Website| https://provenandprobable.com/

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals – https://www.milesfranklin.com/

Goldshore Resources – (TSX.V: GSHR | OTCQB: GSHRF)

Website: https://goldshoreresources.com/

3D Deck: https://goldshoreresources.com/investors/#corporate-presentation

Goal: To Create the Next Tier One Asset in Ontario, Canada.

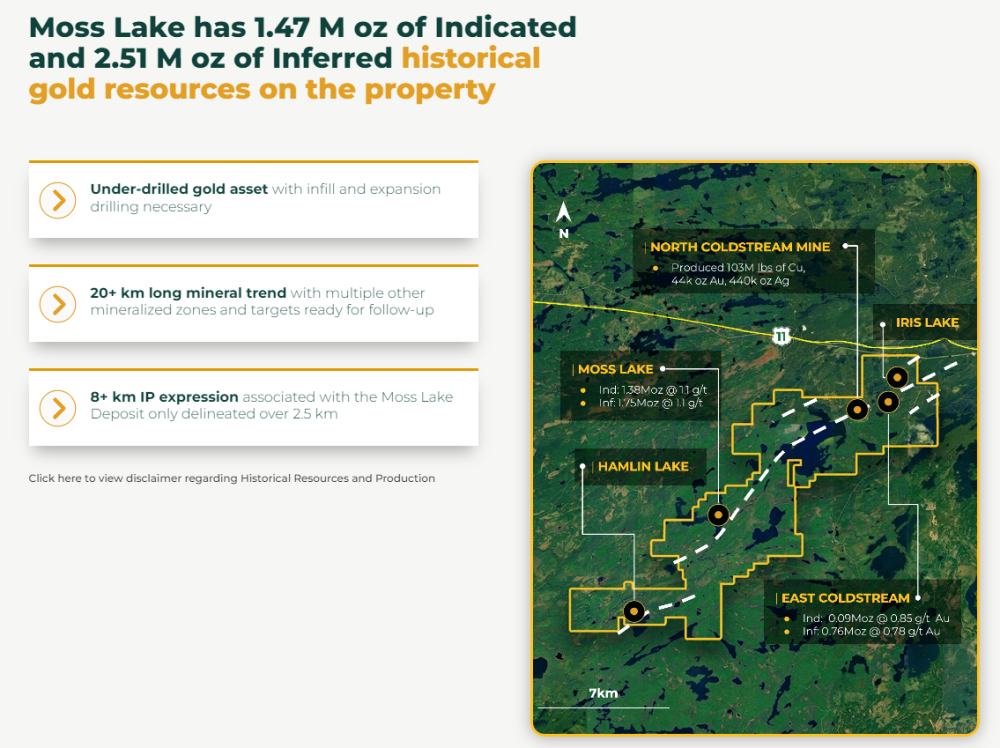

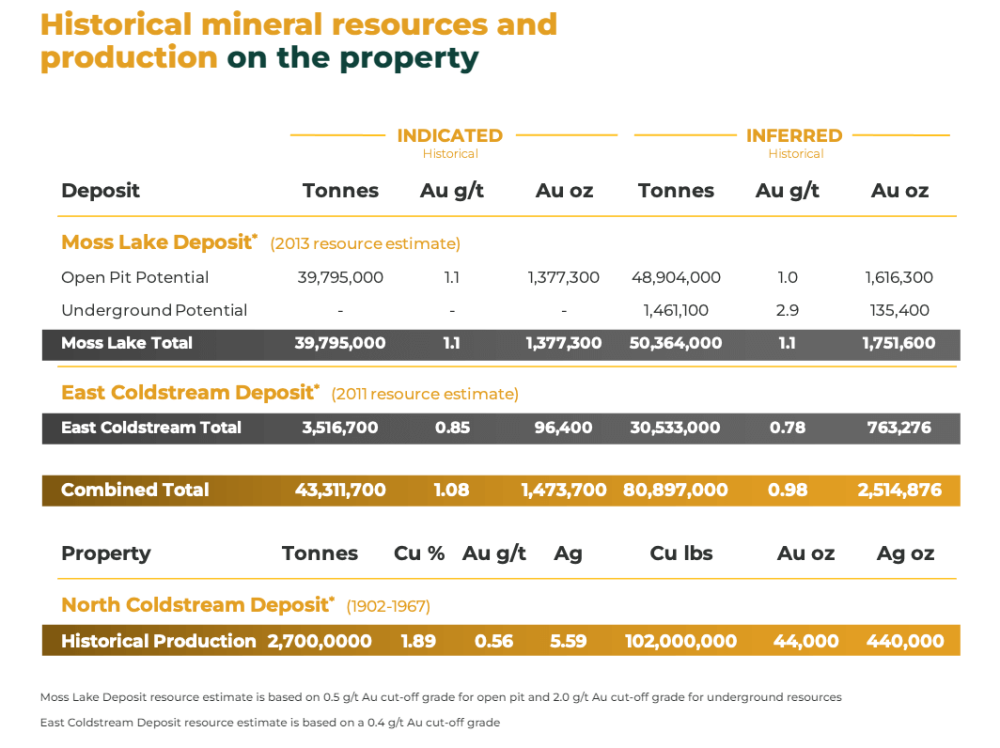

Flagship Project: The Moss Lake Property located in Ontario, Canada has 1.47 M oz of Indicated and 2.51 M oz of Inferred historical gold resources, along with a robust Preliminary Economic Assessment conducted in 2020.

Joining us for our conversation is Brett Richards, the CEO of Goldshore Resources.

Maurice Jackson: Mr. Richards, it’s a pleasure to be speaking with you today as Goldshore Resources has some exciting news for shareholders, as the company continues on its path to creating the next Tier One asset in Ontario, Canada. Mr. Richards, for someone new to the story, please introduce us to Goldshore Resources and the exciting opportunity the company presents to shareholders.

Brett Richards: Goldshore is a company that was formed last year. We’ve been trading for just over a year now, and on the back of acquiring the Moss Lake Project from Wesdome Gold Mines for $52 million in cash and shares last year, we have put together a strategy over the last nine months to drill this up to let’s call it critical mass. What we acquired in the Moss Lake Project was a 4 million-ounce historic resource, and our view is that the extensions of this resource, both laterally along strike and at depth, are significant, particularly along strike.

Our original strategy was let’s put together a 100,000-meter drill program. Let’s get financed and let’s get on with it, and that’s what we’ve been doing for the past nine months, and most recent results are starting to I’ll say support the original thesis we had about Moss Lake being much bigger than first thought.

Maurice Jackson: Before we deep dive into the press release, some important competitive advantages distinguish Goldshore Resources from its peers and truly make the Moss Lake property a unique value proposition. Mr. Richards, for someone new to the flagship Moss Lake property, please acquaint us with the deposit, beginning with your location and some of your neighbors in the region.

Brett Richards: The Moss Lake Property is about 120 kilometers northwest of Thunder Bay in Ontario. We are probably in the most mining-friendly jurisdiction in the world, plus we are on the Trans-Canada Highway, Yonge Street in Toronto, which happens to be the longest street in the world, going all the way to Manitoba. Our concession is adjoined to Trans-Canada Highway.

And why is that important? It’s important for several reasons, particularly about infrastructure. When I look at mining projects, at the end of the day, obviously there’s the technical side of things, but there’s also what I call the do-ability factor. Is this mine really doable? Can you get this into production easily? And the answer for Moss Lake is yes.

Being on the Trans-Canada Highway means we’re afforded 10-cent kilowatt-hour power, which goes right by our doorstep. We have a four-lane highway, so access to our site is as good as it gets. We have power, water, rail, people, consultants, contractors, and government, all within nothing more than an hour’s drive into the City of Thunder Bay, and an international port and an international airport. So, we tick all the boxes when it comes to infrastructure, so that is kind of, I’ll say the description of where we are, and why I think it’s so compelling to be where we are.

There are a lot of people around us as well. The Shebandowan Greenstone Belt where we’re located has been a bit under-explored over the years because low-grade bulk tonnage style deposits were not in favor when gold was $1,500. But now gold is kind of trading on a floor of $1,800, they seem to be much more appealing to investors. Certainly, after the success of Detour Lake, I think you’ll see these types of deposits more and more come into production.

