VANCOUVER, BC / ACCESSWIRE / April 27, 2022 / Group Ten Metals, Inc. (TSXV:PGE) (OTCQB:PGEZF) (FSE:5D32) (the “Company” or “Group Ten”) is very pleased to announce the appointment of Dr. Danie Grobler to the role of Vice-President, Exploration and Mr. Albie Brits to the role of Senior Geologist, as of May 1st, 2022. Dr. Grobler and Mr. Brits both have extensive senior level experience from more than two decades of advancing major deposits on the northern limb of the Bushveld Igneous Complex in South Africa including, most recently, at Ivanhoe Mines’ Platreef PGE-Ni-Cu-Au mine, which is now in construction.

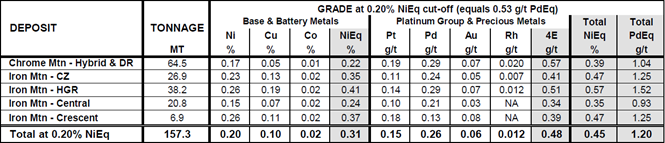

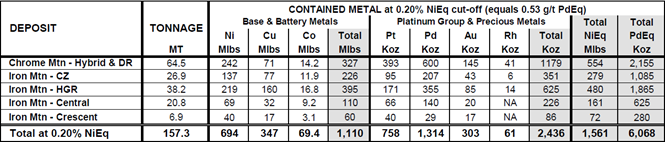

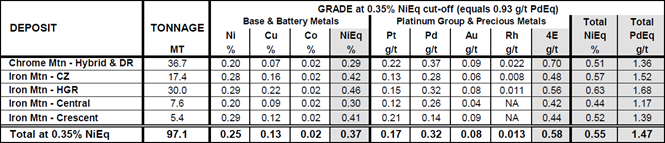

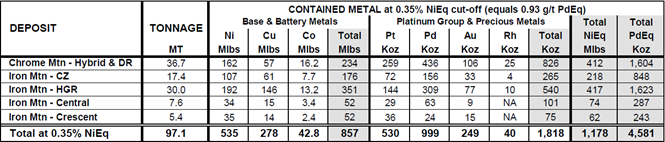

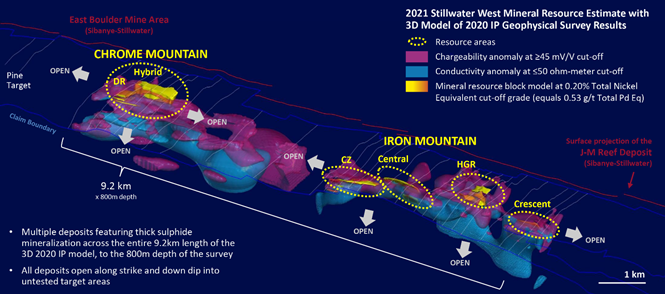

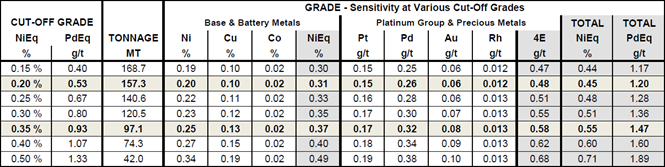

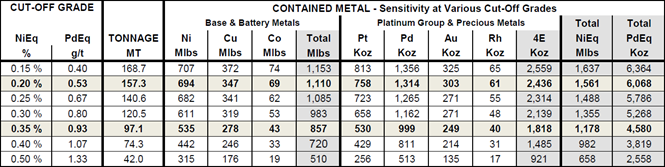

The addition of Dr. Grobler and Mr. Brits to the Group Ten Metals team is an important step in the advancement of the Company’s Stillwater West project as a major U.S.-based source of critical minerals – nickel, palladium, copper, cobalt, platinum, and rhodium – in Montana’s productive and famously metal-rich Stilllwater Igneous Complex. Their expertise in similar geologic models from the giant mines of South Africa’s Bushveld Igneous Complex is expected to drive expansion of Group Ten’s inaugural NI 43-101 resource estimates, announced October 2021, which delineated five deposits totaling 1.1 billion pounds of nickel, copper and cobalt and 2.4 million ounces of palladium, platinum, rhodium and gold in Platreef-style mineralization in the lower Stillwater Igneous Complex. All deposits are open for expansion at depth and along trend within the 12-kilometer core project area, and more broadly within earlier stage targets across the 32-kilometer span of the Stillwater West PGE-Ni-Cu-Co + Au project.

Dr. Danie Grobler has more than 25 years of industry experience as an exploration and mine geologist including most recently as Head of Geology and Exploration for Ivanplats Pty Ltd (an Ivanhoe Mines company) where since 2011 he led the delineation and advancement of Ivanhoe’s world-class Platreef PGE-Ni-Cu mine on the northern limb of the Bushveld complex. Including previous experience as Project Manager at Platinum Group Metals’ at their project on the Bushveld’s northern limb, Dr. Grobler brings decades of senior level experience focused on the discovery and mining of battery and platinum group metals in ultramafic magmatic systems and has published numerous papers on Ivanhoe’s Flatreef deposit.

