Website| https://provenandprobable.com/

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals – https://www.milesfranklin.com/

Website| https://provenandprobable.com/

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals – https://www.milesfranklin.com/

Goldshore Resources – (TSX.V: GSHR | OTCQB: GSHRF)

Website: https://goldshoreresources.com/

3D Deck: https://goldshoreresources.com/investors/#corporate-presentation

Goal: To Create the Next Tier One Asset in Ontario, Canada.

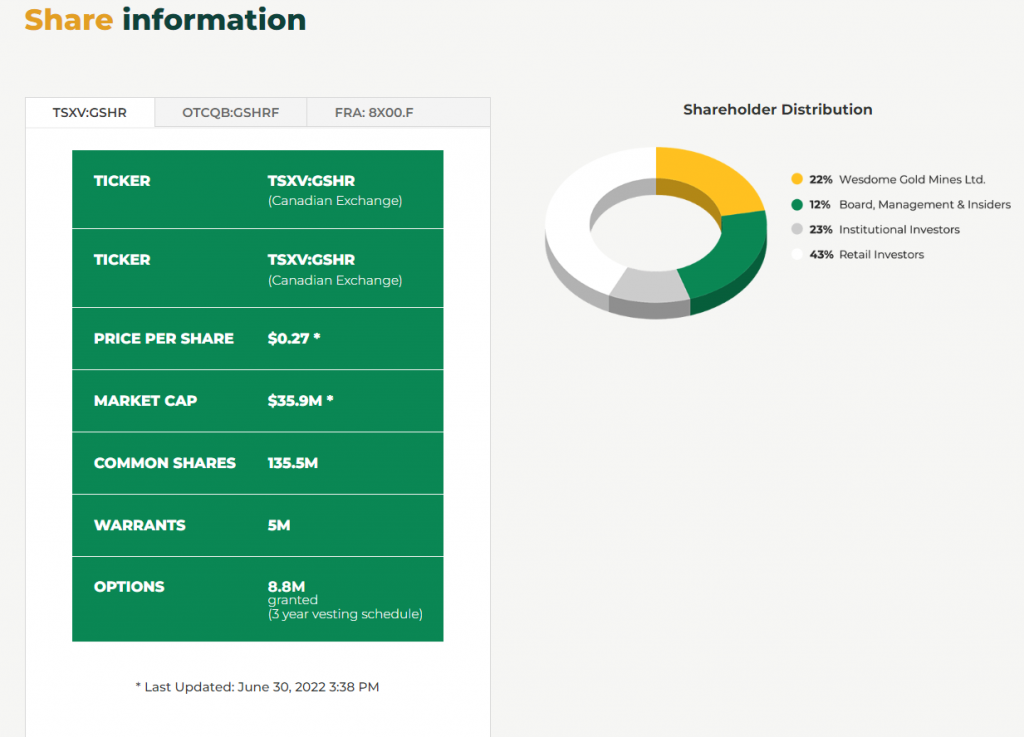

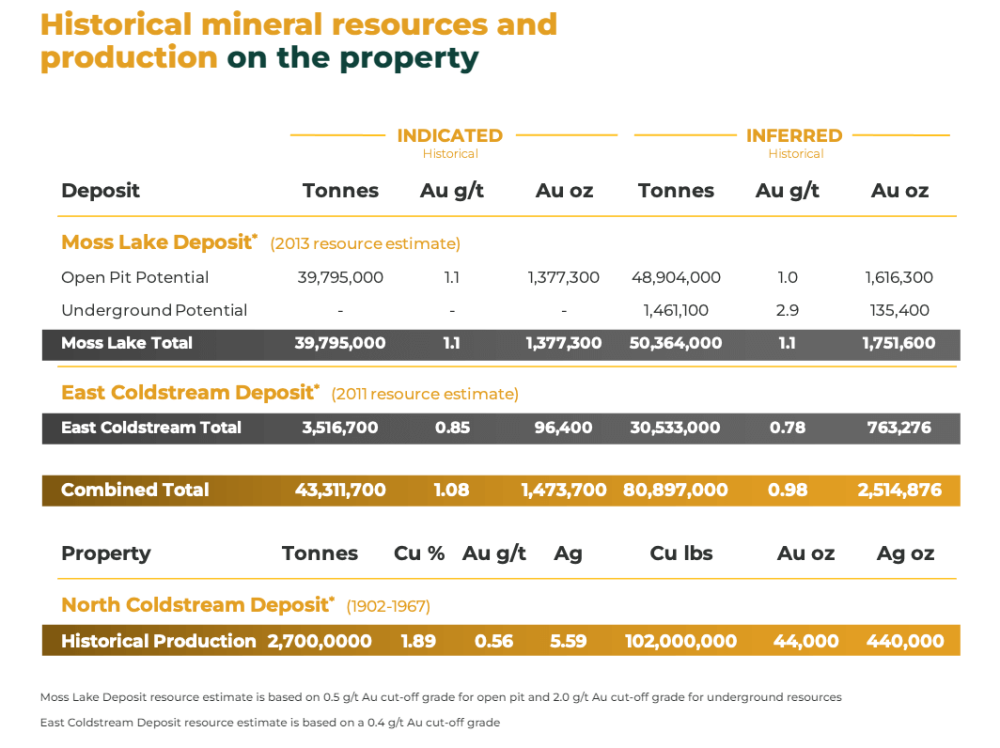

Flagship Project: The Moss Lake Property located in Ontario, Canada has 1.47 M oz of Indicated and 2.51 M oz of Inferred historical gold resources, along with a robust Preliminary Economic Assessment conducted in 2020.

Joining us for our conversation is Brett Richards, the CEO of Goldshore Resources.

Maurice Jackson: Mr. Richards, it’s a pleasure to be speaking with you today as Goldshore Resources has some exciting news for shareholders, as the company continues on its path to creating the next Tier One asset in Ontario, Canada. Mr. Richards, for someone new to the story, please introduce us to Goldshore Resources and the exciting opportunity the company presents to shareholders.

Brett Richards: Goldshore is a company that was formed last year. We’ve been trading for just over a year now, and on the back of acquiring the Moss Lake Project from Wesdome Gold Mines for $52 million in cash and shares last year, we have put together a strategy over the last nine months to drill this up to let’s call it critical mass. What we acquired in the Moss Lake Project was a 4 million-ounce historic resource, and our view is that the extensions of this resource, both laterally along strike and at depth, are significant, particularly along strike.

Our original strategy was let’s put together a 100,000-meter drill program. Let’s get financed and let’s get on with it, and that’s what we’ve been doing for the past nine months, and most recent results are starting to I’ll say support the original thesis we had about Moss Lake being much bigger than first thought.

Maurice Jackson: Before we deep dive into the press release, some important competitive advantages distinguish Goldshore Resources from its peers and truly make the Moss Lake property a unique value proposition. Mr. Richards, for someone new to the flagship Moss Lake property, please acquaint us with the deposit, beginning with your location and some of your neighbors in the region.

Brett Richards: The Moss Lake Property is about 120 kilometers northwest of Thunder Bay in Ontario. We are probably in the most mining-friendly jurisdiction in the world, plus we are on the Trans-Canada Highway, Yonge Street in Toronto, which happens to be the longest street in the world, going all the way to Manitoba. Our concession is adjoined to Trans-Canada Highway.

And why is that important? It’s important for several reasons, particularly about infrastructure. When I look at mining projects, at the end of the day, obviously there’s the technical side of things, but there’s also what I call the do-ability factor. Is this mine really doable? Can you get this into production easily? And the answer for Moss Lake is yes.

Being on the Trans-Canada Highway means we’re afforded 10-cent kilowatt-hour power, which goes right by our doorstep. We have a four-lane highway, so access to our site is as good as it gets. We have power, water, rail, people, consultants, contractors, and government, all within nothing more than an hour’s drive into the City of Thunder Bay, and an international port and an international airport. So, we tick all the boxes when it comes to infrastructure, so that is kind of, I’ll say the description of where we are, and why I think it’s so compelling to be where we are.

There are a lot of people around us as well. The Shebandowan Greenstone Belt where we’re located has been a bit under-explored over the years because low-grade bulk tonnage style deposits were not in favor when gold was $1,500. But now gold is kind of trading on a floor of $1,800, they seem to be much more appealing to investors. Certainly, after the success of Detour Lake, I think you’ll see these types of deposits more and more come into production.

Maurice Jackson: You referenced Goldshore Resources as having a historical resource, and the company also completed a robust Preliminary Economic Assessment (PEA) back in 2020. Can you share some of those highlights with us?

