Gold79

https://servedbyadbutler.com/creative-181210-3802616/index.html?clickTag=https%3A%2F%2Fservedbyadbutler.com%2Fredirect.spark%3FMID%3D181210%26plid%3D2058808%26setID%3D472441%26channelID%3D0%26CID%3D753328%26banID%3D520987628%26PID%3D0%26textadID%3D0%26tc%3D1%26adSize%3D0x0%26mt%3D1683083375239614%26sw%3D412%26sh%3D915%26spr%3D1.75%26referrer%3Dhttps%253A%252F%252Fwww.mining.com%252F%26hc%3D6e042cf92092b1f43be3097d2f0e92bb8b012039%26location%3D&clicktag=https%3A%2F%2Fservedbyadbutler.com%2Fredirect.spark%3FMID%3D181210%26plid%3D2058808%26setID%3D472441%26channelID%3D0%26CID%3D753328%26banID%3D520987628%26PID%3D0%26textadID%3D0%26tc%3D1%26adSize%3D0x0%26mt%3D1683083375239614%26sw%3D412%26sh%3D915%26spr%3D1.75%26referrer%3Dhttps%253A%252F%252Fwww.mining.com%252F%26hc%3D6e042cf92092b1f43be3097d2f0e92bb8b012039%26location%3D&__ab_location=https%3A%2F%2Fservedbyadbutler.com%2Fredirect.spark%3FMID%3D181210%26plid%3D2058808%26setID%3D472441%26channelID%3D0%26CID%3D753328%26banID%3D520987628%26PID%3D0%26textadID%3D0%26tc%3D1%26adSize%3D0x0%26mt%3D1683083375239614%26sw%3D412%26sh%3D915%26spr%3D1.75%26referrer%3Dhttps%253A%252F%252Fwww.mining.com%252F%26hc%3D6e042cf92092b1f43be3097d2f0e92bb8b012039%26location%3D&__ab_zone_id=472441&__ab_zone_name=MDC%20-%20Responsive%20Premium%20Top&__ab_publisher_id=96522&__ab_publisher_name=MDC%20%28Mining%20Dot%20Com%29&__ab_campaign_id=753328&__ab_campaign_name=Saudi%20Ministry%20of%20Industry%20and%20Mineral%20Resources%20%28MIM%29%20%7C%202023%20May%20%7C%20MDC%20%7C%20Responsive%20Leaderboard%20%7C%2020230501%20-%200531&__ab_advertiser_id=196087&__ab_advertiser_name=Saudi%20Ministry%20of%20Industry%20and%20Mineral%20Resources%20%28MIM%29.&__ab_banner_id=520987628&__ab_extra_data=&sw=412&sh=915&spr=1.75

Reuters | May 2, 2023 | 2:08 pm Markets Africa Platinum

Stock image.

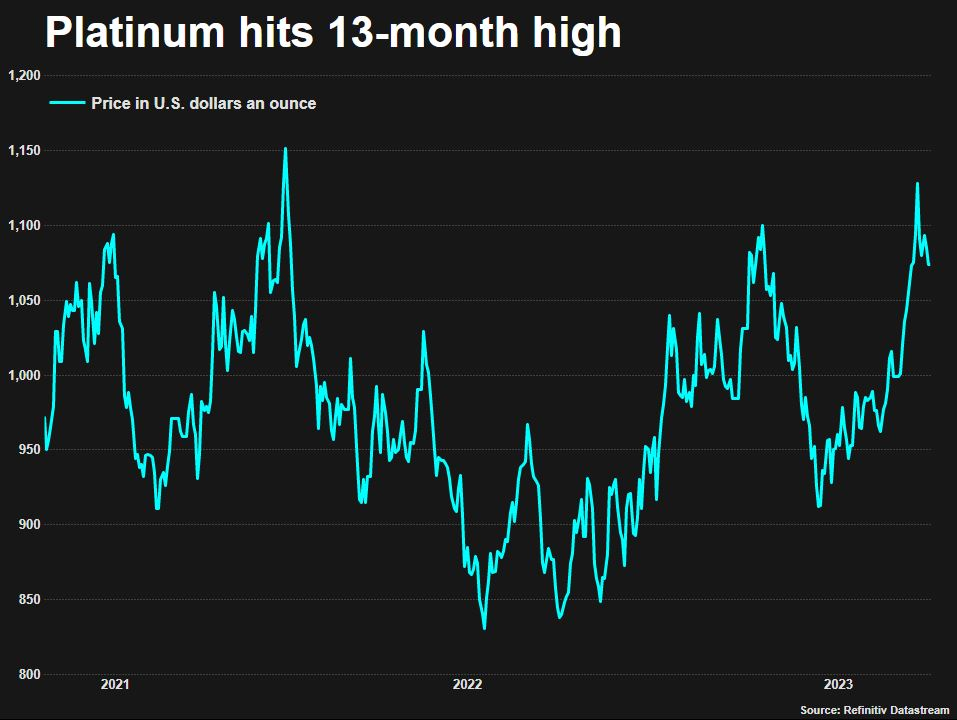

Platinum prices have shot up as speculators bet that power outages at South African mines and rising demand from auto makers and the hydrogen industry will create supply shortages.

Platinum is used to neutralize harmful engine emissions, as well as in other industries and jewellery. Prices leaped from just above $900 an ounce in late February to $1,132.17 on April 21 — the highest in more than a year — before easing to around $1,050 by Tuesday.

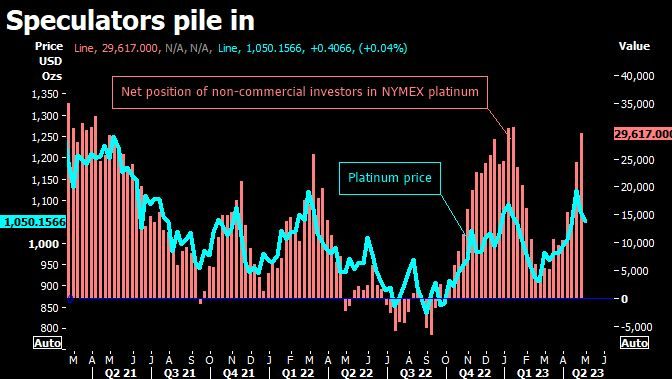

Speculative investors have expanded their net long position in NYMEX platinum futures to 1.5 million ounces from 145,000 ounces in late February, exchange data show.

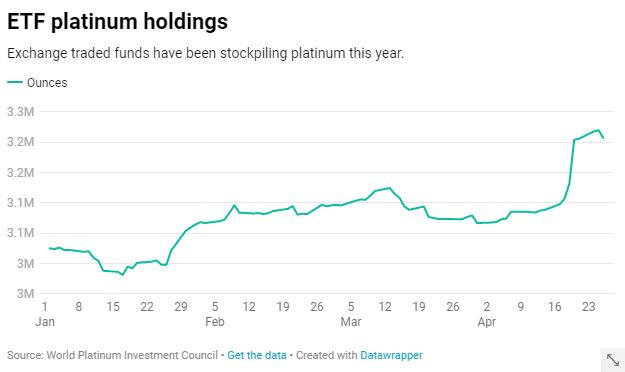

Exchange traded funds (ETFs) storing platinum for their shareholders meanwhile bought around 120,000 ounces in just a few days in late April, according to the World Platinum Investment Council (WPIC), which tracks funds.

“We think this is the first year of serial deficits in the platinum market,” said Standard Chartered analyst Suki Cooper.

However, Cooper said prices could weaken in the short term before supply risks worsen later in the year.

South Africa produces 70-75% of mined platinum supply. Miners there have said rolling power cuts could cut their output by 5-15% this year, Cooper said, adding that Russian production may also disappoint.

“We’re now entering the winter period in South Africa and getting more frequent alerts on power outages,” she said. “The market is concerned.”

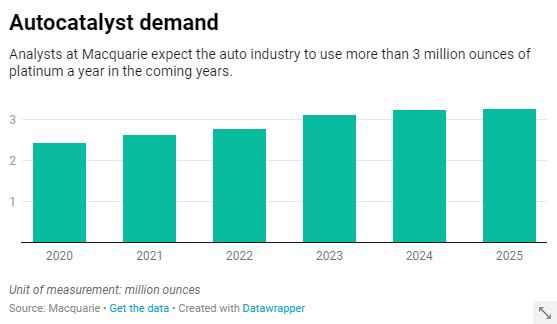

Demand from the auto industry — the biggest consumer of platinum — should rise by 8% this year as vehicle production increases, said StoneX analyst Rhona O’Connell.

O’Connell forecasts a 900,000 ounce deficit in the roughly 8 million ounce a year platinum market this year. The WPIC predicts a shortfall of around 500,000 ounces.

Investors also hope that large amounts of platinum will be used in the production and use of hydrogen.

But analysts at Macquarie said this could take years. “In our base case, the sector (across fuel cells and PEM electrolysers) would account for around 220,000 of demand in 2030 but be approaching 2 million ounces by 2040,” they wrote in a note.

(By Peter Hobson; Editing by Alexandra Hudson)

The company said the accident occurred on April 30 and that it had temporarily ceased work in the affected section.

Reuters | May 2, 2023 | 10:43 am

Kouroussa is forecast to produce an average of 100,000 ounces of gold per annum over an initial seven year LOM.

MINING.COM Staff Writer | May 2, 2023 | 9:09 am

The miner will acquire 50% of the Windfall gold project in Quebec.

Reuters | May 2, 2023 | 8:05 am

Headpiece, earrings and rings wore by co-host Michaela Coel were made from more than 2kg of gold from the Ity mine in Côte d’Ivoire.

Staff Writer | May 2, 2023 | 6:51 am

TORONTO, May 1, 2023 /CNW/ – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) will be presenting at the OTC Markets Group Inc. Battery and Precious Metals Virtual Investor Conference on Wednesday, May 3, 2023, at 10:00am ET.

Using the link below, investors can register and listen to the presentation, and take part in a question and answer session at the end. The presentation is expected to last 30 minutes.

DATE: May 3, 2023

TIME: 10:00am ET – 10:30am ET

LINK: https://bit.ly/44jNv83

An archived webcast will also be made available after the event.

