Spotify:https://open.spotify.com/episode/09FO0OzuguyQF0PKbYl1Pz

Tag: #MauriceJackson

YERINGTON, Nev., Dec. 21, 2021 (GLOBE NEWSWIRE) — Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada Copper” or the “Company”) today provided a further positive operations update at its underground mine at the Company’s Pumpkin Hollow Project (the “Underground Mine”).

December Underground Operations Highlights:

- Development Achieves Record Rates

- In line with the continued ramp-up, the Company is on track to advance over 1,100 lateral equivalent feet of development in December.

- Development is running at the highest rate for 2021, and rates achieved month-to-date in December are almost 50% higher than November (representing almost a 100% increase since August 2021).

- Additional Mobile Equipment Delivered and Commissioned

- The first planned bolter has been delivered and is now operating underground, resulting in increased development rates and supporting further increases continuing into Q1 2022.

- Two additional bolters are on track to be delivered to the underground mine in January enhancing further development rates.

- First Delivery of Surface Ventilation Fans Arrived on Site

- The first of three deliveries of the ventilation fan infrastructure has arrived on site, with full installation and commissioning continuing to be planned to be completed in Q1 2022.

- The final package delivery is expected for the first week of January 2022.

- Preparing to Mine Sugar Cube

- Mining of the Sugar Cube, the first high-grade area in the East North Zone of the underground mine, continues to be planned for Q1 2022 (News Release, November 30, 2021).

“The Company continues to build on the operational improvements achieved over the past two quarters, providing further acceleration to the development and production ramp-up,” stated Randy Buffington, President and Chief Executive Officer. “The implementation of additional equipment, manpower and operational efficiencies led to the highest development rates attained this year. We are on track to complete 1,100 feet of lateral development this month, which puts the Company in a position to mine the first stope of the high-grade Sugar Cube as planned next month.”

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., VP Head of Exploration of Nevada Copper, and Neil Schunke, P.Eng., a consultant to Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which is now in the production stage, and a large-scale open pit project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

www.nevadacopper.com

Randy Buffington, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Cautionary Language

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to mine development, production and ramp-up objectives and equipment installation.

Forward-looking statements and information include statements regarding the expectations and beliefs of management. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information should not be read as guarantees of future performance and results. They are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and events to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

Such risks and uncertainties include, without limitation, those relating to: the ability of the Company to complete the ramp-up of the Underground Mine within the expected cost estimates and timeframe; requirements for additional capital and no assurance can be given regarding the availability thereof; the impact of the COVID-19 pandemic on the business and operations of the Company; the state of financial markets; history of losses; dilution; adverse events relating to milling operations, construction, development and ramp-up, including the ability of the Company to address underground development and process plant issues; ground conditions; cost overruns relating to development, construction and ramp-up of the Underground Mine; loss of material properties; interest rates increase; global economy; limited history of production; future metals price fluctuations; speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labor disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates from management’s expectations and the difference may be material; legal and regulatory proceedings and community actions; accidents; title matters; regulatory approvals and restrictions; increased costs and physical risks relating to climate change, including extreme weather events, and new or revised regulations relating to climate change; permitting and licensing; volatility of the market price of the Company’s securities; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those risks discussed in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2020 and in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 18, 2021. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. The forward-looking information or statements are stated as of the date hereof. Nevada Copper disclaims any intent or obligation to update forward-looking statements or information except as required by law. Readers are referred to the additional information regarding Nevada Copper’s business contained in Nevada Copper’s reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on Nevada Copper and the risks and challenges of its business, investors should review Nevada Copper’s filings that are available at www.sedar.com.

Nevada Copper provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

| HIGHLIGHTS• Steinert KSS 100F LIXT fine mechanical sorting unit (the “Sorter”) constructed and commissioned at the Company’s Nullagine gold project (the “Nullagine Gold Project”) in Western Australia • Comet Well and Purdy’s Reward samples have been processed with results pending • Concentrates undergoing assessment by Novo geologists ahead of assay to determine gold content |

| VANCOUVER, BC – Novo Resources Corp. (“Novo” or the “Company”) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to advise that Phase 2 mechanical sorter trials have commenced at the Nullagine Gold Project. Over recent weeks, the Sorter infrastructure has been mobilized, constructed, and commissioned adjacent to the Company’s Golden Eagle processing plant at the Nullagine Gold Project. Fifty samples from the Company’s Comet Well, Purdy’s Reward, Egina, and Talga Talga projects ranging in size from 800 kg to approximately five tonnes have been delivered to the site for crushing and screening ahead of Phase 2 Sorter testwork . The testwork program in late 2021 and early 2022 is designed to achieve multiple objectives: • Construct and commission the Sorter and associated infrastructure (Phase 1 – complete) • Tune the Sorter to the various geological regimes and size fractions and train Novo operators in its use • Process samples from multiple Novo projects around the Pilbara to field test mass pull to concentrate1 • Establish assay protocols for Sorter concentrate ‘accepts’ and waste ‘rejects’. Smaller concentrate mass will be processed by Chrysos PhotonAssay at Intertek’s laboratory in Perth, Western Australia . The Acacia reactor and electrowinning apparatus in the gold room at the Nullagine Gold Project is being commissioned to accept larger masses of material from accepts and reject samples. This will be particularly important as the testwork program moves to Phase 3 at the Company’s Comet Well project in 2022 to test bulk samples (up to 20,000 tonnes of potentially mineralized material from the Comet Well and Purdy’s Reward projects). The Sorter infrastructure, designed and constructed by OPS Screening and Crushing Equipment, is a fully modular and containerized turn-key plant deployable to any of Novo’s tenements in the future for testwork and potential large bulk sampling and processing. The Sorter includes feed and product transfer conveyors, allowing the Sorter to produce gold-bearing concentrates in a single pass for further upgrading or downstream processing. This Phase 2 trial of the Sorter within the Golden Eagle processing facility area is the culmination of several years of test work conducted by Novo to determine the amenability of mechanical sorting to its 13,250 sq km of tenements across Western Australia. Mechanical sensor-based sorting utilizes x-ray technology, 3D colour laser, and metal induction to identify gold-bearing material. A high-pressure air jet ‘shoots’ these gold bearing particles into a collection system to produce a concentrate for further downstream processing. A drone fly-over video of the installed Sorter facility at the Nullagine Gold Project is available below. |

| Next steps: • Phase 2 completion prior to May 2022 – complete processing and assaying of all outstanding coarse, mid, and fines samples from the Company’s Comet Well, Purdy’s Reward, Egina and Talga Talga projects and establish operating protocols for processing larger mass • Phase 3 commencing May 2022 (subject to approval from the Western Australian Department of Water and Environmental Regulation) – relocate the Sorter and infrastructure to the Comet Well project for bulk testwork |

