VANCOUVER, BC / ACCESSWIRE / December 15, 2021 / Metallic Minerals (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to announce the successful completion of 2021 exploration activities at the La Plata silver-gold-copper project in the prolific Colorado Mineral Belt of southwest Colorado. The multi-faceted program included 1,980 meters of diamond drilling, resampling of historical drill core, and underground sampling from the Allard Tunnel, along with surface mapping and sampling across the broader property.

In addition, the Company engaged the team at Goldspot Discoveries (“GoldSpot”) to apply their proprietary Artificial Intelligence (“AI”), machine learning technology and specialized geoscience expertise in porphyry and epithermal systems to the La Plata project. GoldSpot completed their first phase analysis work on geological, geochemical, geophysical, and remote sensing data developing 16 new porphyry and high-grade epithermal priority targets for follow up work and future drilling.

2021 La Plata Exploration Program

The 2021 La Plata project work program was designed to achieve a number of important objectives:

- Completion of confirmatory drilling and underground sampling within the main Allard porphyry target to confirm historical drill results from Rio Tinto, Freeport and others totaling 14,400 meters (“m”) in 54 drill holes drilled from the 1950s to the 1970s. This confirmatory drilling is an important step towards upgrading of the historical resource to a NI 43-101 compliant mineral resource estimate for the project;

- Conduct surface exploration and follow-up sampling to further define the scale of mineralization along multiple identified trends that comprise multi-kilometer-scale soil and geophysical targets;

- Undertake field confirmation of deep-penetrating Induced Polarization (“IP”) and airborne electromagnetic (“EM”) geophysical targets developed in the 2020 surveys; and

- Initiate work with GoldSpot Discoveries to apply AI technology towards definition of priority targets to potentially accelerate the discovery process on the project.

