VANCOUVER, BC / ACCESSWIRE / January 10, 2024 / Metallic Minerals Corp. (TSXV:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce results from its fall 2023 exploration drilling campaign at the Company’s 100%-owned, 171 square kilometer (“km2″) Keno Silver project, adjacent to Hecla Mining (“Hecla”) in the high-grade Keno Hill silver district of Canada’s Yukon Territory. The 2023 exploration program included 1,112 meters (“m”) in four diamond drill holes focused on expansion of the Formo target in the West Keno area, which is on trend with the 100 million-ounce (“Moz”) historic Hector-Calumet mine controlled by Hecla.

Drill hole FOR23-03 represents one of the best intercepts to date for the Keno Silver project, returning grades of 256 grams per tonne (g/t) silver equivalent recovered (“Ag Eq”) over 46 m. This is also the deepest intercept to date on the Formo vein structure (only 275 m vertically from surface) and mineralization remains fully open down dip and along strike. Formo is anticipated to be one of the highest grade and largest contributors to the forthcoming inaugural NI-43-101 mineral resource estimate for the Keno Silver project, currently nearing completion by SGS Geological Services.

2023 West Keno Exploration Highlights

- High-grade silver (“Ag”), lead (“Pb”), zinc, (“Zn”) and significant gold (“Au”) mineralization was encountered in all four 2023 drill holes (See Table 1) which will contribute to the pending NI 43-101 Mineral Resource Estimate for the project.

- Both high-grade Ag-Au-Pb-Zn vein-style mineralization and broader zones of bulk tonnage Ag-Au-Pb-Zn mineralization comprised of high-grade vein intervals and associated stringers and stockwork veining were encountered.

- FOR23-03 returned 256.8 g/t Ag Eq (99.1 g/t Ag, 0.52 g/t Au, 0.65% Pb, 2.62% Zn) over 46.05 m with multiple internal higher-grade zones including, 3.3 m of 1,413.45 g/t Ag Eq (562.4 g/t Ag, 0.20 g/t Au, 2.35% Pb and 20.3% Zn). The bulk tonnage interval of this hole represents one of the highest gram-meter (g/t Ag Eq x interval thickness) intervals on the Keno Silver project to date, and extended mineralization by 140 m from the nearest 2022 and historic drill holes.

- FOR23-04, a large step-out hole, drilled nearly 250 m west of the nearest Formo vein drilling, returned four separate silver-dominant vein structures of considerable width providing additional confirmation of the potential for on-strike expansion of the Formo target.

- The Formo target remains open to further expansion, down-dip and on-trend, and shows potential for new discoveries within the Formo property footprint.

Metallic Minerals President, Scott Petsel, stated, “The Formo target is an exciting, advanced exploration stage “resource-ready” target with significant room to grow featuring both high-grade and bulk mineable widths that make it amenable to lower-cost mining methods. The Formo target is ideally located near infrastructure as it is adjacent to the Silver Trail highway (Highway 11) and power lines that feed the central Keno Hill mill. It also directly adjoins Hecla’s Keno Hill property, where Hecla is actively mining the nearby Bermingham mine. We are excited to be able to include these new drill results in our upcoming inaugural resource for the Keno Silver project as these results at Formo continue to demonstrate our ability to build a significant resource base for the project. The resource estimate is expected to be complete in Q1 2024.”

“In addition, the Company looks forward to meeting with interested investors at the upcoming Vancouver Resource Investment Conference, AMEBC Mineral Roundup and Prospectors and Developers annual conferences where Metallic Minerals has been invited to display drill core from its 2023 exploration programs at La Plata and Keno Silver. We anticipate reporting additional results from the Keno Silver project and La Plata projects over the next few weeks.”

Upcoming Events

Vancouver Resource Investment Conference (VRIC)

Metallic Minerals and fellow Metallic Group members, Granite Creek Copper and Stillwater Critical Minerals, in Booth #112 at the 2024 VRIC event, January 21 and 22, 2024. For more information click here.

AMEBC Mineral Roundup Core Shack

Metallic Minerals will be displaying core from the 2023 drill season at the upcoming AMEBC Mineral Roundup event held in Vancouver, BC January 22 to 25, 2024. For more information click here.

