Bob Moriarty

Archives

Sep 20, 2021

We are in the liquidity crisis that happens at the end of all roaring bull markets when the piper shows up at the door and demands to be paid. It’s something that both Bob Hoye and I have been predicting for months. Perhaps it will be laid at the feet of Evergrande but it really doesn’t matter. It was fated to happen and someone will always be blamed. The general stock market is about to start the biggest financial crash in history.

Think of the resource market in 2008 that topped in March and kept diving lower and lower into October and beyond. I did some research into the DSI of gold and silver back then. Gold hit a low of 11 and silver a DSI of 5 on September 11th of 2008. Remarkably gold and silver both hit 10 on September 16th of 2021. That should be a tradable low. And Monday September 20th is a full moon and that tends to mark both tops and bottoms. Look for an immediate but short-term bounce.

That is one of those good news-bad news deals though. We were undergoing a liquidity event in 2008 just as we are now. Everything was getting sold because they could sell it. That’s true today. What resource investors have to understand is that this is 100% temporary. Yes, shares are getting creamed but it will end and when the DOW and S&P are much lower, gold and resource stocks are going a lot higher. But gold and silver went sideways from September of 2008 for another four months. That could happen again.

So instead of whining about how low your stocks are, you need to be trimming the dead beats and putting in stink bids for the low hanging fruit. What you do over the next four months is literally going to make you rich or keep you poor. If you think this is a disaster, you are going to end up poor. If you understand what an incredible opportunity it is, you are going to be rich in a year. Bob Hoye says the time to buy gold shares will be November but I see a lot of low hanging fruit right now.

I have written a book a year for pretty much the last five or six years. They are especially valuable today because they will show you how to avoid being part of the crowd that always gets slaughtered.

If you have not read, Nobody Knows Anything or Basic Investing in Resource Stocks you are being either penny wise and pound foolish or just plain stupid. I tell people how to make money. There isn’t any magic to it. You have to make yourself learn to buy low and sell high. Right now the mass of investors is in a panic and trying to figure out how to sell so they can catch the bottom. This is the bottom, you need to be buying, not selling and I tell you how. You can read both books for under $10. If I was a total idiot doing nothing more that putting words on a page it would still be worth spending $10 in the hope that something I say makes sense.

Frankly in 2008 there were hundreds of interesting crapshoots in the resource market. But they were just crapshoots and most of them died on the vine, as they should have. The quality of stocks today is ten times higher. I am going to cover some of my favorites but there are dozens of quality companies out there with real stories selling for pennies. Unlike any other time frame for investing that I am familiar with, you have to take a global point of view. We are in the end phase that happens after every roaring stupid bull market where people pay silly prices for NFTs of farts. We are going to transition from paper assets to real assets.

But it’s a liquidity crisis and values of what has been booming are going to plummet overnight. You have to buy what will be valuable, not what the crowd has been chasing. Gold and silver are about to have their day. While the $305 billion collapse of Evergrande will be blamed at first, we are going to learn just how many companies have been swimming naked as the tide goes out.

Figure out the companies you would like to own. Put in really stupid stink bids that you know can never be filled. They will be.

For certain, one of the greatest stories of this particular resource cycle is that of Eloro Resources (ELO-V) my last piece on them was six weeks ago. Eighteen months ago the shares were selling for $.175. They hit a high of $5.89 in February of this year and have since corrected to $3.29. That’s a 44% correction that is perfectly normal.

What I am going to say right now is not based on any inside information but rather is based on my visits to hundreds of projects. Actually both Tom Larsen and Quinton Hennigh are far more conservative than I am on Bolivia. They are also dead wrong. The Iska Iska polymetallic deposit is going to be one of the biggest silver deposits in the world. It almost certainly will be the biggest tin project. I have been telling both of them for months that this is far bigger than they think.

Both started out by thinking they would like to see a four hundred or five hundred million tonne project. And they are missing the forest because of all the trees in the way. It’s a caldera. That’s the heat source. The whole damned thing is mineralized. It will be two to three billion tonnes at least of $100 rock. So think $200 billion or $300 billion worth of metal in the ground. And I’m being conservative. That ought to be worth something.

Eloro has been crippled by how long it has taken assay labs to get results to them. By all rights, they have the money to support ten drills turning and that is what should happen but they are 3,000 assays behind because of Covid. When you drill you have to know what you are hitting to know which direction to move. In normal times Eloro would already have a billion dollar market cap. As it stands they are only worth $203 million today in spite of having $21 million in the bank.

