VANCOUVER, BC / ACCESSWIRE / July 31, 2023 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce an updated National Instrument 43-101 Mineral Resource Estimate representing a 25% increase in contained metal based on an additional 1,730 meters of diamond drilling completed at its La Plata project in 2022. Inferred mineral resources at the Allard deposit now total 1,211 million pounds of copper (“Mlbs”) and 17.6 million ounces (“Moz”) of silver in a constrained model with 147.3 million tonnes at an average grade of 0.41% Copper Equivalent (“CuEq”) (0.37% Cu and 3.72 g/t Ag) using a 0.25% CuEq cut-off grade (See Table 1 notes).

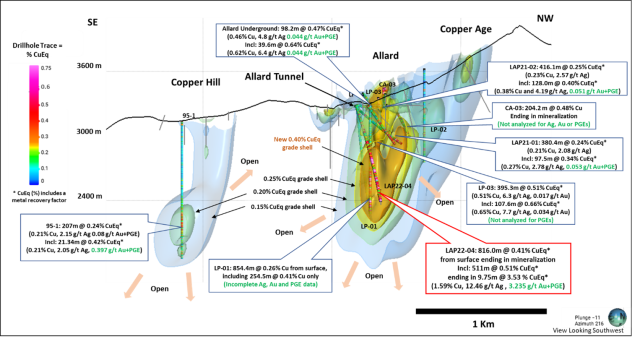

The expansion from the inaugural resource to the current 1,317 Mlbs CuEq is largely driven by the major discovery in drill hole LAP22-04 (drilled in 2022), which intersected 816 meters of 0.41% CuEq recovered (0.30% Cu, 2.47 g/t Ag, 0.038 g/t Au, 0.055 g/t Pd and 0.093 g/t Pd) bottoming in 5.39% CuEq recovered over 5.2 m (2.44% Cu, 18.7 g/t Ag, 5.0 g/t Au+PGE). Follow-up drilling is currently underway to test the extent of this newly discovered high-grade mineralization, and at the time of this news release, the first offset drill hole was drilling in porphyry mineralization and had reached approximately 500 m depth.

The Allard deposit resource remains completely open to expansion laterally and to depth. Future mineral resource estimates will add gold, platinum and palladium to the copper and silver resource with additional drilling. These metals were not previously assayed for in historic drilling but add significant value to the recent drill intercepts. Furthermore, the greater La Plata copper-silver-gold-PGE project remains underexplored and open to new discoveries of both additional copper porphyry centers, as well as high-grade epithermal silver, gold and telluride mineralization that were the focus of historic mining in the district.

Highlights

- Inferred mineral resources at the Allard deposit now total 1,211 million pounds of copper and 17.6 million ounces of silver in a constrained model with 147.3 million tonnes at an average grade of 0.41% CuEq (0.37% Cu and 3.72 g/t Ag) using a 0.25% CuEq cut-off grade.

- Contained copper equivalent metal has increased by 25% to 1,317 million pounds and the overall grade of the deposit also increased 5% to 0.41% CuEq.

- Significant upside exists for both increases in equivalent grade and precious metal ounces due to limited historic assaying for gold, platinum and palladium. These metals, which are found in high concentrations in the 2022 drilling but are not included in the current resource estimate, are anticipated to be added with additional drilling. The precious metals component of LAP22-04 (silver, gold, platinum, and palladium) can add 50% or more in equivalent value above the copper only values in that hole.

- The Allard resource remains open to expansion at depth and along strike with the discovery drill hole LAP22-04 being the easternmost hole drilled in the deposit.

- Sixteen (16) untested potential porphyry centers have been identified on the greater La Plata project area, as well as target areas with potential for significant high-grade epithermal silver, gold and telluride mineralization.

- Resource expansion drilling in 2022 totaled 1,780 m bringing the project total to 16,930 m in 59 drill holes.

An NI 43-101-compliant technical report on the 2023 La Plata Resource will be filed on Sedar.com within 45 days.