Prospectors and Developers Association of Canada Annual Convention (PDAC)

Metallic Minerals will be displaying core from the 2023 drill season at the La Plata project during the PDAC convention held in Toronto, March 3 to 6, 2024. For more information click here.

Table 1 – Highlights of 2023 Drill Results from the West Keno – Formo Target Area

| DDH Hole ID | From (m) | To (m) | Length (M) | Recovered Ag Eq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| FOR23-001 | 148.74 | 149.43 | 0.69 | 499.23 | 3.6 | 6.20 | 0.00 | 0.01 |

| and | 196.95 | 215 | 18.05 | 234.45 | 121.4 | 0.05 | 1.22 | 2.06 |

| including | 196.95 | 198.9 | 1.95 | 513.39 | 300.3 | 0.07 | 2.71 | 3.74 |

| also incl | 208.4 | 214 | 5.6 | 478.25 | 241.0 | 0.10 | 2.41 | 4.43 |

| with | 208.4 | 211.2 | 2.8 | 687.57 | 367.9 | 0.18 | 4.02 | 5.37 |

| FOR23-002 | 172.3 | 173.35 | 1.05 | 67.04 | 3.5 | 0.79 | 0.01 | 0.01 |

| and | 218 | 221 | 3 | 131.42 | 51.9 | 0.38 | 0.35 | 1.07 |

| incl | 218.75 | 219.75 | 1 | 277.81 | 137.0 | 0.00 | 0.96 | 3.08 |

| FOR23-003 | 239.95 | 286 | 46.05 | 256.82 | 99.1 | 0.52 | 0.65 | 2.62 |

| including | 239.35 | 263.65 | 23.7 | 462.37 | 176.0 | 1.0 | 1.13 | 4.67 |

| with | 239.35 | 245.5 | 5.5 | 406.57 | 46.6 | 4.07 | 0.49 | 0.60 |

| and with | 255.8 | 263.65 | 7.85 | 899.27 | 392.4 | 0.13 | 2.06 | 11.68 |

| including | 260.35 | 263.65 | 3.3 | 1,413.45 | 562.4 | 0.20 | 2.35 | 20.30 |

| with | 260.75 | 261.5 | 0.75 | 1,411.76 | 994.0 | 0.03 | 3.01 | 7.36 |

| and with | 262.05 | 263.65 | 1.6 | 1,769.44 | 416.0 | 0.39 | 2.64 | 32.32 |

| and | 284 | 286 | 2 | 302.55 | 116.5 | 0.03 | 1.07 | 4.07 |

| FOR23-004 | 122 | 124.46 | 2.46 | 76.62 | 43.7 | 0.11 | 0.33 | 0.43 |

| and | 153.5 | 154.1 | 0.6 | 284.52 | 154.0 | 0.09 | 1.67 | 2.14 |

| and | 177.5 | 183 | 5.5 | 72.95 | 61.2 | 0.00 | 0.28 | 0.18 |

| including | 179 | 180.75 | 1.76 | 144.67 | 130.0 | 0.00 | 0.46 | 0.21 |

| and | 300.3 | 301 | 0.7 | 83.26 | 5.6 | 0.97 | 0.01 | 0.00 |

Notes to reported values:

- Ag equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $22.0/oz silver (Ag), $1,850/oz gold (Au), $1.00/lb lead (Pb), $1.40/lb zinc (Zn).

- Recovered Silver Equivalent in Table 1 is determined as follows: Ag Eq g/t = [Ag g/t x recovery] + [Au g/t x recovery x Au price/ Ag price] + [Pb % x 10,000 x recovery x Pb price / Ag price] + [Zn% x 10,000 x recovery x Zn price / Ag price].

- In the above calculations: 1% = 10,000 ppm = 10,000 g/t.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 95% for precious metals (Ag/Au) and 90% for all other listed metals, based on recoveries at similar nearby operations.

- Intervals are reported as measured drill intersect lengths and do not represent true width.