There is a second way to own Eloro and that is through Cartier Iron (CFE-C). They own 2.12 million shares of Eloro worth an interesting $6.6 million as of last Friday. For the longest time that was pretty much their entire market value but they do have an interesting gold project in Newfoundland. There is a 10,000-meter drill program in progress on the Big Easy project now but obviously assays are the same problem as everywhere else in Canada.

I wrote a piece earlier in the year talking about both companies, Eloro and Cartier. It is probably worth reading. While the Big Easy drill program is a crapshoot, the 2.12 million-share position in Eloro is like having money in the bank.

Eskay Mining (ESK-V) is another home run out of the park that is still way below the radarscope for most investors. At their peril. Granted, it does have a market cap of $344 million today with enough cash to go into next year before having to do a raise. Like Eloro it is one of the most incredible stories of this cycle. Two years ago the shares were $.075. They hit a high of $3.15 in early February of 2021 when assays showed a major VMS discovery. But two years ago Eskay seemed like a ten year long wet dream of Mac Balkam. He carried the company on his back, convinced he had a deposit similar to that of the original Eskay Creek Mine.

He’s wrong of course. What Eskay Mining has is far bigger than the original Eskay Creek deposit. We have to have a lot more assay information before we know about the grade. The Eskay Creek mine was exceptional and the assay labs in Canada are quoting sixteen weeks for assays today thanks to the idiots in government and their panic over a bad flu season.

The original Eskay Creek Mine was a hit or miss affair with the discovery only taking place on the 109th hole. Mac brought in Quinton Hennigh as an advisor over 2 years ago and he put together a team headed by Dr. John DeDecker with help of some serious VMS people from the Colorado School of Mines. They have done things right this time and done a lot of serious technical work that seems to be showing a whole slew of VMS deposits larger than the original Eskay Creek.

All deposits share certain similarities with others of the same breed. Porphyries tend to be very big and low grade. VMS deposits were originally on the sea floor as black smokers. They tend to occur in clusters. Mac knew this and believed it for years but never had the technical team that could put it all together. Now they have.

The company is well financed into next year so all the assays will be in before they need to tap the market again. If investors will go to the Eskay website there are so many pictures and so much information that if they said more they would be violating 43-101 rules. You can look at VMS material and know what you have. They have more than two major discoveries. My biggest question is who will be the most valuable in two years time, New Found Gold or Eskay? Both are going to be worth multiples of a billion dollars.

New Found Gold (NFG-V) is about as simple a story as you will ever find. They have tonnes of high grade gold in Newfoundland with some of the highest-grade intercepts in the last twenty years. Their initial hole was a discovery hole with a 19.2-meter hole showing 92.9 grams of gold per tonne. The shares shot from $1.85 a year ago to an amazing $13.50 in June before beginning a perfectly normal fifty percent correction.

New Found Gold raised a bunch of money and started drilling a 200,000-meter drill program on their Queensway project in Newfoundland. The company has nine drill rigs turning and will be adding an additional rig shortly. If you do not understand the story you have not been paying attention to the resource market. Here is the last piece I did on the company.

The Swan Zone at the Fosterville gold mine in Australia helped to take Kirkland Lake Gold from a $2 billion dollar market cap at the time of the merger in 2017 to a high of $18 billion. The Swan Zone was deep, expensive to mine and only had just over three million ounces of gold. The Keats/Lotto Zones at Queensway are much closer to the surface, similar grades to that of Fosterville and a lot more gold than the Swan Zone. If you don’t own any shares of NFG you are going to be at the airport when your ship sails in.

With all these stocks that are now the low hanging fruit, you need to be looking for those who have been hammered the most. An almost identical story to that of New Found Gold and on the same mineralized trend is that of Labrador Gold (LAB-V). Lab Gold is in the midst of drilling a 10,000 meter drill program at their 100% owned Kingsway project immediately northeast of New Found Gold. Lab Gold has four drill rigs turning and is generating the same sort of high-grade intercepts as that of New Found Gold.

Labrador Gold was as low as $.30 in March of this year before assay results started flowing showing that they are on the same structure as New Found Gold. The shares shot higher with each release until they hit a high of $1.85 in June.

