Tag: #JuniorMining

Whoa! Joining us for an action packed interview is the legendary Bob Moriarty the founder of http://www.321gold.com/, as we will cover a lot of ground in this interview! Topics ranging from Market Conditions, Bitcoin, the Colorado River, Junior Mining Companies, and Precious Metals. This is an absolute must watch!

Lion One Metals: https://liononemetals.com/

Irving Resources: https://irvresources.com/

Labrador Gold: https://labradorgold.com/

Interview: https://provenandprobable.com/labrador-gold-discovers-54-17-gpt-at-big-vein-on-kingsway-gold-project/

Roogold: https://roogoldinc.com/

Interview: https://provenandprobable.com/roogold-positioned-to-be-the-next-dominant-player-in-the-new-south-whales/

Dolly Varden Silver: https://www.dollyvardensilver.com/

Interview: https://provenandprobable.com/dolly-varden-silver-3-rigs-30000-meter-drill-program-on-the-kitsault-valley-project/

Provenance Gold: https://www.provenancegold.com/

Interview: https://provenandprobable.com/provenance-gold-has-2-gold-projects-that-offer-a-tremendous-opportunity-for-savvy-gold-investors/

Eloro Resources: https://elororesources.com/

Vancouver, British Columbia–(Newsfile Corp. – June 22, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) has acquired ownership of 7,924,106 common shares (representing 7.25% of the outstanding shares) of Norra Metals Corp. (TSXV: NORA) of Vancouver, BC. The acquisition was made pursuant to a property sale agreement with Norra executed in December 2018.

Prior to the acquisition, EMX owned 5,771,000 common shares (representing 5.69% of Norra’s outstanding common shares). EMX now has ownership of and control over 13,695,106 common shares of Norra (representing 12.53% of Norra’s outstanding common shares).

The shares were acquired on June 15, 2022, under the prospectus exemption set out in section 2.13 [Petroleum, natural gas and mining properties] of National Instrument 45-106 Prospectus Exemptions of the Canadian Securities Administrators.

Presently, EMX does not have any intention of acquiring any further securities of Norra.

EMX will file an Early Warning Report with the British Columbia and Alberta Securities Commissions in respect of the acquisition. Copies of the Report may be obtained from SEDAR (www.sedar.com) or without charge from EMX’s Corporate Secretary, Rocio Echegaray (604-688-6390).

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe) Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

VANCOUVER, BC / ACCESSWIRE / June 22, 2022 / (CSE:ROO) (OTC:JNCCF) (Frankfurt: 5VHA) -RooGold Inc. (“RooGold” or the “Company“) is pleased to announce that at its shareholder meeting (“Meeting”) on June 21, 2022, shareholders approved the re-appointment of Carlos Espinosa, Michael Singer and Michael Mulberry to the Board of Directors of the Company. Shareholders also approved, subject to final TSX Venture Exchange (“Exchange”) acceptance, the adoption of a new “rolling up to 10%” stock option plan (“Stock Option Plan”), as disclosed in detail in the Meeting materials, that complies with Policy 4.4 of the Exchange. The maximum aggregate common shares that are issuable pursuant to the Stock Option Plan is 10% of the issued common shares of the Company (“Listed Shares”), a maximum of 10% of issued Listed Shares are issuable to insiders (as a group) in any 12 month period, a maximum of 5% of issued Listed Shares may be granted or issued pursuant to the Stock Option Plan to any one person, a maximum of 2% of issued Listed Shares may be granted or issued pursuant to the Stock Option Plan to any one Consultant or Investor Relations Service Provider. The Company currently has 72,559,950 common shares (“Listed Shares”) issued and outstanding and accordingly, there are 7,255,995 Listed Shares issuable pursuant to the Stock Option Plan.

Immediately following the Meeting, the Directors approved the re-appointment of Carlos Espinosa as Chief Executive Officer & President, Remantra (Anup) Sheopaul as Chief Financial Officer & Corporate Secretary, and Alexandra Bonner as Vice-President Exploration.

About RooGold Inc.

