- APC-64 intersected 451.40 metres grading 2.67 g/t gold equivalent from near surface, including 98.50 metres @ 3.36 g/t gold equivalent in the sheeted CBM vein zone located above and contiguous to the Apollo porphyry system. On a gram x metre basis, APC-64 returned 1,206 g/t gold equivalent, which represents the second largest grade accumulation drilled to date at Apollo. The hole bottomed in mineralization with the final 10 metres grading 0.76 g/t AuEq.

- APC-63 intersected 593.65 metres grading 1.69 g/t gold equivalent including 353.10 metres @ 1.39 g/t gold equivalent from surface in the same sheeted CBM vein zone before transitioning into the brecciated porphyry system. The hole bottomed in mineralization with the final 11.85 metres grading 0.75 g/t AuEq.

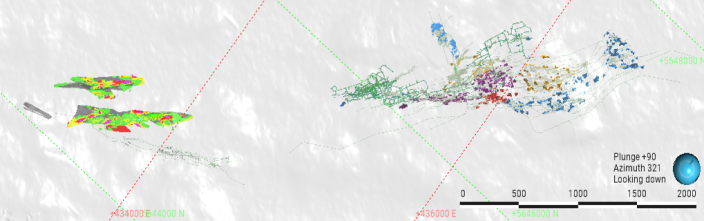

- As a result of hole APC-63 and APC-64, the overall maximum known area of outcropping mineralization (combined brecciated porphyry and sheeted CBM vein zones) has expanded to 320 metres by 220 metres (previously 260 metres by 220 metres) and remains open for expansion to the north. New drill pads are nearing completion and are designed to test for extensions to the shallow mineralization, with drilling set to commence before the end of September 2023.

- Drill hole APC-67 was designed to test Target 2 to the northeast of the Apollo system and cut significant shallow mineralization grading 53.55 metres @ 1.31 g/t gold equivalent from 109.25 metres down hole. Based on new modelling, the Company believes that this intercept is an extension to the Apollo system and as a result the maximum known strike length of the system has been increased by 65 metres and now measures 520 metres in strike (previously 455 metres) by 395 metres width by 915 metres vertical. Apollo remains open for further expansion in various directions.

- Eleven new holes have been completed in the Apollo system with assays pending including APC-65 and APC-72, which cut long mineralized and continuous zones of the sheeted CBM vein system and the brecciated porphyry.

Ari Sussman, Executive Chairman commented: “The Apollo system continues to shine with the system continuing to expand. Our corporate strategy for the Guayabales project for the balance of 2023 and into 2024 is to focus on growth through the drill bit by looking to grow the sheeted vein and brecciated porphyry systems at Apollo and testing the six targets which surround it. In fact, we have already discovered new mineralization through reconnaissance drilling at Targets 1 and 2 with assay results outstanding for hole APC-68, which tested Target 3. Over the next few days, we will begin testing Target 6 for the first time and are excited about its potential given we have sampled oxidized mineralized sheeted CBM veins within a brecciated porphyry body at surface. Lastly, we have completed the initial two holes at the Plutus system’s northern corridor with a third hole about to start. It is a busy and exciting time for the Company with five drill rigs now operating at site.”

TORONTO, Sept. 7, 2023 /CNW/ – Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results for four holes drilled at the Apollo area, which is part of the Guayabales project located in Caldas, Colombia. Apollo already hosts an outcropping high-grade, bulk tonnage copper-silver-gold porphyry system and six newly generated targets surrounding it. The porphyry system at Apollo owes its excellent metal endowment to an older copper-silver and gold porphyry system being overprinted by younger precious metal rich, carbonate base metal veins (intermediate sulphidation porphyry veins) within a magmatic, hydrothermal inter-mineral breccia and diorite porphyry bodies currently measuring 520 metres x 395 metres x 915 metres and open for expansion.

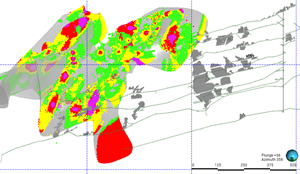

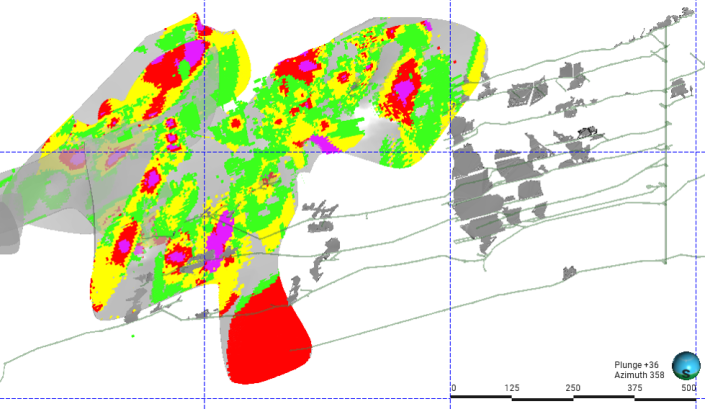

Details (See Table 1 and Figures 1-4)

