Integrous- Oil & Gas- Drilling & Exploration- The Answer to Supply-Side Inflation

- Crude oil at the highest price since 2008- Inventories and product prices support higher highs

- Natural gas is also at a fourteen-year high- Inventories, and European prices support the continuation of a very volatile bull market

- The four reasons for higher fossil fuel prices- SPR releases are a temporary band-aid

- Drilling and exploration are the answer to supply-side economic woes

- XOP outperforming the stock market in 2022- The trend is your best friend

Throughout most of 2021, the US Federal Reserve called the rising inflationary pressures “transitory.” Late last year, increasing consumer and producer price data convinced the central bank that the economic condition was not a temporary event. The Fed told markets it was preparing to shift to a more hawkish approach to monetary policy to address the economy’s demand-side pressures. The artificially low interest rates, liquidity, and government stimulus in 2020 and 2021 planted the inflationary seeds which sprouted during the second half of 2020, throughout 2021, and into early 2022.

In early 2022, the geopolitical landscape threw a curveball at the central bank when Russia invaded Ukraine, launching the first major war in Europe since WW II. Sanctions on Russia and Russian retaliation began to cause even more upside pressure on commodity prices as Russia is a leading producer of energy and other raw materials. China and Russia’s “no-limits” support agreement complicated matters, setting the stage for the invasion.

Crude oil and natural gas prices had already been rising by the end of 2021. The leading benchmark crude oil futures are the Brent and WTI contracts. After falling to a record low below zero in April 2020, nearby WTI crude oil futures at $75.21 per barrel. Brent futures fell to $16 per barrel, the lowest price of this century in April 2020, and closed 2021 at the $77.78 level.

Meanwhile, nearby natural gas futures dropped to $1.44 per MMBtu in June 2020 and were at the $3.73 level on December 31, 2021. The oil and gas futures markets had been rising, making higher lows and higher highs throughout the second half of 2020 and in 2021. In 2022, they took off on the upside, reaching fourteen-year highs.

Increasing inflation and post-pandemic demand created a bull market in crude oil and natural gas that turned into a perfect bullish storm in 2022. The war and a dramatic geopolitical shift made dynamics shift from demand to supply-side concerns. The Fed has few if any tools to deal with supply-side economic events, and the only answer could be increasing supplies, which is a challenge in the current environment.

Just as the Fed mischaracterized inflation as “transitory,” US and European policies addressing climate change have played a role in the ascent of hydrocarbon prices. Since energy prices are inflation’s root cause, exploration and drilling could be the only answer to address the economic condition. Fossil fuels continue to power the world, and the price action is screaming that monetary policy has taken a backseat to the energy debacle.

Crude oil at the highest price since 2008- Inventories and product prices support higher highs