Ari Sussman, Executive Chairman of Collective Mining will be presenting on the Apollo discovery at the Guayabales project in Colombia and will be focusing on the most recent drill results and outlining plans for the balance of 2023. The Apollo system is an outcropping, high-grade and bulk tonnage copper-silver-gold porphyry system. On April 25, 2023, the Company announced the discovery of a new subzone of high-grade mineralization beginning at surface with assay results yielding 104.8 metres @ 5.56 g/t gold equivalent including a 44.6 zone of oxide mineralization averaging 6.99 g/t gold equivalent. (see press release dated April 25, 2023 for AuEq calculation)

The Company’s Guayabales project is located in the mining-friendly department of Caldas, Colombia, in the heart of a long-established mining camp with ten fully permitted and operating mines located within three kilometres of the project. As a result, the Guayabales project is blessed with excellent infrastructure with roads and hydroelectric powerlines traversing the project and an abundant labour force located nearby in the townships of Supia and Marmato.

Three rigs continue to drill at Apollo with a fourth one expecting to be added by the end of Q2, 2023. Additional assay results are anticipated in the near term.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com.

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver, and gold exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo target, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold Apollo porphyry system. The Company’s near-term objective is to drill the shallow portion of the porphyry system while continuing to expand the overall dimensions of the system, which remains open in most directions and test newly generated targets.

Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSXV under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) and Collective Mining (@CollectiveMini1) on Twitter.

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Collective Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2023/01/c2990.html

North Vancouver, British Columbia–(Newsfile Corp. – April 25, 2023) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) reports significant new high-grade results from grade control drilling at the Company’s 100% owned Tuvatu Alkaline Gold Project in Fiji.

Following on the initial mining and extraction of the URA1 lode, the Company is here reporting new high-grade results from grade control drilling on the URW1 lode system, approximately 120m further east. Mining of URW1 is expected to begin over the next 2-4 weeks. Strike drive development on URW1 has commenced.

Highlights of new high-grade gold mineralization intersected by grade control drilling:

Figure 1. Plan map showing the locations of the URA1 and URW1 lodes (in red) relative to the main Tuvatu decline. The gray outlines indicate planned development to reach the URW1 lodes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/163583_9a144002c4db2a3f_001full.jpg

Close spaced grade control drilling has resulted in much higher resolution of the lode arrays as compared to previous infill drilling, including the identification of bonanza grade (>50g/t Au) zones.

The tightened drill pattern will facilitate optimised development and extraction of high-grade gold mineralization from the URW1 lodes while minimizing dilution. High-grade gold mineralization extracted from the URW1 lode system will contribute significantly to the growing high-grade stockpile constituting the initial feed for the Company’s plant and processing facility, on schedule for start-up in Q4 2023.

Mineralization

Mineralization consists of abundant free gold, typically in association with light to dark gray chalcedonic quartz and roscoelite, locally accompanied by minor amounts of pyrite, sphalerite, galena and lesser chalcopyrite (Figure 3).

Figure 2. Long section view west of grade control drilling at URW1. Intersections >5m and 10g/t Au highlighted in red.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/163583_9a144002c4db2a3f_002full.jpg

Figure 3. A) Coarse disseminated gold in a quartz-roscoelite veinlet, TGC-0034 67.5m. Sample returned 1396.3 g/t Au over 0.3m. B) Coarse gold in gray quartz veinlet, TGC-0034 81.6m. Sample returned 166.2 g/t Au over 0.9m. C) Coarse honey sphalerite rimmed by dark pyrite in variable light to dark gray quartz vein, TGC-0032 71.0m. Sample returned 112.9 g/t Au over 0.3m. D) Banded chalcedonic quartz-roscoelite-pyrite-fine native gold, TGC-0002 77.4m. Sample returned 44.3 g/t Au over 0.3m.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/163583_9a144002c4db2a3f_003full.jpg

URW1 Lode System

The URW1 lode system consists of narrow, high-grade to locally bonanza-grade vein arrays and vein swarms that strike approximately N-S and dip sub-vertically to steeply east and is located approximately 120m east of the URA1 lode (Figure 1, 2, 4).

As currently modelled based on earlier drilling, the URW1 lode measures approximately 300m in the NS-direction by approximately 300m of vertical extent, thus forming one of the major N-S trending lodes that have been recognized in this part of the Tuvatu deposit. The URW1 lode intersects with numerous flat-lying to moderately south-dipping EW veins referred to as the Murau lode system (Figure 4).

Grade control drilling has been conducted from both the new decline and the historic exploration adit (Figures 1 & 2). This drilling is targeting a 60m strike section of the URW1 system, within the >300m strike of the overall URW1 system. Detailed drilling of this nature is the first conducted at the project and has served to confirm both the location of structures and the extent of some of the higher-grade zones within the overall mineralized envelope. These bonanza zones (>50g/t Au * true width) have been intersected that show a considerably higher-grade than the previous wide-spaced resource drilling in the area. The high-grade zones are interpreted to relate to the intersection of the N-S URW1 lode with E-W striking structures such as the Murau lodes.

Figure 4. Plan view of 3D models illustrating the earlier interpretation of the URA1 and URW1 lodes (blue). The lighter pink shapes are the flat-lying stacked Murau lodes (left) and SKL lodes (right). Underground development is shown in red.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/163583_9a144002c4db2a3f_004full.jpg

The URW1 lode system is interpreted as a series of parallel vein arrays.

This interpretation has come by way of a series of closely spaced grade control drill holes, drilled from two separate locations, east-directed drilling from the main decline, as well as west-directed drilling from the exploration decline (Figure 1). To date, a total of 34 diamond drill holes totalling approximately 3538m have been completed resulting in 5m to 10m spacing between adjacent holes covering a limited extent of the URW1 lode system. Despite the relatively limited size of the area drilled thus far, the grade control program has significantly increased the level of confidence in the geometry, widths, and grade distribution of the URW1 lodes, thereby allowing for detailed development planning.

Composited assay results for mineralized intervals interpreted as URW1 lodes in holes completed to date are presented in Table 1, with Tables 2 and 3 in the appendix containing full drill hole details. The URW1 lode system represents the next main area of mining and extraction of high-grade mineralization at Tuvatu. Development has commenced with first grade control and mapping expected shortly.

Table 1. Summary of composited drill results intersecting mineralization from the area of URW1 in this release. (TGC = new grade control drilling ordered by strongest intersections; TUDDH and TUG indicates previous exploration drilling (surface and underground) targeting this zone). For full results refer Table 2 in the appendix.

| Hole ID | Grade (g/t Au) | Drill intersection width (m) | True Width (m) |

| TGC-0034 | 88.07 | 5.7 | 5.1 |

| TUG-056 | 27.52 | 5.55 | 5.5 |

| TGC-0003 | 20.93 | 7.2 | 6.5 |

| TGC-0014 | 16.12 | 9.3 | 8.4 |

| TGC-0002 | 16.48 | 9.6 | 8.2 |

| TUG-058 | 100.21 | 0.85 | 0.85 |

| TGC-0032 | 14.6 | 6.6 | 5.3 |

| TGC-0018 | 14.97 | 5.4 | 4.9 |

| TGC-0013 | 10.85 | 6.9 | 6.2 |

| TGC-0011 | 11.04 | 5.4 | 4.6 |

| TGC-0035 | 6.6 | 6.55 | 6.2 |

| TGC-0019 | 11.57 | 3.6 | 3.4 |

| TGC-0028 | 11.52 | 4.8 | 3.4 |

| TGC-0031 | 8.86 | 5.1 | 4.1 |

| TUDDH-350 | 21.11 | 2.7 | 1.7 |

| TUDDH-349 | 14.37 | 9.73 | 2.4 |

| TGC-0016 | 4.35 | 8.1 | 7.7 |

| TUDDH-409 | 7.83 | 6.77 | 4.1 |

| TGC-0005 | 10.14 | 3 | 2.4 |

| TUDDH-219 | 8.33 | 14.15 | 2.9 |

| TGC-0008 | 10.29 | 3 | 2.3 |

| TUG-057 | 17.7 | 1.2 | 1.1 |

| TURC-167 | 8.88 | 3 | 1.8 |

| TGC-0009 | 4.58 | 3.6 | 3.2 |

| TGC-0017 | 2.22 | 6.9 | 6.2 |

| TGC-0036 | 5.16 | 3 | 2.3 |

| TGC-0025 | 5.04 | 3 | 2.3 |

| TGC-0029 | 1.6 | 3.3 | 2.6 |

| TGC-0030 | 3.22 | 1.5 | 1.2 |

| TGC-0015 | 2.39 | 1.8 | 1.4 |

| TUDDH-225 | 0.73 | 0.9 | 0.9 |

| TUG-123 | 0.32 | 0.95 | 0.8 |

| TUDDH-075 | 0.84 | 0.35 | 0.25 |

| TUG-125 | 0.2 | 0.54 | 0.3 |

About Tuvatu

The Tuvatu Alkaline Gold Project is located on the island of Viti Levu in Fiji. The January 2018 mineral resource for Tuvatu as disclosed in the technical report “Technical Report and Preliminary Economic Assessment for the Tuvatu Gold Project, Republic of Fiji”, dated September 25, 2020, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,007,000 tonnes indicated at 8.50 g/t Au (274,600 oz. Au) and 1,325,000 tonnes inferred at 9.0 g/t Au (384,000 oz. Au) at a cut-off grade of 3.0 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedar.com.