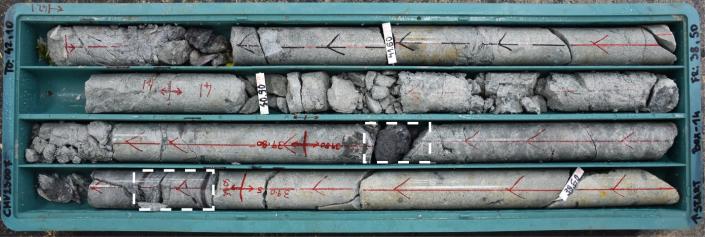

This press release outlines results from four holes testing the Apollo system. Step out holes APC-63 and APC-64 were drilled northeastwards to test an upper zone of sheeted CBM veining and continued, directly below, within depth extensions to the main brecciated porphyry body. Exploratory holes APC-66 and APC-67 were drilled to test potential extensions to the Apollo system in previously undrilled areas in the northwest and at exploration Target 2 in the northeast.

APC-63 was drilled northeastwards from Pad 10 to a maximum downhole depth of 593.65 metres (557 metres vertical due to topography). The hole commenced in grade within oxides from surface and was drilled in continuous mineralization to the end of the hole. The first 353.10 metres downhole cut the recently discovered outcropping sheeted CBM vein zone located above the main brecciated porphyry body. The sheeted CBM vein zone hosts chalcopyrite, sphalerite, and galena up to 0.8% while the brecciated porphyry zone below consisted of sulphides filling the cement matrix hosting 0.2% chalcopyrite, 1.2% pyrite, 0.5% sphalerite, 0.3% galena and pyrrhotite (up to 0.7%). The hole bottomed in mineralization with the final 11.85 metres averaging 0.75 g/t gold equivalent with assay results as follows:

- 593.65 metres @ 1.69 g/t gold equivalent from surface (consisting of 1.46 g/t gold, 15 g/t silver and 0.03% copper) including:

APC-64 was drilled to the east-northeast from Pad 9 to a maximum downhole depth of 484.8 metres (435 metres vertical due to topography) and was designed to test the shallow, high grade, sheeted CBM zone and the main brecciated porphyry zone contiguous and below it. The drill hole intercepted 451.40 metres of continuous mineralization beginning at 33.40 metres downhole within the upper sheeted CBM vein zone for 98.50 metres with mineralization associated to sphalerite (up to 5%), galena (up to 3%), pyrite and chalcopyrite (up to 1%). Below this sheeted CBM zone, the hole transitioned into the brecciated porphyry zone until the end of the hole at 484.80 metres. At 309.40 metres downhole, a high-grade 70.95 metres long zone of brecciated porphyry with a strong CBM vein sulphide overprint was intercepted containing a sulphide cement matrix of chalcopyrite (0.5% to 1.5%), pyrite (up to 2%), pyrrhotite (up to 0.6%) and sphalerite and galena (up to 1%). The hole bottomed in mineralization with the final ten metres yielding 0.76 g/t gold equivalent. The following assay results are highlighted:

- 451.40 metres @ 2.67 g/t gold equivalent from 33.40 metres downhole (consisting of 1.48 g/t gold, 57 g/t silver and 0.26% copper) including:

As a result of holes APC-63 and APC-64, the zone of outcropping mineralization (combined brecciated porphyry and sheeted CBM vein zones), has expanded to 320 metres by 220 metres (previously 260 metres by 220 metres) and remains open for expansion to the north. New drill pads are nearing completion with drilling designed to test for further expansions to the shallow mineralization and scheduled to commence before the end of September 2023.

APC-66 was drilled steeply to the southwest from Pad 1 to a final downhole depth of 514.05 metres (503 metres vertical due to topography) and intercepted a much shallower projection to the brecciated porphyry zone in this area compared to what the model previously predicted. An upper zone at 245.20 metres downhole consists of 22.25 metres of CBM vein mineralization overprinting quartz diorite porphyry rock. A 101.05 metres zone of brecciated porphyry, commencing at 292.50 metres downhole, contains a sulphide cement matrix of chalcopyrite (0.1% to 0.2%), pyrite (up to 1.5%), pyrrhotite (up to 1.0%) and sphalerite (up to 0.3%). The following assay results are highlighted:

- 22.25 metres @ 0.51 g/t gold equivalent from 245.15 metres downhole (consisting of 0.28 g/t gold, 12 g/t silver and 0.04% copper), and

- 101.05 metres @ 0.87 g/t gold equivalent from 292.50 metres downhole (consisting of 0.62 g/t gold, 14 g/t silver and 0.04% copper) including:

APC-67 was drilled to the east from Pad 5 to test Target 2, located to the northeast of Apollo and which is one of the six recently generated new targets within the Apollo area. The hole was drilled to a downhole depth of 225.65 metres (149 metres vertical due to topography) and encountered 53.55 metres of mineralization from 109.25 metres downhole related to brecciated porphyry with its cement matrix consisting of chalcopyrite traces, pyrite (1.2%), sphalerite (1.0%) and galena (0.5%). Based on new interpretation by the Company, this intercept confirms an extension of the Apollo porphyry system to the northeast with maximum known dimensions now measuring 520 metres x 395 metres x 915 metres (previously 455 metres x 395 metres x 915 metres). The system remains open for expansion in the north, southeast and at depth with assay results as follows:

- 53.55 metres @ 1.31 g/t gold equivalent from 109.25 metres downhole (consisting of 1.13 g/t gold, 11 g/t silver and 0.02% copper) including:

Apollo Drill Program and Assay Update

The 2023 Phase II drilling program is advancing on schedule with assay results reported for 36 holes and an additional eleven holes awaiting assay results from the lab. Since the announcement of the discovery hole at Apollo in June 2022, a total of 67 drill holes (approximately 29,109 metres) have been completed and assayed.