ROOGOLD is a Canadian based junior venture mineral exploration issuer which is uniquely positioned to be a dominant player in New South Wales, Australia, through a growth strategy focused on the consolidation and exploration of high potential, mineralized precious metals properties in this prolific region of Australia. Through its announced acquisitions of Southern Precious Metals Ltd., RooGold Ltd. and Aussie Precious Metals Corp. properties, RooGold commands a portfolio of 13 high-grade potential gold (9) and silver (4) concessions covering 1,380 km2 which have 137 historic mines and prospects.

For further information please contact:

Ryan Bilodeau

T: 416-910-1440

info@roogoldinc.comhttps://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%2522%252C%2522wiki_topics%2522%253A%2522TSX_Venture_Exchange%253BCarlos_Espinosa%253BMichael_Alan_Singer%253BCommon_stock%253BOption_(finance)%253BCompany%2522%252C%2522lmsid%2522%253A%2522a077000000LnOyOAAV%2522%252C%2522revsp%2522%253A%2522accesswire.ca%2522%252C%2522lpstaid%2522%253A%2522e63c698f-523e-31a9-9fff-1811d59a59a7%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities law. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur.

Although the Issuer believes that the expectations reflected in applicable forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements.

VANCOUVER, British Columbia, June 20, 2022 (GLOBE NEWSWIRE) — Irving Resources Inc. (CSE:IRV; OTCQX: IRVRF) (“Irving” or the “Company”) reports that the investment agreement (the “Investment Agreement”) entered into between Irving and Newmont Corporation (“Newmont”) in April 2019, as amended (please refer to the Company’s news releases dated April 23, 2019, February 20, 2020 and April 12, 2021), has been further amended such that the next private placement which Newmont has the right to require the Company to undertake is now in the maximum amount of US$4,400,000 (the “2022 Newmont Placement”). In addition, Newmont has the right to require the Company to undertake a further private placement in the amount of US$6,000,000.

Irving also reports that Newmont has given notice of exercise of its right to proceed with the 2022 Newmont Placement. These funds will be raised by the issuance of common shares of the Company (“Common Shares”) at a price equal to the volume-weighted average trading price for the 30 trading days immediately preceding the date on which Newmont delivered its exercise notice. The funds from the 2022 Newmont Placement will be allocated as to 70% towards exploration on Irving’s Omu project in Hokkaido, Japan and 30% towards the alliance formed between Irving and an affiliate of Newmont to identify and, if designated by Newmont’s affiliate, jointly exploit mineral exploration opportunities throughout Japan.

Irving also intends to concurrently undertake a non-brokered private placement of units (the “Concurrent Placement”) to raise up to C$3,000,000 by the issuance of units (“Units”) at a price of C$1.00 per Unit. Each Unit will consist of one Common Share and one-half of one Common Share purchase warrant, each whole Warrant entitling the holder to purchase one Common Share at a price of C$1.60 for a period of three years. It is expected that the Concurrent Placement will close concurrently with the 2022 Newmont Placement. The funds from the Concurrent Placement will be allocated towards exploration on the Company’s mineral resource projects and general working capital.

About Irving Resources Inc.:

Irving is a junior exploration company with a focus on gold in Japan. Irving also holds, through a subsidiary, a Joint Exploration Agreement with Japan Oil, Gas and Metals National Corporation (JOGMEC). JOGMEC is a government organization established under the law of Japan, administrated by the Ministry of Economy, Trade and Industry of Japan, and is responsible for stable supply of various resources to Japan through the discovery of sizable economic deposits of base, precious and rare metals.

Additional information can be found on the Company’s website: www.IRVresources.com.

Akiko Levinson,

President, CEO & Director

For further information, please contact:

Tel: (604) 682-3234 Toll free: 1 (888) 242-3234 Fax: (604) 971-0209

info@IRVresources.com

THE CSE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE.

Forward-looking information

Some statements in this news release may contain forward-looking information within the meaning of Canadian securities legislation including, without limitation, statements as to the expected completion of the 2022 Newmont Placement and the Concurrent Placement and the use of the proceeds therefrom. Forward-looking statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the interest of investors in the Concurrent Placement as well as customary risks of the mineral resource exploration industry.

This news release does not constitute an offer for sale, or a solicitation of an offer to buy, in the United States or to any “U.S. Person” (as such term is defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “1933 Act”)) of any securities of Irving. The securities of Irving have not been, and will not be, registered under the 1933 Act or under any state securities laws and may not be offered or sold in the United States or to a U.S. Person absent registration under the 1933 Act and applicable state securities laws or an applicable exemption therefrom.

