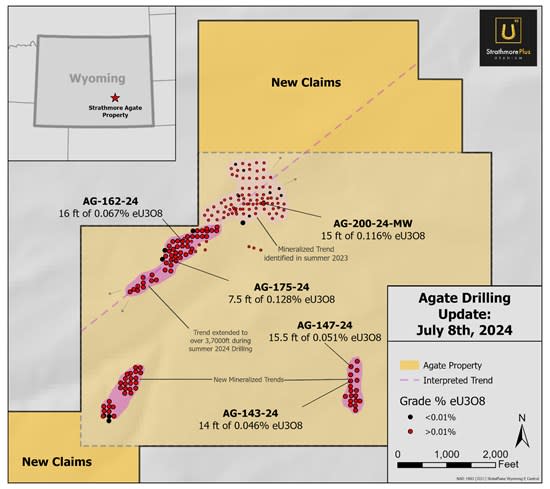

Kelowna, British Columbia–(Newsfile Corp. – July 9, 2024) – Strathmore Plus Uranium Corporation (TSX: SUU) (OTCQB: SUUFF) (“Strathmore” or “the Company“) is pleased to announce it has extended the mineralization from the Phase 1 drilling for the 2024 exploration season at the Agate project in Wyoming. The Company completed 100 exploration holes across the project area, resulting in the extension of the Lower sand’s northern trend to 3,700 feet in length.

Highlights for the drilling along this trend included holes:

*AG-175-24 (7.5 feet of 0.128% eU3O8 from 103.5-110.0 feet)

*AG-200-24 (15 feet of 0.116% eU3O8 from 82.5-97.5 feet).

*AG-162-24 (16 feet of 0.067% eU3O8 from 87.5-103.5 feet)

In addition, five piezometer wells were completed for groundwater testing and five holes were prepared for core recovery this summer.

Phase 1 of the 2024 drilling explored the Eocene Wind River Formation, an arkosic-rich sandstone which is noted for its high porosity and permeability, and high groundwater transmissivity. In addition to continued exploration of the Lower sand, the recent drilling discovered shallow mineralization within the overlying Middle sand, which is thicker than the Lower sand, and historically produced most of the uranium in the Shirley Basin district.

Dev Randhawa, CEO commented:

The BOD and I, along with our new Director, Mr. Marion Loomis, and technical advisors Ray Ashley and Sam Hartmann, toured both our Agate and Beaver Rim properties on June 26 & 27th.

We are excited to see the higher-grade intercepts as we move further SW. at Agate. The drill results are validating our prediction of the Wyoming roll front model as applied to our Agate property. With continued exploration by our field team and geophysical modeling by the University of Wyoming personnel, I expect Strathmore to further define the east side of the mineralized tongue at Agate and move towards a draft ISR resource assessment.

Agate Exploration:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3282/215737_ae406299f46f3955_002full.jpg

| Hole ID | Latitude | Longitude | Depth (ft) | Top (ft) | Bottom (ft) | Thickness (ft) | Grade % eU3O8 | Grade x Thickness |