(Figure 1: The Sorter and associated infrastructure undergoing final construction and commissioning at the Nullagine Gold Project.) (Figure 1: The Sorter and associated infrastructure undergoing final construction and commissioning at the Nullagine Gold Project.) |

(Figure 2: The Sorter. Note the Company’s Golden Eagle processing facility in the background.) (Figure 2: The Sorter. Note the Company’s Golden Eagle processing facility in the background.) |

“Novo is delighted to see the Sorter in operation at the Nullagine Gold Project,” commented Mr. Rob Humphryson, CEO and a director of Novo. “This represents the culmination of considerable planning involving a dedicated consortium of mechanical, electrical, geological and processing experts aiming to maximize the likelihood of success of an innovative application for sorting in the gold industry. Results from Phase 3 bulk sampling program set to commence in 2022 at the Comet Well and Purdy’s Reward projects, together with the results of the Phase 2 trials at the Nullagine Gold Project this year, are expected to provide sufficient geological and operating certainty to enable Novo to progress towards commercial operations at Novo’s nuggety gold deposits.” QP STATEMENT Dr. Quinton Hennigh (P.Geo.) is the qualified person, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is the non-executive co-chairman and a director of Novo. ABOUT NOVO Novo operates its flagship Beatons Creek gold project while exploring and developing its prospective land package covering approximately 13,250 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com. On Behalf of the Board of Directors, Novo Resources Corp. “Michael Spreadborough” Michael Spreadborough Executive Co-Chairman Forward-looking information Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, that samples from the Company’s Comet Well, Purdy’s Reward, Egina, and Talga Talga projects ranging in size from 800 kg to approximately five tonnes will be crushed and screened ahead of Sorter testwork, that the Phase 2 testwork in late 2021 and Phase 3 testwork in early 2022 will achieve its objectives, including construction and commission the Sorter and infrastructure, tuning the Sorter to the various geological regimes and size fractions and training Novo operators in its use, processing samples from multiple Novo projects around the Pilbara to field test mass pull to concentrate, establishing assay protocols for Sorter concentrate ‘accepts’ and waste ‘rejects’, with Nullagine Gold Project gold room Acacia reactor and electrowinning apparatus being commissioned to accept larger masses of material from accepts and reject samples, that the Phase 3 testwork program will move to the Company’s Comet Well project in 2022 to test bulk samples (up to 20,000 tonnes of potentially mineralised material from the Comet Well and Purdy’s Reward projects), that processing and assaying of all outstanding coarse, mid and fines samples from Comet Well, Purdy’s Reward, Egina and Talga Talga will be completed and operating protocols for processing larger mass will be established prior to May 2022, and that the Sorter and associated infrastructure will be relocated to the Comet Well project for Phase 3 bulk testwork from May 2022 onwards pending receipt of approvals from DWER. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s management’s discussion and analysis for the nine-month period ended September 30, 2021, which is available under Novo’s profile on SEDAR at www.sedar.com. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements. |

Vancouver, British Columbia–(Newsfile Corp. – December 21, 2021) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company“, or “EMX“) is pleased to announce the execution, by its wholly-owned subsidiary Bronco Creek Exploration Inc., of exploration and option agreements (the “Agreements”) for four precious-metals projects (the “Projects” or individually a “Project”) located in Idaho and Nevada to Hochschild Mining PLC (LSE: HOC) (“Hochschild”). The Agreements provide EMX with work commitments and cash payments during Hochschild’s earn-in period, and upon earn-in for a given project, a 4% net smelter return (“NSR”) royalty, annual advance royalty payments, and milestone payments. Prior to final execution of the agreements, EMX and Hochschild agreed to, and commenced, initial exploration programs on all four Projects.

The three Idaho Projects, Valve House, Timber Butte, and Lehman Butte are located in southern and south-central Idaho (see Figure 1). Valve House and Timber Butte host Carlin-style gold mineralization in prospective carbonate-rich lithologies. Lehman Butte hosts epithermal style veins in Eocene volcanic rocks and jasperoids in older Paleozoic carbonate rocks. The Speed Goat Project hosts an intrusion-related gold-copper target located in the greater Battle Mountain-Eureka gold belt of north-central Nevada.

The Projects were recently acquired by staking prospective open ground during EMX’s ongoing regional scale, field-oriented royalty generation gold program. The Agreements with Hochschild serve as an example of the Company’s successful execution of the royalty generation aspect of its business model. Part and parcel to EMX’s business model, the Projects are now advancing with funding from a quality international mining company with EMX receiving pre-production payments while retaining upside optionality with retained NSR royalty interests.

Commercial Terms Overview. Pursuant to the Agreements, Hochschild can earn a 100% interest in a Project by (all dollar amounts in USD): (a) making option payments totaling $600,000, (b) completing $1,500,000 in exploration expenditures before the fifth anniversary of a given Agreement, and (c) reimbursing EMX the previous year’s holding costs. For clarity, the above terms are per individual Agreement covering an individual Project.

Upon an option exercise, EMX will retain a 4% NSR royalty on a Project. Hochschild may buyback up to a total of 1.5% of the royalty by first completing an initial 0.5% royalty buyback for a payment of 300 ounces of gold (or the cash equivalent) to the Company prior to the third anniversary of the option exercise. If the first buyback is completed, then the remaining 1% of the royalty buyback can be purchased anytime thereafter for a payment of 1,700 ounces of gold (or the cash equivalent) to the Company. Hochschild will also make annual advance royalty (“AAR”) payments of $50,000 that increase to $100,000 upon completion of a Preliminary Economic Assessment (“PEA”). The AAR payments for a Project cease upon commencement of production. In addition, Hochschild will make Project milestone payments consisting of: (a) $500,000 upon completion of a PEA, (b) $1,000,000 upon completion of a Prefeasibility Study, and (c) $1,000,000 upon completion of a Feasibility Study.

