Vancouver, British Columbia–(Newsfile Corp. – February 12, 2024) – Dolly Varden Silver Corporation (TSXV: DV) (OTC: DOLLF) (the “Company” or “Dolly Varden“) is pleased to announce 2023 step-out drilling at the Homestake Ridge property intersected a new gold-rich zone, to the northwest from the Homestake Silver Deposit.

Highlights of Homestake Silver step-outs to the northwest include: (intervals shown are core length**)

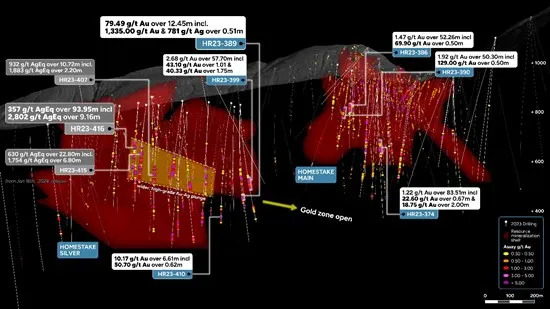

- HR23-389: 79.49 g/t Au and 60 g/t Ag (80.21 g/t AuEq*) over 12.45 meters including 1,335 g/t Au*** and 781 g/t Ag (1,344.42 g/t AuEq*) over 0.68 meters within a broad mineralized zone grading 15.26 g/t Au and 20.05 g/t Ag (15.50 g/t AuEq*) over 66.50 meters.

- HR23-399: 43.10 g/t Au and 66 g/t Ag (43.90 g/t AuEq*) over 1.01 meters and 40.33 g/t Au and 418 g/t Ag (45.37 g/t Au Eq**) over 1.75 meters within a broad mineralized zone grading 2.68 g/t Au and 20 g/t Ag (2.92 g/t AuEq*) over 57.70 meters.

- HR23-410: 10.17 g/t Au over 6.61 meters including 50.70 g/t Au over 0.62 meters.

Highlights from Homestake Main infill drilling below high-grade plunge include: (intervals shown are core length**)

- HR23-374: 22.60 g/t Au over 0.67 meters, 18.75 g/t Au over 2.00 meters and 10.15 g/t Au over 1.00 meter in separate vein breccias included in a wider mineralized envelope grading 1.22 g/t Au and 1.90 g/t Ag (1.24 g/t AuEq*) over 83.51 meters.

- HR23-386: 18.14 g/t Au and 30 g/t Ag (18.51 g/t AuEq*) over 2.50 meters including 69.9 g/t Au and 42 g/t Ag (70.41 g/t AuEq*) over 0.50 meters.

- HR23-390: 129.00 g/t Au and 218 g/t Ag (131.63 g/t AuEq*) over 0.50 meters in a vein breccia included in a wider mineralized envelope grading 1.92 g/t Au and 3.58 g/t Ag (1.96 g/t AuEq*) over 50.30 meters.

*AuEq and AgEq are calculated using $US1650/oz Au, $US20/oz Ag

**Estimated true widths vary depending on intersection angles and range from 50% to 85% of core lengths.

***Determined using metallic screen fire assay on 1.0 kg split

“Whether we discover new zones of high-grade gold at Homestake Ridge or expand the large, wide and high-grade silver deposits at Wolf and Torbrit, drilling continues to deliver results from the premier, undeveloped gold-silver trend in Canada,” said Shawn Khunkhun, CEO of Dolly Varden Silver.

“The new high-grade gold and silver mineralization encountered in step out drilling to the northwest of Homestake Silver represents a significant breakthrough in further defining, upgrading and expanding the mineralization at Homestake Ridge,” said Rob van Egmond, Vice-President Exploration.” This new zone remains open to the northwest, projecting towards the Homestake Main Deposit.”