I started selling some of my shares that I bought in the last year and some I had bought years ago for about a dime. If you are trying to prove just how smart you are, go ahead and marry good stocks with high potential. You can watch them go up and down like a bride’s nighty and you don’t make anything. If on the other hand you buy stocks to make money, you have to learn how to trade them in and out. You will have that opportunity every year. LAB has had a five hundred percent range in the last six months. If you can’t make a profit on a stock with that sort of range, you are going about it in the wrong way.

Trade the damn stocks like baseball cards. They are like lottery tickets. To profit you have to buy low and sell high, unlike the weak hands that want to buy high and sell low.

I make the perfectly valid point in my books that if nothing else has changed on a stock that you have fallen in love with except the price, when it tumbles, instead of seeing it as a problem, treat it as an opportunity and buy more. Lab Gold is a screaming good deal after a 60% drop in three months.

Sokoman Resources (SIC-V) is located in Newfoundland but west of where Lab Gold and New Found Gold are drilling. They had really great drill results for years but weren’t doing a great job of telling their story and as a result got little respect from the market. They talked to me in March. I was as direct with them as I am with everyone else I deal with. If you don’t tell your story, you don’t have a story.

I wrote the company up and all I did was put the information out that was already available. There was no magic to my piece other than I did a better job of telling the story. The stock shot higher and touched $.78 in June before starting a similar correction of 60% as did Lab Gold. So officially as far as I am concerned, nothing has changed except the price and it is cheap today.

There are some times when buying a stock has the potential for getting you into serious legal problems. Such is the case of White Rock Minerals (WRM-AX, WRMCF-OTCBB). If White Rock got any cheaper and you bought shares, the Bobbies would be at your door shortly thereafter for stealing. No shit. This is the most absurdly under priced stock I have ever owned.

White Rock is an Australian listed company with OTCBB listed shares for American and Canadian investors. It has a pair of world class potential projects in Alaska including a VMS project with a $3.5 billion dollar rock in the ground 43-101 and a couple of interesting gold projects worth drilling the crap out of. Alas they signed up a drill contractor who thought he was a hooker and he screwed them royally.

You have a short 100-120 day work period in Alaska. Winter ends late and starts early. If you don’t have drills and crews in place by late June you are screwed for the year. The drill contractor brought the drills but only half the men he promised. While that’s a common story in the north this year, it has cost White Rock tens of millions of dollars in lost market cap. They aren’t producing much in the way of drill core to be sampled. In addition the assay labs are 4-6 months backed up so they may as well be tossing a dart at a dartboard to know where to drill. Since Alaska has been the primary focus, investors are throwing in the towel at exactly the time they should be throwing money at White Rock.

In addition, WRM merged with AuStar Gold in August this year to acquire the Woods Point Gold project in Victoria in Australia with 670 square kilometers of exploration potential. The project is near the Fosterville Mine owned and operated by Kirkland Lake Gold. It includes the former Morningstar Gold mine showing past production of over 800,000 ounces of gold at 26 grams gold per tonne. Currently White Rock has one drill turning underground. The core from the drilling shows visual gold. Australia has the same problem with assays as the US and Canada so results will trickle in over the next few months.

White Rock did come up with incredible drill results already from the Red Mountain silver/zinc/lead VMS in Alaska. On the 16th they released the first assay for this year showing 0.2m @ 11.9% Zinc (Zn), 2.8% lead (Pb), 0.9% Copper (Cu), 63g/t silver (Ag), and 0.2g/t gold (Au), from 184.8m down hole. This polymetallic suite of metals can also be summarized as a 17.5% Zinc equivalent grade. That’s not a wide intercept but it does indicate the strike extends further than they realized. Remember this project already has $3.5 billion worth of high grade gold in the ground.

White Rock has another Australian asset in the Mt Carrington gold and silver project with 352,000 ounces of gold and 23.2 million ounces of silver in a JORC resource. That should be worth something.

WRM has been crippled this year by a lack of obvious progress in Alaska. I’m not concerned, the gold and silver are still there regardless of the lack of progress on the assay side. The current drilling at Morningstar could cause an overnight rerating of the shares. As of right now White Rock has a market cap of about $39 million Aussie with somewhere around $12 million in cash. I was adding to my already very large position a week or so ago at $.24 USD and thought I was robbing a bank. It’s $.19 USD now some 20% cheaper in a week.