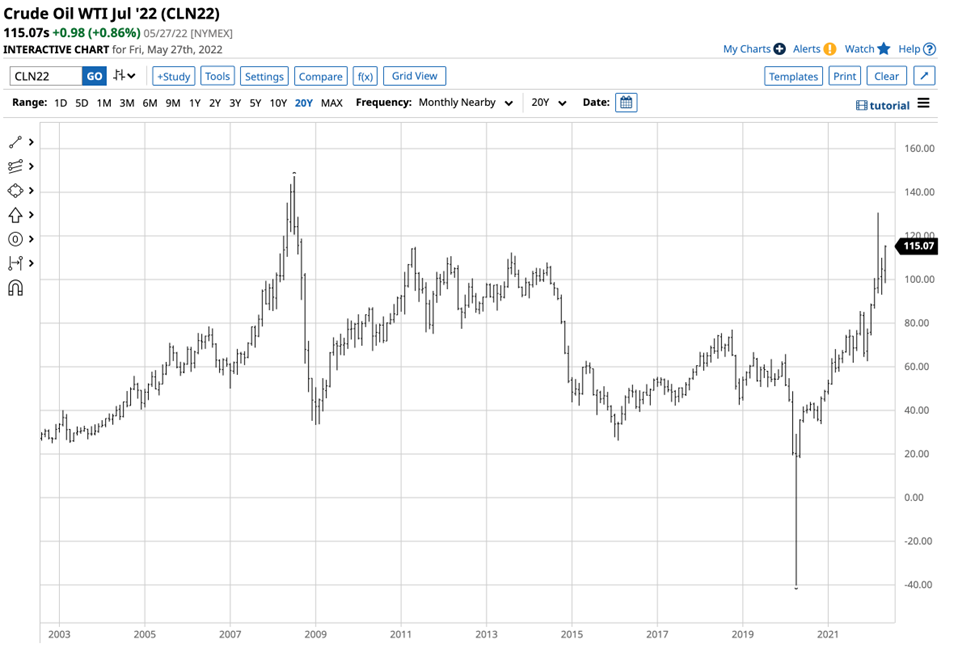

Nearby NYMEX WTI futures rose to $130.50 per barrel on March 7 after Russia invaded Ukraine on February 24, and the war escalated.

Source: Barchart

The chart highlights that the WTI futures were sitting at just above the $115 level on May 27. Brent crude oil hit a high of $139.13 in early March.

Source: Barchart

The chart shows the price was at around the $119.43 per barrel level in late May 2022. The all-time 2008 peaks in WTI and Brent were at $147.27 and $147.50.

While crude oil missed an all-time high, gasoline and heating oil hit record prices in 2022.

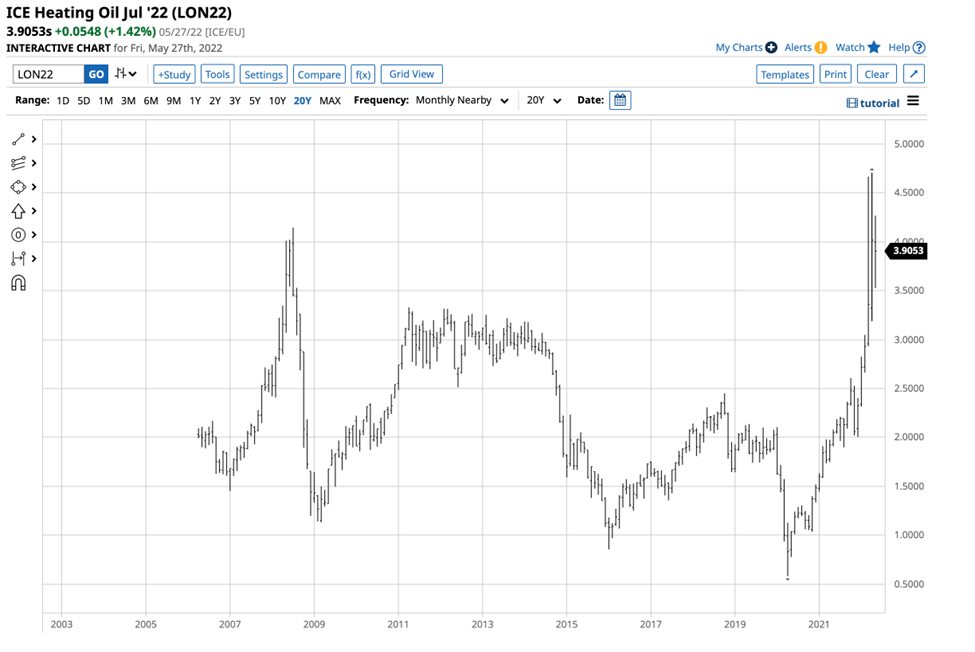

Source: Barchart

The chart shows that gasoline futures prices reached $4.0640 per gallon wholesale in May, an all-time high. July gasoline was sitting at over the $3.90 level on May 27.