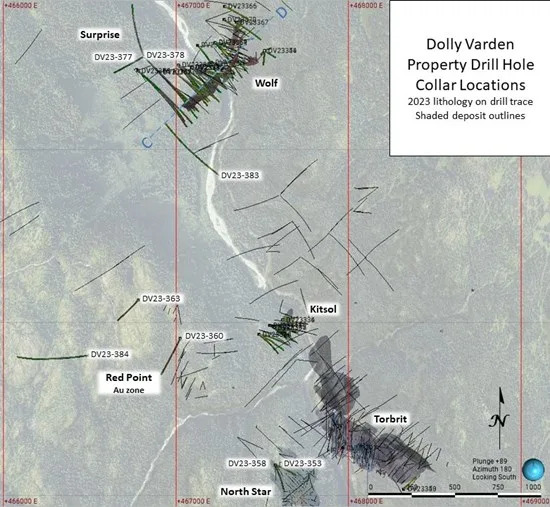

This release includes the remaining drill results from 48 drill holes from the 2023 drill program at the 100%-owned Kitsault Valley Project that includes the Homestake Ridge and Dolly Varden properties in BC’s Golden Triangle. Reporting 26 drill holes at Homestake Main (11,054.90m), four drill holes (2,478.00m) from the new gold-rich zone at the Homestake Silver northwestern extension, and six exploration drill holes on the Homestake Ridge property (1,627.00m). In addition, twelve holes (6,971.00m) from the Dolly Varden property including the North Star, Red Point and Wolf areas are reported in this release.

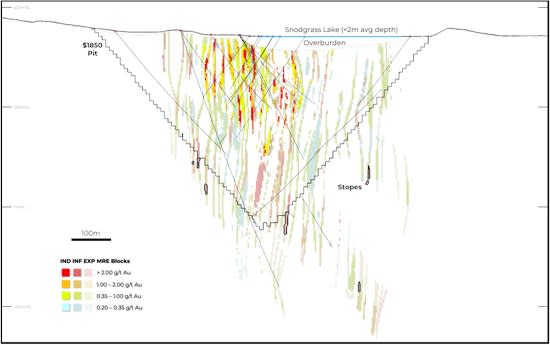

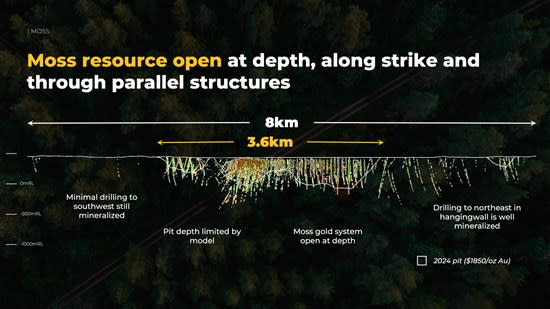

Homestake Silver Step-Out Drilling

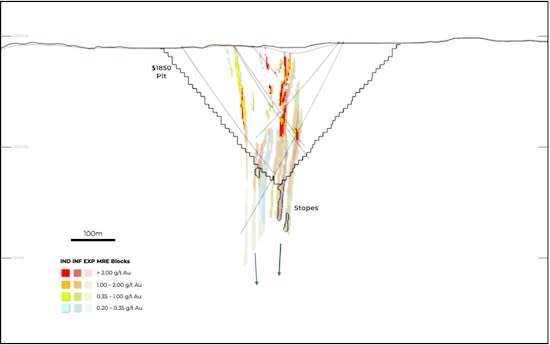

The high-grade gold and silver intersections in holes HR23-389 and HR23-399 are horizontally separated by approximately 40m and are interpreted to be a new gold zone extending northwest, at depth towards the Homestake Main deposit. Deeper in these holes a second, targeted mineralized envelope was encountered (Figure 5). In longitudinal section, the new gold zone overlaps parallel with the known mineralized envelopes approximately 50 meters to the east. This zone remains open to the northwest below historic drilling. Drilling in 2024 will target a 350m long gap between the Homestake Silver and Homestake Main Deposits to expand this new zone (Figure 2).

Drill hole HR23-410 is a 75-meter step-out from previously released holes HR23-395 and 398 (January 4th, 2024 release) and represents an extension of the higher grade veins to depth and below the wide, higher grade plunge.

The dip of drill hole HR23-394 steepened due to hole deviation more than anticipated and remained in the footwall to mineralized zones.

