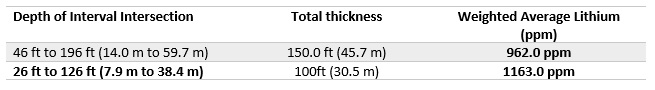

VANCOUVER, BC / ACCESSWIRE / June 2, 2022 / Sandy MacDougall, CEO of Noram Lithium Corp. (“Noram” or the “Company“) (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is pleased to announce the successful completion of CVZ-75 (PH-01) and CVZ-76 (PH-02) and release of the final assay results. The Company completed core hole CVZ-75 at a depth of 326 feet (99.4 m). Sampling for assays began at 46 ft (14.0 m) and continued to the bottom of the hole, an interval thickness of 150 ft (45.7 m) was intersected from 46 ft (14.0 m) to 196 ft (59.7 m). The hole ended in mineralization and the weighted average lithium values present are summarized below. The Company completed core hole CVZ-76 at a depth of 338 feet (103.0 m). Sampling for assays began at 26 ft (7.9 m) and continued to the bottom of the hole, an interval thickness of 100 ft (30.5 m) was intersected from 26 ft (7.9 m) to 126 ft (38.4 m). The hole ended in mineralization and the weighted average lithium values present are summarized below.

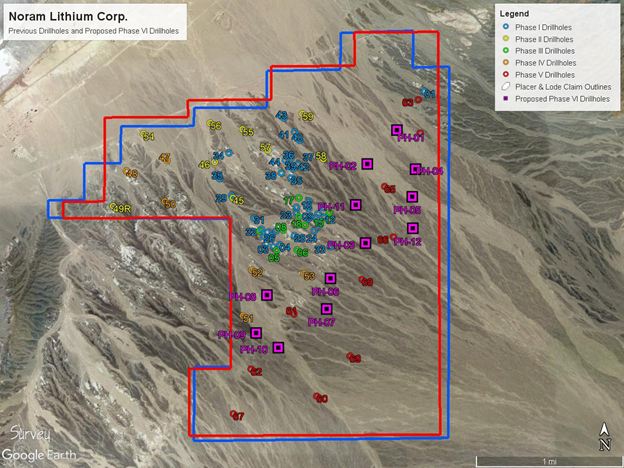

Figure 1 – Location of all past drill holes (Phase I to Phase V) previously completed in addition to the 12 proposed holes for Phase V1. Phase VI holes are indicated in purple.

Figure 2 – Comparative stratigraphy and assay results for drill holes CVZ-76 and CVZ-75 as compared to CVZ-63 which was drilled as part of a prior program. The histogram on the sides of the holes are the composited lithium grades in ppm Li. The cross section has a 4X vertical exaggeration.

“Holes CVZ-75 and CVZ-76 were located near the northeast end of the Phase V and Phase VI drilling. This is an area where the sediments are thinner since we are getting close to the basin margin. However, the lithium grades continue to be high. These holes are expected to continue to upgrade portions of the Zeus resource from inferred to indicated in Noram’s upcoming PFS.” comments Brad Peek, VP of Exploration and geologist on all six phases of Noram’s Clayton Valley exploration drilling.

| Hole ID | Sample No. | From (ft) | To (ft) | From (m) | To (m) | Li (ppm) |

| CVZ-75 | 1748394 | 46 | 56 | 14.0 | 17.1 | 1690 |

| CVZ-75 | 1748395 | 56 | 66 | 17.1 | 20.1 | 890 |

| CVZ-75 | 1748396 | 66 | 76 | 20.1 | 23.2 | 840 |

| CVZ-75 | 1748397 | 76 | 86 | 23.2 | 26.2 | 910 |

| CVZ-75 | 1748398 | 86 | 96 | 26.2 | 29.3 | 1420 |

| CVZ-75 | 1748399 | 96 | 106 | 29.3 | 32.3 | 1160 |

| CVZ-75 | 1748400 | 106 | 116 | 32.3 | 35.4 | 1010 |

| CVZ-75 | 1748401 | 116 | 126 | 35.4 | 38.4 | 900 |

| CVZ-75 | 1748402 | 126 | 136 | 38.4 | 41.5 | 870 |

| CVZ-75 | 1748404 | 136 | 146 | 41.5 | 44.5 | 850 |

| CVZ-75 | 1748405 | 146 | 156 | 44.5 | 47.5 | 820 |

| CVZ-75 | 1748406 | 156 | 166 | 47.5 | 50.6 | 810 |

| CVZ-75 | 1748407 | 166 | 176 | 50.6 | 53.6 | 620 |

| CVZ-75 | 1748408 | 176 | 186 | 53.6 | 56.7 | 510 |

| CVZ-75 | 1748409 | 186 | 196 | 56.7 | 59.7 | 1130 |

| CVZ-75 | 1748410 | 196 | 206 | 59.7 | 62.8 | 800 |

| CVZ-75 | 1748411 | 206 | 216 | 62.8 | 65.8 | 560 |

| CVZ-75 | 1748412 | 216 | 226 | 65.8 | 68.9 | 650 |

| CVZ-75 | 1748413 | 226 | 236 | 68.9 | 71.9 | 680 |

| CVZ-75 | 1748414 | 236 | 246 | 71.9 | 75.0 | 510 |

| CVZ-75 | 1748415 | 246 | 256 | 75.0 | 78.0 | 650 |

| CVZ-75 | 1748416 | 256 | 266 | 78.0 | 81.1 | 570 |

| CVZ-75 | 1748417 | 266 | 276 | 81.1 | 84.1 | 770 |

| CVZ-75 | 1748418 | 276 | 286 | 84.1 | 87.2 | 570 |

| CVZ-75 | 1748419 | 286 | 296 | 87.2 | 90.2 | 510 |

| CVZ-75 | 1748420 | 296 | 306 | 90.2 | 93.3 | 770 |

| CVZ-75 | 1748421 | 306 | 316 | 93.3 | 96.3 | 470 |

| CVZ-75 | 1748422 | 316 | 326 | 96.3 | 99.4 | 600 |

Table 1 – Sample results from CVZ-75 from 46 ft (14.0 m) to depth of 326 ft (99.4 m).

