Metallic Minerals: TSX.V: MMG | OTC: MMNGF)

Website: https://metallic-minerals.com/

Corporate Presentation: https://metallic-minerals.com/investors/presentations/

Metallic Minerals: TSX.V: MMG | OTC: MMNGF)

Website: https://metallic-minerals.com/

Corporate Presentation: https://metallic-minerals.com/investors/presentations/

VANCOUVER, BC / ACCESSWIRE / May 26, 2022 / Metallic Minerals (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to report the final set of assay results from its 2021 drilling completed at the Company’s 100%-owned, 166-square-kilometer Keno Silver Project located within the historic, high-grade Keno Hill silver district in Canada’s Yukon Territory. These drill tests were targeted at extending high-grade silver-gold-lead-zinc mineralization at the Formo deposit in the West Keno target area, one of several advanced stage targets moving toward an initial NI 43-101 mineral resource estimate for the Keno Silver project.

Highlights

The Formo target area hosts multiple parallel vein structures and mineralized zones within a broader structural envelope that remains open to expansion and shows excellent opportunities for resource delineation. Results from 2021 drilling intercepted extremely high grades, including FOR21-05 returning three intervals over 1,000 g/t silver Ag Eq and FOR21-06 with 3,229.9 g/t Ag Eq over 1.0 m within an interval of 4.6 m of 938.3 g/t Ag Eq (see Table 1 below). Both zones were encountered at shallow depths of less than 150 m down hole and these intersections extend high-grade silver mineralization below the 2020 drilling and the historically productive Formo mine. Geophysical and geochemical surveys, enhanced by the 2021 fieldwork, demonstrate significant resource potential opportunities in the Formo target area.

The Formo vein structure lies at the intersection of a north-easterly extension of the Bermingham-Calumet and the Elsa vein system, which are hosts to the some of the largest historic producing mines and current resources and reserves in the Keno Hill silver district (see Figure 1). The Formo Target remains open for expansion along trend and down dip and has several untested surface targets.

Metallic Minerals President, Scott Petsel, stated, “These exciting results from this most recent follow-up drilling program at the Formo target area in the western Keno Hill District, combined with the exceptional 2020 drill results, demonstrate the potential to delineate significant, high-grade resources at the Keno Silver project. Our team has done remarkable work to build on our understanding of the geology and the important controls to mineralization in the highly productive Keno Hill silver district.”

“As we prepare to embark on our upcoming exploration campaign, we recognize the importance of moving toward the definition of an inaugural resource estimates at Keno Silver, with Formo and Caribou being the two most advanced in that regard. We are also very focused on and enthusiastic about conducting robust follow-up work on our recent discoveries of both high-grade silver veins and bulk mineable mineralization in the East Keno area. We expect to provide updates with respect to planned programs at both Keno Silver and the La Plata project in Colorado over the coming weeks and look forward to meeting with investors during the upcoming Prospectors and Developers Conference in Toronto in mid-June.”

Upcoming Events

PDAC 2022 – Metallic will join fellow Metallic Group members at PDAC in Toronto, May 13-15 (Booth IE2851).

Yukon Property Tours & Conference – Metallic will be in Dawson City June 20-24 for the 2022 Yukon Property Tours

Figure 1. Keno Silver Project

West Keno Exploration Program and Formo Target

The Western Keno Hill district is host to the largest historic production and current resources in the prolific Keno Hill silver district. The Formo target is located at the intersection of a north-easterly structural zone extending from the Hector-Calumet mine, which was the largest producer in the district producing nearly 100 million ounces of silver and the Elsa structural trend, which was the second largest silver producer in the district (see Figure 2). The historic Formo mine produced silver at various times since the 1930s from high-grade vein structures that graded an average of over 5,000 g/t silver1. The majority of this historic production came from an open pit located alongside of the Silver Trail highway between the Elsa townsite and Keno City.

Metallic Minerals’ exploration efforts at the Formo target area have integrated recent drilling with surface and underground sampling into a 3D geologic model, along with multi-spectral studies and geophysical surveys covering the area (see Figure 3). In addition to the mineralization at the known Formo deposit, two new surface targets have been identified through surface soil and rock sampling along the same structural corridors that show potential to host high-grade and bulk tonnage Keno-style Ag-Au-Pb-Zn. The opportunity to significantly expand the known mineralization defined from underground sampling and surface drilling, as well as the potential to define new high-grade deposits along the main mineralized structural corridor, positions Formo as a top priority target for near-term resource definition at the Keno Silver project.

Table 1 – Significant Drill Results from 2020-2021 at the Formo Target Area

| DDH Hole ID | From (m) | To (m) | Width (m) | Ag Eq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| FOR21-05 | 92.7 | 115.5 | 22.8 | 219.5 | 69 | 0.4 | 0.30 | 2.07 |

