Vancouver, British Columbia–(Newsfile Corp. – November 14, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to report results for the quarter ended September 30, 2022 (“Q3-2022”). The Company’s filings for the quarter are available on SEDAR at www.sedar.com, on the U.S. Securities and Exchange Commission’s website at www.sec.gov, and on EMX’s website at www.EMXroyalty.com. Financial results were prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board.

HIGHLIGHTS FOR Q3-2022

Financial Update

All dollar amounts in this news release are Canadian dollars (CDN) unless otherwise noted.

- Revenue and other income for the three months ended September 30, 2022 was $9,338,000 which includes continuing royalty income from the Leeville, Gediktepe, and Balya royalty interests totaling $4,881,000. Other income of $4,113,000 relates to other property payments from partnered properties. Adjusted revenue and other income1 was $12,105,000 which included $2,767,000 for the Company’s share of royalty revenue from its effective Caserones copper royalty interest in Chile.

- After recovering $4,210,000 from partners, the Company’s net royalty generation costs totaled $2,652,000.

- General and administrative costs totaled $1,644,000. Impacting general and administrative costs, were higher investor relations costs for increased marketing and communications activities offset by a reduction in fees paid to consultants during the period.

- Share-based payments totaled $481,000 for the period compared to $1,206,000 in Q3-2021. The aggregate share-based payments relate mainly to the fair value of stock options and restricted share units (“RSUs”) granted and vested during the period.

- Finance expenses of $1,579,000 associated with the Sprott Credit Facility. The Company had repaid in full the SSR VTB note (including interest) totaling $10,774,000 in the previous quarter.

- For the quarter, the Company had income from operations of $1,311,000 and a net loss of $16,346,000.

- Other significant items affecting income for the three months ended September 30, 2022 included unrealized fair value losses on investments of $7,241,000, impairment charges of $7,130,000 primarily related to the Gediktepe royalty in Turkey, and foreign exchange adjustments of $518,000.

- As at September 30, 2022, the Company had unrestricted cash and cash equivalents of $14,297,000, investments and long-term investments valued at $19,877,000, and a loan payable of $54,961,000.

Corporate Updates

Appointment of Independent Director

In Q3-2022, EMX announced that Mr. Geoff Smith was appointed to the Board of Directors of the Company effective July 5, 2022. Mr. Smith brings to the board the benefit of 17 years of M&A and corporate finance experience having advised on or financed many of the largest, most complex and innovative streaming transactions in the past 10 years.

Purchase of Royalty Portfolio from Nevada Exploration

In Q3-2022, EMX announced it had executed a purchase and sale agreement (the “Agreement”) for a portfolio of royalties, with Pediment Gold LLC, a wholly owned subsidiary of Nevada Exploration Inc. (“NGE”) for US$500,000. The portfolio consists of a 2% net smelter return royalty (“NSR”) on NGE’s Nevada gold exploration portfolio covering ~62.5 square miles in Nevada and includes four district-scale land positions as well as certain other interests. In addition, if NGE options, farms out, or sells a project, beginning on the first anniversary of the third-party agreement, EMX will receive AARs of US$20,000 that escalate US$10,000 per year and are capped at US$50,000. NGE has the right to buy back half of EMX’s 2% NSR by purchasing a 0.5% NSR interest for US$1,000,000 any time prior to the 7th anniversary of the Agreement and then, if the first NSR interest is purchased, purchasing the second 0.5% NSR interest any time prior to production for US$1,500,000.

Receipt of Initial Production Royalty Payments from Gediktepe

In Q3-2022, EMX announced the receipt of initial royalty production payments from its Gediktepe royalty property in western Turkey. EMX holds a 10% NSR on oxide gold production at Gediktepe, a newly commissioned mine operated by Polimetal Madencilik Sanayi ve Ticaret A.S. (“Polimetal”), a private Turkish company. EMX has received payments for production from the months of June and July totaling US$1,842,452, inclusive of US$281,052 in Value Added Tax (“VAT”) for which EMX has credits to recover. These represent the first royalty production payments received from Gediktepe after receiving notice that the definition of commercial production had been satisfied in early June.

