What will the stock market look like in 2025, a year that has started grimly with catastrophic fires burning in California and dangerous snow and ice blanketing the east even before the presidential inauguration?

While interviewing 321gold’s Bob Moriarty this week on CEO & Market Expert Interviews on YouTube, Lucijan Valkovic said his own unofficial private polling found that 95% of people he asked said the market is heavily overvalued and is “about to crash or correct big.”

Moriarty said that while he was a “contrarian,” and it scares him “when 95% of people agree on anything,” the market is “clearly in a bubble.”

“The stock market is a giant bubble in search of a pin,” said Moriarty.

“There are some immense forces in play (and) no one can really predict what’s going to happen,” he said. “However, it’s very easy to predict whatever happens is going to be bad. So, my belief is the stock market’s an accident waiting to happen. And it’s like Bitcoin, you’ve got a lot of people playing musical chairs. And everybody thinks when the music stops, they’re going to be able to reach a chair. And there’s one slight problem with that theory, . . . and that is, what if there’s no chairs?”

Moriarty predicted the fall would be worse than 1929, “much worse.”

“We are going to go through pain, and it’s going to be extreme pain because this economy is so far out of whack,” he said.

Precious Metals as Insurance Policies

How to protect yourself? “You should put your money in something that is not part of the bubble,” Moriarty said.

“I happen to believe the highest value of precious metals is not their investment potential; it’s their potential as an insurance policy against chaos,” he said. “But the cheapest thing in the world right now is resource stocks. They’re literally being given away.”

The world’s central banks have “added significant amounts of gold to their reserves in recent years — and their buying continues even as gold’s price reaches new highs,” Sharon Wu reported for CBS News in December.

“While the precious metal offers unique protections during economic uncertainty, it also comes with challenges,” she wrote. “Storage costs and lack of income generation, for example, make it a complex investment choice.”

However, Valkovic noted that central bank gold purchases are expected to continue this year.

Gold and silver are insurance policies “against financial chaos,” Moriarty told him. “We all need reserves. You need it as an individual. You need it as a family. You need it as a town or city. You need it as a country. And you certainly need it as a bank.”

Moriarty said the banks are looking at the world and the state of the economy and deciding they need extra protection from negative events.

“There are some very dangerous black swans flying, and we need to protect ourselves,” he said. ” And that’s exactly the reason that individuals should be doing the same thing.”

Could Silver Outperform Gold?

Both gold and silver recently hit four-week highs, and gold is expected to have another solid year, but investors should brace for some volatility and temper their upside expectations, Kirill Kirilenko, Senior Analyst at CRU, told Kitco News’ Neils Christensen.

But he predicted gold prices would average around US$2,580 per ounce in 2025 as markets react to Trump’s proposed economic policies. The analyst had more optimism for silver, forecasting an average price of US$31.35 per ounce for the year.

“Silver could slightly outperform gold this year, driven by an increasingly tight fundamental outlook,” he said.

The British research firm expects silver, which as nature’s most conductive metal remains integral to the green energy transition, to remain well-supported.

Moriarty gave another reason for looking at the white metal. “Silver is absurdly cheap,” he said. “My belief is if you’re faced with three or four different alternatives for investing, you should buy what’s cheap, and you should save.”

While gold recently reached a zenith, silver’s top amount of US$49.95 per ounce was hit in 1980. It was US$30.57 per ounce on Friday at the time of writing.

“Silver has got a long way to run,” Moriarty said. “My opinion is silver will always be the most attractive investment in the resource sector.”

Nuclear: Very Cheap, Very Safe

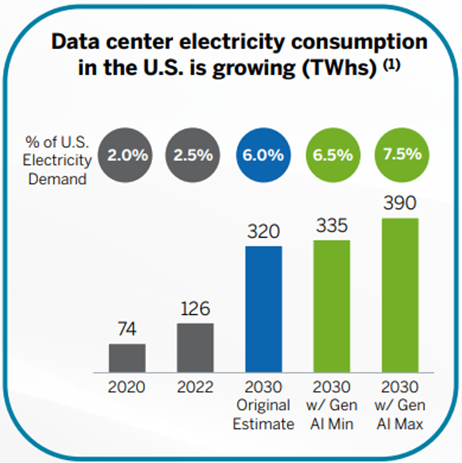

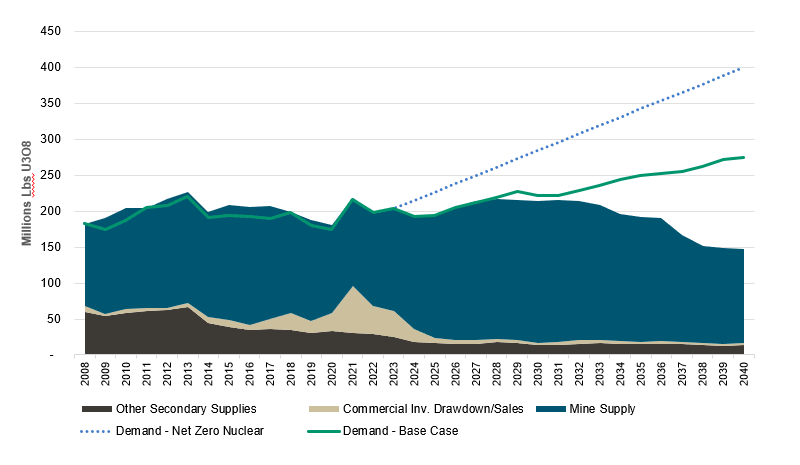

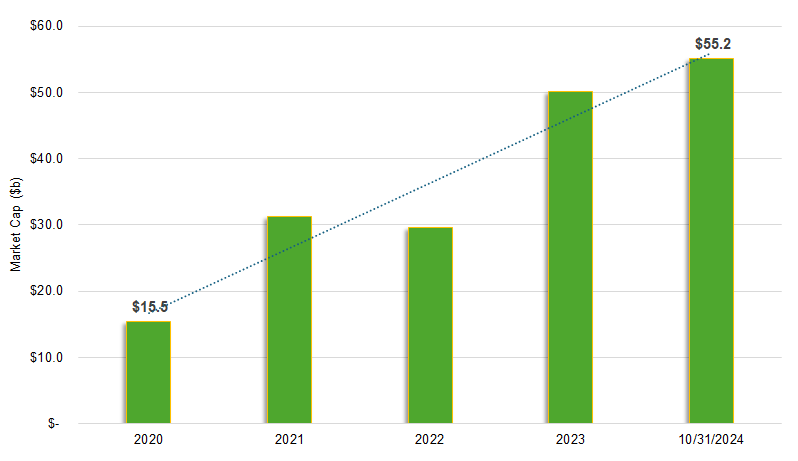

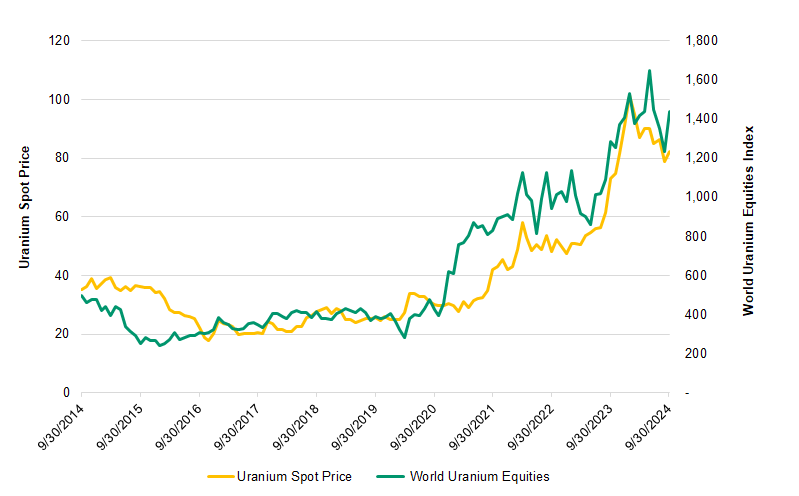

Moriarty also said he saw uranium stocks performing well as artificial intelligence (AI) and a surging number of data centers recently helped push the price for element, the main fuel for nuclear reactors, to a record high, according to a Yolowire release posted on Barchart.

Prices for enriched uranium rose to US$190 per separative work unit, the commodity’s standard measure, which is up 239% from US$56 three years ago,” according to the report.

“A resurgence of interest in nuclear power has come as governments and companies source carbon-free power to service major industrial facilities and communities,” the release said.

“Nuclear power is a very cheap, very safe form of energy,” Moriarty said. “And we need more of it. … Green energy has been oversold. It is not a solution. It is a very expensive problem.”

But which uranium stocks to invest in? “I think you could walk into a dark room, and you could put the names of the stocks up on a wall. You could shut the light off and throw a dart, and hit something. Uranium is very cheap.”

Moriarty said he doesn’t know which bubble will burst first. But “we’ve got a lot of bubbles, and it is a time for safety, and in a time for safety, you go for what is the least bubbly,” he said.

“The least bubbly, I like that,” agreed Valkovic.

| Want to be the first to know about interesting Gold, Silver, Special Situations and Uranium investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.