| AG-101-24 | 42.30469 | (106.29538) | 120 | 80.5 | 86.0 | 5.5 | 0.017 | 0.094 |

| AG-102-24 | 42.30502 | (106.29534) | 120 | 84.5 | 98.0 | 13.5 | 0.026 | 0.351 |

| AG-103-24 | 42.30474 | (106.29495) | 120 | 74.5 | 82.5 | 8.0 | 0.035 | 0.280 |

| AG-104-24 | 42.30447 | (106.29533) | 100 | 81.0 | 87.0 | 6.0 | 0.019 | 0.114 |

| AG-105-24 | 42.30500 | (106.29573) | 120 | 86.5 | 98.5 | 12.0 | 0.014 | 0.168 |

| AG-106-24 | 42.30472 | (106.29573) | 100 | 79.0 | 83.0 | 4.0 | 0.037 | 0.148 |

| 86.5 | 89.0 | 2.5 | 0.046 | 0.115 | ||||

| AG-107-24 | 42.30446 | (106.29579) | 120 | 80.5 | 83.5 | 3.0 | 0.034 | 0.102 |

| 88.5 | 92.5 | 4.0 | 0.044 | 0.176 | ||||

| AG-108-24 | 42.30529 | (106.29531) | 120 | 88.0 | 90.0 | 2.0 | 0.023 | 0.046 |

| AG-109-24 | 42.30558 | (106.29533) | 120 | 84.5 | 87.0 | 2.5 | 0.031 | 0.078 |

| 89.5 | 99.5 | 10.0 | 0.032 | 0.320 | ||||

| AG-110-24 | 42.30531 | (106.29493) | 120 | 82.5 | 92.5 | 10.0 | 0.019 | 0.190 |

| AG-111-24 | 42.30477 | (106.29610) | 120 | 83.0 | 92.0 | 9.0 | 0.026 | 0.231 |

| AG-112-24 | 42.30505 | (106.29608) | 120 | 81.5 | 85.0 | 3.5 | 0.023 | 0.081 |

| AG-113-24 | 42.30505 | (106.29493) | 120 | 83.0 | 93.0 | 10.0 | 0.022 | 0.219 |

| AG-114-24 | 42.30528 | (106.29573) | 120 | 84.5 | 95.5 | 11.0 | 0.014 | 0.154 |

| AG-115-24 | 42.30566 | (106.29493) | 120 | 88.0 | 89.5 | 1.5 | 0.031 | 0.047 |

| AG-116-24 | 42.30561 | (106.29456) | 120 | 83.0 | 87.5 | 4.5 | 0.027 | 0.122 |

| AG-117-24 | 42.30590 | (106.29494) | 120 | 75.0 | 87.5 | 12.5 | 0.015 | 0.188 |

| AG-118-24 | 42.30589 | (106.29459) | 120 | 87.0 | 100.5 | 13.5 | 0.024 | 0.324 |

| AG-119-24 | 42.30553 | (106.29558) | 120 | 87.5 | 105.5 | 18.0 | 0.033 | 0.594 |

| AG-120-24 | 42.30293 | (106.29702) | 140 | BARREN | ||||

| AG-121-24 | 42.30318 | (106.29700) | 120 | BARREN | ||||

| AG-122-24 | 42.30346 | (106.29699) | 120 | 89.5 | 94.5 | 5.0 | 0.022 | 0.110 |

| AG-123-24 | 42.30322 | (106.29739) | 140 | 90.0 | 92.0 | 2.0 | 0.024 | 0.048 |