Scott Petsel, Metallic Minerals’ President, states, “The current expansion of the La Plata resource is an early first step in realizing the true potential of the project and the fact that we were able to achieve a 25% increase over the inaugural resource with a modest amount of drilling in 2022 speaks to the well mineralized yet underexplored nature of the project. Hole LAP22-04 resulted in the discovery of new, extremely rich mineralization that is unconstrained to the east, north and at depth and clearly requires follow-up drilling to understand the true size and nature of the Allard resource. Metallic Minerals in collaboration with our strategic investor Newcrest Mining is excited to pursue expansion on this discovery in 2023 and have secured a drill capable of penetrating well beyond the current resource extent. The continuity of mineralization starting from surface, coupled with the very high grades at depth, represent significant upside to both scale and grade in future resource updates. We expect considerable expansion of the contained precious metals and copper with subsequent drilling and envision the potential scale for a Tier 1 asset. In addition, numerous high-priority untested targets have been identified outside of the resource area that we hope to begin testing in 2023.”

Table 1 – 2023 Updated La Plata Inferred Mineral Resource Estimate at a Base Case Cut-off Grade of 0.25% CuEq with Grade and Contained Metal Sensitivity Analysis at Various CuEq Cut-off Grades.

| Class | CuEq (%) | Tonnes | Cu | Ag | CuEq (%) | |||

| Cut-off | Grade (%) | Mlbs | Grade (g/t) | Ounces | Grade (%) | Mlbs | ||

| Inferred | 0.15 | 212,243,000 | 0.32 | 1,480 | 3.24 | 22,131,000 | 0.34 | 1,613 |

| Inferred | 0.20 | 187,173,000 | 0.34 | 1,391 | 3.42 | 20,597,000 | 0.37 | 1,515 |

| Inferred | 0.25 | 147,344,000 | 0.37 | 1,211 | 3.72 | 17,604,000 | 0.41 | 1,317 |

| Inferred | 0.30 | 116,438,000 | 0.41 | 1,041 | 3.95 | 14,783,000 | 0.44 | 1,130 |

| Inferred | 0.35 | 87,871,000 | 0.44 | 854 | 4.20 | 11,861,000 | 0.48 | 925 |

- The Allard deposit mineral resource estimate (the “2023 Resource Estimate”) generally respects industry standard practices as recently established by the CIM in the Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). The classification of the 2023 Resource Estimate is consistent with current CIM Definition Standards for Mineral Resources and Mineral Reserves (2014).

- Completion of the 2023 Resource Estimate involved the assessment of a validated database, which included all data for surface and underground sampling completed through the fall of 2022, as well as a three-dimensional (“3D”) mineral resource model, a topographic surface model, models of the underground workings and underground channel samples, and available written reports. SGS used 59 drillholes and 2 channels, and 17,215 m of data from 1959 to 2022 to delineate the Allard deposit.

- Inverse Distance squared (“ID2“) restricted to a mineralized domain is used to Interpolate grades for the main elements of interest including Cu (ppm) and Ag (g/t) into a block model.

- Based on a review of the project location and size, geometry, and continuity of mineralization of the Allard deposit, and its spatial distribution, it is envisioned that the Allard deposit may be mined using a large-scale underground bulk mining method.

- The 2023 Resource Estimate is reported at a base case cut-off grade of 0.25% CuEq, based on metal prices of $3.75/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. CuEq % = Cu % + (Ag g/t x Ag price/gram).

- The values in the 2023 Resource Estimate table reported above and below the base-case cut-off 0.25% CuEq should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of the base case cut-off grade.

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add or calculate exactly due to rounding.

- The 2023 Resource Estimate is presented undiluted and in situ, constrained by a continuous 3D wireframe model (the constraining volume) and below topography, and is considered to have reasonable prospects for eventual economic extraction.

- The 2023 Resource Estimate is not a Mineral Reserve as it does not have demonstrated economic viability. The Inferred Mineral Resource in the 2023 Resource Estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- A fixed specific gravity value of 2.60 g/cm3 is used to estimate the Mineral Resource tonnage from a block model volume.

- Composites of 3.05 m in length, constrained to the Allard domain, are used for the resource estimation procedure. Grades for Cu and Ag were interpolated into blocks by the ID2 calculation method.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

La Plata Property Overview

Metallic Minerals’ La Plata project covers 44 square kilometers 20 km north of Mancos, Colorado, within the historic La Plata mining district, that is in the southwest portion of the prolific Colorado Mineral Belt. The La Plata project is easily accessible by highways and improved gravel roads and is near significant power transmission lines.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from mineralized deposits at over 90 individual mines and prospects1. From the 1950s to 1970s, major miners, including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge), explored the district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization2. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

A total of 17,215 meters in 59 drill holes has been drilled on the property from the 1950s to present, this drilling has demonstrated the presence of a large multi-phase porphyry system with copper, silver, gold with more recent discoveries highlighting the potential for significant PGEs, rare earth minerals and tellurium. This large-scale mineralized system is associated with a 10 km2 strongly magnetic signature with intense hydrothermal alteration. Surrounding the central porphyry system is an associated high-grade silver and gold-rich epithermal system measuring at least 8 km by 2 km that hosts 56 identified mineralized veins, replacement, and breccia structures. Historical production from some of these high-grade structures included bonanza grades for silver and gold.