Figure 1. Keno Silver District Geology and Deposits

West Keno and the Formo Target Area

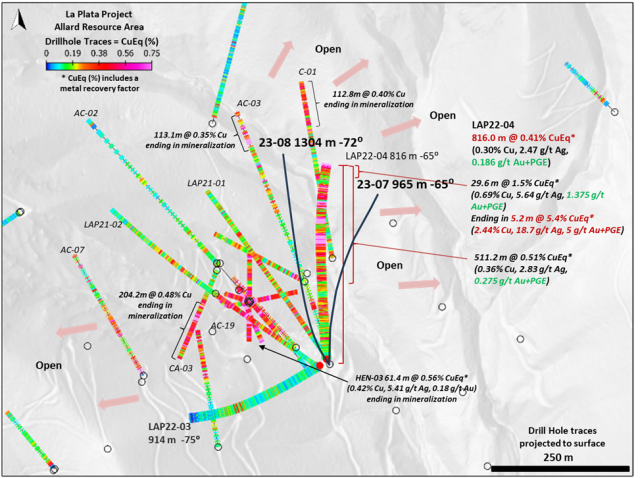

The Western Keno Hill district is host to the largest historic production and current resources in the prolific Keno Hill silver district. The Formo target is located at the intersection of a north-easterly structural zone extending from the Hector-Calumet mine, which was the largest producer in the district producing nearly 100 million ounces of silver and the Elsa structural trend, which was the second largest silver producer in the district (see Figure 2).

The Formo property, which includes the historic Formo Mine, was acquired by Metallic Minerals in 2017. The historic Formo mine produced high-grade silver at various times since the 1930s from high-grade vein structures that graded over 1,000 g/t silver1. Significant underground exploration drifts were developed in the 1950s with most of the historic production from an open pit located alongside of the Silver Trail highway between the Elsa townsite and Keno City and last mined in the 1980s.

The primary Formo vein structure is exposed at surface in an open cut. Multiple veins have been encountered in the target area that demonstrate an association with Triassic greenstones in the Earn group schist, similar to the Sadie Ladue deposit which produced 12.7 Moz silver at a grade of 1,620 g/t Ag1. In addition to the mineralization at the known Formo target, two new surface targets have been identified through soil and rock sampling along the same structural corridors that show potential to host high-grade and bulk tonnage Keno-style Ag-Au-Pb-Zn veins on the Formo property (Figure 2).

Since 2020, Metallic Minerals has drilled 26 holes (4,419 m) at the Formo target building on the six core holes and 54 percussion holes drilled by previous owners between 1980 and 1981. The Formo target is open to significant expansion down dip and along trend with several newly identified targets for drill testing (Figure 2 and 3 below).

Figure 2 – West Keno and Formo Target Plan Map

Figure 3 – Formo Target Cross Section (Looking East)

Pending 43-101 Mineral Resource Estimate for Keno Silver Project

The upcoming inaugural independent 43-101 mineral resource estimate is focused on four initial deposits across the Keno Silver project, including: Formo, Caribou, Fox and Homestake. These four deposits are the most advanced of over 40 identified target areas, each of which is characterized by a kilometric scale Ag in soil anomaly, exposed outcropping high-grade veins, and varying levels of exploration activity or historic production. Metallic Minerals has completed 165 drill holes totalling 18,983 m of combined reverse circulation and diamond core drilling at the Keno Silver project since 2017 on a total of 11 targets, all of which have returned encouraging results. The four most advanced “resource-ready” targets will be part of the upcoming mineral resource estimate being completed by SGS Geological Services and include:

- Formo Target – In the West Keno District, it demonstrates potential for lower-cost bulk tonnage mining or high-grade selective methods with drill highlights including:

- Hole FOR22-04 – 20.87 m @ 220.5 g/t Ag Eq (144.6 g/t Ag, 0.70% Pb, 1.59% Zn), and 1.63 m @ 1,487.19 g/t Ag Eq (1,049 g/t Ag, 4.21% Pb, 9.45% Zn)

- Hole FOR21-05 – 19.8 m @ 216.26 g/t Ag Eq (70 g/t Ag, 0.41 g/t Au, 0.30% Pb, 2.07% Zn) and 0.7 m @ 1,405 g/t Ag Eq (421.0 g/t Ag, 0.15 g/t Au, 1.53% Pb, 24.2% Zn)

- Hole FOR20-003 – 3.0 m @ 2,954.52 g/t Ag (1,568 g/t Ag, 29.45% Pb, 1.35% Zn)

- Caribou Target – In the Central Keno target area the Caribou target historically produced very high-grade material from a shallow surface pit grading more than 6,000 g/t silver.