| 94.0 | 101.0 | 7.0 | 0.014 | 0.098 | ||||

| AG-124-24 | 42.30349 | (106.29736) | 140 | 90.0 | 95.0 | 5.0 | 0.017 | 0.085 |

| AG-125-24 | 42.30373 | (106.29697) | 120 | 91.0 | 94.0 | 3.0 | 0.027 | 0.081 |

| AG-126-24 | 42.30319 | (106.29662) | 120 | 84.0 | 88.5 | 4.5 | 0.019 | 0.086 |

| AG-127-24 | 42.30374 | (106.29738) | 140 | 97.0 | 99.0 | 2.0 | 0.015 | 0.030 |

| AG-128-24 | 42.30320 | (106.29744) | 140 | 92.0 | 98.0 | 6.0 | 0.013 | 0.078 |

| AG-129-24 | 42.30370 | (106.29668) | 120 | 86.5 | 88.5 | 2.0 | 0.013 | 0.026 |

| AG-130-24 | 42.30402 | (106.29697) | 120 | 90.0 | 94.5 | 4.5 | 0.059 | 0.266 |

| AG-131-24 | 42.30360 | (106.27836) | 130 | 19.0 | 27.0 | 8.0 | 0.030 | 0.242 |

| 31.5 | 34.0 | 2.5 | 0.022 | 0.055 | ||||

| 41.0 | 43.0 | 2.0 | 0.028 | 0.056 | ||||

| AG-132-24 | 42.30414 | (106.27911) | 100 | 37.5 | 42.0 | 4.5 | 0.029 | 0.131 |

| 48.5 | 50.5 | 2.0 | 0.012 | 0.024 | ||||

| 63.5 | 65.5 | 2.0 | 0.012 | 0.024 | ||||

| AG-133-24 | 42.30417 | (106.27866) | 100 | 37.5 | 39.5 | 2.0 | 0.013 | 0.026 |

| 41.5 | 63.5 | 22.0 | 0.013 | 0.288 | ||||

| 68.0 | 71.0 | 3.0 | 0.015 | 0.045 | ||||

| AG-134-24 | 42.30387 | (106.27872) | 120 | 42.5 | 50.5 | 8.0 | 0.013 | 0.105 |

| 56.0 | 58.5 | 2.5 | 0.013 | 0.033 | ||||

| 62.5 | 64.5 | 2.0 | 0.011 | 0.022 | ||||

| AG-135-24 | 42.30389 | (106.27831) | 120 | 16.0 | 32.5 | 16.5 | 0.035 | 0.578 |

| 34.0 | 36.5 | 2.5 | 0.013 | 0.033 | ||||

| 44.0 | 48.5 | 4.5 | 0.025 | 0.113 | ||||

| AG-136-24 | 42.30335 | (106.27836) | 100 | 9.5 | 13.0 | 3.5 | 0.013 | 0.046 |

| 20.0 | 24.0 | 4.0 | 0.012 | 0.048 | ||||

| 35.5 | 42.5 | 7.0 | 0.014 | 0.095 | ||||

| 45.0 | 49.0 | 4.0 | 0.014 | 0.056 | ||||

| AG-137-24 | 42.30365 | (106.27874) | 140 | 17.5 | 28.0 | 10.5 | 0.032 | 0.336 |

| 32.5 | 36.0 | 3.5 | 0.027 | 0.095 | ||||

| AG-138-24 | 42.30446 | (106.27828) | 120 | 36.5 | 40.5 | 4.0 | 0.062 | 0.248 |

| Hole ID | Latitude | Longitude | Depth (ft) | Top (ft) | Bottom (ft) | Thickness (ft) | Grade % eU3O8 | Grade x Thickness |

