October 24, 2022

Silver47 Exploration Corp. (Vancouver) (the “Company”) is pleased to report that it has completed 5 shallow diamond drill core holes at the Silver Matt Discovery on its wholly owned Michelle Project located in north-central Yukon, Canada. All 5 holes intersected oxide-sulphide mineralization. Mineralization was first discovered in the Silver Matt area in 2009 by prospecting, where a grab sample returned 4180 g/t Ag and where a 2015 hand trench yielded 2.8m of 894 g/t Ag, 46.9% Pb and 8.09% Zn. The initial drill discovery at the Silver Matt Target was made in 2021 through RC drilling in hole MCH-21-005 as highlighted below.

Highlights

· Discovery RC hole MCH-21-005 graded 19.8m of 556 g/t Ag, 20.3% Pb, 3.16% Zn, including 7.6m of 824ppm Ag, 28.7% Pb, 1.54% Zn.

· Discovery confirmation core hole MCH-22-002 yielded 15m of 907 g/t Ag, 26% Pb, 2.7% Zn including 7.7m of 1577 g/t Ag, 45% Pb, 4% Zn.

Drilling

Holes MCH-22-001 to MCH-22-003 were completed from the same collar as the 2021 RC holes to test potential down-dip and strike extension from the discovery hole MCH21-005. Holes MCH22-004 and MCH22-005 were collared 50m northwest to test strike extension (results pending).

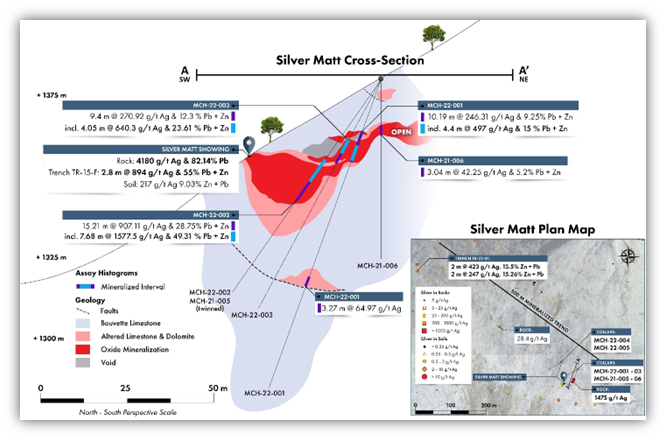

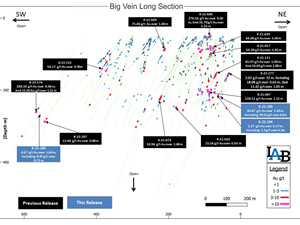

Hosted in Bouvette Formation limestone and dolostone, mineralization occurs primarily as strongly oxidized material with remnant intervals of massive sulphide, primarily galena. The high-grade intervals are typically surrounded by a gradational alteration halo into fresh carbonates. Karst voids above and within the mineralized zones were noted. Mineralization appears to have a shallow northeast dip to flat-lying with a NW/SE strike orientation observed across the 5 holes drilled in 2022, please see Figure 2 below

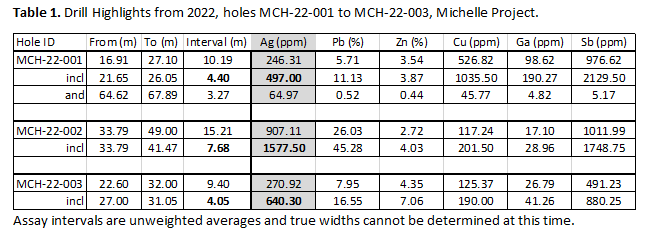

Table 1. Drill Highlights from 2022, holes MCH-22-001 to MCH-22-003, Michelle Project.

Assay intervals are unweighted averages and true widths cannot be determined at this time.

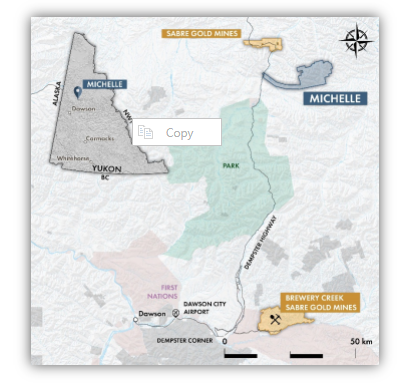

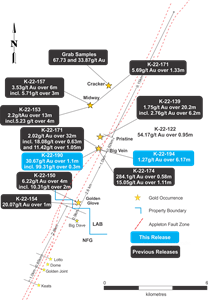

Figure 1. General Location Map for the Michelle Project.