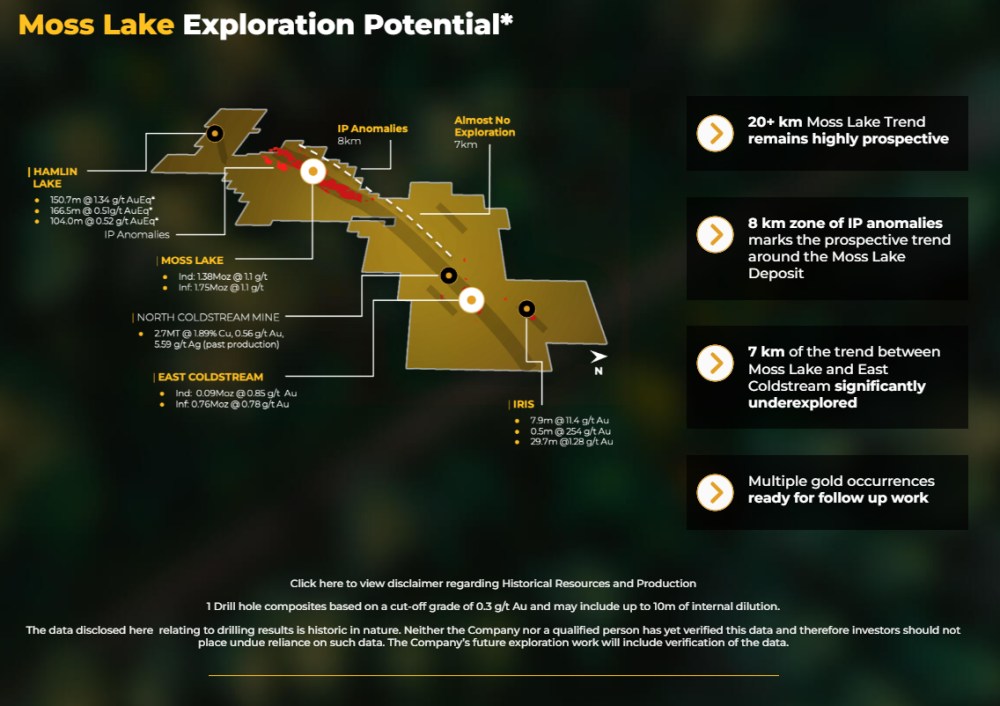

Brett Richards: Historically the area has been, let’s, so-called cobbled together as a big land package. There are three distinct areas within our domain, the Moss Lake area being kind of the flagship. It is what carries three and a half million ounces of that historical resource. Up in the Northeast, up near the highway, we have Coldstream and North Coldstream and Iris Lake against all kinds of compartmentalized land packages that were cobbled together by Wesdome.

There’s a 500,000-ounce historical resource on Coldstream, and a former actual operating mine at North Coldstream that ran for about 30 years in the, about 40 or 50 years ago. We have a very interesting kind of, I’ll say land package, and the work that has been done on this culminated in 2013 when a PEA was done on the property by Moss Lake Gold Mines.

Again, the PEA was updated in 2020 by WesDome before kind of launching a sale process and let’s face it, PEAs are a snapshot in time, and the time in 2013 and the time in 2020, and the time today are all very, very different, knowing that we are in a hyperinflationary environment today, what CAPEX might have been $500 million back in 2020, might be 600 million or $650 million today.

We have to keep that in mind as we go through. But I think back in 2013, and back in 2020, this project, at these gold levels, at $1,800 to $2,200 gold, and trades between a 27% and a 40% IRR. So, after-tax, the internal rate of return, is very, very compelling. We can look at the new present values of these projects, but again, they’re snapshots in time. What that tells me is that this is a robust project that when tested, even with inflation, even with different input assumptions, relative to the economic circumstances at the time, it is going to be a robust project.

Maurice Jackson: Goldshore Resources currently is embarked on a 100,000-meter drill program. Are you twinning the holes, and conducting step-out drilling on this?

Brett Richards: We are doing some verification drilling of the existing historical resource. We are stepping out laterally. We are stepping out along strike, and we have identified a parallel zone to the Moss Lake deposit, which is very exciting, and some high-grade structural areas within the deposit, which we’ll look to improve the overall grade and volume as we get further down the road, and get closer to a resource estimate.

Maurice Jackson: Speaking of your drill program, some of the initial assay results have just been released. What do they seem to indicate thus far?

Brett Richards: Well, I think they, we’ve always been trying to test our thesis that this is bigger and much more robust as a deposit than the historical resource illustrates. We’ve done that through a geophysical survey, and you can see that on our website, the 3D model of it, where you can see the potential for future mineralization up along strike, that goes 7 to 12 kilometers further than where Moss Lake is now.

But I think the results that we started to put out from the very beginning show between one, 1.1, 1.2, and 1.3 grams over long intervals, long intercepts of 50, 60, 70, 100, and 120 meters in some cases. I’ll say, some good intercepts, but I think what the surprise has been where we have gone kind of not twining holes, but stepping out a little bit, and stepping into an area that might be classified as inferred.

We’ve hit some high-grade structures, and I think that’s simply because of the geophysical work we’ve done, the structural work we’ve done with a structural geologist by the name of Brett Davis, who’s on-site currently. Pete Flindell, who is our VP of Exploration, he and the team have kind of figured this out. Targeting of some of these higher grade holes has been something that we wanted to do, because ultimately when we kind of go to, I’ll say, interpret all of this data, I don’t think the market is going to want another kind of $1.5 or $2 billion project that does 60,000 tons a day and produces 600,000 ounces of gold. That’s just not viable in this current economic environment.

You’re not going to be able to raise that kind of money. You’re not going to be able to get traction on that type of project. I think we have to start pivoting and looking at alternatives, and what are those? Is there a higher-grade starter pit alternative here within the deposit? I think that’s what we’re going to try and kind of focus on over the next little while. Therefore, there will be more infill and more delineation drilling than anything. But, we are still doing some step-out as well.

Maurice Jackson: All right. Well, let’s get to the press release. Goldshore Resources just received some welcoming news from the assay labs, which identify significant downhole gold intercepts. What can you share with us, Sir?

Brett Richards: We just announced, 78 meters at 1.17 grams from about 170 meters depth. This is a great hole. It’s all going to get contained within an open-pit mine. It’s going to pull a lot of tonnage in. I think, there were some high-grade areas within that, including 22 meters at 2.3 grams and 5.6 meters at 5.69 grams, in and around the 200 to the 220-meter range.

So, this is encouraging, and there are some other intercepts on some other holes that we announced, but it’s all more of the same. There’s anywhere from 20 to a hundred meters at over a gram.

Our objective is to try to maximize the grade. A little bit of grade, 0.1 grams here is going to add 10% to our resource. Even 1 gram or 1.1 gram, it’s quite meaningful at the end of the day. We’ll figure all this out once we get all the data and get towards a mineral source update at the end of the year. But I think right now, and I can talk a lot about the current market dynamics, but sadly, putting good results out into the market has not moved our share price. It’s actually, we have been impacted like all the other junior minors and we’ve been trading downwards.

Maurice Jackson: Looking forward, what can you share with us regarding optionality and economic open pit shells as you model your resource?

Brett Richards: I think we’re going to see a lot of results come out over the next six months or more of the same, illustrating our thesis that this is going to be a real project. Also, I think better delineation on defining this higher-grade starting project, but we can’t lose sight that this is, I think, this is a Tier One asset. This is going to be 10 million ounces by the time the drilling has wrapped up. Whether that’s a year or two or three from now. This is such a large area. There’s probably going to be another 100,000 meters as this gets towards a feasibility study.

Like I’ve said, we’ve got a footprint here that is a Tier One asset at the end of the day, but I think we need to start focusing on what the market is going to respond to. The market is going to respond to, is this a project that has a smaller CAPEX option, a smaller starter with that positive cash flow as soon as possible. Those types of questions need to be addressed and need to be presented to the market. So, we’re going to be looking at some permutations at the end of the day, when we do a PEA next year.