| AG-139-24 | 42.30417 | (106.27832) | 120 | 43.5 | 49.0 | 5.5 | 0.018 | 0.099 |

| AG-140-24 | 42.30387 | (106.27802) | 120 | 33.5 | 36.5 | 3.0 | 0.016 | 0.048 |

| 40.0 | 44.0 | 4.0 | 0.013 | 0.052 | ||||

| AG-141-24 | 42.30445 | (106.27869) | 120 | 35.0 | 41.5 | 6.5 | 0.013 | 0.085 |

| 67.0 | 69.0 | 2.0 | 0.012 | 0.024 | ||||

| AG-142-24 | 42.30469 | (106.27872) | 120 | 34.0 | 36.0 | 2.0 | 0.035 | 0.070 |

| 62.5 | 65.0 | 2.5 | 0.015 | 0.038 | ||||

| 70.0 | 72.0 | 2.0 | 0.014 | 0.028 | ||||

| AG-143-24 | 42.30500 | (106.27869) | 120 | 30.5 | 44.5 | 14.0 | 0.046 | 0.644 |

| 51.0 | 56.0 | 5.0 | 0.010 | 0.052 | ||||

| 64.5 | 71.0 | 6.5 | 0.012 | 0.076 | ||||

| AG-144-24 | 42.30503 | (106.27821) | 120 | 16.0 | 23.0 | 7.0 | 0.013 | 0.094 |

| 30.5 | 32.5 | 2.0 | 0.041 | 0.082 | ||||

| 36.5 | 40.5 | 4.0 | 0.038 | 0.152 | ||||

| AG-145-24 | 42.30559 | (106.27820) | 120 | 18.0 | 20.0 | 2.0 | 0.012 | 0.024 |

| 23.0 | 28.0 | 5.0 | 0.011 | 0.055 | ||||

| 33.5 | 36.0 | 2.5 | 0.012 | 0.030 | ||||

| 44.0 | 48.5 | 4.5 | 0.014 | 0.063 | ||||

| 53.0 | 57.0 | 4.0 | 0.014 | 0.056 | ||||

| 61.0 | 64.5 | 3.5 | 0.013 | 0.044 | ||||

| 71.0 | 73.5 | 2.5 | 0.012 | 0.030 | ||||

| AG-146-24 | 42.30535 | (106.27869) | 120 | 20.5 | 23.5 | 3.0 | 0.013 | 0.038 |

| 25.5 | 48.0 | 22.5 | 0.014 | 0.304 | ||||

| AG-147-24 | 42.30580 | (106.27865) | 120 | 29.0 | 44.5 | 15.5 | 0.051 | 0.791 |

| 57.0 | 68.0 | 11.0 | 0.013 | 0.143 | ||||

| AG-148-24 | 42.30610 | (106.27818) | 120 | 28.0 | 31.5 | 3.5 | 0.011 | 0.037 |

| 35.0 | 48.0 | 13.0 | 0.013 | 0.165 | ||||

| 54.0 | 56.5 | 2.5 | 0.011 | 0.027 | ||||

| AG-149-24 | 42.31234 | (106.29066) | 140 | 101.0 | 104.5 | 3.5 | 0.046 | 0.161 |

| 110.5 | 116.5 | 6.0 | 0.011 | 0.068 | ||||

| AG-150-24 | 42.31252 | (106.29057) | 140 | 103.5 | 107.5 | 4.0 | 0.010 | 0.042 |

| AG-151-24 | 42.31322 | (106.29053) | 140 | 95.0 | 106.0 | 11.0 | 0.079 | 0.869 |

| AG-152-24 | 42.31321 | (106.29016) | 160 | 101.0 | 105.5 | 4.5 | 0.049 | 0.221 |

| AG-153-24 | 42.31352 | (106.29048) | 140 | BARREN | ||||

| AG-154-24 | 42.31353 | (106.29015) | 140 | 93.0 | 95.5 | 2.5 | 0.027 | 0.068 |

| AG-155-24 | 42.31353 | (106.28978) | 140 | 90.5 | 93.0 | 2.5 | 0.039 | 0.098 |

| 94.5 | 100.0 | 5.5 | 0.060 | 0.330 | ||||

| AG-156-24 | 42.31321 | (106.28978) | 160 | 98.5 | 108.0 | 9.5 | 0.056 | 0.532 |

| AG-157-24 | 42.31293 | (106.29090) | 140 | 100.5 | 103.0 | 2.5 | 0.037 | 0.093 |

| 104.5 | 106.5 | 2.0 | 0.025 | 0.050 | ||||

| AG-158-24 | 42.31321 | (106.29090) | 140 | 92.5 | 97.0 | 4.5 | 0.012 | 0.054 |

| AG-159-24 | 42.31321 | (106.28945) | 160 | 107.0 | 109.0 | 2.0 | 0.028 | 0.056 |

| AG-160-24 | 42.31351 | (106.28942) | 140 | 95.0 | 99.5 | 4.5 | 0.044 | 0.198 |

| AG-161-24 | 42.31364 | (106.28944) | 140 | 91.5 | 102.5 | 11.0 | 0.021 | 0.231 |

| AG-162-24 | 42.31295 | (106.29128) | 140 | 77.5 | 79.5 | 2.0 | 0.036 | 0.072 |

| 87.5 | 103.5 | 16.0 | 0.067 | 1.072 | ||||

| AG-163-24 | 42.31269 | (106.29129) | 140 | 107.0 | 108.5 | 1.5 | 0.013 | 0.020 |

| AG-164-24 | 42.31266 | (106.29090) | 140 | 99.5 | 105.0 | 5.5 | 0.033 | 0.182 |

| AG-165-24 | 42.31266 | (106.29168) | 140 | 105.0 | 107.5 | 2.5 | 0.013 | 0.033 |

| AG-166-24 | 42.31298 | (106.29164) | 140 | 83.5 | 86.0 | 2.5 | 0.037 | 0.093 |

| AG-167-24 | 42.31295 | (106.29201) | 140 | 80.5 | 83.0 | 2.5 | 0.029 | 0.073 |

| Hole ID | Latitude | Longitude | Depth (ft) | Top (ft) | Bottom (ft) | Thickness (ft) | Grade % eU3O8 | Grade x Thickness |