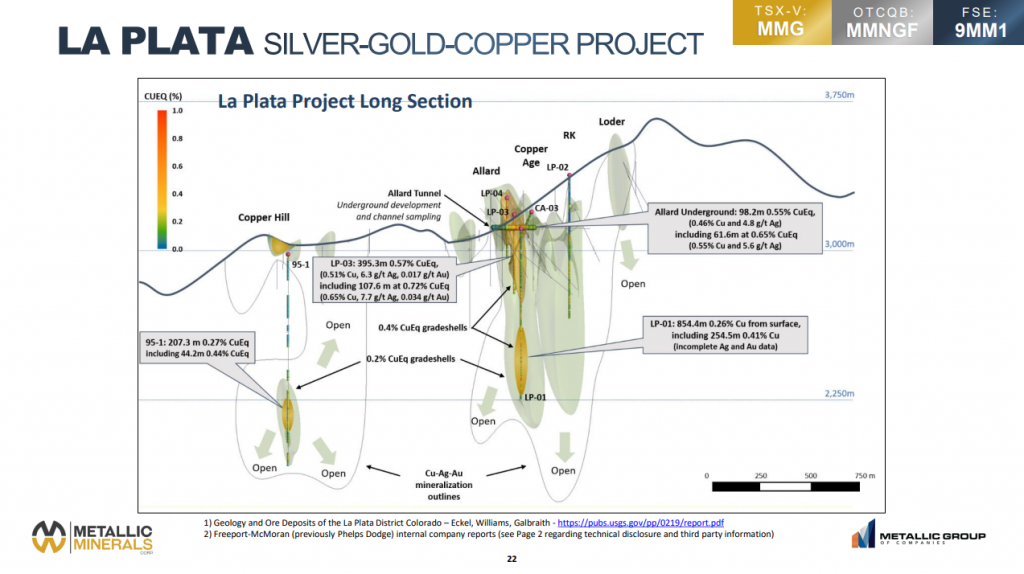

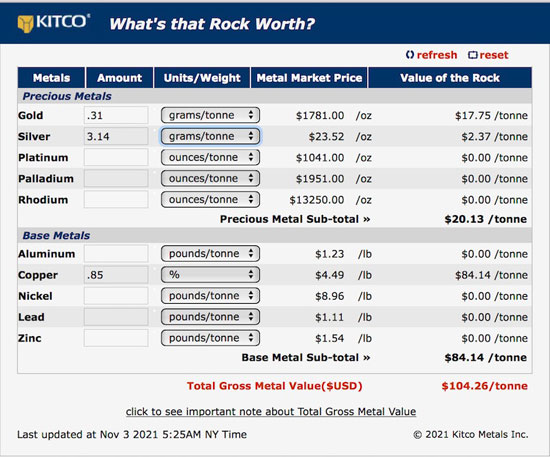

Drilling and resampling of core in the main Allard porphyry system, along with underground sampling from the Allard Tunnel, has confirmed the tenor of copper, silver and gold mineralization from previous exploration on the property. The 3 kilometer (“km”) by 1 km mineralized system remains open to expansion at depth and along trend. This year’s work has also shown significant potential for palladium, platinum and gold associated with the porphyry system. Highlight historical drill intercepts include 395 m grading 0.57% copper equivalent (0.51% Cu, 6.3 g/t Ag, and 0.017 g/t Au) including 108 m grading 0.75% copper equivalent (0.65% Cu, 7.7 g/t Ag and 0.034 g/t Au) in drill hole LP-03 starting from surface. Final assay results for drill samples are pending.

Surface sampling has also expanded the main mineralized zone to 6 km in length and up to 1.5 km in width with anomalous copper, silver and gold in soils and rock samples. In addition, a second 4 km by 1 km target, which may represent a new porphyry and epithermal center, has been identified based on geophysics, remote sensing, and surface sampling with rock sample values in porphyry related mineralization up to 1.1% copper with 0.9 g/t gold and multi-gram silver. Rock samples of epithermal related mineralization included values up to 95 g/t silver and 10 g/t Au.

Metallic Minerals’ CEO and Chairman, Greg Johnson, stated, “We are pleased to have completed our first drill campaign at La Plata, and the first on the project in nearly 50 years, as we apply new thinking to this historic American high-grade silver, gold and copper district. Our work is confirming the potential for a multi-kilometer-scale mineralized porphyry and epithermal system – a much larger system than previously recognized – with excellent potential to expand known mineralization and to make new discoveries. Drilling, underground and surface sampling, geophysics, and satellite based remote sensing data for La Plata demonstrate real potential to become a strategic, US-based sourced of both precious and base metals, including silver necessary for solar power, and copper necessary for carbon-free energy and broader electrification of the global economy. Our 2021 work program has successfully advanced our understanding of the projects potential and is a major step towards the delineation of an inaugural mineral resource estimate. We look forward to providing additional updates including drill results from both our La Plata and Keno projects, as well as updates from our on-going work on the high-grade alluvial projects in the Klondike Gold district.”

