VANCOUVER, BC / ACCESSWIRE / January 25, 2023 / Stillwater Critical Minerals (TSX.V:PGE)(OTCQB:PGEZF)(FSE:5D32) (the “Company” or “SWCM”) is pleased to report a 62% increase in the updated independent National Instrument 43-101 (“NI 43-101”) mineral resource estimate (the “2023 Resource”) for its 100%-owned Stillwater West platinum group element, nickel, copper, cobalt, and gold (“PGE-Ni-Cu-Co + Au”) project in Montana, USA. The study, which was completed by SGS Geological Services (“SGS”), showed significant increases in tonnage and contained metal at both a bulk tonnage 0.20% nickel equivalent (“NiEq”) cut-off (“Base Case”) and a 0.35% NiEq higher grade bulk tonnage cut-off. A high-grade, selective mining component at a 0.70% NiEq cut-off is presented for the first time.

The Company will host a live webcast on January 31, 2023, at 10am PT | 1pm ET to discuss the Stillwater West project and the 2023 Resource. To register, click here.

2023 Resource Highlights

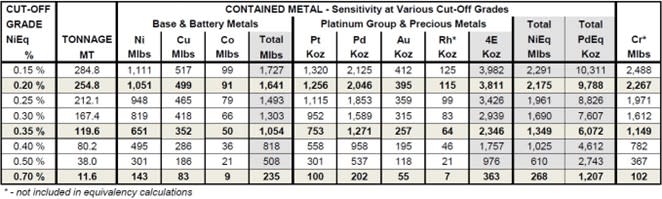

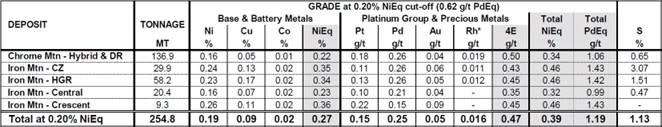

- Base Case Inferred mineral resources of 1.6 billion pounds (“Blbs”) of nickel, copper and cobalt and 3.8 million ounces (“Moz”) palladium, platinum, rhodium, and gold (“4E”) in a constrained model totaling 255 million tonnes (“Mt”) at an average grade of 0.39% total estimated recovered NiEq (or 1.19 g/t Palladium Equivalent “PdEq”). See detailed breakdown in Tables 1 and 2, below.

- Significant increases in contained metals over the 2021 study at the Base Case 0.20% NiEq cut-off:

| Tonnage: 255Mt (62% increase) | Palladium: 2.05Moz (56% increase) |

| Nickel: 1.05Blbs (52% increase) | Platinum: 1.26Moz (66% increase) |

| Copper: 499Mlbs (44% increase) | Gold: 395Koz (30% increase) |

| Cobalt: 91Mlbs (31% increase) | Rhodium: 115Koz (76% increase) |

- The selective mining high-grade component yielded 11.6Mt at 1.05% Total NiEq (or 3.24 g/t Total PdEq) as 0.56% Ni, 0.33% Cu, 0.03% Co with 0.54 g/t Pd, 0.27 g/t Pt, 0.15 g/t Au and 0.019 g/t Rh. Expansion of this high-grade component results from the addition of high-grade mineralization encountered in the 2021 drill campaign.

- Sulphur grades of 1.13% to 6.16% indicate desirable high nickel tenor in sulphide, supporting effective recovery via conventional flotation techniques.

- 2.27Blbs of chromium has been inventoried. Chromium is defined by the US government as a critical mineral.

- Deposits in the 2023 Resource are defined by 156 drill holes from a total of 230 holes drilled on the Stillwater West property and include all holes from the Company’s three campaigns to date.