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analyzed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 85% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analyzed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analyzed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“, Chairman and CEO

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Appendix 1: full drill results and drill details

Table 2. Composited results from grade control drillholes targeting the URW1 lodes

| Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) | |

| TGC-0001 | 33.0 | 33.9 | 0.9 | 0.64 | |

| TGC-0002 | 77.1 | 77.4 | 0.3 | 44.25 | |

| TGC-0002 | 80.1 | 84.9 | 4.8 | 8.03 | |

| TGC-0002 | including | 80.1 | 82.2 | 2.1 | 11.60 |

| TGC-0002 | which includes | 81.6 | 81.9 | 0.3 | 72.20 |

| TGC-0002 | and including | 83.1 | 84.9 | 1.8 | 7.86 |

| TGC-0002 | 89.4 | 97.5 | 8.1 | 13.07 | |

| TGC-0002 | including | 89.4 | 91.2 | 1.8 | 4.68 |

| TGC-0002 | including | 92.1 | 97.5 | 5.4 | 17.97 |

| TGC-0002 | which includes | 93.6 | 93.9 | 0.3 | 41.54 |

| TGC-0002 | and | 93.9 | 94.2 | 0.3 | 45.40 |

| TGC-0002 | and | 94.2 | 94.5 | 0.3 | 74.38 |

| TGC-0002 | and | 94.5 | 94.8 | 0.3 | 38.43 |

| TGC-0002 | and | 94.8 | 95.1 | 0.3 | 56.89 |

| TGC-0002 | 100.2 | 103.8 | 3.6 | 7.93 | |

| TGC-0002 | 108.3 | 111.9 | 3.6 | 10.09 | |

| TGC-0002 | including | 108.3 | 109.2 | 0.9 | 4.05 |

| TGC-0002 | including | 110.1 | 111.9 | 1.8 | 18.15 |

| TGC-0002 | which includes | 111.0 | 111.3 | 0.3 | 77.72 |

| TGC-0002 | 113.7 | 114.6 | 0.9 | 17.11 | |

| TGC-0003 | 52.5 | 53.4 | 0.9 | 2.79 | |

| TGC-0003 | 77.4 | 80.4 | 3.0 | 3.84 | |

| TGC-0003 | including | 77.4 | 77.7 | 0.3 | 5.34 |

| TGC-0003 | and | 78.6 | 78.9 | 0.3 | 4.40 |

| TGC-0003 | and | 79.2 | 79.5 | 0.3 | 27.18 |

| TGC-0003 | 89.7 | 95.7 | 6.0 | 9.57 | |

| TGC-0003 | including | 89.7 | 93.3 | 3.6 | 14.63 |

| TGC-0003 | which includes | 90.6 | 91.2 | 0.6 | 81.18 |

| TGC-0003 | 98.0 | 99.2 | 1.2 | 0.95 | |

| TGC-0003 | 102.2 | 110.6 | 8.4 | 5.73 | |

| TGC-0003 | including | 102.2 | 107.0 | 4.8 | 7.97 |

| TGC-0003 | which includes | 105.8 | 106.1 | 0.3 | 35.58 |

| TGC-0003 | and includes | 107.3 | 108.5 | 1.2 | 6.84 |

| TGC-0003 | 112.4 | 112.7 | 0.3 | 1.15 | |

| TGC-0003 | 115.1 | 116.0 | 0.9 | 59.85 | |

| TGC-0004 | 3.4 | 4.3 | 0.9 | 2.93 | |

| TGC-0005 | 75.3 | 75.9 | 0.6 | 2.11 | |

| TGC-0005 | 91.5 | 99.0 | 7.5 | 2.77 | |

| TGC-0005 | including | 93.3 | 94.2 | 0.9 | 10.67 |

| TGC-0005 | 102.6 | 102.9 | 0.3 | 2.10 | |

| TGC-0005 | 104.1 | 104.7 | 0.6 | 21.01 | |

| TGC-0005 | 107.1 | 108.0 | 0.9 | 1.65 | |

| TGC-0005 | 109.8 | 110.4 | 0.6 | 0.78 | |

| TGC-0005 | 120.0 | 122.1 | 2.1 | 2.51 | |

| TGC-0005 | including | 121.8 | 122.1 | 0.3 | 14.83 |

| TGC-0007 | 28.2 | 28.5 | 0.3 | 1.31 | |

| TGC-0008 | 74.8 | 76.9 | 2.1 | 10.51 | |

| TGC-0008 | 82.3 | 82.9 | 0.6 | 25.57 | |

| TGC-0008 | 94.0 | 94.3 | 0.3 | 4.20 | |

| TGC-0008 | 96.4 | 101.2 | 4.8 | 3.77 | |

| TGC-0008 | including | 96.4 | 98.5 | 2.1 | 3.73 |

| TGC-0008 | and | 99.1 | 101.2 | 2.1 | 4.78 |

| TGC-0008 | 105.1 | 105.7 | 0.6 | 2.78 | |

| TGC-0008 | 108.7 | 109.3 | 0.6 | 1.05 | |

| TGC-0008 | 110.8 | 111.4 | 0.6 | 2.16 | |

| TGC-0008 | 122.5 | 123.1 | 0.6 | 61.39 | |

| TGC-0009 | 18.6 | 21.3 | 2.7 | 0.91 | |

| TGC-0009 | 28.5 | 29.1 | 0.6 | 1.61 | |

| TGC-0009 | 30.9 | 31.5 | 0.6 | 8.33 | |

| TGC-0009 | 32.7 | 34.2 | 1.5 | 33.38 | |

| TGC-0009 | 49.5 | 49.8 | 0.3 | 10.54 | |

| TGC-0009 | 53.4 | 56.4 | 3.0 | 1.07 | |

| TGC-0009 | 61.2 | 61.5 | 0.3 | 1.97 | |

| TGC-0009 | 65.4 | 65.7 | 0.3 | 3.06 | |

| TGC-0009 | 66.9 | 67.8 | 0.9 | 6.10 | |

| TGC-0009 | 69.0 | 75.0 | 6.0 | 5.01 | |

| TGC-0009 | including | 69.6 | 70.2 | 0.6 | 4.66 |

| TGC-0009 | and | 70.5 | 72.3 | 1.8 | 6.62 |

| TGC-0009 | and | 72.9 | 73.5 | 0.6 | 6.80 |

| TGC-0009 | and | 73.8 | 75.0 | 1.2 | 8.78 |

| TGC-0009 | 76.5 | 78.0 | 1.5 | 0.97 | |

| TGC-0010 | 17.1 | 18.9 | 1.8 | 6.52 | |

| TGC-0010 | including | 17.1 | 17.4 | 0.3 | 37.04 |

| TGC-0010 | 20.1 | 21.0 | 0.9 | 2.54 | |

| TGC-0010 | 23.4 | 30.3 | 6.9 | 2.67 | |

| TGC-0010 | including | 24.9 | 27.6 | 2.7 | 4.71 |

| TGC-0010 | 36.0 | 36.9 | 0.9 | 8.92 | |

| TGC-0011 | 19.0 | 19.3 | 0.3 | 0.89 | |

| TGC-0011 | 22.3 | 23.8 | 1.5 | 7.56 | |

| TGC-0011 | 27.1 | 29.3 | 2.2 | 2.49 | |

| TGC-0011 | including | 27.1 | 28.0 | 0.9 | 5.34 |

| TGC-0011 | 31.1 | 31.4 | 0.3 | 1.26 | |

| TGC-0011 | 32.6 | 35.3 | 2.7 | 7.64 | |

| TGC-0011 | including | 32.6 | 34.1 | 1.5 | 11.33 |

| TGC-0011 | and | 34.4 | 35.3 | 0.9 | 4.04 |

| TGC-0011 | 40.4 | 40.7 | 0.3 | 1.22 | |

| TGC-0011 | 52.7 | 53.3 | 0.6 | 1.91 | |

| TGC-0011 | 54.8 | 56.9 | 2.1 | 2.18 | |

| TGC-0011 | 58.7 | 59.9 | 1.2 | 2.62 | |

| TGC-0011 | including | 59.3 | 59.9 | 0.6 | 4.09 |

| TGC-0011 | 63.2 | 66.5 | 3.3 | 2.68 | |

| TGC-0011 | including | 64.1 | 66.5 | 2.4 | 3.58 |

| TGC-0011 | 68.6 | 75.8 | 7.2 | 6.72 | |

| TGC-0011 | including | 68.6 | 69.2 | 0.6 | 19.95 |

| TGC-0011 | which includes | 68.9 | 69.2 | 0.3 | 37.28 |

| TGC-0011 | and | 69.5 | 73.4 | 3.9 | 8.84 |

| TGC-0011 | which includes | 71.0 | 71.3 | 0.3 | 59.70 |

| TGC-0012 | 79.5 | 81.9 | 2.4 | 7.86 | |

| TGC-0012 | including | 79.5 | 79.8 | 0.3 | 59.46 |

| TGC-0012 | 85.2 | 85.5 | 0.3 | 2.79 | |

| TGC-0012 | 87.3 | 88.5 | 1.2 | 5.11 | |

| TGC-0012 | 92.1 | 92.4 | 0.3 | 2.47 | |

| TGC-0012 | 98.4 | 99.6 | 1.2 | 1.32 | |

| TGC-0012 | 102.3 | 104.1 | 1.8 | 0.63 | |

| TGC-0012 | 105.9 | 106.2 | 0.3 | 4.67 | |

| TGC-0013 | 19.2 | 19.5 | 0.3 | 1.55 | |

| TGC-0013 | 23.1 | 23.7 | 0.6 | 1.28 | |