| 94.6 | 95.1 | 0.5 | 1,657.8 | 25 | 17.0 | 0.01 | 0.44 | |

| 98.8 | 108 | 9.2 | 430.5 | 164 | 0.1 | 0.69 | 4.85 | |

| 102.4 | 103.1 | 0.7 | 1,408.8 | 361 | 0.0 | 2.17 | 20.09 | |

| 107 | 107.5 | 0.5 | 1,649.9 | 421 | 0.1 | 1.53 | 24.20 | |

| FOR21-06 | 96 | 97 | 1.0 | 221.8 | 155 | 0.0 | 0.45 | 1.03 |

| 111.6 | 123 | 11.4 | 413.7 | 234 | 0.0 | 1.97 | 2.07 | |

| 114.4 | 119 | 4.6 | 938.3 | 528 | 0.1 | 4.48 | 4.82 | |

| 116 | 117 | 1.0 | 3,229.9 | 1,978 | 0.4 | 13.09 | 14.97 | |

| 121.2 | 123 | 1.8 | 202.8 | 128 | 0.0 | 1.00 | 0.76 | |

| FOR-20-001 | 50.9 | 57 | 6.1 | 284.5 | 218 | 0.0 | 0.3 | 1.14 |

| including | 50.9 | 53.95 | 3.05 | 447.5 | 369 | 0.0 | 0.11 | 1.52 |

| FOR-20-002 | 49.45 | 52.3 | 2.85 | 48 | 22 | 0.0 | 0.18 | 0.39 |

| FOR-20-003 | 96 | 100.1 | 4.1 | 2,536.0 | 1,165 | 0.0 | 21.74 | 11.32 |

| including | 96 | 99 | 3.0 | 3,425.9 | 1,568 | 0.0 | 29.45 | 15.35 |

| FOR-20-004 | 89.8 | 95.9 | 6.1 | 367.6 | 225 | 0.0 | 2.04 | 1.35 |

| including | 91.8 | 93.7 | 1.9 | 698.4 | 454 | 0.0 | 3.48 | 2.32 |

| including | 93.2 | 93.7 | 0.5 | 1,083.6 | 601 | 0.0 | 7.33 | 4.25 |

| FOR-20-005 | 104.76 | 105.45 | 0.69 | 365.0 | 146 | 0.0 | 1.32 | 3.52 |

| 152.17 | 152.67 | 0.5 | 85.5 | 6 | 0.4 | 0.01 | 0.76 | |

| FOR-20-006 | 137.63 | 139.78 | 2.15 | 740.6 | 332 | 0.0 | 3.06 | 6.04 |

| including | 139.13 | 139.78 | 0.65 | 2,255.9 | 1,001 | 0.1 | 8.92 | 18.92 |

| FOR-20-007 | 98.1 | 98.65 | 0.55 | 77 | 12 | 0.0 | 0.12 | 1.2 |

| 107.65 | 108.15 | 0.5 | 86.1 | 46 | 0.2 | 0.24 | 0.34 | |

| 125.55 | 126.05 | 0.5 | 75.5 | 1 | 0.2 | 0 | 1.23 | |

| FOR-20-008 | 116.45 | 116.95 | 0.5 | 289.2 | 178 | 0.1 | 2.2 | 0.42 |

| including | 168.6 | 169.6 | 1.0 | 79.2 | 57 | 0.0 | 0.25 | 0.25 |

| FOR-20-009 | 69.7 | 70.14 | 0.44 | 67.4 | 15 | 0.0 | 0.21 | 0.91 |

| 113.2 | 113.7 | 0.5 | 211.6 | 26 | 0.4 | 0.06 | 3 | |

| FOR-20-011 | 55.3 | 59.7 | 4.4 | 75.6 | 3 | 0.0 | 0.05 | 0.04 |

| including | 57.7 | 58.6 | 0.9 | 307.7 | 195 | 0.0 | 2.79 | 0.1 |

Silver equivalent (Ag Eq) values assume Ag $19/oz, Pb $1.05/lb, Zn $1.30/lb, Au $1,800/oz and 100% metallurgical recovery. Sample intervals are based on measured drill intersect lengths and are believed to be representative of true widths.

Figure 2 – West Keno Plan Map

Figure 3 – Formo Vein Long Section (Looking NW)

About Metallic Minerals

Metallic Minerals Corp. is a growth-stage exploration company, focused on high-grade silver and gold projects in underexplored, brownfields mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to exploration in the Keno Hill silver district, La Plata silver-gold-copper district, and Klondike gold district through new discoveries and advancing resources to development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with nearly 300 million ounces of high-grade silver in past production and current M&I resources. In addition, exploration at the recently acquired La Plata silver-gold-copper project in southwestern Colorado is targeting a silver and gold-enriched copper porphyry and adjacent high-grade silver and gold epithermal systems. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s Minto copper district, and Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com

Email: cackerman@mmgsilver.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals’ mineral properties has been reviewed and approved by Scott Petsel, P.Geo., President, who is a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Assurance / Quality Control

All samples were assayed by 36 Element Aqua Regia Digestion ICP-MS methods at Bureau Veritas labs in Vancouver. with sample preparation in Whitehorse, Yukon and geochemical analysis in Vancouver, British Columbia. Samples with over limit silver and gold were re-analyzed using a 30-gram fire assay fusion with a gravimetric finish. Over-limit lead and zinc samples were analyzed by multi-acid digestion and atomic absorption spectrometry. All results have passed the QAQC screening by the lab and the company utilized a quality control and quality assurance protocol for the project, including blank, duplicate, and standard reference samples.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

VANCOUVER, BC / ACCESSWIRE / May 18, 2022 / Metallic Minerals Corp. (TSX-V:MMG) (OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce a non-brokered private placement offering of 9,600,000 flow-through units (“Units”) at a price of $0.42 per Unit for aggregate gross proceeds of $4,032,000 (the “Offering”), which represents a premium to the May 17th closing price of the Company’s common shares on the TSX Venture Exchange (the “Exchange”). The Units consist of a flow-through share and a half warrant and are being issued as part of a charity arrangement structured by Peartree Securities Inc.

