Vancouver, British Columbia–(Newsfile Corp. – February 13, 2023) – Gladiator Metals Corp. (TSXV: GLAD) (“Gladiator” or the “Company“) is pleased to announce that, further to its news release on November 14, 2022, it has received final approval from the TSX Venture Exchange (the “TSX-V“) for the Mineral Property Option Agreement (the “Option Agreement“) dated November 8, 2022 with H. Coyne & Sons Ltd. (the “Optionor“) whereby the Optionor has granted the Company the right to acquire a 100% legal and beneficial interest in all of the Optionor’s title and interest (the “Option“) in and to 315 contiguous mineral claims located in the Yukon (the “Whitehorse Copper Project” or the “Project“).

Trading of the Company’s common shares will resume on February 15, 2023.

The Whitehorse Copper Project

Project Highlights:

- High Grade historical copper production of >10Mt @ 1.5% Cu produced (plus Au/Ag credits) via open pit (1967-1971) and underground (1972-1982).

- Whitehorse Copper Project includes 30 known prospects within a 35km x 5km area. Shallow, high grade copper results from multiple prospects. Limited systematic drilling away from existing pits. All previous operations and unmined prospects are all open along strike and down dip.

- Approximately 10,000 metres of unassayed core from exploration drilling to be assayed and logged. Year-round access for work programs, good road and drill access network established, low-cost exploration due to proximity to Whitehorse and strong partnership with the Optionors, and an experienced local drilling service provider.

- Significant future exploration potential with drilling outside of historic areas of operation including:

- Cowley Park: Most advanced prospect area with near term resource potential. Mineralization open at depth and along strike (mineralization drilled to max 150m vertical depth only). Gladiator’s initial focus will be on defining and extending mineralization at the Cowley Park Copper deposit through diamond drilling. Cowley Park had reached feasibility stage before operations in the belt were shut down in 1982 and remains open along strike and down dip.

- Historic drill hole intercepts include:

- CP-125: 18.44m @ 4.42% Cu, from 56.39m downhole and 1.41% Cu from 87.84m downhole

- CP-144: 38.57m @ 1.73% Cu, 7.15 g/t Ag from 33.98m downhole

- 18-CP-03: 9.14m @ 2.0% Cu, 12.5 g/t Ag from 83.82m downhole

- 18-CP-06: 23.04m @ 1.59% Cu, 10.28 g/t Ag from 74.98m downhole

- 19-CP-08: 40.54m @ 2.36% Cu, 4.75.3 g/t Ag including 13.72m @ 5.41% Cu and 19.22g/t Ag from 109.42m downhole

Other prospects within the Project area, with historic drill hole intercepts, include:

- War Eagle:

- HT-1: 10.55m @ 4.99% Cu, 1.05g/t Au, 40.3g/t Ag from 124.39m.

- North Star:

- NS-15: 14.63m @ 4.95% Cu from 419.65m.

The drill results reported in this news release are historical in nature. Gladiator has not undertaken any independent investigation, nor has it independently analyzed the results of the historical exploration work in order to verify the results. The Company believes that the historical drill results may not all conform to the presently accepted industry standards. Gladiator considers these historical drill results relevant as the Company will use this data as a guide to plan future exploration programs. The Company also considers the data to be reliable for these purposes, however, the Company’s future exploration work will include verification of the data through drilling.

The Company has filed a technical report for the Whitehorse Copper Project (the “Technical Report“). The Technical Report, entitled “NI 43-101 Technical Report on the Whitehorse Copper Project Yukon Territory” and dated effective November 23, 2022, was prepared for the Company by Derek Torgerson, P. Geo., of Summit Geosciences Ltd, a “qualified person,” as such term is defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“), and independent of the Company for the purposes of NI 43-101. A copy of the Technical Report is available under the Company’s SEDAR profile at www.sedar.com.

The Whitehorse Copper Project is an advanced-stage copper (Cu) ± molybdenum (Mo) ± silver (Ag) ± gold (Au) skarn exploration project in the Yukon Territory, Canada. The property comprises 315 contiguous claims covering approximately 5,380 Hectares (13,294 acres) in the Whitehorse Mining District. The Whitehorse Copper Project covers a significant portion of what has historically been known as the Whitehorse Copper Belt. Gladiator Metals Corp. has entered into a 6-year option agreement with H. Coyne and Sons Ltd. to earn a 100% interest in the Project.

