Vancouver, British Columbia–(Newsfile Corp. – April 3, 2023) – Silver Hammer Mining Corp. (CSE: HAMR) (OTCQB: HAMRF) (FSE: 7BW0) (the “Company” or “Silver Hammer“) is pleased to announce that it has recently completed a property-wide geophysical compilation at its Silver Strand Project in Idaho. Results were very positive and highlighted multiple new priority targets for the Company’s 2023 exploration program.

“Silver Hammer is excited to discover 15 new priority exploration target zones from our recently completed geophysical compilation using data from 2004 to 2022,” commented President & CEO, Peter A. Ball. “Most of the new targets within the property are located in the Revett Formation, which hosts our Silver Strand Mine. The same silver belt is within the renowned Coeur d’Alene mining district in Idaho that has produced over 1.2 billion ounces of silver and is host to some of the world’s largest silver mines. We are currently finalizing our submission of a Plan of Operations to the United States Forest Service, and with the new target zones, we anticipate an active year of exploration at our Silver Strand project.”

Geophysical Compilation Summary

Fifteen moderate to priority exploration target zones were identified from the geophysical surveys. The highest ranked targets are associated with chargeability anomalies and moderate to low conductivity. Most of the targets are located within the Revett Formation, which hosts the Silver Strand Mine.

The targets primarily identified from the Direct Current Induced Polarization (“DCIP“) results are considered moderate to high priority for follow-up, because these areas most closely resemble the responses identified around the Silver Strand Mine. These targets will be scheduled for ground follow-up to investigate the geological sources of the responses, and further geological interpretation of the geophysical surveys may identify further structural information in the data.

Technical Overview

Geophysical Compilation Overview

- In 2004, DCIP and Very Low Frequency (“VLF“) surveys were conducted by Lou O’Connor and Minex Exploration for New Jersey Mining Company at the Silver Strand property.

- In 2021, an Unmanned Aerial Vehicle (“UAV“) magnetic survey was completed by MWH Geo-Surveys International Inc.

- In 2022, Big Sky Geophysics completed a DCIP survey.

The geophysical compilation and interpretation study was completed by Condor North Consulting ULC. The study was focused on investigating the resistivity and chargeability models along with the magnetic data to determine geophysical responses to help highlight areas of interest on the project area. The 2004 DCIP and VLF survey consisted of 4 line-kilometres (“km”) of surveying over five lines. The DCIP survey used 50 metre (“m”) dipoles in a dipole-dipole electrode configuration. VLF readings were taken along the same lines at 12.5 m intervals using three stations, Jim Creek, Lualualei and Cutler. The 2022 DCIP survey consisted of 4.5 line-km of surveying over 3 lines. A 100 m dipole spacing was used with a dipole-dipole electrode configuration.

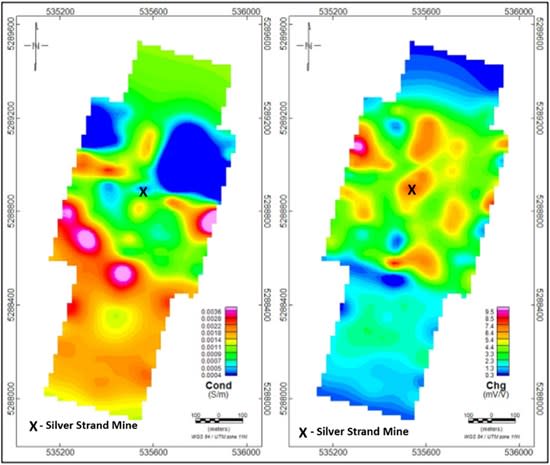

Figure 1: The combined 2004 and 2022 3D (DCIP) conductivity (left) and chargeability (right)

inversion results for a draped depth surface 50 m below topography.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/160801_4e3a8055b41c7ad3_001full.jpg.

“The geophysical results compared to the known geological model appear to highlight key features of the Silver Strand deposit, and have generated some exciting new previously unknown targets,” commented Phil Mulholland, Chief Geologist. “After working on the Silver Strand Project for two years, the geophysical study clearly indicates the potential of the property and provides additional information to execute an aggressive property-wide exploration program.”

The conductivity results in Figure 1 show that the southern half of the survey area is more conductive than the northern half. The strongest conductivity feature runs along the south edge of the 2004 survey area. Several chargeability anomalies are present within the central portion of the surveys, including the Silver Strand Mine.

UAV Magnetic Survey

The UAV magnetic survey was completed from August 3rd to 19th, 2021. A total of 521 line-km was collected with a line spacing of 25 m (MWH, 2021).

