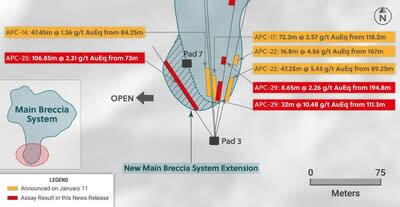

Drill hole APC-29 intercepted the highest grade near-surface copper-silver-gold mineralization encountered to date at the Main Breccia system at the Apollo target (“Apollo”) yielding 32 metres @ 10.48 g/t gold equivalent from 80 metres vertical. This hole was designed to test directly below where the Main Breccia system daylights at surface in the southern part of the system and to follow up on recently announced results for hole APC-22, which intersected 47.25 metres @ 5.45 g/t gold equivalent (see press release dated January 11, 2023). Further down-hole in APC-29, a broad zone of mineralization was encountered averaging 214.4 metres @ 1.04 g/t gold equivalent. APC-29 had to be abandoned short of target depth due to a fault while still in mineralization with the final 0.5 metre sample assaying 1.72 g/t gold, 39 g/t silver and 0.1% copper.

Drill hole APC-25 was designed as a step out hole along strike of the near surface high-grade zone of mineralization and intersected 106.85 metres @ 2.31 g/t gold equivalent starting at 65 metres vertical below surface. As a result, APC-25 has confirmed a shallow, westward expansion to the Main Breccia system and an apparent thickening to the high-grade near surface mineralized zone as the system is traced to the west.

Hole APC-26 was drilled to the northeast from Pad 4 and confirmed continuity of mineralization in that direction returning 136.9 metres @ 1.51 g/t gold equivalent contained within 311.2 metres at 1.04 g/t gold.

The phase II drilling program is underway with three rigs currently operating focused on testing near surface mineralization and expanding the dimensions of the Main Breccia system. Assay results are expected in the near term for the final three holes of the 2022 program, including westwards step-out hole APC-28, which cut more than 600 metres of continuous mineralization. Additionally, the first hole of the Phase II program is now complete, and core has been dispatched to the lab for assaying.

Ari Sussman, Executive Chairman commented: “Not only is the Main Breccia system at Apollo a large, bulk tonnage deposit but it now appears to host an outcropping and shallow zone of high-grade mineralization, which clearly enhances the value of this exciting discovery. Based on surface sampling, the system appears to daylight over an area measuring approximately 150 metres in diameter and remains open for expansion. The Main Breccia system is truly evolving into a brand-new world-class discovery right in the heart of a prolific mining camp with continuous precious metal production dating back more than 500 years.”

TORONTO, Jan. 31, 2023 /CNW/ – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from a further three holes drilled into the Main Breccia discovery at the Apollo target (“Apollo”), which is part of the Guayabales project located in Caldas, Colombia. The Main Breccia discovery is a high-grade, bulk tonnage copper-silver-gold porphyry-related system, which owes its excellent metal endowment to multiple phases of mineralization which includes older copper-silver-gold porphyry mineralization and younger, overprinting, precious metal rich sheeted carbonate base metal vein systems.

Details (See Table 1 and Figures 1–6)

Assay results for twenty-eight diamond drill holes have now been announced at Apollo with results for additional holes expected in the near term. This press release announces results of three diamond drill holes with results summarized below.

APC-25 was drilled to the northwest from Pad 3 to a maximum depth of 215.80 metres and intersected a shallow, western extension to the Main Breccia discovery averaging:

- 106.85 metres @ 2.31 g/t gold equivalent consisting of 0.81 g/t Au, 30 g/t Ag, 0.62% Cu and 30 ppm Mo beginning at 73 metres downhole (65 metres vertical).