Copper mineralization was first discovered in 1897 on the Whitehorse Copper Belt, as it became to be known. The Whitehorse Copper Belt comprised over 30 copper-related, primarily skarn occurrences covering an area of 35 by 5 km in a north westerly trending arc. Exploration and mining development have been carried out intermittently since that time with the main production era lasting between 1967 and 1982 where production totaled 267,500,000 pounds copper, 225,000 ounces of gold and 2,838,000 ounces of silver from 11.1 million tons of mineralized skarn ore were milled (Watson, 1984).

The Project is road accessible with numerous access roads located within 2 km of the South Klondike Highway and the Alaska Highway. An extensive network of historical gravel exploration and haul roads exists throughout the project area and provide excellent access to the majority of the claim package. Access to existing electric power facilities is available through the main Yukon power grid.

The Whitehorse Copper Project is located within the traditional territory of the Kwanlin Dün and Ta’an Kwäch’än Council First Nations. Gladiator acknowledges and respects the traditional territory of the Kwanlin Dün and Ta’an Kwäch’än Council First Nations and is committed to developing a respectful relationship with them.

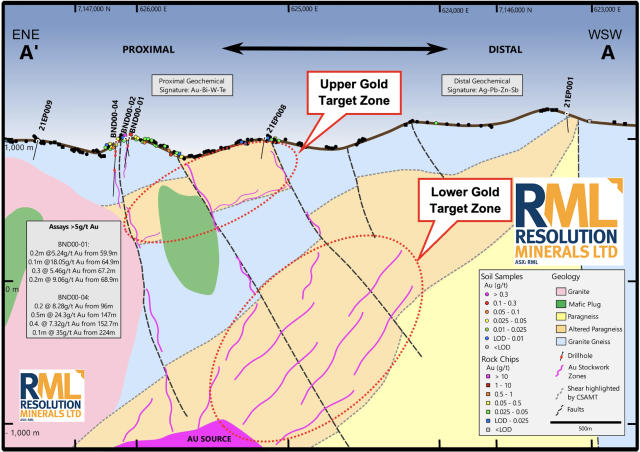

The intrusive rocks of the region are predominantly granodioritic to dioritic and Cretaceous in age (109 – 199 Ma). They are thought to form the upper reaches of a large batholith belonging to the Whitehorse Plutonic Suite and intrude primarily into Triassic to Jurassic Lewes River Group clastic and carbonate metasediments. Throughout the Whitehorse Copper Project, skarning occurs variably through limestone horizons and along the contacts with the intrusive rocks. Skarn deposits within the Whitehorse Copper Project are considered exoskarns that formed within 150 m of the mid Cretaceous calc-alkaline Whitehorse Batholith contact; however, a number of endoskarns are documented within the intrusion as well. Two main types of skarn deposits are observed. Iron-rich, in which copper occurs with magnetite, serpentine, specularite, talc, chlorite and occasional pyrrhotite and pyrite and Iron-poor (calc-silicate) where copper occurs with garnet, diopside, wolastonite, tremolite, epidote, chlorite, calcite and quartz. The copper minerals occur as grains, blebs, pods and stringers that appear to postdate the skarn minerals. Bornite is predominant in the iron-rich skarns and is slightly more abundant than chalcopyrite in the silicate skarns. Silver content is proportional to the copper grade but gold is more erratically distributed, being more abundant in the iron-rich skarn deposits.

The most recent work on the Project and Gladiator’s initial focus is on defining and extending mineralization at the Cowley Park Copper deposit through diamond drilling. The recent drilling campaigns have returned drill core assay intervals consistent in grade with historical results. Cowley Park sits at the southern end of the Project and had reached feasibility stage before operations in the belt were shut down in 1982. Diamond drilling was carried out in the 1960’s loosely defining the main zone mineralization and more thorough drilling was conducted in the early 1970’s culminating in a total of ~125 holes and ~11,500 meters of core (Hureau, 1981).