Project Overviews and 2021 Work Programs. The Projects optioned to Hochschild represent diverse styles of precious metals mineralization within, and along extensions of, key mineral belts in Idaho and Nevada.

Valve House, Idaho. Valve House is located approximately 25 kilometers southeast of Pocatello, Idaho. The Project covers 9.5 square kilometers of Carlin-style alteration and mineralization hosted within lower Paleozoic silty carbonate units. Gold mineralization is both structurally and stratigraphically controlled. The last noteworthy exploration, conducted in the 1980’s, identified three separate areas of gold mineralization and jasperoid replacement in limestone lithologies. Historical drill intercepts from this work included 42.7 meters averaging 0.87 g/t gold (from 10.7 to 53.4 m, true width unknown) and 21.3 meters averaging 0.71 g/t gold (from 0 to 21.3 m, true width unknown)1. Mineralization remains open for expansion.

To date, Hochschild has conducted additional reconnaissance mapping and rock chip sampling, a property-wide soil survey and an induced polarization (“IP”) geophysical survey. As well, Hochschild expanded the property position by staking additional claims. Hochschild’s exploration results are pending.

Timber Butte, Idaho. Timber Butte is located approximately 15 kilometers northeast of Carey, Idaho. The Project is a Carlin-style target characterized by anomalous gold mineralization associated with jasperoid and decalcified carbonate bearing rocks along north-northwest oriented structures cutting Roberts Mountains Formation, a key host to Carlin-style mineralization in Nevada. Cordex explored a portion of Timber Butte in the 1970’s and completed three rotary holes that intersected anomalous gold mineralization. EMX’s work has extended beyond the historical target area with additional targets identified along trend and under shallow colluvial cover. EMX’s rock chip sampling of altered outcrops on the main structural trend returned assay results including 1.25 g/t gold (n=19, avg. 0.1 g/t Au) along a strike length of approximately 3.2 kilometers.

After completing additional reconnaissance mapping and rock chip sampling, Hochschild expanded the land position, completed soil sampling geochemical surveys over key target areas, and collected stream sediment samples. An IP survey is planned for the first part of 2022 while awaiting assay results from the geochemical sampling programs.

Lehman Butte, Idaho. Lehman Butte is located in south-central Idaho, approximately 15 kilometers west-northwest of Mackay. The target at Lehman Butte is low sulfidation epithermal precious metals mineralization in quartz-sulfide veins cutting Eocene lavas and tuffs which overlie Paleozoic carbonate units. The quartz-sulfide veins are commonly greater than one meter wide and associated with widespread quartz-clay-adularia alteration in intermediate volcanic rocks, as well as with jasperoid alteration in the underlying Mississippian age limestone. The Project was identified from an EMX regional stream sediment geochemical program. Follow-up reconnaissance work included a rock chip sample of 3.1 g/t gold and 19.8 g/t silver (n=35, avg. 0.185 g/t Au and 6.7 g/t Ag) coincident with silicified zones and quartz-pyrite feeder veins. EMX and Hochschild are targeting bulk-tonnage precious metals mineralization hosted within permeable tuffaceous units.

Hochschild’s recently completed work program entailed property-wide geologic mapping and rock chip sampling along with an 800-sample soil survey and ground magnetic geophysical program. Results are pending. An IP survey together with an initial drill test is planned for the spring of 2022.

Speed Goat, Nevada. Speed Goat is located within the Battle Mountain-Eureka Trend, approximately 30 kilometers northwest of the Phoenix-Fortitude intrusion-related skarn system in north-central Nevada. EMX identified gold-copper mineralization composed of sheeted quartz-iron oxide after sulfide veins cutting Jurassic granodiorite. Mineralization appears to be related to a series of north-south striking porphyry dikes. Reconnaissance soil sampling by EMX outlined a 0.6 by 1 kilometer gold-in-soil anomaly (n=73, avg. 82 ppb Au) coincident with rock chip assays from outcrop that included 5.1 g/t gold (n=20, avg. 0.67 g/t Au). The mineralization is also anomalous in pathfinder geochemical elements (e.g., Bi-As-Sb-Cu), consistent with other intrusion-related gold systems in the nearby Battle Mountain district.

At Speed Goat, Hochschild completed additional geologic mapping and select channel sampling across the target zone in addition to ground magnetic and IP geophysical surveys in preparation for an initial drill test.

Comments on Sampling, Assaying, QA/QC, and Historical Exploration Results. EMX’s exploration samples were collected in accordance with industry standard best practices. The samples were submitted to ALS laboratories in Reno, Nevada and Vancouver, Canada (ISO 9001:2017 and ISO/IEC 17025:2017 accredited) for sample preparation and analysis. Gold assays were performed by fire assay with an ICP/AES finish. EMX conducts routine QA/QC analysis on its exploration samples, including the utilization of certified reference materials, blanks, and duplicate samples. Gold assays were performed by fire assay with an ICP/AES finish. Silver and other elements were analyzed by four acid digestion with ICP-AES or AAS finish.

From EMX’s independent field work, including geological mapping and geochemical sampling, the historical drill results referenced from Meridian and Cordex are judged to be representative and relevant.

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and an employee of the Company, has reviewed, verified, and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

Ibelger@EMXroyalty.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1: Locations of the EMX Projects optioned to Hochschild

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/108153_6b64df24a4b0f9a6_002full.jpg

____________________________

1 Meridian Gold and Cordex Exploration, 1984-1991. Unpublished internal company data.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108153

VANCOUVER, BC / ACCESSWIRE / December 20, 2021 / Group Ten Metals Inc. (TSX.V:PGE)(OTCQB:PGEZF)(FSE:5D32) (the “Company” or “Group Ten”) today reports partial results from the first two drill holes of the 14-hole resource expansion campaign completed in 2021 at the Company’s flagship Stillwater West PGE-Ni-Cu-Co + Au project in Montana, USA. Results are expected to form the basis of an updated resource estimate in 2022.

