VANCOUVER, BC / ACCESSWIRE / September 12, 2023 / Blackwolf Copper and Gold Ltd. (“Blackwolf“, or the “Company“) (TSXV:BWCG)(OTC PINK:BWCGF) and Optimum Ventures Ltd. (“Optimum“) (TSXV:OPV) are pleased to announce that they have completed their previously announced plan of arrangement, pursuant to which the Company acquired all the issued and outstanding shares of Optimum, and, in exchange, shareholders of Optimum received 0.65 of a common share of Blackwolf for each Optimum share held (the “Transaction“). In addition, Andrew Bowering, mining entrepreneur, a founder of Optimum, has joined the Company’s board of directors, replacing Don Birak, who stepped down effective September 12, 2023.

Andrew Bowering is a renowned venture capitalist with over 30 years of experience in global mineral exploration and development and a track record of building shareholder value. He has founded, funded, and led teams in the pursuit of various metals, from initial exploration to production. Mr. Bowering has held senior management roles, overseeing asset acquisitions, sales, and raising over $250 million in development capital. He was a founder of Millennial Lithium Corp (acquired by Lithium Americas) and is actively involved in other publicly traded companies in the battery metals and precious metals sectors, such as Prime Mining Corp and American Lithium Corp.

Morgan Lekstrom, CEO and Director of the Company stated, “With the acquisition of Optimum, Blackwolf has become a top developer of precious and strategic metal projects in Alaska and British Columbia’s Golden Triangle. We are excited to welcome Optimum shareholders and our new board member, Andrew Bowering. This merger has brought exciting projects and expertise to Blackwolf, and we believe it contribute significantly to our goal of creating value for our shareholders.“

Rob McLeod, Executive Chairman of Blackwolf, said, “We are proud to welcome Andrew Bowering as a new director of Blackwolf. Andy is one of Canada’s top mining entrepreneurs, and we have a history of working together in the Golden Triangle since 1995. We are looking forward to working together again. Also, on behalf of the rest of the Blackwolf Team, I want to thank Don Birak for his valuable service to the Company and wish him the best in his future endeavours.“

Delisting of Optimum Shares and Information for Optimum Shareholders

The Optimum shares are expected to be delisted from the TSX Venture Exchange at the close of trading on September 14, 2023, and Optimum intends to submit an application to the applicable securities regulators to cease to be a reporting issuer and to terminate its public reporting obligations.

Further information about the Transaction is set forth in Optimum’s management information circular dated July 31, 2023 relating to the annual general and special meeting of securityholders of Optimum (the “Circular“), which is available under Optimum’s SEDAR+ profile at www.sedarplus.ca. Information regarding the procedure for exchange of Optimum shares for Blackwolf shares is provided for in the Circular. In order to receive Blackwolf shares in exchange for Optimum shares, registered shareholders of Optimum must complete, sign, date and return the letter of transmittal that was mailed to each registered Optimum shareholder along with the Circular. For those shareholders of Optimum whose Optimum shares are registered in the name of a broker, investment dealer, bank, trust company or other intermediary or nominee, they should contact such intermediary or nominee for instructions and assistance in depositing their Optimum shares.

Advisors and Counsel

In connection with the Transaction, Fiore Management and Advisory Corp. was issued 567,299 common shares of the Company in consideration for advisory services provided to the Company.

DuMoulin Black LLP acted as legal counsel to Blackwolf. Boughton Law Corporation acted as legal counsel to Optimum.

Upon closing of the Transaction and the issuance of shares for advisory services the Company’s issued and outstanding common shares is 108,957,568.

About Blackwolf Copper and Gold Ltd.

Blackwolf’s founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska as well as six Hyder Area gold-silver and base metal properties in southeast Alaska and northwest British Columbia in the Golden Triangle, including the Cantoo and Harry properties. For more information on Blackwolf, please visit the Company’s website at www.blackwolfcopperandgold.com.

On behalf of the Board of Directors of Blackwolf Copper and Gold Ltd.