MCH-21-005

Initial drilling at the Silver Matt Zone was completed using a Reverse Circulation drilling in late summer of 2021. Oriented to drill under the 2015 trench, hole MCH-21-005 intersected a broad zone of oxide mineralization over 19.8m of 556 g/t Ag, 20.3% Pb, 3.16% Zn, including 7.6m of 824ppm Ag, 28.7% Pb, 1.54% Zn

MCH-21-006

The second hole drilled at Silver Matt in 2021 was drilled vertically from the same collar and intersected 3.04m of oxide mineralization grading 42.25 g/t Ag, 2.4% Pb, and 2.8% Zn at 13.72m depth.

MCH-22-001

The objective of MCH-22-001 was to undercut the RC discovery hole MCH-21-005. MCH-22-001 intercepted high-grade mineralization at a shallower depth than expected, indicating a flat to shallow-dipping lens. An intensely oxidized interval of 4.40m from 21.65m to 26.05m contained up to 2% blebby galena with fine white crystalline precipitate zinc and lead oxides.

MCH22-002 was drilled to twin MCH-21-005 to obtain structural data and better-define the mineralized zone, as hole 22-001 produced unexpected results. The higher resolution data provided by core drilling the RC intercept allowed for readjustment of the following drill hole orientations. MCH-22-002 resulted in similar mineralized widths, but with significantly higher-grade silver, lead and zinc. This can be attributed to the better recovery percentage of core drilling compared to RC drilling, as well as more control on sampling intervals in the logging process. Up to 7% metallic sulphides, with lead-zinc precipitates were observed through the 7.68m interval.

Figure 2. Cross Section of the Silver Matt Zone, Michelle Project.

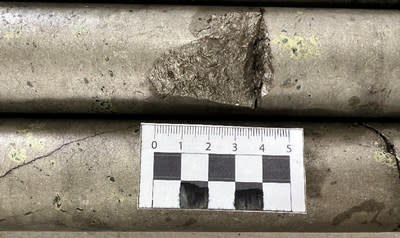

Figure 3. Galena mineralization with pervasive oxidation at 39m in MCH-22-002.

Figure 4. Galena mineralization with pervasive oxidation at 41m in hole MCH-22-002.

MCH-22-003

MCH-22-003 was oriented to test the NW/SE proposed strike trend, and intersected 9.4m of high-grade mineralization including 1.05m of 1395 g/t Ag, 51.47% Pb (final values pending), 12.25% Zn at 30m – 31.05m. Hole 3 confirmed the strike orientation and shallow-dip of the mineralized lens.

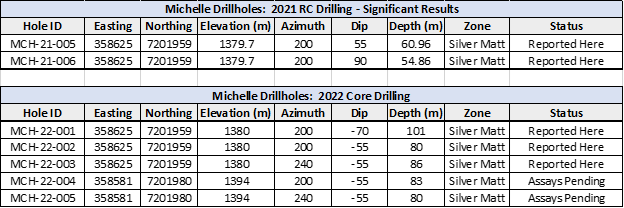

Table 2. 2021 RC and 2022 DDH collar table.

Easting and northing in meters, NAD 1983 Zone 8.

Geochemical Sampling

Concurrent to drilling operations, a property-wide surface sample and trenching program was carried out on high-priority targets. A total of 754 soil samples and 92 rock samples (including trenches) were collected. All trenches were hand-dug and reclaimed prior to the end of the program. Notably, a trench dug approximately 500m NW of the Silver Matt drill holes reported two 2-meter contiguous samples grading 423 g/t Ag and 247 g/t Ag, with +10% Pb, indicating a significant potential strike extension of the mineralized trend.

Silver Matt Target

Trench TR22-01 was dug approximately 500m northwest, and on strike, to the Silver Matt showing produced two 2m composite samples of 423 g/t Ag, 11.9% Pb, 1.6% Zn; and 247 g/t Ag, 14.5% Pb and 0.76% Zn from 2.3m-4.3m and 4.3m-6.4m, respectively. A rock grab sample taken 50m north of this trench graded 226 g/t Ag, 15.8% Pb, 2.1% Zn. Additional samples indicated anomalous zinc concentrations northeast and east of the known mineralization.

Heeler Target

Located 10km east of the Silver Matt Zone, 5 trenches were completed at the Heeler showing, following up a 2015 high-grade sample. Trench TR22-03 contained two samples (1m-1.6m, and 2.85-2.95) with 14.5 g/t Ag, 2.1% Pb, 1.5% Zn; and 22.9 g/t Ag, 1.5% Pb, 1.6% Zn. Both samples also contained anomalous values of critical minerals returning 303ppm chromium, 3400ppm copper, 208ppm gallium, 1940ppm nickel, 936ppm antimony and 4980ppm vanadium.

Two anomalous zinc samples were taken while prospecting east of the Heeler Target. Sample E814060 graded 2.18% Zn and sample E814531 graded 3.6% Zn, 0.6% Pb, and 5.76 g/t Ag.