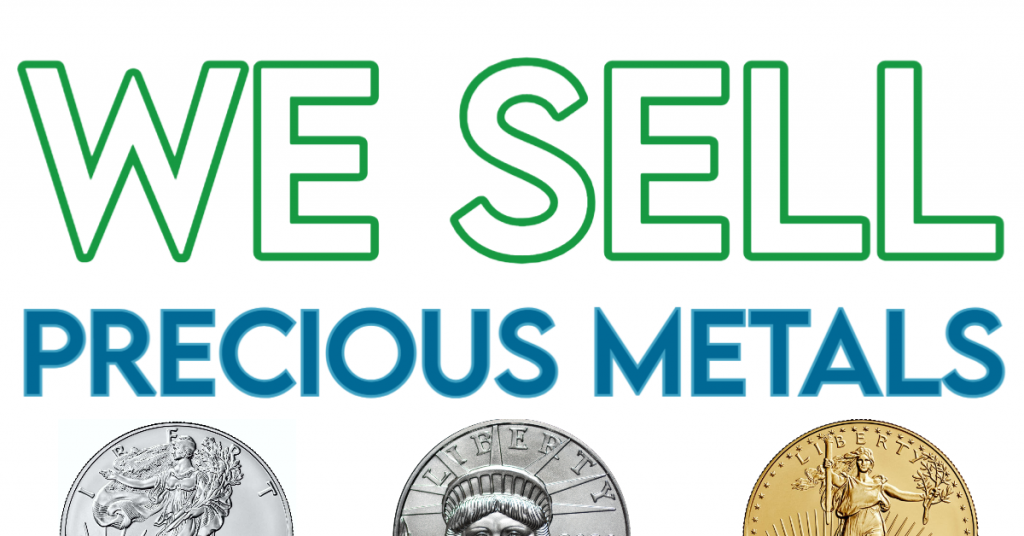

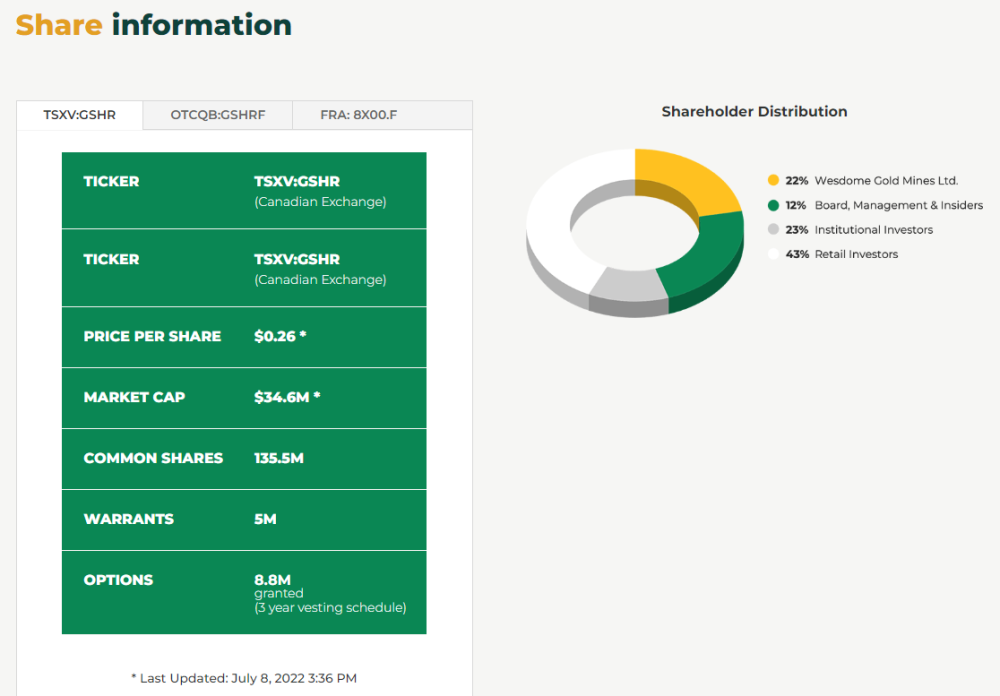

Maurice Jackson: Let’s get into some numbers. Mr. Richards, please provide the capital structure for Goldshore Resource.

Brett Richards: Goldshore Resources has about 143 million shares outstanding today, and only 5 million out warrants outstanding, and we’ve got about $13 million in the bank as of June. We’re well-positioned here and can ride this out.

As I’ve said before, we got caught in a bit of the whole market dynamics. We wanted to play a bit of catch-up, and get ahead of the curve on drilling, so we ramped up our drilling just before the whole market started crashing.

Our team took our foot off the pedal, and we put the brakes on it a little bit. We did scale up to seven rigs, but we’ve pulled back now to a couple of rigs. I want to ride this out. Preservation of cash and preservation of this company is first and foremost.

The capital markets are so volatile and so unpredictable right now, I’m very comfortable just burning a couple of million dollars a month and just watching this, or less than a couple of million dollars a month, and just watching how this unfolds to the fall because we don’t want to be in a situation where, where we have to go to the market and the market is not there for us.

Maurice Jackson: Speaking of being comfortable, I just want to share with everyone that I am a proud shareholder, and I’m looking to add to my position under these circumstances. The value proposition is extremely compelling, and I’m not discouraged by the price. I understand how markets work, and I never complain about a sale when it comes to capital goods. Now, since we’re covering numbers, how does Goldshore Resources compare with some of your peers?

Brett Richards: Well, we’ve never been able to kind of figure this one out, but we’re trading today somewhere kind of in order of magnitude around $10 an ounce, it’s crazy, but that is kind of where we are today. Our peers have also been impacted, but they also had a higher starting point. We’ve got a trading comparable sheet in our presentation that has us at the bottom of our peer group, and this is a peer group put together by a bank. At trading at $10 today, and our peers trading anywhere from $15, $20, $25, all the way up to $100 an ounce for Marathon.Looking at a pure comparison basis, Goldshore Resources is the least expensive among our peers. When you start looking at what it costs to bring ounces onto a resource statement, to put ounces into the inferred category costs about $30 an ounce. If you have a million ounces of inferred resource, it’ll probably cost $30 million to get there, then drilling in other activities.

So we’re trading at a third of that, a third of what it costs to do it. So, I think from an investment opportunity standpoint, there’s one way here, and it’s up.

Maurice Jackson: In closing, Sir, what would you like to say to shareholders?

Brett Richards: I think the really compelling investment case here is how we have performed against the general market, and where we are today. I’ll say the leverage that we have on the way back up. This is not going to go on forever. We may still feel some pain in the capital markets going forward, but we are going to recover, and commodities and equity, gold equities are going to accelerate, and probably much faster than the market when it does turn around, and when it does come back. We are actually leveraged to that even greater than the normal gold equity market, because of our size and our scale, and our potential to bring this up to a Tier One status.

So, there are some compounding, compelling investment reasons why to choose Goldshore, and I am also a major shareholder of this company. I have never continued to lose sight of the fact that this is a real project, and this is going to get into production one day.

Maurice Jackson: Mr. Richards, it’s been a pleasure speaking with you today. Wishing you and Goldshore Resources, the absolute best, Sir.

Brett Richards: Thanks, Maurice.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will improve the world.

NEW YORK, June 10, 2022 (GLOBE NEWSWIRE) — Virtual Investor Conferences, the leading proprietary investor conference series, today announced the agenda for the upcoming OTCQX Best 50 Companies Virtual Investor Conference to be held on June 16 th . Individual investors, institutional investors, advisors, and analysts are invited to attend. The program begins at 9:30 AM ET on Thursday, June 16th.

REGISTER NOW AT: https://bit.ly/3ztPQjz

It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates. There is no cost to log-in, attend live presentations and schedule 1×1 meetings.

“We are delighted to welcome ten of our OTCQX Best 50 companies participating in our upcoming Virtual Investor Conference,” said Jason Paltrowitz, OTC Markets Group EVP of Corporate Services. “We are proud to highlight the impressive efforts of these companies which span a range of industries including Technology, Metals & Mining, Industrial Goods, Financials and more.”

June 16 th Agenda:

| Eastern Time (ET) | Presentation | Ticker(s) |

| 9:30 AM | Global Atomic Corp. | OTCQX: GLATF | TSX: GLO |

| 10:00 AM | IsoEnergy Ltd. | OTCQX: ISENF | TSXV: ISO |

| 10:30 AM | InPlay Oil Corp. | OTCQX: IPOOF | TSX: IPO |

| 11:00 AM | TAAL Distributed Information Technologies Inc. | OTCQX: TAALF | CSE: TAAL |

| 11:30 AM | Labrador Gold Corp. | OTCQX: NKOSF | TSXV: LAB |

| 12:00 PM | Deep Yellow Ltd. | OTCQX: DYLLF | ASX: DYL |

| 1:00 PM | Nanalysis Scientific Corp. | OTCQX: NSCIF | TSXV: NSCI |

| 1:30 PM | Grayscale Investments LLC | OTCQX: GBTC |

| TBD | Novonix Ltd. | OTCQX: NVNXF | ASX: NVX |

| TBD | Thunderbird Entertainment Group Inc. | OTCQX: THBRF | TSXV: TBRD |

To facilitate investor relations scheduling and to view a complete calendar of Virtual Investor Conferences, please visit www.virtualinvestorconferences.com .

About Virtual Investor Conferences ®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly traded companies to seamlessly present directly to investors.

Providing a real-time investor engagement solution, VIC is specifically designed to offer companies more efficient investor access. Replicating the components of an on-site investor conference, VIC offers companies enhanced capabilities to connect with investors, schedule targeted one-on-one meetings and enhance their presentations with dynamic video content. Accelerating the next level of investor engagement, Virtual Investor Conferences delivers leading investor communications to a global network of retail and institutional investors.

Media Contact:

OTC Markets Group Inc. +1 (212) 896-4428, media@otcmarkets.com

Virtual Investor Conferences Contact:

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

(212) 220-2221

johnv@otcmarkets.com

North Vancouver, British Columbia–(Newsfile Corp. – June 6, 2022) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is delighted to announce the discovery of a major new feeder structure at its Tuvatu Alkaline Gold Project in Fiji. Hole TUG-141, targeting a complex network of high-grade structures called the 500 Zone, has encountered the longest high-grade intercept yet recorded at Tuvatu, 20.86 g/t Au over 75.9m, including 43.62 g/t Au over 30.0m which includes 90.35 g/t Au over 7.2m. The new discovery is located at depth beneath the current resource fully within the permit boundaries of the Tuvatu mining lease.