Figure 1:

Figure 2:

Figure 3:

Figure 4:

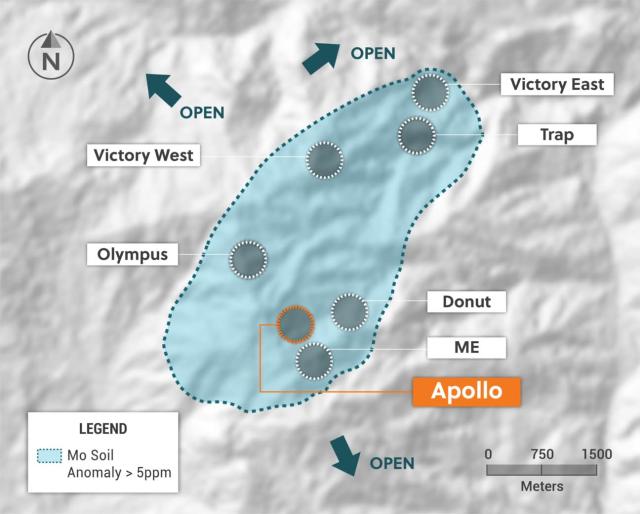

TORONTO, June 22, 2022 (GLOBE NEWSWIRE) — Collective Mining Ltd. (TSXV: CNL) (“Collective” or the “Company”) is excited to announce the discovery of a new high-grade copper-gold-silver porphyry-related breccia at the Guayabales project, located in Caldas, Colombia. APC-1, which is the first ever diamond drill hole to test the Apollo target (“Apollo”), was collared approximately 600 metres southeast of the previously announced Olympus discovery hole that assayed 302 metres @ 1.11 g/t gold equivalent (see release dated March 15, 2022). Apollo is one of eight porphyry-related targets situated within a three-by-four-kilometre cluster area generated by the Company through grassroots exploration. As part of its fully funded 20,000 metre drill program for 2022, there are currently three diamond drill rigs operating at Guayabales, with two turning at Apollo and one turning at the Trap target.

| Highlights (See Figures 1 – 4) | ||||

| • | APC-1, intercepted the mineralized breccia from 291.6 metres downhole (170 metres vertical) with results as follows: | |||

| • | 87.8 metres @ 2.49 g/t AuEq including: | |||

| 10.9 metres @ 4.55 g/t AuEq from 291.6 metres down hole; and | ||||

| 14.3 metres @ 3.67 g/t AuEq from 352 metres down hole | ||||

| • | Mineralization is remarkably continuous along the axis of the discovery intercept and is hosted within a breccia sulphide matrix consisting of chalcopyrite (Cu) and pyrite. Additionally, overprinting carbonate base metal porphyry veins flood the breccia matrix in various locations along the mineralized interval in APC-1 with visible sphalerite (Zn) and Galena (Pb) observed. The breccia clasts are all quartz diorite in composition and this hydrothermal system is clearly linked to a porphyry system. | |||

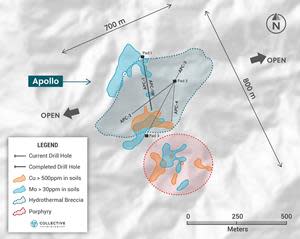

| • | APC-1 was drilled to the south from Pad 1 on the northern fringe of an 800 metre X 700 metre target area as defined by rock sampling, soil geochemistry and geology mapping. Apollo remains open to the east, west, south and at depth for further expansion. Due to the size of the target area at Apollo, the Company has completed the construction of two additional drill pads. Drill holes APC-1W and APC-2 have already been completed with APC-3 and APC-4 currently underway. Future assay results for Apollo will be reported in batch format once received and interpreted by the Company. | |||

| • | The Apollo target area consists of newly generated porphyry and porphyry related targets with coincidental high-grade copper and molybdenum soil anomalies in places measuring greater than 500 parts per million (“ppm”) in copper and 30 ppm in molybdenum. Additionally, surface sampling at Apollo has uncovered a series of high-grade gold outcrops with numerous rock samples assaying greater than 3 g/t gold. | |||

| • | Apollo is road accessible all year-round and is situated within an elevation range of 1,800 to 2,000 metres above sea level. Additionally, an electrical substation is located less than one kilometre from the target area. | |||