I’m not going to spend a lot of time talking about Novo Resources (NVO-V). I wrote a book nine months ago just before they poured the first gold bar at Nullagine. What Became of the Crow? has been very well received with some of the highest ratings I have ever seen on any book. In the book I talk about a flight I made delivering a Rockwell 685 aircraft to Lang Hancock in 1976. I had Hancock’s son in law with me on the flight and I had to put up with 85 hours of him talking about how the Pilbara had the world’s highest grade banded iron formation consisting of 30% of the entire world’s reserve of iron.

Quinton Hennigh came up with a theory that says gold precipitated out of salt water in exactly the same way as iron did around 2.8 billion years ago when single cell creatures began to produce oxygen and that changed the chemistry of the water. His work in the Pilbara over the past dozen years has pretty much proven his theory. If iron and gold each precipitated out of salt water about the same time under the same conditions, if you have the world’s biggest iron deposit in the Pilbara (and they do) by necessity you have to have the world’s biggest gold deposit.

Novo is producing gold today. With a market cap down to right at $500 million CAD it is cheaper with less risk than it has been for years.

The biggest problem in Australia right now is the price of iron and it has blown the entire economy up. It’s about to get way worse. Iron hit an all time high price of about $215 USD in May of this year. That has caused chaos for everyone doing exploration work or mining anything other than iron in the country. The iron companies were throwing money at everyone with two basic attributes. As long as they were warm and had a heartbeat they could earn upwards of $25,000 a month. And everyone thought that was just wonderful.

Did I fail to mention we are in a liquidity event? Since May the price of iron has fallen off a cliff. Last Friday the price dropped under $100 a tonne. UBS predicts $89 a tonne average for next year. A lot of those warm bodies counting on paying off the mortgage this year and still having some spare change for a celebration Barbie are in for a rude awakening.

Labor has been a giant problem for every non-iron company in Australia. Novo has lost a lot of good people who ran over to the iron companies for higher wages. In addition, the iron companies raided every government agency to hire anyone who could spell ionr correctly. So permitting has slowed to a snail’s pace and labor turnover is literally out of control.

The liquidity event is not over, it has just begun and will be getting far worse sooner than anyone but Bob Hoye and me realize. But I suppose I should mention you now have a clue.

Lion One (LIO-V) in Fiji is well cashed up with $57 million in the bank, is permitted to begin construction of a mill and they have their own assay lab so they are not being held hostage by the failure of worldwide assay labs. But they were trying to run the project out of Perth since Australia has turned back into a prison colony. Prisoners don’t do a great job of running mining projects with the sole exception of they do a great job of busting up big rocks into small rocks.

Lion One has been trying to get two highly experienced exploration guys into Fiji for six months. I’ve flown through Fiji dozens of times. The people are industrious, hard working and intelligent. But they are not experienced in drilling and exploration without professional help and supervision. That exists now.

The guys got into the country a month ago and finished quarantine. Lion One now has six drills turning and I expect the shares to get back to all time highs in the next six months regardless of the giant crash we are in. They have millions of ounces of gold with a market cap of $172 million with $57 million in cash. I think Lion One is still my biggest position and I was buying shares at over $2. The shares are down 65% from their high but that isn’t going to last for long.

I-80 Gold (IAU-V) only went public in April at $2.36. It rocketed higher to $3.54 about ten days ago before dropping back to the current $2.52. The company has a $587 million market cap with a 770,000 ounces of high-grade gold deposit in the Granite Creek underground mine. IAU management is highly experienced in Nevada and is doing deals with other mining companies to combine resources.

Granite Creek has an average of +11 g/t gold but the material is refractory. I-80 plans on trucking the material over to an autoclave they control at Lone Tree.

In all categories and deposits, I-80 controls over 14 million ounces of gold. An almost $600 million market cap may seem expensive but that’s about $40 a resource ounce. It should probably be $120-$200 an ounce at the stage they are.

This year I-80 plans a 20,000-meter drill program at Granite Creek. The first assays came out three weeks ago and they were what the company hoped they would find, 51.1 meters of 6.8 g/t gold. Because the company has so many irons in the fire I highly suggest investors take a look at the company presentation because it is complicated to explain.

On occasion I do look at other companies that just resource companies. Someone came to me in the middle of the summer and wanted me to look at a young company that wants to use new technology to improve battery charging performance and behavior. I did and wrote about it. The company is called Neo Battery Materials (NBM-V). It went from about $.20 to $1.31 in a month. It continues to have extraordinary liquidity.

This is going to get a little technical.

