July 14, 2021

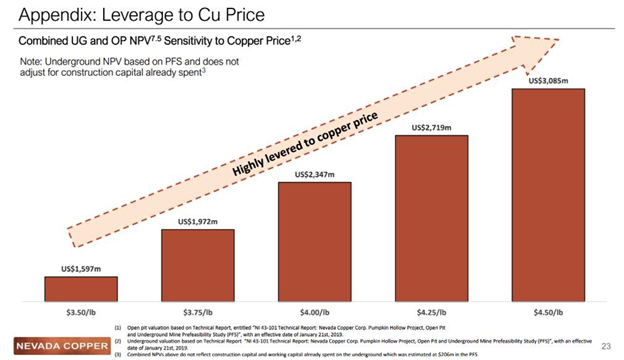

Vancouver, B.C., Granite Creek Copper Ltd. (TSX.V: GCX | OTCQB: GCXXF) (“Granite Creek” or the “Company”) is pleased to announce that Simcoe Geophysics has completed a 20.8 line kilometer (“km”) induced polarization (IP) survey on the Company’s Carmacks North target area. Preliminary results from the survey have identified several near surface chargeability anomalies that have been prioritized as trenching and reverse circulation (“RC”) drill targets for Phase 2 of the 2021 season.

Granite Creek further announces the completion of Phase 1 of its 2021 drilling program, which consisted of 19 holes totalling 6355 meters of diamond drilling on Zones 1, 2000S and 13 of the Carmacks deposit. The first tranche of assays from Phase 1 are expected very soon and will be released in batches as received and reviewed by the Company. With this initial stage of drilling completed, Vision Quest Exploration, based in Whitehorse, Yukon, has mobilized a reverse circulation (“RC”) drill rig to the property and commenced Phase 2 drilling which is expected to consist of approximately 3000 meters.

Given the early start to the 2021 field season and encouraging early indications of success, Granite Creek has made the decision to expand the previously defined 10,000-meter program by adding a third phase which is expected to add an additional 2700 meters of diamond drilling to the overall program. Launch date for Phase 3 is tentatively targeted for early September, with potential to bring that forward to late August. The Company will provide further guidance in this regard in the ensuing weeks.

Granite Creek President & CEO, Tim Johnson, commented, “We are extraordinarily pleased with the progress we have made to date in advancing the Carmacks project. It is a testament to the strength and dedication of our team that we have been able to maintain a very aggressive pace as we move towards an updated 43-101 resource estimate and subsequent economic assessment. This drill campaign has been a showcase of professionalism from our site teams and contractors, and we are very much looking forward to carrying that momentum ahead through Phase 2 and the newly announced Phase 3. In total, we are now expecting to complete over 13,000 meters of drilling, data from which will be incorporated into the new resource update being targeted for Q4.”