Maurice Jackson: You referenced Goldshore Resources as having a historical resource, and the company also completed a robust Preliminary Economic Assessment (PEA) back in 2020. Can you share some of those highlights with us?

Brett Richards: Historically the area has been, let’s, so-called cobbled together as a big land package. There are three distinct areas within our domain, the Moss Lake area being kind of the flagship. It is what carries three and a half million ounces of that historical resource. Up in the Northeast, up near the highway, we have Coldstream and North Coldstream and Iris Lake against all kinds of compartmentalized land packages that were cobbled together by Wesdome.

There’s a 500,000-ounce historical resource on Coldstream, and a former actual operating mine at North Coldstream that ran for about 30 years in the, about 40 or 50 years ago. We have a very interesting kind of, I’ll say land package, and the work that has been done on this culminated in 2013 when a PEA was done on the property by Moss Lake Gold Mines.

Again, the PEA was updated in 2020 by WesDome before kind of launching a sale process and let’s face it, PEAs are a snapshot in time, and the time in 2013 and the time in 2020, and the time today are all very, very different, knowing that we are in a hyperinflationary environment today, what CAPEX might have been $500 million back in 2020, might be 600 million or $650 million today.

We have to keep that in mind as we go through. But I think back in 2013, and back in 2020, this project, at these gold levels, at $1,800 to $2,200 gold, and trades between a 27% and a 40% IRR. So, after-tax, the internal rate of return, is very, very compelling. We can look at the new present values of these projects, but again, they’re snapshots in time. What that tells me is that this is a robust project that when tested, even with inflation, even with different input assumptions, relative to the economic circumstances at the time, it is going to be a robust project.

Maurice Jackson: Goldshore Resources currently is embarked on a 100,000-meter drill program. Are you twinning the holes, and conducting step-out drilling on this?

Brett Richards: We are doing some verification drilling of the existing historical resource. We are stepping out laterally. We are stepping out along strike, and we have identified a parallel zone to the Moss Lake deposit, which is very exciting, and some high-grade structural areas within the deposit, which we’ll look to improve the overall grade and volume as we get further down the road, and get closer to a resource estimate.

Maurice Jackson: Speaking of your drill program, some of the initial assay results have just been released. What do they seem to indicate thus far?