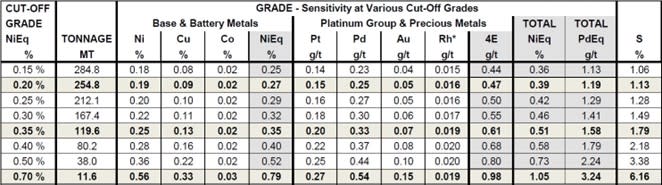

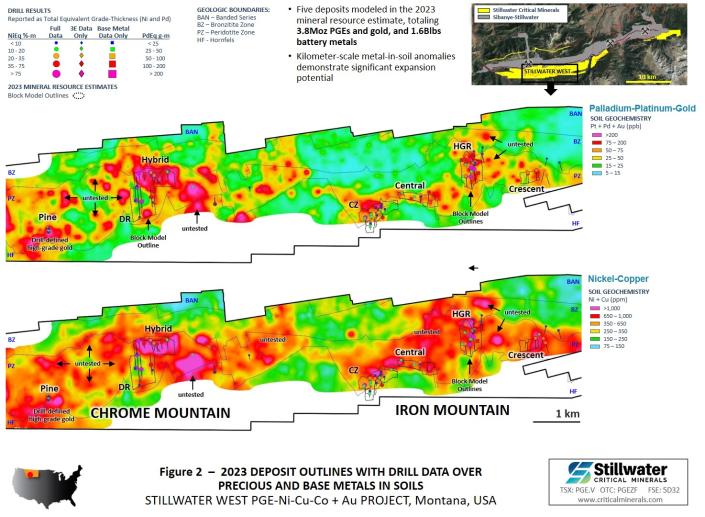

- The 2023 Resource is contained within five deposits in the 9-kilometer central area of the project, all of which are open along strike and at depth. Multi-kilometer scale geophysical targets (Figure 1) and metal-in-soil anomalies indicate excellent expansion potential (Figures 2 to 4). Untested anomalies and earlier stage targets extend across much of the 32-kilometer-long Stillwater West project.

An NI 43-101-compliant technical report on the 2023 Resource for the Stillwater West project will be filed on Sedar.com within 45 days.

Michael Rowley, President and CEO stated, “We are very pleased with the expanded 2023 resource, which returned substantial increases in tonnage and contained metals while also increasing the high-grade component. Overall, these increases speak to the fantastic growth potential and under-explored nature of the Stillwater West project, and to our ability to rapidly increase resources in these wide-open deposits with targeted expansion drilling at low discovery costs. Our Stillwater West project, with its world-class endowment of eight critical minerals, is unique in the United States as a district-scale asset located in an active, producing district that has a long history of large-scale critical mineral production. The US government has recognized the importance of critical minerals to both economic and national security interests and is taking increasing action to secure domestic supply of these key metals at a time when we are advancing Stillwater West and demonstrating its potential. Our exceptional team, with multi-decades of experience at both Stillwater and in the parallel layered geology of the Bushveld Igneous Complex, is well-positioned to advance the asset. We look forward to continuing to build on our success and low discovery costs as we finalize our follow up expansion programs for 2023.”

Dr. Danie Grobler, Vice-President of Exploration, commented, “The 2022 field season, with a renewed focus on geology and structure, has contributed to the understanding of the multi-target geometry and mineralization controls within the Ultramafic Series of the Stillwater Complex, as an analogue to the Platreef of the Bushveld Complex. Our advanced understanding of Platreef-style mineralization and ore mineralogy, and our collaboration with Professor Wolfgang Maier at Cardiff University United Kingdom, as well as key staff at the US Geological Survey, has increased our confidence in the stratigraphic and structural models guiding resource estimation. Enhanced continuity and a significant tonnage increase, as well as increased medium and higher-grade categories, is a direct result of this effort. Our 2023 exploration programs will be focused on expansion of these thick zones of mineralized pegmatoidal pyroxenite/peridotite and associated chromites, as well as broad zones of massive to net-textured sulphides near the base of the layered sequence. We are seeing similar metal distribution characteristics when compared to the Platreef, as well as sulfur contents in relation to distance from the footwall contact. Our direct application of the detailed controls to mineralization in the Platreef-style models is guiding us along an exciting path of discovery.”