Gladiator has recently compiled a digital database containing 475 dill holes within the current and historical project boundaries. Many of the drill holes are historical in nature and lack documented modern QA/QC methods, chain of custody documentation, proper GPS collar locations and down hole surveying and would not meet the standard for a current NI 43-101 resource estimate. The more recent drilling, from 2007 onward appears to have been conducted in a much more systematic manner but significant amounts of core is currently in storage and needs to be logged, sampled and assayed.

The Company is planning an initial work program which would include data compilation and digitization of the historical drill logs, geological mapping, surface geochemistry and geophysical surveys. Additionally, approximately 10,000 m of diamond drill core will be logged and assayed. A 250-line km ground-based magnetics survey should be conducted over the south-eastern portion of the Project where a 2014 airborne survey was not completed. Targets generated from this work will guide a follow up diamond drilling program.

Transaction Summary

Pursuant to the terms and conditions of the Option Agreement, the Optionor has granted the Company the right to acquire all of the Optionor’s title and interest in and to 315 mineral claims located in the Yukon that constitute the Project. In order to exercise the Option the Company must over a six (6) year period:

(i) issue the Optionor an aggregate of 15,000,000 common shares in the capital of the Company;

(ii) pay the Optionor an aggregate of $300,000 in cash; and

(iii) incur an aggregate of $12,000,000 in exploration expenditures on the Project.

Following the exercise of the Option, the Company must pay the Optionor, or such other person(s) as the Optionor may direct from time to time, a 1.0% net smelter returns royalty on the Whitehorse Copper Project. Certain mineral claims forming part of the Whitehorse Copper Project are also encumbered by pre-existing royalties which the Company shall be responsible for following the exercise of the Option.

The Company has also granted the Optionor: (i) a right of right of first refusal to undertake each exploration or development program on the Whitehorse Copper Project; (ii) the right to subscribe for and be issued as part of any public offering of the securities of the Company up to such number of securities that will allow the Optionor to maintain a percentage ownership interest of the common shares of the Company that is equal to the percentage of common shares that it then owns or controls of the total issued and outstanding common shares at such time; and (iii) the right to nominate one (1) director to the board of the directors of the Company, each for specified time periods as set forth in the Option Agreement.

All common shares issued in connection with the Option Agreement will be subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities laws.

Finder’s Fees

In connection with the Option Agreement, the Company has entered into a finder’s fee agreement pursuant to which the Company has agreed to issue a finder up to 1,362,500 Common Shares for introducing the Optionor to the Company.

Change in Officers

The Company announces that Ian Harris has resigned as Chief Executive Officer of the Company. Mr. Harris will continue as a member of the Company’s board of directors. The Company would like to thank Mr. Harris for his service to the Company as Chief Executive Officer.

Jason Bontempo, a current director of the Company, has been appointed as Chief Executive Officer following Mr. Harris’ resignation. Additionally, the Company has appointed Kell Ivar Nielsen as Vice President, Exploration, of the Company. The Company looks forward to continuing under the leadership of both Mr. Bontempo and Mr. Nielsen.

Investor Relations

The Company has entered into a consulting agreement (the “Consulting Agreement“) with Zinger Ventures Inc. (the “Consultant“), based in Vancouver, British Columbia, pursuant to which the Consultant will provide the Company with investor relations services (the “Services“). The Consulting Agreement has an initial term of six (6) months, unless terminated earlier in accordance the Consulting Agreement, and which may be extended for ensuing one month terms by agreement in writing between the Consultant and the Company.

The Services provided by the Consultant will include, but not be limited to, consulting with the Company’s management concerning marketing and investor relations services, building relationships with the Company’s investors, and attending conferences while representing the Company.

As consideration for the provision of the Services and in accordance with the terms and provisions of the Consulting Agreement, the Company will (i) pay the Consultant a monthly fee of $5,000 plus GST, (ii) grant the Consultant 150,000 stock options (the “Options“), and (iii) reimburse the Consultant for pre-approved out of pocket expenses actually and properly incurred by the Consultant in connection with the Services. The Options will vest in stages over a 12 month period with 37,500 Options vesting every three months following the grant date.

The Consultant and its principal, Dustin Zinger, are arm’s length from the Company and neither holds any securities of the Company nor has any interest, direct or indirect, in the Company.