| 85.5 | 87.5 | 2.0 | 0.040 | 0.080 | ||||

| 89.5 | 91.5 | 2.0 | 0.027 | 0.054 | ||||

| AG-168-24 | 42.31251 | (106.29198) | 140 | 78.5 | 80.5 | 2.0 | 0.068 | 0.136 |

| 91.5 | 94.0 | 2.5 | 0.011 | 0.028 | ||||

| 97.5 | 104.0 | 6.5 | 0.014 | 0.088 | ||||

| AG-169-24 | 42.31230 | (106.29179) | 140 | 96.0 | 100.5 | 4.5 | 0.014 | 0.063 |

| 102.0 | 107.0 | 5.0 | 0.014 | 0.070 | ||||

| AG-170-24 | 42.31241 | (106.29229) | 140 | 101.0 | 104.5 | 3.5 | 0.013 | 0.046 |

| AG-171-24 | 42.31270 | (106.29229) | 140 | 90.0 | 92.5 | 2.5 | 0.015 | 0.038 |

| 94.5 | 101.0 | 6.5 | 0.013 | 0.085 | ||||

| 105.5 | 107.5 | 2.0 | 0.011 | 0.021 | ||||

| AG-172-24 | 42.31216 | (106.29212) | 140 | 97.0 | 107.0 | 10.0 | 0.014 | 0.138 |

| AG-173-24 | 42.31213 | (106.29257) | 140 | 101.5 | 107.0 | 5.5 | 0.068 | 0.374 |

| AG-174-24 | 42.31246 | (106.29262) | 140 | BARREN | ||||

| AG-175-24 | 42.31191 | (106.29215) | 140 | 103.5 | 111.0 | 7.5 | 0.128 | 0.960 |

| AG-176-24 | 42.31196 | (106.29282) | 140 | BELOW CUTOFF | ||||

| AG-177-24 | 42.31175 | (106.29253) | 140 | 59.5 | 63.0 | 3.5 | 0.012 | 0.042 |

| 108.5 | 112.0 | 3.5 | 0.020 | 0.070 | ||||

| AG-178-24 | 42.31162 | (106.29217) | 140 | 51.0 | 53.0 | 2.0 | 0.011 | 0.022 |

| 69.5 | 72.5 | 3.0 | 0.013 | 0.040 | ||||

| 109.5 | 113.5 | 4.0 | 0.010 | 0.041 | ||||

| AG-179-24 | 42.31186 | (106.29178) | 140 | 109.0 | 112.0 | 3.0 | 0.045 | 0.135 |

| AG-180-24 | 42.31231 | (106.29144) | 140 | 85.0 | 91.5 | 6.5 | 0.122 | 0.793 |

| 95.0 | 99.0 | 4.0 | 0.038 | 0.152 | ||||

| AG-181-24 | 42.31135 | (106.29262) | 140 | 80.5 | 86.0 | 5.5 | 0.023 | 0.127 |

| 101.5 | 113.0 | 11.5 | 0.015 | 0.172 | ||||

| AG-182-24 | 42.31129 | (106.29219) | 140 | 100.0 | 112.0 | 12.0 | 0.014 | 0.168 |

| AG-183-24 | 42.31209 | (106.29182) | 140 | 100.0 | 102.5 | 2.5 | 0.037 | 0.093 |

| 105.0 | 108.5 | 3.5 | 0.014 | 0.050 | ||||

| 112.0 | 114.0 | 2.0 | 0.012 | 0.024 | ||||

| AG-184-24 | 42.31204 | (106.29146) | 140 | 96.0 | 99.5 | 3.5 | 0.055 | 0.193 |

| 100.0 | 110.5 | 10.5 | 0.014 | 0.147 | ||||

| AG-185-24 | 42.31220 | (106.29104) | 140 | 84.5 | 86.5 | 2.0 | 0.012 | 0.024 |

| 93.5 | 96.0 | 2.5 | 0.015 | 0.038 | ||||