All net proceeds from the Offering are planned to be used to incur Canadian Exploration Expenses (“CEE”) under the Income Tax Act (Canada) primarily at Metallic Minerals’ Keno Silver project in the historic, high-grade Keno Hill Silver District in Canada’s Yukon Territory.

Greg Johnson, CEO & Chairman, stated, “We are very pleased to add these new investors to our supportive shareholder base and are in a position to complete important follow-up programs at the Company’s Keno Silver and the La Plata projects, using a combination of existing funding and new flow-through funds. We remain positive on the underlying fundamentals for commodities as the current cycle continues to build and look forward to providing additional project updates as our exploration programs get underway.”

Each whole share purchase warrant is exercisable into one additional common share of the Company at a price of $0.50 per share for a period of 30 months from the date of closing. Subject to approval by the Exchange, if the closing share price five (5) trading days prior to the end of the 30-month warrant period is at or below $0.50, the Company shall, upon written request by a warrant holder, extend expiry of such warrants for an additional six (6) months.

Closing of the Offering is expected on or about June 8, 2022, subject to certain customary conditions, including, but not limited to, acceptance of the Exchange. All securities issued under the Offering will be subject to a statutory hold period of four months plus a day following the date of closing.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

About Metallic Minerals

Metallic Minerals Corp. is an exploration and development stage company, focused on silver, gold and copper in the high-grade Keno Hill and La Plata mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources and advancing projects toward development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. In addition, the Company recently announced the inaugural resource estimate for the La Plata silver-gold-copper project in southwestern Colorado. All of the districts in which the Company works have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s Minto copper district, and Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com

Phone: 604-629-7800

Email: cackerman@mmgsilver.com

Toll Free: 1-888-570-4420

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding the completion of the financing and the gross proceeds raised therefrom, the use of proceeds from the financing and their qualification as CEE, the date of closing of the financing, potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, trends in commodities prices and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

VANCOUVER, BC / ACCESSWIRE / May 4, 2022 / Metallic Minerals (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to announce the creation of a dedicated Community & First Nations Relations team for the Metallic Group of Companies and the appointment of Lindsay Wilson to the role of Manager, Community and Investor Relations. Ms. Wilson will be working alongside Lauren Blackburn, the Company’s Yukon-based Regulatory & Permitting Manager, in further strengthening our relationships with First Nations, local communities and governments.

The Metallic Group is well established in the Yukon with multiple projects under development by member companies. The Group employs dedicated personnel in Whitehorse, who are long-time residents of the Yukon and, as such, have an affinity for and understanding of its people, its history and its robust mineral endowment. Ms. Blackburn has been with Metallic Minerals and the Metallic Group since its founding and has taken a leading role in the Company’s community, permitting and regulatory initiatives. The addition of Ms. Wilson greatly increases our capacity to build meaningful and long-lasting and mutually beneficial partnerships in keeping with our strong commitment to environmental, social, and governance (“ESG”) aspects of the resource sector. The Metallic Group is committed to applying best industry practices to exploration and to make positive contributions in the Territory and the specific communities in which we work.

Lauren Blackburn – Manager, Regulatory and Permitting

Ms. Blackburn has over 15 years of Yukon-based experience in the mineral exploration sector focused on the exploration and development of early to advanced-stage silver, gold, and base metal deposits. Her primary concentration has been in northern Canada where she has garnered a dynamic skill set that includes expertise in the exploration process, permitting, lands management, regulatory lobbying, land-use planning and community engagement. Ms. Blackburn is highly involved in Territorial legislation and policy review, permitting activities and assists in evaluation of potential project acquisitions and strategic development.

Lindsay Wilson – Manager, Community & Investor Relations

A member of the Snuneymuxw First Nation on Vancouver Island, Ms. Wilson is focused on incorporating traditional ways of being into her work within the resource sector and seeking to develop sustainable and credible partnerships within the communities that she works. Ms. Wilson has a comprehensive background in indigenous studies and public relations, alongside practical experience in the mineral resource sector. Having worked previously in the Yukon with the Yukon Mining Alliance, Ms. Wilson is excited about the opportunity to return to work in the Yukon and looking forward to reconnecting with the communities there.

Arctic Indigenous Investment Conference (AIIC)

The Metallic Group Community and First Nations Team will be attending the AIIC on May 4th & 5th in Whitehorse, Yukon.

Connecting globally – through a hybrid (in-person & virtual) experience – AIIC 2022 will highlight and promote indigenous development corporations and businesses in the northern economy, alongside the north’s business community and colleagues across sectors. The goals of AIIC 2022 are to support economic reconciliation and growth, and youth entrepreneurship by forging new and stronger relationships, advancing meaningful partnerships, and connecting people across the arctic. Indigenous development corporations and businesses play a key role across northern Canada. These efforts are supported when we stand together with a collaborative voice for business, northern investment and our citizens, to ensure a diverse and prosperous economy, community and future.

