Thu, July 22, 2021, 5:00 PM In this article:

VOYRF0.00%

Explore the topics mentioned in this articleMy WatchlistMy WatchlistView my watchlistsMy WatchlistMy WatchlistView my watchlists

VANCOUVER, British Columbia, July 22, 2021 (GLOBE NEWSWIRE) — Skyharbour Resources Ltd. (TSX-V: SYH) (OTCQB: SYHBF) (Frankfurt: SC1P) (the “Company”) is pleased to announce that partner company Valor Resources Limited (“Valor”) has received the results and interpretation from the airborne magnetic and very low frequency electromagnetic (VLF-EM) geophysical survey completed over the Hook Lake Project in April. The purpose of the survey was to gather data that would help identify areas of shallow structural complexity, known to be favorable for the deposition of uranium in basement lithologies, and determine the geophysical signature of known occurrences.

Hook Lake (Formally North Falcon) Project

https://skyharbourltd.com/_resources/projects/Falcon-Point-Project.jpg

The Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. Skyharbour signed a Definitive Agreement with Valor Resources on the Hook Lake (previously North Falcon Point) Uranium Project whereby Valor can earn-in 80% of the project through $3,500,000 in total exploration expenditures, $475,000 in total cash payments over three years and an initial share issuance of 233,333,333 shares of Valor.

Highlights:

- Airborne geophysical survey reinforces size potential of historic uranium occurrences and highlights additional targets across the Hook Lake Project:

- Both the VLF-EM and Magnetic data confirm extensive NE-SW trending structural features as well as N-S trending structures

- Data confirms known uranium showings are situated where these structural trends intersect and in close association with shallow VLF-EM conductors

- The N-S structural features may represent the influence of the Tabbernor Fault System, a major structural feature associated with known uranium deposits in the eastern Athabasca Basin

- “Heat maps” illustrating structural complexity highlighted additional areas for follow-up work

- Field work set to commence very shortly at the Hook Lake Project to follow up new targets and historic uranium occurrences

- Work approvals received including approval for drilling

- Radiometric survey has commenced with coverage of the northeastern third of the Hook Lake Project and will be completed by the end of July

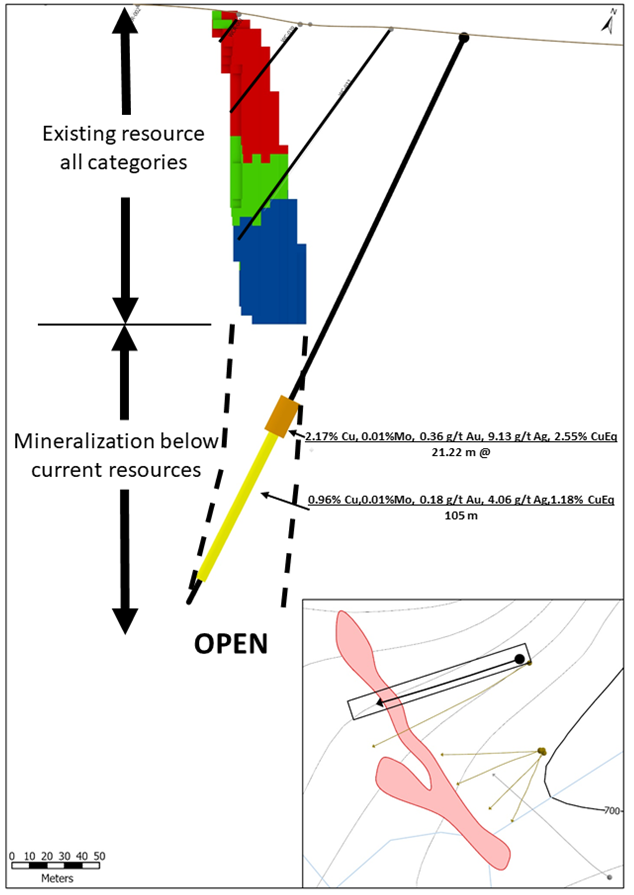

Figure 1: Hook Lake Project – VLF-EM image showing priority target areas

https://www.skyharbourltd.com/_resources/maps/Hook-Lake-VLF-EM.jpg

Valor Executive Chairman, Mr. George Bauk commented: “The survey has confirmed the key targets for immediate follow up and has provided data to verify additional targets for drilling. Significant new geological information has come out of the survey including the N-S structural features, possibly representing the Tabbernor Fault System. These results have exceeded our expectations with the number of target areas to follow up. We have secured all permits that allow us to follow up on the ground, including drilling, which we are targeting for the December quarter. The field crew will be mobilising to site July 23rd, 2021. The company is excited to be commencing field work in Saskatchewan and looks forward to the results of the exploration effort at Hook Lake.”

