VANCOUVER, BC / ACCESSWIRE / May 3, 2022 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company“) is pleased to announce that it has retained SGS to complete an updated Preliminary Economic Assessment (“PEA”) on the Carmacks project. The PEA will use the 2022 Resource Estimate (Table 1), consisting of 36.2 million tonnes (Mt) in Measured and Indicated categories (M&I), grading 1.07% CuEq (0.81% Cu, 0.26g/t Au, 3.23g/t Ag and 0.011% Mo) for a total of 651 million pounds (Mlbs) of contained M&I copper and an additional 38 Mlbs Cu Inferred as the main input. Building off a 2017 PEA(1), the updated study will encompass the following:

- Significant Increase in Contained Copper – The 2022 resource estimate marked a 43% increase in contained copper over the previous estimate referenced(2)

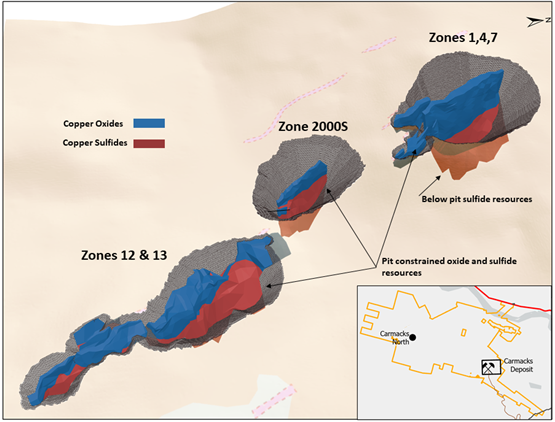

- Inclusion of Sulphide Processing – As of the publication of the 2022 resource estimate the Carmacks project consists of roughly 50/50 sulfide and oxide resources by contained metal. The Company sees the inclusion of sulphide resources as a significant potential value driver having a positive impact on the economics of the project; and

- High Proportion of Resources Modeled in Three Conceptual Open Pits – 96% of the 2022 resources are contained within the conceptual pits (Figure 1). With a high percentage of current resources reporting in conceptual pits the cash cost per pound of copper is expected to be significantly lower when compared to a similar sized underground operation.

Timothy Johnson, Granite Creek President & CEO, stated, “The launch of the updated Preliminary Economic Assessment study marks a major milestone in the development of the Carmacks deposit at a time when commodities demand is seeing rapid growth. The Carmacks project is well-positioned by its location, access to infrastructure, and proximity to the operating, high-grade Minto mine just to the north. Both copper and molybdenum have been deemed by the Canadian government to be ‘critical minerals‘ based on their role in the transition to a low-carbon economy which we expect will provide prolonged price strength well into the future. We look forward to continuing to bring positive news as we develop this high-grade copper project.”

Upcoming Events

OTC Markets Mining and Metals Virtual Conference – Tim Johnson, President & CEO, will present live at VirtualInvestorConferences.com on May 5th, 2022 at 10am PT | 1pm ET. To register, click here.

Vancouver Resource Investment Conference – Granite Creek Copper will join fellow members of the Metallic Group of Companies at the 2022 VRIC event at the Vancouver Convention Centre on May 17-18. Visit us in Booth 111.

2022 Technical Report Filing

Granite Creek also announces that further to its news release dated March 15, 2022 it has filed on SEDAR a National Instrument 43-101 technical report (the “Technical Report”) for the Carmacks project, located in the Yukon, Canada.

The report, entitled “Technical Report on the Updated Mineral Resource Estimates for the Carmacks Cu-Au-Ag Project Near Carmacks, Yukon, Canada”, has an effective date of February 25, 2022. The Technical Report was authored Allan Armitage Ph.D., P.Geo of SGS Geological Services(“SGS”) an independent Qualified Person and was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

The Technical Report is available under the Company’s profile at www.sedar.com and will also be available on the Company’s website at www.gcxcopper.com.

Table 1 – 2022 Carmacks Copper Project Mineral Resources

Cu=copper, Au=gold, Mo=molybdenum, Ag=silver, Mt=millions of tonnes, Mlbs=millions of pounds, klbs=thousands of pounds, koz=thousands of ounces. Mineral Resources are reported using the 2014 CIM Definition Standards. Mineral Resources are reported within a conceptual constraining pit shell that includes the following input parameters: Metal prices of $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo and pit slope angles that vary from 35° for overburden to 55°for granodiorite host. Metal prices are in US$. Metallurgical recoveries reflective of prior test work that averages: 85% Cu, 85% Au, 65% Ag in the oxide domain and 90% Cu, 76% Au, 65% Ag in the sulphide domain. Mo recovery is assumed to be 70% in both oxide and sulphide domain. Tonnes are metric tonnes, with Cu and Mo grades as percentages and Au and Ag grades as gram per tonne units. Cu and Mo metal content is reported in lb and Au and Ag content is reported in troy oz. Totals and Metal content may not sum due to rounding and significant digits used in calculations. Cu Eq calculation is based on 100% recovery of all metals using the same metal prices used in the resource calculation: $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo.

Figure 1 – Oblique view of 2022 resources and proposed pits (total strike length of 2,950 m)

Qualified Persons

The Carmacks project 2022 Resource Estimate was prepared by Allan Armitage, P.Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of February 25, 2022. Armitage conducted a site visit to the property on November 9, 2021.

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Ms. James is a Senior Geologist with TruePoint Exploration and a Project Manager at Carmacks.

1PEA: “NI 43-101 Preliminary Economic Assessment Technical Report on the Carmacks Project, Yukon, Canada” Effective Date 12 October 2016. Report Date: 25 November 2016. SEDAR Filing Date: 9 February 2017

1News Release: “Copper North Expands Oxide Mineral resources at Carmacks” Published on SEDAR 9 April 2018.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project is on trend with the high-grade Minto copper-gold mine, operated by Minto Metals Corp., to the north, and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Twitter: @yukoncopper

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/699894/Granite-Creek-Copper-Retains-SGS-Canada-for-Updated-Preliminary-Economic-Assessment-on-High-Grade-Carmacks-Copper-Gold-Silver-Project-in-Yukon-Canada