| TGC-0013 | 32.4 | 34.5 | 2.1 | 3.36 | |

| TGC-0013 | including | 32.4 | 33.0 | 0.6 | 6.97 |

| TGC-0013 | and | 33.9 | 34.5 | 0.6 | 4.67 |

| TGC-0013 | 42.9 | 43.5 | 0.6 | 1.16 | |

| TGC-0013 | 47.1 | 47.7 | 0.6 | 0.80 | |

| TGC-0013 | 50.4 | 51.3 | 0.9 | 13.58 | |

| TGC-0013 | 55.6 | 56.2 | 0.6 | 1.37 | |

| TGC-0013 | 67.6 | 70.3 | 2.7 | 5.70 | |

| TGC-0013 | 72.7 | 73.6 | 0.9 | 4.09 | |

| TGC-0013 | 75.1 | 79.3 | 4.2 | 11.03 | |

| TGC-0013 | including | 75.1 | 76.6 | 1.5 | 4.86 |

| TGC-0013 | and | 77.2 | 78.1 | 0.9 | 8.51 |

| TGC-0013 | and | 78.4 | 79.3 | 0.9 | 34.87 |

| TGC-0013 | which includes | 78.7 | 79.3 | 0.6 | 49.52 |

| TGC-0013 | 81.1 | 83.8 | 2.7 | 5.97 | |

| TGC-0013 | 94.3 | 97.6 | 3.3 | 1.21 | |

| TGC-0014 | 10.8 | 11.1 | 0.3 | 1.21 | |

| TGC-0014 | 19.2 | 19.5 | 0.3 | 1.03 | |

| TGC-0014 | 34.5 | 36.3 | 1.8 | 2.47 | |

| TGC-0014 | including | 34.5 | 35.4 | 0.9 | 3.38 |

| TGC-0014 | and | 36.0 | 36.3 | 0.3 | 4.72 |

| TGC-0014 | 42.6 | 42.9 | 0.3 | 3.21 | |

| TGC-0014 | 52.2 | 53.1 | 0.9 | 0.57 | |

| TGC-0014 | 56.1 | 56.4 | 0.3 | 1.69 | |

| TGC-0014 | 66.0 | 75.6 | 9.6 | 13.28 | |

| TGC-0014 | including | 66.0 | 66.9 | 0.9 | 54.81 |

| TGC-0014 | which includes | 66.3 | 66.6 | 0.3 | 95.47 |

| TGC-0014 | and | 66.6 | 66.9 | 0.3 | 67.96 |

| TGC-0014 | and | 67.5 | 69.0 | 1.5 | 7.83 |

| TGC-0014 | and | 69.3 | 72.6 | 3.3 | 9.89 |

| TGC-0014 | and | 72.9 | 73.2 | 0.3 | 3.32 |

| TGC-0014 | and | 74.1 | 75.0 | 0.9 | 32.29 |

| TGC-0014 | which includes | 74.4 | 74.7 | 0.3 | 57.95 |

| TGC-0014 | and | 74.7 | 75.0 | 0.3 | 38.34 |

| TGC-0014 | and | 75.3 | 75.6 | 0.3 | 9.41 |

| TGC-0014 | 80.7 | 84.6 | 3.9 | 7.69 | |

| TGC-0014 | 85.8 | 88.8 | 3.0 | 1.86 | |

| TGC-0014 | 92.4 | 95.1 | 2.7 | 1.10 | |

| TGC-0015 | 71.1 | 71.4 | 0.3 | 0.54 | |

| TGC-0015 | 87.3 | 87.9 | 0.6 | 2.17 | |

| TGC-0015 | 105.6 | 106.2 | 0.6 | 2.50 | |

| TGC-0016 | 38.7 | 43.5 | 4.8 | 6.22 | |

| TGC-0016 | including | 38.7 | 41.4 | 2.7 | 9.67 |

| TGC-0016 | which includes | 40.8 | 41.1 | 0.3 | 45.75 |

| TGC-0016 | 68.1 | 68.7 | 0.6 | 2.16 | |

| TGC-0016 | 70.8 | 71.4 | 0.6 | 2.55 | |

| TGC-0016 | 72.6 | 73.5 | 0.9 | 6.50 | |

| TGC-0016 | 81.0 | 83.4 | 2.4 | 14.23 | |

| TGC-0016 | including | 81.0 | 81.6 | 0.6 | 19.42 |

| TGC-0016 | and | 81.9 | 83.4 | 1.5 | 14.99 |

| TGC-0016 | which includes | 83.1 | 83.4 | 0.3 | 45.51 |

| TGC-0016 | 84.6 | 85.5 | 0.9 | 1.86 | |

| TGC-0016 | 92.4 | 94.5 | 2.1 | 4.83 | |

| TGC-0016 | 95.7 | 97.8 | 2.1 | 3.58 | |

| TGC-0017 | 5.1 | 5.7 | 0.6 | 1.28 | |

| TGC-0017 | 17.4 | 17.7 | 0.3 | 4.32 | |

| TGC-0017 | 36.0 | 36.6 | 0.6 | 1.26 | |

| TGC-0017 | 38.7 | 44.1 | 5.4 | 9.39 | |

| TGC-0017 | 69.3 | 69.9 | 0.6 | 9.60 | |

| TGC-0017 | 72.3 | 73.8 | 1.5 | 3.03 | |

| TGC-0017 | including | 73.2 | 73.8 | 0.6 | 7.01 |

| TGC-0017 | 76.8 | 77.4 | 0.6 | 65.63 | |

| TGC-0017 | 82.5 | 84.0 | 1.5 | 3.08 | |

| TGC-0018 | 78.9 | 79.5 | 0.6 | 0.92 | |

| TGC-0018 | 85.8 | 86.1 | 0.3 | 11.42 | |

| TGC-0018 | 88.5 | 90.6 | 2.1 | 5.67 | |

| TGC-0018 | 94.2 | 95.1 | 0.9 | 0.54 | |

| TGC-0018 | 96.3 | 97.2 | 0.9 | 0.63 | |

| TGC-0018 | 102.0 | 105.9 | 3.9 | 15.62 | |

| TGC-0018 | 109.2 | 111.0 | 1.8 | 2.74 | |

| TGC-0019 | 10.8 | 12.0 | 1.2 | 0.86 | |

| TGC-0019 | 13.8 | 16.5 | 2.7 | 2.31 | |

| TGC-0019 | 31.2 | 32.7 | 1.5 | 3.21 | |

| TGC-0019 | 40.2 | 45.0 | 4.8 | 16.05 | |

| TGC-0019 | including | 41.4 | 45.0 | 3.6 | 21.18 |

| TGC-0019 | which includes | 42.6 | 42.9 | 0.3 | 49.70 |

| TGC-0019 | and | 43.2 | 43.5 | 0.3 | 166.81 |

| TGC-0019 | 51.0 | 52.2 | 1.2 | 2.60 | |

| TGC-0019 | 65.1 | 66.3 | 1.2 | 0.85 | |

| TGC-0019 | 70.5 | 79.8 | 9.3 | 4.92 | |

| TGC-0019 | including | 70.5 | 75.0 | 4.5 | 6.70 |

| TGC-0019 | and | 75.3 | 76.5 | 1.2 | 7.69 |

| TGC-0019 | 83.7 | 84.0 | 0.3 | 15.22 | |

| TGC-0019 | 95.7 | 96.9 | 1.2 | 9.13 | |

| TGC-0020 | 16.8 | 18.3 | 1.5 | 3.09 | |

| TGC-0020 | 24.3 | 26.4 | 2.1 | 0.92 | |

| TGC-0020 | 28.2 | 29.7 | 1.5 | 4.10 | |

| TGC-0021 | 4.4 | 5.0 | 0.6 | 1.40 | |

| TGC-0021 | 24.5 | 26.9 | 2.4 | 2.86 | |

| TGC-0021 | including | 24.5 | 25.4 | 0.9 | 6.34 |

| TGC-0021 | 44.3 | 44.9 | 0.6 | 1.36 | |

| TGC-0021 | 74.0 | 74.3 | 0.3 | 0.65 | |

| TGC-0022 | 28.2 | 29.4 | 1.2 | 1.36 | |

| TGC-0022 | 54.6 | 54.9 | 0.3 | 1.04 | |

| TGC-0022 | 57.9 | 58.8 | 0.9 | 1.22 | |

| TGC-0022 | 66.9 | 70.5 | 3.6 | 2.31 | |

| TGC-0022 | 75.0 | 75.6 | 0.6 | 2.23 | |

| TGC-0023 | 90.2 | 90.8 | 0.6 | 1.71 | |

| TGC-0023 | 100.7 | 101.3 | 0.6 | 0.63 | |

| TGC-0024 | 13.8 | 14.4 | 0.6 | 0.50 | |

| TGC-0024 | 58.8 | 59.7 | 0.9 | 1.30 | |

| TGC-0024 | 65.4 | 65.7 | 0.3 | 0.54 | |

| TGC-0025 | 7.5 | 9.3 | 1.8 | 2.79 | |

| TGC-0025 | including | 7.5 | 8.4 | 0.9 | 5.22 |

| TGC-0025 | 13.5 | 14.1 | 0.6 | 4.33 | |

| TGC-0025 | 15.6 | 16.5 | 0.9 | 0.68 | |

| TGC-0025 | 78.6 | 83.1 | 4.5 | 3.76 | |

| TGC-0025 | including | 78.6 | 79.2 | 0.6 | 4.69 |

| TGC-0025 | and | 79.5 | 80.7 | 1.2 | 3.07 |

| TGC-0025 | and | 81.0 | 83.1 | 2.1 | 4.91 |

| TGC-0025 | 84.6 | 84.9 | 0.3 | 1.77 | |

| TGC-0025 | 87.0 | 87.3 | 0.3 | 6.55 | |

| TGC-0026 | 14.7 | 15.3 | 0.6 | 0.58 | |

| TGC-0026 | 28.8 | 29.7 | 0.9 | 2.28 | |

| TGC-0026 | 33.9 | 34.8 | 0.9 | 5.94 | |

| TGC-0026 | 39.9 | 40.8 | 0.9 | 10.20 | |

| TGC-0026 | 42.3 | 42.9 | 0.6 | 3.72 | |

| TGC-0026 | 71.7 | 72.0 | 0.3 | 0.65 | |

| TGC-0027 | 70.2 | 70.8 | 0.6 | 2.41 | |

| TGC-0027 | 80.7 | 82.2 | 1.5 | 3.75 | |

| TGC-0027 | 87.9 | 88.5 | 0.6 | 1.72 | |

| TGC-0027 | 93.6 | 94.2 | 0.6 | 2.46 | |

| TGC-0027 | 96.6 | 99.0 | 2.4 | 0.79 | |

| TGC-0027 | 104.4 | 105.9 | 1.5 | 4.98 | |