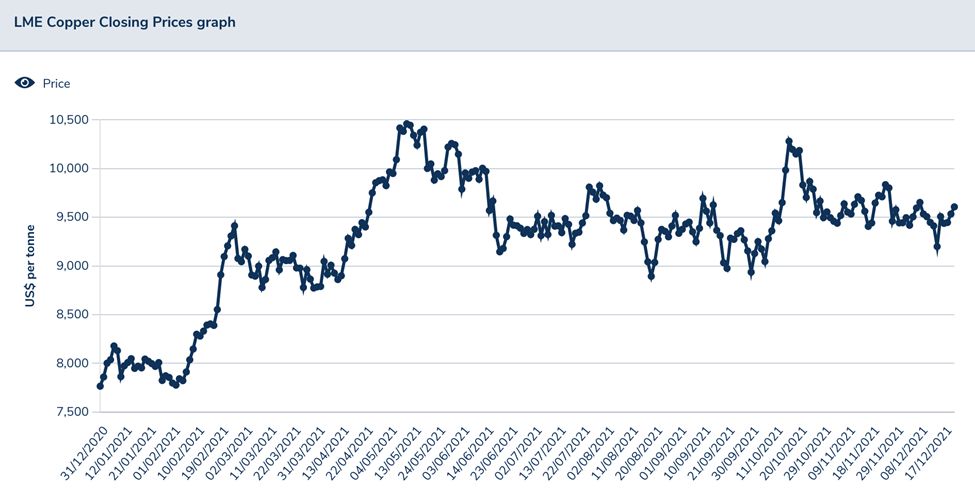

Source: CQG

Heating oil is also a proxy for distillates like diesel and jet fuels. The chart shows the spike to a record peak in distillate in April at $4.7072 per gallon wholesale. Heating oil was also over the $3.90 per gallon level on May 27.

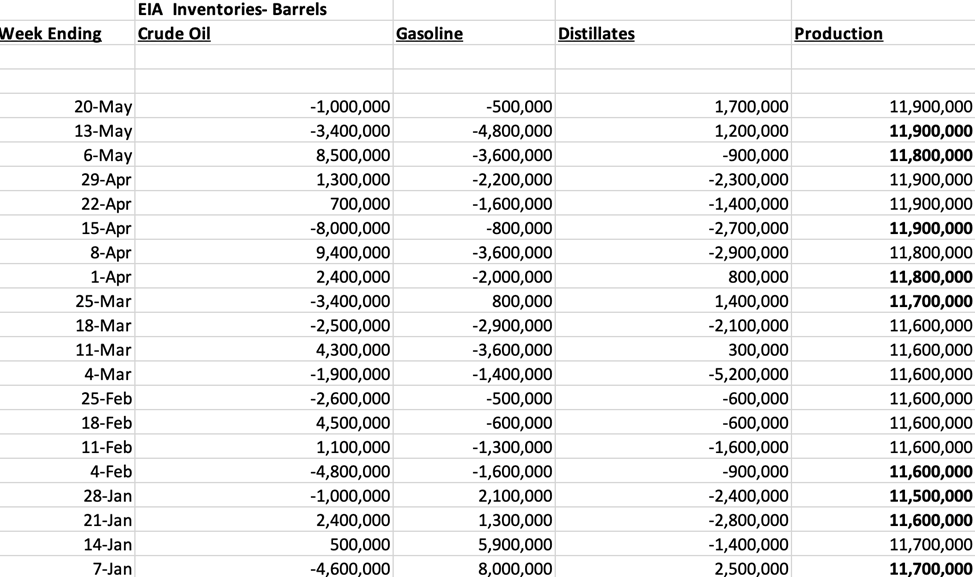

Inventories and US production have supported prices:

Source: US Energy Information Administration

So far, in 2022, US crude oil stockpiles rose by 1.9 million barrels, but the data includes strategic stockpile releases. Meanwhile, gasoline inventories declined by 12.9 million barrels, and distillate stocks fell by 19.9 million barrels from the beginning of 2022 through May 20. Consumers require oil products, and the data supports higher prices. While US daily output rose from 11.7 to 11.9 million barrels per day in 2022, they remain below the March 2020 13.2 mbpd record peak.