Dr. Danie Grobler commented, “The geological parallels between Stillwater West and the Platreef/Flatreef-type mineralized ore bodies in South Africa are truly exceptional. I am very enthusiastic to be joining the highly experienced Group Ten Metals team and am excited to be able to apply my extensive Bushveld and Platreef experience at Stillwater West, with a focus on expanding the recently announced mineral resource. Utilizing the wealth of exploration data available, our immediate goal will be to continue to identify and grow shallow, continuous high-grade Platreef-style PGE-Ni-Cu mineralization within the lower part of the Stillwater Igneous Complex.”

Mr. Albie Brits has more than 28 years focused on the advancement of projects from grassroots stage to advanced exploration and full-scale mining operations, starting at Gold Fields of South Africa and including, most recently, the role of Senior Geologist and Manager Project Geology for Ivanplats Pty Ltd (an Ivanhoe Mines company). Focused on exploration for platinum group and base metals on the northern limb of the Bushveld complex since 2001, Mr. Brits was part of the team that discovered Ivanhoe’s Flatreef deposit. He has extensive experience in the exploration of mafic-ultramafic magmatic systems and has presented and co-authored numerous papers on the Flatreef deposit.

Mr. Brits commented, “I am very excited to be joining Group Ten’s excellent Stillwater West team and looking forward to applying my experience developing geological and structural models for the feasibility study of the Platreef project to drive new success in Montana. The Stillwater district is truly world class and Stillwater West shows remarkable expansion potential based on the geologic similarities with the Bushveld complex.”https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%253B1480989%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%253B1480989%2522%252C%2522wiki_topics%2522%253A%2522Platinum_group%253BBushveld_Igneous_Complex%253BIvanhoe_Mines%253BStillwater_igneous_complex%253BMontana%253BExploration%253BSouth_Africa%253BNatural_resource%2522%252C%2522lmsid%2522%253A%2522a077000000LnOyOAAV%2522%252C%2522revsp%2522%253A%2522accesswire.ca%2522%252C%2522lpstaid%2522%253A%252231c0ceeb-bd8e-34f0-832d-e67ffef5ff62%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

Michael Rowley, President and CEO, commented, “Developments at the Stillwater Igneous Complex have generally paralleled those at the Bushveld Igneous Complex, highlighting their significant geologic similarities. For example, the discovery and large-scale production of platinum group metals from the high-grade Merensky reef deposit in the Bushveld preceded the discovery and mining of the high-grade J-M Reef deposit at Stillwater by many decades. The more recent development of the Platreef deposits, starting with Anglo American’s bulk mineable PGE-Ni-Cu Mogalakwena mines in 1993 and continuing today with Ivanhoe’s Platreef mine, have demonstrated the world-class nature of these bulk-tonnage, critical mineral systems within the Bushveld complex. Our recent discoveries of comparable bulk-tonnage Platreef-style systems at Stillwater West demonstrate the continuation of the geologic parallels between the systems and highlight the incredible potential value creation for Group Ten Metals.”

Mr. Rowley continued “The addition of two such renowned experts, literally among the very top globally in large-scale critical mineral systems, is a watershed moment in the advancement of the Stillwater West project. Their unique expertise and perspective, earned from decades of work on world-class systems in the Bushveld, will directly complement the knowledge of our existing team which has decades of experience in the Stillwater district. We look forward to further announcements including our 2022 exploration plans and further assay results from our 2021 resource expansion drill campaign in the very near term.”

Upcoming News and Events

Live Webinar with Q&A

Group Ten will be hosting a live webinar on Wednesday, May 4th at 10am PT (1PM ET). To register click here or the thumbnail.

OTC Markets Metals and Mining Conference Virtual Conference

Michael Rowley will present on Thursday, May 5 at 10:30am PT (1:30PM ET). To register, click here.

About Stillwater West

Group Ten is advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions Group Ten as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater’s PGE mines in south-central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. Group Ten’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex2. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 12-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

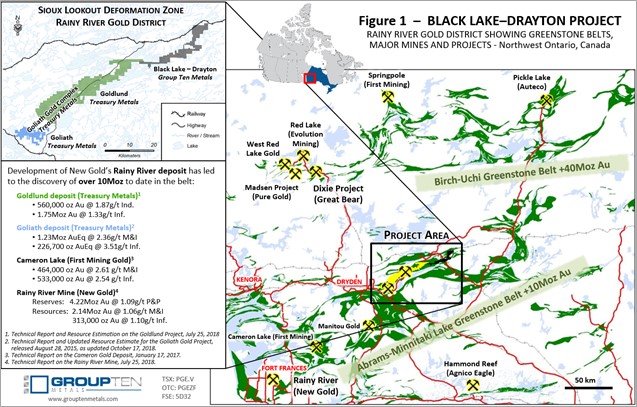

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available on the company’s profile at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Group Ten Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/699034/Group-Ten-Metals-Appoints-Danie-Grobler-as-Vice-President-Exploration-and-Albie-Brits-as-Senior-Geologist-to-Advance-the-Stillwater-West-Critical-Minerals-Project-in-Montana-USA