2021 Drill Highlights:

- CZ2021-01 returned the widest high-grade intercept to date on the project being 63.7 meters of 0.92% Nickel Equivalent (“NiEq”), equal to 2.46 g/t Palladium Equivalent (“PdEq”), with 0.47% Ni, 0.42 g/t Pd, 0.27% Cu, and 0.04% Co as well as significant Pt and Au values, within 367.6 meters of continuous mineralization at 0.31% NiEq (or 0.83 g/t PdEq). See Table 1 for details.

- CM2021-01 returned the longest mineralized intercept ever recorded in the Stillwater district with 728 meters of continuous sulphide mineralization at 0.27% NiEq, or 0.73 g/t PdEq, including contained intervals of successively higher grades:

- 352.9 meters of 0.39% NiEq (or 1.04 g/t PdEq) with 0.52 g/t 3E (Pd, Pt, and Au), and 0.17% Ni, plus significant Cu and Co values;

- 159.2 meters of 0.48% NiEq (or 1.29 g/t PdEq) with 0.77 g/t 3E, 0.18% Ni, plus significant Cu and Co values;

- 50.2 meters of 0.54% NiEq (or 1.45 g/t PdEq) with 1.0 g/t 3E, 0.19% Ni, plus significant Cu and Co values; and

- Shorter intervals of high-grade mineralization including 7.2 meters of 1.33 g/t Pd, 0.93 g/t Pt, and 0.24% Ni, plus significant Au, Cu, and Co values, for 1.02% NiEq (or 2.72 g/t PdEq).

- Both holes are step-outs completed with the objective of expanding deposits delineated by the 2021 Mineral Resource Estimate announced on October 21, 2021:

- CM2021-01 was one of six holes drilled in 2021 in the area between the DR and Hybrid deposits to step out from high-grade nickel sulphide-PGE mineralization identified in hole CM2020-04;

- CZ2021-01 is one of two holes drilled in 2021 to step-out on the CZ deposit in the area of wide, high-grade mineralization returned in hole CZ2019-01.

- Mineralization starts at or near surface in both holes.

- Assay results are pending from the lowest portion of CZ2021-01, and from the remaining 12 holes drilled in 2021. Rhodium results are also pending on all holes.

Michael Rowley, President and CEO, commented, “These initial results from the first two holes of our 2021 resource expansion drill campaign provide the strongest demonstration to date of our ability to target highly mineralized zones at Stillwater West, with significant wide intervals reaching more than five times the cut-off grade used in our recent resource estimate. This is very clear evidence that our predictive geologic model, utilizing tools like deep penetrating induced polarization geophysics, is accurately and effectively guiding us to drill wide zones of higher-grade nickel-copper-cobalt sulphide mineralization (battery metals), enriched in palladium, platinum, rhodium (platinum group elements), and gold. In addition to driving increased size and grade in our planned resource update, our ability to target effectively as we step-out from known mineralization in a large magmatic system is delivering incredibly low discovery costs as we advance the project.”

“Our work to date has demonstrated the exceptional scale and potential of the mineralized system in the lower Stillwater Complex. These results confirm and refine that understanding with Chrome Mountain hole CM2021-01 returning nearly three-quarters of a kilometer of continuous mineralization from a site that is over seven kilometers west of the HGR deposit in the Iron Mountain area, where hole IM2019-03 previously held the record for highest grade-thickness. Both areas have additional very high grade-thickness intervals in drill results, as does the CZ deposit located between the two. All of this confirms our observation that the lower Stillwater Complex has an immense endowment of contained metal and yet is surprisingly underexplored, despite its location in a famously productive and well-mineralized American mining district. Our systematic approach to exploration has quickly delineated five resource-stage deposits that are open for expansion across the nine-kilometer core of the Stillwater West project and we will continue to focus on their expansion while also advancing earlier stage targets that continue across the 32 kilometers of prospective magmatic stratigraphy covered by the property. We look forward to announcing results from the remaining drill holes along with results of our 2021 IP expansion survey in the near term as they become available.”

Table 1 – Highlight Results from 2021 Expansion Drill Campaigns at the DR, Hybrid, and CZ Deposit Areas

Assays pending for rhodium and certain intervals denoted by *. Highlighted significant intercepts with grade-thickness values over 20 gram-meter PdEq are presented above. Grade thickness values cover significant mineralized intervals with total palladium and nickel equivalent grade-thickness determined by multiplying the thickness of continuous mineralization (in meters) by the palladium equivalent grade (in grams/tonne) to provide gram-meter values (g-m) or by multiplying the nickel equivalent grade (in percent) to provide percent-meter values as shown. Total nickel and palladium equivalent calculations reflect total gross metal content using metals prices as follows (all USD): $7.00/lb nickel (Ni), $3.50/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,800/oz palladium (Pd), and $1,600/oz gold (Au). Equivalent values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals. In terms of dollar value, 0.20% nickel equates to a copper value of 0.40%, or a palladium value of 0.53 g/t, using the above metal values. Intervals are reported as drilled widths and are believed to be representative of the actual width of mineralization.

Grade-Thickness

Grade-thickness values of the mineralized intervals continue to demonstrate the remarkable metal endowment of the lower Stillwater Complex, with both holes reported here being well above 100 gram-meter (“g-m”) palladium equivalent grade-thickness. CM2021-01 returned 530 g-m PdEq grade-thickness, which is a record high for the Stillwater Complex. For comparison, this equates to 596 g-m gold equivalent, 954 g-m platinum equivalent, or 199 %-meter nickel equivalent. Grade-thickness values are an exploration tool used for comparing the intensity of mineralization across different mineralized widths. A grade-thickness value of 10 gram-meter Pd is equivalent to 1 g/t Pd over 10 meters, or 10 g/t Pd over 1 meter and is considered economically significant. The adjacent J-M Reef deposit now mined by Sibanye-Stillwater averages approximately 34 gram-meter Pd and Pt1,2. Values over 100 g-m PdEq are considered exceptional, highlighting the strength of the mineralized system, and values of more than 250 g-m PdEq (or 281 g-m AuEq) are rare across the industry. To date, the Stillwater West project has returned 31 drill holes with over 50 g-m PdEq grade-thickness, including five with more than 250 g-m PdEq.

