Nevada Copper

North Vancouver, British Columbia–(Newsfile Corp. – September 8, 2022) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to announce the results from 20 additional drill holes, as part of ongoing infill drilling at its high-grade, fully permitted Tuvatu Alkaline Gold Project in Fiji.

Drill results for 20 holes totalling approximately 3,900m of diamond drilling in Zone 5 cover a portion of the Tuvatu gold project, part of the Navilawa volcanic caldera which is host to numerous gold occurrences. outcropping mineralization, as well as the high-grade Tuvatu Alkaline gold deposit.

The drill program represents a significant improvement to the extent of known mineralization; additions are highlighted in blue in Table 1. The main orebody (Figure 1), is scheduled to enter production in Q2 of 2023. Its dimensions and continuity are further defined and expanded with the infill program which adds to the 11 earlier holes in Zone 5 (Lion One news release: May 31, 2022). The additional data outlines high-grade to bonanza-grade mineralized lode swarms <100m from surface. Vein-hosted mineralization remains open along strike and at depth. Lion One is upgrading its resource model which is expected to be significantly improved by this round of drill results. The mineralization reported here is a significant development which is expected to upgrade the resource model, as it represents a critical addition of gold mineralisation to the resources model that grades well above the average resource grade, at relatively shallow levels. As a result, the newly identified mineralization will enhance the economic model, likely upgrading the production stream at Tuvatu.

Top Intercepts include:

Results are summarized below in Table 1, with vertical sections including all of the newly reported drill holes presented as Figures 2-8. Highlighted in blue on Table 1 are drill intercepts outside of the mineralized lodes that define the existing resource model. Each additional intercept will likely add width, grade, and continuity to the resource in the near-surface portion of the Tuvatu orebody.

Lion One Drilling Programs in Progress

Lion One reports that in addition to its Zone 5 infill drilling it is progressing with deep extensional drilling on the 500 Zone, where TUDDH-608, targeting the high-grade intersection of TUG-141 and TUDD-601, has been terminated at a depth of 678.1m. Visible veining and sulphide mineralization has been recorded from approximately ~530m to 645m depth along the drill hole. Assay results for TUDDH-608 have been commissioned from the Lion One Lab with preliminary results expected soon. Drilling on TUG-147 from the underground decline, targeting the same dilational zone further to the north and deeper has also commenced this week.

The Company has also mobilized a drill rig 2km northeast of Tuvatu to test the Batiri Creek occurrence, the new regional discovery in the Navilawa Caldera (see news release dated August 29, 2022), and underground development continues toward the near-surface Zone 2 of the Tuvatu resource with the No. 2 decline having advanced >80m. Finally, results from a separate batch of 6 PQ diameter diamond drill holes aimed at collecting a 300 kg composite sample for metallurgical testing of Zone 2 mineralization have also been received and compiled. The company will continue to provide further progress updates and results on these activities.

Lion One CEO, Walter Berukoff, stated, “We are confident that the high-grade intercepts indicated by our infill programs and the increased drilling density will lead to a more robust resource model. The high-grade near-surface infill results, along with the continuing success of the deep-drilling program, underscores the potential of Tuvatu to be a multi-million-ounce, high-grade Au producer. Lion One is well positioned to continue advancing all three tiers of our exploration strategy: ongoing, near-surface infill drilling; extensions of deep, high-grade feeder targets, and from our pipeline of regional targets in the surrounding Navilawa caldera.”

Infill Drilling Program

Two phases of infill drilling have been planned at Tuvatu with the aim of infilling areas within the current resource and thus augmenting the data density, to further improve the resolution of the geological model in portions of the deposit scheduled for earliest production. Phase 1 infill drilling was completed over Zone 2 (Figure 1) in mid-February 2022, adding over 8,400m of new data from drill core, including 7,475m of new drilling and 955m of sampling of previously unsampled historic drill core (see Feb. 23, 2022 News Release).

This release presents final assay data from 20 previously unreported drill holes completed as part of the Phase 2 infill program, which is planned for approximately 8,200m of diamond drilling from surface and underground, and which is aimed at upgrading the resource database in Zone 5 of the Tuvatu orebody. The Phase 2 program as planned includes 30 holes totalling 5,475m carried out from 4 separate drill stations at surface, and 35 holes totalling 2,695m carried out from 6 underground drill stations. Phase 2 infill drill program began February 17, 2022, with drill hole TUDDH-577, and is expected to require 8-9 months of drilling using three rigs (two from surface and one from underground) to complete.

Results from the initial approximately 6,200m of drilling in Zone 5, represent approximately 75% of the planned program total, indicating and indeed confirming consistent high-grade to locally bonanza-grade Au mineralization for known mineralized lodes in this portion of the current resource, as well as new high-grade mineralization that was not identified prior to this drill program (Table 1, highlighted), and therefore not included in the current resource model.

Numerous high-grade mineralized intervals occur outside of existing modelled lodes. These notably include 35.98 g/t Au over 1.8m which includes a bonanza grade intercept of 194.00 g/t Au from a downhole depth of only 53.0m in hole TUDDH-609, as well as 19.70 g/t Au over 1.8m from only 99.3m downhole depth in hole TUG-146. These additional near-surface intercepts will add significantly to the overall inventory of high-grade mineralization slated for early production at Tuvatu.

Figure 1: A) Oblique view looking N060° and down 17° showing the current conceptual mine plan ore panels (gold) highlighting the location of Zone 2 and Zone 5, the exploration decline (yellow) and the planned Zone 5 infill drilling program (blue). The planned drilling consists of 4 surface and 6 underground drill stations. B) Oblique view looking N060° and down 40° showing the UR1 to UR5, URW1A, URW1C, and URW3 lodes (transparent grey), exploration decline (yellow) and the planned Zone 5 infill drilling program (blue).