About Metallic Minerals

Metallic Minerals Corp. is an exploration and development stage company, focused on silver, gold and copper in the high-grade Keno Hill and La Plata mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources and advancing projects toward development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. In addition, the Company recently announced the inaugural resource estimate for the La Plata silver-gold-copper project in southwestern Colorado. All of the districts in which the Company works have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon’s Minto copper district, and Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com

Email: cackerman@mmgsilver.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/700071/Metallic-Minerals-and-Metallic-Group-of-Companies-Expands-Community-and-First-Nations-Relations-Team-with-Dedicated-Community-Relations-Manager

VANCOUVER, BC / ACCESSWIRE / May 4, 2022 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company“) is pleased to announce the creation of a dedicated Community & First Nations Relations Team for the Metallic Group of Companies and the appointment of Lindsay Wilson to the role of Manager, Community and Investor Relations. Ms. Wilson will be working alongside Lauren Blackburn, the Company’s Yukon-based Regulatory & Permitting Manager, in further strengthening our relationships with First Nations, local communities and governments.

The Metallic Group is well established in the Yukon with multiple projects under development by member companies. The Group employs dedicated personnel in Whitehorse, who are long-time residents of the Yukon and, as such, have an affinity for and understanding of its people, its history and its robust mineral endowment. Ms. Blackburn has been with Metallic Minerals and the Metallic Group since its founding and has taken a leading role in the Company’s community, permitting and regulatory initiatives. The addition of Ms. Wilson greatly increases our capacity to build meaningful and long-lasting and mutually beneficial partnerships in keeping with our strong commitment to environmental, social, and governance (“ESG”) aspects of the resource sector. The Metallic Group is committed to applying best industry practices to exploration and to make positive contributions in the Territory and the specific communities in which we work.

Lauren Blackburn – Manager, Regulatory and Permitting

Ms. Blackburn has over 15 years of Yukon-based experience in the mineral exploration sector focused on the exploration and development of early to advanced-stage silver, gold, and base metal deposits. Her primary concentration has been in northern Canada where she has garnered a dynamic skill set that includes expertise in the exploration process, permitting, lands management, regulatory lobbying, land-use planning and community engagement. Ms. Blackburn is highly involved in Territorial legislation and policy review, permitting activities and assists in evaluation of potential project acquisitions and strategic development.

Lindsay Wilson – Manager, Community & Investor Relations

A member of the Snuneymuxw First Nation on Vancouver Island, Ms. Wilson is focused on incorporating traditional ways of being into her work within the resource sector and seeking to develop sustainable and credible partnerships within the communities that she works. Ms. Wilson has a comprehensive background in indigenous studies and public relations, alongside practical experience in the mineral resource sector. Having worked previously in the Yukon with the Yukon Mining Alliance, Ms. Wilson is excited about the opportunity to return to work in the Yukon and looking forward to reconnecting with the communities there.

Arctic Indigenous Investment Conference (AIIC)

The Metallic Group Community and First Nations Team will be attending the AIIC on May 4th & 5th in Whitehorse, Yukon.

Connecting globally – through a hybrid (in-person & virtual) experience – AIIC 2022 will highlight and promote indigenous development corporations and businesses in the northern economy, alongside the north’s business community and colleagues across sectors. The goals of AIIC 2022 are to support economic reconciliation and growth, and youth entrepreneurship by forging new and stronger relationships, advancing meaningful partnerships, and connecting people across the arctic. Indigenous development corporations and businesses play a key role across northern Canada. These efforts are supported when we stand together with a collaborative voice for business, northern investment and our citizens, to ensure a diverse and prosperous economy, community and future.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration and development companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Granite Creek Copper in the Yukon’s Minto copper district, Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, and Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana and Kluane district in the Yukon. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration and development using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. Members of the Metallic Group have been recognized as recipients of awards for excellence in environmental stewardship demonstrating commitment to responsible resource development and appropriate ESG practices. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB, and Frankfurt stock exchanges.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project is south of the high-grade Minto copper-gold mine, operated by Minto Metals Corp., and features a high-grade copper, gold and silver resource with excellent access to road, power and port infrastructure. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Twitter: @yukoncopper

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/700049/Granite-Creek-Copper-and-Metallic-Group-of-Companies-Expand-Community-and-First-Nations-Relations-Team-with-Dedicated-Community-Relations-Manager

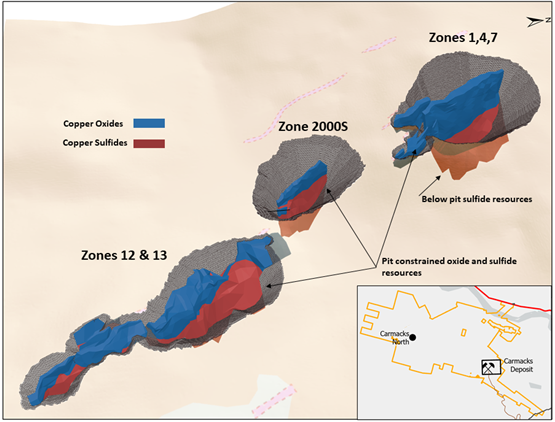

VANCOUVER, BC / ACCESSWIRE / May 3, 2022 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company“) is pleased to announce that it has retained SGS to complete an updated Preliminary Economic Assessment (“PEA”) on the Carmacks project. The PEA will use the 2022 Resource Estimate (Table 1), consisting of 36.2 million tonnes (Mt) in Measured and Indicated categories (M&I), grading 1.07% CuEq (0.81% Cu, 0.26g/t Au, 3.23g/t Ag and 0.011% Mo) for a total of 651 million pounds (Mlbs) of contained M&I copper and an additional 38 Mlbs Cu Inferred as the main input. Building off a 2017 PEA(1), the updated study will encompass the following:

Timothy Johnson, Granite Creek President & CEO, stated, “The launch of the updated Preliminary Economic Assessment study marks a major milestone in the development of the Carmacks deposit at a time when commodities demand is seeing rapid growth. The Carmacks project is well-positioned by its location, access to infrastructure, and proximity to the operating, high-grade Minto mine just to the north. Both copper and molybdenum have been deemed by the Canadian government to be ‘critical minerals‘ based on their role in the transition to a low-carbon economy which we expect will provide prolonged price strength well into the future. We look forward to continuing to bring positive news as we develop this high-grade copper project.”