Figure 1. Location in this release along Dolly Varden’s Kitsault Valley trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_002full.jpg

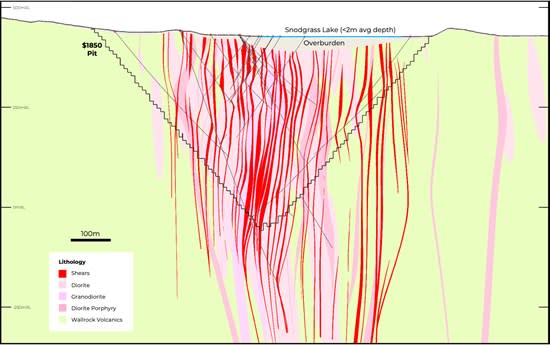

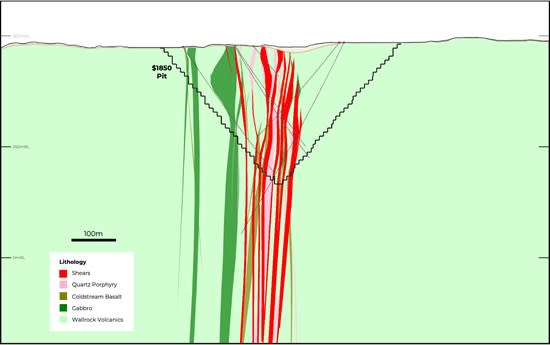

Homestake Main Drilling

The objective of drilling during 2023 at the Homestake Main and Homestake Silver deposits was to expanded multiple, subparallel mineralized zones and to upgrade Inferred Mineral Resources in the projected plunge of the wider, higher-grade zone. The drilling completed in 2023 at Homestake Main was primarily resource expansion drilling, targeting both down dip and along strike from current Mineral Resources.

At Homestake Main, the 2023 drilling tested the depth extent of the structural corridor that hosts the mineralization and infilled in areas of higher grades. Drill hole HR23-374 is located approximately 200m down dip from the modelled wide, high-grade plunge, planned as a depth test at the bottom edge of the known mineralized envelope.

Drilling along the northwest projection of the Homestake Main zone intersected the structural corridor and associated alteration but with a decrease in vein stockwork and vein breccias density.

Homestake Ridge Exploration Drilling

Four exploration drill holes (HR23-417, 420, 421 and 424) tested two parallel, northwest trending structures located 300 metres and 600 meters to the west of the Homestake Silver deposit. HR23-424 tested the Fox Reef, a parallel structure approximately 900 meters to the southwest. Numerous veins and breccias were intersected with lower grade gold values (Table 3). Another two drill holes (HR23-422 and 423) tested the Dilly – Rambler exploration target 1,500m to the south of Homestake Silver. Although zones of QSP alteration and structures of interest were intersected, no significant precious metal grades were returned from the samples in these holes.

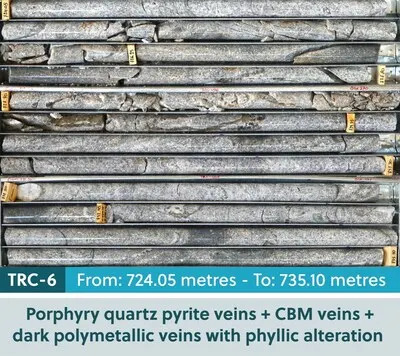

The Homestake Ridge deposits are interpreted as a structurally controlled, multi-phase epithermal vein stockwork and vein breccia system hosted in Jurassic Hazelton Volcanic rocks. Mineralization consists of pyrite and chalcopyrite in a breccia matrix within a silica breccia vein system and quart-carbonate veining (Figure 3). The northwest orientation of the main Homestake structural trend appears to have numerous subparallel internal structures that are interpreted to form the controls for higher grade gold and silver shoots within a broader low-grade (>0.1 g/t Au) zone at the Homestake Main deposit. The main structural corridor dips steeply to the northeast at Homestake Main and rolls to steeply Southwest at Homestake Silver (Figure 2 and 5).

