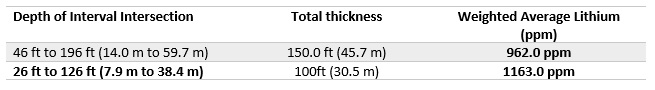

- New assay results from detailed soil geochemistry sampling have outlined a high-grade porphyry anomaly averaging greater than 500 parts per million (“ppm”) copper and 30 ppm molybdenum with highest values up to 1,125 ppm copper and 163 ppm molybdenum.

- Located only approximately 150 metres south of the southernmost modelled boundary of the Main Breccia discovery at Apollo, this new high-grade anomaly covers an area measuring 250 metres by 150 metres and remains completely open for expansion to the west, east and south.

- Follow-up reconnaissance geological work at surface has identified a potassic altered porphyry diorite hosting quartz, molybdenum, and chalcopyrite veins. Surface rock chip sampling from limited weathered (leached) outcrop has returned grades of up to 0.28% copper and 0.13% molybdenum.

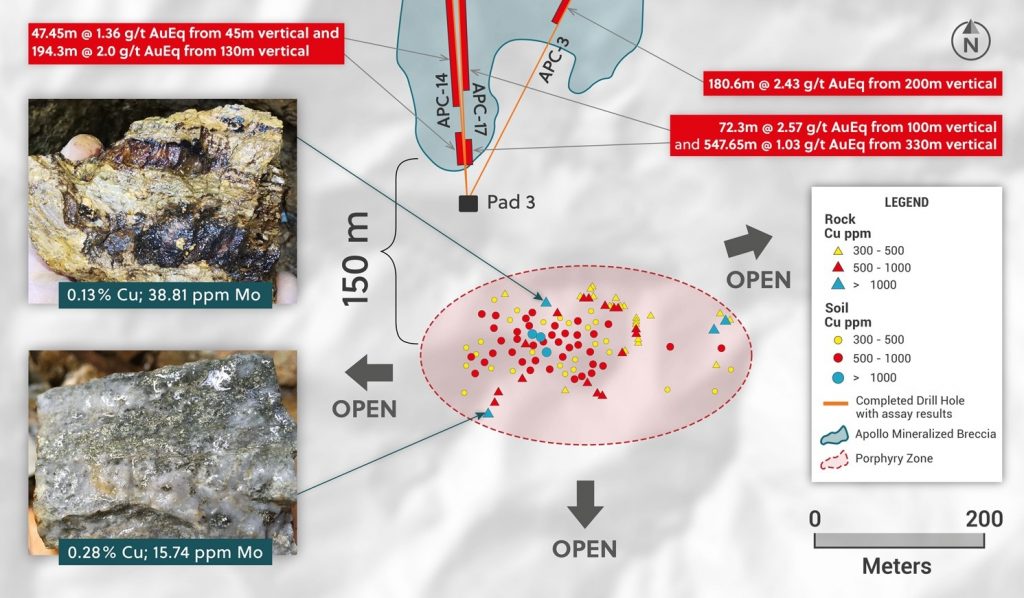

- The soil anomaly compares favorably in grade and is slightly larger than the soil anomaly covering the southern portion of the Main Breccia discovery at Apollo where recent assay results from drilling have intercepted the highest copper grades to date including drill hole APC-18 which averaged 168.6 metres at 0.98 g/t gold, 69 g/t silver and 0.5% copper.

- Immediate plans are underway to test the porphyry target with the first drill hole expected to begin in early Q1, 2023.

- Three rigs continue to drill the Main Breccia at Apollo with holes APC-22 through APC-27 awaiting assay results and holes APC-28 through APC-30 nearing completion ahead of a short break for the seasonal holiday.