The June and July payments are based upon the sales of 4,490 ounces of gold and 23,309 ounces of silver in June and 4,030 ounces of gold and 44,164 ounces of silver in July. The payment for June was pro-rated for the portion of the month’s sales that took place after the satisfaction of the definition of commercial production in the royalty agreement, which took place on June 8th.

The Company has also taken an impairment in Q3-2022 against the carrying value of Gediktepe. While assessing whether any indications of impairment exist, consideration is given to external and internal sources of information. While the operation has only been in production for less than year, review of the oxide operation to date, potential for delay of the sulfide circuit along with revisions to metal pricing and Turkish royalty rates, the Company has reduced the value of Gediktepe by $7,092,000. Please refer to the Company’s interim financial statements for the nine months ended September 30, 2022 for additional information.

Receipt of Initial Production Royalty Payments from Balya North

In Q3-2022, EMX announced the receipt of initial royalty production payments from its Balya North royalty property in western Turkey. EMX holds an uncapped 4% NSR royalty on metals production from Balya North, a newly commissioned lead-zinc-silver mine operated by Esan Eczacibaşi Endüstriyel Hammaddeler San. ve Tic. A.Ş. (“Esan”), a private Turkish company.

In the first half of 2022, Esan’s advancement of the Balya North asset consisted of mine development and opening of production headings and faces for exploitation in Q3 and Q4 of 2022. Production and processing of materials from Balya North in the first half of 2022 largely consisted of material stockpiled during the construction process. EMX received payments from the processing of this material totaling US$98,787, inclusive of US$15,069 in VAT. These royalty payments are from 30,223 tonnes of processed material averaging 1.68% lead, 1.34% zinc, and 39.9 g/t silver.

Receipt of Milestone Payment for the Parks-Salyer Royalty Property

Subsequent to Q3-2022, EMX received a US$3,000,000 milestone payment from Arizona Sonoran Copper Company, Inc. (“ASCU”) for the Parks-Salyer royalty property (the “Royalty Property”) in Arizona. The Royalty Property was held under a lease arrangement by EMX’s wholly owned subsidiary Bronco Creek Exploration Inc. and was transferred to ASCU via Assignment and Royalty Agreements (the “Agreements”) executed earlier this year. EMX’s Royalty Property covers 158 acres of ASCU’s Parks-Salyer copper project. The milestone payment results from ASCU’s maiden resource estimate for the Parks-Salyer project that exceeds thresholds for contained copper included within EMX’s Royalty Property footprint. The Company also retains a 1.5% NSR covering the Royalty Property.

Impact of Covid 19

EMX continues to monitor developments regarding the ongoing coronavirus pandemic (“COVID-19”), with a focus on the jurisdictions in which the Company operates. EMX has implemented COVID-19 prevention, monitoring and response plans following the guidelines of international agencies and the governments and regulatory agencies of each country in which it operates. EMX’s priority is to safeguard the health and safety of its personnel and host communities, support government actions to slow the spread of COVID-19 and assess and mitigate the risks to business continuity.

Royalty and Royalty Generation Updates

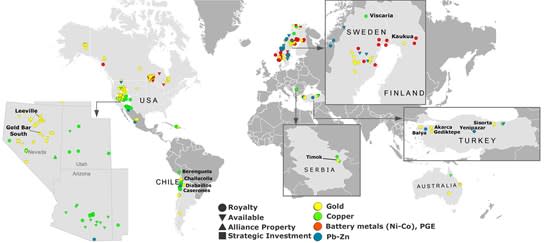

EMX’s royalty and mineral property portfolio consists of 265 properties in North America, Europe, Turkey, Latin America and Australia (See Figure 1). The Company’s portfolio is comprised of the following:

| Producing Royalties | 5 |

| Advanced Royalties | 9 |

| Exploration Royalties | 152 |

| Royalty Generation Properties | 99 |

Figure 1. EMX’s royalty and mineral property portfolio.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/1508/144216_fd23da17d415d84b_002full.jpg

During Q3-2022, the Company’s royalty generation business was active in North America, South America, Europe, Turkey, and Australia. The Company spent $6,862,000 and recovered $4,210,000 from partners. During the quarter the Company completed two new property agreements in Northern Europe and one new partnership in the US, and continued to grow the portfolio with new mineral property acquisitions.