| Hole ID | Sample No. | From (ft) | To (ft) | From (m) | To (m) | Li (ppm) |

| CVZ-76 | 1748426 | 26 | 36 | 7.9 | 11.0 | 1320 |

| CVZ-76 | 1748427 | 36 | 46 | 11.0 | 14.0 | 1620 |

| CVZ-76 | 1748428 | 46 | 56 | 14.0 | 17.1 | 1620 |

| CVZ-76 | 1748429 | 56 | 66 | 17.1 | 20.1 | 970 |

| CVZ-76 | 1748430 | 66 | 76 | 20.1 | 23.2 | 830 |

| CVZ-76 | 1748431 | 76 | 86 | 23.2 | 26.2 | 910 |

| CVZ-76 | 1748432 | 86 | 96 | 26.2 | 29.3 | 1460 |

| CVZ-76 | 1748433 | 96 | 106 | 29.3 | 32.3 | 1070 |

| CVZ-76 | 1748434 | 106 | 116 | 32.3 | 35.4 | 930 |

| CVZ-76 | 1748435 | 116 | 126 | 35.4 | 38.4 | 900 |

| CVZ-76 | 1748436 | 126 | 136 | 38.4 | 41.5 | 780 |

| CVZ-76 | 1748437 | 136 | 146 | 41.5 | 44.5 | 710 |

| CVZ-76 | 1748438 | 146 | 156 | 44.5 | 47.5 | 670 |

| CVZ-76 | 1748439 | 156 | 168 | 47.5 | 51.2 | 720 |

| CVZ-76 | No Sample | 168 | 178 | 51.2 | 54.3 | |

| CVZ-76 | 1748440 | 178 | 188 | 54.3 | 57.3 | 460 |

| CVZ-76 | 1748441 | 188 | 198 | 57.3 | 60.4 | 840 |

| CVZ-76 | 1748442 | 198 | 208 | 60.4 | 63.4 | 700 |

| CVZ-76 | 1748443 | 208 | 218 | 63.4 | 66.4 | 740 |

| CVZ-76 | 1748444 | 218 | 228 | 66.4 | 69.5 | 720 |

| CVZ-76 | 1748445 | 228 | 238 | 69.5 | 72.5 | 710 |

| CVZ-76 | 1748446 | 238 | 248 | 72.5 | 75.6 | 520 |

| CVZ-76 | 1748447 | 248 | 258 | 75.6 | 78.6 | 680 |

| CVZ-76 | 1748448 | 258 | 268 | 78.6 | 81.7 | 640 |

| CVZ-76 | 1748449 | 268 | 278 | 81.7 | 84.7 | 640 |

| CVZ-76 | 1748450 | 278 | 288 | 84.7 | 87.8 | 590 |

| CVZ-76 | 1748451 | 288 | 298 | 87.8 | 90.8 | 590 |

| CVZ-76 | 1748452 | 298 | 308 | 90.8 | 93.9 | 449 |

| CVZ-76 | 1748453 | 308 | 318 | 93.9 | 96.9 | 610 |

| CVZ-76 | 1748454 | 318 | 328 | 96.9 | 100.0 | 560 |

| CVZ-76 | 1748455 | 328 | 338 | 100.0 | 103.0 | 470 |

Table 2 – Sample results from CVZ-76 from 26 ft (7.9 m) to depth of 338 ft (103.0 m).

All samples were analyzed by the ALS laboratory in Reno, Nevada. QA/QC samples were included in the sample batch and returned values that were within their expected ranges.

The technical information contained in this news release has been reviewed and approved by Brad Peek., M.Sc., CPG, who is a Qualified Person with respect to Noram’s Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV:NRM | OTCQB:NRVTF | Frankfurt:N7R) is a well-financed Canadian based advanced Lithium development stage company with less than 90 million shares issued and a fully funded treasury. Noram is aggressively advancing its Zeus Lithium Project in Nevada from the development-stage level through the completion of a Pre-Feasibility Study in 2022.

The Company’s flagship asset is the Zeus Lithium Project (“Zeus”), located in Clayton Valley, Nevada. The Zeus Project contains a current 43-101 measured and indicated resource estimate* of 363 million tonnes grading 923 ppm lithium, and an inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off. In December 2021, a robust PEA** indicated an After-Tax NPV(8) of US$1.3 Billion and IRR of 31% using US$9,500/tonne Lithium Carbonate Equivalent (LCE). Using the LCE long term forecast of US$14,000/tonne, the PEA indicates an NPV (8%) of approximately US$2.6 Billion and an IRR of 52% at US$14,000/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Chief Executive Officer and Director

C: 778.999.2159

For additional information please contact:

Peter A. Ball

President and Chief Operating Officer

peter@noramlithiumcorp.com

C: 778.344.4653

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws. *Updated Lithium Mineral Resource Estimate, Zeus Project, Clayton Valley, Esmeralda County, Nevada, USA (August 2021) **Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

SOURCE: Noram Ventures Inc.

View source version on accesswire.com:

https://www.accesswire.com/703581/Noram-Receives-Results-for-CVZ-75-76-High-Grade-Intercepts-of-150-Ft-457-M-Averaging-962-PPM-100-Ft-305-M-Averaging-1163-PPM-Respectively