Natural gas is also at a fourteen-year high- Inventories, and European prices support the continuation of a very volatile bull market

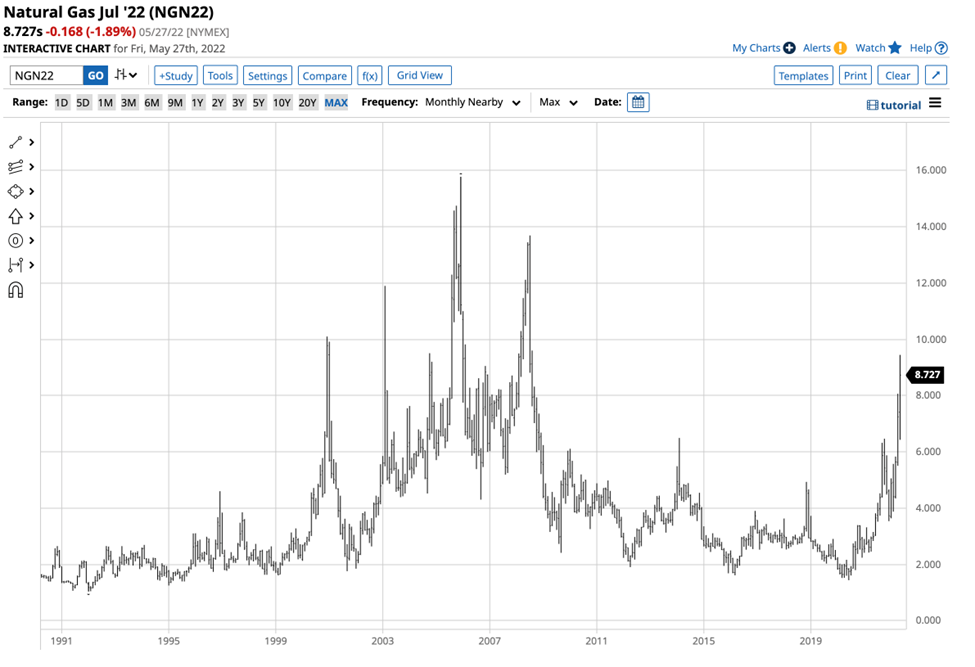

NYMEX natural gas futures fell to a twenty-five-year low in June 2020, reaching $1.432 per MMBtu.

Source: CQG

The long-term chart shows that natural gas futures moved over six times higher by May 2022, reaching a high of $9.447 per MMBtu and sitting at over the $8.70 level on May 27.