The Company’s engagement of the Consultant and the issuance of the Options are subject to the acceptance of the TSX-V.

Qualified Person

All scientific and technical information in this news release has been prepared or reviewed and approved by Kell Nielsen, a “qualified person” for the purposes of NI 43-101.

ON BEHALF OF THE BOARD

“Jason Bontempo“

Jason Bontempo

Chief Executive Officer and Director

604-638-8063

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain of the statements and information in this news release constitute “forward-looking statements” or “forward-looking information.” Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “believes”, “plans”, “estimates”, “intends”, “targets”, “goals”, “forecasts”, “objectives”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) that are not statements of historical fact may be forward-looking statements or information.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, the need for additional capital by the Company through financings, and the risk that such funds may not be raised; the speculative nature of exploration and the stages of the Company’s properties; the effect of changes in commodity prices; regulatory risks that development of the Company’s material properties will not be acceptable for social, environmental or other reasons; availability of equipment (including drills) and personnel to carry out work programs; and that each stage of work will be completed within expected time frames. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/154606

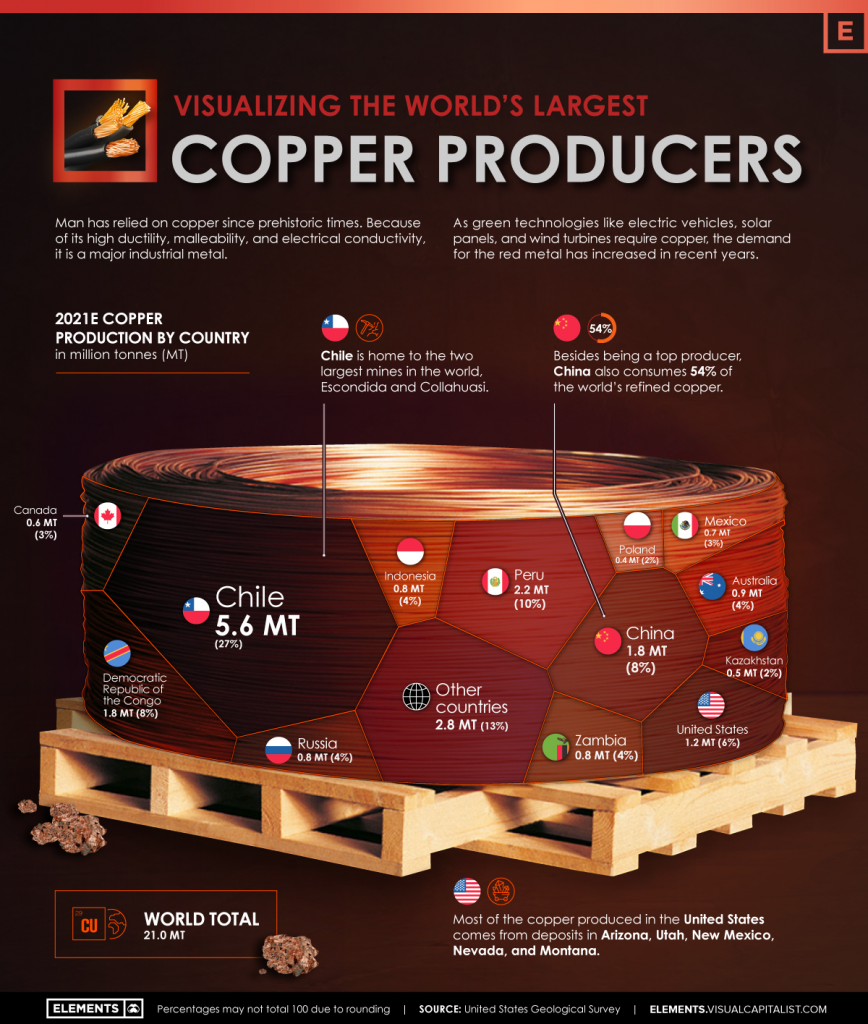

Chile

Chile Peru

Peru China

China DRC

DRC United States

United States Australia

Australia Russia

Russia Zambia

Zambia Indonesia

Indonesia Mexico

Mexico Canada

Canada Kazakhstan

Kazakhstan Poland

Poland