Cannot view Figure 1? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure1.jpg

Cannot view Figure 2? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure2.jpg

Cannot view Figure 3? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure3.jpg

Cannot view Figure 4? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure4.jpg

Cannot view Figure 5? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure5.jpg

Cannot view Figure 6? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure6.jpg

Cannot view Figure 7? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure7.jpg

Figures 2-8: Composite vertical sections through Zone 5 at Tuvatu, showing the UR1 to UR5, URW1A, URW2A, and URW3 lodes (labelled) and the traces of the infill drilling reported in this release (drill holes are labelled). Grade legend is as follows: orange = >3g/t Au; red = >10 g/t Au; magenta = >30 g/t Au. All figures are at the same scale with views as indicated.

Cannot view Figure 8? Visit:

https://images.newsfilecorp.com/files/2178/136388_figure8.jpg

Table 1: Drilling intervals returning >0.5 g/t Au (intervals > 3.0 g/t Au cutoff are shown in red, and intervals >9.0 g/t Au or longer than 1.2m are bolded). Intercepts that are outside of the current geological model are highlighted in light blue.

| Hole ID | From (m) | To (m) | Interval (m) | Grade (g/t Au) |

| TUDDH-589 | 19.1 | 19.4 | 0.3 | 0.91 |

| 85.1 | 85.4 | 0.3 | 0.81 | |

| 89.6 | 91.4 | 1.8 | 1.44 | |

| 113 | 113.6 | 0.6 | 17.33 | |

| 170.9 | 171.2 | 0.3 | 7.36 | |

| 209.3 | 209.6 | 0.3 | 0.96 | |

| 210.8 | 224 | 13.2 | 3.79 | |

| Incl. | 213.2 | 213.5 | 0.3 | 17.03 |

| Incl. | 213.8 | 214.1 | 0.3 | 7.85 |

| Incl. | 215.6 | 215.9 | 0.3 | 7.17 |

| Incl. | 216.5 | 216.8 | 0.3 | 11.41 |

| Incl. | 218 | 218.3 | 0.3 | 33.30 |

| Incl. | 222.5 | 222.8 | 0.3 | 7.21 |

| Incl. | 223.7 | 224 | 0.3 | 15.34 |

| TUDDH-591 | 73.4 | 74.0 | 0.6 | 1.04 |

| 102.3 | 102.6 | 0.3 | 9.28 | |

| 103.7 | 104.6 | 0.9 | 0.93 | |

| 106.1 | 106.6 | 0.5 | 2.01 | |

| 107.5 | 110.5 | 3.0 | 7.14 | |

| Incl. | 107.5 | 107.8 | 0.3 | 28.56 |

| Incl. | 108.1 | 108.4 | 0.3 | 10.54 |

| Incl. | 109.0 | 109.3 | 0.3 | 28.74 |

| 112.0 | 112.6 | 0.6 | 0.73 | |

| 113.2 | 113.5 | 0.3 | 0.84 | |

| 117.7 | 118.6 | 0.9 | 2.02 | |

| 126.3 | 127.8 | 1.5 | 1.29 | |

| 129.0 | 130.2 | 1.2 | 0.65 | |

| 132.9 | 134.1 | 1.2 | 0.88 | |

| 142.7 | 143.6 | 0.9 | 1.71 | |

| TUDDH-592 | 14.6 | 14.9 | 0.3 | 1.83 |

| 18.5 | 18.8 | 0.3 | 0.55 | |

| 75.2 | 75.5 | 0.3 | 0.55 | |

| 101.6 | 102.2 | 0.6 | 15.24 | |

| 147.5 | 148.7 | 1.2 | 0.74 | |

| 158.9 | 159.2 | 0.3 | 7.76 | |

| 184.1 | 184.7 | 0.6 | 8.32 | |

| Incl. | 184.4 | 184.7 | 0.3 | 10.36 |

| TUDDH-593 | 9.9 | 11.7 | 1.8 | 4.49 |

| Incl. | 10.5 | 11.1 | 0.6 | 8.98 |

| 28.2 | 29.4 | 1.2 | 0.54 | |

| 34.5 | 34.8 | 0.3 | 0.69 | |

| 88.5 | 89.7 | 1.2 | 4.31 | |

| 140.1 | 140.4 | 0.3 | 3.50 | |

| 152.7 | 154.2 | 1.5 | 0.78 | |

| 168.9 | 170.4 | 1.5 | 1.42 | |

| TUDDH-594 | 105.0 | 105.3 | 0.3 | 13.10 |

| 189.9 | 191.1 | 1.2 | 8.01 | |

| 195.0 | 195.3 | 0.3 | 1.80 | |

| 203.4 | 207.6 | 4.2 | 0.85 | |

| 203.4 | 203.7 | 0.3 | 3.67 | |

| TUDDH-595 | 54.9 | 56.1 | 1.2 | 0.64 |

| 112.2 | 112.8 | 0.6 | 0.85 | |

| 114.0 | 114.3 | 0.3 | 80.65 | |

| 121.8 | 123.9 | 2.1 | 1.61 | |

| 190.2 | 191.1 | 0.9 | 2.20 | |

| 194.4 | 194.7 | 0.3 | 3.75 | |

| 201.3 | 201.6 | 0.3 | 1.31 | |

| 209.7 | 211.5 | 1.8 | 1.88 | |

| 213.6 | 213.9 | 0.3 | 2.18 | |

| 224.4 | 225.9 | 1.5 | 1.46 | |

| 234.9 | 235.5 | 0.6 | 0.52 | |

| 236.7 | 238.2 | 1.5 | 3.19 | |

