at the south end of the Property. (2)

- 2018 sampling extending from 50 metres from the boundary of the adjacent Sinova Quartz quarry tenure encountered up to 99.9% SiO2 and an average of 99.6% SiO2 from 7 grab samples taken over a traverse of approximately 190 metres, along strike from the Sinova Quartz quarry. Deleterious elements were found to be very low, with an average of 0.03% Fe2O3, 0.02% CaO, 0.02% MgO, 0.01% P2O5, and 0.10% Al2O3. Grab samples in the northern area of the Property yielded grades up to 99.1% SiO2. (Figure 2) (3) *

- Also in 2018, 92 Resources Corp (now Patriot Battery Metals Inc (TSX:PMET)), the former owner of the majority of the Silicon Valley Project area, encountered grades of 99.11, 98.56 and 98.28% SiO2 from grab samples in the northern area of the Property. (Figure 3) (4) *

- According to Sinova Global’s website, regarding their expansion at Sinova Quartz:

- Quartz from this deposit requires very limited processing relative to material from other quartz operations. With high-purity silica and correspondingly low levels of impurities such as boron, iron, phosphorus and aluminum, the Sinova Quartz operation creates minimal by-products and requires less energy to process.

- A tailings management facility is not necessary to mitigate environmental impacts. Only primary crushing will be done on-site then it will be stockpiled and hauled offsite to be processed.

- No wastewater will be treated at the Sinova Quartz project as minimal water will be used in processing for dust control, and no tailings facilities will be constructed. (1)

Figure 1. Silicon Valley Project Map

Figure 2. Silicon Valley Project Map – South Sampling Area

Figure 3. Silicon Valley Project Map – North Sampling Area and HCJ MINFILE Location

Transaction Terms

The Company has entered into the Transaction with Orichalcum Holdings Inc., dated July 19, 2024, an arm’s length party. The terms of the option agreement are set forth below:

In order to exercise the Option and acquire a 100% interest in the Property, the Company is required to:

- incur at least $1,020,000 in exploration expenditures over 24 months from the signing of a definitive agreement. A minimum of $20,000 is to be incurred in the first three months.

- issue common shares to the Vendor as follows:

- 2,000,000 common shares of the Company (“Common Shares“) on or before ninety (90) days after the date of execution of the Definitive Agreement;

- such number of Common Shares having an aggregate value of $50,000, on or before the 6-month anniversary of the execution date of the Definitive Agreement, calculated based on the 10-day VWAP;

- such number of Common Shares having an aggregate value of $100,000, on or before the 12-month anniversary of the execution date of the Definitive Agreement, calculated based on the 10-day VWAP;

- such number of Common Shares having an aggregate value of $200,000, on or before the 24-month anniversary of the execution date of the Definitive Agreement, calculated based on the 10-day VWAP;

- such number of Common Shares having an aggregate value of $200,000, on or before the earlier of the 36-month anniversary of the execution date of the Definitive Agreement or the issuance of a mining or quarry permit for the Property, calculated based on the 10-day VWAP;

- such number of Common Shares having an aggregate value of $250,000, on or before the earlier of the 48-month anniversary of the execution date of the Definitive Agreement or the commencement of commercial production on the Property, calculated based on the 10-day VWAP.

- make cash payments to the Vendor in the aggregate amount of $855,000 as follows:

- $10,000 on signing of the Definitive Agreement;

- $15,000 within 10 weeks of signing the Definitive Agreement;

- $80,000 on or before the 12-month anniversary of signing the Definitive Agreement;

- $200,000 on or before the 24-month anniversary of signing the Definitive Agreement;

- $200,000 on or before the earlier of the 36-month anniversary of signing the Definitive Agreement or the issuance of an extraction permit for the Property;

- $350,000 on or before the earlier of the 48-month anniversary of signing the Definitive Agreement or the commencement of commercial production on the Property.

If the Buyer fails to satisfy the payment terms and conditions of the Option, Buyer’s option to acquire the Property will terminate, and the Property shall automatically become the sole possession of the Vendor. Buyer must ensure the claims will be in good standing for at least 12 months following the date of termination.

The Vendor will retain a 2% Gross Overriding Royalty (“GORR“) on the Property. For so long as the Company holds an interest in the Property the Company shall have the right to purchase, at any time prior to production, 0.5% of the Vendor’s GORR (for cancellation) for purchase price of $500,000, and an additional 0.5% for an additional $500,000.

The Property shall be surrounded by a specified area of interest in which any claims staked within this area by the Vendor or the Buyer shall automatically be included in the Definitive Agreement.