Toronto, Ontario, December 14, 2022 – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from soil and rock chip sampling undertaken south of the Main Breccia discovery at the Apollo target (“Apollo”) within the Company’s Guayabales project located in Caldas, Colombia. As part of its fully funded 23,000 metre drill program for 2022, there are currently three diamond drill rigs operating at the Apollo target. The Main Breccia discovery at Apollo is a high-grade, bulk tonnage copper-gold-silver porphyry-related breccia system with previously announced assay results including:

| Hole | Intercept (m) | Au (g/t) | Ag (g/t) | Cu % | Zn % | Pb % | Mo % | AuEq (g/t) * |

| APC-2 | 207.15 | 1.46 | 45 | 0.31 | 0.08 | 0.05 | 0.002 | 2.68 |

| APC-8 | 265.75 | 1.26 | 55 | 0.22 | 0.07 | 0.05 | 0.045 | 2.44 |

| APC-12 | 237.70 | 1.15 | 72 | 0.38 | 0.08 | 0.07 | 0.001 | 2.88 |

* See press releases dated August 10th, September 13th and October 6th respectively.

Executive Chairman, Ari Sussman stated: “The discovery of a high-grade copper and molybdenum soil anomaly associated with a mineralized porphyry body just south of our Main Breccia discovery at Apollo is exciting. As drilling continues to expand the Main Breccia discovery at Apollo, our early-stage exploration team has been focused on prospecting the rest of the Apollo target area to determine if a possible source exists for the copper mineralization found within the breccia discovery. Given the proximity to our Main Breccia discovery, this new high-grade porphyry target suggests we may have found the source. We are eager to test the new target and plan to initiate drilling in January as part of our upcoming 2023 drilling program. We are looking forward to an exciting 2023 as we continue to drive shareholder value through aggressive expansion drilling of the Main Breccia discovery while testing new targets.”