| 247.5 | 247.8 | 0.3 | 1.10 | |

| TUDDH-596 | 77.1 | 77.4 | 0.3 | 0.8 |

| 88.8 | 91.2 | 2.4 | 1.35 | |

| 92.1 | 96.3 | 4.2 | 6.8 | |

| Incl. | 92.1 | 92.4 | 0.3 | 10.39 |

| Incl. | 93.3 | 93.9 | 0.6 | 24.57 |

| Incl. | 94.8 | 95.4 | 0.6 | 9.62 |

| 102.3 | 102.9 | 0.6 | 7.77 | |

| TUDDH-597 | 91.1 | 91.7 | 0.6 | 1.24 |

| 137.9 | 138.5 | 0.6 | 8.59 | |

| Incl. | 137.9 | 138.2 | 0.3 | 16.50 |

| 152.9 | 153.5 | 0.6 | 1.37 | |

| 176.6 | 178.4 | 1.8 | 0.81 | |

| 189.5 | 190.4 | 0.9 | 0.55 | |

| 194.9 | 195.8 | 0.9 | 8.89 | |

| TUDDH-598 | 96.7 | 97 | 0.3 | 0.84 |

| 139.6 | 140.5 | 0.9 | 1.85 | |

| 144.1 | 144.7 | 0.6 | 9.19 | |

| 170.2 | 173.8 | 3.6 | 4.68 | |

| Incl. | 170.2 | 170.5 | 0.3 | 12.89 |

| Incl. | 171.4 | 172.6 | 1.2 | 8.37 |

| 209.5 | 209.8 | 0.3 | 0.65 | |

| TUDDH-600 | 65 | 65.3 | 0.3 | 0.55 |

| 73.4 | 77 | 3.6 | 2.66 | |

| Incl. | 74 | 74.3 | 0.3 | 5.75 |

| Incl. | 74.9 | 75.2 | 0.3 | 10.95 |

| 78.8 | 79.4 | 0.6 | 0.96 | |

| 147.8 | 148.7 | 0.9 | 1.26 | |

| TUDDH-602 | 127.4 | 127.7 | 0.3 | 2.73 |

| 152 | 153.2 | 1.2 | 0.79 | |

| 182.3 | 182.6 | 0.3 | 1.03 | |

| 209.6 | 210.5 | 0.9 | 3.12 | |

| Incl. | 210.2 | 210.5 | 0.3 | 7.45 |

| 214.4 | 214.7 | 0.3 | 1.10 | |

| 225.2 | 225.5 | 0.3 | 7.12 | |

| TUDDH-603 | 28.7 | 30.5 | 1.8 | 1.64 |

| TUDDH-604 | 84.6 | 84.9 | 0.3 | 0.64 |

| 144.6 | 146.4 | 1.8 | 56.90 | |

| Incl. | 144.6 | 145.2 | 0.6 | 163.19 |

| 167.1 | 170.7 | 3.6 | 8.75 | |

| Incl. | 167.1 | 167.7 | 0.6 | 45.36 |

| TUDDH-605 | 127.9 | 128.5 | 0.6 | 17.85 |

| Incl. | 127.9 | 128.2 | 0.3 | 26.79 |

| Incl. | 128.2 | 128.5 | 0.3 | 8.90 |

| 157.6 | 158.5 | 0.9 | 4.10 | |

| Incl. | 158.2 | 158.5 | 0.3 | 10.21 |

| 161.8 | 164.5 | 2.7 | 5.52 | |

| Incl. | 164.2 | 164.5 | 0.3 | 36.81 |

| 190 | 190.6 | 0.6 | 1.21 | |

| 193.9 | 194.5 | 0.6 | 0.71 | |

| 197.2 | 199 | 1.8 | 0.64 | |

| 201.1 | 201.7 | 0.6 | 2.05 | |

| 214 | 214.3 | 0.3 | 1.09 | |

| TUDDH-606 | 66.0 | 66.6 | 0.6 | 0.88 |

| 98.4 | 98.7 | 0.3 | 1.00 | |

| TUDDH-609 | 53.0 | 54.8 | 1.8 | 35.98 |

| Incl. | 53.9 | 54.2 | 0.3 | 194.0 |

| Incl. | 54.2 | 54.8 | 0.6 | 9.32 |

| TUG-143 | 14.7 | 15.3 | 0.6 | 2.96 |

| 17.1 | 17.7 | 0.6 | 0.89 | |

| 30.3 | 30.9 | 0.6 | 0.93 | |

| 32.4 | 33.0 | 0.6 | 1.29 | |

| 54.9 | 58.2 | 3.3 | 12.22 | |

| Incl. | 54.9 | 55.5 | 0.6 | 32.08 |

| Incl. | 57 | 57.6 | 0.6 | 24.08 |

| Incl. | 57.6 | 58.2 | 0.6 | 8.82 |

| 60.9 | 61.2 | 0.3 | 17.23 | |

| 66.6 | 67 | 0.4 | 2.26 | |

| 67.8 | 68.4 | 0.6 | 1.24 | |

| 71.1 | 73.2 | 2.1 | 0.86 | |

| 74.4 | 74.7 | 0.3 | 7.19 | |

| 80.4 | 80.7 | 0.3 | 2.2 | |

| 89.4 | 89.7 | 0.3 | 8.48 | |

| TUG-144 | 6.9 | 8.4 | 1.5 | 6.82 |

| Incl. | 6.9 | 7.5 | 0.6 | 8.07 |

| Incl. | 7.5 | 7.8 | 0.3 | 9.77 |

| 10.5 | 12.0 | 1.5 | 9.33 | |

| Incl. | 11.1 | 11.4 | 0.3 | 37.42 |

| 30.6 | 31.5 | 0.9 | 4.25 | |

| Incl. | 30.6 | 31.2 | 0.6 | 5.77 |

| 43.5 | 43.8 | 0.3 | 0.9 | |

| 45.6 | 45.9 | 0.3 | 0.9 | |

| 51 | 51.6 | 0.6 | 0.95 | |

| 52.8 | 54 | 1.2 | 2.03 | |

| 64.2 | 66.6 | 2.4 | 0.81 | |

| 68.4 | 69.9 | 1.5 | 3.93 | |

| Incl. | 68.4 | 68.7 | 0.3 | 8.35 |

| Incl. | 69.6 | 69.9 | 0.3 | 11.08 |

| 75.3 | 76.2 | 0.9 | 1.83 | |

| 77.7 | 78.3 | 0.6 | 0.78 | |

| 84.3 | 86.7 | 2.4 | 1.52 | |

| 93.9 | 95.1 | 1.2 | 8.3 | |

| Incl. | 93.9 | 94.5 | 0.6 | 12.48 |

| 98.4 | 102.3 | 3.9 | 20.59 | |

| Incl. | 98.4 | 99.9 | 1.5 | 52.89 |

| which includes | 98.4 | 98.7 | 0.3 | 11.35 |

| and | 99.0 | 99.3 | 0.3 | 171.5 |

| and | 99.6 | 99.9 | 0.3 | 79.18 |

| 103.8 | 106.8 | 3.0 | 4.76 | |

| Incl. | 104.4 | 104.9 | 0.5 | 17.11 |