| TGC-0027 | 107.7 | 109.8 | 2.1 | 1.99 | |

| TGC-0027 | including | 109.5 | 109.8 | 0.3 | 11.28 |

| TGC-0027 | 112.8 | 114.0 | 1.2 | 0.63 | |

| TGC-0028 | 8.7 | 9.6 | 0.9 | 1.02 | |

| TGC-0028 | 13.2 | 16.2 | 3.0 | 11.27 | |

| TGC-0028 | 78.0 | 78.9 | 0.9 | 0.63 | |

| TGC-0028 | 83.4 | 83.7 | 0.3 | 1.17 | |

| TGC-0028 | 85.2 | 85.8 | 0.6 | 0.55 | |

| TGC-0028 | 92.1 | 97.5 | 5.4 | 10.86 | |

| TGC-0028 | including | 92.1 | 93.6 | 1.5 | 26.67 |

| TGC-0028 | which includes | 92.1 | 92.4 | 0.3 | 45.29 |

| TGC-0028 | and | 92.4 | 92.7 | 0.3 | 72.80 |

| TGC-0028 | and | 94.5 | 95.7 | 1.2 | 12.97 |

| TGC-0028 | and | 96.6 | 97.5 | 0.9 | 3.44 |

| TGC-0028 | 101.1 | 102.6 | 1.5 | 9.53 | |

| TGC-0029 | 14.7 | 16.2 | 1.5 | 10.82 | |

| TGC-0029 | 74.4 | 75.0 | 0.6 | 4.93 | |

| TGC-0029 | 83.7 | 86.7 | 3.0 | 1.00 | |

| TGC-0029 | 95.7 | 96.9 | 1.2 | 3.14 | |

| TGC-0030 | 18.0 | 19.2 | 1.2 | 56.88 | |

| TGC-0030 | 22.8 | 25.2 | 2.4 | 4.87 | |

| TGC-0030 | including | 24.0 | 25.2 | 1.2 | 9.62 |

| TGC-0030 | 51.9 | 52.2 | 0.3 | 1.47 | |

| TGC-0030 | 54.6 | 54.9 | 0.3 | 3.60 | |

| TGC-0030 | 61.2 | 61.5 | 0.3 | 3.75 | |

| TGC-0030 | 71.4 | 72.0 | 0.6 | 20.01 | |

| TGC-0030 | 83.1 | 84.6 | 1.5 | 3.65 | |

| TGC-0030 | 88.8 | 92.4 | 3.6 | 0.97 | |

| TGC-0030 | 94.2 | 95.4 | 1.2 | 1.40 | |

| TGC-0031 | 13.5 | 20.4 | 6.9 | 6.60 | |

| TGC-0031 | including | 13.5 | 15.3 | 1.8 | 17.28 |

| TGC-0031 | which includes | 14.1 | 14.7 | 0.6 | 34.62 |

| TGC-0031 | and | 15.6 | 18.3 | 2.7 | 4.76 |

| TGC-0031 | and | 19.2 | 19.5 | 0.3 | 3.25 |

| TGC-0031 | 62.0 | 63.8 | 1.8 | 3.21 | |

| TGC-0031 | including | 62.9 | 63.8 | 0.9 | 5.88 |

| TGC-0031 | 72.5 | 73.4 | 0.9 | 1.27 | |

| TGC-0031 | 74.9 | 75.8 | 0.9 | 6.93 | |

| TGC-0031 | 77.0 | 77.6 | 0.6 | 3.30 | |

| TGC-0031 | 82.4 | 85.1 | 2.7 | 3.12 | |

| TGC-0031 | 86.9 | 95.6 | 8.7 | 13.73 | |

| TGC-0031 | including | 86.9 | 89.9 | 3.0 | 10.80 |

| TGC-0031 | which includes | 87.2 | 87.5 | 0.3 | 39.53 |

| TGC-0031 | and | 87.5 | 87.8 | 0.3 | 36.62 |

| TGC-0031 | and including | 90.5 | 91.1 | 0.6 | 28.85 |

| TGC-0031 | and | 92.0 | 94.7 | 2.7 | 24.94 |

| TGC-0031 | which includes | 92.6 | 92.9 | 0.3 | 116.56 |

| TGC-0031 | and | 93.8 | 94.1 | 0.3 | 64.28 |

| TGC-0031 | and | 95.3 | 95.6 | 0.3 | 6.90 |

| TGC-0032 | 10.2 | 10.8 | 0.6 | 0.68 | |

| TGC-0032 | 18.0 | 18.3 | 0.3 | 32.02 | |

| TGC-0032 | 22.8 | 23.7 | 0.9 | 20.11 | |

| TGC-0032 | 52.2 | 52.8 | 0.6 | 2.66 | |

| TGC-0032 | 58.2 | 58.5 | 0.3 | 9.18 | |

| TGC-0032 | 69.6 | 72.0 | 2.4 | 19.46 | |

| TGC-0032 | 76.5 | 80.1 | 3.6 | 4.58 | |

| TGC-0032 | 85.2 | 87.3 | 2.1 | 14.59 | |

| TGC-0032 | 88.5 | 91.5 | 3.0 | 2.80 | |

| TGC-0032 | including | 88.5 | 89.7 | 1.2 | 5.59 |

| TGC-0032 | 98.4 | 98.7 | 0.3 | 16.30 | |

| TGC-0032 | 106.2 | 107.1 | 0.9 | 41.62 | |

| TGC-0032 | 108.9 | 109.5 | 0.6 | 4.20 | |

| TGC-0034 | 21.6 | 23.7 | 2.1 | 24.84 | |

| TGC-0034 | 24.0 | 32.1 | 8.1 | 25.96 | |

| TGC-0034 | including | 24.0 | 24.9 | 0.9 | 14.30 |

| TGC-0034 | which includes | 24.0 | 24.3 | 0.3 | 33.61 |

| TGC-0034 | and | 25.2 | 32.1 | 6.9 | 28.61 |

| TGC-0034 | which includes | 25.2 | 25.8 | 0.6 | 47.66 |

| TGC-0034 | and | 30.3 | 30.6 | 0.3 | 59.31 |

| TGC-0034 | and | 30.6 | 31.5 | 0.9 | 118.95 |

| TGC-0034 | 56.1 | 56.4 | 0.3 | 0.90 | |

| TGC-0034 | 60.3 | 61.2 | 0.9 | 4.33 | |

| TGC-0034 | 66.3 | 69.9 | 3.6 | 120.76 | |

| TGC-0034 | including | 66.3 | 68.1 | 1.8 | 237.52 |

| TGC-0034 | which includes | 67.5 | 67.8 | 0.3 | 1396.31 |

| TGC-0034 | and | 69.0 | 69.9 | 0.9 | 7.92 |

| TGC-0034 | 72.6 | 73.2 | 0.6 | 0.61 | |

| TGC-0034 | 74.7 | 75.6 | 0.9 | 5.70 | |

| TGC-0034 | 80.7 | 83.1 | 2.4 | 22.46 | |

| TGC-0034 | including | 81.6 | 82.5 | 0.9 | 57.46 |

| TGC-0034 | which includes | 81.6 | 81.9 | 0.3 | 166.16 |

| TGC-0034 | and | 82.8 | 83.1 | 0.3 | 4.25 |

| TGC-0034 | 86.1 | 90.3 | 4.2 | 3.06 | |

| TGC-0034 | including | 88.8 | 90.3 | 1.5 | 7.06 |

| TGC-0034 | 91.5 | 91.8 | 0.3 | 1.42 | |

| TGC-0034 | 93.0 | 94.2 | 1.2 | 1.06 | |

| TGC-0034 | 95.4 | 99.9 | 4.5 | 3.10 | |

| TGC-0034 | including | 98.7 | 99.9 | 1.2 | 9.10 |

| TGC-0035 | 33.0 | 33.6 | 0.6 | 8.28 | |

| TGC-0035 | 36.0 | 37.5 | 1.5 | 6.21 | |

| TGC-0035 | 39.3 | 40.5 | 1.2 | 10.55 | |

| TGC-0035 | 48.0 | 51.9 | 3.9 | 4.33 | |

| TGC-0035 | including | 50.1 | 51.9 | 1.8 | 8.72 |

| TGC-0035 | which includes | 51.0 | 51.3 | 0.3 | 46.28 |

| TGC-0035 | 53.7 | 54.3 | 0.6 | 1.71 | |

| TGC-0035 | 56.1 | 65.1 | 9.0 | 3.70 | |

| TGC-0035 | including | 61.5 | 62.1 | 0.6 | 7.65 |

| TGC-0035 | and | 62.7 | 63.9 | 1.2 | 11.80 |

| TGC-0035 | which includes | 63.0 | 63.3 | 0.3 | 31.89 |

| TGC-0035 | and including | 64.2 | 65.1 | 0.9 | 11.36 |

| TGC-0035 | 67.5 | 72.9 | 5.4 | 3.44 | |

| TGC-0035 | including | 69.0 | 72.9 | 3.9 | 4.03 |

| TGC-0035 | 74.7 | 77.7 | 3.0 | 4.38 | |

| TGC-0035 | 78.9 | 82.5 | 3.6 | 2.54 | |

| TGC-0035 | including | 80.1 | 82.5 | 2.4 | 3.24 |

| TGC-0035 | 91.5 | 92.7 | 1.2 | 1.16 | |

| TGC-0036 | 11.4 | 12.0 | 0.6 | 2.50 | |

| TGC-0036 | 18.0 | 19.2 | 1.2 | 4.08 | |

| TGC-0036 | 52.5 | 53.4 | 0.9 | 0.74 | |

| TGC-0036 | 57.3 | 59.7 | 2.4 | 51.58 | |

| TGC-0036 | 70.5 | 71.4 | 0.9 | 11.52 | |

| TGC-0036 | 86.1 | 88.2 | 2.1 | 2.43 | |

| TGC-0036 | including | 87.0 | 88.2 | 1.2 | 3.84 |

| TGC-0036 | 95.1 | 98.4 | 3.3 | 0.83 |

Table 3. Collar coordinates and dates of completion for grade control drillholes reported in this release. Coordinates are in Fiji map grid.

| Hole ID | Date | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| Completed | (m) | ||||||

