Continued Growth and Larger Diamonds result in Net Income of $1,016,568

KELOWNA, BC / ACCESSWIRE / October 26, 2022 / Diamcor Mining Inc. (TSXV.DMI)(OTCQB:DMIFF)(FRA:DC3A), (“Diamcor” or, the “Company”) today reported its quarterly financial statements and related management discussion and analysis for the quarter ended September 30, 2022.

Highlights

- Operating results improved quarter over quarter with the tender and sale of 3,776.33 carats of rough diamonds for the interim period ended September 30, 2022 (3,061.70 – June 30, 2022), generating increased revenue of (USD) $2,099,951.32 ($557,559.22 – June 30, 2022), resulting in an average price of (USD) $556.08 per carat ($182.11 – June 30, 2022).

- The Company recorded a net income of $1,016,568 for the interim period ended September 30, 2022, as compared to a net loss of $918,953 in the previous interim period ended June 30, 2022

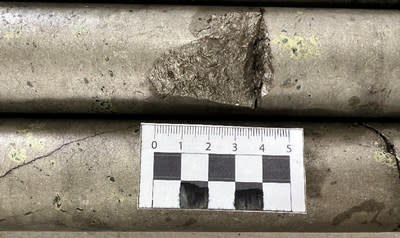

- The above total revenue and average price per carat was positively affected by the sale of a 59.35 carat gem quality special rough diamond.

- The Company’s focus during the period continued to be on managing costs and remaining supply chain delays, the optimization of operational hours to minimize the effects of national load-shedding in South Africa by the state-run national power supplier (Eskom), and continued refinements to processing plants and equipment aimed at sustaining increased processing volumes for the long-term.

“We are very pleased with the continued quarterly growth achieved again for the period ending September 30, 2022, and remain optimistic given the recent announcement of the delivery of 5,833 carats for the first tender and sale of this quarter” stated Mr. Dean Taylor, Diamcor CEO.

The Company’s recently filed financial statements for the quarter ended September 30, 2022, and accompanying management discussion and analysis can be viewed by interested parties on SEDAR at www.sedar.com.

About Diamcor Mining Inc.

Diamcor Mining Inc. is a fully reporting publicly traded junior diamond mining company which is listed on the TSX Venture Exchange under the symbol V.DMI, the OTCQB International under the symbol DMIFF, and on the Frankfurt Exchange under the symbol DC3A. The Company has a well-established operation in South Africa with a proven history of supplying rough diamonds to the world market. Diamcor has established a long-term strategic alliance with world famous luxury retailer Tiffany & Co. and is now in the final stages of developing the Krone-Endora at Venetia Project co-located with De Beer’s flagship Venetia mine.

About the Tiffany & Co. Alliance

The Company has established a long-term strategic alliance and first right of refusal with Tiffany & Co. Canada, a subsidiary of world famous New York based Tiffany & Co., to purchase up to 100% of the future production of rough diamonds from the Krone-Endora at Venetia Project at then current prices to be determined by the parties on an ongoing basis. In conjunction with this first right of refusal, Tiffany & Co. Canada also provided the Company with financing to advance the Project. Tiffany & Co. is owned by Moet Hennessy Louis Vuitton SE (LVMH), a publicly traded company which is listed on the Paris Stock Exchange (Euronext) under the symbol LVMH and on the OTC under the symbol LVMHF. For additional information on Tiffany & Co., please visit their website at www.tiffany.com.

About Krone-Endora at Venetia

In February 2011, Diamcor acquired the Krone-Endora at Venetia Project from De Beers Consolidated Mines Limited, consisting of the prospecting rights over the farms Krone 104 and Endora 66, which represent a combined surface area of approximately 5,888 hectares directly adjacent to De Beers’ flagship Venetia Diamond Mine in South Africa. On September 11, 2014, the Company announced that the South African Department of Mineral Resources had granted a Mining Right for the Krone-Endora at Venetia Project encompassing 657.71 hectares of the Project’s total area of 5,888 hectares. The Company has also submitted an application for a mining right over the remaining areas of the Project. The deposits which occur on the properties of Krone and Endora have been identified as a higher-grade “Alluvial” basal deposit which is covered by a lower-grade upper “Eluvial” deposit. The deposits are proposed to be the result of the direct-shift (in respect to the “Eluvial” deposit) and erosion (in respect to the “Alluvial” deposit) of material from the higher grounds of the adjacent Venetia Kimberlite areas. The deposits on Krone-Endora occur in two layers with a maximum total depth of approximately 15.0 metres from surface to bedrock, allowing for a very low-cost mining operation to be employed with the potential for near-term diamond production from a known high-quality source. Krone-Endora also benefits from the significant development of infrastructure and services already in place due to its location directly adjacent to the Venetia Mine.

Qualified Person Statement:

Mr. James P. Hawkins (B.Sc., P.Geo.), is Manager of Exploration & Special Projects for Diamcor Mining Inc., and the Qualified Person in accordance with National Instrument 43-101 responsible for overseeing the execution of Diamcor’s exploration programmes and a Member of the Association of Professional Engineers and Geoscientists of Alberta (“APEGA”). Mr. Hawkins has reviewed this press release and approved of its contents.

On behalf of the Board of Directors

Mr. Dean H. Taylor

President & CEO

Diamcor Mining Inc.

www.diamcormining.com

For further information contact:

Mr. Dean H. Taylor

Diamcor Mining Inc

DeanT@Diamcor.com

+1 250 862-3212

Mr. Rich Matthews

Integrous Communications

rmatthews@integcom.us

+1 (604) 355-7179

This press release contains certain forward-looking statements. While these forward-looking statements represent our best current judgement, they are subject to a variety of risks and uncertainties that are beyond the Company’s ability to control or predict and which could cause actual events or results to differ materially from those anticipated in such forward-looking statements. Further, the Company expressly disclaims any obligation to update any forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements.

WE SEEK SAFE HARBOUR

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Diamcor Mining Inc.