| Incl. | 105.3 | 105.9 | 0.6 | 5.80 |

| 115.5 | 115.8 | 0.3 | 0.64 | |

| 119.1 | 121.5 | 2.4 | 1.46 | |

| TUG-146 | 3.3 | 3.6 | 0.3 | 3.86 |

| 10.8 | 11.4 | 0.6 | 1.73 | |

| 12.9 | 13.5 | 0.6 | 6.30 | |

| 38.4 | 39.3 | 0.9 | 5.48 | |

| Incl. | 38.4 | 38.7 | 0.3 | 10.97 |

| 60.3 | 63.6 | 3.3 | 9.13 | |

| Incl. | 60.3 | 60.9 | 0.6 | 44.85 |

| 68.4 | 70.8 | 2.4 | 1.41 | |

| 97.5 | 102.6 | 5.1 | 8.15 | |

| which includes | 99.3 | 101.7 | 1.8 | 19.70 |

| Incl. | 99.3 | 99.9 | 0.6 | 13.28 |

| and | 99.9 | 100.5 | 0.6 | 11.73 |

| and | 101.1 | 101.7 | 0.6 | 34.08 |

| 105 | 109.5 | 4.5 | 3.95 | |

| Incl. | 106.5 | 107.1 | 0.6 | 8.29 |

| Incl. | 107.7 | 108 | 0.3 | 7.62 |

| 110.7 | 111 | 0.3 | 9.37 | |

| 111.9 | 113.1 | 1.2 | 1.44 | |

| 114.3 | 119.4 | 5.1 | 2.76 | |

| Incl. | 115.5 | 115.8 | 0.3 | 8.27 |

| 144.3 | 145.2 | 0.9 | 5.59 | |

| Incl. | 144.3 | 144.6 | 0.3 | 14.63 |

Table 2: Survey details of diamond drill holes referenced in this release

| Hole No | Coordinates (Fiji map grid) | RL | final depth | dip | azimuth | |

| N | E | m | (TN) | |||

| TUDDH-589 | 1876513 | 3920435 | 348.5 | 266.6 | -65 | 255 |

| TUDDH-591 | 1876442 | 3920520 | 314.0 | 149.3 | -65 | 297 |

| TUDDH-592 | 1876513 | 3920435 | 348.6 | 221.6 | -55 | 220 |

| TUDDH-593 | 1876513 | 3920435 | 348.6 | 224.4 | -45 | 220 |

| TUDDH-594 | 1876527 | 3920502 | 309.6 | 239.3 | -45 | 200 |

| TUDDH-595 | 1876527 | 3920502 | 309.6 | 265.9 | -56 | 225 |

| TUDDH-596 | 1876442 | 3920520 | 314.0 | 132.0 | -55 | 297 |

| TUDDH-597 | 1876527 | 3920502 | 309.6 | 227.3 | -42 | 200 |

| TUDDH-598 | 1876527 | 3920502 | 309.6 | 296.3 | -52 | 280 |

| TUDDH-600 | 1876442 | 3920519 | 311.1 | 150.8 | -71 | 251 |

| TUDDH-602 | 1876530 | 3920503 | 309.8 | 251.4 | -54 | 275 |

| TUDDH-603 | 1876529 | 3920503 | 309.8 | 234.6 | -40 | 290 |

| TUDDH-604 | 1876529 | 3920503 | 309.9 | 212.4 | -45 | 291 |

| TUDDH-605 | 1876530 | 3920503 | 309.7 | 254.5 | -57 | 288 |

| TUDDH-606 | 1876442 | 3920519 | 311.1 | 142.5 | -65 | 249 |

| TUDDH-609 | 1876442 | 3920519 | 311.4 | in progress | -54 | 250 |

| TUG-142 | 3920486 | 1876411 | 102.0 | 85.8 | -12 | 090 |

| TUG-143 | 3920486 | 1876412 | 103.7 | 97.7 | +30 | 087 |

| TUG-144 | 3920486 | 1876411 | 101.3 | 156.3 | -40 | 089 |

| TUG-146 | 3920486 | 1876411 | 101.3 | 163.9 | -45 | 089 |

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analysed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 80% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analysed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. For samples with multiple fire assay runs, the average of duplicate runs is presented. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analysed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses for 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“

Chairman and CEO

For further information

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider

accepts responsibility for the adequacy or accuracy of this release.

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/136388

(CNN)Chilean voters resoundingly rejected a newly proposed constitution in a referendum on Sunday.

With 98% of the ballots counted, 62% of voters rejected the proposal with 38% voting in favor, according to the Chile Electoral Service.

The new constitution would have provided full gender parity, added designated seats for indigenous representatives, and increased environmental regulations.

The constitution currently in place was written under the dictatorship of Augusto Pinochet, who ruled the country from 1973 to 1990.