Airborne Magnetic and VLF-EM Survey:

A project-wide, high-resolution, magnetic and VLF-EM survey was completed in April. The 5,172-line km survey was completed by Precision Geosurveys of Langley, British Columbia, using a fixed wing aircraft at a line spacing of 75m. The purpose of the survey was to gather data that would help identify areas of shallow structural complexity, known to be favorable for the deposition of uranium in basement lithologies, and determine the geophysical signature of known occurrences.

Geophysical Data Interpretation:

The geophysical data confirms extensive and complex structural trends across the property that could indicate structural and/or lithological traps for uranium mineralisation. Both the magnetic and VLF-EM data show a strong NE-SW structural trend similar to that present in other basement-hosted uranium deposits in the eastern Athabasca Basin area. A significant N-S structural trend is also present that has features similar to those associated with the Tabbernor Fault System.

Several of the known in-situ uranium occurrences on the property (Hook Lake, Nob Hill and West Way – see news release dated October 22nd, 2020) are coincident with the intersection of these structural trends. The most significant uranium occurrences within the property also appear to have a close association with shallow VLF-EM conductors (see Figure 1 above). Several other conductors, that have previously seen little exploration and have no known nearby occurrences, also represent excellent prospects for follow-up exploration.

The magnetic data shows the Hook Lake mineralisation, with high grade surface outcrop with reported grades in grab samples up to 68% U3O8, may be part of a larger and broader anomalous zone than originally thought. 3D Inversion of the magnetic data indicates a potential feeder system coming up through the stratigraphy.

Tabbernor Fault System:

The presence of a N-S structural influence similar to that recognised in the Tabbernor Fault System could be an important feature on the Hook Lake property. The Tabbernor Fault System is a wide structural feature that runs N-S for over 1,500 km along Saskatchewan’s eastern provincial border. While there is no direct link between the Tabbernor system and current known uranium deposits, several deposits are associated with a N-S structural component within the sphere of influence of the Tabbernor system. It has been proposed that reactivation of the Tabbernor Fault System coincided with the formation of large uranium deposits in the Athabasca Basin and the Tabbernor system may have controlled deposit location. Deposits exhibiting N-S structural control, with features consistent with the Tabbernor system include Rabbit Lake (Collins Bay B Zone and Eagle Point), Dawn Lake, Midwest and the Sue deposit (reference Davies, J.R. (1998): The origin, structural style, and reactivation history of the Tabbernor fault zone, Saskatchewan, Canada; Masters thesis, McGill University, Montreal, Quebec, 105p.).

Airborne Radiometric Survey:

A high-resolution airborne radiometric survey is being flown over the northeastern third of the Hook Lake Project, which will include the Hook Lake historical high grade uranium occurrence. The survey is being flown by Special Projects Inc. (“SPI”) from Calgary, Alberta. SPI is considered an industry-leading provider of high-resolution airborne radiometric surveying. SPI flew the radiometric survey that delineated Fission Uranium’s PLS boulder field which eventually led to the discovery of the high-grade Triple R uranium deposit.

Any significant new radiometric anomalies generated from this survey will be followed up on ground during the upcoming field program.

Ground Field Work Program:

Valor has received the required work permits to carry out its follow-up ground exploration program on the Hook Lake project. The permits, issued by Saskatchewan Ministry of Environment include Crown Land Work Authorization and Forest Product Permit, Aquatic Habitat Protection Permit, and Temporary Work Camp Permit. They allow Valor to conduct ground exploration, including drilling, until the end of 2022.

Field work is set to commence in the next few days at the Hook Lake Project to follow-up on the historic uranium occurrences and new targets generated from the recently completed magnetic/VLF-EM survey. A field crew supported by a helicopter is being mobilised to the area to carry out a field program which will take 2-3 weeks.

The initial field work program will be conducted by Dahrouge Geological Consulting Ltd. Dahrouge Geological is a North American mineral exploration, consulting, and project management group with offices in Canada and the United States. They provide professional geological, logistical, and project management services to the world’s mining and mineral resource industry including project generation, program design, geophysics, project evaluation, geology & resources, as well as mine engineering and geotechnics. Dahrouge Geological has extensive exploration experience in Saskatchewan’s Athabasca Basin, with a consistent presence in the area since the early 2000’s; this experience and network of contacts makes Dahrouge Geological an ideal team to lead the exploration program on the Hook Lake Project.