Highlights from Q3-2022 include the following:

- In the US the Company added to its growing royalty portfolio with the completion of one new royalty agreement on a copper project in Arizona, the advancement of ten partner-funded work programs, including five drill projects, the acquisition of four large royalty positions from Nevada Exploration covering key land positions in Nevada, and new generative work leading to the acquisition of a large (i.e., greater than 1950 hectares), prospective land position in the Silver Valley district in Idaho.

- US highlights also include Arizona Sonoran Copper Company’s (“ASCU”) announcement of a maiden resource at the Parks-Salyer deposit (see ASCU news release dated September 28, 2022) and key drill intercepts within the EMX royalty footprint which include 162 meters at 1.10% copper in drill hole ECP-084 and 68.3 meters at 2.24% copper in drill hole ECP-086 (true widths unknown) (see ASCU news release dated September 7, 2022). As noted earlier, subsequent to Q3-2022, EMX received a US$3,000,000 Milestone Payment from ASCU resulting from the announced resource exceeding 200 million pounds of contained copper within the royalty footprint (see EMX new release dated October 4, 2022).

- In Canada, EMX continued its summer work programs to advance and delineate targets on available properties in the portfolio as partners conducted multiple field programs, including drill programs on optioned and EMX royalty properties. EMX received $63,000 in cash payments and $4,000 in share equity payments during the quarter.

- EMX’s Latin American royalty portfolio advanced through field programs at Morros Blancos and Morros Colorado by Austral Gold Limited, Block 4 by Pampa Metals Corporation, and drill programs conducted by AbraSilver Resource Corp., Aftermath Silver Ltd, and GR Silver Mining Ltd. Q3 drill programs at San Marcial, as well as Diablillos and Berenguela continue to produce significant results that expand known resources and add new discoveries at nearby targets. Highlights at San Marcial include the discovery of a new silver zone by GR Silver with a 250 meter step out drill hole intersecting 101.6 meters at 308 g/t silver with multiple higher grade sub-intervals (true width unknown) (see GR Silver news release dated August 8, 2022). An updated resource estimation for San Marcial is scheduled for Q1-2023.

- As a subsequent event, AbraSilver announced an updated, open pit constrained mineral resource estimate for the Diablillos project’s Oculto deposit reported as measured and indicated of 51.3 Mtonnes averaging 66 g/t silver (109 Moz contained Ag) and 0.79 g/t gold (1.3 Moz contained Au), as well as inferred of 2.2 Mtonnes averaging 30 g/t silver (2.1 Moz contained Ag) and 0.51 g/t gold (37 Koz contained Au) (see AbraSilver news release dated November 3, 2022). The updated resource was based upon drilling through Phase II. The ongoing Phase III drill program is focused on the near surface, high-grade Southwest Zone discovery.

- In Northern Europe the Company continued to expand its portfolio of projects, acquiring a gold-copper project in Sweden and a gold-cobalt project in Finland totaling nearly 20,000 hectares. Two Norwegian polymetallic projects were sold to Minco Silver in Q3 and eight partner funded projects advanced EMX royalty assets, including three drill programs. Overall, approximately US$2.3 million was spent by partners on EMX royalty properties in Northern Europe in Q3.

- Drill results were announced at the Tomtebo Project in Sweden by District Metals in Q3. Highlights included 25.5 meters averaging 2.4% zinc, 2.05% lead and 65 ppm silver in drill hole TOM22-38 starting at 249 meters (true width unknown) (see District Metals news release dated August 17, 2022)2.

- Drill programs were also completed in Norway at Playfair Mining’s RKV project and at Norden Crown Metals’s Burfjord project. Nineteen diamond drill holes totaling 1,107 meters were drilled at Playfair’s RKV Project and 18 diamond drill holes totaling 3,500 meters were drilled at Burfjord.

- EMX continued to advance its understanding of the newly discovered cobalt enriched manganese mineralization at its 100% owned Yarrol Project in Australia. Soil sampling grids continued to expand the footprint of cobalt-rich mineralization and preparations for an upcoming drill program commenced in Q3.

- Work also proceeded in the Balkans and in Morocco, where multiple exploration license applications have been filed by the Company, and new areas are being assessed for further acquisitions.