| “The discovery at Apollo opens a new and very exciting front for the Company. Firstly, it is the first time that the Company has discovered a significant amount of copper. Secondly, large mineralized systems generally have multiple styles of overprinting mineralization and in the case of Apollo, we have already observed three different mineralization types, namely two types of porphyry related CBM veins and of course the mineralized breccia. Our technical team also believes that the Apollo discovery may be the first in a series of porphyry and breccia discoveries at the Apollo target,” commented Ari Sussman, Executive Chairman. “With a second rig recently commissioned and now coring, we have made the decision to soon add a third rig to the program in order to aggressively unlock the potential value of this discovery.” |

Table 1: Assays Results

| HoleID | From (m) | To (m) | Intercept (m)** | Au (g/t) | Ag (g/t) | Cu % | Zn % | Pb % | Mo % | AuEq (g/t)* |

| APC-1 | 291.60 | 379.40 | 87.80 | 0.88 | 61 | 0.39 | 0.07 | 0.05 | 0.001 | 2.49 |

| Incl | 291.60 | 302.50 | 10.90 | 1.03 | 156 | 0.58 | 0.34 | 0.26 | 0.001 | 4.55 |

| and | 352.00 | 366.30 | 14.30 | 2.41 | 28 | 0.50 | 0.02 | 0.00 | 0.001 | 3.67 |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.014 x 0.95) + (Cu (%) x 2.06 x 0.95) + (Mo (%) x 6.86 x 0.95+(Zn(%)x 0.80 x 0.95)+ (Pb(%)x 0.45 x 0.95) utilizing metal prices of Cu – US$4.50/lb, Mo – US$15.00/lb, Zn – US$1.75/lb, Pb – US$1.0/lb, Ag – $21/oz and Au – US$1,500/oz and recovery rates of 95% for Au, Ag, Cu, Mo, Zn and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.4 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown, and grades are uncut.https://embed.fireplace.yahoo.com/embed?ctrl=Monalixa&m_id=monalixa&m_mode=document&site=sports&os=android&pageContext=%257B%2522ctopid%2522%253A%25221542500%253B1577000%2522%252C%2522hashtag%2522%253A%25221542500%253B1577000%2522%252C%2522wiki_topics%2522%253A%2522Target_Corporation%253BMultiview_orthographic_projection%253BPorphyry_(geology)%253BApollo%2522%252C%2522lmsid%2522%253A%2522a0770000002m0AbAAI%2522%252C%2522revsp%2522%253A%2522globenewswire.com%2522%252C%2522lpstaid%2522%253A%252217662b79-0a3d-3672-b481-a63f394d6cd3%2522%252C%2522pageContentType%2522%253A%2522story%2522%257D

Figure 1: Plan View of the Guayabales Project Highlighting the Apollo Target

Figure 2: Plan View of the Apollo Target Area Outlining the Porphyry and Breccia Targets, their Related Soil Anomalies and Drill Holes Completed or Currently Underway

Figure 3: Plan View of the Hydrothermal Breccia Discovery Made at Apollo

Figure 4: Apollo Target Cross Section N-S With APC-1 and Related Core Photos Highlighted

About Collective Mining Ltd.

To see our latest corporate presentation, please visit www.collectivemining.com

Collective Mining is an exploration and development company focused on identifying and exploring prospective mineral projects in South America. Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, the mission of the Company is to repeat its past success in Colombia by making significant new mineral discoveries and advance the projects to production. Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. Collective currently holds an option to earn up to a 100% interest in two projects located in Colombia. As a result of an aggressive exploration program on both the Guayabales and San Antonio projects, a total of eight major targets have been defined. The Company is fortuitous to have made significant grassroot discoveries at both projects with near-surface discovery holes at the Guayabales project yielding 302 metres at 1.11 g/t AuEq at the Olympus target, 163 metres at 1.3 g/t AuEq at the Donut target and 87.8 metres at 2.49 g/t AuEg at the Apollo target. At the San Antonio project, the Company intersected, from surface, 710 metres at 0.53 AuEq. (See press releases dated October 27th, 2021, November 15, 2021, March 15, 2022 and June 28, 2022 for AuEq calculations)

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Contact Information

Collective Mining Ltd.

