This press release corrects, replaces and entirely supersedes the prior version published on November 21, 2022 at 4:00 PM ET

VANCOUVER, BC / ACCESSWIRE / November 22, 2022 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company“) is pleased to announce results from an Induced Polarization (“IP”) survey conducted on the Company’s 100%-owned Carmacks copper-gold-silver project (“Carmacks” or the “Deposit”) in the Minto Copper District of central Yukon, Canada. The large, highly prospective, potential resource expansion targets identified adjacent to or near the proposed open pits warrant follow-up exploration in upcoming campaigns. The Company further announces it has closed the second and final tranche of the private placement financing described in a news release dated October 5, 2022.

President & CEO, Tim Johnson, stated, “These multiple new zones and targets adjacent to the conceptual open pits, as defined by the March NI 43-101 Mineral Resource Estimate update, further highlight the prospectivity of our Carmacks project. Our team continues to do excellent work at Carmacks and we are confident in our ability to expand known mineralization and make new discoveries in the lesser explored parts of the 176km2 project. The current focus is the completion of the upcoming PEA and we look forward to reporting on the robust economics of the Carmacks project in the near term.”

Survey Overview

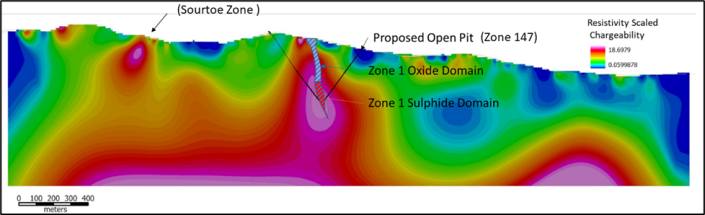

The first survey line (Line 1100S) was conducted over Zone 147 to investigate the correlation between known copper sulphide mineralization and the chargeability response from the Simcoe Geophysics deep-penetrating IP survey (see Figure 2 below). Subsequent survey lines were conducted over near-deposit target areas.

The results of the survey were enhanced by Resistivity Scaled Chargeability (“RSC”). RSC is a ratio of chargeability to resistivity (electrical properties measured by the IP survey) with the applied ratio determined by comparing various ratios to known mineralized bodies. The well-defined Zone 147 was used as a model to determine the RSC ratio that best fit the known mineralization. (See Figure 4 below).

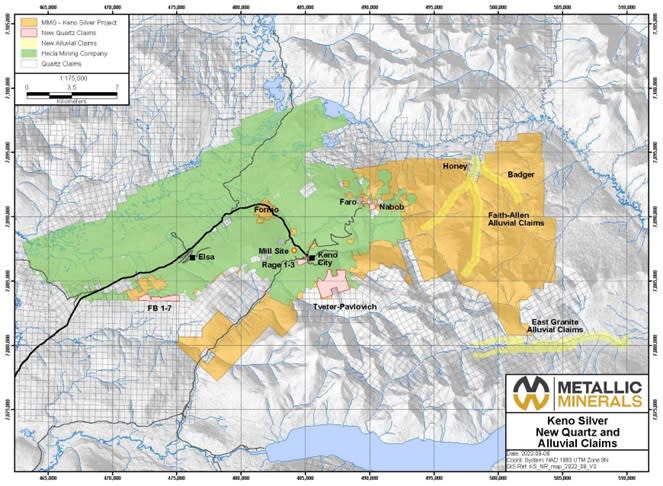

Figure 1 – Carmacks Copper-Gold Project Location

To view the full sized image (Click Here)

Figure 2 – Location of 2022 Simcoe IP Lines

To view the full sized image (Click Here)

Select Results

Line 1100S, surveyed over defined sulfide copper mineralization in Zone 147, established a model for the RSC response and identified a new zone ~920 meters to the west. This new zone, named the Sourtoe Zone, extends 200m south to Line 1300S. This zone has been investigated with soil samples and trenching, exposing visually mineralized material close to surface (results pending). The soils and trenching were designed to evaluate the geochemical and geological signatures of this near-surface IP response and their similarities to known mineralized zones.

Figure 3 – 2022 IP Survey Line 1100S

To view the full sized image (Click Here)

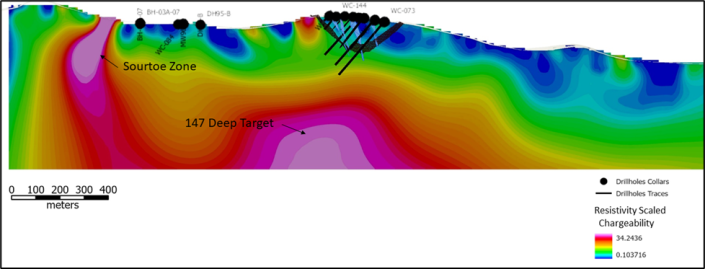

Line 1300S shows a potential continuation of the Sourtoe Zone, giving the zone a minimum of 200m strike length as well as a new, deeper target, the 147 Deep Target, several hundred meters below the proposed 147 pit.

Figure 4 – 2022 IP Survey Line 1300S

To view the full sized image (Click Here)

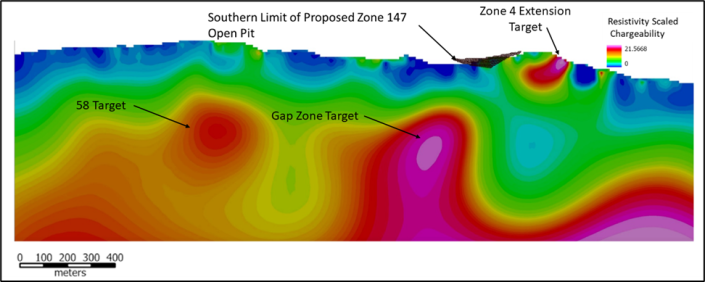

Line 1500S, designed to test the gap area between zones 2000 and 147 (the “Gap Zone”), was successful in identifying a significant anomaly that is offset to the west from both zones. 3D modeling of historic drilling shows that this target has not been drill tested and could represent a southern extension of the 147 zone. The Gap Zone Target is a top candidate for additional near-deposit exploration (See figure 4). Additionally, a new, deeper target area that appears on this line and extends to line 1700S has been identified as the 58 Target.

