Figure 1. Project location map.

Figure 1. Project location map.

Figure 2. Prospect Location Map

Figure 2. Prospect Location Map

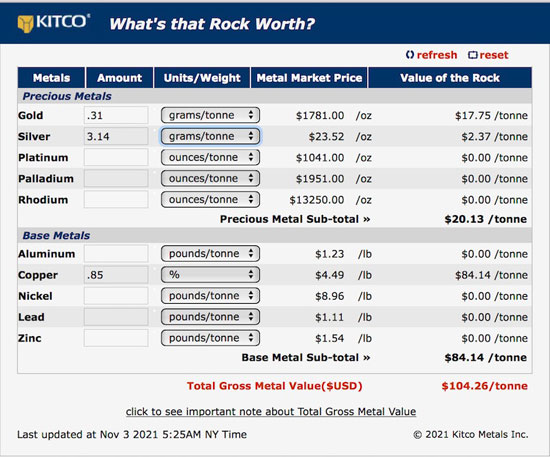

VANCOUVER, British Columbia, Nov. 08, 2021 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) is pleased to announce it has signed a binding letter agreement (“Letter Agreement”) with Mine Discovery Fund Pty. Ltd. (“MDF”) concerning its El Batamote porphyry copper exploration project in Mexico. MDF is a private Australian company. In good faith, MDF has made an initial US$50,000 cash payment upon signing the Letter Agreement. A definitive agreement (“Definitive Agreement”) has been prepared will be signed immediately following the formation of a Mexico subsidiary company by MDF. MDF has placed Batamote into a wholly-owned subsidiary company called Latin America Copper Limited(“LatCopper”) along with other assets in Chile. MDF indicates it has commenced compliance documentation for a potential ASX or TSX listing in the first half of 2022.

Millrock President and CEO Gregory Beischer commented: “Batamote has excellent potential to discover a porphyry copper deposit. We know already that breccia-style and porphyry copper mineralization is present. We are particularly excited to drill-test beneath what appears to be a leach cap alteration zone at a prospect called El Choclo NW. The project is situated within a belt that has produced very large porphyry copper deposits being mined by others as evidenced by the Cananea and La Caridad mines.”

Latin American Copper Director Joseph Webb commented: “With the addition of El Batamote, LatCopper has three exceptional cornerstone exploration assets with evidence of Tier 1 scale potential in the globally significant copper belts of Latin America. El Batamote is 25 kilometers northwest of Grupo Mexico’s La Caridad copper mine (5.98 billion tonnes at 0.34% copper equivalent) with an untested leach cap identified along strike from known mineralisation. This indicates potential for supergene mineralisation at Choclo. The Bata Sur definitive mineralised porphyry system intersected by historic drilling remains open along strike.”

Under the terms of the Definitive Agreement, LatCopper will have the option to purchase a 100% interest in the concessions that underlie the Batamote copper project. To earn the interest, LatCopper will have to make cash payments totalling US$1,000,000 over five years, execute US$6,000,000 dollars in exploration work, and pay Millrock US$250,000 in shares when LatCopper becomes a publicly listed company. In the event that LatCopper exercises the option to purchase the Batamote project, annual advanced minimum royalty (“AMR”) payments will be triggered. The first payment will be US$50,000 and the payment will increase by US$50,000 each year until a cap of US$500,000 is reached. Annual payments will then remain at the capped level until a mine reaches commercial production. At that point, a Net Smelter Return production royalty of 1.0% will be triggered. Any AMR payments made by LatCopper can be credited against production royalty payments.

About the El Batamote Project

The project is located 100 kilometers south of the Sonora – Arizona border and 140 kilometers north of the mining hub of Hermosillo in northeastern Sonora State, Mexico. The project is fully accessible by road and covers nearly 4,000 hectares. Millrock previously purchased the concessions and historical exploration data from a subsidiary of Teck Resources Ltd., as announced by Millrock in a November 2015 press release. The project is situated within the Cananea-La Caridad Copper Porphyry belt (Figure 1). This district-scale structural trend is situated within the larger North American porphyry copper province containing over 20 copper-molybdenum deposits and mines in Arizona, New Mexico, and Sonora.

Figure 1. Project location map is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/639437fc-1d2c-4f6a-9a1c-b6e6ac47e702.

El Batamote contains alteration and geochemistry characteristics of a Cu-Mo porphyry system. Important historical work has been conducted on the property by large companies such as Phelps Dodge, BHP, Noranda, Peñoles, and Teck. Abundant information was generated by prior workings in the south and central part of the claim block and includes regional and semi-detail mapping, geochemistry, petrography, spectrometry, geophysics and drilling with more than 10,000 meters of diamond core having been drilled.

The exploration led to the discovery of several key prospects: Bata Sur, El Choclo NW and El Choclo West (Figure 2). Review of the historic data has led Millrock geologists to make new exploration observations, conclusions, and recommendations. Preliminary plans include geophysical surveys at El Choclo NW, where a possible leach cap is situated adjacent to known porphyry mineralization. No drilling has been done beneath the alteration zone. At the Bata Sur prospect, breccia pipe style mineralization has been intersected by prior drilling. Drilling is recommended to test for higher grade and to test previously untested geochemical anomalies. Millrock has drilling permits in hand.

Figure 2. Prospect Location Map is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b48bb9da-f767-4ecf-af5b-4b76c395f052.

The lithology and alteration at Batamote are similar to that found at the La Caridad and Cananea mines. The mining concession covers Late Cretaceous Laramide age intermediate composition volcanic sequences which are intruded by a large, multi-phase batholith with multiple, mineralized porphyry pulses along a northwest-trending structural corridor. Porphyry dikes cut the system and are followed by later, mid-Tertiary post-mineral tuffaceous rocks, all of which are cut by long-lived northeast-trending and north-south fault structures. Intermediate volcanic rocks are the main host to copper mineralization. These rocks contain strong hydrothermal alteration related to porphyry-type systems in a three-kilometer by six-kilometer area that on the west side, is truncated by north-west to north-south trending post-mineral faults. Quaternary gravels cover bedrock west of these faults, but porphyry mineralization may be concealed below as potentially indicated by geophysical surveys at Choclo W.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Coeur Explorations, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, Felix Gold, Tocvan, and now Mine Discovery Fund.

About Mine Discovery Fund

Mine Discovery Fund (MDF) is a private investment vehicle backed by some of the industry’s leading technical advisors and professional mining investors. MDF focus is on Tier 1 orebody discovery in the jurisdictions that provide the highest probability of exploration success (in the most fertile Tier 1 Belts and in areas with clear pathways for development potential.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the intention to mount further exploration including drilling in 2021 and 2022, and the intention to enter a definitive agreement with Mine Discovery Fund. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.