On Saturday night ahead of the opening of polls Sunday morning, Chilean President Gabriel Boric tweeted, “In Chile, we resolve our differences with more democracy, never with less. I am deeply proud that we have come this far.”

The proposed change was initiated in 2020 when then-president Sebastien Piñera called a referendum on creating a new constitution amid social turmoil and popular discontent sparked by a metro fare increase in October 2019.

In October 2020, more than 78% of Chilean voters approved a plebiscite that proposed constitutional change, and in June 2021, they cast their ballots again to pick the members for a constituent assembly.

The Constitutional Assembly was the first in the world to have full gender parity and the first in the country´s history to include designated seats for indigenous representatives.

Supporters were hopeful its progressive stance would be reflected in a new, updated constitution.

Some waved flags as they celebrated the rejection of the proposed constitution.

Some waved flags as they celebrated the rejection of the proposed constitution.

And the constitutional process itself was praised internationally for giving the country an institutional way out of a social crisis, and for responding to modern Chileans’ demands for more equality and a more inclusive and participatory democracy.

After much deliberation, the final draft of the revised constitution was submitted to Piñera’s successor, leftist Gabriel Boric, in July this year.

But although most Chilean voters supported the idea of constitutional change back in October 2020, divisions appeared over the proposed draft.

Soon after the draft was made public, different polls began showing an increasing trend toward the rejection of the charter, with the government publicly recognizing that scenario.

The defeated constitution would have one of the most progressive in the world, giving the state a front-line role in the provision of social rights.

The draft put a strong emphasis on indigenous self-determination and on the protection of the environment, and would have dismantled the highly privatized water rights system. It had required gender equality in all public institutions and companies, and enshrined the respect for sexual diversity. It also envisaged a new national healthcare system.

But the project became bitterly divisive.

The right argued the draft would shift the country too far left, or that it was too ambitious and difficult to turn into efficient laws. In the lead-up to the vote, even some of its supporters on the left wanted adjustments made, with their slogan “approve to reform.”

Images from the country’s capital Santiago on Sunday show a sombre mood among supporters of the constitution, while others celebrated the news it had been voted down.

CNN’s Michelle Velez, Daniela Mohor W. and Jorge Engels contributed to this report.

Sept 2 (Reuters) – Mountain Province Diamonds Inc said on Friday that an employee from a contractor died due to injuries sustained in an incident at Gahcho Kue mine in Canada’s Northwest Territories.

The cause of the incident, which happened on Thursday, was unclear and all non-essential work at the mine has been stopped.

The mine is a joint venture between Canada’s Mountain Province Diamonds and De Beers Group, which owns 51%.

“The circumstances around what happened are under investigation by the appropriate authorities,” the companies said. (Reporting by Ankit Kumar; Editing by Maju Samuel)

Over the last couple of years, public companies have been arm-twisted into promoting certain people to meet diversity criteria. Of course, this has come at the cost of meritocracy and has become a rationality trap. Forced diversity does tremendous social harm, although when accepted as a necessity, individual companies lose out if they don’t have a diversity program. Fund Managers are hesitant to invest in companies that do not have at least a woman on the board of Directors. Big companies and even junior mining companies have been forced into implementing diversity. Here are my thoughts:

On Investments

I have written about Maritime Resources (MAE; $0.045) several times. I pay close attention, for I am likely the largest non-institutional shareholder. MAE recently released a news release about the completion of a feasibility report. The report is yet to be filed, but it meets most of my expectations.

MAE is trading for its lowest ever. It had a working capital of $0.5 million on 30th June 2022. The quarterly corporate expenses are more than $0.6 million. This means that MAE likely has a working capital deficit today and must be desperate to raise money.

If they raise one-third of the capital requirement in equity, MAE will get diluted by >100%, even if they issue no warrants, destroying any upside. Investors knowing fully well that the company needs cash, have no reason to buy at $0.05, which is also the lowest price at which the stock exchange allows companies to raise money. So, I cannot see why investors would give a bid higher than $0.045 and not sell at $0.05.

MAE share price is stuck in a $0.04 and $0.05 range. And there is no significant news awaited to lift the share price. I don’t envy the management, and I certainly don’t envy my position as a shareholder.

A few years back, Signal Gold made a hostile bid for MAE for half of their share. If the same offer came again, it would be worth $0.20. I don’t see such an offer coming. Still, a merger with Signal would remove the corporate expenses related to MAE, a saving of $2.5 million per year, a significant value for a small company. Operationally, it would be a massive win-win. MAE has $25 per tonne ore as trucking costs. This should fall significantly if the mill of Signal is used. With lower operating costs, they can perhaps even reduce the grade delivered to the mill and increase the total resources. Signal would benefit from a higher-grade ore for their hungry mill.

What would Signal pay for MAE? I see enough value in MAE to get an offer between $0.075 and $0.14. Moreover, a three-way merger of MAE, Signal Resources, and Rambler Metals & Mining would significantly reduce the corporate expenses of these three small companies and provide several other operational synergies than what I have explained above.

What would I do now? I would buy MAE at $0.04, hoping that a corporate transaction would happen. And I do hope that they do not raise money at the current share price.

Disclaimer: All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment, or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. The sole purpose of these musings is to show my thinking process when analyzing a stock, not to provide any recommendations. I will not and cannot be held liable for any actions you take resulting from anything you read here. Conduct your due diligence, or consult a licensed financial advisor or broker before making any investment decisions. Any investments, trades, speculations, or decisions made based on any information found on this site, expressed or implied herein, are committed at your own risk, financial or otherwise.

President Biden’s Inflation Reduction Act calls for at least 50% of an electric vehicle’s battery to be made in the U.S. to qualify for a federal discount. WSJ’s George Downs breaks down a battery to explain why that’s going to be a challenge. Illustration: George DownsGeorge Downs

George Downs explores the evolution of transportation, from electric vehicles to commercial aviation and the future of spaceflight.