Upcoming Events

OTC Markets Mining and Metals Virtual Conference – Tim Johnson, President & CEO, will present live at VirtualInvestorConferences.com on May 5th, 2022 at 10am PT | 1pm ET. To register, click here.

Vancouver Resource Investment Conference – Granite Creek Copper will join fellow members of the Metallic Group of Companies at the 2022 VRIC event at the Vancouver Convention Centre on May 17-18. Visit us in Booth 111.

2022 Technical Report Filing

Granite Creek also announces that further to its news release dated March 15, 2022 it has filed on SEDAR a National Instrument 43-101 technical report (the “Technical Report”) for the Carmacks project, located in the Yukon, Canada.

The report, entitled “Technical Report on the Updated Mineral Resource Estimates for the Carmacks Cu-Au-Ag Project Near Carmacks, Yukon, Canada”, has an effective date of February 25, 2022. The Technical Report was authored Allan Armitage Ph.D., P.Geo of SGS Geological Services(“SGS”) an independent Qualified Person and was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

The Technical Report is available under the Company’s profile at www.sedar.com and will also be available on the Company’s website at www.gcxcopper.com.

Table 1 – 2022 Carmacks Copper Project Mineral Resources

Cu=copper, Au=gold, Mo=molybdenum, Ag=silver, Mt=millions of tonnes, Mlbs=millions of pounds, klbs=thousands of pounds, koz=thousands of ounces. Mineral Resources are reported using the 2014 CIM Definition Standards. Mineral Resources are reported within a conceptual constraining pit shell that includes the following input parameters: Metal prices of $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo and pit slope angles that vary from 35° for overburden to 55°for granodiorite host. Metal prices are in US$. Metallurgical recoveries reflective of prior test work that averages: 85% Cu, 85% Au, 65% Ag in the oxide domain and 90% Cu, 76% Au, 65% Ag in the sulphide domain. Mo recovery is assumed to be 70% in both oxide and sulphide domain. Tonnes are metric tonnes, with Cu and Mo grades as percentages and Au and Ag grades as gram per tonne units. Cu and Mo metal content is reported in lb and Au and Ag content is reported in troy oz. Totals and Metal content may not sum due to rounding and significant digits used in calculations. Cu Eq calculation is based on 100% recovery of all metals using the same metal prices used in the resource calculation: $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo.

Figure 1 – Oblique view of 2022 resources and proposed pits (total strike length of 2,950 m)

Qualified Persons

The Carmacks project 2022 Resource Estimate was prepared by Allan Armitage, P.Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of February 25, 2022. Armitage conducted a site visit to the property on November 9, 2021.

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Ms. James is a Senior Geologist with TruePoint Exploration and a Project Manager at Carmacks.

1PEA: “NI 43-101 Preliminary Economic Assessment Technical Report on the Carmacks Project, Yukon, Canada” Effective Date 12 October 2016. Report Date: 25 November 2016. SEDAR Filing Date: 9 February 2017

1News Release: “Copper North Expands Oxide Mineral resources at Carmacks” Published on SEDAR 9 April 2018.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project is on trend with the high-grade Minto copper-gold mine, operated by Minto Metals Corp., to the north, and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Twitter: @yukoncopper

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/699894/Granite-Creek-Copper-Retains-SGS-Canada-for-Updated-Preliminary-Economic-Assessment-on-High-Grade-Carmacks-Copper-Gold-Silver-Project-in-Yukon-Canada

VANCOUVER, BC / ACCESSWIRE / April 27, 2022 / Group Ten Metals, Inc. (TSXV:PGE) (OTCQB:PGEZF) (FSE:5D32) (the “Company” or “Group Ten”) is very pleased to announce the appointment of Dr. Danie Grobler to the role of Vice-President, Exploration and Mr. Albie Brits to the role of Senior Geologist, as of May 1st, 2022. Dr. Grobler and Mr. Brits both have extensive senior level experience from more than two decades of advancing major deposits on the northern limb of the Bushveld Igneous Complex in South Africa including, most recently, at Ivanhoe Mines’ Platreef PGE-Ni-Cu-Au mine, which is now in construction.

The addition of Dr. Grobler and Mr. Brits to the Group Ten Metals team is an important step in the advancement of the Company’s Stillwater West project as a major U.S.-based source of critical minerals – nickel, palladium, copper, cobalt, platinum, and rhodium – in Montana’s productive and famously metal-rich Stilllwater Igneous Complex. Their expertise in similar geologic models from the giant mines of South Africa’s Bushveld Igneous Complex is expected to drive expansion of Group Ten’s inaugural NI 43-101 resource estimates, announced October 2021, which delineated five deposits totaling 1.1 billion pounds of nickel, copper and cobalt and 2.4 million ounces of palladium, platinum, rhodium and gold in Platreef-style mineralization in the lower Stillwater Igneous Complex. All deposits are open for expansion at depth and along trend within the 12-kilometer core project area, and more broadly within earlier stage targets across the 32-kilometer span of the Stillwater West PGE-Ni-Cu-Co + Au project.

