Vancouver, British Columbia–(Newsfile Corp. – January 16, 2026) – Elemental Royalty Corporation (TSXV: ELE) (NASDAQ: ELE) (“Elemental” or the “Company”) is pleased to announce the execution of a definitive option and earn-in agreement (the “Agreement”) covering three exploration licenses in the Bor Mining District of Serbia to a wholly owned subsidiary of BHP Group Limited (“BHP”). The three exploration-stage projects are currently held by Elemental’s wholly owned Serbian subsidiary Magma Resources doo (“Magma”) and BHP will have the option to acquire Magma in exchange for cash payments and by satisfying work commitments. Elemental will retain 2% NSR royalties on the projects as well as other considerations (see discussion of Commercial Terms below).

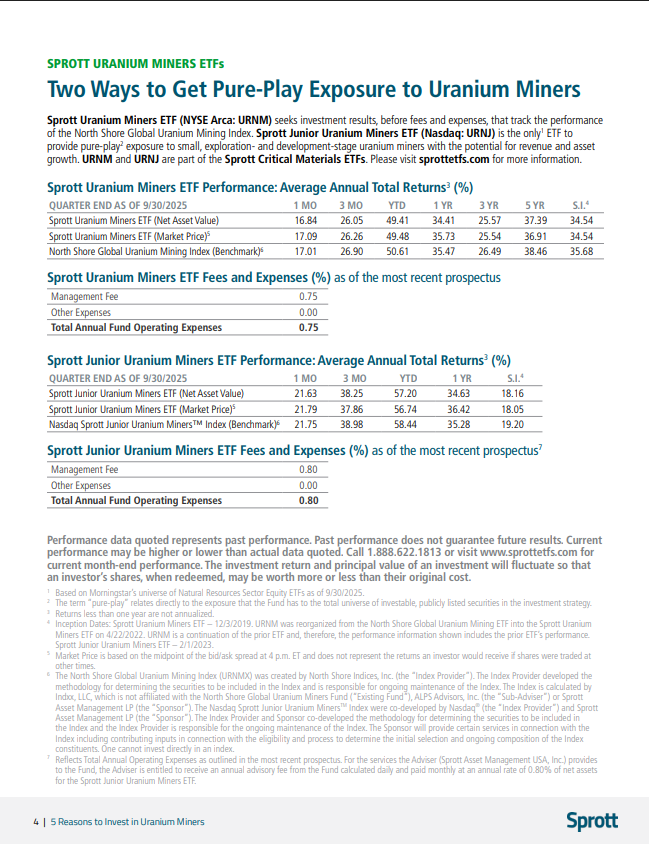

The Projects nicely complement Elemental’s other royalty interests in the Bor District, which include the Brestovac, Brestovac West, and Jasikovo East-Durlan Potok properties (see Figure 1). Brestovac is one of Elemental’s flagship royalties, covering Zijin Mining Group Co., Ltd’s producing Čukaru Peki copper-gold mine and recently discovered Malka Golaja copper-gold deposit. Zijin has been rapidly expanding its Čukaru Peki operations, increasing capacity at its current mill while continuing to add infrastructure for the development of the “Lower Zone” porphyry copper-gold deposit. Zijin’s published mineral resources and reserves for Čukaru Peki have also continued to grow rapidly, as shown in Zijin’s recent annual reports. The Lenovac projects, included in the BHP Agreement, cover the extension of the geologic trend that hosts the Čukaru Peki and Malka Golaja copper-gold deposits to the south.

Commercial Terms Overview. (all terms in USD)

Pursuant to the Agreement, BHP can acquire and retain a 100% interest in Magma and the Projects by satisfying each of the following conditions: (a) making a payment of $200,000 to the Company on the six-month anniversary of the Agreement, (b) annual payments of $200,000 to the Company on every anniversary of the Agreement until the earn-in is complete, and (c) completing $5,000,000 in cumulative exploration expenditures on the Projects within five years.

Upon BHP’s option exercise and earn-in, Elemental will retain a 2% NSR royalty interest on each Project. BHP may buy back up to a total of half a percent (0.5%) of the royalty in quarter percent (0.25%) increments; 0.25% can be purchased for $5,000,000 before the eighth anniversary of the agreement and 0.25% can be purchased for $5,000,000 before the 11th anniversary of the agreement. BHP will also make annual advance royalty payments of $200,000 to the Company until the commencement of commercial production.

Overview of the Projects.

