Vancouver, British Columbia–(Newsfile Corp. – May 3, 2023) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“), is pleased to announce the preliminary results from its PEA-level metallurgical test work at the Moss Gold Project in Northwest Ontario, Canada (the “Moss Gold Project“). The results were produced from the recent metallurgical testing program completed by Base Metallurgical Laboratories in Kamloops, British Columbia under the overall supervision of Ausenco Engineering Canada Inc. (“Ausenco”).

Highlights:

- Test work shows significantly increased gold recoveries from a flotation-regrind-leach process averaging:

- 93% recovery at Moss

- 98% recovery at East Coldstream

- These results represent an 8% to 13% increase in gold recoveries from previously conducted standard leach test work.

- Coarse bottle roll leach test results returned gold recoveries between 53% and 64%, which encourage investigation of a low recovery heap leach solution for low-grade mineralization that may bring gold production forward and reduce tailings.

President and CEO Brett Richards stated: “We are very pleased with the early results from the metallurgical test program, as recoveries have increased from the InnovExplo’s 2011 mineral resource estimate and subsequent 2013 preliminary economic assessment by 8%-13%. This detailed testing being undertaken will enhance the economics of our new mineral resource estimate due out in the near future; and the new preliminary economic assessment due to commence immediately thereafter. As well, these results also appear to provide early support for heap leaching the low-grade material, which positively changes the dynamics of an economic analysis.”

Technical Overview

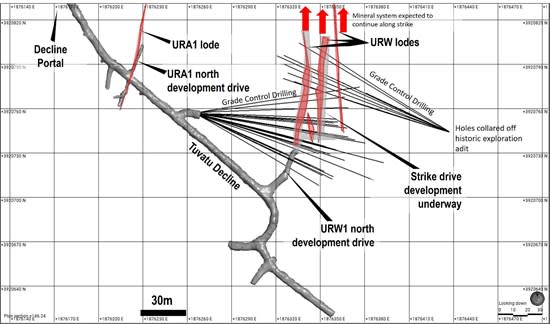

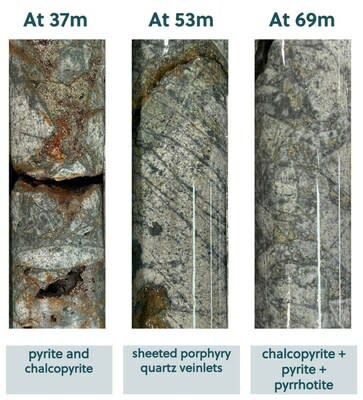

Figure 1 shows the location of the samples that make up the metallurgical composites.

Figure 1: Location map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/164622_6b7cf742f4645943_002full.jpg

The metallurgical gold recovery test-work was conducted to assess the potential gold recoveries and potential process flowsheets for the Moss Gold Project, which include the Moss Gold Deposit (“Moss”) and East Coldstream Gold Deposit (“East Coldstream”). Testing started in early 2023 on composite and variability samples from the Main, QES and SW Zones at Moss, and from East Coldstream. The program included comminution testing, grind optimization for leaching and flotation, gravity concentration, and leach testing. Cyanide destruction and solid liquid separation testing are still ongoing and will be completed later in Q2 2023.

Gold Recovery Test Work Results Summary

The program evaluated 18 discrete composite samples representing the two gold deposits. Each composite consisted of multiple samples collected from diamond drill core and coarse rejects. Primary composites were selected for the Main / QES Zones (three samples), and one sample each for the SW Zone and East Coldstream deposits to reflect grade, spatial and lithological distributions. The composition of the primary pit composites was designed to have anticipated average grades that will be confirmed in a planned mineral resource estimate. Variability samples were selected to provide representation from higher grade shear zones and lower grade host rocks from the deposits.

Crushing and Grinding Testing

Comminution testing characterized sample hardness by Steve Morell Comminution (“SMC”) testing, Bond Rod Mill (“RWI”), Ball Mill Work Index (“BWI”) and Bond Abrasion Index (“Ai”) tests. Three samples from the Main QES deposit were used for this testing.

The results showed:

- SMC Axb average value of 34.7, indicates the samples are competent.

- Average RWI and BWI values of 18.4 and 19.5 (metric) respectively, considered hard to very hard range of hardness.

- Average Ai value of 0.175 g, which is classified as low to moderately abrasive.

Gravity Concentration Testing

The Main and QES Zone composite samples were tested with the Extended Gravity Recoverable Gold protocol to determine their amenability to gravity concentration.

The results showed:

- Moderate Gravity Recoverable Gold content totaling 40% gold.

- At full scale, this would be in the 10% to 15% gold recovery range.