Dr. Danie Grobler has more than 25 years of industry experience as an exploration and mine geologist including most recently as Head of Geology and Exploration for Ivanplats Pty Ltd (an Ivanhoe Mines company) where since 2011 he led the delineation and advancement of Ivanhoe’s world-class Platreef PGE-Ni-Cu mine on the northern limb of the Bushveld complex. Including previous experience as Project Manager at Platinum Group Metals’ at their project on the Bushveld’s northern limb, Dr. Grobler brings decades of senior level experience focused on the discovery and mining of battery and platinum group metals in ultramafic magmatic systems and has published numerous papers on Ivanhoe’s Flatreef deposit.

Dr. Danie Grobler commented, “The geological parallels between Stillwater West and the Platreef/Flatreef-type mineralized ore bodies in South Africa are truly exceptional. I am very enthusiastic to be joining the highly experienced Group Ten Metals team and am excited to be able to apply my extensive Bushveld and Platreef experience at Stillwater West, with a focus on expanding the recently announced mineral resource. Utilizing the wealth of exploration data available, our immediate goal will be to continue to identify and grow shallow, continuous high-grade Platreef-style PGE-Ni-Cu mineralization within the lower part of the Stillwater Igneous Complex.”

Mr. Albie Brits has more than 28 years focused on the advancement of projects from grassroots stage to advanced exploration and full-scale mining operations, starting at Gold Fields of South Africa and including, most recently, the role of Senior Geologist and Manager Project Geology for Ivanplats Pty Ltd (an Ivanhoe Mines company). Focused on exploration for platinum group and base metals on the northern limb of the Bushveld complex since 2001, Mr. Brits was part of the team that discovered Ivanhoe’s Flatreef deposit. He has extensive experience in the exploration of mafic-ultramafic magmatic systems and has presented and co-authored numerous papers on the Flatreef deposit.

Mr. Brits commented, “I am very excited to be joining Group Ten’s excellent Stillwater West team and looking forward to applying my experience developing geological and structural models for the feasibility study of the Platreef project to drive new success in Montana. The Stillwater district is truly world class and Stillwater West shows remarkable expansion potential based on the geologic similarities with the Bushveld complex.”https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%253B1480989%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%253B1480989%2522%252C%2522wiki_topics%2522%253A%2522Platinum_group%253BBushveld_Igneous_Complex%253BIvanhoe_Mines%253BStillwater_igneous_complex%253BMontana%253BExploration%253BSouth_Africa%253BNatural_resource%2522%252C%2522lmsid%2522%253A%2522a077000000LnOyOAAV%2522%252C%2522revsp%2522%253A%2522accesswire.ca%2522%252C%2522lpstaid%2522%253A%252231c0ceeb-bd8e-34f0-832d-e67ffef5ff62%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

Michael Rowley, President and CEO, commented, “Developments at the Stillwater Igneous Complex have generally paralleled those at the Bushveld Igneous Complex, highlighting their significant geologic similarities. For example, the discovery and large-scale production of platinum group metals from the high-grade Merensky reef deposit in the Bushveld preceded the discovery and mining of the high-grade J-M Reef deposit at Stillwater by many decades. The more recent development of the Platreef deposits, starting with Anglo American’s bulk mineable PGE-Ni-Cu Mogalakwena mines in 1993 and continuing today with Ivanhoe’s Platreef mine, have demonstrated the world-class nature of these bulk-tonnage, critical mineral systems within the Bushveld complex. Our recent discoveries of comparable bulk-tonnage Platreef-style systems at Stillwater West demonstrate the continuation of the geologic parallels between the systems and highlight the incredible potential value creation for Group Ten Metals.”

Mr. Rowley continued “The addition of two such renowned experts, literally among the very top globally in large-scale critical mineral systems, is a watershed moment in the advancement of the Stillwater West project. Their unique expertise and perspective, earned from decades of work on world-class systems in the Bushveld, will directly complement the knowledge of our existing team which has decades of experience in the Stillwater district. We look forward to further announcements including our 2022 exploration plans and further assay results from our 2021 resource expansion drill campaign in the very near term.”

Upcoming News and Events

Live Webinar with Q&A

Group Ten will be hosting a live webinar on Wednesday, May 4th at 10am PT (1PM ET). To register click here or the thumbnail.

OTC Markets Metals and Mining Conference Virtual Conference

Michael Rowley will present on Thursday, May 5 at 10:30am PT (1:30PM ET). To register, click here.

About Stillwater West

Group Ten is advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions Group Ten as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater’s PGE mines in south-central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. Group Ten’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex2. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 12-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available on the company’s profile at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Group Ten Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/699034/Group-Ten-Metals-Appoints-Danie-Grobler-as-Vice-President-Exploration-and-Albie-Brits-as-Senior-Geologist-to-Advance-the-Stillwater-West-Critical-Minerals-Project-in-Montana-USA

VANCOUVER, BC / ACCESSWIRE / April 26, 2022 / Metallic Minerals (TSXV:MMG)(OTCQB:MMNGF) (“Metallic Minerals“, , or the “Company“) is pleased to announce the first National Instrument 43-101 (“NI 43-101”) mineral resource estimate (the “2022 Resource Estimate”) on the Company’s La Plata project, which focuses on the central Allard copper-silver porphyry deposit. The Company acquired the project in 2019 and with confirmatory drilling and sampling has quickly generated a NI 43-101 compliant resource estimate consisting of 115.7 million tonnes at an average grade of 0.39% copper equivalent (“Cu Eq”) (0.35% Cu and 4.02 g/t Ag) using a 0.25% Cu Eq cut-off grade.