Upcoming News and Events

Group Ten is pleased to confirm that it will participate in the upcoming Vancouver Resource Investment, AME Roundup, and Prospectors and Developers Association conferences in Q1 2022.

About Stillwater West

Group Ten is rapidly advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions Group Ten as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater’s PGE mines in south-central Montana, USA1. The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. Group Ten’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex2. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 9.2-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

2021 drill core samples were analyzed by ACT Labs in Vancouver, B.C. Sample preparation: crush (< 7 kg) up to 80% passing 2 mm, riffle split (250 g) and pulverize (mild steel) to 95% passing 105 µm included cleaner sand. Gold, platinum, and palladium were analyzed by fire assay (1C-OES) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with 8-Peroxide ICP-OES finish to insure complete dissolution of resistate minerals. Following industry QA/QC standards, blanks, duplicate samples, and certified standards were also assayed.

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1 – 2021 Resource Expansion Drill Holes with Deposit Outlines over Drill Data and Geophysics (Conductivity)

Figure 2 – 2021 Resource Expansion Drill Holes with Deposit Outlines and Drill Data over Precious and Base Metals in Soils

Figure 3 – 2021 Mineral Resource Estimate over 9 KM Core Project Area with 3d Model of Ip Survey Results

SOURCE: Group Ten Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/678533/Group-Ten-Reports-Highest-Grade-and-Widest-Mineralized-Intercepts-to-Date-at-the-Stillwater-West-Battery-Metals-and-Platinum-Group-Elements-Project-in-Montana-USA-Including-637-Meters-of-092-Nickel-Equivalent-Mineralization-246-gt-Palladium-Equivalent

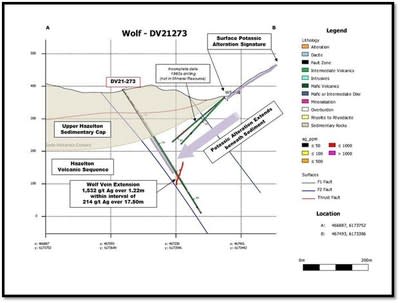

VANCOUVER, BC, Dec. 20, 2021 /PRNewswire/ – Dolly Varden Silver Corporation (“Dolly Varden” or the “Company“) (TSXV: DV) (OTC: DOLLF), is pleased to announce drill results from regional exploration and reconnaissance drilling at its 100%-owned Dolly Varden Project located near tidewater in northwestern British Columbia, with particularly encouraging results from the Wolf Vein, as well as the identification of large, new porphyry related copper-gold system.

At the Wolf Deposit, drill hole DV21-273 tested the southwest projection of the Wolf Vein, 94m down plunge from the current Mineral Resources, intersecting 1,532 g/t Ag, 0.44 g/t Au, 2.11 % Pb and 1.07% Zn over 1.22m core length within a brecciated sulphide-rich quartz vein hosted within a broader pyrite stockwork breccia zone of 17.50m averaging 214 g/t Ag and 0.47% Pb. The current NI 43-101 Mineral Resource Estimate hosts 3.83 million ounces of silver at 296 g/t in the Indicated category at Wolf. It is located approximately two kilometers northwest of the 25.0 million ounces of silver in the Indicated Category and additional 10.5 million ounces of silver in the Inferred category at Dolly Varden’s Torbrit Deposit.

In other regional exploration drilling, Dolly Varden’s technical team is highly encouraged by long intervals of stockwork quartz with strongly anomalous gold (>100 ppb) over wide intervals (up to 303 meters) along with silver and copper at the Western Gold Belt Area. Hosted within early Jurassic volcanic rocks, this style of stockwork and alteration is analogous to numerous alkalic gold-copper deposits and mines in British Columbia. The Company plans appropriate geophysical surveys for porphyry-style mineralization and subsequent follow-up drilling in this area.

“This high-grade silver intercept at Wolf demonstrates the excellent exploration and resource expansion potential on the Property. The next phase of exploration drilling will prioritize connecting our historic mines and current deposits of the Dolly Varden Trend with the deposits at Homestake 5.4km to the northwest along the Kitsault Valley Trend that comprise the recently announced proposed acquisition from Fury Gold Mines,” said Shawn Khunkhun, CEO of Dolly Varden Silver. “Additionally, the strong indicator of porphyry related gold-copper-silver style indicators potentially the most significant exploration breakthrough on the Property in years”.

A total of 10,506m in 31 diamond drill holes were completed at Dolly Varden during the 2021 field season. Results have been received for 10 holes that tested five regional exploration targets on the Property including the Wolf Vein extension and Western Gold-Copper Belt. Assays will be announced in the near future for the 21 holes completed at the high-grade Torbrit and Kitsol Silver Deposits. The 21 near-Resource holes were drilled as part of a two phase program with the objective of expanding Resources as well as upgrading current Inferred Resources to Measured and Indicated Classification.

The 2021 drilling at Dolly Varden initiated the Company’s two-year strategy to aggressively expand and upgrade the Torbrit Silver Deposit and multiple satellite zones with the objective of advancing Dolly Varden to be the next high-grade silver mine in British Columbia.

| Hole ID | From (m) | To (m) | Length (m) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| DV21-273 | 302.00 | 319.50 | 17.50 | 214 | 0.47 | 0.06 | |

| including | 303.18 | 304.40 | 1.22 | 1532 | 0.44 | 2.11 | 1.07 |

| including | 311.85 | 315.80 | 3.95 | 328 | 0.12 | 0.52 | 0.83 |

| *true width is estimated at 85% of core length, using angle to core from oriented core data. |

Table 1: Wolf Extension Exploration drilling results

Hole DV21-273 is also significant as it tested the prospective Hazelton volcanic rock that underlies the sedimentary units of the Upper Hazelton for the Wolf Vein extension. Discovering that the strong potassic alteration associated with silver mineralization within the volcanogenic Torbrit Deposit continues beneath the sediment suggests that the mineralizing system continues to the west of the 4.5 km long surface alteration anomaly. This opens up exploration potential of the entire bottom of the Kitsault valley north of Wolf towards the Property boundary and onto Homestake Ridge.