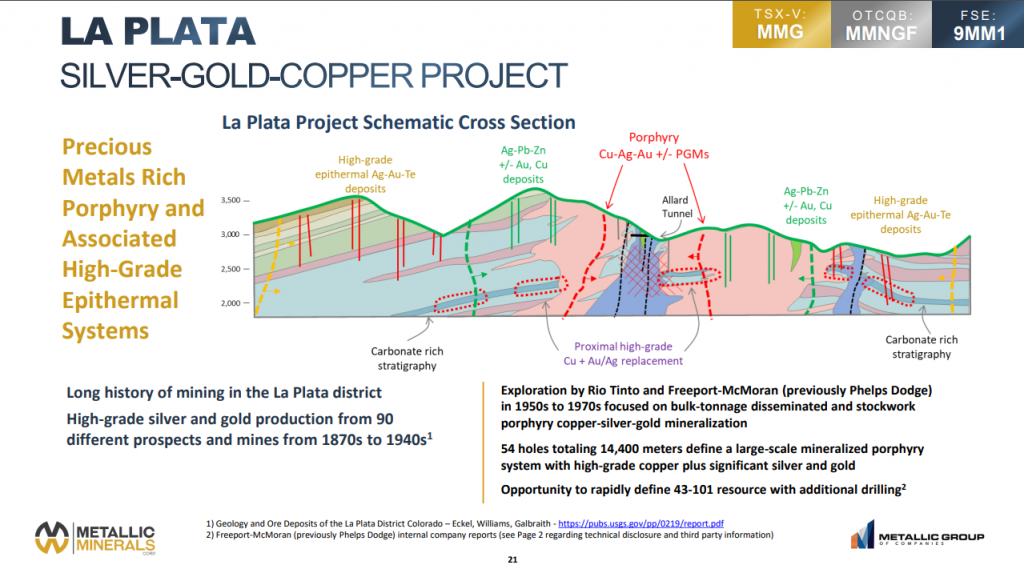

About La Plata Silver-Gold-Copper Project

The road accessible La Plata project covers 33 km2 approximately 26 km northwest of Durango, Colorado within the historic high-grade La Plata mining district located at the southwest end of the prolific Colorado Mineral Belt. Mineralization is related to a large-scale precious-metals-rich porphyry copper system with associated high-grade silver and gold epithermal vein and replacement deposits. Historical production from some of these high-grade structures exceeded 1,000 grams per tonne (“g/t”) silver and over 15 g/t gold with some of the richest deposits delivering true bonanza grades for silver and gold1.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from vein structures, replacement bodies and breccia zones at over 90 individual mines and prospects1. From the 1950s to 1970s, major miners including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge) explored in the La Plata district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization2. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

A total of 56 drill holes totaling 15,200 m has been drilled on the property since the 1950s which confirm the presence of large-scale, multi-phase porphyry system with significant silver, gold and copper. This large-scale mineralized system is associated with a 10 km2 strongly magnetic signature with intense hydrothermal alteration.

Metallic Minerals is the first company to complete significant exploration on the La Plata project in nearly 50 years, applying modern technologies and deposit modeling techniques. The Company sees the potential to rapidly extend the size of the known mineralized system and to identify and expand the higher-grade zones within the broader porphyry and epithermal mineralized zones.

Foot notes: 1) Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949; 2) Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports; 3) Christoffersen, Geological report on the Allard deposit, La Plata Mining District, Durango, Colorado, 2005.