| TGC-0001 | 24.10.22 | 1876437 | 3920744 | 140 | 290 | 27.4 | 34.0 |

| TGC-0002 | 10.11.22 | 1876437 | 3920744 | 139 | 286 | 3.4 | 118.7 |

| TGC-0003 | 25.11.22 | 1876437 | 3920744 | 139 | 288 | 4.0 | 116.8 |

| TGC-0004 | 29.11.22 | 1876269 | 3920755 | 154 | 115 | 12.0 | 101.4 |

| TGC-0005 | 13.12.22 | 1876437 | 3920744 | 137 | 115 | 12.0 | 128.5 |

| TGC-0007 | 12.01.23 | 1876269 | 3920756 | 154 | 105 | 12.0 | 131.2 |

| TGC-0008 | 21.01.23 | 1876437 | 3920744 | 139 | 293 | 4.0 | 124.2 |

| TGC-0009 | 16.01.23 | 1876269 | 3920756 | 153 | 106 | -10.0 | 80.3 |

| TGC-0010 | 18.01.23 | 1876269 | 3920755 | 153 | 114 | -11.0 | 83.3 |

| TGC-0011 | 23.01.23 | 1876269 | 3920755 | 153 | 102 | -10.0 | 95.2 |

| TGC-0012 | 27.01.23 | 1876437 | 3920745 | 139 | 300 | 5.0 | 106.6 |

| TGC-0013 | 27.01.23 | 1876269 | 3920757 | 153 | 97 | -8.0 | 102.6 |

| TGC-0014 | 2.02.22 | 1876269 | 3920757 | 153 | 93 | -9.0 | 95.1 |

| TGC-0015 | 10.02.22 | 1876437 | 3920744 | 139 | 289 | -11.0 | 122.5 |

| TGC-0016 | 7.02.22 | 1876269 | 3920757 | 153 | 85 | -7.0 | 101.4 |

| TGC-0017 | 10.02.22 | 1876269 | 3920757 | 153 | 82 | -8.0 | 99.4 |

| TGC-0018 | 22.02.23 | 1876437 | 3920744 | 139 | 285 | -8.0 | 111.3 |

| TGC-0019 | 15.02.23 | 1876269 | 3920758 | 153 | 79 | -8.0 | 110.4 |

| TGC-0020 | 20.02.23 | 1876269 | 3920755 | 153 | 119 | -12.0 | 94.9 |

| TGC-0021 | 23.02.23 | 1876269 | 3920755 | 153 | 115 | -4.0 | 92.3 |

| TGC-0022 | 27.02.23 | 1876269 | 3920755 | 153 | 113 | -19.0 | 103.7 |

| TGC-0023 | 4.03.23 | 1876437 | 3920744 | 139 | 293 | -8.0 | 105.4 |

| TGC-0024 | 1.03.23 | 1876269 | 3920755 | 152 | 113 | -22.0 | 98.4 |

| TGC-0025 | 4.03.23 | 1876269 | 3920756 | 152 | 108 | -29.0 | 140.8 |

| TGC-0026 | 8.03.23 | 1876269 | 3920756 | 153 | 106 | -4.0 | 84.1 |

| TGC-0027 | 3.04.23 | 1876437 | 3920744 | 139 | 299 | 10.0 | 120.5 |

| TGC-0028 | 10.03.23 | 1876269 | 3920756 | 152 | 106 | -27.0 | 116.7 |

| TGC-0029 | 14.03.23 | 1876269 | 3920756 | 152 | 106 | -23.0 | 95.2 |

| TGC-0030 | 20.03.23 | 1876269 | 3920756 | 153 | 103 | -16.0 | 98.6 |

| TGC-0031 | 22.03.23 | 1876269 | 3920756 | 152 | 103 | -25.0 | 95.6 |

| TGC-0032 | 24.03.23 | 1876269 | 3920756 | 153 | 97 | -16.0 | 110.6 |

| TGC-0034 | 28.03.23 | 1876269 | 3920756 | 153 | 97 | -12.0 | 101.4 |

| TGC-0035 | 31.03.23 | 1876269 | 3920756 | 153 | 98 | 0.0 | 113.0 |

| TGC-0036 | 4.04.23 | 1876269 | 3920756 | 153 | 94 | -16.0 | 104.4 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/163583

Vancouver, British Columbia–(Newsfile Corp. – April 25, 2023) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“), is pleased to announce assay results from its 100,000-meter drill program at the Moss Gold Project in Northwest Ontario, Canada (the “Moss Gold Project” or “Moss Gold Deposit“).

Highlights:

President and CEO Brett Richards stated: “These results continue to support our thesis that the size and scale of the Moss Gold Project will be large enough to support a material and meaningful update to the mineral resource estimate, which is expected in early May 2023.

“These additional results highlighting the mineralization in the south-west zone augment the press release of April 20, 2023, and continue to expand the zone well outside the historical resource, still open in several directions and at depth. In addition to the May 2023 MRE, we still have 30 quality drill targets to be tested. These include gold, coppercobalt, and polymetallic prospects. We have drilled less than 10% of the identified targets on our land package and are currently building a plan to drill test the better targets. It will be an exciting period when we are ready to evaluate the additional resource potential of the larger inventory of targets within our land package.

“We have focused on the currently defined portion of the Moss Gold Deposit as a meaningful Phase One Project that Goldshore itself can build. The Moss Gold Deposit remains open at depth and through several yet-to-be drilled parallel structures; and it is part of an overall 8-kilometer strike length of gold mineralization in drill holes. This strongly suggests that the Phase One Project is part of a much larger total project.”

Technical Overview

Figure 1 shows the location of the drill holes in this press release and Figure 2 shows a close up of the drilled area with significant intercepts. Figure 3 is a typical section through hole MMD-23-116, -118A. Table 1 shows the significant intercepts. Table 2 shows the drill hole locations.

Figure 1: Location of drill holes in this release relative to the November 2022 MRE and $1,500 open pit shell constraint.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_002full.jpg

Figure 2: Close up of Southwest Zone with significant intercepts relative to the November 2022 MRE and $1,500 open pit shell constraint.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_003full.jpg

Figure 3: Drill section through holes MMD-23-116 and -118A showing the significant expansion of the mineralized model beneath the November 2022 MRE and $1,500 open pit shell constraint, which should add to mineral resources in the May 2023 MRE.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_004full.jpg

The Southwest Zone was previously considered to be a small fault-offset extension of the Main Zone. As a result, it was poorly drilled, which led to the definition of only a small open pit-constrained Mineral Resource (Figure 1 and 2).

Oriented core measurements from earlier drilling showed a significant change in strike of the Southwest Zone, revealing it to be 035º rather than the assumed 065º strike based on the known orientation of the Main and QES Zones. The nine holes reported herein were drilled perpendicular to the new strike to infill a poorly drilled volume in the center of the Southwest Zone at a closer spacing (30 meters) along each section to confirm the continuity of high-grade shears. This should enable greater confidence in the resource and an expansion of the open pit constraints at depth.

Holes MMD-22-111, MMD-23-116, -118A, and -119 intersected several high-grade shears (e.g., 0.65m @ 36.8 g/t Au in MMD-23-116) hosting quartz-carbonate veinlets with up to 3-5% pyritechalcopyrite within a strongly albite-hematite and silica-sericite-pyrite and carbonate altered diorite intrusion complex (Figure 4). The shears anastomose along the same orientation of the zone and trend beyond the area explored by historical drilling.

Holes MMD-22-107, -110, MMD-23-115, -117, -120 intersected wide intervals of low-grade mineralization within the altered intrusion containing localized narrow higher-grade shears. The results are similar to those encountered in the historic drilling and include:

Hole MMD-22-107, -110, and -111 represent the most western holes drilled to date in the Southwest Zone, including historical drilling. They illustrate the continued potential to expand the Moss Gold Deposit beyond the original footprint with the newly understood orientation of the shear structures trending southwest of the historical exploration drilling. Gold has been intersected in scout drill holes over a further three kilometers along strike. Our airborne VTEM/magnetics data show that more favourable targets exist along this corridor in areas that have yet to be drilled.

Figure 4: Drill core from 416.4 – 417.05m (0.65 m @ 36.8 g/t Au) in MMD-23-116 highlighting a pyrite + chalcopyrite mineralized quartz-carbonate vein within the sheared, altered intrusion.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163605_14b848a0f4042ad4_005full.jpg

Pete Flindell, VP Exploration for Goldshore, said, “These results show that the Southwest Zone is much better mineralized than historical drillholes suggested. They also show that the Moss Gold Deposit is yet to be closed off, confirming our belief that this is a much bigger mineralized system than is appreciated.”