“Intercepting silver mineralization associated with potassic alteration in the older volcanic rocks underneath the sediment package within the fold axis of a regional syncline gives our team further reason to drill test several geophysical anomalies identified along the northerly trend towards the deposits at Homestake Ridge”, explained Rob van Egmond, Chief Geologist for Dolly Varden Silver.

Wolf is the northernmost deposit that comprises the current Mineral Resources at the Dolly Varden Project. Modelling of the epithermal vein style deposit indicates a stepped vein system, offset by steep faults. The hanging wall of the deposit has strong barium signature and the veins contain barite and quartz. There are historic underground drifts at Wolf but no historic production was reported.

Western Gold-Copper Belt

On the Western side of the Kitsault Valley, three holes (DV21-267, 268 and 269) tested the Red Point target with structures related to a gold in soil anomaly within the southern end of the Western Gold belt quartz, sericite, pyrite (QSP) alteration zone. Drilling intercepted wide zones of stockwork veins with strongly anomalous gold, silver and copper mineralization within Hazelton volcanic rocks. Proximal to intrusive rocks, this wide zone mineralization is analogous to other alkalic copper-gold porphyry related systems in British Columbia. In the Golden Triangle, these deposits include KSM, Treaty Creek, Saddle (GT Gold), Red Chris and Snowfield.

This Western Gold Belt is located on the west side of the Kitsault valley and trends from near the Dolly Varden Mine northward for several kilometers towards Homestake Ridge. Intrusive-related QSP alteration is associated with zones of increased silica stockwork and multi-phased breccias with pyritic matrix. This style of alteration, mineralization and brecciation is also common at other higher grade deposits in the Golden Triangle, including Homestake Ridge and Ascot’s past-producing Premier and Big Missouri mines, as well as Goliath Resource’s recent discoveries west of Dolly Varden. Results are as follows:

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Ag (g/t) | Cu (%) |

| DV21-267 | 1.55 | 170.10 | 168.55 | 0.13 | ||

| DV21-267 | 26.00 | 26.65 | 0.65 | 0.35 | 13 | |

| including | 79.00 | 80.00 | 1.00 | 1.15 | 24 | |

| including | 81.80 | 83.00 | 1.20 | 0.95 | 5 | 0.07 |

| including | 168.00 | 170.10 | 2.10 | 0.33 | 10 | 0.41 |

| DV21-268 | 2.36 | 186.80 | 184.44 | 0.17 | ||

| including | 66.00 | 72.00 | 6.00 | 0.57 | 6 | |

| and | 192.06 | 192.56 | 0.50 | 128 | 0.94 | |

| DV21-269 | 2.65 | 85.00 | 82.35 | 0.17 | ||

| DV21-269 | 127.00 | 430.00 | 303.00 | 0.15 | ||

| including | 289.00 | 290.12 | 1.12 | 1.1 | ||

| including | 316.00 | 317.00 | 1.00 | 1.12 |

| *true width has not been determined as there is insufficient drilling to model the orientation of the broad mineralization and alteration zone |

Table 2: Red Point – Combination, Western Gold Belt results

Medallion

Three holes were completed at the Medallion Prospect (DV21-264, 265 and 266) located at the southern end of the Project. Historic trenches and small adits explored narrow zones of veining within weakly altered volcanic rocks hosting silver, copper lead and zinc mineralization. No significant results were returned.

Syndicate

Diamond drill holes DV21-270 and 271 were drilled from the same setup as Medallion to test the Syndicate Target. A near-surface vein in DV21-270 returned 126 g/t Ag and 1.31 g/t Au over a core length of 1.10m.

| Target | Hole ID | From | To | Core Length (m) | Ag (g/t) | Au (g/t) |

| Syndicate | DV21-270 | 52.4 | 53.5 | 1.10 | 126 | 1.31 |

| Syndicate | DV21-271 | No significant results |

| *true width has been estimated at between 80% to 90% of core length based on limited drilling for geometry modelling |

Table 3: Syndicate results

Silver Horde

One drill hole tested the potassic alteration zone at Silver Horde, approximately 900m north of Wolf. It was collared in sediment cap rocks to test the volcanic units down plunge of previously encouraging drill results. Hole DV21-272 intersected two zones where diffuse sheeted veinlets were found carrying dark silver sulphosalts. The structure returned 9.0 meters core length averaging 126.7 g/t Ag within the volcanic host, plunging towards the axis of the valley syncline.

| Target | Hole ID | From | To | Core Length (m) | Ag (g/t) |

| Silver Horde | DV21-272 | 41 | 50 | 9.0 | 126.75 |

| including | 41 | 42.5 | 1.5 | 256 | |

| Silver Horde | DV21-272 | 202.5 | 203 | 0.5 | 249 |

| *true width has not been determined as there is insufficient drilling to model the orientation of the diffuse sheeted veins |

Table 4: Silver Horde results

| Hole ID | Area | Easting NAD 83 | Northing NAD 83 | Elevation (m) | Azimuth | Dip | Depth |

| DV21-264 | Medallion | 467181 | 6168686 | 514 | 210 | -50 | 203 |

| DV21-265 | Medallion | 467199 | 6168813 | 457 | 193 | -46 | 341 |

| DV21-266 | Medallion | 467220 | 6169100 | 444 | 193 | -50 | 501 |

| DV21-267 | Red Point | 466637 | 6172476 | 735 | 56 | -50 | 356 |

| DV21-268 | Red Point | 466637 | 6172476 | 735 | 56 | -75 | 425 |

| DV21-269 | Red Point | 466637 | 6172476 | 735 | 236 | -50 | 430 |

| DV21-270 | Syndicate | 466196 | 6176721 | 453 | 80 | -47 | 493 |

| DV21-271 | Syndicate | 466196 | 6176721 | 453 | 80 | -80 | 107 |

| DV21-272 | Silver Horde | 466760 | 6174562 | 377 | 55 | -50 | 365 |

| DV21-273 | Wolf | 467093 | 6173630 | 387 | 120 | -55 | 449 |

Table 5: Exploration portion of 2021 program: drill hole location data

Quality Assurance and Quality Control

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its Project. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed and a 500 gram split is pulverized to minus 200mesh. Multi-element analyses were determined by Inductively–Coupled Plasma Mass Spectrometry (ICP-MS) for 48 elements following a 4-acid digestion process. High grade silver testing was determined by Fire Assay with either an atomic absorption, or a gravimetric finish, depending on grade range. Au is determined by Fire Assay on a 30g split.