Steve Gold, Vice President, Corporate Development and Investor Relations

Tel. (416) 648-4065

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at:

VANCOUVER, British Columbia, June 21, 2022 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) reports that it has entered into a Loan Agreement with Redplug Capital Corporation. The loan is in the amount of $500,000 and will be used for general working capital. Millrock intends to repay the loan within the coming year by 1) liquidation of shares that it holds in other companies, 2) sale of royalty interests, and/or 3) from proceeds that may be realized on sale or purchase agreements concerning Millrock mineral exploration projects. The term of the loan is one year. Interest for the first six months of the loan is 6.0% per annum and thereafter at 12.0% per annum. Additionally, Millrock will pay the Redplug Capital Corporation 2,000,000 bonus shares of the Company upon acceptance of the TSX Venture Exchange.

Millrock President & CEO, Gregory Beischer, commented: “Millrock has found itself in a tight financial position at a time when market conditions limit our ability to raise further operating funds. In any event, an equity financing at the current share price would be highly dilutive to existing shareholders. At the same time, Millrock has many catalysts that have potential to drive the Company’s share price higher. More than 18,000 metres of drilling has been planned and budgeted at several projects in which Millrock has an interest. All the funds for these drilling programs come from partner companies. Additionally, Millrock is closing in on option agreements on other projects that could bring more cash into the company treasury. Shareholders that have invested in Millrock over the past few years have looked forward to the big year of drilling underway in 2022. Millrock has determined that it is best not to incur excessive dilution by equity financing at this particular juncture. The less dilutive loan transaction will allow operations to continue in the short term. Potential asset sales will cover longer term needs while results of ongoing drilling programs unfold. We are hopeful that results of the drilling programs will make an equity financing under more favourable and less dilutive terms later in 2022 possible. We think all the drilling programs have a good chance at making gold discoveries.”

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc., and owns a large shareholding in each of Resolution Minerals Limited and Felix Gold Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Coeur Explorations, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet, and Altius, as well as junior explorers Resolution, Riverside, PolarX, Felix Gold and Tocvan.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the intention of partner companies to complete all the planned drilling they have indicated, the sale of Millrock assets, that Millrock has many catalysts that have potential to drive the Company’s share price higher, that Millrock is closing in on option agreements on other projects that could bring more cash into the company treasury, that potential asset sales will cover longer term needs, that all the drilling programs have a good chance at making gold discoveries, and the possibility of share price increase upon receipt of future drilling results. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Millrock’s management’s discussion and analysis for the three-month period ended March 31, 2022, which is available under Millrock’s profile on SEDAR at www.sedar.com. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Millrock assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Millrock updates any forward-looking statement(s), no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Vancouver, British Columbia–(Newsfile Corp. – June 21, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce drill results from EMX’s Hardshell royalty property at a new exploration target, named the Peake prospect, which is part of South32 Limited’s Hermosa project in southeast Arizona (Figure 1). Hermosa also includes the feasibility stage Taylor lead-zinc-silver deposit situated directly north of EMX’s royalty claim block (see map in Appendix 1). EMX retains a 2% net smelter return (“NSR”) royalty on Hardshell that is not capped nor subject to buy down.

Drill results from Peake, which is partially covered by the Hardshell royalty, include copper-enriched skarn type mineralized intercepts of 76.5 meters (1,308.2-1,384.7 m) averaging 1.52% copper, 0.2% zinc, 0.4% lead, and 25 g/t silver in hole HDS-552, as well as 73.8 meters (1,386.8-1,460.6 m) averaging 1.06% copper, 0.5% zinc, 0.7% lead, and 67 g/t silver in HDS-661. In addition, intercepts more typical of Taylor carbonate replacement deposit (“CRD”) style mineralization include 9.8 meters (966.2-976.0 m) averaging 0.69% copper, 12.2% zinc, 8.2% lead, and 77 g/t silver in HDS-353. South32’s geological model indicates the potential for Peake to host a structurally and lithologically controlled mineralized skarn system that connects to the Taylor CRD mineralization.