The Bor Mining District in eastern Serbia has been one of Europe’s largest copper producers for over a century, where historic and current mining operations have been developed within a cluster of porphyry Cu-Au, high-sulfidation epithermal and skarn systems (including Bor, Veliki Krivelj, Majdanpek and Čukaru Peki; see Figure 1). The Elemental projects (the “Projects”) were originally acquired in 2023 and 2024 and are positioned along trend of Zijin Mining’s Bor and Čukaru Peki operations. Although there are still near-surface deposits being identified in the area, several recent discoveries have been made at relatively deep levels (such as Zijin’s Čukaru Peki and Dundee Precious Metals’ Čoka Rakita deposits) and require deep drilling. BHP’s deep-sensing geophysical capabilities and existing regional interest make them an ideal exploration partner for the Projects.

Elemental has acquired over 150 square kilometres of mineral rights along trend of the major copper and gold deposits within the Bor Mining District (see Figure 1). Previous exploration in the Bor District has typically targeted Upper Cretaceous andesite units, which host the majority of the epithermal and porphyry systems at the Bor Copper Complex and Čukaru Peki mine. However, new discoveries such as Dundee Precious Metals’ Čoka Rakita skarn deposit highlights that the different geologic settings and older Jurassic and Paleozoic host rocks are also prospective for additional discoveries. The Elemental Projects include both the traditionally prospective Upper Cretaceous andesite units of the Timok Magmatic Complex, as well as deeper host rock packages where several recent discoveries have been made.

The Lenovac North and South licenses lie directly south of the Zijin’s Brestovac license, which hosts the Čukaru Peki and the recently discovered Malka Golaja copper-gold deposits. Elemental’s Lenovac licenses cover the southern extension of this trend where a regional fault displaces the trend of mineralization and favorable host rocks to the southwest. The licenses are largely comprised of prospective Cretaceous volcanic and sedimentary units with some areas of Miocene cover.

The Durlan Istok license is located to the southeast of Zijin’s Majdanpek porphyry copper-gold mine and east of Čoka Marin, a high-grade polymetallic volcanogenic/epithermal deposit. The Durlan Istok license contains the stratigraphic sections that hosts Čoka Marin and the Čoka Rakita skarn further to the southwest.

Comments on adjacent or nearby Districts, Mines, and Deposits.

The districts, mines, and deposits discussed in this news release provide context for Elemental’s projects, which occur in similar geologic settings, but this is not necessarily indicative that the Company’s projects host similar tonnages or grades of mineralization.

North American Investor Relations

Elemental has retained the services of Renmark Financial Communications Inc. to handle its investor relations activities in North America. In consideration of the services to be provided, the monthly fees incurred by Elemental will be a cash consideration of up to C$9,000, starting January 1, 2026, for a period of seven months ending on July 31, 2026, and monthly thereafter. Renmark Financial Communications does not have any interest, directly or indirectly, in Elemental or its securities, or any right or intent to acquire such an interest.

David M. Cole

CEO and Director

For more information, please contact:

| David M. Cole | info@elementalroyalty.com |

| CEO | |

| Tara Vivian-Neal | info@elementalroyalty.com |

| Investor Relations |

(TSXV: ELE) (NASDAQ: ELE) | ISIN: CA28620K1066 | CUSIP: 28620K

About Elemental Royalty Corporation.

Elemental Royalty is a new mid-tier, gold-focused streaming and royalty company with a globally diversified portfolio of 16 producing assets and more than 200 royalties, anchored by cornerstone assets and operated by world-class mining partners. Formed through the merger of Elemental Altus and EMX, the Company combines Elemental Altus’s track record of accretive royalty acquisitions with EMX’s strengths in royalty generation and disciplined growth. This complementary strategy delivers both immediate cash flow and long-term value creation, supported by a best-in-class asset base, diversified production, and sector-leading management expertise.

Elemental Royalty trades on the TSX Venture Exchange under the ticker symbol “ELE”, and on the NASDAQ Stock Market under the ticker symbol “ELE”.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology.

Forward-looking statements and information include, but are not limited to, the Company’s ability to deliver a materially increased revenue profile with a lower cost of capital, the future growth, development and focus of the Company, and the acquisition of new royalties and streams. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies.

Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Elemental Royalty to control or predict, that may cause Elemental Royalty’ actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the impact of general business and economic conditions, the absence of control over the mining operations from which Elemental Royalty will receive royalties, risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits;; the possibility that future exploration, development or mining results will not be consistent with Elemental Royalty’ expectations; accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. For a discussion of important factors which could cause actual results to differ from forward-looking statements, refer to the annual information form of Elemental Royalty for the year ended December 31, 2024. Elemental Royalty undertakes no obligation to update forward-looking statements and information except as required by applicable law. Such forward-looking statements and information represents management’s best judgment based on information currently available. No forward-looking statement or information can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

Figure 1. Elemental Royalty interests and projects in the Bor Mining District of Serbia.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8358/280566_3dabfe0184c6bbcd_001full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280566