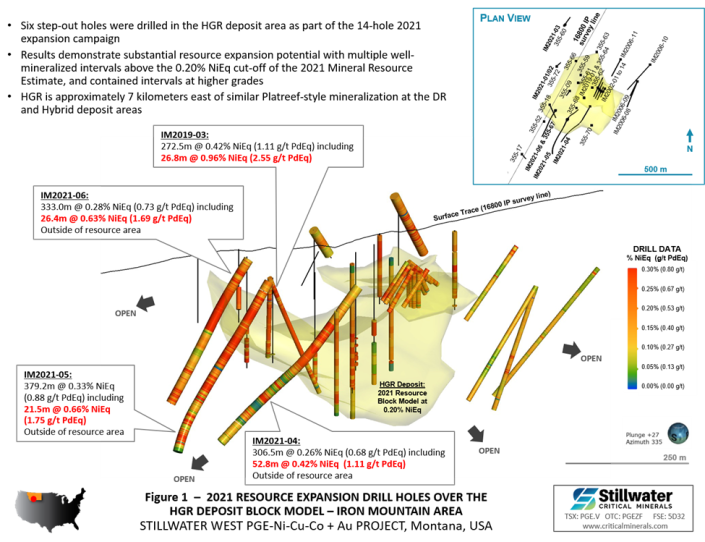

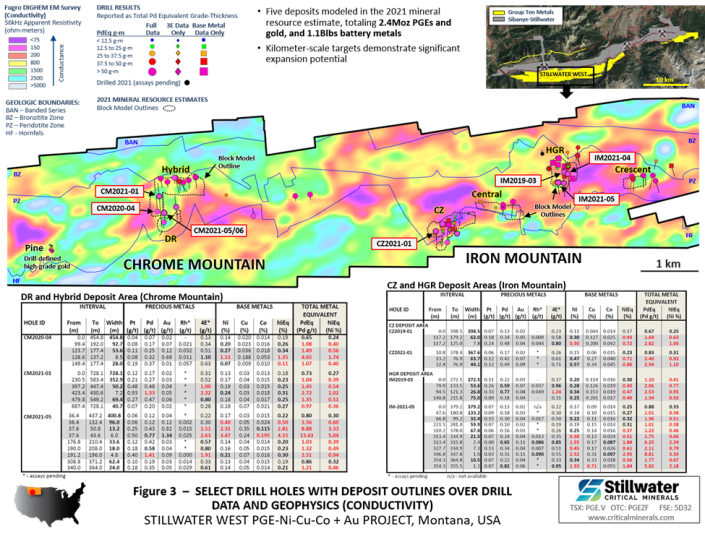

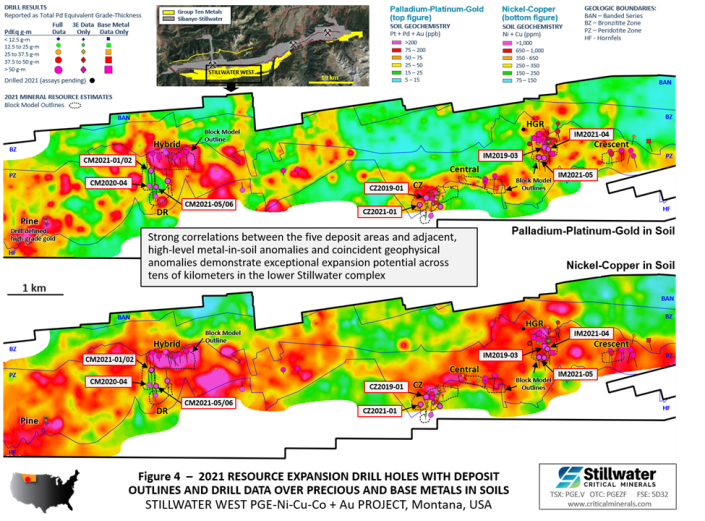

Details (See Figures 1–3)

The Company’s exploration teams have recently undertaken outcrop mapping and soil sampling within the Apollo area with the objective of outlining new targets for drilling. This work has outlined a coherent and well-defined soil anomaly for copper and molybdenum covering dimensions of 250 metres east-west by 150 metres north-south. The anomaly is defined by over 70 soil samples with copper values ranging from 310-1,125pmm and Molybdenum values up to 163ppm. Gold in soil within the anomaly has also returned numerous samples (n=12) ranging from 0.1 to 0.4 g/t. The soil anomaly locates only 150 metres south of the southernmost outcropping portion of the northerly dipping Main Breccia discovery at Apollo as defined by drilling and surface outcrop sampling. The southern copper and molybdenum anomaly is still open at surface to the west, east and to the south.

Reconnaissance geological mapping and rock chip sampling within the anomalous soil area has identified porphyry diorites with secondary biotite alteration hosting porphyry “B” veins with center and border lines of chalcopyrite and molybdenum. Disseminated chalcopyrite was also observed within the limited outcrop exposures with rock chip sampling reporting grades up to 0.28% of copper, 0.13% of molybdenum and 0.8 g/t gold.

The Company is currently organizing and constructing a new drill pad to test the target with diamond drilling in January 2023.