It has been well known for years that to improve battery charging time and performance the battery manufacturers should use some form of silicon in the anodes. But the metal expands under charging and is not flexible. So companies are trying various forms of silicon nano particles or micro particles. The micro particles are eight to ten percent of the cost of the nano particles. NBM is achieving exceptional performance improvements through the use of micro particles while keeping their cost of production low. Such anodes stand to drive down battery costs on a dollar per kilowatt-hour basis that in turn will drive the cost of mass-market electrical vehicles lower.

The company is sending out samples on a daily basis of their proprietary silicon anodes to battery producers, the developers of solid-state batteries and automotive manufacturers. Since their initial tests are proving so productive NBM is planning upgrading a pilot plant to a semi-commercial facility with production of 120 tons of anodes per year that would supply anodes for up to forty thousand vehicles per year.

The next leg up in the lithium battery market will be the production of solid-state batteries. NBM has already achieved exceptional performance using a sulphides-based all solid-state electrolyte. This would also solve the flammability issues of current batteries in the market place.

NBM has some of the most experienced battery scientists in the world working with them with five patents already in hand. Similar companies in the silicon anode market place have market caps far higher than NBM’s $65 million. If you like the EV market, NBM offers attractive potential for price appreciation.

Goliath Resources (GOT-V) is another great stock that has gotten absolutely hammered in the last six weeks with the stock dropping from an all time high of $1.62 in August to $.76 on Friday for a 55% decline. I think that 100% of the issue is the criminal delay in assay results.

Company management has been posting a number of news releases giving the length of the intercept in terms of quartz-sulfide veining. And while in that neck of the woods that “should” be an accurate measure of grade potential $5 bucks and some quartz-sulfide veining “should” get you a small cup of coffee at Starbucks.

The Surebet Zone is in the Golden Triangle and actual assay results so far indicate a high degree of correlation between the sulfide veins and the actual gold and silver numbers. This is all part of a fully funded 6,000 meter drill program. In a liquidity crisis investors want, indeed, demand hard numbers. The price of the shares is back to where it was in May taking virtually all the risk out of buying the shares. And who knows, maybe assays will come in some day.

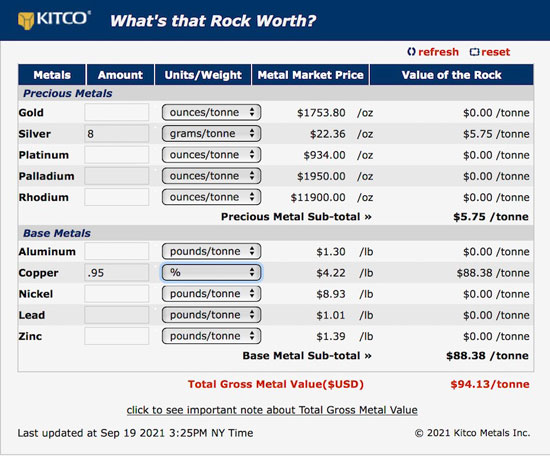

The next company, Solis (SLMN-V) is going to be a simple story to tell and for investors to understand. The company has an option on a copper project in Chile with a historic 10 million tonne resource of near surface high-grade copper/silver. At today’s prices that is worth $94.13 a tonne in USD or just short of a billion dollars.

(Click on image to enlarge)

The option calls for Solis to pay $5 million to the vendor over a four-year period and to invest $5 million in exploration over the same four years. That will get them 100% ownership subject to a 2% NSR. But Solis is not interested in a $940 million copper/silver project in Chile where the government just turned really stupid.

Solis believes the near surface mineralization comes from porphyry located about 300 meters down. Initial plans call for a 2,500 meter drill program on one of five different targets over a ten square km package identified with technical studies.

One of two things happens. They either hit what they are aiming for or they don’t. Should they hit the shares go to $500 million and current shareholders get rich. The market cap of the company today is $8.44 million. If you need me to work out the potential for you, you really should be investing in something safe like Evergrande or Tether.

Golden Lake (GLM-C) is another dead easy to understand company. The company has a $10 million market cap and is in the midst of a 6,000 meter drill program on their Jewel Ridge gold project in Nevada on the Eureka trend. Results to date show economic value of gold near surface.

Investors are not big fans of stocks found on the C-Exchange in a declining market but when the bull shows up again they get real popular. With a $10 million market cap and options on two highly potential projects, it’s a cheap lottery ticket.