Table 1: Significant downhole gold intercepts

| HOLE ID | FROM | TO | LENGTH (m) | TRUE WIDTH (m) | CUT GRADE (g/t Au) | UNCUT GRADE (g/t Au) |

| MMD-22-107 | 11.30 | 49.00 | 37.70 | 24.4 | 0.58 | 0.58 |

| including | 25.30 | 30.70 | 5.40 | 3.5 | 2.93 | 2.93 |

| 97.10 | 101.80 | 4.70 | 3.2 | 0.40 | 0.40 | |

| 113.20 | 122.45 | 9.25 | 6.3 | 0.35 | 0.35 | |

| 175.20 | 177.50 | 2.30 | 1.6 | 0.95 | 0.95 | |

| 193.60 | 201.50 | 7.90 | 5.5 | 0.33 | 0.33 | |

| 210.10 | 217.00 | 6.90 | 4.9 | 0.30 | 0.30 | |

| 222.05 | 225.50 | 3.45 | 2.4 | 0.43 | 0.43 | |

| 236.00 | 251.00 | 15.00 | 10.7 | 0.32 | 0.32 | |

| 334.00 | 344.00 | 10.00 | 7.5 | 0.65 | 0.65 | |

| including | 334.00 | 336.00 | 2.00 | 1.5 | 1.77 | 1.77 |

| MMD-22-110 | 7.00 | 57.95 | 50.95 | 33.3 | 0.41 | 0.41 |

| 73.05 | 83.55 | 10.50 | 7.0 | 0.35 | 0.35 | |

| 88.15 | 97.00 | 8.85 | 6.0 | 0.38 | 0.38 | |

| 104.45 | 112.00 | 7.55 | 5.2 | 0.53 | 0.53 | |

| 127.00 | 132.90 | 5.90 | 4.1 | 0.49 | 0.49 | |

| 166.00 | 169.00 | 3.00 | 2.1 | 0.39 | 0.39 | |

| 174.00 | 182.00 | 8.00 | 5.7 | 0.68 | 0.68 | |

| 202.95 | 208.00 | 5.05 | 3.6 | 0.35 | 0.35 | |

| 241.80 | 255.00 | 13.20 | 9.8 | 0.31 | 0.31 | |

| 273.60 | 277.00 | 3.40 | 2.5 | 0.82 | 0.82 | |

| 301.00 | 319.00 | 18.00 | 13.6 | 0.57 | 0.57 | |

| including | 315.05 | 319.00 | 3.95 | 3.0 | 1.83 | 1.83 |

| 336.00 | 342.00 | 6.00 | 4.6 | 0.34 | 0.34 | |

| 379.00 | 388.00 | 9.00 | 7.1 | 1.37 | 1.37 | |

| including | 379.00 | 381.00 | 2.00 | 1.6 | 4.02 | 4.02 |

| MMD-22-111 | 83.00 | 101.15 | 18.15 | 12.6 | 0.30 | 0.30 |

| 102.80 | 109.60 | 6.80 | 4.8 | 0.31 | 0.31 | |

| 115.40 | 122.90 | 7.50 | 5.3 | 0.60 | 0.60 | |

| 133.00 | 148.90 | 15.90 | 11.5 | 0.51 | 0.51 | |

| 161.70 | 166.00 | 4.30 | 3.1 | 0.32 | 0.32 | |

| 180.00 | 184.10 | 4.10 | 3.0 | 0.42 | 0.42 | |

| 231.00 | 240.85 | 9.85 | 7.4 | 0.30 | 0.30 | |

| 290.00 | 293.00 | 3.00 | 2.3 | 0.50 | 0.50 | |

| 375.30 | 392.20 | 16.90 | 13.5 | 1.47 | 1.47 | |

| including | 386.00 | 391.60 | 5.60 | 4.5 | 3.88 | 3.88 |

| including | 391.00 | 391.60 | 0.60 | 0.5 | 16.1 | 16.1 |

| 456.00 | 458.05 | 2.05 | 1.7 | 0.32 | 0.32 | |

| 487.90 | 490.00 | 2.10 | 1.7 | 0.36 | 0.36 | |

| MMD-23-115 | 56.00 | 77.60 | 21.60 | 15.2 | 0.48 | 0.48 |

| 88.40 | 97.35 | 8.95 | 6.3 | 0.69 | 0.69 | |

| including | 93.40 | 96.00 | 2.60 | 1.8 | 1.50 | 1.50 |

| 111.00 | 113.25 | 2.25 | 1.6 | 0.50 | 0.50 | |

| 120.30 | 132.60 | 12.30 | 8.7 | 0.53 | 0.53 | |

| 207.00 | 210.00 | 3.00 | 2.2 | 0.42 | 0.42 | |

| 215.00 | 219.00 | 4.00 | 2.9 | 0.66 | 0.66 | |

| 241.60 | 251.00 | 9.40 | 7.0 | 0.32 | 0.32 | |

| 257.00 | 259.55 | 2.55 | 1.9 | 0.33 | 0.33 | |

| 280.20 | 282.50 | 2.30 | 1.7 | 0.44 | 0.44 | |

| MMD-23-116 | 65.00 | 67.00 | 2.00 | 1.4 | 0.55 | 0.55 |

| 176.00 | 178.00 | 2.00 | 1.5 | 0.32 | 0.32 | |

| 221.15 | 226.70 | 5.55 | 4.2 | 0.33 | 0.33 | |

| 231.90 | 287.00 | 55.10 | 42.8 | 0.38 | 0.38 | |

| 297.30 | 307.00 | 9.70 | 7.6 | 0.44 | 0.44 | |

| 316.60 | 348.40 | 31.80 | 25.3 | 0.47 | 0.47 | |

| 359.00 | 377.00 | 18.00 | 14.4 | 0.58 | 0.58 | |

| including | 374.00 | 377.00 | 3.00 | 2.4 | 1.61 | 1.61 |

| 400.85 | 437.85 | 37.00 | 30.1 | 1.34 | 1.46 | |

| including | 405.55 | 418.60 | 13.05 | 10.6 | 3.25 | 3.59 |

| including | 416.40 | 417.05 | 0.65 | 0.5 | 30.0 | 36.8 |

| MMD-23-117 | 24.70 | 147.00 | 122.30 | 82.7 | 0.43 | 0.43 |

| including | 45.00 | 47.00 | 2.00 | 1.3 | 2.22 | 2.22 |

| and | 67.05 | 71.00 | 3.95 | 2.7 | 1.30 | 1.30 |

| and | 106.00 | 114.00 | 8.00 | 5.5 | 1.79 | 1.79 |

| 165.65 | 182.75 | 17.10 | 11.8 | 0.41 | 0.41 | |

| 217.35 | 258.00 | 40.65 | 28.5 | 0.35 | 0.35 | |

| including | 217.35 | 219.40 | 2.05 | 1.4 | 1.86 | 1.86 |

| 307.00 | 310.00 | 3.00 | 2.1 | 0.45 | 0.45 | |

| 353.00 | 388.00 | 35.00 | 25.3 | 0.31 | 0.31 | |

| 404.65 | 414.10 | 9.45 | 6.9 | 0.99 | 0.99 | |

| including | 404.65 | 412.90 | 8.25 | 6.0 | 1.03 | 1.03 |

| 446.00 | 448.00 | 2.00 | 1.5 | 0.62 | 0.62 | |

| MMD-23-118A | 35.85 | 45.00 | 9.15 | 5.5 | 0.88 | 0.88 |

| 101.00 | 109.00 | 8.00 | 5.1 | 0.96 | 0.96 | |

| 202.00 | 220.00 | 18.00 | 12.3 | 0.31 | 0.31 | |

| 241.30 | 249.10 | 7.80 | 5.4 | 0.30 | 0.30 | |

| 261.05 | 279.00 | 17.95 | 12.6 | 0.68 | 0.68 | |

| including | 271.55 | 274.10 | 2.55 | 1.8 | 3.66 | 3.66 |

| 290.20 | 310.00 | 19.80 | 14.1 | 0.67 | 0.67 | |

| including | 306.90 | 309.00 | 2.10 | 1.5 | 1.79 | 1.79 |

| 369.20 | 451.00 | 81.80 | 60.7 | 0.58 | 0.58 | |

| including | 374.80 | 379.00 | 4.20 | 3.1 | 1.03 | 1.03 |

| and | 389.45 | 391.90 | 2.45 | 1.8 | 1.45 | 1.45 |

| and | 409.00 | 423.00 | 14.00 | 10.4 | 1.63 | 1.63 |

| 461.95 | 467.10 | 5.15 | 3.9 | 0.59 | 0.59 | |

| 483.00 | 485.00 | 2.00 | 1.5 | 2.44 | 2.44 | |

| 495.05 | 516.55 | 21.50 | 16.4 | 0.37 | 0.37 | |

| MMD-23-119 | 84.75 | 96.00 | 11.25 | 7.8 | 0.30 | 0.30 |

| 116.00 | 238.80 | 122.80 | 87.8 | 0.51 | 0.51 | |

| including | 157.00 | 167.95 | 10.95 | 7.8 | 1.97 | 1.97 |

| including | 165.20 | 165.90 | 0.70 | 0.5 | 19.4 | 19.4 |

| and | 189.80 | 192.95 | 3.15 | 2.3 | 1.48 | 1.48 |

| 305.00 | 329.50 | 24.50 | 18.2 | 0.41 | 0.41 | |

| 362.00 | 365.05 | 3.05 | 2.3 | 0.51 | 0.51 | |

| 414.00 | 417.00 | 3.00 | 2.3 | 0.43 | 0.43 | |

| 431.20 | 437.20 | 6.00 | 4.6 | 0.31 | 0.31 | |

| 439.00 | 441.05 | 2.05 | 1.6 | 0.32 | 0.32 | |

| 447.85 | 481.05 | 33.20 | 25.6 | 0.61 | 0.61 | |

| including | 479.00 | 481.05 | 2.05 | 1.6 | 3.45 | 3.45 |

| 508.00 | 514.40 | 6.40 | 5.0 | 0.58 | 0.58 | |

| MMD-23-120 | 12.90 | 31.95 | 19.05 | 12.4 | 0.59 | 0.59 |

| 43.65 | 61.10 | 17.45 | 11.4 | 0.30 | 0.30 | |

| 63.00 | 125.00 | 62.00 | 40.9 | 0.32 | 0.32 | |

| 137.85 | 154.30 | 16.45 | 11.0 | 0.33 | 0.33 | |

| 165.90 | 170.00 | 4.10 | 2.7 | 0.37 | 0.37 | |

| 175.00 | 178.85 | 3.85 | 2.6 | 0.80 | 0.80 | |

| 208.20 | 211.55 | 3.35 | 2.3 | 0.43 | 0.43 | |

| 241.15 | 263.20 | 22.05 | 15.2 | 0.30 | 0.30 | |

| 276.00 | 282.10 | 6.10 | 4.2 | 0.61 | 0.61 | |

| 352.00 | 377.00 | 25.00 | 17.7 | 0.47 | 0.47 | |

| including | 368.00 | 370.05 | 2.05 | 1.5 | 1.15 | 1.15 |

Intersections calculated above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a maximum internal waste interval of 10 metres. Shaded intervals are intersections calculated above a 1.0 g/t Au cut off. Intervals in bold are those with a grade thickness factor exceeding 20 gram x metres / tonne gold. True widths are approximate and assume a subvertical body.

Table 2: Location of drill holes in this press release

| HOLE | EAST | NORTH | RL | AZIMUTH | DIP | EOH |

| MMD-22-107 | 668,208 | 5,378,030 | 442 | 127° | -50° | 450 |

| MMD-22-110 | 668,166 | 5,378,056 | 448 | 126° | -50° | 402 |

| MMD-22-111 | 668,147 | 5,378,114 | 445 | 143° | -50° | 552 |

| MMD-23-115 | 668,388 | 5,378,145 | 429 | 125° | -45° | 324 |

| MMD-23-116 | 668,387 | 5,378,392 | 446 | 124° | -49° | 525 |

| MMD-23-117 | 668,334 | 5,378,203 | 435 | 124° | -49° | 450 |

| MMD-23-118a | 668,375 | 5,378,401 | 444 | 126° | -54° | 552 |

| MMD-23-119 | 668,277 | 5,378,239 | 447 | 126° | -50° | 525 |

| MMD-23-120 | 668,255 | 5,378,123 | 436 | 125° | -49° | 450 |

Analytical and QA/QC Procedures

All samples were sent to ALS Geochemistry in Thunder Bay for preparation and analysis was performed in the ALS Vancouver analytical facility. ALS is accredited by the Standards Council of Canada (SCC) for the Accreditation of Mineral Analysis Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were analyzed for gold via fire assay with an AA finish (“Au-AA23”) and 48 pathfinder elements via ICP-MS after four-acid digestion (“ME-MS61”). Samples that assayed over 10 ppm Au were re-run via fire assay with a gravimetric finish (“Au-GRA21”).

In addition to ALS quality assurance / quality control (“QA/QC”) protocols, Goldshore has implemented a quality control program for all samples collected through the drilling program. The quality control program was designed by a qualified and independent third party, with a focus on the quality of analytical results for gold. Analytical results are received, imported to our secure on-line database and evaluated to meet our established guidelines to ensure that all sample batches pass industry best practice for analytical quality control. Certified reference materials are considered acceptable if values returned are within three standard deviations of the certified value reported by the manufacture of the material. In addition to the certified reference material, certified blank material is included in the sample stream to monitor contamination during sample preparation. Blank material results are assessed based on the returned gold result being less than ten times the quoted lower detection limit of the analytical method. The results of the on-going analytical quality control program are evaluated and reported to Goldshore by Orix Geoscience Inc.

Grant of Stock Options and RSUs

In addition, the Company announces that it has granted a total of 4,100,000 stock options (“Options“) to purchase common shares of the Company to certain directors, officers, employees and consultants. Such Options are exercisable into common shares of the Company at an exercise price of $0.25 per common share for a period of five years from the date of grant. Of the Options, 3,900,000 will vest 1/3 on October 24, 2023, 1/3 on October 24, 2024, and 1/3 on October 24, 2025; and 200,000 will vest 1/3 immediately and 1/3 annually thereafter. All Options expire on April 24, 2028.