Buyer to maintain all claims in good standing until the exercise of the Option.

Additional Technical Details on the Silicon Valley Project, B.C.

The property is underlain by thick sequences of extremely pure quartzite of the Ordovician Mount Wilson Formation, occurring as north-northwest striking, usually steeply east-dipping thrust panels.

Locally, quartzite of the Mount Wilson Formation occurs as friable sandstone, grading deeper to well cemented quartzite. Several faulted and displaced segments of the Mount Wilson quartzite unit occur on the Property, totaling approximately 12 kilometres of strike length at an average apparent width of 250-300 metres at surface. Structurally repeated segments of the same lithological unit host the Moberly Silica Mine (9.0 kilometres to the north), which previously produced up to 150,000 tonnes of silica sand annually, and the Sinova Quartz silica quarry (500 metres to the south), which produced up to 90,000 tonnes of silica annually, both of which exhibit economic grade silica greater than 99.6% SiO2 purity. (5)(6)

The quartzite can be described as frosty white, sedimentary quartzite with a clastic texture containing fine, well-rounded polished grains 1/8 – 1/4 mm in diameter. Very competent bonding allows breaking to occur through the quartz grains.

* Cautionary Note

The reader is cautioned that grab samples are selective by nature and may not represent the true grade or style of mineralization across the property.

Sources

- https://sinovaglobal.com/wp-content/uploads/2023/05/Sinova-Quartz-Brief-Final.pdf

- https://apps.nrs.gov.bc.ca/pub/aris/Report/03685.pdf/

- https://apps.nrs.gov.bc.ca/pub/aris/Report/37599.pdf/

- https://apps.nrs.gov.bc.ca/pub/aris/Report/38110.pdf/

- https://minfile.gov.bc.ca/Summary.aspx?minfilno=082N++001

- https://minfile.gov.bc.ca/Summary.aspx?minfilno=082N++043

$0.03 Unit Financing

Further to the Company’s release of July 3, 2024, the Company $0.03/unit financing (the “Private Placement“) is now closed. Rover received total orders of $327,344 resulting in the issuance of 10,911,467 common shares, and 10,911,467 common share purchase warrants. No finders’ commissions will be paid in connection with the Private Placement. The closing is subject to final acceptance and approval by the TSX Venture Exchange. It is expected that a new financing will be announced later this month as a result of the Transaction disclosed in this release.

Related Party Transaction

The Private Placement constitutes a “related party transaction” as such term is defined under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101“) as an investment by a director of the Company has participated in the financing, acquiring aggregate of 10,000,000units for aggregate consideration of $300,000. The Company has relied on exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(b) and 5.7(1)(a) of MI 61-101 in respect of related party participation in the Private Placement as the Company is not listed on a specified market and neither the fair market value (as determined under MI 61-101) of the subject matter of, nor the fair market value of the consideration for, the transaction, insofar as it involved the related party, exceeded 25% of the Company’s market capitalization (as determined under MI 61-101). A material change report was not filed in connection with the related party participation in the Private Placement less than 21 days in advance of closing of the Private Placement as approval of the Private Placement occurred less than 21 days prior to closing. The Private Placement was approved by the board of directors of the Company with the conflicted director abstaining.

Qualified Person (QP) Statement

Technical information in this news release has been reviewed and approved by Case Lewis, P.Geo., a “Qualified Person” as defined under NI 43-101 Standards of Disclosure for Mineral Projects and a director of the Silicon Valley Project vendor company, Orichalcum Holdings Inc.

About Rover Critical Minerals

Rover is a publicly traded junior mining company that trades on the TSXV under symbol ROVR, on the OTCQB under symbol ROVMF, and on the FSE under symbol 4XO.

ON BEHALF OF THE BOARD OF DIRECTORS,

“Judson Culter”

Chief Executive Officer and Director

For further information, please contact:

Email: info@rovermetals.com

Phone: +1 (778) 754-2617

Neither the TSX Venture Exchange nor its regulation provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

Statement Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause Rover’s actual results, performance, achievements, or developments in the industry to differ materially from the anticipated results, performance, or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

The forward-looking statements and information in this press release include information relating to the Transaction, the Company’s intention to complete a private placement and all other statements that are not historical in nature. Such statements and information reflect the current view of Rover. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information.

There can be no assurance that such statements prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements. Any factor could cause actual results to differ materially from Rover’s expectations. Rover undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates, opinions, or other factors, should change.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

SOURCE: Rover Critical Minerals Corp.

View the original press release on accesswire.com