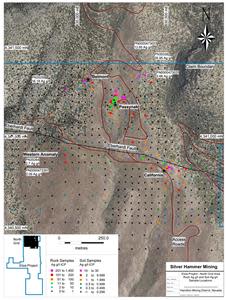

The measured magnetic data reveals a small variation in magnitude throughout the survey area. This small range indicates there is a low variation in the magnetic susceptibilities of the underlying rocks. The magnetic data shows several west-northwest trending narrow magnetic highs, predominately along the southwest half of the grid. These highs may indicate the presence of mafic dikes, which is of interest due to the proximity of these dikes to mineralization found in the Silver Strand Mine. These magnetic lineaments are displayed along with faults from geologic maps in Figure 2.

Figure 2: Interpreted magnetic lineaments with faults, (Idaho Geological Survey, Browne 2002)

on draped depth slice from the 3D susceptibility model at a depth of 50 m below surface.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/160801_4e3a8055b41c7ad3_002full.jpg.

VLF Results

The 2004 VLF data identified several conductors, which corresponded with conductive areas in the DCIP conductivity model. The VLF conductors appear to correlate with magnetic highs to the northeast of the mine area, while the southern conductive trend shows a more variable magnetic response. The two VLF anomalies to the southwest of the mine area are associated with a broad magnetic low.

Target Zones Study

The purpose of this study was to compare DCIP, VLF and UAV magnetic data of a known mineral occurrence located at the Silver Strand Mine. Target zones would have similar geophysical characteristics and may include areas of anomalous conductivity, chargeability and/or susceptibility.

The 50 m draped depth slices from these two products are shown in Figure 3 with the mapped mafic dikes at the mine site shown in black. From these images a chargeability anomaly and low conductivity are located along the western half of the dike location and extending further to the northwest. The conductivity low may be related to silicification observed at the mine site, while the chargeability anomaly is likely caused by disseminated sulphides that are also present at the mine site. These observations indicate that other chargeability anomalies in the survey area, especially where they are coincident with conductivity lows, are of interest for further investigation.

The target zones are based on the DCIP results along with the magnetic trends. The geophysical responses observed in the area of the Silver Strand Mine were used to prioritize the targets.

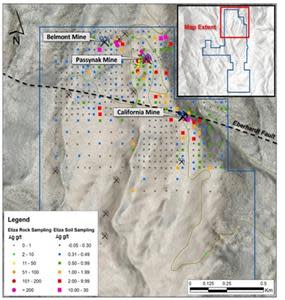

Figure 3: Target Zones are shown from 3D conductivity (left), chargeability (centre)

and susceptibility (right) models 50 m below the surface. Mafic

dikes are shown from the mine site by black polygon.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/160801_4e3a8055b41c7ad3_003full.jpg.

Figure 4: Magnetic Target Zones are shown on draped depth slice 50 m below the

surface from 3D susceptibility model with interpreted faults.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/160801_4e3a8055b41c7ad3_004full.jpg.

Qualified Person

Technical aspects of this press release have been reviewed and approved under the supervision of Philip Mulholland, P.Geo. Mr. Mulholland is a Qualified Person (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Silver Hammer Mining Corp.

Silver Hammer Mining Corp. is a junior resource exploration company advancing its flagship past-producing Silver Strand Mine in the Coeur d’Alene Mining District in Idaho, as well both the Eliza Silver Project and the Silverton Silver Mine in one of the world’s most prolific mining jurisdictions in Nevada. Silver Hammer’s primary focus is defining and developing silver deposits near past-producing mines that have not been adequately explored. The Company’s portfolio also provides exposure to copper and gold discoveries.

On Behalf of the Board of Silver Hammer Mining Corp.

Peter A. Ball

President & CEO, Director

E: peter@silverhammermining.com

For investor relations inquiries, contact:

Kristina Pillon

High Tide Consulting Corp.

T: 604.908.1695

E: investors@silverhammermining.com

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of Canadian securities legislation. Such forward-looking statements concern, without limitation, the Company’s strategic plans, timing and expectations for the Company’s exploration and drilling programs, estimates of mineralization from drilling, geological information projected from sampling results and the potential quantities and grades of the target zones. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; and the historical basis for current estimates of potential quantities and grades of target zones. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors, including the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data, and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

The CSE does not accept responsibility for the adequacy or accuracy of this release. The Canadian Securities Exchange has neither approved nor disapproved the contents of this press release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/160801