Leach Testing

Coarse Particle Size Leach Tests

Intermittent bottle rolls leach tests were conducted on the samples at crush sizes of -6.25 mm and -2 mm to evaluate potential for heap leaching. Tests were run over 8 days with bottles rolled for 1 minute per hour.

The results showed:

- Average leach extraction for the -6.25 mm crush size samples is 52.6% Au.

- Average leach extraction for the -2 mm crush size samples is 64.2% Au.

Standard Leach Tests

Initial standard bottle rolls leach tests were completed on the primary composites from Main and QES Zones, over a range of grind sizes with 48 hours leaching and without gravity concentration prior to leaching. The results showed a weak relationship between grind size and recovery. As a result, a grind of 80% passing 100 microns was selected for further testing. The selected retention time was 48 hours. Gold leach extractions averaged 84% for these tests.

A total of 25 leach tests were conducted including initial screening tests and a bulk leach test (pending) that will generate sample for cyanide detox testing. The results showed:

- Gold leach extractions ranging from 74% to 93%, averaging 83%, with final residue values of 0.08 g/t to 0.32 g/t gold, averaging 0.20 g/t gold.

- Calculated gold head grades ranging from 0.40 g/t to 3.06 g/t gold, averaging 1.36 g/t gold.

- Shear Zone samples and low-grade Intrusion domain samples showed similar leach extractions to higher grade shear zone samples, based on leach residue grades as a function of head grades.

- Sodium cyanide consumption averaged 0.50 kg/t.

Flotation-Leach Tests

Testing was also completed using a flotation-leach flowsheet which includes:

- Grinding to 80% passing 100 microns.

- Flotation of a sulphide concentrate.

- Concentrate regrind to 80% passing 15 microns followed by 48 hours leaching.

- Flotation tailings leach without regrinding for 48 hours.

Results were positive with higher extractions than the standard leach tests. Key results include:

- Sulphide concentrate mass recoveries averaged 11%, ranging from 5% to 19%.

- Concentrate leach extractions averaged 96%, ranging from 92% to 98%.

- Flotation tailings leach extractions averaged 76%, ranging from 69% to 90%.

- Combined leach extractions averaged 93%, ranging from 87% to 98%.

- Calculated gold head grades ranging from 0.60 g/t to 2.77 g/t gold, averaging 1.46 g/t gold.

- Sodium cyanide consumption averaged 0.75 kg/t.

A summary of the results from the primary composites with the two flowsheets evaluated are shown in Table 1.

Table 1: Moss Project Primary Composite Leach Extractions Based on Flowsheet

| Composite ID | Head Grade (Au g/t) | Recovery (Au%) | |

| Whole Ore Leach | Flotation Leach | ||

| Main/QES West Composite | 1.48 | 84 | 89 |

| Main/QES Central Composite | 0.53 | 80 | 87 |

| Main/QES East Composite | 1.98 | 86 | 96 |

| Main/QES Combined Composite | 1.14 | 82 | 93 |

| Southwest Zone Composite | 0.83 | 76 | 93 |

| East Coldstream Composite | 2.64 | 93 | 98 |

Plant recoveries will be estimated with typical plant losses for use in the planned mineral resource estimate.

Pete Flindell, VP Exploration for Goldshore, said, “These metallurgical test results affirm our belief that gold recoveries in the sulphide-bearing shear zone mineralization can be significantly improved by flotation, while the low sulphide-bearing low-grade intrusion domain mineralization may be amenable to heap leaching. Further test work is required to investigate the latter, but we have now established +90% gold recoveries for the bulk of the contained ounces at Moss and East Coldstream are achievable with a flotation-regrind-leach circuit.”

Qualified Persons

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice President – Exploration of the Company and Tommaso Roberto Raponi, P.Eng., an independent consultant with Ausenco Engineering Canada Inc., are both “Qualified Persons” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) have reviewed and verified the scientific and technical information contained in this news release.

About Goldshore

Goldshore is an emerging junior gold development company, and owns 100% of the Moss Gold Project located in Ontario. Wesdome is currently a large shareholder of Goldshore. Well-financed and supported by an industry-leading management group, board of directors and advisory board, Goldshore is positioned to advance the Moss Gold Project through the next stages of exploration and development.

About Ausenco

Ausenco is a global diversified engineering, construction and project management company providing consulting, project delivery and asset management solutions to the resources, energy and infrastructure sectors. Ausenco’s experience in gold projects ranges from conceptual, pre-feasibility and feasibility studies for new project developments to project execution with EPCM and EPC delivery. Ausenco is currently engaged on a number of global projects with similar characteristics and opportunities to the Moss Gold Project.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

For More Information – Please Contact:

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288 4416 M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes | Twitter: GoldShoreRes | LinkedIn: goldshoreres

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project, including gold recoveries, the release of an updated mineral resource estimate and preliminary economic assessment, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; and the impact of COVID-19.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/164622