About Hook Lake (previously North Falcon Point) Project:

Valor has the right to earn an 80% working interest in the Hook Lake Uranium Project located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. Covering 25,846 hectares, the 16 contiguous mineral claims host several prospective areas of uranium mineralisation including:

- Hook Lake / Zone S – High grade surface outcrop with reported grades in grab samples up to 68% U3O8; a bio-geochemical survey carried out over the trenches in 2015 responded positively with along-strike anomalies 2 km to the northeast

- Nob Hill – Fracture-controlled vein-type uranium mineralisation on surface outcrop with up to 0.130% – 0.141% U3O8 in grab samples; diamond drilling intersected anomalous uranium in several drill holes with values up to 422 ppm U over 0.5 m

- West Way – Vein type U mineralisation within a NE-trending shear zone; grab samples taken from the surface showing contained variable uranium values including up to 0.475% U3O8 and drilling of the structure intersected the altered shear zone at depth, along with anomalous Cu, Ni, Co, As, V, U, & Pb

- Grid T – Fracture-hosted secondary uranium mineralisation in sheared calc-silicates and marbles in a 100 m x 20 m zone of anomalous radioactivity with grab samples having up to 800 ppm U

- Alexander Lake Boulder Field – 30 biotite-quartz-k-feldspar pegmatite boulders NE of Alexander Lake; the best results include 360 ppm U, 1,400 ppm U and 1,600 ppm U respectively

- Thompson Lake Boulder Field – Numerous radioactive boulders and blocks of pegmatized meta-arkose, pegmatite, and granite; the best value obtained was 738 ppm U from a granite boulder

- NE Alexander Lake – Several calc-silicate, plagioclase-quartz granulite, quartzite, and meta-arkose boulders with up to 4,800 ppm U, 7,600 ppm Mo and 1,220 ppm Ni

The project area is in close proximity to two all-weather northern highways and grid power. Historical exploration has consisted of airborne and ground geophysics, multi-phased diamond drill campaigns, detailed geochemical sampling and surveys, and ground-based prospecting culminating in an extensive geological database for the project area.

Qualified Person:

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Richard Kusmirski, P.Geo., M.Sc., Skyharbour’s Head Technical Advisor and a Director, as well as a Qualified Person.

About Valor Resources Ltd:

Valor Resources Limited (ASX: VAL) is an exploration company focused on creating shareholder value through acquisitions and exploration activities.

About Skyharbour Resources Ltd.:

Skyharbour holds an extensive portfolio of uranium exploration projects in Canada’s Athabasca Basin and is well positioned to benefit from improving uranium market fundamentals with six drill-ready projects covering over 240,000 hectares of land. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine. Moore is an advanced stage uranium exploration property with high grade uranium mineralization at the Maverick Zone that returned drill results of up to 6.0% U3O8 over 5.9 metres including 20.8% U3O8 over 1.5 metres at a vertical depth of 265 metres. The Company is actively advancing the project through drill programs.

Skyharbour has a joint-venture with industry-leader Orano Canada Inc. at the Preston Project whereby Orano has earned a 51% interest in the project through exploration expenditures and cash payments. Skyharbour now owns a 24.5% interest in the Project. Skyharbour also has a joint-venture with Azincourt Energy at the East Preston Project whereby Azincourt has earned a 70% interest in the project through exploration expenditures, cash payments and share issuance. Skyharbour now owns a 15% interest in the Project. Preston and East Preston are large, geologically prospective properties proximal to Fission Uranium’s Triple R deposit as well as NexGen Energy’s Arrow deposit.

The Company also owns a 100% interest in the South Falcon Uranium Project on the eastern perimeter of the Basin, which contains a NI 43-101 inferred resource totaling 7.0 million pounds of U3O8 at 0.03% and 5.3 million pounds of ThO2 at 0.023%. Skyharbour has signed a Definitive Agreement with ASX-listed Valor Resources on the Hooke Lake (previously North Falcon Point) Uranium Project whereby Valor can earn-in 80% of the project through $3,500,000 in total exploration expenditures, $475,000 in total cash payments over three years and an initial share issuance.

Skyharbour’s goal is to maximize shareholder value through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the Athabasca Basin:

http://skyharbourltd.com/_resources/maps/SYH-Athabasca-Map.jpg

To find out more about Skyharbour Resources Ltd. (TSX-V: SYH) visit the Company’s website at www.skyharbourltd.com.

SKYHARBOUR RESOURCES LTD.

“Jordan Trimble”

Jordan Trimble

President and CEO

For further information contact myself or:

Riley Trimble

Corporate Development and Communications

Skyharbour Resources Ltd.

Telephone: 604-687-3376

Toll Free: 800-567-8181

Facsimile: 604-687-3119

Email: info@skyharbourltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

This release includes certain statements that may be deemed to be “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expects, are forward-looking statements. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. The Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause actual results to differ materially from those in forward-looking statements, include market prices, exploration and development successes, continued availability of capital and financing, and general economic, market or business conditions. Please see the public filings of the Company at www.sedar.com for further information.