“Morgan Lekstrom”

CEO and Director

For more information, contact:

| Morgan Lekstrom 250-574-7350 (Mobile) 604-343-2997 (Office) mll@bwcg.ca | Liam Morrison 604-897-9952 (Mobile) 604-343-2997 (Office lm@bwcg.ca |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Statements

This news release contains “forward-looking information” and “forward looking statements” within the meaning of applicable Canadian securities legislation (collectively herein referred to as “forward-looking information”). Wherever possible, words such as “expects”, “expected”, “strategic” and similar expressions or statements that certain actions, events or results “will” or “may” be taken, occur or be achieved, or the negative forms of any of these terms and similar expressions, have been used to identify forward-looking information. Forward-looking information contained herein includes, but is not limited to, the anticipated benefits of the Transaction, and discussion of future plans, projects, objectives, estimates and forecasts and the timing related thereto, the timing of the delisting of Optimum, Optimum ceasing to be a reporting issuer.

Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events, conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking information, including, without limitation, risks related to exploration and potential development of the Company’s projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and native groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and such other risks as are identified in the public disclosure documents of the Company filed on SEDAR+ at www.sedarplus.ca (the “Disclosure Documents”). This list is not exhaustive of the factors that may affect any of our forward-looking information. Although we have attempted to identify important factors that could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking information, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those anticipated, estimated or intended.

Our forward-looking information is based on the assumptions, beliefs, expectations, and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond our control. In connection with the forward-looking information contained in this news release, we have made certain assumptions about, among other things, the Company’s ability to achieve the business and operational synergies expected as a result of the Transaction and explore and develop its projects as currently anticipated. Although we believe that the assumptions inherent in forward-looking information are reasonable as of the date of this news release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained in this news release.

Additional information about the risks and uncertainties concerning forward-looking information and material factors or assumptions on which such forward-looking information is based is provided in the Disclosure Documents. Forward-looking information is not a guarantee of future performance. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Forward-looking information involves statements about the future and is inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this news release and the Disclosure Documents. For the reasons set forth above, readers and prospective investors should not place undue reliance on forward-looking information.

We do not assume any obligation to update forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable law.

SOURCE: Blackwolf Copper and Gold Ltd

View source version on accesswire.com:

https://www.accesswire.com/783173/blackwolf-completes-acquisition-of-optimum-ventures-andrew-bowering-joins-the-board-of-directors

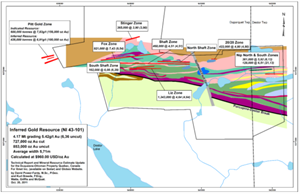

![FIGURE 3. Rowan Mine drill section showing assay highlights for Hole RLG-23-163B[1]](https://s.yimg.com/ny/api/res/1.2/wf7062LXhQm0zlij_lx.vg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTQyMDtoPTIzNw--/https://media.zenfs.com/en/globenewswire.com/3dc4aeb5b318da4c8f94d651e07ef2f2)

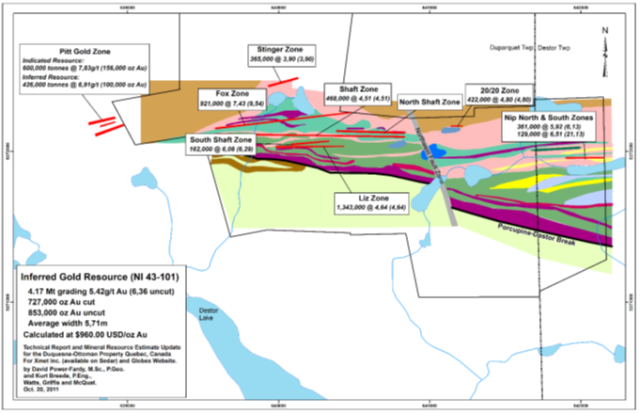

![FIGURE 4. Rowan Mine longitudinal section for Vein 101 showing 2023 intercepts > 4 g/t Au. Assay highlights from current press release shown in red[1]](https://s.yimg.com/ny/api/res/1.2/ugh.B3sIG9.mYS6IZXoP2Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTQyMDtoPTIzNw--/https://media.zenfs.com/en/globenewswire.com/cd6d6b57ba7dfb0b68a4d1fabc006153)