High-grade intercepts from TUG-141 include:

– 138.15 g/t Au over 0.30m from 450.9-451.2m

– 396.16 g/t Au over 0.30m from 479.1-479.4m

– 103.54 g/t Au over 0.30m from 498.6-498.9m

– 340.07 g/t Au over 0.30m from 498.9-499.2m

– 600.42 g/t Au over 0.30m from 499.5-499.8m

– 244.37 g/t Au over 0.30m from 502.5- 503.1m

– 230.18 g/t Au over 0.30m from 507.3-507.6m

– 105.58 g/t Au over 0.30m from 518.7-519.0m

Lion One CEO, Walter Berukoff, stated: “Like the initial discovery of the high-grade 500 Zone drilled two years ago, I believe this new robust high-grade gold feeder mineralization encountered by hole TUG-141 represents a substantial discovery for Lion One. The notable high grades and continuity of mineralization of this intercept demonstrate Tuvatu’s potential to become a large-scale, high-grade underground gold mine. I have long encouraged our team to find that “gold room” at Tuvatu, and hole TUG-141 leads me to believe they have found it. We have only to look at other notable large alkaline Au deposits as direct analogues to better understand what this latest discovery tells us, and it is clear that the discovery of a major high-grade feeder such as this should be viewed as very promising. I am confident that Tuvatu will one day fall in the ranks of notable multi-million ounce Au deposits such as Porgera and Vatukoula. I commend our team on this truly outstanding discovery and I look forward to continued successful execution of both our exploration strategy to realize growth at Tuvatu and our development strategy targeting the commencement of gold production in the second half of 2023.”

Lion One Senior VP of Exploration, Sergio Cattalani, commented: “The mineralized intercepts reported by TUG-141 represent a highly significant development. The grades and continuity observed by the intercepts in hole TUG-141 are of a magnitude not previously documented at Tuvatu, and highlights the largely untapped potential of this deposit. The significance of having identified what may be a new principal feeder conduit for Tuvatu confirms the model that has driven this deep exploration program since the discovery of hole TUDDH-500 in July 2020. Our immediate priority is to follow up of this significant discovery with additional drilling in what remains a relatively poorly drilled portion of the Tuvatu system. Lion One, is now more than ever, convinced of the potential of Tuvatu to become a prominent, multi-million ounce Au deposit at the top of the Au grade distribution worldwide.”

Lion One Technical Advisor, Quinton Hennigh, commented: “Alkaline gold systems tend to be deep-rooted and very structurally complex. Exploring them can be analogous to drilling a tree from the top down. In the shallow part of the system, one finds the upper “branches,” or gold-bearing lodes, but as exploration persists to depth, bigger and bigger “branches,” or lodes, are encountered ultimately leading to the “trunk,” the feeder. The way this remarkable discovery at Tuvatu has unfolded is quite similar to the experience at Porgera, where after approximately ten years of diligent drilling, the high-grade Romane Fault Zone was discovered beneath a myriad of smaller lodes. What is most exciting about this discovery is that now that we have a clear idea where the deep fluid-tapping conduit of this system is located, we can effectively chase it to depth, and alkaline gold systems are known to persist to great depths, sometimes as deep as 2 km. Considering this intercept is only approximately 500m below surface, this discovery is wide open for growth at depth.”

TUG-141 was drilled in the area between modelled 500 Zone lodes 500A, 500C and 500F (Figure 1) where it intersected continuous high-grade Au mineralization grading 20.86 g/t Au over 75.9m that is predominantly hosted by intensely altered, fractured and brecciated andesite. The highest grade core of this zone is characterized by hydrothermal breccia displaying extreme silicification, potassic alteration and sulfidation with regular occurrences of visible gold (Figure 2). In addition, the presence of abundant roscoelite (a vanadium mica mineral) is very encouraging and is a mineral synonymous with the high-grade zones of world-class alkali gold systems such as Cripple Creek in Colorado and Porgera in Papua New Guinea. Some fragments within portions of this breccia are visibly milled, or rounded, indicating vigorous fluid flow. Observations of fracture patterns and textures ranging from incipient and in-situ to full-on brecciation (Figure 2) point to this zone being a dilational breccia that likely formed along a major structural intersection where stresses were being released at the time of mineralization. Rapid depressurisation accompanying seismic movement along such a dilational zone would allow rapid ascent of hydrothermal fluids resulting in silicification, K-metasomatism, sulfidation and rapid precipitation of Au. Textures of minerals observed in veins and open spaces is consistent with a rapid depositional regime.

Lion One is concurrently undertaking a two-pronged exploration drill campaign: 1) shallow infill drilling to enhance definition of its current resource in preparation for mine planning, and 2) deep drilling focussed on better understanding the geometry and extent of the underlying high-grade feeder network. As part of the latter program, hole TUG-141 targeted the upper portion of the 500 Zone at depths between approximately 450-550m where it is projected to connect with the base of lodes making up the Inferred resource. As discussed above, TUG-141 drilled into a very wide and exceptionally high-grade zone, 20.86 g/t Au over 75.9m, cored by hydrothermal breccia (Figure 2). Such a zone of extreme fracturing and brecciation has never before been observed at Tuvatu. It is significant to note that the bulk of this mineralized interval is hosted within andesite rather than by intrusive monzonite, the typical host rock for many lodes at Tuvatu. The significance of this observation has yet to be determined.

Furthermore, it is also notable that the nearest drill holes to TUG-141 are TUG-135 (70m below), TUG-136 (45m to the E), and TUG-138 (60m to the W), indicating that there is considerable space for a substantial increase in the ultimate size of the feeder conduit. All three of these holes have returned previously reported bonanza grade mineralization, similar in tenor and texture to that in TUG-141, including:

24.92 g/t Au over 3.70m from 415.7-419.4m in hole TUG-135 including 159.3 g/t Au over 0.30m;

87.83 g/t Au over 1.5m from 445.1-446.6m in hole TUG-136 including 108.41 g/t Au over 0.60m;

and 23.14 g/t Au over 3.0m from 571.5-574.5m in hole TUG-138 including 118.6 g/t Au over 0.30m.

The area remains open at depth. This target has now become of utmost importance for follow up drilling.

In addition to the impressive intercept of 20.86 g/t Au over 75.9m discussed above, hole TUG-141 encountered numerous other significant mineralized intercepts both above and below this interval including:

Above the high-grade intercept

Below the high-grade intercept

In aggregate, all mineralized intercepts reported from hole TUG-141 total 1,909 g/t Au-meters.

Complete results, received to date, from hole TUG-141 are summarized below in Table 1. This is the first drill hole in this part of the Tuvatu alkaline gold system, and as such, orientation and true thicknesses of mineralized intercepts discussed above are not known at this time. Further drilling is required to better understand this new discovery. At the time of writing, hole TUG-141 is still being drilled, and is currently >600m in depth with other mineralised structures yet to be assayed.

Figure 1. Plan view (upper) and vertical section looking E (lower) of the trace of TUG-141 and selected drill holes relative to the 500 Zone lodes modeled to date. TUG-141 was drilled from underground along the Tuvatu exploration decline. The traces of known lodes UR2 and UR4, and modelled lodes of the 500 Zone feeder are shown in red.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/2178/126617_fig%201ed%20lm.jpg.

Figure 2. Compilation of photographs from TUG-141. (A) Abundant visible gold grains (0.2-2mm) in highly altered potassium metasomatized groundmass and roscoelite. (B) Visible gold (~2mm grains) associated with coarse pyrite in a silicified breccia. (C & D) Intensely silicified and pyritized andesite with microfractures of visible gold (~0.5mm grains).

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/2178/126617_81354d06c4e0dad0_003full.jpg.

Figure 2 (continued). (E) Vuggy breccia with coarse pyrite and silicified-sulfidized ground mass. Breccia clasts are angular to sub-rounded. (F) Coarse pyrite breccia with silicified-sulfidized ground mass. (G) Network fracture stockwork ~1-5mm veins with two generations of pyrite. The clasts are highly altered silicified andesite, with the veins containing quartz-pyrite. (H) Network fracture stockwork veins at multiple angles, with intense silicification, quartz-carbonate infill and pyrite.

To view an enhanced version of Figure 2 continued, please visit:

https://orders.newsfilecorp.com/files/2178/126617_81354d06c4e0dad0_004full.jpg.

Mineralization is observed as two generations of pyrite; an earlier bright euhedral pyrite that forms coarse crystals in the core of the veins and breccia, and a darker brownish, spongy pyrite that typically forms extremely fine-grained encrustations or overgrowths on earlier pyrite and wallrock fragments, as well as lining the edges of most veins (Figure 2). Quartz occurs commonly as bluish grey, amorphous to locally colloform silica. Open space vuggy textures are common, as are visible gold grains. Highest grades (up to 600 g/t Au) appear to be associated with an interval of intense pervasive silicification and sulfidation by up to 30% or more extremely fine-grained pyrite developed throughout the host rock, giving the rock an overall massive chocolate brown appearance (Figure 2). The intensity of replacement suggests this is a zone of very high and sustained fluid flux.