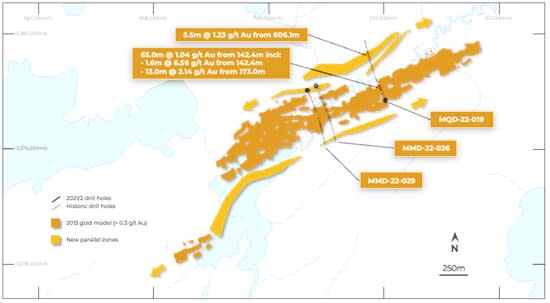

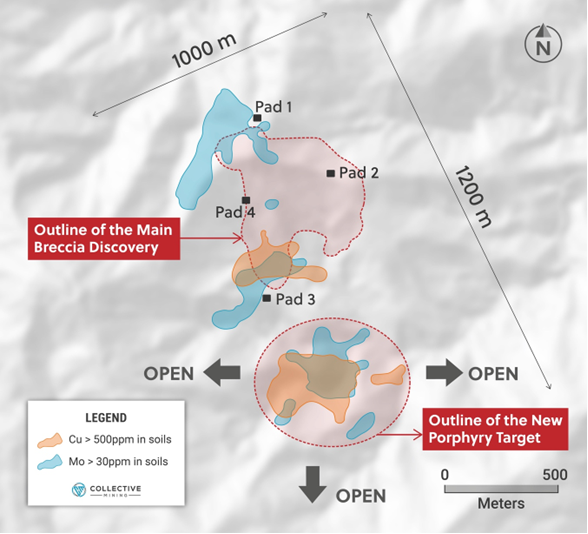

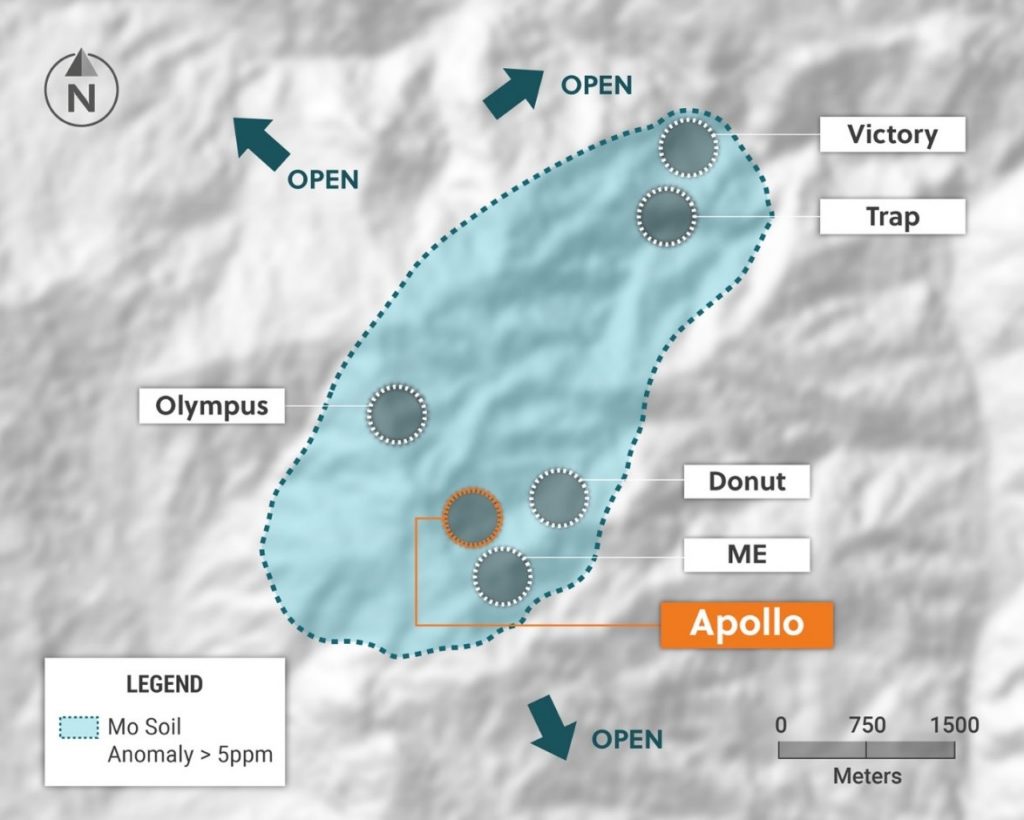

The larger Apollo target area, which includes the Main Breccia discovery and other breccia and porphyry targets, is defined to date by surface mapping, rock sampling and copper and molybdenum soil geochemistry and covers a 1,000 metres X 1,200 metres area. The Apollo target area hosts the Company’s new Main Breccia discovery plus multiple CBM vein systems located within and above and below the mineralized angular breccia. Additional untested breccia discoveries locate to the NE and SE of the main breccia discovery. The newly defined porphyry target, as outlined in this press release, is located 150 metres due south of the southernmost end the Main Breccia discovery and is flanked to the southeast by outcrops hosting a high density of porphyry quartz veins associated with early biotite veins in diorite porphyry. The larger Apollo target area also remains open for further expansion.

Figure 1: Plan View of the New Porphyry Target Soil Anomaly in Relation to the Main Breccia Discovery at Apollo

Figure 2: Detailed View of the Soil Anomaly Covering the New Porphyry Target with Photos and Assay Results for Rock Samples

Figure 3: Plan View of the Guayabales Project Highlighting the Apollo Target Location

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver and gold exploration company based in Canada, with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo target, which hosts the large-scale, bulk-tonnage and high-grade copper, silver and gold Main Breccia discovery. The Company’s near-term objective is to continue with expansion drilling of the Main Breccia discovery while increasing confidence in the highest-grade portions of the system.

Management, insiders and close family and friends own nearly 35% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSXV under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Contact Information

Collective Mining Ltd.

Steven Gold, Vice President, Corporate Development and Investor Relations

Tel. (416) 648-4065

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.