With five diamond drill rigs now operating at site, the Company is focused on:

- Expanding the Apollo porphyry system including depth extensions and high-grade sub-zones.

- Further drill testing to expand the newly discovered, east-west trending, shallow and outcropping, sheeted CBM vein zone.

- Testing the remaining three of six newly generated targets surrounding the Apollo porphyry system. Three targets have been drill tested to date with new mineralization being discovered at Targets 1 and 2 with assay results pending for a hole which tested Target 3.

- Testing Plutus, a new large-scale porphyry target located up to 1.5 kilometres east of Apollo.

- Generating new exploration targets for future drilling.

The Apollo area, as defined to date by surface mapping, rock sampling and copper and molybdenum soil geochemistry covers a 1,000 metres X 1,200 metres area and represents a large and unusually high-grade copper-silver-gold porphyry system. Mineralization styles include early-stage porphyry veins, inter-mineral brecciated porphyry mineralization and multiple zones of late stage, sheeted, carbonate-base metal veins with high gold and silver grades. The Apollo area is still expanding as the Company’s geologists have found multiple additional outcrop areas with porphyry veining, breccia, and late stage, sheeted, carbonate base metal veins. (See press release dated April 18, 2023)

Results for holes outlined in this press release are summarized below:

Table 1: Assay Results for APC-63, APC-64, APC-66 and APC-67

| Hole # | From (m) | To (m) | Length (m) | Au g/t | Ag g/t | Cu % | Mo % | AuEq g/t* |

| APC-63** | – | 593.65 | 593.65 | 1.46 | 15 | 0.03 | 0.001 | 1.69 |

| Incl | – | 353.10 | 353.10 | 1.16 | 15 | 0.02 | 0.002 | 1.39 |

| and incl | 353.10 | 593.65 | 240.55 | 1.90 | 15 | 0.03 | 0.001 | 2.12 |

| APC-64** | 33.40 | 484.80 | 451.40 | 1.48 | 57 | 0.26 | 0.001 | 2.67 |

| Incl | 34.65 | 133.15 | 98.50 | 3.13 | 16 | 0.05 | 0.001 | 3.36 |

| and incl | 309.40 | 380.35 | 70.95 | 2.05 | 104 | 0.38 | 0.001 | 4.10 |

| APC-66 | 245.15 | 267.40 | 22.25 | 0.28 | 12 | 0.04 | – | 0.51 |

| And | 292.50 | 393.55 | 101.05 | 0.62 | 14 | 0.04 | 0.001 | 0.87 |

| Incl | 348.10 | 362.25 | 14.15 | 0.89 | 19 | 0.04 | 0.001 | 1.21 |

| and incl | 384.00 | 393.55 | 9.55 | 2.27 | 39 | 0.10 | 0.005 | 2.96 |

| APC-67 | 109.25 | 162.80 | 53.55 | 1.13 | 11 | 0.02 | 0.002 | 1.31 |

| Incl | 112.20 | 136.85 | 24.65 | 2.21 | 19 | 0.03 | 0.002 | 2.47 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag g/t x 0.016 x 0.88) + (Cu (%) x 1.79 x 0.90)+ (Mo (%)*11.62 x 0.85) utilizing metal prices of Cu – US$3.85/lb, Ag – $24/oz Mo – US$25/lb and Au – US$1,475/oz and recovery rates of 97% for Au, 88% for Ag, 85% for Mo, and 90% for Cu. Recovery rate assumptions are speculative as limited metallurgical work has been completed to date. True widths are unknown, and grades are uncut. |

| ** Hole bottomed in strong mineralization |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver, and gold exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold Apollo porphyry system. The Company’s near-term objective is to drill the shallow portions of the Apollo system, continue to expand the overall dimensions of the system, which remains open in most directions and test newly generated grassroots targets.

Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSX under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) and Collective Mining (@CollectiveMini1) on Twitter

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking information and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking information. In this news release, forward-looking information relate, among other things, to: anticipated advancement of mineral properties or programs; future operations; future growth potential of Collective; and future development plans.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; conclusions of future economic evaluations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, precious and base metals or certain other commodities; fluctuations in currency markets; change in national and local government, legislation, taxation, controls regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formation pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties, as well as those risk factors discussed or referred to in the annual information form of the Company dated April 7, 2022. Forward-looking information contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and there may be other factors that cause results not to be anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.

SOURCE Collective Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2023/07/c3353.html