Table 1: Table showing all drilling intervals returning >0.5 g/t Au for hole TUG-141. Intervals > 3.0 g/t Au, which is the cutoff grade used for the current resource, are shown in red, and intervals >9.0 g/t Au, which is the average grade of the resource, are bolded.

| Sample ID | From (m) | To (m) | Interval (m) | Grade (g/t Au) |

| TUG08584 | 71.7 | 72 | 0.3 | 0.96 |

| TUG08535 | 101.7 | 102 | 0.3 | 3.96 |

| TUG08536 | 102 | 102.3 | 0.3 | 12.17 |

| TUG08537 | 102.3 | 102.6 | 0.3 | 5.35 |

| TUG08538 | 102.6 | 102.9 | 0.3 | 1.42 |

| TUG08539 | 102.9 | 103.2 | 0.3 | 3.09 |

| TUG08541 | 103.5 | 103.8 | 0.3 | 1.19 |

| TUG08542 | 103.8 | 104.1 | 0.3 | 8.64 |

| TUG08543 | 104.1 | 104.4 | 0.3 | 7.67 |

| TUG08544 | 104.4 | 104.7 | 0.3 | 7.56 |

| TUG08545 | 104.7 | 105 | 0.3 | 7.90 |

| TUG08546 | 105 | 105.3 | 0.3 | 3.53 |

| TUG08548 | 105.6 | 105.9 | 0.3 | 0.60 |

| TUG08549 | 105.9 | 106.5 | 0.6 | 4.83 |

| TUG08452 | 107.1 | 107.4 | 0.3 | 1.42 |

| TUG08456 | 109.8 | 110.1 | 0.3 | 15.41 |

| TUG08457 | 110.1 | 110.4 | 0.3 | 0.74 |

| TUG08458 | 110.4 | 110.7 | 0.3 | 1.12 |

| TUG08459 | 110.7 | 111 | 0.3 | 5.28 |

| TUG08460 | 111 | 111.3 | 0.3 | 0.80 |

| TUG08462 | 111.6 | 111.9 | 0.3 | 2.66 |

| TUG08463 | 111.9 | 112.2 | 0.3 | 1.45 |

| TUG08464 | 112.2 | 112.5 | 0.3 | 1.22 |

| TUG08466 | 112.5 | 112.8 | 0.3 | 1.50 |

| TUG08467 | 112.8 | 113.1 | 0.3 | 2.67 |

| TUG08468 | 113.1 | 113.4 | 0.3 | 3.47 |

| TUG08469 | 113.4 | 113.7 | 0.3 | 2.92 |

| TUG08470 | 113.7 | 114 | 0.3 | 2.93 |

| TUG08471 | 114 | 114.3 | 0.3 | 8.74 |

| TUG08473 | 114.6 | 114.9 | 0.3 | 7.36 |

| TUG08474 | 114.9 | 115.5 | 0.6 | 0.90 |

| TUG08475 | 115.5 | 115.8 | 0.3 | 7.20 |

| TUG08476 | 115.8 | 116.1 | 0.3 | 3.14 |

| TUG08477 | 116.1 | 116.4 | 0.3 | 0.92 |

| TUG08479 | 116.7 | 117 | 0.3 | 3.62 |

| TUG08481 | 117 | 117.3 | 0.3 | 15.85 |

| TUG08482 | 117.3 | 117.6 | 0.3 | 2.06 |

| TUG08483 | 117.6 | 117.9 | 0.3 | 1.95 |

| TUG08484 | 117.9 | 118.2 | 0.3 | 0.58 |

| TUG08485 | 118.2 | 118.5 | 0.3 | 5.51 |

| TUG08486 | 118.5 | 118.8 | 0.3 | 6.35 |

| TUG08487 | 118.8 | 119.1 | 0.3 | 38.27 |

| TUG08488 | 119.1 | 119.4 | 0.3 | 3.02 |

| TUG08489 | 119.4 | 119.7 | 0.3 | 1.41 |

| TUG08490 | 119.7 | 120 | 0.3 | 2.19 |

| TUG08494 | 122.4 | 122.7 | 0.3 | 1.35 |

| TUG08946 | 213.6 | 213.9 | 0.3 | 2.11 |

| TUG08947 | 213.9 | 214.2 | 0.3 | 0.97 |

| TUG08948 | 214.2 | 214.5 | 0.3 | 3.03 |

| TUG09446 | 214.5 | 214.8 | 0.3 | 0.82 |

| TUG08949 | 214.8 | 215.1 | 0.3 | 1.50 |

| TUG09401 | 215.1 | 215.4 | 0.3 | 1.61 |

| TUG09402 | 215.4 | 215.7 | 0.3 | 1.75 |

| TUG09407 | 216.9 | 217.2 | 0.3 | 3.22 |

| TUG09408 | 217.2 | 217.5 | 0.3 | 0.18 |

| TUG09409 | 217.5 | 217.8 | 0.3 | 0.62 |

| TUG09423 | 222.9 | 223.2 | 0.3 | 0.72 |

| TUG09432 | 226.5 | 226.8 | 0.3 | 1.41 |

| TUG09444 | 233.4 | 233.7 | 0.3 | 1.32 |

| TUG09445 | 233.7 | 234 | 0.3 | 3.13 |

| TUG09447 | 234 | 234.3 | 0.3 | 6.30 |

| TUG09448 | 234.3 | 234.6 | 0.3 | 2.08 |

| TUG09529 | 274.8 | 275.1 | 0.3 | 0.77 |

| TUG09536 | 276.6 | 276.9 | 0.3 | 0.59 |

| TUG09540 | 277.8 | 278.1 | 0.3 | 0.64 |

| TUG09566 | 291.3 | 291.6 | 0.3 | 14.77 |

| TUG09567 | 291.6 | 291.9 | 0.3 | 4.01 |

| TUG09568 | 291.9 | 292.2 | 0.3 | 16.55 |

| TUG09569 | 292.2 | 292.5 | 0.3 | 17.85 |

| TUG09570 | 292.5 | 292.8 | 0.3 | 1.75 |

| TUG09582 | 299.1 | 299.4 | 0.3 | 2.12 |

| TUG09583 | 299.4 | 299.7 | 0.3 | 1.94 |

| TUG09584 | 299.7 | 300 | 0.3 | 0.63 |

| TUG09585 | 300 | 300.3 | 0.3 | 1.13 |

| TUG09586 | 300.3 | 300.6 | 0.3 | 0.99 |

| TUG09587 | 300.6 | 300.9 | 0.3 | 0.79 |

| TUG09588 | 300.9 | 301.2 | 0.3 | 4.31 |

| TUG09591 | 301.8 | 302.1 | 0.3 | 1.58 |

| TUG09594 | 302.7 | 303 | 0.3 | 0.92 |

| TUG09595 | 303 | 303.3 | 0.3 | 0.78 |

| TUG09605 | 308.1 | 308.4 | 0.3 | 1.28 |

| TUG09614 | 311.7 | 312 | 0.3 | 1.35 |

| TUG09616 | 312 | 312.3 | 0.3 | 2.61 |

| TUG09617 | 312.3 | 312.6 | 0.3 | 0.08 |

| TUG09619 | 313.2 | 313.5 | 0.3 | 4.56 |

| TUG09620 | 313.5 | 313.8 | 0.3 | 3.54 |

| TUG09621 | 313.8 | 314.1 | 0.3 | 2.47 |

| TUG09622 | 314.1 | 314.4 | 0.3 | 1.65 |

| TUG09625 | 315.3 | 315.6 | 0.3 | 1.25 |

| TUG09626 | 315.6 | 315.9 | 0.3 | 7.71 |

| TUG09628 | 316.8 | 317.1 | 0.3 | 0.54 |

| TUG09629 | 317.1 | 317.4 | 0.3 | 2.57 |

| TUG09631 | 317.4 | 317.7 | 0.3 | 1.00 |

| TUG09633 | 318 | 318.3 | 0.3 | 1.42 |

| TUG09634 | 318.3 | 318.6 | 0.3 | 3.11 |

| TUG09635 | 318.6 | 318.9 | 0.3 | 5.42 |

| TUG09636 | 318.9 | 319.2 | 0.3 | 4.25 |

| TUG09637 | 319.2 | 319.5 | 0.3 | 7.68 |

| TUG09638 | 319.5 | 319.8 | 0.3 | 5.78 |

| TUG09639 | 319.8 | 320.1 | 0.3 | 0.85 |

| TUG09641 | 320.4 | 320.7 | 0.3 | 3.19 |

| TUG09642 | 320.7 | 321 | 0.3 | 3.49 |

| TUG09643 | 321 | 321.3 | 0.3 | 7.93 |

| TUG09644 | 321.3 | 321.6 | 0.3 | 2.40 |

| TUG09645 | 321.6 | 321.9 | 0.3 | 2.04 |

| TUG09646 | 321.9 | 322.2 | 0.3 | 7.42 |

| TUG09647 | 322.2 | 322.5 | 0.3 | 18.75 |

| TUG09648 | 322.5 | 322.8 | 0.3 | 12.75 |

| TUG09650 | 322.8 | 323.1 | 0.3 | 12.55 |

| TUG09651 | 323.1 | 323.4 | 0.3 | 15.64 |

| TUG09652 | 323.4 | 323.7 | 0.3 | 19.67 |

| TUG09653 | 323.7 | 324 | 0.3 | 13.55 |