EMX’s Hardshell royalty was organically generated by the Company’s wholly-owned subsidiary Bronco Creek Exploration Inc. (“BCE”). BCE recognized the alteration and mineralization zoning patterns within the district, and staked prospective open ground. Hardshell was optioned in 2015 for a 2% NSR retained royalty interest. The Hermosa project, including Hardshell, was subsequently acquired by South32 in 2018. South32 has steadily advanced Hermosa, which now includes the step-out exploration drilling that has delineated Peake. The Peake mineralization covered by the Hardshell royalty highlights the discovery optionality within EMX’s royalty portfolio.

Discussion of Drill Results. South32’s drilling at Hardshell has focused on the copper-rich skarn mineralization at the Peake prospect, but has also intersected potential extensions of the Taylor CRD system. Peake consists of copper-lead-zinc-silver mineralization delineated as a 1,200 meter by 550 meter, west-northwest trending zone of variable thickness at depths of 1,300 to 1,500 meters. South32 is following up on the Peake drill results as part of its Hermosa exploration programs, and has directed US$13 million to its exploration programs at Hermosa in the nine months ended March 2022.1

EMX’s royalty covers much of the currently known extents of the Peake prospect, and South32 has provided EMX a database with ~23,300 meters of angled diamond drilling from within the Hardshell royalty footprint. Select intercepts are summarized in Table 1. Copper-enriched skarn intercepts are reported at a 0.2% copper cutoff, reflecting the early-stage nature of exploration and evaluation of the Peake prospect. CRD style intercepts are reported at a 2.0% zinc equivalent (“ZnEq”) cutoff, reflecting the current feasibility stage of evaluation for the Taylor deposit.

Table 1. Select drill intercepts from EMX’s Hardshell royalty property.

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/1508/128370_table1.jpg

Skarn intercepts in green and CRD intercepts in light blue. ZnEq cutoff calculated using metal prices of Zn (US$2,695/t), Pb (US$1,992/t), and Ag (US$25.50/oz) and recoveries of Zn (90%), Pb (91%) and Ag (81%). Cu was NOT included in the ZnEq calculation. True widths are approximately 65-85% of the reported interval lengths. *Note: HDS-661 missing data from 1563.4 meters to EOH.

Figure 1. EMX’s Hardshell royalty property and South32 drill intercepts.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/128370_figure1.jpg

Hermosa Project and Hardshell Royalty Property Overview. South32’s Hermosa project, located in the Patagonia mining district of southeastern Arizona, includes CRD sulfide (i.e., Taylor) and oxide (i.e., Clark) deposits (which are not covered by EMX’s Hardshell royalty), as well as the Peake skarn prospect (partially covered by EMX’s Hardshell royalty). In a July 21, 2021 Public Report titled “Hermosa Project – Mineral Resource Estimate Update” South32 disclosed a JORC (2012) Mineral Resource estimate for Taylor at a US$80/dmt NSR cutoff as a) 29 Mtonnes @ 4.10% Zn, 4.05% Pb, and 57 g/t Ag Measured, b) 86 Mtonnes @ 3.76% Zn, 4.44% Pb, and 86 g/t Ag Indicated, c) and 24 Mtonnes @ 3.73% Zn, 3.82% Pb, and 91 g/t Ag Inferred.2 The resource estimate was prepared by M. Hastings, MAusIMM, of SRK Consulting (US), a Competent Person in accordance with the requirements of the JORC Code. JORC is an “acceptable foreign code” under NI 43-101 for disclosure of mineral resources and mineral reserves.

In a January 17, 2022 Public Report, South32 announced an update to the Hermosa project with the completion of a pre-feasibility study on the Taylor deposit and a scoping study for the Clark deposit.3 South32 also stated that 1) Taylor had moved to the feasibility stage of evaluation with a final investment decision expected by mid-2023, and 2) shaft development is expected to commence in FY2024, subject to a final investment decision and receipt of required permits.

EMX’s Hardshell 2% NSR royalty property consists of 16 unpatented federal lode mining claims that are included as part of South32’s Hermosa project. Mineralization is primarily hosted within a sequence of dipping upper Paleozoic (i.e., Pennsylvanian-Permian) carbonate sedimentary rocks adjacent to the Sunnyside porphyry system which is being explored by Barksdale Resources. The delineation of the Peake prospect by South32 represents the potential to create significant value for the Company’s Hardshell royalty property. EMX looks forward to South32’s continued exploration success at Hardshell, as well as from the greater Hermosa project.