Figure 2. Long Section of Homestake Silver and Main. Modelled mineralized envelope from resource in Red (looking southwest)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_003full.jpg

Figure 3. Drill hole HR23-389 at the gold zone from the Homestake Silver deposit hosting quartz carbonate vein and stockwork with high-grade gold and silver mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_004full.jpg

Figure 4. Location of 2023 Drill holes at Homestake Main and northwest step outs at Homestake Silver in this release. Plan View with Current Mineral Resource block model in grey, primarily of Inferred Classification

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_005full.jpg

Figure 5. Homestake Silver northwest extension Cross Section (A-B) with 2023 and previous drill holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_006full.jpg

Table 1. Completed Drill Hole Assays from the Homestake Silver Deposit Northern Extension drilling

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-389 | 329.50 | 369.93 | 40.43 | 0.11 | 67 | 0.00 | 0.91 | 76 |

| including | 366.00 | 368.00 | 2.00 | 0.52 | 559 | 0.03 | 7.26 | 602 |

| including | 367.00 | 368.00 | 1.00 | 0.99 | 996 | 0.04 | 13.00 | 1078 |

| New Au Zone | 377.50 | 444.00 | 66.50 | 15.26 | 20 | 0.01 | 15.50 | 1285 |

| including | 401.00 | 413.45 | 12.45 | 79.49 | 60 | 0.01 | 80.21 | 6649 |

| including | 409.90 | 410.58 | 0.68 | 1335*** | 781 | 0.01 | 1344.42 | 111440 |

| Lower Zone | 503.07 | 550.35 | 47.28 | 1.22 | 1 | 0.01 | 1.23 | 102 |

| including | 510.60 | 511.85 | 1.25 | 13.70 | 4 | 0.01 | 13.75 | 1140 |

| including | 522.77 | 523.37 | 0.60 | 8.53 | 4 | 0.01 | 8.57 | 711 |

| including | 525.79 | 526.81 | 1.02 | 13.65 | 6 | 0.01 | 13.72 | 1137 |

| HR23-394 | 416.50 | 421.50 | 5.00 | 0.52 | 14 | 0.02 | 0.69 | 57 |

| including | 416.50 | 417.50 | 1.00 | 2.10 | 26 | 0.03 | 2.42 | 200 |

| and | 484.00 | 486.00 | 2.00 | 2.20 | 50 | 0.02 | 2.79 | 231 |

| HR23-399 New Au Zone | 377.90 | 435.60 | 57.70 | 2.68 | 20 | 0.02 | 2.92 | 242 |

| including | 396.24 | 397.25 | 1.01 | 43.10 | 66 | 0.23 | 43.90 | 3639 |

| including | 413.00 | 414.75 | 1.75 | 40.33 | 418 | 0.13 | 45.37 | 3761 |

| and | 446.80 | 452.00 | 5.20 | 1.40 | 5 | 0.02 | 1.46 | 121 |

| Lower Zone | 545.10 | 570.00 | 24.90 | 0.36 | NSV | 0.36 | 30 | |

| HR23-410 | 329.35 | 329.85 | 0.50 | 0.12 | 1215 | 0.04 | 14.77 | 1225 |

| and | 329.85 | 330.35 | 0.50 | 0.06 | 192 | 0.41 | 2.37 | 197 |

| 75m Step out | 566.11 | 572.72 | 6.61 | 10.17 | 7 | 0.03 | 10.25 | 850 |

| including | 567.58 | 571.47 | 3.89 | 16.81 | 10 | 0.04 | 16.93 | 1403 |

| including | 567.58 | 568.20 | 0.62 | 50.70 | 26 | 0.08 | 51.01 | 4229 |

| including | 570.00 | 571.47 | 1.47 | 15.30 | 9 | 0.05 | 15.41 | 1277 |

Table 2. Completed Drill Hole Assays from the Homestake Main Deposit Area

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-367 | 295.75 | 304.80 | 9.05 | 1.66 | 1 | 0.01 | 1.68 | 139 |