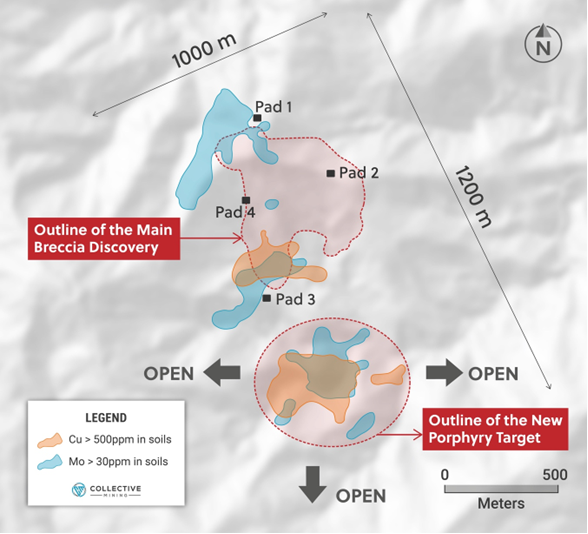

TABLE 1 – Grade and Contained Metal at Various NiEq Cut-off Grades

Stillwater West Inferred Mineral Resource Estimate, January 20, 2023

Notes: 1) In-Pit Inferred Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Values in this table reported above and below the cut-off grades are only presented to show the sensitivity of the block model estimates to the selection of cut-off grade. Equivalent grade and contained metal calculations do not include Rhodium values; 2) All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add or calculate exactly due to rounding.

TABLE 2 – BASE CASE – Grade and Contained Metal by Deposit at 0.20% NiEq Cut-Off (Equals 0.62 g/t PdEq) Stillwater West 2023 Inferred Mineral Resource Estimate, January 20, 2023

Notes: 1) No assays shown as – ; 2) equivalent contained metal and grades do not include Rh. See additional notes on page 4.

2023 Exploration Planning

The Company is finalizing 2023 exploration plans with work expected to include extension of the highly effective geophysical surveys and completion of expansion drilling, focused on large, thick zones of mineralized pegmatoidal pyroxenite and peridotite within the resource areas. These zones show direct parallels to the thick Flatreef-style mineralized zones discovered in recent years by Ivanhoe Mines on the Platreef. A second focus for drilling will be to expand on the nickel-rich massive sulphide zones, as well as the very high-grade gold-PGE mineralization within structurally controlled zones.

Metallurgy

Preliminary metallurgical assessments by SWCM returned strong nickel tenor in sulphides drilled by the Company to date. In addition, favorable historic bench-scale metallurgical results completed historically by AMAX at the Iron Mountain target area demonstrate the potential for effective nickel and copper sulphide flotation and PGE recovery. Sample collection for more detailed metallurgical testing is on-going as part of the expanding development of Stillwater West, with a view to including full metallurgical assessment in future studies.

Carbon Capture at Stillwater West

All five deposits in the 2023 Resource contain desirable nickel sulphide mineralization that has been shown to require a much lower environmental footprint in subsequent processing to nickel metal or nickel sulphate in comparison to the laterite nickel ores that dominate global production. As part of SWCM’s commitment to global sustainability initiatives, the Company is also examining the potential for large-scale carbon sequestration with the objective of further reducing and possibly eliminating the carbon footprint of a potential mining operation at Stillwater West.

Preliminary results demonstrate the presence of certain ultramafic minerals that are known to have high capacity to bind carbon dioxide by a natural process known as mineral carbonation. As announced in a news release on September 23, 2021, the Company is continuing its research with Dr. Greg Dipple and his team at ARCA (formerly based at the University of British Columbia, Canada), to assess the capacity of rock samples from Stillwater West to bind carbon dioxide for permanent disposal as part of a potential mining operation. The Company has partnered with Cornell University for more active carbon sequestration methods, as well as hydrometallurgical processing.

This work strongly aligns with SWCM’s Environmental, Social and Governance guidelines and principles, and the incorporation of carbon uptake may bring financial benefits via initiatives such as the 45Q Tax Credit for Carbon Oxide Sequestration that is now in place in the US.

About Stillwater West

Stillwater Critical Minerals is rapidly advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions SWCM as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater’s operating PGE mines in south-central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. SWCM’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex2. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 12-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals (TSX.V: PGE | OTCQB: PGEZF) is a mineral exploration company focused on its flagship Stillwater West PGE-Ni-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the recent addition of two renowned Bushveld and Platreef geologists to the team, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group and other metals by neighboring Sibanye-Stillwater. The Platreef-style nickel and copper sulphide deposits at Stillwater West contain a compelling suite of critical minerals and are open for expansion along trend and at depth, with an updated NI 43-101 mineral resource update announced in January 2023.