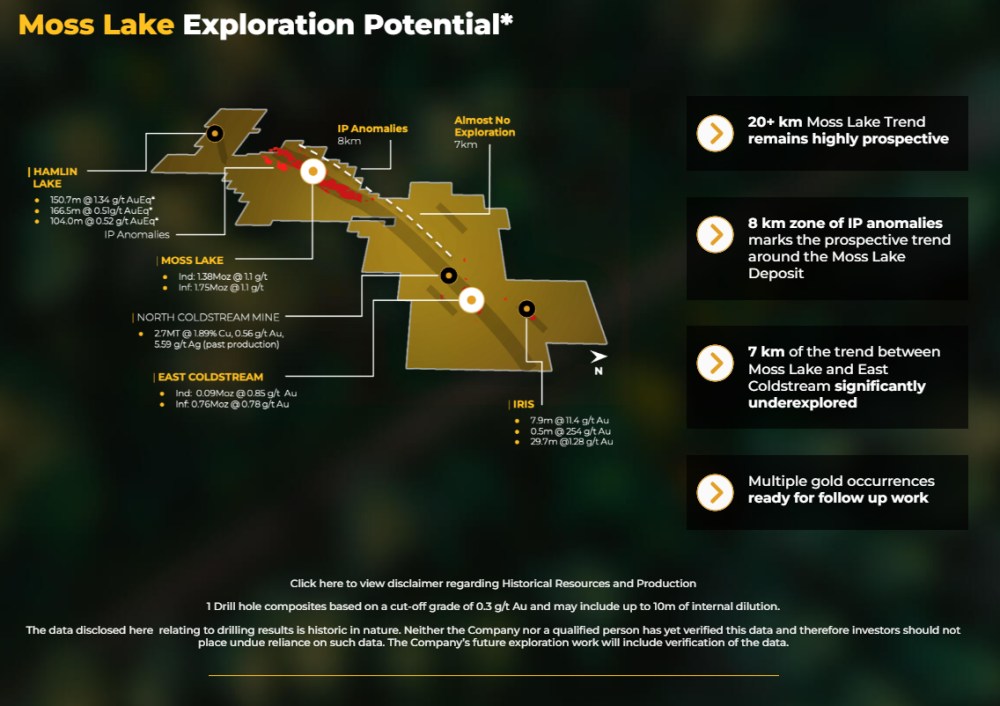

Brett Richards: Well, I think they, we’ve always been trying to test our thesis that this is bigger and much more robust as a deposit than the historical resource illustrates. We’ve done that through a geophysical survey, and you can see that on our website, the 3D model of it, where you can see the potential for future mineralization up along strike, that goes 7 to 12 kilometers further than where Moss Lake is now.

But I think the results that we started to put out from the very beginning show between one, 1.1, 1.2, and 1.3 grams over long intervals, long intercepts of 50, 60, 70, 100, and 120 meters in some cases. I’ll say, some good intercepts, but I think what the surprise has been where we have gone kind of not twining holes, but stepping out a little bit, and stepping into an area that might be classified as inferred.

We’ve hit some high-grade structures, and I think that’s simply because of the geophysical work we’ve done, the structural work we’ve done with a structural geologist by the name of Brett Davis, who’s on-site currently. Pete Flindell, who is our VP of Exploration, he and the team have kind of figured this out. Targeting of some of these higher grade holes has been something that we wanted to do, because ultimately when we kind of go to, I’ll say, interpret all of this data, I don’t think the market is going to want another kind of $1.5 or $2 billion project that does 60,000 tons a day and produces 600,000 ounces of gold. That’s just not viable in this current economic environment.

You’re not going to be able to raise that kind of money. You’re not going to be able to get traction on that type of project. I think we have to start pivoting and looking at alternatives, and what are those? Is there a higher-grade starter pit alternative here within the deposit? I think that’s what we’re going to try and kind of focus on over the next little while. Therefore, there will be more infill and more delineation drilling than anything. But, we are still doing some step-out as well.

Maurice Jackson: All right. Well, let’s get to the press release. Goldshore Resources just received some welcoming news from the assay labs, which identify significant downhole gold intercepts. What can you share with us, Sir?

Brett Richards: We just announced, 78 meters at 1.17 grams from about 170 meters depth. This is a great hole. It’s all going to get contained within an open-pit mine. It’s going to pull a lot of tonnage in. I think, there were some high-grade areas within that, including 22 meters at 2.3 grams and 5.6 meters at 5.69 grams, in and around the 200 to the 220-meter range.

So, this is encouraging, and there are some other intercepts on some other holes that we announced, but it’s all more of the same. There’s anywhere from 20 to a hundred meters at over a gram.

Our objective is to try to maximize the grade. A little bit of grade, 0.1 grams here is going to add 10% to our resource. Even 1 gram or 1.1 gram, it’s quite meaningful at the end of the day. We’ll figure all this out once we get all the data and get towards a mineral source update at the end of the year. But I think right now, and I can talk a lot about the current market dynamics, but sadly, putting good results out into the market has not moved our share price. It’s actually, we have been impacted like all the other junior minors and we’ve been trading downwards.

Maurice Jackson: Looking forward, what can you share with us regarding optionality and economic open pit shells as you model your resource?

Brett Richards: I think we’re going to see a lot of results come out over the next six months or more of the same, illustrating our thesis that this is going to be a real project. Also, I think better delineation on defining this higher-grade starting project, but we can’t lose sight that this is, I think, this is a Tier One asset. This is going to be 10 million ounces by the time the drilling has wrapped up. Whether that’s a year or two or three from now. This is such a large area. There’s probably going to be another 100,000 meters as this gets towards a feasibility study.