| including | 299.96 | 300.80 | 0.84 | 3.16 | 2 | 0.03 | 3.19 | 264 |

| including | 301.32 | 301.82 | 0.50 | 19.80 | 11 | 0.06 | 19.94 | 1652 |

| HR23-368 | 186.90 | 188.90 | 2.00 | 0.18 | NSV | 0.18 | 15 | |

| and | 207.70 | 212.95 | 5.25 | 0.17 | NSV | 0.17 | 14 | |

| HR23-369 | 204.00 | 211.00 | 7.00 | 0.60 | NSV | 0.60 | 50 | |

| including | 231.07 | 231.62 | 0.55 | 0.83 | 4 | 0.01 | 0.88 | 73 |

| and | 294.50 | 317.34 | 22.84 | 0.37 | NSV | 0.37 | 31 | |

| including | 313.19 | 314.50 | 1.31 | 3.31 | 18 | 0.00 | 3.52 | 292 |

| HR23-370 | 288.00 | 295.00 | 7.00 | 1.65 | 2 | 0.01 | 1.67 | 139 |

| including | 293.00 | 295.00 | 2.00 | 4.83 | 5 | 0.01 | 4.89 | 405 |

| HR23-371 | 323.00 | 323.50 | 0.50 | 1.45 | NSV | 1.45 | 120 | |

| HR23-372 | 234.36 | 258.50 | 24.14 | 0.87 | 1 | 0.04 | 0.88 | 73 |

| including | 246.50 | 250.50 | 4.00 | 3.58 | 3 | 0.10 | 3.61 | 299 |

| including | 257.70 | 258.50 | 0.80 | 1.05 | 7 | 0.52 | 1.13 | 94 |

| HR23-373 | 341.00 | 343.00 | 2.00 | 0.45 | NSV | 0.45 | 37 | |

| HR23-374 | 261.03 | 344.54 | 83.51 | 1.22 | 2 | 0.04 | 1.24 | 103 |

| including | 268.48 | 269.15 | 0.67 | 22.60 | 10 | 0.17 | 22.72 | 1883 |

| including | 311.00 | 313.00 | 2.00 | 18.75 | 8 | 0.22 | 18.85 | 1562 |

| including | 321.00 | 322.00 | 1.00 | 10.15 | 9 | 0.09 | 10.26 | 850 |

| HR23-375 | 234.00 | 237.18 | 3.18 | 0.14 | 2 | 0.01 | 0.17 | 14 |

| HR23-376 | 402.09 | 409.13 | 7.04 | 0.97 | 1 | 0.05 | 0.98 | 81 |

| including | 408.32 | 409.13 | 0.81 | 5.29 | 5 | 0.32 | 5.35 | 444 |

| HR23-377 | 475.75 | 477.26 | 1.51 | 0.32 | 4 | 0.04 | 0.37 | 31 |

| HR23-378 | 523.55 | 526.00 | 2.45 | 0.36 | NSV | 0.36 | 30 | |

| and | 569.85 | 571.46 | 1.61 | 0.45 | NSV | 0.45 | 37 | |

| HR23-379 | 264.00 | 293.00 | 29.00 | 0.47 | 1 | 0.02 | 0.49 | 40 |

| including | 284.88 | 286.50 | 1.62 | 4.96 | 14 | 0.25 | 5.13 | 425 |

| and | 299.75 | 315.35 | 15.60 | 0.29 | NSV | 0.29 | 24 | |

| and | 387.00 | 416.00 | 29.00 | 0.38 | NSV | 0.38 | 31 | |

| including | 395.00 | 399.50 | 4.50 | 0.80 | NSV | 0.80 | 66 | |

| including | 403.00 | 406.00 | 3.00 | 0.92 | NSV | 0.92 | 76 | |

| HR23-380 | 420.44 | 446.00 | 25.56 | 0.25 | 0 | 0.00 | 0.25 | 21 |

| HR23-381 | 259.97 | 277.00 | 17.03 | 0.56 | 12 | 0.03 | 0.71 | 59 |

| including | 265.24 | 265.89 | 0.65 | 3.38 | 111 | 0.41 | 4.72 | 391 |

| including | 268.02 | 268.61 | 0.59 | 1.30 | 4 | 0.00 | 1.35 | 112 |

| HR23-382 | 312.00 | 394.41 | 82.41 | 0.26 | NSV | 0.02 | 0.26 | 22 |

| including | 324.60 | 325.12 | 0.52 | 3.33 | 4 | 0.44 | 3.38 | 280 |

| including | 359.50 | 360.22 | 0.72 | 1.95 | 13 | 0.48 | 2.11 | 175 |

| and | 404.00 | 434.00 | 30.00 | 0.38 | NSV | 0.01 | 0.38 | 31 |

| including | 426.30 | 427.12 | 0.82 | 4.86 | 21 | 0.32 | 5.11 | 424 |

Table 2 con’t. Completed Drill Hole Assays from the Homestake Main Deposit Area

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-383 | 166.08 | 168.00 | 1.92 | 0.86 | 39 | 0.00 | 1.33 | 110 |

