VANCOUVER, BC / ACCESSWIRE / November 10, 2021 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company“) is pleased to announce the retention of SGS Geological Services (‘SGS”) to provide an updated National Instrument 43-101 mineral resource estimate on the Company’s Carmacks copper-gold-silver deposit in the Minto Copper Belt located in central Yukon, Canada.

Granite Creek will be incorporating drilling completed in 2017, 2020 and 2021 into an updated resource estimate which will build on the existing NI 43-101 compliant resources last published in 20171,2. Resource expansion drilling completed in 2021 consisted of 22 diamond drill holes primarily targeted at sulfide mineralization in Zones 1, 2000S and 13 and is expected to add to the existing sulfide resource (see news release dated October 28, 2021).

Table 1. Current Mineral Resource Estimate on the Carmacks Copper Project

| Category | Tonnes (000) | Cu (%) | Au (g/t) | Ag (g/t) | |

| Oxide & Transition Mineralization | Measured | 6,484 | 0.86 | 0.41 | 4.24 |

| Indicated | 9,206 | 0.97 | 0.36 | 3.80 | |

| M&I | 15,690 | 0.94 | 0.38 | 3.97 | |

| Inferred | 913 | 0.45 | 0.12 | 1.90 | |

| Sulphide Mineralization | Measured | 1,381 | 0.64 | 0.19 | 2.17 |

| Indicated | 6,687 | 0.69 | 0.17 | 2.34 | |

| M&I | 8,068 | 0.68 | 0.18 | 2.33 | |

| Inferred | 8,407 | 0.63 | 0.15 | 1.99 |

About SGS Geological Services

SGS Geological services has a very strong team, with valuable experience, known, renown and respected in the international mining industry. The team has considerable experience in estimation and modeling of deposits of all types and practical and theoretical experience having realized hundreds of assessments for clients. A multidisciplinary group of qualified persons with a strong understanding of the disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects (2016), CIM Definition Standards – For Mineral Resources and Mineral Reserves (2014) and a strong understanding of the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines 2019.

Resource Road Update

On November 8th the Yukon government announced the following road construction update that directly effects Granite Creek’s Carmacks Project.

“Whitehorse based company Pelly Construction has been awarded the contract for the Carmacks Bypass Project, a $29.6 million investment to construct a new road and bridge near Carmacks. This project is a key component under the Yukon Resource Gateway Program and a collaborative effort between the Government of Yukon and Little Salmon/Carmacks First Nation.

The project, which is anticipated to be complete in 2024, will allow industrial vehicles to bypass the community of Carmacks, creating an enhanced and safer flow of traffic for residents. It will also improve access to mining activities while enabling the Little Salmon/Carmacks First Nation to benefit from contracting, education and training benefits associated with the project.

The Yukon Resource Gateway Program improves infrastructure to Yukon’s most mineral-rich areas. The Carmacks Bypass project is jointly funded by Canada and the Yukon and is the first project to be awarded under the program.”

Granite Creek President & CEO, Tim Johnson, commented, “We are very pleased to have engaged with a top calibre firm like SGS on this key milestone in the Company’s relatively short history. With the amount of highly targeted new drilling we have completed, we anticipate a robust update to the existing resource estimate and that this, along with the mine planning and trade-off studies being developed by Sedgman and Mining Plus, will have a significant impact on the project economics. In our continuing development of Carmacks, the recent announcement by the Yukon government of the start of construction on the Carmacks Bypass is extremely good news. The incremental improvement in access represented by this road upgrade is welcomed and this, combined with an updated resource estimate, will pave the way for and even more extensive exploration program in 2022.”

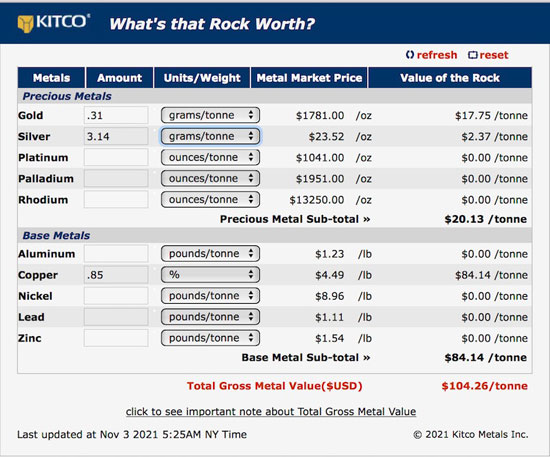

[1] JDS Energy and Mining. Feb 9, 2017. NI 43-101 Preliminary Economic Assessment Technical Report on the Carmacks Project, Yukon, Canada. Contained metal based on 23.76 million tonnes of NI 43-101 compliant resources in the Measured and Indicated categories grading 0.85% Cu, 0.31 g/t Au, 3.14 g/t Ag.

[2] Arseneau Consulting Services, 2016 Independent Technical Report on the Carmacks Copper Project, Yukon, Canada.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory. The project is on trend with the high-grade Minto copper-gold mine, operated by Minto Explorations Ltd, to the north, and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Qualified Person

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/672206/Granite-Creek-Copper-Retains-SGS-for-43-101-Mineral-Resource-Update-on-Carmacks-Deposit-in-Yukon-Canada

https://s.yimg.com/rq/darla/4-9-0/html/r-sf-flx.htmlhttps://openweb.jac.yahoosandbox.com/0.8.1/safeframe.html