Bob Moriarty

Archives

Dec 19, 2024

As of December 18th, 2024 the DSI for gold is 48, for silver 21. The highest value for gold based on the DSI showed 89 back in May of this year. On the same day silver reached a peak DSI of 90. Those numbers are not good enough to make a major top in either gold or silver. For example, it took a DSI of 96 to mark the top for silver in April of 2011 and a DSI of 95 on January 21, 1980 to mark the all-time high for silver. In my view gold and silver are going to go a lot higher not far off. I expect silver to break its all time high of $50.75 in the next six months or so. Once silver makes a new all-time high I think it will be off to the races.

Tax Loss Silly Season is that six week or so period starting in November and running into just before Christmas when investors clean out the stocks they own that have gone down the most to be able to write off the losses for the current year. It’s the worst time of the year to sell and the best time of the year to buy. Since so many junior lottery tickets have been hammered this year there has been a lot of carnage in the space due to the lack of liquidity and the sheer number of punters willing to take anything on offer for their shares.

But all things change.

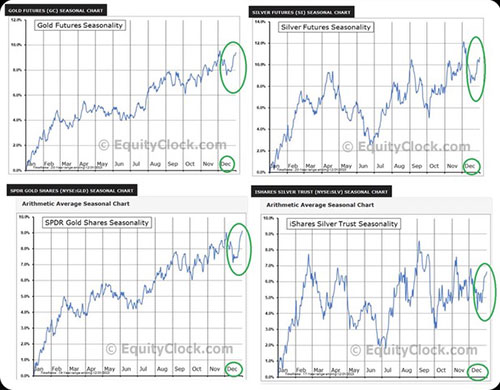

The ten-week period from the middle of December each year into the end of February is seasonally the best time of the year for gold and silver. In the past five days, gold has gone down about $130 or over 5%. Now looks to be a good buying opportunity if Trump isn’t whacked between now and a month from now. If he gets whacked, it would be an extraordinary opportunity as the US moves into a civil war.

http://www.321gold.com/editorials/moriarty/moriarty121924/1.jpg(Click on image to enlarge)

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd