Vancouver, British Columbia–(Newsfile Corp. – November 15, 2022) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“) is pleased to announce a mineral resource estimate (the “MRE“) for the Moss Lake deposit (the “Moss Lake Deposit“) located at its 100%-owned Moss Lake Gold Project in Northwest Ontario, Canada (the “Project” or the “Moss Lake Gold Project“).

Open-Pit Constrained Inferred Mineral Resource Estimate with an Effective Date of November 14, 2022:

| Inferred Resources (Domains) | Tonnes (Mt) | Grade (g/t Au) | Contained Metal (Moz Au) |

| Shear | 34.7 | 2.0 | 2.20 |

| Intrusion | 87.0 | 0.7 | 1.97 |

| Total | 121.7 | 1.1 | 4.17 |

Note: Based on a US$1,500 per ounce gold price and economic cut-off grade of 0.40 g/t Au. Refer to complete notes on Mineral Resource Assumptions below.

- This is a major milestone for the Company as the shear domain represents an opportunity for a high-grade open-pit gold resource.

- There is significant and clear expansion potential through strike and dip extensions to known shears, as well as parallel shears. The Company has included 48 holes from its 2021 and 2022 drilling campaign in the new MRE and has drilled an additional 52 holes that are not included in the MRE because assays have not been received to date.

- The current MRE represents a significant expansion over the 2013 historical estimate for the Project with 35% more tonnes and 33% more contained gold ounces.

- The Moss Lake Gold Project is host to 29 additional targets over a 35 km trend, which the Company continues to evaluate.

President and CEO, Brett Richards, stated: “This mineral resource estimate confirms our belief that the Moss Lake Deposit is larger than previously thought. More importantly, there is a mass of higher-grade mineralization that can be prioritized in a potential phase one operation that Goldshore can build with a smaller capital requirement. Our findings on this MRE are exciting for the future of the Moss Lake Gold Project, as we now have short- and medium-term options to continue to deliver value to the Goldshore shareholders, as we explore expansions and quality increases (infill drilling to Indicated resource category) to the higher-grade resource; but also while testing other areas of known strong mineralization like East Coldstream, North Coldstream, Iris and Vanguard, across a trend of 35 km on the project.”

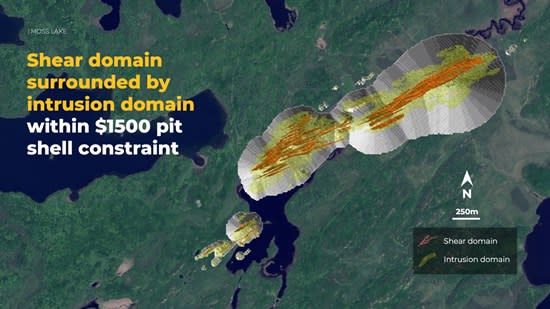

Figure 1: Shear domain (red) and intrusion domain (yellow) within optimized pit constraints

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/8051/144351_b836ade6a4de9af8_002full.jpg

Figure 2: Cross section showing extension of shear domain beneath the constraining pit shell

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/8051/144351_b836ade6a4de9af8_003full.jpg

Notes on MRE Assumptions (refer to table above)

- Numbers have been rounded to reflect the precision of an Inferred mineral resource estimate. Totals may vary due to rounding.

- Estimation has been completed within the two separate reported geological domains: a higher-grade shear domain which occurs within a larger lower-grade intrusive domain; modelling of domain boundaries has considered both geology and grade.

- Gold cut-off has been calculated based on a gold price of US$1,500/oz, mining costs of US$2.50 per tonne, processing costs of US$12.50 per tonne, and mine-site administration costs of US$2.50 per tonne processed. Metallurgical recoveries of 85% are based on prior metallurgical test work.

- An economic cut-off grade of 0.40 g/t Au was applied to mineralized rock in the optimized open pit for processing determination.

- Mineral Resources conform to NI 43-101, and the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines and 2014 CIM Definition Standards for Mineral Resources & Mineral Reserves.

- The Qualified Person and Company are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, or political factors that might materially affect the Mineral Resource estimate.

- Mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in the MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated and/or Measured Resources. The Company will continue exploration intended to upgrade the Inferred Mineral Resources to Indicated Mineral Resources.

Technical Overview

Details of the MRE will be provided in a technical report with an effective date of November 14, 2022 prepared in accordance with National Instrument 43-101 (“NI 43-101“), which will be filed under the Company’s SEDAR profile within 45 days of this news release. The MRE was prepared by independent mining consulting firm CSA Global Canada (“CSA Global“), a division of ERM Consultants Canada Ltd., in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM“) Definition Standards on Mineral Resources and Reserves (2014).

Moss Lake Geology and Model

The Moss Lake Gold Deposit is a structurally controlled gold deposit within the greenstone terrain of the Archean Superior Province. Mineralization is localized where the major NE-trending Wawiag Fault Zone cuts a dioritic to granodioritic intrusive complex. The deposit is defined by a series of anastomosing centimeter- to meter-scale NE-trending shear zones carrying higher-grade gold mineralization, and lower-grade gold mineralization associated with more brittle-style deformation and veining in the intrusive rock mass between the shear zones. Mineralization is associated with pyritic sericitic and chloritic alteration and millimeter- to centimeter-scale irregular quartz-carbonate veinlets.

Detailed geological logging and multi-element geochemical analysis of drill core from the 2021-22 drilling has supported modelling of discrete shear domains within the larger altered and variably mineralized intrusive domain. The shear domains have a different higher-grade gold population to the low-grade intrusive domain and these domains have been estimated separately using different search parameters. Importantly, this allows a more accurate representation of the true variability within the deposit than has been achieved in previous estimates.

Drill Hole Data and QAQC Procedures

The Moss Lake Deposit has been evaluated by several diamond drill programs since the 1970s and earlier. The greatest number of drill holes were completed between 1986 and early 1992 by Tandem/Storimin and Noranda Inc. (311 drill holes for 86,196 meters). A smaller drilling program in 2008 served to validate the older data and lead to the completion of the historical resource estimate (“historical estimate“) by Moss Lake Gold Mines Ltd. in 2013. Following acquisition of the Moss Lake Gold Project, Goldshore commenced a drill program in 2021 that is still ongoing. The program aims to systematically redrill the deposit defined by previous campaigns and, in the process, to validate as much of the historical data as possible.

Prior to the 2008 program, there are no documented QAQC procedures or data available. Additionally, down-hole surveys were not undertaken or used an acid-bottle technique that measured dip and not azimuth. This is the case for most of the historical drilling which was completed in the late 1980s to early 1990s. The ongoing Goldshore drilling program utilizes full industry-standard survey control and QAQC programs and is designed to systematically redrill the Moss Lake Deposit and validate as much of the historical drilling as possible through collar surveys, re-logging, and re-sampling.

Mineral Resource Estimation Methodology

The current MRE is based on an improved understanding of the geological controls on gold mineralization that follows the detailed logging of 48 new drill holes (27,851.75 metres) drilled since August 2021 and with a drill hole database cut-off date of October 14, 2022. The MRE does not include the high-grade intercepts around the margins of the deposit reported on November 1, 2022.

CSA Global was provided with the wireframes for resource estimation by Goldshore. Goldshore modelled the shear zones domain using a combination of geological features and raw assay values above 1 g/t Au using explicit digitizing methods in Seequent Leapfrog 3D geological modelling software (“Leapfrog”). Goldshore modelled the intrusive domain using implicit modelling techniques in Leapfrog using a cut-off grade of 0.25 g/t Au.

CSA Global reviewed the provided wireframes to confirm validity for resource estimation. Statistical and geostatistical assessment of 1 m composites confirmed that the shear domains should be estimated within hard boundaries separating them from the intrusive domain. Statistical analysis was used to determine high-grade capping for each shear zone wireframe and ranged from 20 g/t Au to 60 g/t Au.

The MRE was estimated with a block size of 15 m x 15 m x 5 m utilizing subblocks and constrained within wireframes with a minimum width of 1.50 m. Gold content was estimated using ordinary kriging methods using dynamic anisotropy variogram models. The maximum range of the variogram models generally are between 60 m x 30 m x 10 m in the shear domain and 60 m x 60 m x 40 m in the intrusive domain. The search ellipse was constrained to selecting composites flagged within each domain and varied from half (1st), the full (2nd) and double the variogram ranges (3rd). Additional check estimates were completed using inverse distance squared (ID2) and nearest neighbour methods, the latter on bench scale composites.

Density values for 1,737 samples collected from all Goldshore drill holes were used to determine an average bulk density for each wireframed zone. Values range between 2.70 and 2.72 t/m3 for the mineralized domains, 2.7 t/m3 for waste rock, and 2.0 t/m3 for glacial overburden.

Mineral resources are presented as undiluted and in situ. The historical underground voids from Noranda’s 1980’s exploration program have been removed from the geological model.

Mineral Resource Classification

The MRE has been classified as an Inferred Mineral Resource. This resource classification reflects the fact that the majority of the drill hole data used for the resource estimate is historical, and no QAQC data or reports exist for the majority of these drill holes. Statistical assessment of historical data and recent data provided some support for the historical data, but also included some inconsistencies. The majority of the historical drill holes did not have acceptable downhole surveys meaning that spatial location of the core samples remains uncertain especially beneath 200 m.

While the downhole surveys and QAQC methods utilized for the modern drill holes is of industry standard, these holes remain too sparsely distributed to permit confident mineral resource estimation on their own. Goldshore is now embarking on an extensive program of relogging and resampling of historical drill core, together with downhole surveying where possible. Goldshore’s program of infill and confirmatory drilling is also ongoing. It is expected that this work will support classification of Indicated mineral resource in any subsequent mineral resource updates by Goldshore.

Reasonable Prospects for Eventual Economic Extraction

To support reasonable prospects for eventual economic extraction for the MRE, CSA Global used the estimated block model to generate an optimized open pit using Datamine NPV Scheduler software and the following assumptions: a gold price of US$1,500/oz, plant recovery of 85%, processing costs of US$12.50/tonne, mine-site general and administration costs of US$2.50/tonne processed, mining costs of US$2.50/tonne moved and an overall pit slope angle of 50 degrees. NPV Scheduler Software is widely used by mining engineers to apply the Lerchs-Grossman algorithm to block models in order to generate optimized pit shells upon which economic open pit mine designs may be based.

The MRE is constrained within the selected optimized pit shell which reaches a maximum depth of approximately 580 m.

Figures 1 and 2 above show the relationship of the shear and intrusion domains within the optimized pit shell.

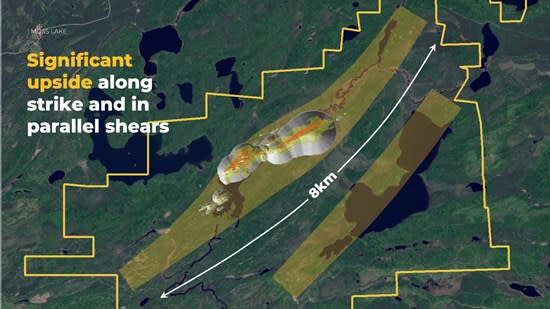

Additional Exploration Potential

The modelled shear-hosted domains extend at depth below the optimized open-pit constraining the reported MRE, but the drill hole data are too sparsely distributed to support underground mining optimization studies and reporting of an underground-constrained MRE at this time.

The shears are also open along strike, beyond the modelled strike length of 3.5 km. Historical drilling intercepted gold mineralization over a total strike length of 8 km, which has been a focus of Goldshore’s summer soil geochemistry and structural mapping programs. Furthermore, there remains potential for additional parallel shears with gold mineralization in historical drill holes 500 m to the southeast of the Moss Lake Deposit.

Figure 3 shows the location of mineralized drill holes along and parallel to the strike of the MRE.

Figure 3: Mineralized zones showing the exploration upside along strike and in parallel structures

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/8051/144351_b836ade6a4de9af8_004full.jpg

Next Steps

Goldshore has commenced an extensive program of relogging and resampling of all historical drill holes whose collars have been located and accurately surveyed. Where possible, these drill holes will also be surveyed using modern downhole surveying equipment.

Notwithstanding the above, a large proportion of the historical drill collars have not been located. The mineralized volumes defined by these historical drill holes will be redrilled in an optimized pattern to accurately define the shear-hosted and intrusive domain mineralization. This will include a full suite of oriented core measurements and multi-element geochemistry analyses.

Work has also commenced on a comprehensive metallurgical testing program led by Ausenco. This work will include a mineral deportment study, grinding tests, gravity separation, flotation, heap leach, and cyanide leach optimization studies. Once complete, Goldshore expects to commence a preliminary economic assessment to evaluate several mining and processing strategies with a view to selecting the most economic and achievable development option. This study is expected to be completed in 2023.

Infill drilling, re-sampling of historical drill holes, and geological modelling will continue throughout the coming months to support a mineral resource estimate update to attempt to upgrade the resource classification from Inferred Resources to Indicated Resources. This work is targeted for completion by the end of 2023 when the Company expects to commence a prefeasibility mining study.

Pete Flindell, VP Exploration for Goldshore, said, “This mineral resource estimate confirms our understanding that high grade shears form the core of the Moss Lake Deposit and will drive the development of the Moss Lake Gold Project. The Inferred Mineral Resource reflects uncertainty in the collar and downhole surveys of the historical drill holes, as well as the selective sampling technique and lack of oriented core measurements that are critical in directing the high-grade structures that drive the overall estimate. While additional drilling is required to replace many of the historical drill holes and infill gaps in the model, we will be aiming to recover as many of these historical holes as possible by relogging and resampling core and conducting downhole surveys using more accurate survey equipment.“

Qualified Person Statements

Dr. Matthew Field (Pr. Sci. Nat), Manager – Resources at CSA Global is an independent Qualified Person under NI 43-101 and responsible for the MRE. Dr. Field has prepared and approved the scientific and technical information related to the MRE contained in this news release.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice President – Exploration of the Company, and a Qualified Person under NI 43-101 has also reviewed and approved the scientific and technical information contained in this news release.

About Goldshore

Goldshore is an emerging junior gold development company, and owns the Moss Lake Gold Project located in Ontario. Wesdome Gold Mines Ltd. is currently a large shareholder of Goldshore with an approximate 27% equity position in the Company. Well-financed and supported by an industry-leading management group, board of directors and advisory board, Goldshore is positioned to advance the Moss Lake Gold Project through the next stages of exploration and development.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

For More Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288 4416 M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes | Twitter: GoldShoreRes | LinkedIn: goldshoreres

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Project, the filing of a technical report supporting the MRE, commencement of a preliminary economic assessment and prefeasibility study, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; the impact of COVID-19; the ongoing military conflict in Ukraine; and other risk factors outlined in the Company’s public disclosure documents.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/144351