Provenance Gold (PAU-V) is another story that is so cheap it screams, “Buy me. Buy me.” The market cap is a tiny $10 million; they have only 61 million shares outstanding. The company is operating in northern Nevada near the Idaho border. That’s interesting to me because company President Rauno Perttu (try bending your tongue around that Finnish origin name) believes the project is an analog of the Black Pine project just north of the border.

I have been to Black Pine twice and frankly I think the way they read the project is 100% correct. Given that Black Pine has a 2 million ounce gold resource starting at surface, a $10 million dollar company with a similar project is damned cheap. Liberty Gold has a market cap 26 times larger than Provenance.

Their primary project today is the White Rock oxide gold project. The project manager is Steve Craig and I have known him for years. He is one of the top geos in Nevada. Between Steve and Rauno, you have a first class management team. White Rock is one of those projects that everyone knows about but no one has ever gotten a real handle on. PAU management believes the project holds a near surface 3.2 by 1.6 oxide gold target. In the past operators were attempting to find the feeder structures.

Provenance theory holds that instead of trying to find the structures with blind drilling, they should simply drill serious stepout holes to define ounces. Last week they announced results from an 800-meter stepout hole showing 117 meters of gold mineralization starting from surface. The hole intercepted 85 meters of 0.369 g/t gold. Within that hole were higher-grade intervals of 0.778 g/t Au from 38 meters to 46 meters. In Nevada oxide gold of those grades is all economic. I believe those assays tend to prove their theory and there will be a lot more similar holes. That is exactly what Liberty Gold was finding at Black Pine.

This is one of the few stocks that has actually acted well over the past couple of months. It is so cheap that I took out a lottery ticket on it and bought some shares. If you buy stocks when they are cheap and sell them when they are dear, you can make a lot of money. It’s not rocket science.

The next six weeks is going to be incredibly dangerous and many people will be wiped out. I own most of these stocks and all of them are advertisers but the combination of a tiny DSI for gold and silver and a full moon on September 20th makes now an interesting time.

As always, I don’t share in your profit or your losses so you need to do your own due diligence. I am biased so take some responsibility for your own actions.

Eloro Resources Ltd

ELO-V $3.29 (Sep 17, 2021)

ELRRF-OTCQX 61.85 million shares

Eloro website

Cartier Iron Corp

CFE-C $.12 (Sep 17, 2021)

CRTIF-OTCBB 140 million shares

Cartier Iron website

Eskay Mining Corp

ESK-V $2.12 (Sep 17, 2021)

ESKYF OTCQB 160 million shares

Eskay Mining website

New Found Gold Corp

NFG-V $7.15 (Sep 17, 2021)

NFGFF-OTCBB 157.4 million shares

New Found Gold website

Labrador Gold Corp

LAB-V $.78 (Sep 17, 2021)

NKOSF-OTCQX 152.9 million shares

Labrador Gold website

Sokoman Minerals Corp

SIC-V $.35 (Sep 17, 2021)

SICNF OTCBB 200 million shares

Sokoman Minerals website

White Rock Minerals Ltd

WRM-AX $.275 Aussie (Sep 17, 2021)

WRMCF-OTCBB 142 million shares

White Rock Minerals website

Novo Resources Corp

NVO-T $2.04 (Sep 17, 2021)

NSRPF-OTCBB 245 million shares

Novo Resources website

Lion One Metals

LIO-V $1.12 (Sep 17, 2021)

LOMLF OTCQX 117.5 million shares

Lion One website

I-80 Gold Corporation

IAU-V $2.52 (Sep 17, 2021)

IAUCF-OTCQX 185 million shares

I-80 Gold website

NEO Battery Materials Ltd

NBM-V $.745 (Sep 17, 2021)

NBMFF OTCBB 87.4 million shares

NEO Battery Materials website

Goliath Resources Limited

GOT-V $.76 (Sep 17, 2021)

GOTRF OTCQB 55.1 million shares

Goliath Resources website

Solis Minerals

SLMN-V $.25 (Sep 17, 2021)

WMRSF OTCBB 87.4 million shares

Solis Minerals website

Golden Lake Exploration Inc

GLM-C $.17 (Sep 17, 2021)

GOLXF OTCBB 59.7 million shares

Golden Lake website

Provenance Gold Corp

PAU-C $.155 (Sep 17, 2021)

PVGDF OTCBB 61 million shares

Provenance Gold website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd