Vancouver, British Columbia–(Newsfile Corp. – September 27, 2024) – Dolly Varden Silver Corporation (TSXV: DV) (OTCQX: DOLLF) (the “Company” or “Dolly Varden“) is pleased to announce the closing of the second and final tranche of its previously announced bought deal financing (the “Offering“) for additional gross proceeds of $4,500,000 from the issuance of 3,600,000 FT Shares (as defined below). The aggregate gross proceeds to the Company from the completion of the Offering (including the gross proceeds raised from the completion of the first tranche of the Offering on September 4, 2024) is $32,200,000, from the issuance of:

- 11,500,000 common shares of the Company (“Common Shares“) at a price of $1.00 per Common Share for gross proceeds of $11,500,000, issued under a prospectus supplement dated August 21, 2024 to the Company’s final short form base shelf prospectus dated April 25, 2023 (“Prospectus Offering“), including the full exercise of the over-allotment option under the Prospectus Offering; and

- 16,560,000 Common Shares that qualify as “flow-through shares” within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “Tax Act“) (each, a “FT Share“) at a price of $1.25 per FT Share for gross proceeds of $20,700,000, on a bought deal private placement basis (“Private Placement Offering“), including the full exercise of the over-allotment option under the Private Placement Offering.

The Offering was completed on a bought deal basis pursuant to an underwriting agreement dated August 21, 2024 (the “Underwriting Agreement“) between the Company and a syndicate of underwriters co-led by Research Capital Corporation, as co-lead underwriter and sole bookrunner, and Haywood Securities Inc., as co-lead underwriter, and including Raymond James Ltd. (collectively, the “Underwriters“). Eventus Capital Corp. is a special advisor to the Company.

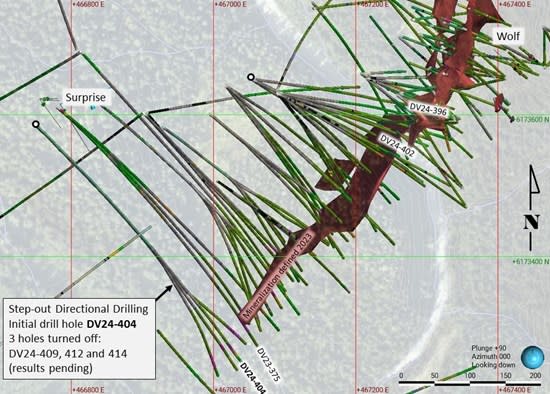

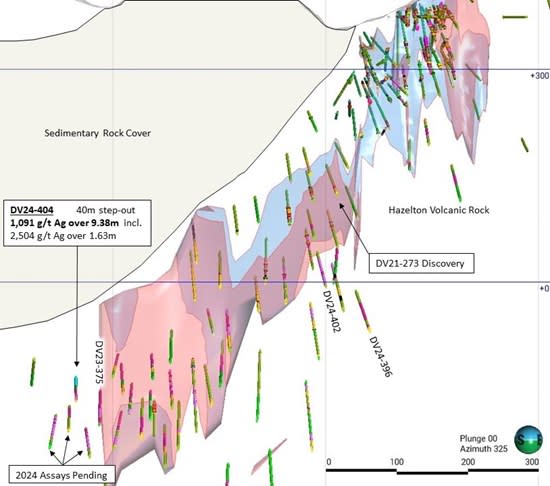

The net proceeds from the sale of Common Shares will be used for working capital and general corporate purposes. The gross proceeds from the sale of FT Shares will be used for further exploration, mineral resource expansion and drilling in the combined Kitsault Valley project, located in northwestern British Columbia, Canada, or any other eligible Canadian property of the Company, as well as for working capital as permitted, as Canadian Exploration Expenses as defined in paragraph (f) of the definition of “Canadian exploration expense” in subsection 66.1(6) of the Tax Act and “flow through mining expenditures” as defined in subsection 127(9) of the Tax Act that will qualify as “flow-through mining expenditures” and “BC flow-through mining expenditures” as defined in subsection 4.721(1) of the Income Tax Act (British Columbia), which will be incurred on or before December 31, 2025 and renounced with an effective date no later than December 31, 2024 to the initial purchasers of FT Shares.

The FT Shares issued pursuant to the closing of the second tranche of the Private Placement Offering are subject to a hold period in Canada expiring on January 28, 2025. The Common Shares issued pursuant to the Prospectus Offering are not subject to a statutory hold period.

In connection with the closing of the second tranche of the Offering, the Underwriters received a cash fee equal to $225,000, representing 5.0% of the gross proceeds of the second tranche of the Private Placement Offering.

This press release is not an offer to sell or the solicitation of an offer to buy the securities in the United States or in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to qualification or registration under the securities laws of such jurisdiction. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from U.S. registration requirements and applicable U.S. state securities laws.

About Dolly Varden Silver Corporation

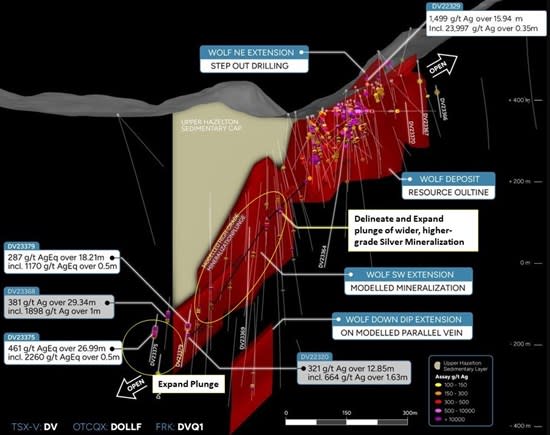

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. These forward‐looking statements or information relate to, among other things the expected use of proceeds from the issuance of the Common Shares and the FT Shares, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; and the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-609-5137, www.dollyvardensilver.com.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/224796