Copper mineralization with associated silver, gold, platinum, and palladium is hosted by a large-scale, Late Mesozoic age, alkalic porphyry system with related silver, gold, telluride epithermal vein, breccia and replacement deposits hosted in adjacent sedimentary rocks. Porphyry copper systems are some of the largest sources of copper and precious metals production worldwide and are frequently cornerstone Tier 1 assets for the major mining companies. The sub-type of porphyry systems, known as alkalic porphyry deposits, commonly contain higher-grade precious metal content like at La Plata and can demonstrate significant scale.

Figure 1 – La Plata Cross Section with Significant Drill Intervals and Mineralized Grade Shells

Critical Minerals

The Allard deposit at La Plata is a significant potential source of copper and silver, both important industrial metals used for modern technologies broadly and particularly in renewable and clean energy applications. Recent and historical work has also demonstrated that the broader La Plata district is also a potential source of other critical minerals identified by the U.S. Government as requirements for economic and national security3. Drilling by Metallic Minerals in 2022 returned multi-gram intervals of platinum group elements with individual grades up to 5 g/t platinum and palladium, as well as critical minerals such as vanadium, and rare earth elements. Tellurium, another element on the critical mineral list, was a by-product of historic high-grade gold and silver production in the district. The potential for these critical minerals to add additional economic value to the La Plata project will be evaluated as part of ongoing exploration efforts.

U.S. Geological Survey Earth Mapping Resources Initiative

The U.S. Geological Survey (“USGS”) is funding the Colorado Geological Survey for geological studies in the La Plata Mountains as part of the Earth Mapping Resources Initiative. The work to be carried out by the Colorado Geological Survey includes geologic mapping as well as geochemical and mineralogical studies in the La Plata Mining District to generate a greater understanding of the area’s potential to host critical minerals. See USGS news release dated January 25, 2023.

About SGS Geological Services

SGS Geological Services has an experienced and respected mining team focused on the domestic and international mining industry. The team has considerable experience in estimation and modeling of deposits of all types and practical and theoretical experience having realized hundreds of assessments for clients. The SGS team consists of a multi-disciplinary group of qualified persons with a strong understanding of the disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects (2016), CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and a strong understanding of the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines 2019.

About Metallic Minerals

Metallic Minerals Corp. is a leading exploration and development stage company focused on copper, silver, gold, and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company’s La Plata project in southwestern Colorado, the new 2023 NI 43-101 mineral resource estimate identifies a significant porphyry copper-silver resource containing 1,211 Mlbs copper and 17.6 Moz of silver. Results from 2022 expansion drilling providing the basis for the updated resource, included the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited to accelerate the advancement of the Company’s La Plata project. In the 2023 Fraser Institute’s Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company’s (“Hecla”) operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla, the largest primary silver producer in the USA and third largest in the world, completed the acquisition of Alexco Resource Corp and its Keno Hill operations in September 2022. Hecla is targeting to start production at the Keno Hill operations by Q3 2023. Metallic Minerals is anticipating the announcement of inaugural mineral resource estimate at Keno Silver in the second half of 2023.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the hit television show, Gold Rush, on the Discovery Channel.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Footnotes:

- 1) Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949.

- 2) Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports.

- 4) The US Geological Survey has released a list of 50 critical minerals that the US economy requires for economic and national security. Earth Mapping Resources Initiative.

Qualified Persons

The La Plata copper-silver project 2023 mineral resource estimate was prepared by Allan Armitage, P. Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) with an effective date of July 10, 2023. Armitage conducted a site visit to the property on August 13, 2021, and again on April 18 and 19, 2023. Jeff Cary, CPG, a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Mr. Cary is a Senior Geologist and La Plata Project Manager for Metallic Minerals.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/771165/Metallic-Minerals-Expands-Resource-at-La-Plata-Copper-Silver-Gold-PGE-Project-in-Southwestern-Colorado-USA