Figure 1

Figure 2

Figure 3

Figure 4

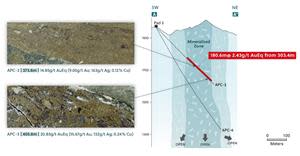

TORONTO, Aug. 29, 2022 (GLOBE NEWSWIRE) — Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results from two additional holes completed at the Apollo target (“Apollo”) at the Company’s Guayabales project located in Caldas, Colombia. Apollo is a newly discovered high-grade copper-gold-silver porphyry-related breccia and is one of eight porphyry-related targets situated within a three-by-four-kilometre cluster area generated by the Company through grassroots exploration at the project. As part of its fully funded 20,000+ metre drill program for 2022, there are currently three diamond drill rigs operating at the Apollo target with an additional rig drilling from underground at the Olympus target.

“These latest drill intercepts demonstrate the remarkably continuous nature of this mineralized breccia and overprinting CBM vein system which is now expanding with every drill hole that we complete. With multiple overprinting events depositing mineralization into the system, the Apollo main breccia has all the right markers to evolve into a large-scale discovery. We will remain aggressive with drilling for the balance of 2022,” commented Ari Sussman, Executive Chairman.

A short video presented by David Reading discussing the results can be seen by clicking here.

Details (See Table 1 and Figures 1 – 4)

Five diamond drill holes with accompanying assay results have now been announced at Apollo and resulted in expansion of this main breccia and overprinting vein system with dimensions of up to 300 metres along strike by 100 metres across by 400 metres vertical. The target remains open in all directions and has the potential to evolve into a significant high-grade, bulk tonnage mineralized system.

Drill holes APC-3 and APC-5 were drilled in opposite directions from two separate drill pads (Pads 2 and 3) to the northeast and southwest respectively to test continuity of the mineralized breccia previously intersected in holes APC-1, APC-1W and APC-2 and to test the early working model of the geometry of the main breccia (see press releases dated April 27, 2022, June 22 and July 6, 2022). The following results are highlighted:

APC-3 is the first hole drilled from a newly constructed pad (Pad 3) located approximately 400 metres to the south of Pad 1 (Holes APC-1 and 1W) and 300 metres to the southwest of Pad 2 (Hole APC-2 and APC-5).

APC-5 was drilled from Pad 2 to the SW with a steeper inclination and a 200-metre vertical difference from the previous intercept reported in APC-2.

Table 1: Assays Results

| HoleID | From (m) | To (m) | Intercept (m) | Au (g/t) | Ag (g/t) | Cu % | Zn % | Pb % | Mo % | AuEq (g/t)* |

| APC-3 | 303.40 | 484.00 | 180.60 | 1.52 | 39 | 0.16 | 0.13 | 0.11 | 0.001 | 2.43 |

| Incl | 304.90 | 326.00 | 21.10 | 2.86 | 24 | 0.04 | 0.28 | 0.28 | 0.001 | 3.47 |

| 363.10 | 409.70 | 46.60 | 3.78 | 58 | 0.20 | 0.33 | 0.27 | 0.001 | 5.13 | |

| APC-5 | 210.25 | 478.25 | 268.00 | 0.89 | 22 | 0.13 | 0.11 | 0.07 | 0.002 | 1.50 |

| Incl | 210.25 | 226.60 | 16.35 | 1.95 | 20 | 0.04 | 0.308 | 0.23 | 0.001 | 2.55 |

| 252.60 | 271.80 | 19.20 | 2.61 | 14 | 0.04 | 0.271 | 0.13 | 0.000 | 3.03 | |

| 456.00 | 478.25 | 22.25 | 2.30 | 21 | 0.04 | 0.332 | 0.24 | 0.002 | 2.92 | |

| and | 496.80 | 510.65 | 13.85 | 0.71 | 9 | 0.02 | 0.144 | 0.11 | 0.001 | 1.00 |

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.014 x 0.95) + (Cu (%) x 1.96 x 0.95) + (Mo (%) x 7.35 x 0.95)+(Zn(%)x 0.86 x 0.95)+ (Pb(%)x 0.44 x 0.95) utilizing metal prices of Cu – US$4.00/lb, Mo – US$15.00/lb, Zn – US$1.75/lb, Pb – US$0.9/lb, Ag – $20/oz and Au – US$1,400/oz and recovery rates of 95% for Au, Ag, Cu, Mo, Zn and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.2 g/t AuEq cut-off grade was employed with no more than 15% internal dilution. True widths are unknown, and grades are uncut.

Figure 1: Plan View of the Guayabales Project Highlighting the Apollo Target

https://www.globenewswire.com/NewsRoom/AttachmentNg/eeb9e76f-a937-4682-a99b-ac6ab09f0c51

Figure 2: Plan View of the Apollo Target Area Outlining the Porphyry and Breccia Targets, their Related Soil Anomalies and Drill Holes Completed or Currently Underway

https://www.globenewswire.com/NewsRoom/AttachmentNg/7eca55ae-f68b-48d2-a2a9-cac7f26df452

Figure 3: Plan View with Traces of drill holes completed to date in the Main Breccia Discovery at Apollo

https://www.globenewswire.com/NewsRoom/AttachmentNg/b56c6abe-3941-438c-8374-c39142a568c3

Figure 4: Apollo Target Cross Section N-S with Core Photo Highlights for APC-5

https://www.globenewswire.com/NewsRoom/AttachmentNg/bb5d25f0-7fdc-4103-9370-fefd14b96872

Marketing Services Agreement

The Company is pleased to announce an agreement with Proven and Probable (“PP”) to provide investor relations services to the Company, subject to approval by the TSX Venture Exchange (the “TSX-V”). PP will provide investor relations services to increase exposure to and awareness of Collective. Services include, but not limited to:

The agreement with PP has a term of one year, for which they will be paid an annual fee of USD $72,000. PP currently owns 3,250 common shares of Collective.