| TUG09654 | 324 | 324.3 | 0.3 | 15.18 |

| TUG09655 | 324.3 | 324.6 | 0.3 | 11.27 |

| TUG09656 | 324.6 | 324.9 | 0.3 | 14.62 |

| TUG09657 | 324.9 | 325.2 | 0.3 | 71.01 |

| TUG09658 | 325.2 | 325.5 | 0.3 | 5.61 |

| TUG09659 | 325.5 | 326.4 | 0.9 | 0.60 |

| TUG09660 | 326.4 | 326.7 | 0.3 | 3.97 |

| TUG09661 | 326.7 | 327 | 0.3 | 4.93 |

| TUG09662 | 327 | 327.3 | 0.3 | 11.64 |

| TUG09663 | 327.3 | 327.6 | 0.3 | 15.86 |

| TUG09667 | 328.5 | 329.4 | 0.9 | 0.98 |

| TUG09668 | 329.4 | 329.7 | 0.3 | 2.77 |

| TUG09669 | 329.7 | 330 | 0.3 | 2.58 |

| TUG09670 | 330 | 330.3 | 0.3 | 6.51 |

| TUG09671 | 330.3 | 330.6 | 0.3 | 4.28 |

| TUG09672 | 330.6 | 330.9 | 0.3 | 6.21 |

| TUG09694 | 345.3 | 345.6 | 0.3 | 0.60 |

| TUG09695 | 345.6 | 345.9 | 0.3 | 4.62 |

| TUG09696 | 345.9 | 346.2 | 0.3 | 4.07 |

| TUG09697 | 346.2 | 346.5 | 0.3 | 1.76 |

| TUG09699 | 346.8 | 347.1 | 0.3 | 2.13 |

| TUG09703 | 348.3 | 348.6 | 0.3 | 33.25 |

| TUG09704 | 348.6 | 348.9 | 0.3 | 3.52 |

| TUG09703 | 348.3 | 348.6 | 0.3 | 33.25 |

| TUG09707 | 350.1 | 350.4 | 0.3 | 12.62 |

| TUG09710 | 351.3 | 351.6 | 0.3 | 3.20 |

| TUG09711 | 351.6 | 351.9 | 0.3 | 0.51 |

| TUG09733 | 366.3 | 366.6 | 0.3 | 1.26 |

| TUG09734 | 366.6 | 366.9 | 0.3 | 2.37 |

| TUG09736 | 367.5 | 367.8 | 0.3 | 0.80 |

| TUG09737 | 367.8 | 368.1 | 0.3 | 11.02 |

| TUG09738 | 368.1 | 368.4 | 0.3 | 7.96 |

| TUG09739 | 368.4 | 368.7 | 0.3 | 3.68 |

| TUG09740 | 368.7 | 369 | 0.3 | 6.95 |

| TUG09741 | 369 | 369.3 | 0.3 | 1.82 |

| TUG09742 | 369.3 | 369.6 | 0.3 | 1.29 |

| TUG09744 | 369.9 | 370.2 | 0.3 | 4.11 |

| TUG09745 | 370.2 | 370.5 | 0.3 | 3.89 |

| TUG09746 | 370.5 | 370.8 | 0.3 | 4.54 |

| TUG09759 | 380.7 | 381 | 0.3 | 2.63 |

| TUG09760 | 381 | 381.6 | 0.6 | 23.15 |

| TUG09761 | 381.6 | 381.9 | 0.3 | 20.60 |

| TUG09762 | 381.9 | 382.2 | 0.3 | 6.13 |

| TUG09763 | 382.2 | 382.5 | 0.3 | 3.37 |

| TUG09764 | 382.5 | 382.8 | 0.3 | 0.64 |

| TUG09777 | 391.8 | 392.1 | 0.3 | 1.08 |

| TUG09778 | 392.1 | 392.4 | 0.3 | 1.08 |

| TUG09779 | 392.4 | 392.7 | 0.3 | 0.89 |

| TUG09781 | 392.7 | 393 | 0.3 | 0.55 |

| TUG09783 | 393.6 | 393.9 | 0.3 | 0.65 |

| TUG09784 | 393.9 | 394.2 | 0.3 | 0.54 |

| TUG09785 | 394.2 | 394.5 | 0.3 | 2.90 |

| TUG09786 | 394.5 | 394.8 | 0.3 | 2.34 |

| TUG09787 | 394.8 | 395.1 | 0.3 | 3.74 |

| TUG09788 | 395.1 | 395.4 | 0.3 | 2.82 |

| TUG09789 | 395.4 | 395.7 | 0.3 | 1.98 |

| TUG09790 | 395.7 | 396 | 0.3 | 1.55 |

| TUG09792 | 396.3 | 396.6 | 0.3 | 2.25 |

| TUG09794 | 396.9 | 397.2 | 0.3 | 0.44 |

| TUG09795 | 397.2 | 397.5 | 0.3 | 1.78 |

| TUG09796 | 397.5 | 397.8 | 0.3 | 3.20 |

| TUG09797 | 397.8 | 398.1 | 0.3 | 1.27 |

| TUG09798 | 398.1 | 398.4 | 0.3 | 15.27 |

| TUG09799 | 398.4 | 398.7 | 0.3 | 2.96 |

| TUG09801 | 398.7 | 399 | 0.3 | 5.34 |

| TUG09802 | 399 | 399.3 | 0.3 | 2.38 |

| TUG09803 | 399.3 | 399.6 | 0.3 | 2.93 |

| TUG09804 | 399.6 | 400.5 | 0.9 | 4.00 |

| TUG09805 | 400.5 | 400.8 | 0.3 | 0.68 |

| TUG09806 | 400.8 | 401.1 | 0.3 | 2.41 |

| TUG09807 | 401.1 | 401.4 | 0.3 | 2.06 |

| TUG09808 | 401.4 | 401.7 | 0.3 | 1.61 |

| TUG09809 | 401.7 | 402 | 0.3 | 1.67 |

| TUG09811 | 402.3 | 402.6 | 0.3 | 1.46 |

| TUG09812 | 402.6 | 402.9 | 0.3 | 0.91 |

| TUG09814 | 403.2 | 403.5 | 0.3 | 3.71 |

| TUG09817 | 403.8 | 404.1 | 0.3 | 0.77 |

| TUG09819 | 405 | 405.3 | 0.3 | 1.56 |

| TUG09811 | 402.3 | 402.6 | 0.3 | 1.40 |

| TUG09812 | 402.6 | 402.9 | 0.3 | 0.95 |

| TUG09814 | 403.2 | 403.5 | 0.3 | 3.57 |

| TUG09817 | 403.8 | 404.1 | 0.3 | 0.83 |

| TUG09819 | 405 | 405.3 | 0.3 | 1.61 |

| TUG09824 | 406.8 | 407.1 | 0.3 | 2.78 |

| TUG09827 | 408 | 408.3 | 0.3 | 1.21 |

| TUG09828 | 408.3 | 408.6 | 0.3 | 0.72 |

| TUG09829 | 408.6 | 409.2 | 0.6 | 1.14 |

| TUG09831 | 409.2 | 409.5 | 0.3 | 3.27 |

| TUG09832 | 409.5 | 409.8 | 0.3 | 0.90 |

| TUG09836 | 410.7 | 411 | 0.3 | 1.86 |

| TUG09837 | 411 | 411.3 | 0.3 | 2.11 |

| TUG09838 | 411.3 | 411.6 | 0.3 | 3.40 |

| TUG09839 | 411.6 | 411.9 | 0.3 | 0.70 |

| TUG09842 | 412.8 | 413.1 | 0.3 | 0.93 |

| TUG09843 | 413.1 | 413.4 | 0.3 | 0.76 |

| TUG09848 | 416.1 | 417 | 0.9 | 0.63 |

| TUG10354 | 418.8 | 419.1 | 0.3 | 0.82 |

| TUG10355 | 419.1 | 419.4 | 0.3 | 0.65 |

| TUG10360 | 420.6 | 420.9 | 0.3 | 0.75 |

| TUG10361 | 420.9 | 421.2 | 0.3 | 1.05 |

| TUG10362 | 421.2 | 421.5 | 0.3 | 1.59 |

| TUG10363 | 421.5 | 421.8 | 0.3 | 1.23 |

| TUG10367 | 422.7 | 423 | 0.3 | 0.68 |

| TUG10368 | 423 | 423.3 | 0.3 | 0.72 |

| TUG10373 | 425.1 | 425.4 | 0.3 | 2.48 |

| TUG10374 | 425.4 | 425.7 | 0.3 | 2.83 |

| TUG10375 | 425.7 | 426 | 0.3 | 3.52 |

| TUG10376 | 426 | 426.3 | 0.3 | 3.77 |

| TUG10377 | 426.3 | 426.6 | 0.3 | 8.47 |

| TUG10378 | 426.6 | 426.9 | 0.3 | 1.64 |

| TUG10379 | 426.9 | 427.2 | 0.3 | 1.53 |

| TUG10381 | 427.2 | 427.8 | 0.6 | 4.11 |

| TUG10382 | 427.8 | 428.1 | 0.3 | 1.65 |

| TUG10383 | 428.1 | 429 | 0.9 | 0.86 |

| TUG10387 | 429.9 | 430.2 | 0.3 | 0.72 |

| TUG10393 | 433.2 | 433.5 | 0.3 | 2.04 |

| TUG10394 | 433.5 | 433.8 | 0.3 | 0.85 |

| TUG10395 | 433.8 | 434.1 | 0.3 | 0.76 |

| TUG10408 | 440.4 | 440.7 | 0.3 | 2.36 |

| TUG10413 | 443.1 | 443.4 | 0.3 | 1.02 |