Soil/talus-fines sampling in the Heeler area was inconclusive with several point anomalies for silver, lead, and zinc. Further prospecting of this showing is warranted given the concentration of critical minerals.

Nanny/Boxer Target

Historic trenching and prospecting at these showings, 21km northeast from the Silver Matt Zone, produced several anomalies for 2022 follow up. Soil/talus-fines sampling along contours and ridgelines in this target area resulted in three high-priority anomalies for silver, lead, zinc, barium, gallium, and vanadium. Trenches TR-22-09 and TR-22-10 contained significant intervals of silver, lead and zinc mineralization. TR-22-09 exposed two non-continuous intervals (trench filled with talus from 4.8m to 8.5m); 0-4.8m graded 2 g/t Ag, 0.1% Pb and 11.9% Zn over 4.8m and 10.2-16.1m graded 7.8 g/t Ag, 0.62% Pb and 7.9% Zn over 5.9m. Both intervals contained anomalous values of cadmium and gallium. TR-22-10 exposed a 9.5m interval of 103 g/t Ag, 8.1% Pb, and 4.2% Zn, including 3mof 355 g/t Ag, 24.5% Pb, 6.2% Zn. Two samples were collected while prospecting the Nanny/Boxer target area with >20% Zn and anomalous silver, lead, cadmium, and antimony concentrations.

Figure 5. Silver Geochemical Map, Michelle Project.

QAQC

Quality assurance and quality control protocols for rock, soil and drill core sampling follow industry standard practices. Rock and soil samples were delivered directly to ALS Minerals preparation facility in Whitehorse, Yukon. Core samples were taken at 1.0m intervals in mineralized zones, and 3.0m intervals in unaltered, fresh host rock. Blank, duplicate (coarse and lab pulp), and certified reference materials were inserted into the sample stream every 8th sample. Core samples were cut in half, bagged, sealed and delivered to ALS Minerals preparation facility in Whitehorse, Yukon. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Rock and core samples were analyzed at ALS Laboratory facilities in North Vancouver using four acid digestion with an ICP-MS finish. Over limits for Ag, Pb, and Zn were analyzed using Ore Grade four acid digestion. Silver values >1,500ppm were analyzed using fire assay with gravimetric finish. Lead >20% and Zinc >30% were analyzed using titration methods. The standards, certified reference materials were acquired from CDN Resource Laboratories Ltd. of Langley, British Columbia and selected to represent expected mineralization. Blank material consisted of non-mineralized limestone landscaping rock.

About the Michelle Property

Silver47 acquired the Michelle project from Silver Range Resources 100% by issuing 5,650,000 shares (16.8%) of Silver47. Silver Range retains a 1% NSR on the Michelle project and is entitled to receive a one-time payment of $1 million if a positive production decision is made on a resource of not less than 80 million ounces of silver as outlined in a feasibility study on the Michelle project. Silver47 holds a ROFR on the sale of the NSR.

Covering 15,900 hectares, the Michelle Project is located in north-central Yukon, 130km north-northeast of Dawson City, YT. First discovered in 1973, exploration has identified 20 named showings with limited drilling defining 3 mineralized zones. Silver, lead, zinc and a number of critical metals are known to occur within oxide and sulphide mineralization of the Bouvette Formation carbonates across the property. Mineralization style is yet to be defined, with showings exhibiting characteristics of Mississippi Valley Type, Carbonate Replacement, within the broader classification of SEDEX deposits. The Michelle Property is considered an early-stage exploration project, with further property-scale sampling and targeted drilling planned, pending a class 3 permit.

Mr. Alex S. Wallis, P.Geo., is Vice President of Exploration for the Company who is a qualified person as defined by National Instrument 43-101. Mr. Wallis has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the information and has approved the technical information in this press release.

Alex Wallis, P.Geo., VP Exploration

(250) 505-6454

awallis@silver47.ca

About Silver47 Exploration Corp.

Silver47 is a private Canadian exploration company focused on advancing its critical minerals project in the Yukon Territory.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain “forward-looking information” under applicable Canadian securities legislation. Forward-looking information involves risks, uncertainties, and other factors that could cause actual results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes the completion of the pending assays, characteristics of the mineralized lens and mineralized trend, anomalous zinc concentrations in the Silver Matt Target, and further prospecting of the Heeler Target. Forward-looking information is necessarily based on a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking information. Accordingly, the forward-looking information discussed in this release, may not occur and could differ materially as a result of these known and unknown risk factors and uncertainties affecting the Company. Although the Company believes that the assumptions and factors used in preparing the forward-looking information are reasonable, undue reliance should not be placed on this information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by law, the Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events, or otherwise.