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Collective Mining is an exploration and development company focused on identifying and exploring prospective mineral projects in South America. Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, the mission of the Company is to repeat its past success in Colombia by making significant new mineral discoveries and advance the projects to production. Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders.

The Company currently holds an option to earn up to a 100% interest in two projects located in Colombia. As a result of an aggressive exploration program on both the Guayabales and San Antonio projects, a total of eight major targets have been defined. The Company has made significant grassroot discoveries at both projects with near-surface discovery holes at the Guayabales project yielding 302 metres at 1.11 g/t AuEq at the Olympus target, 163 metres at 1.3 g/t AuEq at the Donut target and recently, at the Apollo target, 207.15 metres at 2.68 g/t AuEq, 89.4 metres at 2.46 g/t AuEg and 87.8 metres at 2.49 g/t AuEg. At the San Antonio project, the Company intersected, from surface, 710 metres at 0.53 AuEq. (See related press releases on our website for AuEq calculations)

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Contact Information

Collective Mining Ltd.

Steven Gold, Vice President, Corporate Development and Investor Relations

Tel. (416) 648-4065

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Vancouver, British Columbia–(Newsfile Corp. – August 26, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”), is pleased to announce the execution, by its wholly-owned subsidiary Bronco Creek Exploration Inc., of an option to purchase agreement (the “Agreement”) for the Mesa Well property (the “Project”) to Intrepid Metals Corp. (“Intrepid”). The Agreement provides EMX with cash and share payments during Intrepid’s earn-in period, and upon earn-in, a retained 2% net smelter return (“NSR”) royalty interest, annual advance royalty payments, and certain milestone payments.

The Mesa Well Project is located in south-central Arizona’s porphyry copper belt, approximately 100 kilometers northeast of Tucson. The principal target is a structurally dismembered and rotated porphyry copper-molybdenum system concealed beneath strongly tilted, post-mineral cover rocks. There are additional targets of skarn/replacement mineralization, also beneath cover rocks.

The Agreement with Intrepid is an example of EMX’s execution of the royalty generation aspect of its business model. The Company acquired Mesa Well at minimal cost in a premier porphyry copper belt, and has now partnered the Project for further in-the-ground exploration investment, pre-production payments, and a retained NSR royalty interest, all at no additional cost to EMX.

Commercial Terms Overview. Intrepid can earn 100% interest in the Project before the fifth anniversary of the Agreement by: (a) making execution and staged option payments totaling $350,000, (b) delivering 600,000 common shares of Intrepid, and (c) incurring $2,000,000 in exploration expenditures. After earn-in, EMX will retain a 2% NSR royalty interest on the Project and will receive certain annual advance royalty (“AAR”) payments.

Additionally, Intrepid has agreed to make payments to EMX at certain Project milestones: (a) $200,000 upon completion of a Preliminary Economic Assessment; (b) $500,000 upon completion of a Prefeasibility Study; and (c) $1,000,000 upon completion of a Feasibility Study.

All dollar amounts are in USD unless otherwise noted.

Mesa Well Overview. The Mesa Well Project is covered by State of Arizona exploration leases that were acquired as a result of EMX’s southwestern U.S. porphyry copper royalty generation program. The original target concept was derived from the coincidence of locally anomalous water well geochemisty and an unexplored porphyry dike swarm striking toward those anomalies, with several water wells reporting high molybdenum values and notable “multiparameter” anomalies1.

The Mesa Well target area is covered by highly tilted, post-mineral, Tertiary gravels. Field work to the east of the principal target area identified: 1) a variety of porphyry dikes and associated weak, but broadly-developed biotitic and sodic-calcic alteration with sparse chalcopyrite mineralization and 2) exotic, secondary copper mineralization along a low angle fault zone that spans from the dike swarm to the geochemically anomalous water wells. The dikes, alteration, and mineralization are characteristic of the deeper flanks of a porphyry system. The remobilized copper mineralization is interpreted to be sourced from the porphyry target beneath the post-mineral cover.

Exploration by a previous partner included five holes totaling 2,701 meters of reverse circulation and 981 meters of core drilling which intersected distal porphyry copper alteration and mineralization. These drill intercepts increase in alteration intensity and mineralization (pyrite-chalcopyrite-molybdenite-bearing quartz veins with sericitic alteration) and vector toward the target area. Permitting was completed for a planned follow-up drill program that was never executed. As a result, the Mesa Well Project presents “walk-up” drill targets for Intrepid’s upcoming work programs. Intrepid advises it has plans to complete geophysical surveys on the Project prior to year-end, followed by a drill program in Q1 2023.

Qualified Person. Michael P. Sheehan, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the above technical disclosure.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended June 30, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

1 Bolm, K. S., Hayes, T. S., and Brown, J. G., 2008, Using alluvial basin ground-water chemistry to explore for concealed porphyry copper deposits in Arizona, in: Ores and Orogenesis: Circum-Pacific Tectonics, Geologic Evolution, and Ore Deposits, Arizona Geological Society Digest 22, Spencer, J. E., and Titley, S. R., eds. p. 137-149.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/134909

Bob Moriarty

Archives

Aug 19, 2022

Lion One (LIO-V) came out with a press release in early June that shot the shares from $1.04 to $1.67 in less than a week. Obviously the results were excellent. Most of the people who read it appreciated it for what it was. One of the clowns who posts on CEO.CA maintained that the company was only finding high-grade but narrow intercepts and didn’t believe it could be put into production.

So I posted a piece on June 7th and showed Mr. Doom and Gloom a map of Fiji showing the seven million ounces of production from the Vatukoula gold mine only forty km to the North East. The deposits might as well be identical. Same age, same grades and thickness, same type deposit.

The uptick didn’t last long. The shares came off their high and dropped to a low of $1.17 in early July before climbing a little. Gold shares seem to have lost their luster. Right now it really looks like everyone hates gold and gold shares.