| HR23-384 | 338.12 | 371.10 | 32.98 | 0.31 | 1 | 0.01 | 0.33 | 27 |

| and | 391.00 | 444.00 | 53.00 | 0.30 | 1 | 0.00 | 0.31 | 26 |

| HR23-385 | 485.67 | 515.05 | 29.38 | 0.25 | 2 | 0.07 | 0.27 | 22 |

| and | 510.00 | 510.70 | 0.70 | 0.93 | 15 | 0.63 | 1.11 | 92 |

| HR23-386 | 156.69 | 208.95 | 52.26 | 1.47 | 25 | 0.13 | 1.78 | 147 |

| including | 159.00 | 160.00 | 1.00 | 1.35 | 969 | 0.09 | 13.04 | 1081 |

| including | 161.00 | 163.50 | 2.50 | 18.14 | 30 | 0.24 | 18.51 | 1534 |

| including | 161.00 | 161.50 | 0.50 | 69.90 | 42 | 0.18 | 70.41 | 5836 |

| including | 183.90 | 190.00 | 6.10 | 2.19 | 16 | 0.91 | 2.39 | 198 |

| HR23-387 | 146.84 | 190.10 | 43.26 | 0.62 | 6 | 0.13 | 0.69 | 57 |

| including | 150.00 | 150.50 | 0.50 | 6.18 | 10 | 0.16 | 6.31 | 523 |

| including | 166.00 | 168.65 | 2.65 | 2.54 | 35 | 1.68 | 2.96 | 246 |

| including | 189.10 | 189.60 | 0.50 | 2.62 | 1 | 0.11 | 2.64 | 219 |

| HR23-388 | 211.90 | 229.50 | 17.60 | 1.00 | 4 | 0.14 | 1.04 | 86 |

| including | 213.86 | 215.00 | 1.14 | 1.90 | 17 | 0.93 | 2.10 | 174 |

| including | 219.48 | 220.20 | 0.72 | 7.80 | 8 | 0.13 | 7.90 | 655 |

| including | 221.50 | 222.00 | 0.50 | 1.03 | 9 | 0.16 | 1.14 | 94 |

| including | 225.60 | 228.40 | 2.80 | 2.05 | 4 | 0.14 | 2.10 | 174 |

| and | 372.50 | 381.50 | 9.00 | 1.76 | 3 | 0.13 | 1.80 | 149 |

| including | 373.38 | 373.88 | 0.50 | 28.80 | 47 | 2.23 | 29.37 | 2434 |

| HR23-390 | 167.70 | 218.00 | 50.30 | 1.92 | 4 | 0.03 | 1.96 | 162 |

| including | 169.68 | 170.18 | 0.50 | 129.00 | 218 | 1.09 | 131.63 | 10911 |

| including | 173.95 | 174.45 | 0.50 | 5.59 | 8 | 0.13 | 5.68 | 471 |

| including | 206.00 | 207.00 | 1.00 | 2.72 | 1 | 0.00 | 2.73 | 227 |

| including | 216.00 | 218.00 | 2.00 | 2.12 | 5 | 0.03 | 2.18 | 180 |

| HR23-391 | 159.00 | 167.50 | 8.50 | 0.12 | NSV | 0.12 | 10 | |

| and | 232.00 | 239.55 | 7.55 | 1.22 | 5 | 0.14 | 1.28 | 106 |

| including | 234.00 | 236.55 | 2.55 | 3.29 | 11 | 0.36 | 3.43 | 284 |

| and | 246.04 | 306.90 | 60.86 | 0.72 | 3 | 0.09 | 0.76 | 63 |

| including | 246.04 | 246.61 | 0.57 | 3.56 | 40 | 0.12 | 4.04 | 335 |