- Fox Target – Discovered by Metallic Minerals in 2020 in the East Keno target area, the Fox target is characterized as a newly recognized bulk tonnage style of mineralization with shallow-dipping sheeted vein sets up to 177 m in width. Drilling since 2020, has defined a bulk-tonnage mineralized block over 300 m along strike and 150 m down-dip from surface which is open in all directions.

- Homestake Target – A historic producer, the Homestake target in the Central Keno area is fractally spatial with the districts’ giant past producers and current resources (Silver King, Elsa, Bermingham, Hector Calumet, Flame & Moth and Bellekeno) near the contact of the Keno Hill Quartzite and Sourdough Hill formations. With only 88 drill holes (slightly over 5000 m of drilling), and a strike length over 2 km the Homestake target represents considerable resource opportunity and exploration potential.

Metallic Minerals sees considerable opportunity for resource growth from target expansion and new discovery with the further systematic application of exploration, including the expansion of detailed soil geochemical grids, “resource-ready” target expansion through drilling and reconnaissance drilling of early-stage targets.

About Metallic Minerals

Metallic Minerals Corp. is focused on copper, silver, gold, and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

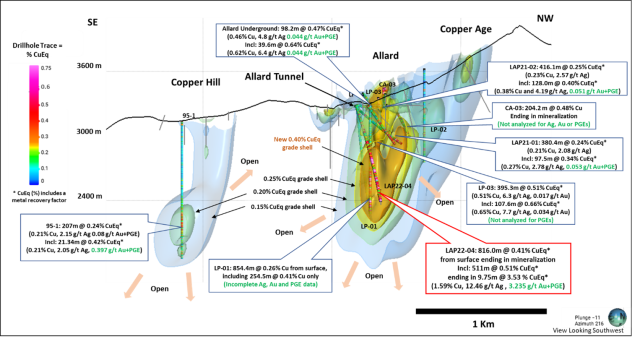

At the Company’s La Plata project in southwestern Colorado, the new 2023 NI 43-101 mineral resource estimate identifies a significant porphyry copper-silver resource containing 1.21 Blbs copper and 17.6 Moz of silver3. The 2022 expansion drilling provided the basis for the updated resource, including the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited (acquired by Newmont Mining in 2023) to accelerate the advancement of the Company’s La Plata project. In the 2023 Fraser Institute’s Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company’s (“Hecla”) operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla, the largest primary silver producer in the USA and third largest in the world, is anticipating full production at its Keno Hill operations by the end of 2023. An inaugural mineral resource estimate on the project is expected in early 2024, with an 1,112-meter expansion drill program completed at the Formo target during fall of 2023.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the Discovery Channel television show, Gold Rush.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. The Company is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

Footnotes:

- Cathro, R. J., Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, Sept. 2006. ISSN 1911-4850.

- Alexco Resource Corp Technical Report, titled “NI 43-101 Technical Report on Updated Mineral Resource and Reserve Estimate of the Keno Hill Silver District” with an effective date of April 1, 2021, and issue date of May 26, 2021.

- See news release dated July 31, 2023. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards. The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% Cu Eq, based on metal prices of $3.75/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Taylor Haid, P. Geo, Project Manager for TruePoint Exploration, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Assurance / Quality Control

All samples were prepared by Bureau Veritas’ (BV) Whitehorse, Yukon facility and geochemically analyzed at the BV laboratory in Vancouver, British Columbia. All samples were prepared using BV code PRP70-250, which crushed, split, and pulverized 250 grams of core to 200 mesh pulps. These pulps were then analyzed by 37 Element 1:1:1 Aqua Regia Digestion followed by Inductively Coupled Plasma Mass Spectrometry (ICP-ES/MS) analyses (BV Code AQ202). Over-limit silver, lead, and zinc samples were further analyzed with multi-acid digestion and atomic absorption spectrometry (BV Code MA404). Samples with over-limit gold (and silver when over-limit was reached via multi-acid) were re-analyzed using a 30-gram fire assay fusion with gravimetric finish (BV Code FA530).

All results have passed the QAQC screening by the lab and the company utilizes a quality control and quality assurance protocol for the project, including insertion of blanks, duplicates, and certified reference materials approximately every tenth sample. Certified reference materials were acquired from OREAS North America Inc. of Sudbury, Ontario, and CDN Resource Laboratories Ltd. Of Langley, British Columbia for the 2023 drill program at the Keno Silver project.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on accesswire.com