That is wonderful news for investors.

But first I want to talk about something that I have been tempted to discuss in one or more of the interviews I have been doing lately. It doesn’t have anything to do with investing but it’s a lifestyle change I learned almost fifty years ago when I worked at Electronic Data Systems. That’s the company that made Ross Perot a billionaire.

EDS made Perot a billionaire within two weeks of the company going public in 1968. He was the first of the billionaires created by taking a company public. When Perot took EDS public only three people made over $1 million. Perot, his secretary and his number 2 man. The company that created the largest number of millionaires was Microsoft. Anyone working there for over five years had picked up enough options by 2000 to be a millionaire. So Perot made the least number of rich employees and Bill Gates made the most.

Perot was a squid; he attended the Naval Academy and served as a line officer in the Navy before leaving the service and going to work with IBM in 1957 selling mainframe computers. In 1962 he formed EDS that made his fortune for him. Perot actually never operated a computer and never wrote a line of code. But he did understand the potential of the machine.

EDS hired me in 1971. We all went through training in Dallas before launching off to whatever contracts EDS had providing computer services. Perot came up with a lot of interesting approaches to life.

The most valuable to me was the concept of how to get a lot of things done. A lot of people who actually believe they are organized will make a list of things they want to do and figure out when it will be convenient to do them.

Don’t ever do things when they are convenient. You will never accomplish very much.

Do things when they are inconvenient.

And the more inconvenient the better. That sounds counter intuitive much like investing in stocks when people hate them but it actually works in real life in both cases.

You see, no matter what you want to do, a lot of the time, in fact most of the time; it’s just inconvenient to do something. There are a lot more inconvenient times to do things than convenient times. So you will accomplish a lot more by doing them when they are a pain in the ass to do. They might never become convenient.

Lion One announced another set of great assays at their Tuvatu Gold mine in Fiji on the 12th of August. Since then the shares have dropped 16%. That’s simply nuts or the assays did nothing more than create a liquidity event. Tuvatu is 100% owned with no NSR.

Lion One came out with a 43-101 back in June of 2014 showing slightly over 910,000 ounces of gold at a 1.0-gram cutoff. They have done a lot of drilling and intercepts since. Remember their neighbor 40 km away has already produced seven million ounces of gold and has another four million identified.

But rich projects require a lot of money and a lot of time to advance. Lion One is drilling for expansion of their resource at the same time they are doing mine planning for their mill scheduled to be into production in Q4 of 2023.

Lion One is my biggest single position. I have an average cost of $1.18 and as of today it trades at $1.16. But I only know half a dozen stocks that have the market cap potential of Lion One and it is by far the cheapest in relative terms. The company has excellent management and technical team. They have their own lab on site supporting the six drill rigs turning.

Lion One is an advertiser. I am a shareholder and just as biased as I can be so do your own due diligence.

Lion One Metals

LIO-V $1.16 (Aug 18, 2022)

LOMLF OTCQX 156.4 million shares

Lion One website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd

TORONTO, ON / ACCESSWIRE / August 16, 2022 / (CSE:ROO) (OTC:JNCCF) (Frankfurt:5VHA) RooGold Inc. (“RooGold” or the “Company“).

RooGold announces the appointment of Vishal Gupta to the Board of Directors. Mr. Gupta replaces Carlos Espinosa, who will be stepping down as a director in order to make room for Mr. Gupta to join the Company’s board of directors. Mr. Espinosa will remain in his role as President and Chief Executive Officer of the Company.

Mr. Gupta is a P. Geo. registered with the Professional Geoscientists of Ontario, who brings considerable mining industry expertise and public markets experience to his role as Director of RooGold. He currently serves as the President and CEO of Caprock Mining Corp., a gold exploration company listed on the Canadian Securities Exchange (“CSE”). Prior to joining Caprock, Mr. Gupta served as the President and CEO of California Gold Mining Inc., an advanced-stage gold exploration company also listed on the CSE. Previously, he worked as an equity research analyst and investment banker covering the mining sector for a number of Toronto-based financial institutions including Desjardins Securities, Cormark Securities, Dundee Capital Markets, Fraser Mackenzie and Global Financial. During his tenure in capital markets, Mr. Gupta performed independent technical due diligence, M&A advisory and comprehensive valuation analysis on a wide variety of resource projects across the United States, Canada, Mexico, Brazil, Argentina, Chile, and Nicaragua. Mr. Gupta holds a Master of Science degree in Geology from the University of Toronto, and started his career as an exploration geologist for junior resource companies where he was involved in the planning, preparation, execution and reconciliation of exploration programs.

“We are very pleased to have Mr. Gupta join our team at this time,” stated Carlos Espinosa, President and CEO of RooGold. “Vishal brings extensive capital markets and mining experience, and we look forward to benefitting from his insights and guidance.”

About RooGold Inc.

ROOGOLD is a Canadian based junior venture mineral exploration issuer which is uniquely positioned to be a dominant player in New South Wales, Australia, through a growth strategy focused on the consolidation and exploration of high potential, mineralized precious metals properties in this prolific region of Australia. Through its announced acquisitions of Southern Precious Metals Ltd., RooGold Ltd. and Aussie Precious Metals Corp. properties, RooGold commands a portfolio of 14 high-grade potential gold (10) and silver (4) concessions covering 2,696 km 2 which have 139 historic mines and prospects.

For further information please contact:

Carlos Espinosa, CEO

cespinosa@roogoldinc.com

Ryan Bilodeau

(416) 910-1440

info@roogoldinc.com

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities law. Forward-looking statements are frequently characterized by words such as “plan”,”expect”, “project”, “intend”,”believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur.

Although the Issuer believes that the expectations reflected in applicable forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE: RooGold Inc.

View source version on accesswire.com:

https://www.accesswire.com/712307/RooGold-Announces-Changes-To-Its-Board-Of-Directors