Like I’ve said, we’ve got a footprint here that is a Tier One asset at the end of the day, but I think we need to start focusing on what the market is going to respond to. The market is going to respond to, is this a project that has a smaller CAPEX option, a smaller starter with that positive cash flow as soon as possible. Those types of questions need to be addressed and need to be presented to the market. So, we’re going to be looking at some permutations at the end of the day, when we do a PEA next year.

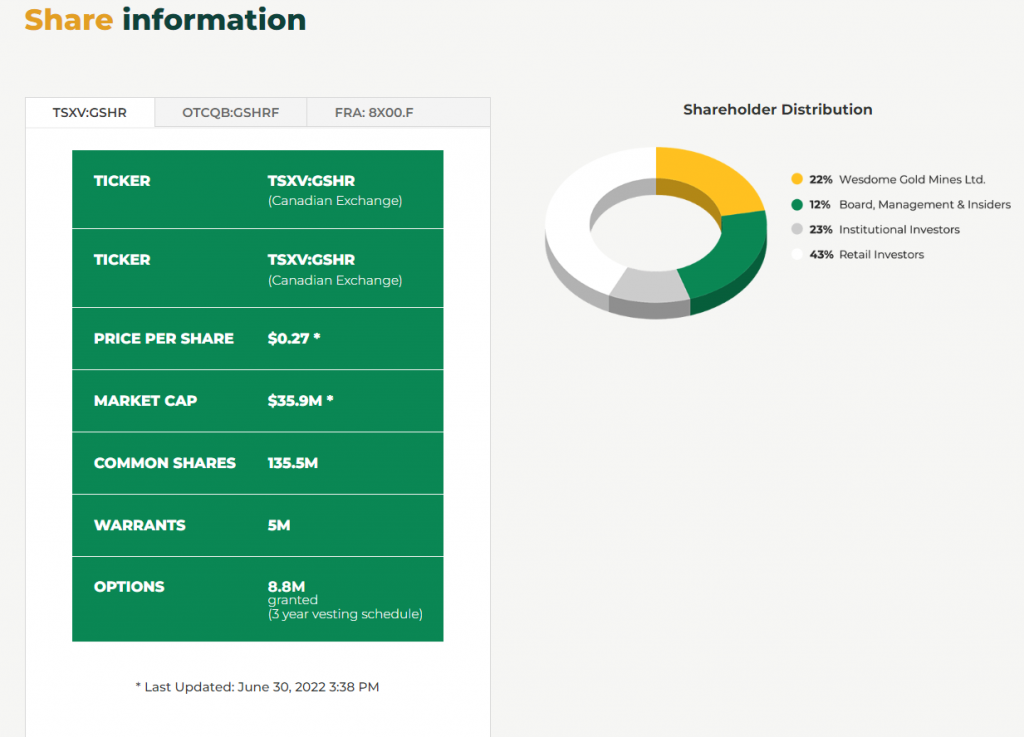

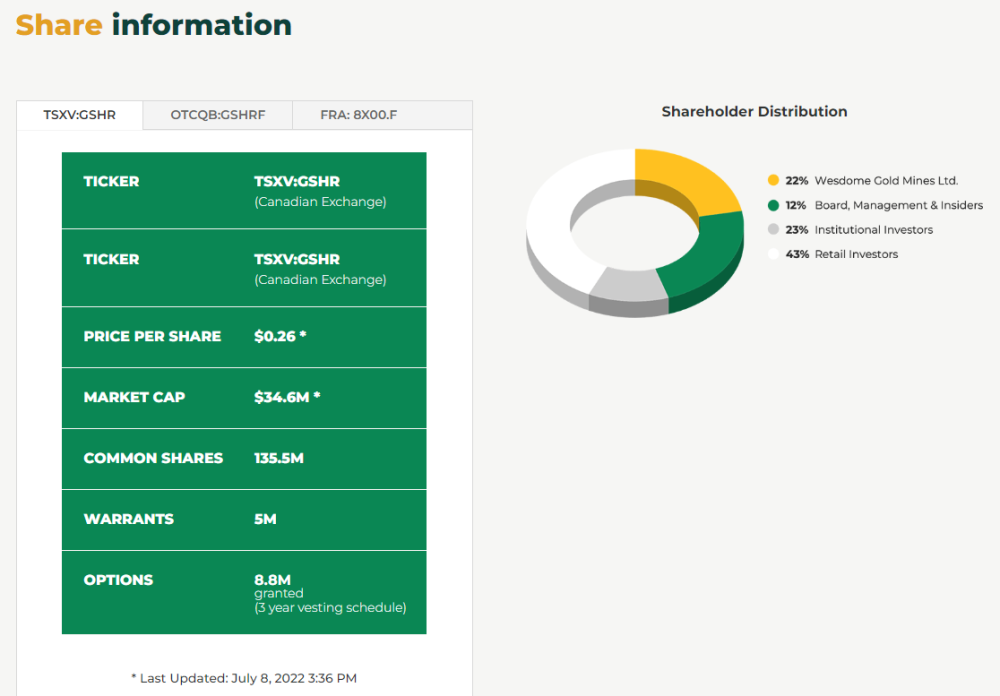

Maurice Jackson: Let’s get into some numbers. Mr. Richards, please provide the capital structure for Goldshore Resource.

Brett Richards: Goldshore Resources has about 143 million shares outstanding today, and only 5 million out warrants outstanding, and we’ve got about $13 million in the bank as of June. We’re well-positioned here and can ride this out.

As I’ve said before, we got caught in a bit of the whole market dynamics. We wanted to play a bit of catch-up, and get ahead of the curve on drilling, so we ramped up our drilling just before the whole market started crashing.

Our team took our foot off the pedal, and we put the brakes on it a little bit. We did scale up to seven rigs, but we’ve pulled back now to a couple of rigs. I want to ride this out. Preservation of cash and preservation of this company is first and foremost.

The capital markets are so volatile and so unpredictable right now, I’m very comfortable just burning a couple of million dollars a month and just watching this, or less than a couple of million dollars a month, and just watching how this unfolds to the fall because we don’t want to be in a situation where, where we have to go to the market and the market is not there for us.

Maurice Jackson: Speaking of being comfortable, I just want to share with everyone that I am a proud shareholder, and I’m looking to add to my position under these circumstances. The value proposition is extremely compelling, and I’m not discouraged by the price. I understand how markets work, and I never complain about a sale when it comes to capital goods. Now, since we’re covering numbers, how does Goldshore Resources compare with some of your peers?