| TUG10414 | 443.4 | 443.7 | 0.3 | 6.82 |

| TUG10417 | 444.9 | 445.2 | 0.3 | 17.94 |

| TUG10418 | 445.2 | 445.5 | 0.3 | 5.83 |

| TUG10423 | 447 | 447.3 | 0.3 | 1.16 |

| TUG10425 | 448.2 | 448.5 | 0.3 | 4.54 |

| TUG10426 | 448.5 | 448.8 | 0.3 | 0.76 |

| TUG10428 | 450 | 450.3 | 0.3 | 4.94 |

| TUG10429 | 450.3 | 450.6 | 0.3 | 1.53 |

| TUG10431 | 450.6 | 450.9 | 0.3 | 0.97 |

| TUG10432 | 450.9 | 451.2 | 0.3 | 138.15 |

| TUG10434 | 451.5 | 451.8 | 0.3 | 0.76 |

| TUG10435 | 451.8 | 452.1 | 0.3 | 1.25 |

| TUG10436 | 452.1 | 452.4 | 0.3 | 1.35 |

| TUG10438 | 452.7 | 453 | 0.3 | 1.65 |

| TUG10439 | 453 | 453.3 | 0.3 | 4.70 |

| TUG10440 | 453.3 | 453.6 | 0.3 | 2.57 |

| TUG10441 | 453.6 | 453.9 | 0.3 | 4.99 |

| TUG10444 | 454.8 | 455.1 | 0.3 | 14.02 |

| TUG10445 | 455.1 | 455.4 | 0.3 | 2.07 |

| TUG10446 | 455.4 | 455.7 | 0.3 | 1.09 |

| TUG10447 | 455.7 | 456 | 0.3 | 1.28 |

| TUG10448 | 456 | 456.3 | 0.3 | 2.55 |

| TUG10453 | 459 | 460.2 | 1.2 | 1.14 |

| TUG10454 | 460.2 | 460.8 | 0.6 | 1.00 |

| TUG10455 | 460.8 | 462 | 1.2 | 1.74 |

| TUG10456 | 462 | 462.3 | 0.3 | 1.28 |

| TUG10457 | 462.3 | 462.6 | 0.3 | 24.98 |

| TUG10458 | 462.6 | 462.9 | 0.3 | 87.13 |

| TUG10459 | 462.9 | 463.8 | 0.9 | 11.34 |

| TUG10461 | 464.4 | 465 | 0.6 | 0.67 |

| TUG10463 | 465.9 | 466.2 | 0.3 | 0.91 |

| TUG10464 | 466.2 | 466.5 | 0.3 | 1.36 |

| TUG10466 | 466.5 | 466.8 | 0.3 | 1.27 |

| TUG10467 | 466.8 | 467.1 | 0.3 | 1.28 |

| TUG10468 | 467.1 | 467.4 | 0.3 | 3.79 |

| TUG10469 | 467.4 | 467.7 | 0.3 | 20.93 |

| TUG10470 | 467.7 | 468 | 0.3 | 20.64 |

| TUG10471 | 468 | 468.3 | 0.3 | 19.40 |

| TUG10473 | 468.6 | 468.9 | 0.3 | 3.46 |

| TUG10474 | 468.9 | 469.2 | 0.3 | 2.78 |

| TUG10475 | 469.2 | 469.5 | 0.3 | 2.10 |

| TUG10482 | 471.3 | 471.6 | 0.3 | 0.81 |

| TUG10483 | 471.6 | 471.9 | 0.3 | 1.03 |

| TUG10484 | 471.9 | 472.2 | 0.3 | 6.72 |

| TUG10485 | 472.2 | 472.5 | 0.3 | 0.88 |

| TUG10486 | 472.5 | 472.8 | 0.3 | 1.45 |

| TUG10487 | 472.8 | 473.1 | 0.3 | 9.05 |

| TUG10488 | 473.1 | 473.4 | 0.3 | 1.35 |

| TUG10490 | 473.7 | 474 | 0.3 | 0.48 |

| TUG10492 | 474.3 | 474.6 | 0.3 | 0.78 |

| TUG10493 | 474.6 | 474.9 | 0.3 | 1.37 |

| TUG10494 | 474.9 | 475.2 | 0.3 | 1.43 |

| TUG10496 | 475.5 | 475.8 | 0.3 | 1.67 |

| TUG10497 | 475.8 | 477 | 1.2 | 1.80 |

| TUG10498 | 477 | 477.6 | 0.6 | 2.64 |

| TUG10500 | 477.6 | 477.9 | 0.3 | 93.49 |

| TUG10501 | 477.9 | 478.2 | 0.3 | 1.01 |

| TUG10502 | 478.2 | 478.5 | 0.3 | 34.17 |

| TUG10503 | 478.5 | 478.8 | 0.3 | 94.57 |

| TUG10504 | 478.8 | 479.1 | 0.3 | 35.04 |

| TUG10505 | 479.1 | 479.4 | 0.3 | 396.16 |

| TUG10506 | 479.4 | 479.7 | 0.3 | 25.06 |

| TUG10507 | 479.7 | 480 | 0.3 | 7.09 |

| TUG10508 | 480 | 480.3 | 0.3 | 4.06 |

| TUG10509 | 480.3 | 480.6 | 0.3 | 31.63 |

| TUG10510 | 480.6 | 480.9 | 0.3 | 5.3 |

| TUG10511 | 480.9 | 481.2 | 0.3 | 114.95 |

| TUG10512 | 481.2 | 481.5 | 0.3 | 1.90 |

| TUG10513 | 481.5 | 481.8 | 0.3 | 0.83 |

| TUG10514 | 481.8 | 482.1 | 0.3 | 9.99 |

| TUG10516 | 482.1 | 482.4 | 0.3 | 0.71 |

| TUG10517 | 482.4 | 482.7 | 0.3 | 6.64 |

| TUG10518 | 482.7 | 483 | 0.3 | 6.05 |

| TUG10519 | 483 | 483.3 | 0.3 | 6.64 |

| TUG10520 | 483.3 | 483.6 | 0.3 | 2.47 |

| TUG10521 | 483.6 | 483.9 | 0.3 | 0.93 |

| TUG10522 | 483.9 | 484.2 | 0.3 | 5.15 |

| TUG10523 | 484.2 | 484.5 | 0.3 | 10.90 |

| TUG10524 | 484.5 | 484.8 | 0.3 | 14.76 |

| TUG10525 | 484.8 | 485.1 | 0.3 | 20.24 |

| TUG10526 | 485.1 | 485.4 | 0.3 | 21.93 |

| TUG10527 | 485.4 | 485.7 | 0.3 | 20.79 |

| TUG10528 | 485.7 | 486 | 0.3 | 32.89 |

| TUG10529 | 486 | 486.3 | 0.3 | 16.13 |

| TUG10531 | 486.3 | 486.6 | 0.3 | 2.55 |

| TUG10532 | 486.6 | 486.9 | 0.3 | 13.04 |

| TUG10533 | 486.9 | 487.2 | 0.3 | 5.42 |

| TUG10534 | 487.2 | 487.5 | 0.3 | 3.95 |

| TUG10535 | 487.5 | 487.8 | 0.3 | 4.89 |

| TUG10536 | 487.8 | 488.1 | 0.3 | 4.24 |

| TUG10537 | 488.1 | 488.4 | 0.3 | 4.41 |

| TUG10538 | 488.4 | 488.7 | 0.3 | 5.21 |

| TUG10539 | 488.7 | 489 | 0.3 | 1.80 |

| TUG10540 | 489 | 489.3 | 0.3 | 16.42 |

| TUG10541 | 489.3 | 489.6 | 0.3 | 7.17 |

| TUG10542 | 489.6 | 489.9 | 0.3 | 6.47 |

| TUG10543 | 489.9 | 490.2 | 0.3 | 4.07 |

| TUG10544 | 490.2 | 490.5 | 0.3 | 4.75 |

| TUG10545 | 490.5 | 490.8 | 0.3 | 4.86 |

| TUG10546 | 490.8 | 491.1 | 0.3 | 7.13 |

| TUG10547 | 491.1 | 491.4 | 0.3 | 11.64 |

| TUG10548 | 491.4 | 491.7 | 0.3 | 35.68 |

| TUG10549 | 491.7 | 492 | 0.3 | 22.53 |

| TUG10551 | 492 | 492.3 | 0.3 | 10.72 |

| TUG10552 | 492.3 | 492.6 | 0.3 | 25.23 |

| TUG10553 | 492.6 | 492.9 | 0.3 | 16.77 |

| TUG10554 | 492.9 | 493.2 | 0.3 | 20.86 |

| TUG10555 | 493.2 | 493.5 | 0.3 | 23.61 |

| TUG10556 | 493.5 | 493.8 | 0.3 | 5.85 |

| TUG10557 | 493.8 | 494.1 | 0.3 | 6.41 |

| TUG10558 | 494.1 | 494.4 | 0.3 | 4.25 |

| TUG10559 | 494.4 | 494.7 | 0.3 | 36.13 |

| TUG10560 | 494.7 | 495 | 0.3 | 19.66 |

| TUG10561 | 495 | 495.3 | 0.3 | 72.65 |

| TUG10562 | 495.3 | 495.6 | 0.3 | 241.21 |

| TUG10563 | 495.6 | 495.9 | 0.3 | 31.77 |

| TUG10564 | 495.9 | 496.2 | 0.3 | 51.52 |

| TUG10566 | 496.2 | 496.5 | 0.3 | 25.17 |

| TUG10567 | 496.5 | 496.8 | 0.3 | 100.35 |

