Outstanding Apollo Silver Warrants Expire in July 2026

VANCOUVER, British Columbia, Dec. 18, 2025 (GLOBE NEWSWIRE) — Apollo Silver Corp. (“Apollo Silver” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF) is pleased to announce that, through its wholly owned subsidiary, Stronghold Silver USA Corp., the Company has completed all payments required under the Option to Purchase Agreement dated December 21, 2020, as amended January 21, 2023 (the “Athena Agreement”), with Athena Minerals Inc. (the “Optionor”). As a result, the Company now owns 100% interest in thirty-six (36) unpatented lode mining claims comprising part of the Langtry Property, which forms part of the Calico Silver Project, in San Bernardino County, California (the “Athena Claims”).

Under the terms of the Athena Agreement, the Company had the right to acquire the Athena Claims for an aggregate purchase price of US$1,000,000, payable on or before December 21, 2025. An initial payment of US$15,000 was paid upon execution of the Athena Agreement in December 2020, followed by annual payments of US$25,000 on each anniversary date. Between 2021 and 2024, the Company made the required annual payments. In accordance with the Athena Agreement, payments made within the twenty-four months preceding option exercise were credited against the purchase price, resulting in a final cash payment of US$950,000 to vest 100% ownership of the Athena Claims.

Pursuant to the Athena Agreement, the Company has granted Athena a 1% net smelter return (“NSR”) royalty on future mineral production from the Athena Claims. The NSR applies only to those claims that do not already carry an existing royalty of 1% or greater, and in all cases the total royalty burden on any claim will not exceed 2%. The acquisition of the Athena Claims consolidates Apollo Silver’s land position at the Calico Silver Project (“Calico Project”) and represents a significant milestone in advancing the Company’s silver and critical minerals strategy in the region (see Figure 1).

About Calico Silver Project

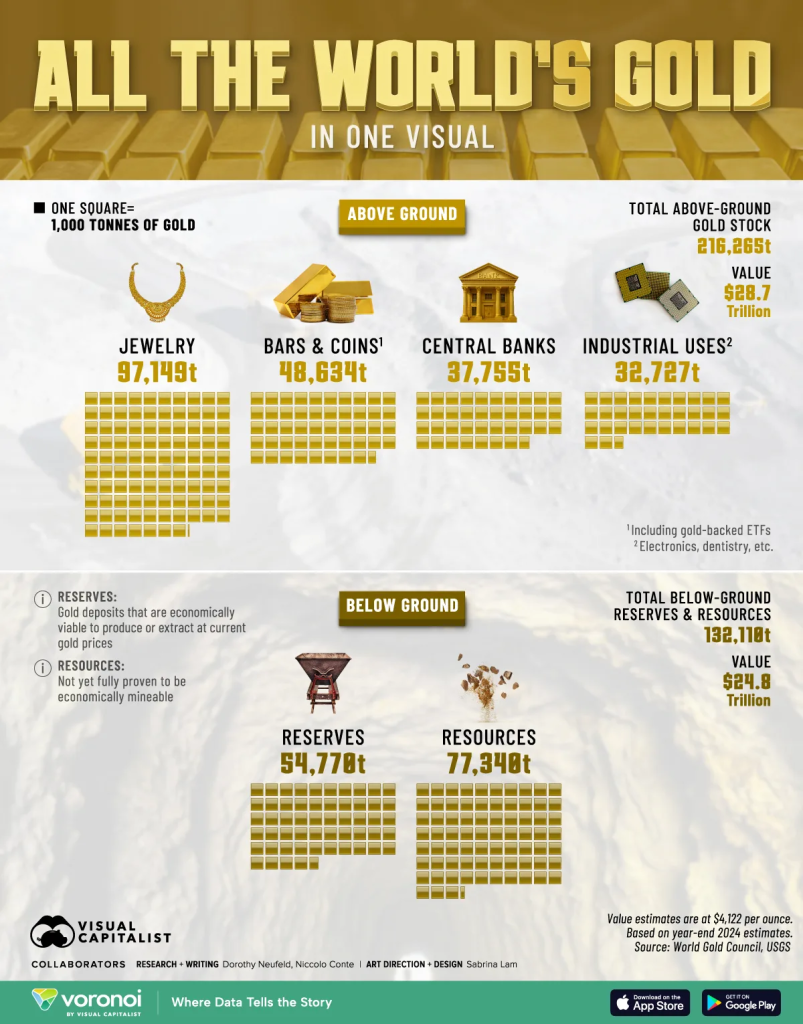

The Calico Project is one of the largest primary undeveloped silver projects in the United States. With silver designated as a U.S. critical mineral and continued strong industrial demand highlighting the importance of secure domestic supply, large scale U.S. silver assets may become increasingly strategic. The Calico Project Mineral Resource Estimate (“MRE”) comprises an Measured and Indicated Resource of 125 Moz Ag in 55 Mt at an average grade of 71 g/t Ag the Measured and Indicated categories and 58 Moz Ag in 25 Mt at a grade of 71 g/t Ag in the Inferred category (see Apollo Silver news releases dated September 4, 2025, and October 16, 2025).

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a QP as defined by NI 43-101 and is not independent of the Company.

Figure 1: Athena Claims

Outstanding Warrants

As of December 18, 2025, the Company had 34,903,440 outstanding share purchase warrants (the “Warrants”), with five (5) Warrants exercisable into one (1) common share of the Company, in accordance with their terms, at an exercise price of $3.95 per share and expiring July 8, 2026. Investors requiring further information regarding the exercise of their Warrants should contact: (i) if the Warrants are held through a brokerage account or other nominee, such broker or nominee; and (ii) if the Warrants are held directly in registered form, the Warrant agent, Endeavor Trust Corporation, by email at admin@endeavortrust.com and following the instructions set forth in the applicable Warrant certificate. Warrant holders should also consult their financial and tax advisors regarding the financial and tax implications applicable to them prior to exercising Warrants.

About Apollo Silver Corp.

Apollo is advancing one of the largest undeveloped primary silver projects in the US. The Calico Project hosts a large, bulk minable silver deposit with significant barite and zinc credits – recognized as critical minerals essential to the US energy and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the Company’s strategic objectives, the consolidation and advancement of its land position at the Langtry Property, and the exploration and development potential at the Calico Project. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ddd1cb0a-9601-41f1-a726-5d5f0f3aad08