Figure 5 – 2022 IP Survey Line 1500S

To view the full sized image (Click Here)

Line 1700S, located 200m south of Line 1500S, shows the probable Gap Zone Target continuing southwards towards Zone 2000 as well as the newly identified 58 Target. Additionally, a shallow anomaly east of the proposed pit is identified as a possible continuation of Zone 4 proximal to the 147 pit.

Figure 6 – 2022 IP Survey Line 1700S

To view the full sized image (Click Here)

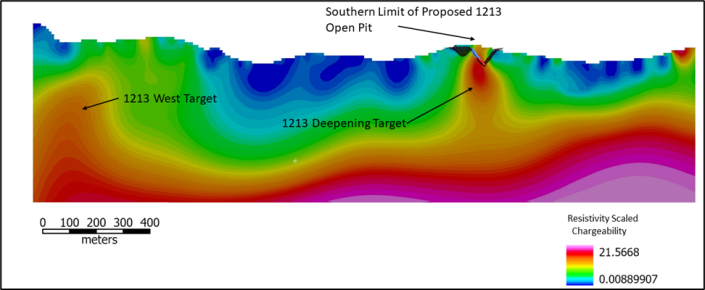

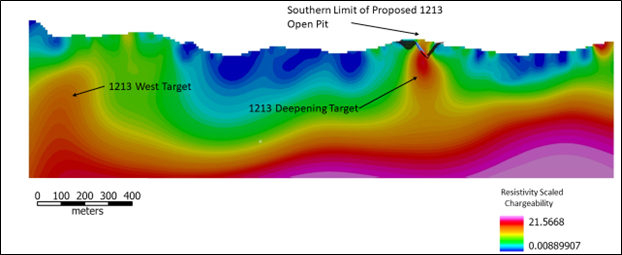

Line 3300S, the southern most line completed in this survey highlights the potentiality of the area underneath the proposed 1213 pit. Additionally, an anomaly on the western portion of the line has been identified as 1213 west target for further follow up. With the current pit design bottoming out at 180 meters there remains significant room to grow the resource in this area. Additional lines on 200m spacing over the 1213 area are planned for subsequent geophysical campaigns to further define the zone.

Figure 7 – 2022 IP Survey Line 3300S

To view the full sized image (Click Here)

Closing of Second Tranche of Private Placement

The Company announces the completion of the second tranche of the previously announced private placement offering (the “Offering”) which has raised aggregate proceeds of $148,700 through the issuance of a total of 1,142,667 non-flow-through units and 572,727 flow-through shares (the “Offering”). The Offering remains subject to the final approval of the TSX Venture Exchange.

The Company issued an aggregate of 1,933,273 flow-through shares (“FT shares”) at a price of $0.11 per share, to raise proceeds of $212,660.03 to incur Canadian Exploration Expenses (“CEE”) under the Income Tax Act (Canada). The Company raised a further $193,799.93 through the issuance of 2,583,999 non flow-through units at a price of $0.075 with each unit consisting of one common share of the Company and one warrant (a “Warrant”), with each Warrant allowing the holder to purchase one common share of the Company at a price of $0.10 per share for twenty-four months from the Closing Date of the Offering.

All shares issued under the Offering are subject to a hold period of four months and one day from issuance in accordance with applicable securities laws and the policies of the TSX Venture Exchange. The Shares have not been, and will not be, registered under the U.S. Securities Act or any U.S. state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. The Offering remains subject to the final approval of the TSX Venture Exchange.

The Company has agreed to pay finders’ fees totalling of $13,259 in cash or shares on a portion of the Private Placement and to issue 127,042 finder warrants. Each finder warrant is exercisable into one common share of the Company at a price of $0.10 per share for a period of 24 months from the date of closing.

The Offering constitutes a related party transaction within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”), as insiders of the Company subscribed for an aggregate of 600,001 units for proceeds of $48,500.08. The Company relied on the exemptions in Section 5.5(b) – Issuer Not Listed on Specified Markets from the formal valuation requirements of MI 61-101 and relied on the exemption in Section 5.7(1)(a) – Fair Market Value Not More Than 25 Per Cent of Market Capitalization from the minority shareholder approval requirements of MI 61-101. The Company did not file a material change report at least 21 days before the expected closing date of the Offering as the aforementioned insider participation had not been confirmed at that time and the Company wished to close the Offering as expeditiously as possible.

Qualified Persons

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release. Ms. James is a Senior Geologist with TruePoint Exploration and a Project Manager at Carmacks.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176km2 Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project hosts a National Instrument 43-101 compliant mineral resource estimate consisting of 36.2 million tonnes grading 0.81% Cu, 0.31 g/t Au and 3.41 g/t Ag on trend with Minto Metals’ high-grade Minto copper-gold mine and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Twitter: @yukoncopper

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/727695/CORRECTING-AND-REPLACING-Granite-Creek-Copper-Identifies-New-High-Priority-Resource-Expansion-Targets-at-Carmacks-Copper-Gold-Silver-Project-in-Yukon-Canada