Comments on Adjacent Properties. The adjacent properties, which include South32’s Taylor deposit and Barksdale’s Sunnyside Project, provide geological context for the Peake prospect, which is partially covered by EMX’s Hardshell royalty claim block. However, this is not necessarily indicative that the Hardshell royalty claim block represents similar tonnages or grades of mineralization as at the Taylor deposit, nor a similar style of mineralization as the Sunnyside porphyry.

Qualified Person. Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended March 31, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Appendix 1

Location of EMX’s Hardshell royalty property with South32 drilling relative to the Hermosa project’s Peake prospect and Taylor and Clark deposits.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1508/128370_figure2.jpg

1 South32 Quarterly Report March 2022.

2 South32 market release dated July 21, 2021 (titled “Hermosa Project – Mineral Resource Estimate Update”) and Annual Report 2021 dated September 21, 2021.

3 South32 market release dated January 17, 2022 (titled “Hermosa Project Update”).

We count on your support, please share this video: https://provenandprobable.com/jayant-bhandari-culture-investing-philosophy/

Joining us for a conversation is Jayant Bhandari the Founder of Capitalism and Morality and highly sought out advisor to institutional investors. As we will travel the globe today to get some insights on geopolitical events that are taking shape that may impact you, along with some arbitrage opportunities for your portfolio, and see how philosophy impacts the aforementioned

Visit: https://jayantbhandari.com/about/

Register for Capitalism and Morality: http://jayantbhandari.com/capitalism-morality/capitalism-morality-2022/

NEW YORK, June 10, 2022 (GLOBE NEWSWIRE) — Virtual Investor Conferences, the leading proprietary investor conference series, today announced the agenda for the upcoming OTCQX Best 50 Companies Virtual Investor Conference to be held on June 16 th . Individual investors, institutional investors, advisors, and analysts are invited to attend. The program begins at 9:30 AM ET on Thursday, June 16th.

REGISTER NOW AT: https://bit.ly/3ztPQjz

It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates. There is no cost to log-in, attend live presentations and schedule 1×1 meetings.

“We are delighted to welcome ten of our OTCQX Best 50 companies participating in our upcoming Virtual Investor Conference,” said Jason Paltrowitz, OTC Markets Group EVP of Corporate Services. “We are proud to highlight the impressive efforts of these companies which span a range of industries including Technology, Metals & Mining, Industrial Goods, Financials and more.”

June 16 th Agenda:

| Eastern Time (ET) | Presentation | Ticker(s) |

| 9:30 AM | Global Atomic Corp. | OTCQX: GLATF | TSX: GLO |

| 10:00 AM | IsoEnergy Ltd. | OTCQX: ISENF | TSXV: ISO |

| 10:30 AM | InPlay Oil Corp. | OTCQX: IPOOF | TSX: IPO |

| 11:00 AM | TAAL Distributed Information Technologies Inc. | OTCQX: TAALF | CSE: TAAL |

| 11:30 AM | Labrador Gold Corp. | OTCQX: NKOSF | TSXV: LAB |

| 12:00 PM | Deep Yellow Ltd. | OTCQX: DYLLF | ASX: DYL |

| 1:00 PM | Nanalysis Scientific Corp. | OTCQX: NSCIF | TSXV: NSCI |

| 1:30 PM | Grayscale Investments LLC | OTCQX: GBTC |

| TBD | Novonix Ltd. | OTCQX: NVNXF | ASX: NVX |

| TBD | Thunderbird Entertainment Group Inc. | OTCQX: THBRF | TSXV: TBRD |

To facilitate investor relations scheduling and to view a complete calendar of Virtual Investor Conferences, please visit www.virtualinvestorconferences.com .

About Virtual Investor Conferences ®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly traded companies to seamlessly present directly to investors.

Providing a real-time investor engagement solution, VIC is specifically designed to offer companies more efficient investor access. Replicating the components of an on-site investor conference, VIC offers companies enhanced capabilities to connect with investors, schedule targeted one-on-one meetings and enhance their presentations with dynamic video content. Accelerating the next level of investor engagement, Virtual Investor Conferences delivers leading investor communications to a global network of retail and institutional investors.

Media Contact:

OTC Markets Group Inc. +1 (212) 896-4428, media@otcmarkets.com

Virtual Investor Conferences Contact:

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

(212) 220-2221

johnv@otcmarkets.com