VANCOUVER, BC / ACCESSWIRE / November 10, 2022 / Metallic Minerals Corp. (TSXV:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce that it has acquired a 100% interest in six (6) patented mineral claims (78.2 acres), known as the Morning Star property, within the La Plata mining district of southwestern Colorado. The claims are surrounded by, and contiguous with, unpatented mining claims held by the Company within the greater La Plata property claim outline, which now totals over 33 square kilometers (km2) in size. The Morning Star claims have the potential to host porphyry-style Cu-Ag-Au mineralization as both an extension of the nearby Allard resource or as a new porphyry center. In addition, the claims host potential for high-grade Au-Ag-Te epithermal mineralization.

Morning Star Property Highlights

The 78.2-acre Morning Star property consists of six (6) federally patented mining claims that include both fee simple surface ownership and sub-surface mineral rights. The claims straddle the Montezuma and La Plata County boundary and have the potential to host both porphyry Cu-Ag-Au mineralization, as well as epithermal style deposits of high-grade gold, silver, and tellurium, a critical metal on the United States Geological Survey’s list of 50 mineral commodities critical to the U.S. economy and national security2. While highly prospective, the acquired property has not seen modern exploration work in recent decades but was patented in the early 1900s, based on the discovery of significant surface mineralization.

Transaction Details

Subject to final TSX approval, Metallic Minerals will acquire a 100% interest in the Morning Star property for a one-time cash payment totaling US$35,000 and the issuance of an aggregate of 275,000 common shares of Metallic Minerals following regulatory approval.

Scott Petsel, Metallic Minerals President stated, “We are pleased to be able to acquire these additional claims in the highly prospective La Plata mining district, where we recently announced an inferred resource of 985 million pounds of copper equivalent at the Allard Deposit1, which represents just one of several significant porphyry target areas on the property. This acquisition comes on the heels of the recently completed 2022 field program, which focused on resource expansion drilling at the Allard Deposit and included property-wide ground-based induced polarization and resistivity geophysical surveys. Along with the results from the 2022 La Plata drill program and field work, which are expected to come in over the next couple of months, these newly acquired claims will be incorporated into the development of our 2023 exploration season plans and targeting.”

“Assay results from the Keno Silver Project on over 3,200 meters of drilling focused on resource definition at several resource ready targets are expected in the coming weeks.”

About La Plata Silver-Gold-Copper Project

The road accessible La Plata project covers 33 km2 approximately 10 km northeast of the town of Mancos, Colorado within the historic high-grade La Plata mining district, located at the southwest end of the prolific Colorado Mineral Belt. Mineralization is related to a large-scale precious-metals-rich porphyry copper system with associated high-grade silver and gold epithermal vein and replacement deposits.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from vein structures, replacement bodies and breccia zones at over 90 individual mines and prospects3. Historical production from some of these high-grade structures exceeded 1,000 grams per tonne (“g/t”) silver and over 15 g/t gold with some of the richest deposits delivering true bonanza grades for silver and gold.

From the 1950s to 1970s, major miners including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge) explored in the La Plata district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

Prior to 2022, a total of 56 drill holes, totaling 15,200 m, have been drilled on the property since the 1950s which confirms the presence of a large-scale, multi-phase porphyry system with significant silver, gold and copper that is associated with a 10 km2 strongly magnetic signature with intense hydrothermal alteration.

The April 2022 NI 43-101 Mineral Resource Estimate, which covers a relatively small part of the overall 33 km2 property, consists of 115.7 million tonnes at an average grade of 0.39% copper equivalent (“Cu Eq”) (0.35% Cu and 4.02 g/t Ag) using a 0.25% Cu Eq cut-off grade1. The deposit is steeply dipping and roughly tabular in shape, occurring over 1 km in length, 400 m in width with over 1 km in vertical extent based on drilling to date. The Allard deposit remains open to expansion in all directions.

The Allard deposit is a significant potential source of copper and silver, both important metals for the modernization and electrification of the economy. In addition, the broader La Plata property is known for the occurrence of important critical minerals that have been identified by the US Government as essential for the functioning of modern technologies and economies and that are at risk of supply disruption2. The resampling of hole 95-1 during the 2021 field season returned significant platinum and palladium assays associated with the Copper Hill target area east of the Allard resource area and corroborated historic accounts of its presence. Tellurium, another element on the critical mineral list, was a by-product of historic high-grade gold and silver production in the district. These and other important metals noted in the district will be evaluated as part of ongoing exploration of the project.

Upcoming Events

Yukon Geoscience

Metallic Minerals will be attending the annual Yukon Geoscience event in Whitehorse, Yukon November 19-22, with geologist, Taylor Haid, scheduled to give a technical presentation on the Keno Silver project.

Mines & Money London

Metallic Minerals President, Scott Petsel, will be attending the Mines & Money one-one-one conference in London, England November 29-December first, with meetings now being booked.

Footnotes

1) See Technical Report on the Inaugural Mineral Resource Estimate for the Allard Cu-Ag Porphyry Deposit, La Plata Project, Colorado, USA with an effective date of April 3, 2022. The Mineral Resource, prepared by Allan Armitage P. Geo of SGS Geological Services, an independent Qualified Person, has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards – For Mineral Resources and Mineral Reserves (2014). The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% CuEq, based on metal prices of $3.60/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. Copper Equivalent (Cu Eq) calculations are included for comparative purposes. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

2) The US Geological Survey has released a list of 50 critical minerals that the US economy requires for economic and national security.

3) Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949.

Qualified Person

Jeff Cary, CPG, a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release. Mr. Cary is a Senior Geologist and La Plata Project Manager for Metallic Minerals.

About Metallic Minerals

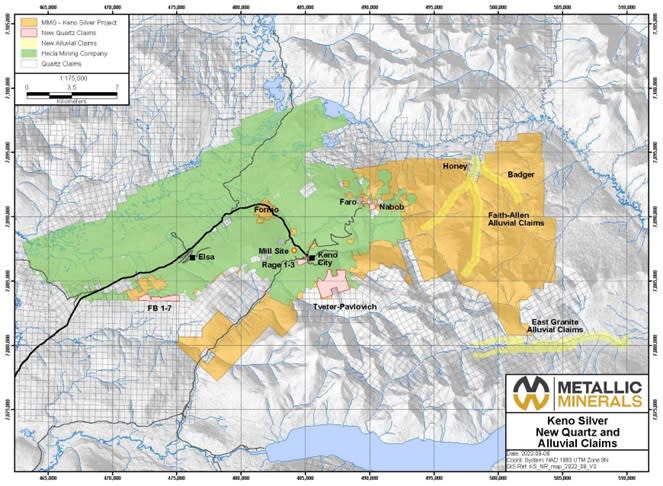

Metallic Minerals Corp. is an exploration and development stage company, focused on silver, gold and copper in the high-grade Keno Hill and La Plata mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources and advancing projects toward development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent Hecla Mining’s operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. Hecla Mining Company, the largest primary silver producer in the USA and third largest in the world, completed the acquisition of Alexco in September 2022. In April 2022, Metallic announced the inaugural NI 43-101 mineral resource estimate for its La Plata silver-gold-copper project in southwestern Colorado. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com

Email: cackerman@mmgsilver.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.