| 98.0 | 103.0 | 5.0 | 0.018 | 0.090 | ||||

| 105.0 | 107.0 | 2.0 | 0.010 | 0.020 | ||||

| AG-186-24 | 42.31108 | (106.29362) | 140 | 112.0 | 121.0 | 9.0 | 0.062 | 0.558 |

| AG-187-24 | 42.31076 | (106.29367) | 140 | 115.0 | 117.0 | 2.0 | 0.033 | 0.066 |

| 117.0 | 129.0 | 12.0 | 0.012 | 0.141 | ||||

| AG-188-24 | 42.31065 | (106.29429) | 140 | 110.5 | 129.0 | 18.5 | 0.012 | 0.221 |

| AG-189-24 | 42.31040 | (106.29429) | 140 | 109.0 | 111.5 | 2.5 | 0.023 | 0.058 |

| 116.5 | 121.5 | 5.0 | 0.012 | 0.062 | ||||

| AG-190-24 | 42.31080 | (106.29329) | 140 | 108.5 | 113.5 | 5.0 | 0.093 | 0.465 |

| AG-191-24 | 42.31046 | (106.29470) | 160 | 124.5 | 132.0 | 7.5 | 0.015 | 0.113 |

| AG-192-24 | 42.31022 | (106.29472) | 140 | 111.0 | 116.0 | 5.0 | 0.012 | 0.062 |

| 117.5 | 127.0 | 9.5 | 0.017 | 0.162 | ||||

| AG-193-24 | 42.31029 | (106.29502) | 140 | 96.0 | 101.0 | 5.0 | 0.012 | 0.058 |

| 113.5 | 122.5 | 9.0 | 0.014 | 0.122 | ||||

| 124.0 | 130.0 | 6.0 | 0.016 | 0.096 | ||||

| AG-194-24 | 42.31015 | (106.29529) | 140 | 112.5 | 120.5 | 8.0 | 0.016 | 0.128 |

| AG-195-24 | 42.31095 | (106.29429) | 160 | 130.0 | 133.5 | 3.5 | 0.016 | 0.056 |

| Hole ID | Latitude | Longitude | Depth (ft) | Top (ft) | Bottom (ft) | Thickness (ft) | Grade % eU3O8 | Grade x Thickness |

| AG-196-24 | 42.31353 | (106.28906) | 140 | 96.0 | 100.0 | 4.0 | 0.029 | 0.116 |

| AG-197-24 | 42.31352 | (106.28869) | 140 | 97.0 | 103.0 | 6.0 | 0.013 | 0.078 |

| AG-198-24 | 42.31373 | (106.28866) | 140 | 97.0 | 105.0 | 8.0 | 0.033 | 0.266 |

| AG-199-24-MW | 42.31395 | (106.28670) | 125 | NOT LOGGED | ||||

| AG-200-24-MW | 42.31502 | (106.28512) | 130 | 82.5 | 97.5 | 15.0 | 0.116 | 1.740 |

Note: The geophysical results are based on equivalent uranium (eU3O8) of the gamma-ray probes calibrated at the Department of Energy’s Test Facility in Casper, Wyoming. A series E Century Geophysical logging tool with gamma-ray, spontaneous potential, resistivity, and drift detectors was utilized. The reader is cautioned that the reported uranium grades may not reflect actual concentrations due to the potential for disequilibrium between uranium and its gamma emitting daughter products.