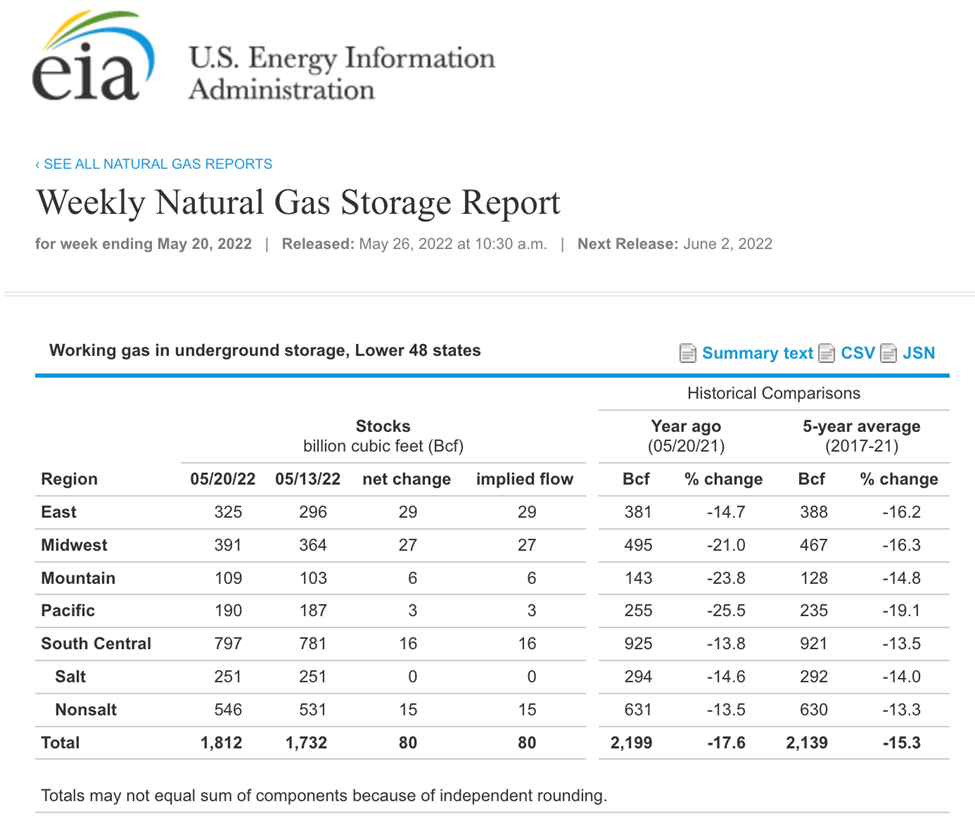

Natural gas inventories are at low levels, with the price at a fourteen-year high.

Source: EIA

At the 1.812 trillion cubic feet level on May 20, natural gas in storage across the US was 17.6% below last year’s level and 15.3% under the five-year average.

Over the past years, natural gas liquefication opened a burgeoning export market for the US energy commodity as it now travels worldwide via ocean vessels. Natural gas’s addressable market expanded far beyond the US pipeline network.

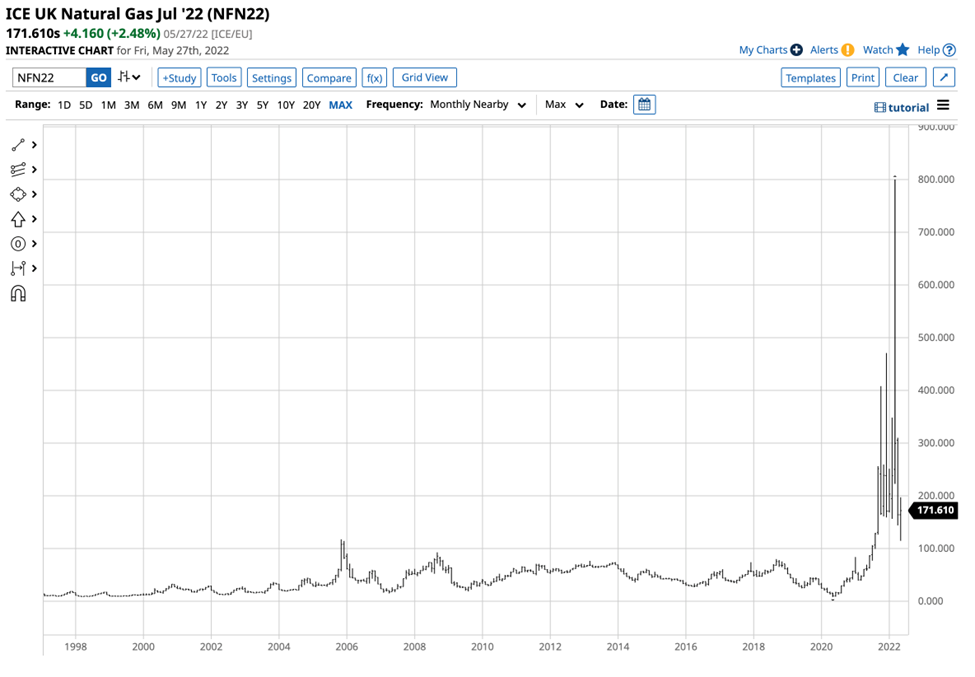

While US natural gas exports have sold LNG to Asian consumers under long-term contracts, the war in Europe and Russian retaliation for sanctions have sent European natural gas prices to record levels.

Source: Barchart

The chart shows that ICE UK natural gas futures rose to the 800 pounds per 1,000 thermals level in March 2022. Before 2021, the all-time high was at the 117 level, and at the 171.61 level on May 27, the price was well above the pre-2021 record peak. Russian natural gas travels by pipeline to European consumers. The Russians have demanded payment in rubles and have cut off “unfriendly” countries that support Ukraine. Moreover, Sweden and Finland’s plans to join NATO only increase Russian export bans, and European consumers are turning to the US for supplies. The bottom line is that

US natural gas has become an international energy market, and the supply shortage is lifting worldwide prices.