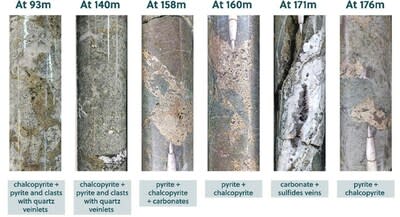

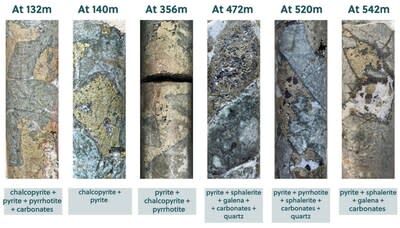

The mineralized angular breccia of this intercept contains a sulphide matrix which includes 1.5% to 2.5% chalcopyrite and between 1% and 3% pyrite plus pyrrhotite. The breccia has been overprinted by a zone of carbonate and base metal (sphalerite and galena) veins, which host higher gold grades and returned an interval of 14 metres grading 3.65 g/t gold equivalent. APC-25 is the westernmost hole drilled into the Main Breccia discovery and demonstrates that the mineralization is open and is thickening in this direction. Drill holes have been designed to continue to step-out to the west to expand upon this high grade and near surface mineralization.

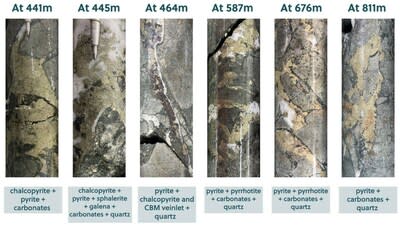

APC-26 was drilled northeast from pad 4 and confirms continuity within the Northern Extension Zone of the Main Breccia system, as previously defined in holes APC-17 and APC-22. The hole was drilled to a maximum downhole length of 813.7 metres and intercepted:

- 311.2 metres @ 1.04 g/t gold equivalent consisting of 0.74 g/t Au, 16 g/t Ag, 0.05% Cu and 10 ppm Mo from 415 metres down hole.

Gold and silver mineralization relates to sulphides hosted within the angular breccia matrix including pyrite (1%-3%), pyrrhotite (1%-2%) and chalcopyrite (0.5%-1%). A higher-grade sub-zone was encountered within the mineralized intercept averaging 136.9 metres at 1.51 g/t gold equivalent and is characterized by an increase in overprinting low and intermediate sulphidation, carbonate base metal (“CBM”) vein material including visible sphalerite and galena.

APC-29 was drilled to the north-northeast from Pad 3 to a maximum depth of 644.8 metres and intercepted three mineralized zones before the hole was abandoned short of target depth due to a complicated fault structure. The two shallow zones within this hole are located directly beneath mineralized surface outcrops with the initial 32.0 metre intercept of mineralization beginning at 111.3 metres downhole (80 metres vertical), and the second 8.65 metre mineralized zone starting at 194.8 metres downhole (143 metres vertical). These high-grade gold, silver, and copper shallow zones of mineralization are hosted within a matrix of angular quartz diorite breccia with the sulphide component consisting of chalcopyrite (0.5%-2%), pyrite (0.5%-2%) and pyrrhotite (0.5-1%). Finally, the third zone, which starts at 343.8 metres downhole (318 metres vertical) intersected more 301 metres of continuous mineralization including a higher-grade subzone over 214.4 metres. The sulphide mineralization within the breccia matrix of this intercept contained pyrrhotite (0.5%-2.5%), pyrite (1%-3%) and multiple zones of sheeted CBM vein material, which are predominantly sphalerite rich with minor galena. The following intercepts are summarized from APC-29:

- 32.00 metres @ 10.48 g/t gold equivalent consisting of 9.23 g/t Au, 60 g/t Ag, 0.44% Cu and 30 ppm Mo from 89.25 metres downhole (80 metres vertical depth).

- 8.65 metres @ 2.26 g/t gold equivalent consisting of 0.57 g/t Au, 82 g/t Ag, 0.27% Cu and 10 ppm Mo from 194.80 metres downhole (143 metres vertical depth).

- 214.40 metres @ 1.04 gold equivalent consisting of 0.77 g/t Au, 14 g/t Ag, 0.05% Cu and 10 ppm Mo from 343.80 metres downhole (318 metres vertical depth), which includes 98.20 metres @ 1.26 g/t gold equivalent.