| TUG10568 | 496.8 | 497.1 | 0.3 | 12.86 |

| TUG10569 | 497.1 | 497.4 | 0.3 | 4.68 |

| TUG10570 | 497.4 | 497.7 | 0.3 | 33.81 |

| TUG10571 | 497.7 | 498 | 0.3 | 37.11 |

| TUG10572 | 498 | 498.3 | 0.3 | 20.74 |

| TUG10573 | 498.3 | 498.6 | 0.3 | 26.29 |

| TUG10574 | 498.6 | 498.9 | 0.3 | 103.54 |

| TUG10575 | 498.9 | 499.2 | 0.3 | 340.07 |

| TUG10576 | 499.2 | 499.5 | 0.3 | 269.25 |

| TUG10577 | 499.5 | 499.8 | 0.3 | 600.42 |

| TUG10578 | 499.8 | 500.1 | 0.3 | 73.02 |

| TUG10579 | 500.1 | 500.4 | 0.3 | 13.41 |

| TUG10581 | 500.4 | 500.7 | 0.3 | 1.85 |

| TUG10582 | 500.7 | 501.3 | 0.6 | 13.32 |

| TUG10583 | 501.3 | 501.6 | 0.3 | 26.54 |

| TUG10584 | 501.6 | 501.9 | 0.3 | 9.04 |

| TUG10585 | 501.9 | 502.2 | 0.3 | 4.79 |

| TUG10586 | 502.2 | 502.5 | 0.3 | 3.93 |

| TUG10587 | 502.5 | 502.8 | 0.3 | 126.85 |

| TUG10588 | 502.8 | 503.1 | 0.3 | 361.90 |

| TUG10589 | 503.1 | 503.4 | 0.3 | 1.95 |

| TUG10590 | 503.4 | 503.7 | 0.3 | 3.27 |

| TUG10591 | 503.7 | 504 | 0.3 | 32.78 |

| TUG10592 | 504 | 504.3 | 0.3 | 23.63 |

| TUG10596 | 505.2 | 505.5 | 0.3 | 8.07 |

| TUG10598 | 505.8 | 506.1 | 0.3 | 18.51 |

| TUG10599 | 506.1 | 506.4 | 0.3 | 53.78 |

| TUG10602 | 506.7 | 507 | 0.3 | 7.50 |

| TUG10604 | 507.3 | 507.6 | 0.3 | 234.39 |

| TUG10605 | 507.6 | 507.9 | 0.3 | 2.22 |

| TUG10606 | 507.9 | 508.8 | 0.9 | 0.58 |

| TUG10612 | 510.3 | 510.6 | 0.3 | 3.37 |

| TUG10613 | 510.6 | 510.9 | 0.3 | 1.32 |

| TUG10614 | 510.9 | 511.2 | 0.3 | 5.53 |

| TUG10616 | 511.2 | 511.5 | 0.3 | 24.91 |

| TUG10617 | 511.5 | 511.8 | 0.3 | 64.47 |

| TUG10618 | 511.8 | 512.1 | 0.3 | 72.56 |

| TUG10619 | 512.1 | 512.4 | 0.3 | 13.35 |

| TUG10620 | 512.4 | 512.7 | 0.3 | 2.08 |

| TUG10621 | 512.7 | 513 | 0.3 | 1.59 |

| TUG10622 | 513 | 513.3 | 0.3 | 0.74 |

| TUG10623 | 513.3 | 513.6 | 0.3 | 0.94 |

| TUG10624 | 513.6 | 513.9 | 0.3 | 0.53 |

| TUG10625 | 513.9 | 514.2 | 0.3 | 1.17 |

| TUG10626 | 514.2 | 514.5 | 0.3 | 23.17 |

| TUG10627 | 514.5 | 514.8 | 0.3 | 0.85 |

| TUG10628 | 514.8 | 515.1 | 0.3 | 2.39 |

| TUG10629 | 515.1 | 515.4 | 0.3 | 1.03 |

| TUG10631 | 515.4 | 515.7 | 0.3 | 0.83 |

| TUG10632 | 515.7 | 516 | 0.3 | 1.74 |

| TUG10633 | 516 | 516.3 | 0.3 | 3.50 |

| TUG10634 | 516.3 | 516.6 | 0.3 | 0.59 |

| TUG10636 | 516.9 | 517.2 | 0.3 | 0.80 |

| TUG10637 | 517.2 | 517.5 | 0.3 | 2.99 |

| TUG10638 | 517.5 | 517.8 | 0.3 | 0.76 |

| TUG10639 | 517.8 | 518.1 | 0.3 | 3.34 |

| TUG10640 | 518.1 | 518.4 | 0.3 | 8.94 |

| TUG10641 | 518.4 | 518.7 | 0.3 | 12.80 |

| TUG10642 | 518.7 | 519 | 0.3 | 105.58 |

| TUG10643 | 519 | 519.3 | 0.3 | 34.42 |

| TUG10644 | 519.3 | 519.6 | 0.3 | 0.55 |

| TUG10645 | 519.6 | 519.9 | 0.3 | 0.80 |

| TUG10656 | 522.6 | 522.9 | 0.3 | 0.59 |

| TUG10657 | 522.9 | 523.2 | 0.3 | 0.88 |

| TUG10658 | 523.2 | 523.5 | 0.3 | 0.76 |

| TUG10659 | 523.5 | 523.8 | 0.3 | 1.09 |

| TUG10660 | 523.8 | 524.1 | 0.3 | 0.61 |

| TUG10661 | 524.1 | 524.4 | 0.3 | 2.11 |

| TUG10664 | 525 | 525.3 | 0.3 | 5.56 |

| TUG10666 | 525.3 | 525.6 | 0.3 | 7.50 |

| TUG10667 | 525.6 | 525.9 | 0.3 | 0.87 |

| TUG10668 | 525.9 | 526.2 | 0.3 | 0.78 |

| TUG10693 | 543.9 | 544.2 | 0.3 | 0.63 |

| TUG10695 | 544.5 | 544.8 | 0.3 | 0.75 |

| TUG10696 | 544.8 | 545.1 | 0.3 | 0.59 |

| TUG10699 | 545.7 | 546 | 0.3 | 0.81 |

| TUG10701 | 546 | 546.3 | 0.3 | 0.63 |

| TUG10702 | 546.3 | 546.6 | 0.3 | 0.59 |

| TUG10706 | 547.5 | 547.8 | 0.3 | 0.52 |

| TUG10719 | 554.1 | 554.4 | 0.3 | 0.84 |

Table 2: Survey details of diamond drill holes referenced in this release

| Hole No | Coordinates (Fiji map grid) | RL | final depth | dip | azimuth | |

| N | E | m | (TN) | |||

| TUG-135 | 3920759 | 1876459 | 139.2 | 689.4 | -64 | 149 |

| TUG-136 | 3920759 | 1876459 | 139.2 | 617.4 | -58 | 151 |

| TUG-138 | 3920759 | 1876459 | 139.2 | 746.4 | -64 | 163 |

| TUG-141 | 3920759 | 1876459 | 139.2 | 633.0 * | -55° | 162° |

* Current depth, hole is still drilling

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analysed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 80% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analysed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. For samples with multiple fire assay runs, the average of duplicate runs is presented. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analysed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses for 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“

Chairman and CEO

For further information

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider

accepts responsibility for the adequacy or accuracy of this release.

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

(TSX.V: GBR | OTCQX: GTBDF)

In this exclusive interview, Chris Taylor of Great Bear Resources sits down with Maurice Jackson of Proven and Probable to provide a detailed analysis on the latest press release details coming from the flagship Dixie Gold Project located in Red Lake District. Find out why Great Bear Resources is up 4,000 Percent!

Contact Great Bear Resources:

Phone : 604-646-8354

Email: info@greatbearresources.ca

https://youtu.be/5wi-0NHtURE

Transcript