In the US, natural gas is heading into the volatile hurricane season. In 2005 and 2008, Hurricanes Katrina and Rita wreaked havoc along the Louisiana coast.

The NYMEX futures delivery point is the Henry Hub in

Erath, Louisiana, along the Gulf Coast hurricane corridor. Storms in 2008 and 2005 lifted the price to $13.694, and $15.65per MMBtu, respectively. Even if the natural gas market makes it through the annual hurricane season without category four or five storms, the 2022/2023 winter season in worn-torn Europe will likely push prices higher, with $10+ NYMEX futures prices on the horizon.

The four reasons for higher fossil fuel prices- SPR releases are a temporary band-aid

At least four factors favor higher oil and gas prices in late May 2022:

- The Biden administration’s green energy initiative favors alternative and renewable fuels while inhibiting fossil fuel production. The US energy policy since early 2021 handed the pricing power to OPEC, the international oil cartel, and Russia. After years of suffering under low prices and lower US demand because of US shale oil and gas production, OPEC+ now controls supplies and owes the US and European consumers no favors. US requests for production increases fell on deaf ears in Riyadh, Moscow, and other production capitals.

- The February 4 “no-limits” agreement between China and Russia creates a bifurcation of the world’s nuclear powers, with the US and Europe on the other side. Russia’s invasion of Ukraine could lead to Chinese reunification attempts with Taiwan. Hostilities and geopolitical tensions make hydrocarbons a political tool for the Russians and allied world oil and gas producers.

- The crude oil and natural gas prices have been rising despite a COVID-19 lockdown in China. When the Chinese economy reopens, the global energy demand will likely rise, putting more upside pressure on oil and gas prices. Meanwhile, a historic heatwave in India is causing increased energy demand in the world’s second-most populous country. India has not cooperated with the US and Europe with sanctions on Russia.

- Even if the US were to shift back to a drill-baby-drill and frack-baby-frack approach to traditional energy production, labor shortages and higher input and equipment prices put upside pressure on production costs. Moreover, the Biden administration has doubled down on its green initiatives, so the potential for production increases remains low.

Instead of increasing production over the past months, President Biden released a historical level of crude oil from the strategic petroleum reserve. Past SPR releases have not weighed on the price in challenging times. Moreover, the US will eventually need to replace its resources, leading to buying in the oil market. The administration released 30 million barrels in early 2022 and has been releasing one million barrels per day from the SPY. The price remains around the $115 per barrel level as the SPR sales have been a short-term, ineffective band-aid. Meanwhile, crack spreads, a real-time demand indicator rose to new all-time highs in May. The level of refining margins are a warning sign that higher crude oil prices are on the horizon.

Drilling and exploration are the answer to supply-side economic woes

The Fed is increasing interest rates and reducing its balance sheet to address the highest inflation in over four decades. The central bank’s toolbox contains monetary policy tools that deal with the economy’s demand-side. In 2020, slashing interest rates and government stimulus encouraged borrowing and spending and inhibited saving.

The Fed now faces supply-side economic factors caused by the war in Ukraine, sanctions, and geopolitical bifurcation. There are few, if any, tools that can deal with the supply-side issues that will continue to fuel inflation. While core inflation data excludes food and energy, food and energy are critical inflationary factors that impact individuals and businesses. Moreover, energy is a crucial cost of goods sold input in all sectors of the economy. Therefore, the only answer to dealing with supply-side inflationary pressures in the current environment is to increase supplies. Just as the Fed woke up from its “transitory” trance, the administration will likely realize that encouraging fossil fuel exploration and drilling is the only route out of the current inflationary spiral. The US is blessed with rich oil reserves in the shale regions, Alaska, and other oil-producing areas. The Marcellus and Utica shale contains quadrillions of cubic feet of natural gas. A hostile Russia and China could cause a reversal of the current path of US energy policy. Rising oil and gas prices will eventually choke all economic growth, and the administration may have no choice but to put climate change initiatives to the side while it deals with the inflationary spiral.