Qualified Person

Rob van Egmond, P.Geo., Chief Geologist for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on exploration in northwestern British Columbia. The Dolly Varden Project consists of the namesake Dolly Varden silver property that hosts a unique pure silver mineral resource as well as the nearby Big Bulk copper-gold porphyry property. The Dolly Varden Project is considered to be highly prospective for hosting high-grade precious metal deposits, since it comprises the same structural and stratigraphic setting that host numerous other high-grade deposits (Eskay Creek, Brucejack).

Dolly Varden has recently entered into an agreement with Fury Gold Mines to acquire the Homestake Ridge Project adjacent to the current Dolly Varden property to consolidate the Kitsault Valley Gold-Silver mineralization trend into one large, high-grade precious metals project with further exploration upside potential. The Big Bulk property is prospective for porphyry and skarn style copper and gold mineralization similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “potential” and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward looking statements or information relates to, among other things, completion of the Offering, Exchange approval of the Offering, the use of proceeds with respect to the Offerings, the results of previous field work and programs and the continued operations of the current exploration program, interpretation of the nature of the mineralization at the project and that that the mineralization on the project is similar to Eskay and Brucejack, results of the mineral resource estimate on the project, the potential to grow the project, the potential to expand the mineralization, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our beliefs about the unexplored portion of the property. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on risks and uncertainties, see the Company’s most recently filed annual management discussion & analysis (“MD&A”), which is available on SEDAR at www.sedar.com. The risk factors identified in the MD&A are not intended to represent a complete list of factors that could affect the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

View original content to download multimedia:https://www.prnewswire.com/news-releases/dolly-varden-silver-intersects-1-532-gt-silver-over-1-22-meters-at-wolf-vein-94-meters-down-dip-301448005.html

SOURCE Dolly Varden Silver Corp.

Vancouver, British Columbia–(Newsfile Corp. – December 20, 2021) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to provide an update on its Balya North lead-zinc-silver royalty property in northwestern Turkey. EMX retains an uncapped 4% NSR royalty on the Balya North development project. EMX representatives recently visited the Balya North operations to tour the project area and meet with operator Esan Eczacibaşi Endüstriyel Hammaddeler San. ve Tic. A.Ş. (“Esan”).

Esan has informed EMX that the development ramps to be used for production at Balya North are nearly complete with the first ramp having reached a length of 520 meters at an 8% grade to access the uppermost bodies of mineralization in the Balya North deposit (approximately 50 meters depth below the surface). A ventilation shaft that will also serve as a secondary escapeway (for safety purposes) has also been completed and initial production is underway.

During ramp development, approximately 18,000 tonnes of lead-zinc-silver mineralized material were intersected by the workings and have been stockpiled on site. This material is now being processed at Esan’s nearby mill facility.

In addition, Esan has multiple drill rigs on site, testing the down-plunge extensions of the Balya North deposit and infill drilling the mineralized zones to improve their level of confidence. Esan has informed EMX that approximately 35,000 meters of exploration drilling have been completed thus far in 2021, and an additional 5,000 meters are planned to be completed in the current campaign. The new drilling is materially expanding the zones of known mineralization along trend and at depths in the system(s) (see Drilling Update below).

In addition to the development work and ongoing drill programs, Esan is also reconfiguring portions of the processing lines at its nearby milling and concentrating facilities to accommodate the feed of new material from the EMX royalty property. This includes modifications to the lines that feed the fine material stockpiles and the addition of an automated sampler to collect representative samples of the Balya North materials as they are fed to the processing systems. It is expected that this work will be completed in early 2022.

Drilling Update. Highlights from recent drilling completed by Esan are shown in Table 1 below. These include several notable intercepts from deep levels in the system (depths of greater than 700 meters), which show that mineralization at Balya North continues to be robust at depth and remains open in multiple directions. Intercepts from these depths have not yet been included in the in-house resource models, as more drilling will be needed to define the extents and limits of mineralization at deep levels.

Also evident were multiple thick intervals of mineralization at shallower levels in the Balya North deposit. Like other parts of the system(s), silver tends to be highly enriched in lead-rich (galena) zones of mineralization, and this is nicely demonstrated by the recent drill results. Esan has informed EMX that it intends to continue its aggressive drill program in 2022.

Table 1: Highlights from recent Balya North drilling

| Drill Hole | From | To | Length (meters)* | Pb % | Zn % | Ag ppm |

| BKS-005 | 830.6 | 837 | 6.4 | 8.61 | 0.16 | 96.82 |

| BKS-020 | 388.5 | 408.6 | 20.1 | 8.05 | 3.61 | 101.15 |

| BKS-031 | 783.5 | 787.4 | 3.9 | 10.30 | 5.08 | 342.00 |

| BKS-057 | 313.6 | 330.6 | 17 | 5.83 | 4.93 | 61.28 |

| BKS-057 | 343.4 | 366.9 | 23.5 | 16.24 | 5.24 | 243.08 |

| BKS-066 | 570.7 | 596.2 | 25.5 | 2.80 | 3.51 | 163.91 |

*as measured in drill core; true widths not reported and remain unknown

Balya North Royalty Property Overview. EMX retains a 4% net smelter return (“NSR”) royalty on its Balya North royalty property, which is situated in the historic Balya mining district of northwestern Turkey. Mining at Balya has taken place since antiquity, with several generations of historical operations. The district contains extensive zones of shear-zone hosted and carbonate replacement style (“CRD”) lead-zinc-silver mineralization in addition to skarn and more copper-rich styles of mineralization developed at depth.

Esan acquired the EMX royalty property at the end of 2019 (See EMX news release dated January 7, 2020) and is a private Turkish company that operates 40 mines and eight processing plants. Most importantly, Esan operates a lead-zinc mine and flotation mill on the property immediately adjacent to EMX’s Balya North royalty property.