The Company’s Phase II, 2023 program is well underway with two rigs focused on drilling near surface, high grade mineralization below mineralized outcrops in the southern and central areas of the Main Breccia system while simultaneously targeting expansion to the overall dimensions of the system to the west, northwest, north and northeast. Furthermore, a new drill pad (pad 8) has been constructed 150 south of the southernmost modelled boundary of the Main Breccia system at Apollo and reconnaissance drilling is underway to test a recently discovered porphyry target.

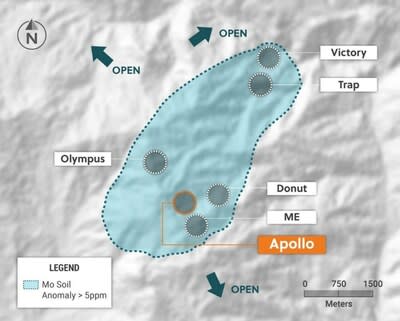

The Apollo target area, as defined to date by surface mapping, rock sampling and copper and molybdenum soil geochemistry, covers a 1,000 metres X 1,200 metres area. The Apollo target area hosts the Company’s Main Breccia discovery and multiple additional untested breccia, porphyry and vein targets. The overall Apollo target area also remains open for further expansion.

Table 1: Apollo Target Assays Results for Holes APC-25, APC-26 and APC-29

| HoleID | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu % | Mo % | AuEq(g/t) * | CuEq(%) * |

| APC-25 | 73.00 | 179.85 | 106.85 | 0.81 | 30 | 0.62 | 0.003 | 2.31 | 1.26 |

| Incl. | 111.00 | 125.00 | 14.00 | 2.00 | 35 | 0.75 | 0.005 | 3.65 | 2.00 |

| APC-26 | 415.00 | 726.20 | 311.20 | 0.74 | 16 | 0.05 | 0.001 | 1.04 | |

| incl. | 415.00 | 551.90 | 136.90 | 1.14 | 20 | 0.06 | 0.001 | 1.51 | |

| APC-29 | 111.30 | 143.30 | 32.00 | 9.23 | 60 | 0.44 | 0.003 | 10.48 | |

| and | 194.80 | 203.45 | 8.65 | 0.57 | 82 | 0.27 | 0.001 | 2.26 | |

| and | 343.80 | 644.80 | 301.00 | 0.63 | 14 | 0.05 | 0.001 | 0.90 | |

| Incl. | 343.80 | 558.20 | 214.40 | 0.77 | 14 | 0.05 | 0.001 | 1.04 | |

| Incl. | 460.00 | 558.20 | 98.20 | 1.26 | 15 | 0.04 | 0.001 | 1.51 |

| * AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.016 x 0.95) + (Cu (%) x 1.83 x 0.95)+ (Mo (%)*9.14 x 0.95) and CuEq (%) is calculated as follows: (Cu (%) x 0.95) + (Au (g/t) x 0.51 x 0.95) + (Ag (g/t) x 0.01 x 0.95)+ (Mo(%)x 3.75 x 0.95) utilizing metal prices of Cu – US$4.00/lb, Ag – $24/oz Mo US$20.00/lb and Au – US$1,500/oz and recovery rates of 95% for Au, Ag, Mo and Cu. Recovery rate assumptions are speculative as no metallurgical work has been completed to date. |

| ** A 0.2 g/t AuEq cut-off grade was employed with no more than 15% internal dilution. True widths are unknown, and grades are uncut. |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver and gold exploration company based in Canada, with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo target, which hosts the large-scale, bulk-tonnage and high-grade copper, silver and gold Main Breccia discovery. The Company’s near-term objective is to continue with expansion drilling of the Main Breccia discovery while increasing confidence in the highest-grade portions of the system.

Management, insiders and close family and friends own nearly 35% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSXV under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski) and Collective Mining (@CollectiveMini1) on Twitter

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Collective Mining Ltd.