Brett Richards: Well, we’ve never been able to kind of figure this one out, but we’re trading today somewhere kind of in order of magnitude around $10 an ounce, it’s crazy, but that is kind of where we are today. Our peers have also been impacted, but they also had a higher starting point. We’ve got a trading comparable sheet in our presentation that has us at the bottom of our peer group, and this is a peer group put together by a bank. At trading at $10 today, and our peers trading anywhere from $15, $20, $25, all the way up to $100 an ounce for Marathon.Looking at a pure comparison basis, Goldshore Resources is the least expensive among our peers. When you start looking at what it costs to bring ounces onto a resource statement, to put ounces into the inferred category costs about $30 an ounce. If you have a million ounces of inferred resource, it’ll probably cost $30 million to get there, then drilling in other activities.

So we’re trading at a third of that, a third of what it costs to do it. So, I think from an investment opportunity standpoint, there’s one way here, and it’s up.

Maurice Jackson: In closing, Sir, what would you like to say to shareholders?

Brett Richards: I think the really compelling investment case here is how we have performed against the general market, and where we are today. I’ll say the leverage that we have on the way back up. This is not going to go on forever. We may still feel some pain in the capital markets going forward, but we are going to recover, and commodities and equity, gold equities are going to accelerate, and probably much faster than the market when it does turn around, and when it does come back. We are actually leveraged to that even greater than the normal gold equity market, because of our size and our scale, and our potential to bring this up to a Tier One status.

So, there are some compounding, compelling investment reasons why to choose Goldshore, and I am also a major shareholder of this company. I have never continued to lose sight of the fact that this is a real project, and this is going to get into production one day.

Maurice Jackson: Mr. Richards, it’s been a pleasure speaking with you today. Wishing you and Goldshore Resources, the absolute best, Sir.

Brett Richards: Thanks, Maurice.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will improve the world.