The Allard deposit remains open to significant expansion within the resource area. In addition, the greater La Plata silver-gold-copper project remains underexplored and open to new discoveries of both additional copper porphyry centers as well as high-grade epithermal silver and gold systems. A robust campaign of follow-up drilling and geophysical surveys is planned for the project in 2022 with the objective of expanding the 2022 Resource and advancing new targets.

Metallic Minerals will host a live webinar on Wednesday April 27th at 10am PT (1pm ET) to discuss the 2022 Resource, current activities, and upcoming plans for the La Plata and Keno Silver projects. To register, click here or the thumbnail.

Highlights

Scott Petsel, Metallic Minerals’ President, states, “This inaugural resource is a major milestone for Metallic Minerals and the La Plata project and puts us on the map in the U.S. with a new resource containing important base and precious metals, that fall under the US government’s critical minerals strategy, in a past-producing yet underexplored district in the southwestern U.S. With 15 million ounces of silver and nearly a billion pounds of copper, at recent metal prices of over $25/oz silver and $4.50/lb copper, the Company has demonstrated the exceptional value opportunity of the La Plata project for Metallic Minerals shareholders.”

Mr. Petsel continued, “We feel this is just the start for us at La Plata and it validates our strategy of identifying and acquiring high-quality district-scale assets during lows in the metal price cycle and applying modern, systematic exploration techniques as a means of value creation. This is also the process we are seeing to fruition at our high-grade Keno Silver property in the Yukon, Canada. Work at La Plata in 2022 will focus on expanding this new resource and testing new priority target areas for porphyry and high-grade silver and gold mineralization.”

The 2022 Resource Estimate will be incorporated into an NI 43-101-compliant technical report for the La Plata project which will be available within 45 days.

Table 1 – La Plata Inferred Mineral Resource Estimate at a Base Case Cut-off Grade of 0.25% CuEq with Grade and Contained Metal Sensitivity Analysis at Various CuEq Cut-off Grades.

| Class | CuEq (%) | Tonnes | Cu | Ag | CuEq (%) | |||

| Cut-off | Grade (%) | Mlbs | Grade (g/t) | Ounces | Grade (%) | Mlbs | ||

| Inferred | 0.15 | 151,327,000 | 0.31 | 1,040 | 3.68 | 17,888,000 | 0.35 | 1,154 |

| Inferred | 0.2 | 142,378,000 | 0.32 | 1,008 | 3.77 | 17,273,000 | 0.36 | 1,118 |

| Inferred | 0.25 | 115,731,000 | 0.35 | 889 | 4.02 | 14,975,000 | 0.39 | 985 |

| Inferred | 0.3 | 86,986,000 | 0.38 | 733 | 4.31 | 12,056,000 | 0.42 | 810 |

| Inferred | 0.35 | 60,752,000 | 0.42 | 565 | 4.61 | 9,000,000 | 0.46 | 622 |

The 2022 Mineral Resource Estimate has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards – For Mineral Resources and Mineral Reserves (2014). The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% CuEq, based on metal prices of $3.60/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. Cu Eq calculations are based on 100% recovery of all metals using the same metal prices used for the resource calculation. All figures are rounded to reflect the relative accuracy of the estimate.

The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Figure 1 – La Plata Cross Section with Significant Drill Intervals and Mineralized Grade Shells

Sensitivity Analysis

In addition to the base case scenario at an economic cut-off grade of 0.25% Cu Eq, a sensitivity analysis is provided in Table 1 above, which demonstrates the variation in grade, tonnage and contained metal for the 2022 Resource Estimate at various cut-off grades. Different cut-off grades may be employed depending on variations in prevailing metal prices and mining costs.

Project Review and Exploration Update

The road accessible La Plata project covers 33 km2 approximately 26 km northwest of Durango, Colorado within the historic high-grade La Plata mining district located at the southwest end of the prolific Colorado Mineral Belt. Mineralization is related to a large-scale precious-metals-rich porphyry copper system with associated high-grade silver and gold epithermal vein and replacement deposits.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from vein structures, replacement bodies and breccia zones at over 90 individual mines and prospects1. Historical production from some of these high-grade structures exceeded 1,000 grams per tonne (“g/t”) silver and over 15 g/t gold with some of the richest deposits delivering true bonanza grades for silver and gold.

From the 1950s to 1970s, major miners including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge) explored in the La Plata district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization2. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

A total of 56 drill holes, totaling 15,200 m, have been drilled on the property since the 1950s which confirms the presence of a large-scale, multi-phase porphyry system with significant silver, gold and copper. This large-scale mineralized system is associated with a 10 km2, strong magnetic signature with intense hydrothermal alteration mapped in satellite based multispectral imaging.

The new 2022 Resource Estimate, at the Allard deposit, covers a relatively small part of the overall 33 km2 property. The deposit is steeply dipping and roughly tabular in shape, occurring over 1 km in length, 400 m in width with over 1 km in vertical extent based on drilling to date. The Allard deposit remains open to expansion in all directions.