- Mineralized holes with thicker, higher-grade intercepts are interpreted to be in the Near Interface, Nose (main front), or Near Seepage ground located within the projected roll front system.

- Mineralized holes with thinner, below cutoff grade intercepts are interpreted to be in the Limb/Tails or Remote Seepage ground located behind (altered) or ahead (reduced) of the projected roll front system, respectively.

- Non-mineralized holes are interpreted to be in the Barren Exterior ground located ahead of the projected roll front system in reduced ground.

- The drill results were determined using thickness and grade % cutoffs of 2-feet and 0.01% eU3O8.

The 2024 drilling was completed by Single Water Services utilizing a mud-rotary rig and the geophysical logging was completed by Hawkins CBM Logging, both of Wyoming with extensive experience in the uranium industry. Mr. Terrence Osier, PG, VP Exploration for Strathmore, was the supervising Geologist and oversaw the drilling activities and lithologic descriptions of the drilled cuttings which were sampled at 5-foot intervals. The drilling was completed on budget (US$275,000) and in a timely manner over a month’s time. The results of the exploration will be analyzed and assist in the layout of additional drill sites proposed for the Phase 2 drilling in autumn 2024.

New Claims Staked

In addition to exploration, the Company has expanded the project area by staking 18 new mining claims continuous to the current claim group, bringing the project total to 85 mining claims. The new claims cover ground where mineralization is anticipated to be on trend with recent and historical drilling. Strathmore plans to amend the drill permit following the Phase 1 drilling to include the new mining claims and anticipates exploration of the acquired ground in Phase 2 drilling later this year.

About the Agate Property

The Agate property consists of 85 wholly owned lode mining claims covering 1,756 acres. The uranium mineralization is contained in classic Wyoming-type roll fronts within the Eocene Wind River Formation, an arkosic-rich sandstone. Historically, 53 million pounds of uranium were mined in Shirley Basin, including from open-pit, underground, and the first commercial in-situ recovery operation in the USA during the 1960s. At the property, the uranium mineralization is shallow, from 20 to approximately 150 feet deep, much of which appears below the water table and likely amenable to in-situ recovery. Kerr McGee Corporation, the largest US uranium mining company at the time, drilled at least 650 holes across the project area in the 1970s, delineating several targets of potential mineralization.

About Strathmore Plus Uranium Corp. Strathmore is focused on discovering uranium deposits in Wyoming, and has three permitted uranium projects including Agate, Beaver Rim, and Night Owl. The Agate and Beaver Rim properties contain uranium in typical Wyoming-type roll front deposits based on historical drilling data. The Night Owl property is a former producing surface mine that was in production in the early 1960s.

Cautionary Statement: “Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release”.

Certain information contained in this press release constitutes “forward-looking information”, within the meaning of Canadian legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward looking statements contained in this press release may include statements regarding the future operating or financial performance of Strathmore Plus Uranium Corp. which involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com. The forward-looking statements included in this press release are made as of the date of this press release and Strathmore Plus Uranium Corp. disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Qualified Person

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed on behalf of the company by Terrence Osier, P.Geo., Vice President, Exploration of Strathmore Plus Uranium Corp., a Qualified Person.

Strathmore Plus Uranium Corp.

Contact Information:

Investor Relations

Telephone: 1 888 882 8177

Email: info@strathmoreplus.com

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/215737