About Metallic Minerals

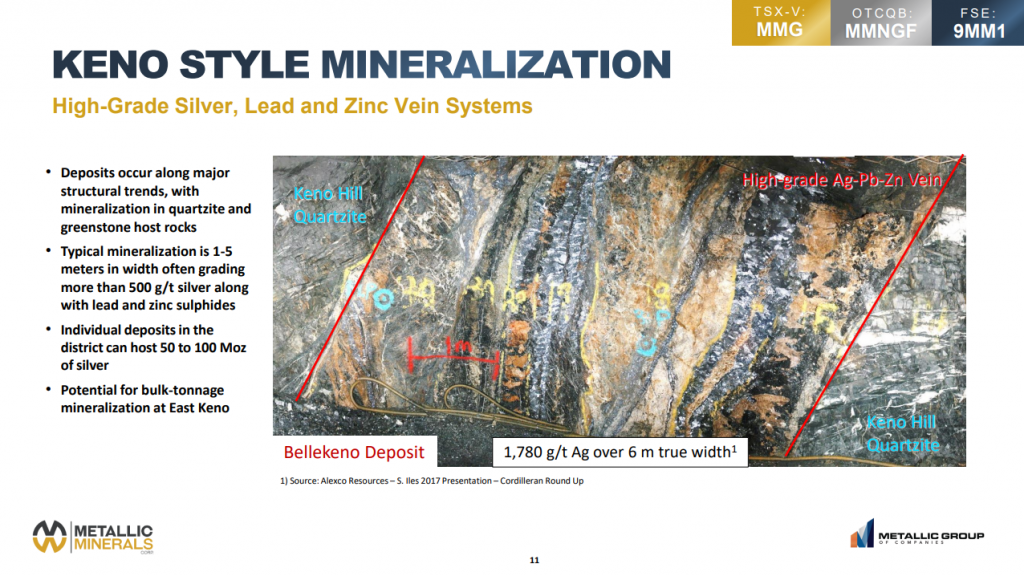

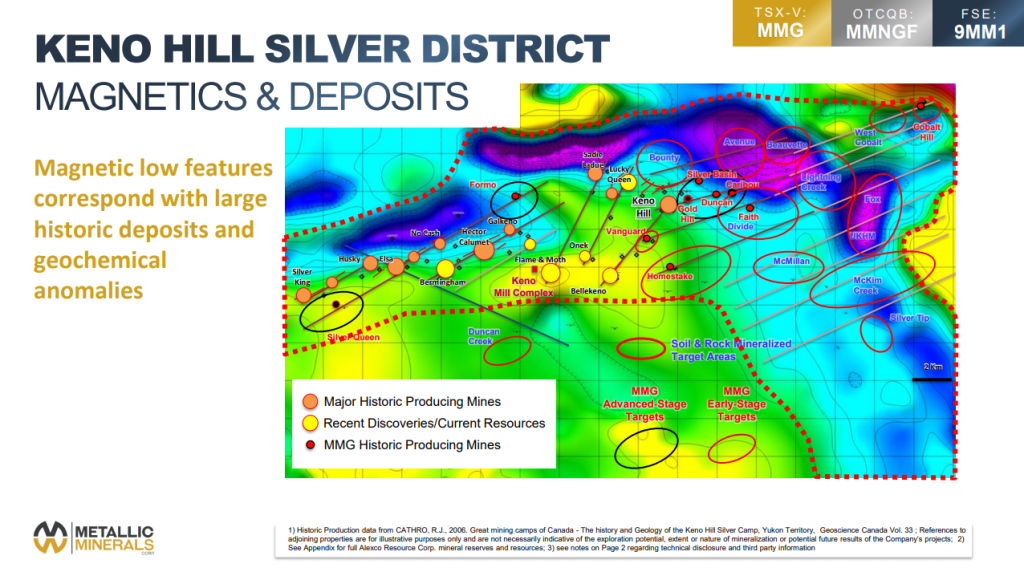

Metallic Minerals Corp. is a growth-stage exploration company, focused on high-grade silver and gold projects in underexplored, brownfields mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to exploration in the Keno Hill silver district, La Plata silver-gold-copper district, and Klondike gold district through new discoveries and advancing resources to development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with nearly 300 million ounces of high-grade silver in past-production and current M&I resources. In addition, exploration at the recently acquired La Plata silver-gold-copper project in southwestern Colorado is targeting a silver and gold-enriched copper porphyry and adjacent high-grade silver and gold epithermal systems. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

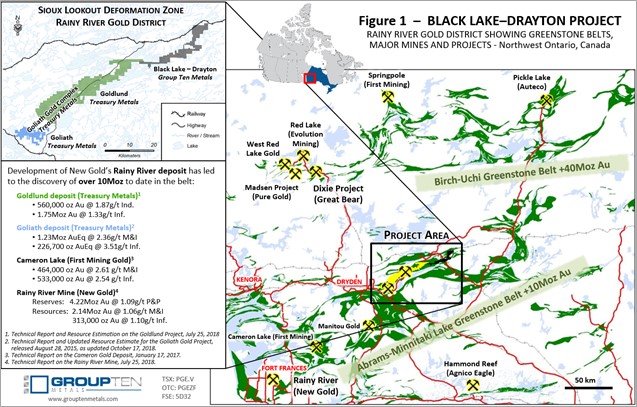

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com

Phone: 604-629-7800

Email: cackerman@mmgsilver.com

Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Jeff Cary, P.Geo., who is Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/677761/Metallic-Minerals-Announces-Completion-of-Exploration-Programs-at-La-Plata-Silver-Gold-Copper-Project