EMX congratulates Esan on its ongoing development progress at Balya North and looks forward to additional updates as production progresses.

Comments on Sampling, Assaying, and QA/QC. ESAN’s drill samples were collected in accordance with industry standard best practices. The samples were submitted to ALS laboratories in Izmir, Turkey and Vancouver, Canada (ISO 9001:2000 and 17025:2005 accredited) for sample preparation and analysis. Silver and base metal analyses are determined by four acid digestion and ICP MS/AES techniques. Over-limit analyses are performed by atomic absorption, and in some cases (>30% Pb and >30% Zn) by volumetric titration techniques. ESAN performs routine QA/QC analyses on their assay results, including the utilization of certified reference materials, blanks, and duplicate samples.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information. For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

(303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential”, “upside” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108010

YERINGTON, Nev., Dec. 09, 2021 (GLOBE NEWSWIRE) — Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada Copper” or the “Company”) today provided an operations update and overview of the H2 2021 milestones achieved at its underground mine at the Company’s Pumpkin Hollow Project (the “Underground Mine”).

The Company has experienced a significant reset and demonstrated significant operational and corporate improvements in H2 2021. These milestones provide a foundation for an accelerating pace of operational ramp-up.

“I am very pleased with the progress the Company has made in H2 of this year,” stated Randy Buffington, President and Chief Executive Officer. “Our mining rates, a key metric for ramp-up production advancement, have been increasing month over month. We are now seeing the efficiencies generated from the advanced management systems implemented in Q3 of this year. The building blocks are in place for increased mining rates and production as we move into H1 of next year.”

Operations

- Equipment availabilities materially improved: 14% improvement from 65% to 74% in total fleet availability since the beginning of Q4, 2021. Additional equipment expected to be added in Q4, 2021.

- Contractor performance improved: Productivity increased by 31% from 1.75 to 2.29ft per person shift between October and November resulting in substantial improvement in operating efficiency as well as cost reductions.

- Increased mining development rates: Sequential monthly increases in development rates, a key leading indicator of production ramp-up, delivered since management changes in August 2021. Rates achieved in December are currently 50% higher than August. Commissioning of additional bolters planned to deliver a further 50% increase in development rates in the coming weeks.

- Consistent mill performance: Milling operations have performed well throughout 2021, with batch processing reaching 4700tpd, recoveries over 90% and concentrate quality performing in-line with design specifications.

- Dike crossing completion: First crossing of the water bearing dike was completed in August 2021, and the second crossing is anticipated to occur later this year. No further crossings are required during the ramp up to 3ktpd expected in H1, 2022.

- Ventilation infrastructure in place: All underground ventilation infrastructure was completed in H1 2021. Final addition of surface ventilation fans remains on schedule, with commissioning planned to be completed in January, 2022, with ventilation no longer expected to be a constraint to production rates thereafter.

Corporate

- Transformational financing completed:

- Closed C$125m public equity offering in November 2021, with a significant portion of the funds provided by select mining sector corporates. This was further complemented by broad participation from other new and existing institutional investors.

- The upsized financing provides additional liquidity to fund exploration and expansion studies at the Company’s open pit project (the “Open Pit Project”) in addition to the ramp-up of Underground Mine.

- Significantly enhanced balance sheet flexibility:

- Long term debt reduced by approximately 30% during Q4, 2021.

- First debt repayment under the Company’s senior credit facility with KfW-IPEX Bank deferred by 2 years to July 2024.

- Hiring of key management positions:

- Joining as Chief Executive Officer on October 6, 2021, Randy Buffington brings substantial operational and development experience in both underground and open pit mines in Nevada and internationally.

- 8 key operational management positions added in H2 2021, resulting in operational improvement and enhanced planning and execution systems.

- Development

- Developed program for Open Pit Project resource extension and feasibility study: The budget and execution plan have been defined and the Company expects that drilling to support the updated open pit feasibility study will commence in Q2 2022, potentially sooner depending on drill rig availability.

- Open Pit Project Decarbonization Program Advanced:

- Solar power studies were completed in 2021, which show:

- Pumpkin Hollow benefits from ample sun and land to support a large solar project with the capacity to meet a significant portion of the Open Pit Project’s power requirements;

- The solar potential at the site is up to 200MW;

- The already low grid power costs in Nevada could be further reduced through an on-site solar plant; and

- A third-party solar project provides an option to remove upfront power infrastructure costs from the Open Pit Project.

- Electric fleet study for mobile mining equipment fleet electrification at the Open Pit Project was completed by US-based energy and sustainability consultant Sprout Energy, which concluded:

- Scope 1 carbon emissions over the life of mine could be reduced by approximately 10% of total estimated emissions; and

- Fuel and maintenance costs could be reduced by up to approximately US$200m over the life of mine.

- Solar power studies were completed in 2021, which show:

- Exploration

- Undertook further property reconnaissance on the Copper Ridge Area, which is located to the northeast of the Open Pit.

- Defined target exploration plan: Initiated further refinement and interpretation of the newer geophysics in key areas such as Tedeboy, Tedeboy porphyry and Copper Ridge.

- Initial grab sampling and mapping of these areas have resulted in areas with high grade copper samples. Surface mapping and sampling are planned for Q1 of 2022, supporting the commencement of drilling in Q2 2022.

Qualified Persons

The technical information and data in this news release was reviewed by Greg French, C.P.G., VP Head of Exploration of Nevada Copper, and Neil Schunke, P.Eng., a consultant to Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which is now in the production stage, and a large-scale Open Pit Project, which is advancing towards feasibility status.

NEVADA COPPER CORP.

www.nevadacopper.com

Randy Buffington, President and CEO

For further information contact:

Rich Matthews, Investor Relations

Integrous Communications

rmatthews@integcom.us

+1 604 757 7179

Cautionary Language

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to mine development, production and ramp-up objectives, exploration activities, equipment installation and the completion of a new feasibility study.

Forward-looking statements and information include statements regarding the expectations and beliefs of management. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information should not be read as guarantees of future performance and results. They are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and events to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.