Carmacks North Target Area

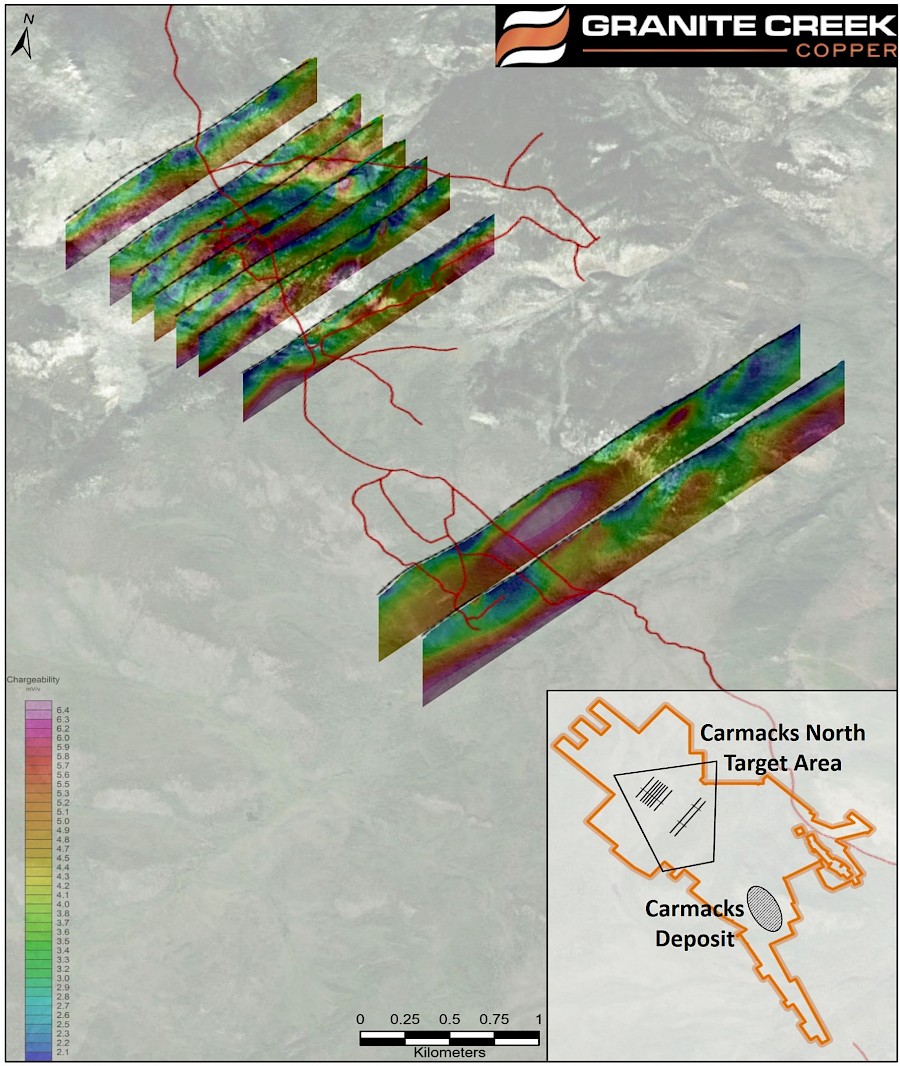

The Carmacks North Target area is comprised of Zones A-D, as well as additional targets currently being developed. Prior to the Granite Creek’s inaugural drill program completed last fall (see news release dated Feb 11, 2021), little work had been completed on the area since 1980. Historical high-grade copper intercepts of up to 2.52% Cu, 1.64 g/t Au, 12.84 g/t Ag over 19.81 meters were successfully followed up with intercepts of 4.31% Cu, 3.41 g/t Au, 23.78 Ag over 4.36 meters and 0.97% Cu, 0.32 g/t Au, 2.84 g/t Ag over 25 meters. Recognizing the discovery potential in the target area the Company is pleased to deploy modern, advanced exploration tools such as the Alpha Induced Polarization survey employed by Simcoe Geophysics. Capable of measuring the chargeability and resistivity of the rock up to 1000m below the surface these types of surveys greatly improves the chance of success with drilling. The use of a rapidly deployable drill rig such as the RC rig being supplied by Vision Quest along with excavator trenching allows for testing of multiple high priority targets during a single field season.

OTCQB Metals and Mining Virtual Conference

Granite Creek Copper will be presenting at the upcoming Green Energy and Precious Metals Investor Conference hosted by OTC Markets on July 29 at 1:30pm ET. President & CEO, Tim Johnson, will provide a comprehensive overview of the Company, including an update on 2021 exploration activities to date and upcoming newsflow. To register, click here.

COVID-19 Protocols

Granite Creek has worked closely with the Yukon government to develop a COVID-19 safety plan that enables the Company to implement an effective work plan while maintaining the highest degree of safety of our workers and surrounding communities. The Company strictly adheres to mandates put in place by health authorities at the Federal and Territorial government level and holds the health and safety of our workers, and the citizens of the communities in which we work, in the highest regard.

Figure 1: Oblique view of the UBC 2D DCIP inversion sections of the chargeability from 20.8 km of IP collected by Simcoe Geophysics over Carmacks North

Figure 2: 2D IP chargeability model of Line 3

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project is on trend with the high-grade Minto copper-gold mine, operated by Minto Explorations Ltd, to the north and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Qualified Person

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource esti-mates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more infor-mation on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.