Stillwater Critical Minerals’ Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario is currently under an earn-in agreement with Heritage Mining and the Company also holds the Kluane PGE-Ni-Cu-Co project on trend in Canada‘s Yukon Territory.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@criticalminerals.com Phone: (604) 357 4790

Web: http://criticalminerals.com Toll Free: (888) 432 0075

Resource estimate notes for Tables 1 and 2:

- The classification of the current Mineral Resource Estimate into Inferred is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add or calculate exactly due to rounding.

- All Resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The update MRE is based on data for 156 surface drill holes representing 29,392 m of drilling, including data for 14 surface drill holes for 5,143 m completed by Stillwater in 2021.

- The mineral resource estimate is based on 6 three-dimensional (“3D”) resource models representing the Chrome Mountain (Hybrid and DR), Camp, HGR, Central and Crescent Zones.

- Composites of 1.2 to 3.0 m have been capped where appropriate.

- Fixed specific gravity values of 2.90 – 3.10 g/cm3 (depending on deposit) were used to estimate the Mineral Resource tonnage from block model volumes (% block model). Waste in all areas was given a fixed density of 2.9 g/cm3.

- Cu, Ni, Co, Pt, Pd, Au and Cr are estimated for each mineralized zone; S and Rh for the majority of the zones. Blocks (5x5x5) within each resource model were interpolated using 1.2 to 3.0 m capped composites assigned to that resource model. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Based on a review of the project location, size, geometry, continuity of mineralization and proximity to surface of the Deposits, and spatial distribution of the five main deposits of interest (all within a 8.7 km strike length), it is envisioned that the Deposits may be mined by open pit.

- In-pit Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Pit optimization and Cut-off grades are based on metal prices of $9.00/lb Ni, $3.75/lb Cu, $24.00/lb Co, $1,000/oz Pt, $2,000/oz Pd and $1,800/oz Au, assumed metal recoveries of 80% for Ni, 85% for copper, 80% for Co, Pt, Pd and Au, a mining cost of US$2.50/t rock and processing and G&A cost of US$18.00/t mineralized material.

- The in-pit Mineral Resource grade blocks were quantified above the base case cut-off grade. At this base case cut-off grade the deposits show excellent geologic and grade continuity. The project is at an early stage of exploration and all deposits are open along strike and down dip. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The results from the pit optimization are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade. Pit optimization does not represent an economic study.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Author is not aware of any known mining, processing, metallurgical, environmental, infrastructure, economic, permitting, legal, title, taxation, socio-political, or marketing issues, or any other relevant factors not reported in this technical report, that could materially affect the current Mineral Resource Estimate.

Qualified Person

The Stillwater West PGE-Ni-Cu-Co + Au project 2023 Resource estimate was prepared by Allan Armitage, Ph.D., P.Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of January 20, 2023. Armitage conducted a recent site visit to the property on June 29 and 30, 2022. Mr. Armitage reviewed and approved the technical content of this news release with respect to the 2023 Resource estimate.

Mr. Mike Ostenson, P.Geo., is the Qualified Person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure outside of the 2023 Resource estimate that is contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater Critical Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater Critical Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

