VANCOUVER, BC / ACCESSWIRE / July 18, 2024 / Stillwater Critical Minerals Corp. (TSXV:PGE)(OTCQB:PGEZF)(FSE:J0G) (the “Company” or “Stillwater”) announces it has commenced 2024 field activities including a property-wide airborne electro-magnetic geophysical survey at its flagship Stillwater West Ni-PGE-Cu-Co + Au project in Montana.

The Company has engaged Expert Geophysics Ltd. for a combined time-domain electromagnetic (“EM”) survey using their TargetEM26 system along with a magneto-telluric survey using their MobileMTm system. The survey will utilize the newest technological advancements in airborne EM, building on the success of the first generation DIGHEM airborne EM survey flown over the project in 2000. The total survey will cover approximately 1,069 line-kilometers and provide higher-resolution and improved depth of investigation from the DIGHEM airborne EM survey, as well as VLF coverage. The survey has been designed in collaboration with Glencore plc via the Stillwater West technical committee to fine-tune priority conductive drill targets across the 12-kilometer main resource area, as well as to assist with prioritization and ranking of additional untested conductive targets across the broader 61-square-kilometer property.

Stillwater’s President and CEO, Michael Rowley, said “We are very pleased to kick off our field activities for the season at Stillwater West. This large-scale geophysical survey is part of a larger program that is expected to include an updated mineral resource estimate that will support the commencement of various studies relating to potential production scenarios. These objectives will be important milestones in preparation for continued resource expansion drilling across the nine-kilometer deposit area as well as in developing target areas. In addition, the Company is pursuing a number of other studies and initiatives with strategic partners such as Cornell University and various US Government agencies.”

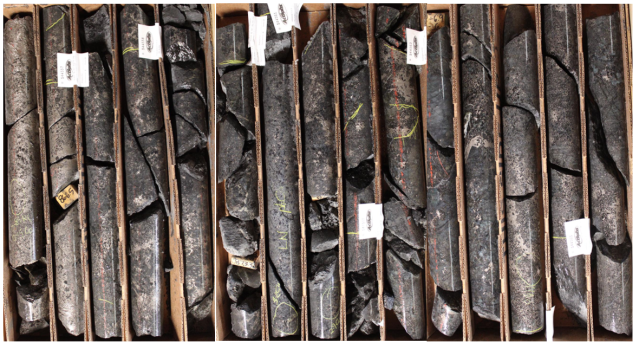

Vice-President of Exploration, Dr. Danie Grobler, said, “Work has been on-going at our core facility as we ramp up for the year. The technical committee, including Glencore, continues to be focused on the expansion potential of the lower Stillwater Igneous Complex. Detailed geological and structural interpretive work during the past two years added significantly to our understanding of the large Platreef-style mineralized system discovered within the footwall contact zone of the Stillwater Complex. Our geological models now display strong geological control and continuity on mineralized zones. The planned airborne surveys will provide important high-resolution datasets to refine targeting of high-grade nickel-copper-PGE sulphide-hosted mineralization within the multi-kilometer-scale geophysical anomalies that we see across the 32-kilometer-long mineralized system.”

Upcoming Events

Stillwater is pleased to announce that President and CEO Michael Rowley will be presenting at the following events:

- Precious Metals Summit, Beaver Creek, Colorado, September 10-13, 2024. For information and registration please click here.

- Precious Metals Summit, Zurich, Switzerland, November 11-12, 2024. For information and registration please click here.

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals (TSXV:PGE)(OTCQB:PGEZF)(FSE:J0G) is a mineral exploration company focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the addition of two renowned Bushveld and Platreef geologists to the team and strategic investments by Glencore plc, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group, nickel, and other metals by neighboring Sibanye-Stillwater. An expanded NI 43-101 mineral resource estimate, released January 2023, positions Stillwater West with the largest nickel resource in an active US mining district as part of a compelling suite of nine minerals now listed as critical in the USA. To date, five Platreef-style nickel and copper sulphide deposits host a total of 1.6 billion pounds of nickel, copper and cobalt, and 3.8 million ounces of palladium, platinum, rhodium, and gold at Stillwater West. All of these deposits remain open for expansion along trend and at depth.

Stillwater also holds the high-grade Black Lake-Drayton Gold project adjacent to Nexgold Mining’s development-stage Goliath Gold Complex in northwest Ontario, currently under an earn-in agreement with Heritage Mining, and the Kluane PGE-Ni-Cu-Co critical minerals project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director – Stillwater Critical Minerals

Email: info@criticalminerals.com Phone: (604) 357 4790

Web: http://criticalminerals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater Critical Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater Critical Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Stillwater Critical Minerals Corp.