The Company has also issued a total of 1,673,968 restricted share units (“RSUs“) to certain directors and officers of the Company. The RSUs will fully vest on the date that is one year from the date of grant. Once vested, each RSU represents the right to receive one common share of the Company, the equivalent cash value thereof, or a combination of the two, at the Company’s discretion. The grant of Options and issuance of RSUs have been made in accordance with the Company’s Omnibus Incentive Plan (the “Plan“) that was approved by the Company’s directors on November 8, 2022. The Plan remains subject to the approval of the shareholders of the Company at its next Annual General and Special Meeting. Any grants of share-based compensation made under the Plan will also be subject to the approval of disinterested shareholders at the next Annual General and Special Meeting of the Company.

In addition, certain directors and officers of the Company have agreed to forgive an aggregate of $168,833 of debt, representing accrued consulting fees incurred during the period from January 2023 to March 2023 and directors’ fees incurred during the period from July 2022 to March 2023.

About Goldshore

Goldshore is an emerging junior gold development company and owns 100% of the Moss Gold Project located in Ontario, with Wesdome Gold Mines Ltd. being a large shareholder. Supported by an industry-leading management group, board of directors and advisory board, Goldshore is positioned to advance the Moss Gold Project through the next stages of exploration and development.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice President – Exploration of the Company, a qualified person under NI 43-101 has approved the scientific and technical information contained in this news release.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

For More Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288 4416 M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes | Twitter: GoldShoreRes | LinkedIn: goldshoreres

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project, the release of an updated mineral resource estimate and preliminary economic assessment, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; and the impact of COVID-19.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/163605

Vancouver, British Columbia–(Newsfile Corp. – April 24, 2023) – Dolly Varden Silver Corporation (TSXV: DV) (OTCQX: DOLLF) (the “Company” or “Dolly Varden“) announces the 2023 Exploration Plans for the Kitsault Valley Project, which includes the Dolly Varden Silver property and Homestake Ridge Gold Silver property. A total of 40,000 to 45,000m of drilling is planned to build upon last year’s successes through further step outs following high grade silver and gold mineralization at the Wolf and Homestake Ridge deposits, as well as appropriately spaced exploration holes to allow the inclusion of new mineralization drilled over the past three drilling programs to be include in an updated Mineral Resource Estimate.

“2022 was a breakthrough exploration season at Dolly Varden Silver’s Kitsault Valley project. It hosts one of the largest, undeveloped high grade precious metals project in Western Canada. With the wide, high-grade silver intercepts in significant step-out holes from the Wolf and Homestake Silver deposits, coupled with the highest grade gold intercepts drilled in all of the Golden Triangle in 2022 from the Homestake Main deposit, we eagerly await the start of this season’s drilling. We are continuing our successful strategy of expanding current Resources, while also testing new exploration targets for discovery. The company has over $26 million in the treasury, positioning our exploration team with a tremendous opportunity to create value with the drill bit,” said Shawn Khunkhun, President and CEO of Dolly Varden Silver.

Figure 1. Kitsault Valley trend with 2023 exploration drilling targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/163488_7c088258f4c53a63_002full.jpg

Dolly Varden: Wolf and Kitsol Veins

Drilling allocated to the Wolf Deposit expansion will focus on both infill drilling of the wide-spaced intercepts from 2022 to be included in an upcoming resource estimate, as well as further step out holes in both the southwest, north and east directions where high grade silver mineralization remains open. Two intercepts from the Wolf Vein drilled in 2022 at the furthest strike extents of the vein, are approximately 825 meters apart. The deposit is wide open for expansion along strike and to depth.

Figure 2. Wolf Vein Long Section outlining 2023 exploration drill targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/163488_dollyvardenimage2.jpg

Similar step out drilling will follow up on high grade silver mineralization at the Kitsol Vein, where drill hole DV22-323 demonstrated the continuity of steeply plunging, high-grade silver mineralization with results of 301g/t Ag, 0.23 %Pb, 0.56% Zn over 15.00 meters (9.60 meters estimated true width) including 434 g/t Ag, 0.41% Pb, 0.69% Zn over 5.90 meters (3.78 meters estimated true width).

Homestake Ridge: Main and Silver

The 2023 exploration drilling at the Homestake deposits are influenced by the structural information gained from the infill drilling at Main where two main plunge directions have been identified; a shallow, northerly plunge and a steep southerly plunge, where NE-SW structures crosscut the main Homestake trend. The planned drilling will target the down plunge extensions of higher grade and wider zones of gold mineralization such as 2022 drill hole HR22-333 which intersected 46.31 g/t Au, 70 g/t Ag and 0.19% Cu over 25.00 meters including 1,145 g/t Au, 826 g/t Ag and 0.51% Cu over 0.48 meters core length.

Figure 3. Homestake Ridge Long Section outlining 2023 exploration drill target

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/163488_7c088258f4c53a63_004full.jpg

Drilling at Homestake Silver will prioritize step out holes where 2022 expansion drilling had success at the southern extent, with HR22-362, a 200 meter step out that intersected 1,252 g/t Ag, 0.81 g/t Au and 0.14% Cu over 2.50 meters, including 3,330 g/t Ag, 0.75 g/t Au and 0.38% Cu over 0.75m.

Discovery Focused Exploration

The Moose Vein is a 2023 exploration drill target, testing an historic prospect with small exploration adit from the 1920s. It is located 1,500 meters north of the Wolf Deposit within the Potassic alteration halo associated with the Torbrit, Dolly Varden and Wolf silver deposits to the south. The Moose vein strikes east-west, similar to the Dolly Varden Vein, hosting silver grades and mineralization styles similar to areas of the Wolf vein, proximal to the high-grade plunge zone. The depth extent and projected extension of the Mooise Vein under the mid-valley sediment cap will be tested in the 2023 program.

Several blind drill targets under the 5.4 kilometer long mid-valley sediment cover will be better defined for later summer drill testing, after a planned ground IP survey is completed

Additional exploration targets will include parallel structural zones to the west of Homestake Main trend, coincident with a broad gold in soils anomalous zone overlying a quartz-sericite-pyrite alteration zone.

Qualified Person

Rob van Egmond, P.Geo. Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward-Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “potential”, and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward-looking statements or information in this release relates to, among other things, the results of previous field work and programs and the continued operations of the current exploration program, interpretation of the nature of the mineralization at the project and that that the mineralization on the project is similar to Eskay and Brucejack, results of the mineral resource estimate on the project, the potential to grow the project, the potential to expand the mineralization and our beliefs about the unexplored portion of the property.

These forward-looking statements are based on management’s current expectations and beliefs and assume, among other things, the ability of the Company to successfully pursue its current development plans, that future sources of funding will be available to the company, that relevant commodity prices will remain at levels that are economically viable for the Company and that the Company will receive relevant permits in a timely manner in order to enable its operations, but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on risks and uncertainties, see the Company’s most recently filed annual management discussion & analysis (“MD&A“) and management information circular dated January 21, 2022 (the “Circular“), both of which are available on SEDAR at www.sedar.com. The risk factors identified in the MD&A and the Circular are not intended to represent a complete list of factors that could affect the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-609-5137, www.dollyvardensilver.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/163488

Vancouver, British Columbia–(Newsfile Corp. – April 20, 2023) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“), is pleased to announce assay results from its recently completed drill program at the Moss Lake Project in Northwest Ontario, Canada (the “Moss Gold Project“).

Highlights:

President and CEO Brett Richards stated: “These results continue to support our belief that the size and scale of the Moss Gold Project is much larger and continues to be open at all directions, along strike both to the northeast and southwest, as well as our understanding of lateral mineralized targets to the south-east of the Southwest Zone and the Main Zone. For now, we have halted the program to step back; understand the quantum of this resource, and prepare for a mineral resource update in early May, we can now see a viable path to a meaningful project PEA (preliminary economic analysis). We look forward to those results in the coming months, as we start to plan for an infill drilling program working towards a pre-feasibility study in the future.”

Technical Overview

Figure 1 shows the location of the drill holes in this press release and Figure 2 shows a close up of the drilled area with significant intercepts. Figure 3 is a typical section through hole MMD-22-105, -108 and -109. Table 1 shows the significant intercepts. Table 2 shows the drill hole locations.

Figure 1: Location of drill holes in this release relative to the November 2022 resource model and $1500 open pit shell constraint

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163107_af741d8ce40c4b17_002full.jpg

Figure 2: insert close up of Southwest Zone with significant intercepts relative to the November 2022 resource model and $1500 open pit shell constraint

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163107_af741d8ce40c4b17_003full.jpg

Figure 3: Drill section through holes MMD-22-105, -108 and -109 showing the significant expansion of the mineralized model beneath the November 2022 resource model and $1500 open pit shell constraint, which should add to mineral resources in the upcoming update

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163107_af741d8ce40c4b17_004full.jpg

Continued infill of the Southwest Zone has delineated a new continuous high-grade structure over a 250m strike length from near surface to 200m depth immediately northeast of the historical Southwest Zone. Holes MMD-22-105, -108, -109 and MMD-23-113, and -114 intersected this structure along with previously released holes MMD-22-031, -042, -063, and -064. The newly understood zone orientation was tested against the phase 1 drill results and confirmed the continuity of the high-grade structures controlling the mineralization.

The mineralized zone occurs within an albitite+hematite altered diorite intrusion complex cut by closely spaced, texturally destructive sericite+chlorite+carbonate altered shears. Additional shearing, and subsequent alteration, is seen extending into the neighboring intermediate volcanics but is poorly mineralized.

The gold mineralization appears more nuggety than elsewhere in the deposit with a greater portion of the mineralization attributed to pyrite±chalcopyrite bearing quartz-carbonate veins within the sheared intervals. Mineralization includes visible gold (Figure 4). Several very high-grade intercepts include:

Holes MMD-22-109 and MMD-23-113 intersected the high-grade structure but encountered lesser vein mineralization resulting in more modest grade intercepts including:

Holes MMD-22-106, and MMD-23-112 were focused on infilling the drill spacing of the existing Southwest Zone. All three holes intercepted broad zones of mineralization hosted primarily within altered granodiorite containing narrow higher grade shear zones. Best intercepts include:

Figure 1: Visible gold flake within a quartz-carbonate-pyrite vein at 190.42m (1.6m @ 54.4 g/t Au) in MMD-22-105 within the sheared, altered intrusion of the Southwest zone. Note that this photo is not intended to be representative of broader mineralization on the Moss Lake Gold Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/163107_af741d8ce40c4b17_005full.jpg