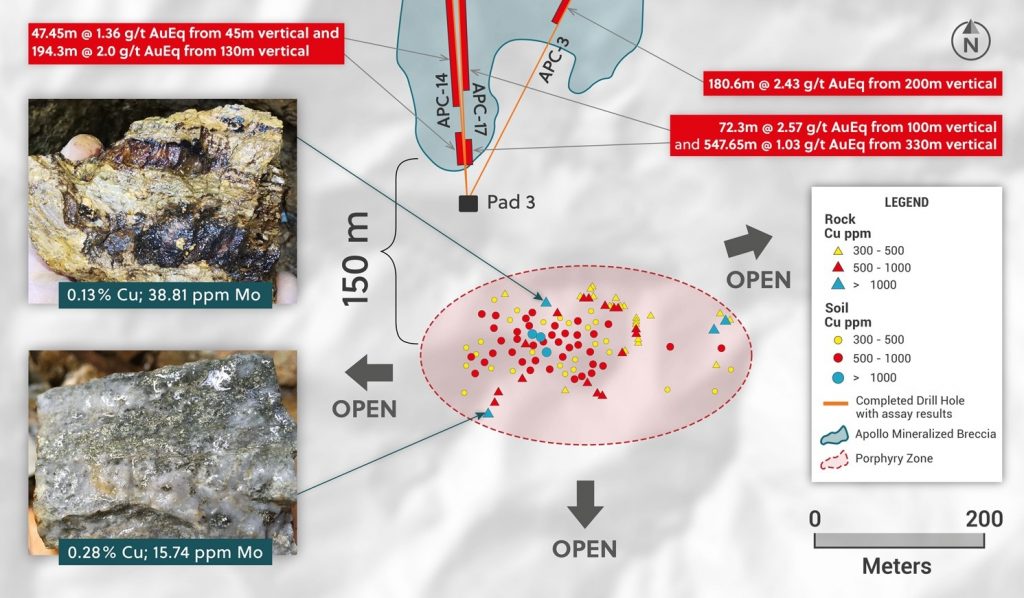

Figure 1 2023 DEPOSIT MODELS WITH SELECT DRILL RESULTS OVER 3D INDUCED POLARIZATION (IP) GEOPHYSICAL SURVEY RESULTS

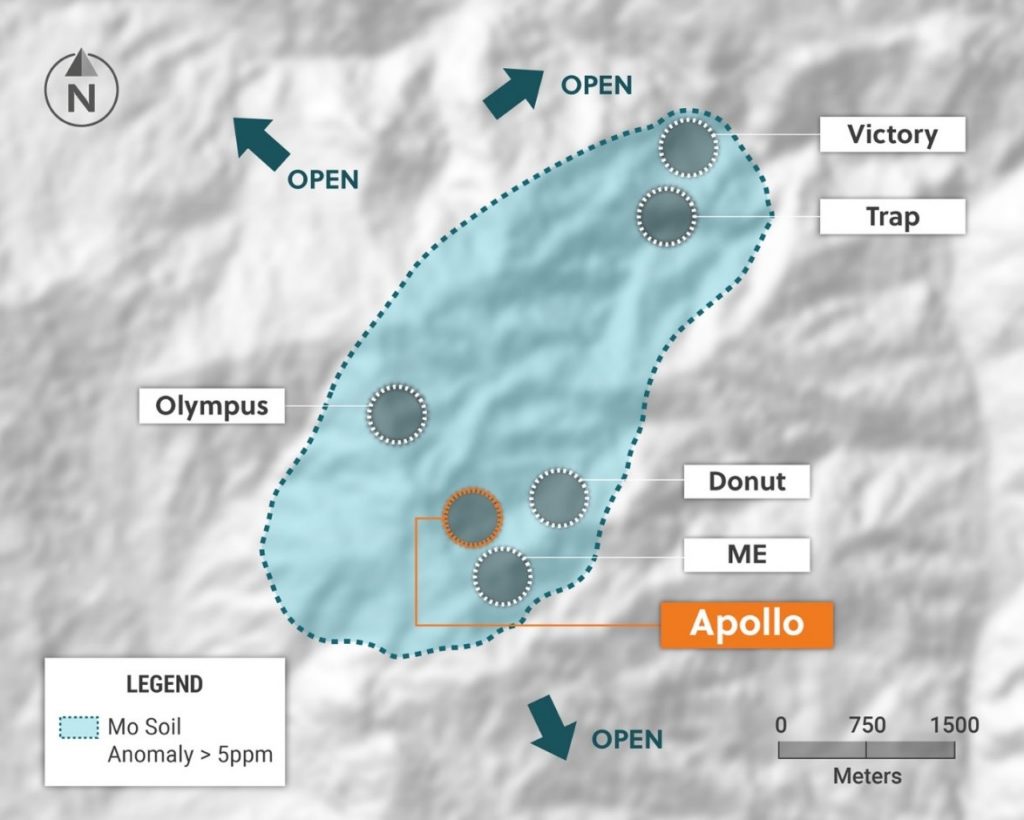

Figure 2 2023 DEPOSIT OUTLINES WITH DRILL DATA OVER PRECIOUS AND BASE METALS IN SOILS

Figure 3 2023 DEPOSIT OUTLINES WITH DRILL DATA OVER GEOPHYSICS (CONDUCTIVITY)

Figure 4 14 TARGET AREAS ACROSS MAIN CLAIM BLOCK INCLUDING PICKET PIN (UPDATED JANUARY 2023)

SOURCE: Stillwater Critical Minerals