Financing Updates

Exercise of Stock Options granted by EMX

Ending Q3-2022, 1,045,000 stock options were exercised at $1.20 per share pursuant to the Company’s Stock Option Plan, which generated proceeds of $1,254,000 to EMX.

Investment Updates

As at September 30, 2022, the Company had investments totaling $19,877,000 which included $13,651,000 in various public and private entities, and $6,226,000 in non-current investments. The Company will continue to generate cash flow by selling certain of its investments when appropriate.

Strategic Investment in Premium Nickel Resources

Between 2020 and 2022, EMX acquired 5,412,702 shares of Premium Nickel Resources Corporation, a private company with nickel-copper-cobalt assets in Botswana. On April 26, 2022, PNR announced the execution of a definitive agreement for a reverse takeover transaction (“RTO”) with North American Nickel Inc. (“NAN”) to create a new reporting entity, Premium Nickel Resources Ltd (“PNRL”). PNRL began trading on the TSX Venture Exchange in Q3, having completed the RTO process with NAN. As a result of the RTO transaction, EMX’s interests were converted to 5,704,987 shares of PNRL, which represents roughly 5% of the issued and outstanding shares of PNRL.

Subsequent to the listing transaction, PNRL announced initial results from its ongoing diamond drilling program at its 100% owned Selebi nickel-copper-cobalt project in Botswana (see PNRL news release dated August 17, 2022). Highlights included an intercept of 25.65 meters of 0.95% nickel, 2.03% copper and 0.04 % cobalt in drill hole SMD-22-001 starting at 1,374.5 meters (true width estimated to be 70-80% of drilled interval). This was the first hole drilled in the 2022 program, and on September 13, 2022, PNRL announced further intercepts from a wedge drilled off hole SMD-22-001 (hole SMD-22-001-W1) of 4.35 meters averaging 0.98% nickel, 1.61% copper and 0.02% cobalt starting at 1,363 meters and 12.55 meters of 0.39% nickel, 1.99% copper and 0.02% cobalt starting at 1,385.65 meters (true thicknesses estimated to be 70-80% of the drilled interval) (see PNRL news release dated September 13, 2022). Assay results from other holes are pending3.

OUTLOOK

This year will see an increase in revenue and other income coming from our cash flowing royalties, including Leeville in Nevada, Gediktepe and Balya in Turkey, potentially Timok in Serbia (pending conclusion of the royalty rate discussions with Zijin), and our effective royalty interest on Caserones in Chile. As in previous years, production royalties will continue to be complemented by option, advance royalty, and other pre-production payments from partnered projects across the global portfolio. As a royalty holder, the Company has limited, if any, access to information on properties for which it holds royalties. Accordingly, the Company has not, and does not anticipate that it will have the ability to, provide guidance or outlook as to future production.

So far in 2022, EMX has acquired an additional (effective) 0.3155% royalty interest on Caserones, completed a $12,580,000 (US $10,000,000) private placement with Franco-Nevada, made a strategic investment in PNR, and repaid in full the vendor take back note issued to SSR Mining Inc.

The Company will continue to strengthen its balance sheet over the course of the year by looking to retire portions of its long-term debt, continuing to evaluate equity markets (including the filing of a shelf prospectus), and the ongoing monetization of the Company’s marketable securities.

EMX is well funded to identify and pursue new royalty and investment opportunities, while further filling a pipeline of royalty generation properties that provide opportunities for additional cash flow, as well as exploration, development, and production success.

QUALIFIED PERSONS

Michael P. Sheehan, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the above technical disclosure on North America, Latin America, and Strategic Investments. Eric P. Jensen, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the above technical disclosure on Europe, Turkey, and Australia.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

1 Adjusted revenue and other income, and adjusted cash provided by (used in) operating activities are non-IFRS financial measures with no standardized meaning under IFRS and might not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-IFRS financial measures” section on page 24 of the Company’s MD&A for the period ended September 30, 2022 for more information on each non-IFRS financial measure.

2 EMX has not done independent and sufficient to work verify the drill results as published by District Metals, and these results should not be relied upon until they are confirmed. However, EMX believes these results to be reliable and relevant.

3 EMX has not done independent and sufficient to work verify the drill results as published by Premium Nickel Resources Ltd, and these results should not be relied upon until they are confirmed. However, EMX believes these results to be reliable and relevant.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/144216