XOP outperforming the stock market in 2022- The trend is your best friend

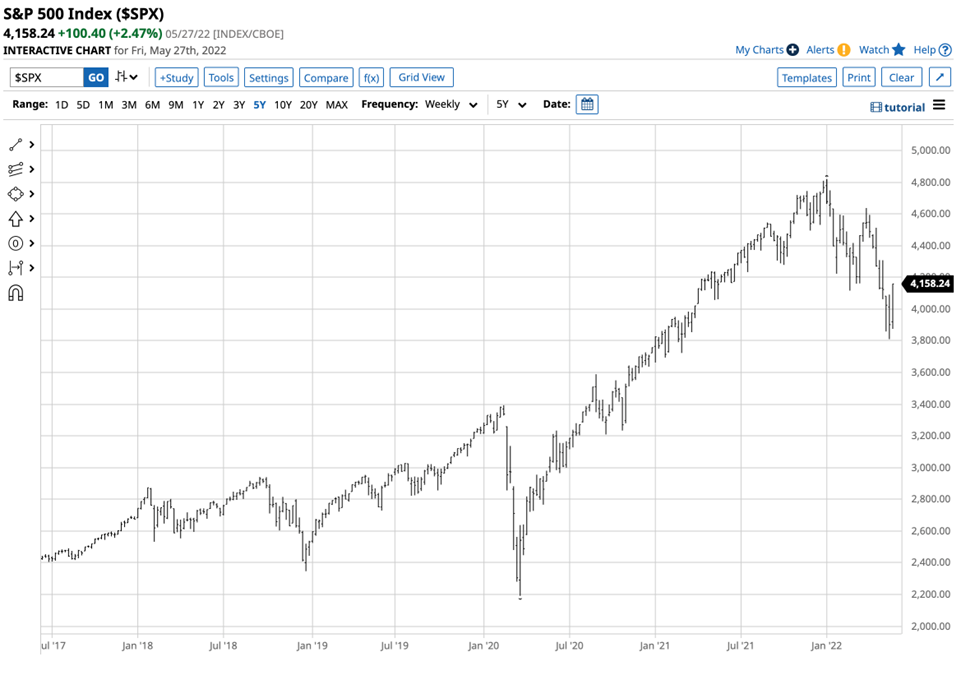

The war, rising interest rates, a strong US dollar, increasing geopolitical turmoil, and other factors have weighed on the stock market in 2022.

Source: Barchart

The S&P 500 is the most diversified US stock market index. After closing at 4,766.18 on December 31, 2021, the index was 12.8% lower at 4,158.24 on May 27.