The Allard deposit is a significant potential source of copper and silver, both important metals for the modernization and electrification of the economy. In addition, the broader La Plata property is known for Critical Minerals also important for the green energy revolution2. The resampling of hole 95-1 during the 2021 field season returned significant platinum and palladium assays (0.14 g/t platinum and 0.10 g/t palladium) associated with the Copper Hill target area east of the Allard resource area and corroborated historic accounts of its presence. Tellurium, another element on the critical mineral list, was a by-product of historic high-grade gold and silver production in the district. These and other important metals noted in the district will be evaluated as part of ongoing exploration of the project.

Work during the 2021 field season focused on the Allard target area with the completion 1,980 m of confirmation drilling, resampling of historical core and the resampling of the underground adit. Metallic Minerals is the first Company to complete significant exploration on the La Plata project in 50 years. Since acquisition, the Company has systematically explored the project by employing an array of modern exploration techniques. Through this work the Company has identified new high-grade epithermal-style targets and over 16 potential porphyry style mineralized zones across the broader property including at the adjacent Copper Hill target area, 1 km from the Allard deposit.

Planning for exploration work in 2022 is currently underway with a focus on resource expansion drilling, geophysics, and follow-up exploration on newly identified porphyry and high-grade silver and gold targets.

Estimation Methodology and Parameters

Completion of the 2022 Resource Estimate involved the assessment of a drill hole database, which included all data for surface and underground sampling completed through the fall of 2021, as well as a three-dimensional (“3D”) mineral resource model, a topographic surface model, models of the underground workings and underground channel samples, and available written reports. SGS used 56 drillholes and 15,200 m of drill data from 1959 to 2021 to delineate the Allard deposit in the 2022 Resource Estimate. All drill data and underground sampling completed by Metallic Minerals in 2021 were included in the 2022 Resource Estimate.

Inverse Distance squared restricted to a relevant underground mining mineralized domain was used to Interpolate grades for the main elements of interest including Cu (ppm) and Ag (g/t) into a block model. Composites of 3.05 m were used for the resource estimation with a 5 x 5 x 5-meter block size. A fixed specific gravity value of 2.65 g/cm3 is used to estimate the Mineral Resource tonnage from the block model volume and for waste density. While gold is seen associated with copper and silver in the deposit, historic assays for gold were limited and as such were not included in the estimate.

The mineral resources are presented undiluted and in situ (no minimum thickness), constrained by a continuous 3D wireframe model, and are considered to have reasonable prospects for eventual economic extraction. Based on a review of the project location and size, geometry and continuity of mineralization of the La Plata deposit, and its spatial distribution, it is envisioned that the La Plata deposit may be mined using a large-scale underground bulk mining method.

The base case cut-off grade of 0.25 % Cu Eq has been used to define Inferred underground resources on the La Plata deposits using bulk underground mining costs of US$5.30/tonne, US$11.50/tonne processing and G&A costs and assumed processing recoveries of 90% for Cu, 65% for Ag at long term metal prices of $3.60/lb Cu and $22.50/oz Ag. The constrained 2022 Resource Estimate grade blocks were quantified above the base case cut-off grade. At this base case economic cut-off grade the deposit shows good geologic and grade continuity.

The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that all or any part of the Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration.

About SGS Geological Services

SGS Geological Services has an experienced and respected mining team focused on the domestic and international mining industry. The team has considerable experience in estimation and modeling of deposits of all types and practical and theoretical experience having realized hundreds of assessments for clients. The SGS team consists of a multi-disciplinary group of qualified persons with a strong understanding of the disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects (2016), CIM Definition Standards – For Mineral Resources and Mineral Reserves (2014) and a strong understanding of the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines 2019.

About Metallic Minerals

Metallic Minerals Corp. is a growth-stage exploration Company, focused on high-grade silver and gold projects in underexplored, brownfields mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to exploration in the Keno Hill silver district, La Plata silver-gold-copper district, and Klondike gold district through new discoveries and advancing resources to development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. In addition, exploration at the recently acquired La Plata silver-gold-copper project in southwestern Colorado is targeting a silver and gold-enriched copper porphyry and adjacent high-grade silver and gold epithermal systems. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTCQB, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Foot notes

1) Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949; 2) Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports; 3) Christoffersen, Geological report on the Allard Copper-Silver-Gold-PGM deposit, La Plata Mining District, Durango, Colorado, 2005.

2) The US Geological Survey has released a list of 50 critical minerals that the USA economy requires for economic and national security.

Qualified Persons

The La Plata copper-silver project 2022 mineral resource estimate was prepared by Allan Armitage, P. Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of October 7, 2021. Armitage conducted a site visit to the property on August 13, 2021. Jeff Cary, CPG, a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Mr. Cary is a Senior Geologist and La Plata Project Manager for Metallic Minerals.

Quality Control and Quality Assurance

Quality assurance and quality control procedures for drilling completed by the Company and consultants to the Company in 2021 include the systematic insertion of duplicate, blank and standard samples, making up 12% of the sample stream. Drill core samples were sawn in half, labelled, placed in sealed bags and shipped directly to the Bureau Veritas preparation laboratory in their Sparks, Nevada facility and analyzed at the Burnaby, B.C. facility. All samples were analyzed using a 30 g multi-acid digestion with an ICP-ES/MS analysis. Samples with over limit gold, platinum or palladium were re-analyzed using a 30-gram fire assay fusion with an ICP-ES analysis. Over-limit copper and silver samples were analyzed by multi-acid digestion and atomic absorption spectrometry analysis. All results have passed the QAQC screening by the lab and the Company utilized a quality control and quality assurance protocol for the project, including blank, duplicate and standard reference samples.

Forward-Looking Statements