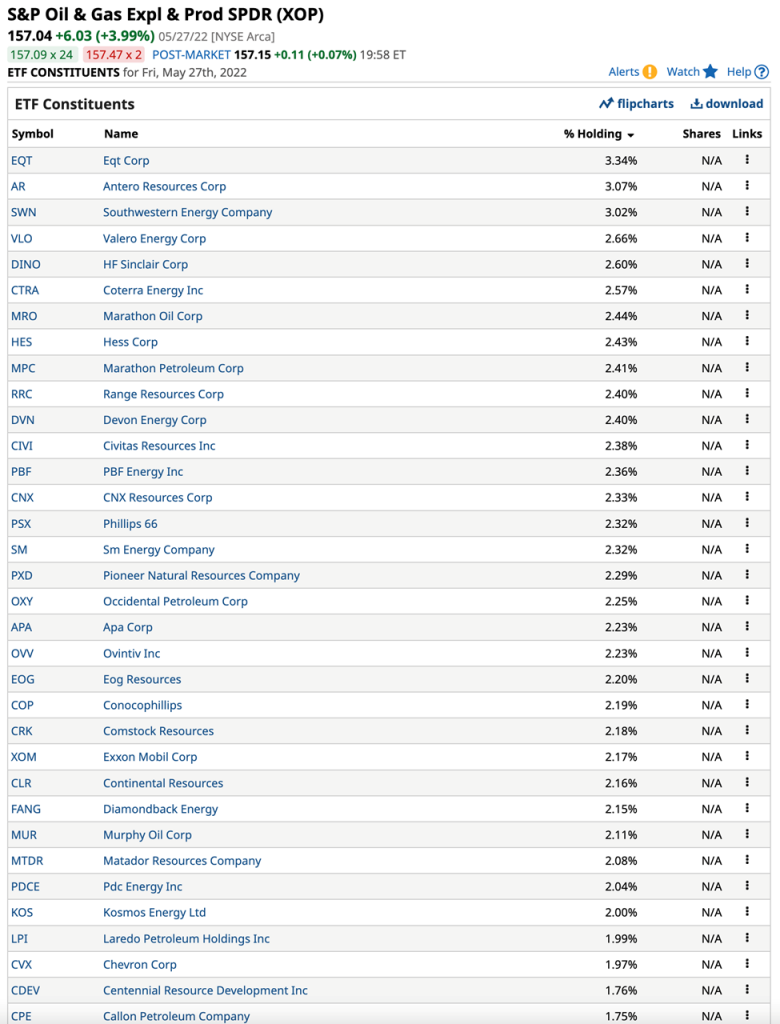

The S&P Oil & Gas Exploration and Production ETF product (XOP) holds many of the top US companies that explore, drill, and produce crude oil and natural gas, including:

Source: Barchart

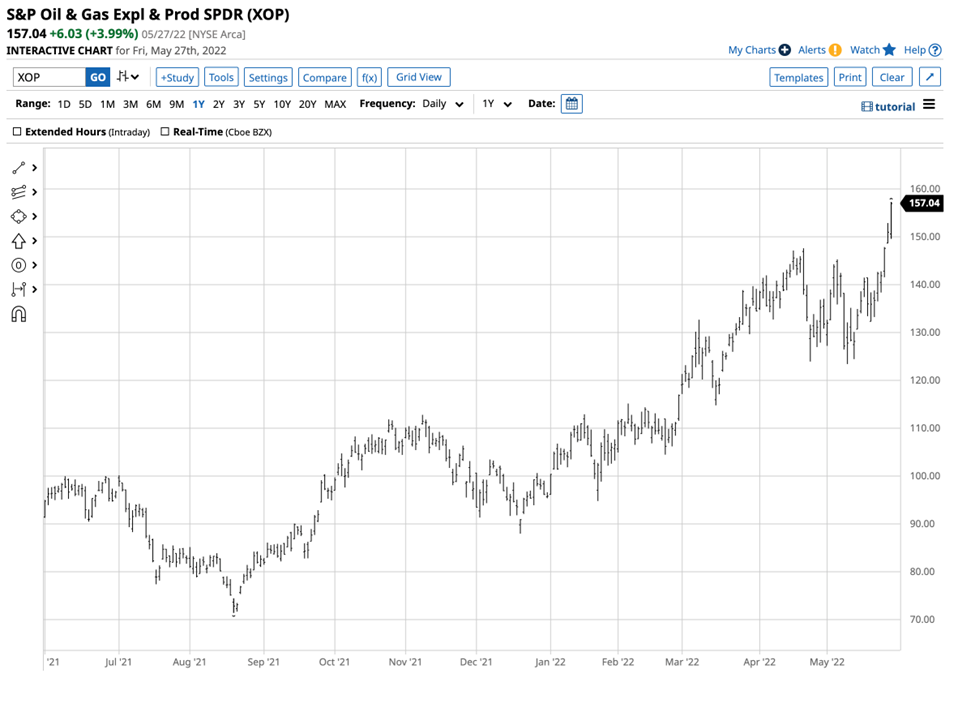

While the S&P 500 is 12.8% lower in 2022, the XOP performance has been impressive:

Source: Barchart

The XOP closed at $95.87 at the end of 2021. At the $157.04 level on May 27, the ETF was over 63.8% higher this year.

Existing oil and gas exploration, drilling, and production companies have experienced a profit bonanza in 2022, but they are struggling to meet the growing worldwide hydrocarbon requirements. The bull market in oil and gas opens the door for newcomers in exploration and drilling. Dealing with inflation requires addressing the root cause, energy shortages, and high prices. An epiphany that shifts US energy policy is the path of fighting inflation. The supply-side problems are beyond the Fed’s reach, and SPR releases are only a band-aid on a worldwide gapping ax wound.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.