| including | 254.48 | 273.30 | 18.82 | 1.52 | 4 | 0.14 | 1.56 | 130 |

| including | 304.70 | 305.20 | 0.50 | 13.55 | 50 | 0.27 | 14.15 | 1173 |

| and | 324.00 | 346.20 | 22.20 | 0.26 | 0 | 0.02 | 0.27 | 22 |

| including | 331.80 | 332.30 | 0.50 | 3.96 | 5 | 0.84 | 4.03 | 334 |

| HR23-392 | 113.00 | 119.00 | 6.00 | 0.45 | 47 | 0.02 | 1.01 | 84 |

Table 3. Completed Drill Hole Assays from the Homestake Ridge Property Exploration

| Hole ID | From (m) | To (m) | Length (m)** | Au (g/t) | Ag (g/t) | Cu (%) | AuEq* | AgEq* |

| HR23-422 | 193.00 | 194.17 | 1.17 | 0.36 | 24 | 0.13 | 0.65 | 54 |

| HR23-424 | 10.00 | 17.00 | 7.00 | 0.27 | NSV | |||

| HR23-424 | 12.00 | 13.16 | 1.16 | 1.06 | 9 | 1.17 | 97 | |

| and | 23.25 | 23.75 | 0.50 | 5.72 | 22 | 0.40 | 5.98 | 496 |

| and | 95.20 | 95.70 | 0.50 | 0.54 | 20 | 0.79 | 65 | |

| and | 196.05 | 196.66 | 0.61 | 1.76 | 2 | 1.79 | 148 | |

| and | 199.35 | 199.85 | 0.50 | 1.97 | 3 | 2.00 | 166 | |

| and | 249.35 | 249.93 | 0.58 | 1.84 | 2 | 1.86 | 154 | |

| HR23-423 | 168.60 | 169.70 | 1.10 | 1.52 | 1 | 1.53 | 127 | |

| and | 246.75 | 247.75 | 1.00 | 0.78 | NSV | 0.78 | 65 | |

| HR23-420 | NSV | |||||||

| HR23-421 | 97.60 | 206.00 | 108.40 | 0.11 | NSV | 0.112 | 9 | |

| HR23-417 | 156.20 | 161.20 | 5.00 | 0.98 | NSV | 0.978 | 81 | |

| including | 158.20 | 159.20 | 1.00 | 2.09 | NSV | 2.09 | 173 |

*AuEq and AgEq are calculated using $US1650/oz Au, $US20/oz Ag.

**Estimated true widths vary depending on intersection angles and range from 50% to 90% of core lengths

***Determined using metallic screen fire assay on 1.0kg

Table 4. Drill Hole Collar Locations for 2023 Homestake Ridge drill holes in this release

| Hole ID | Easting UTM83 (m) | Northing UTM83 (m) | Elev. (m) | Azimuth | Dip | Length (m) |

| HR23-367 | 462840 | 6179693 | 952 | 211 | -58 | 351.00 |

| HR23-368 | 462840 | 6179693 | 952 | 202 | -68 | 402.00 |

| HR23-369 | 463071 | 6179531 | 927 | 237 | -55 | 414.00 |

| HR23-370 | 462840 | 6179693 | 952 | 226 | -56 | 324.90 |

| HR23-371 | 462771 | 6179849 | 1091 | 200 | -75 | 589.00 |

| HR23-372 | 463071 | 6179531 | 927 | 235 | -62 | 390.00 |

| HR23-373 | 462840 | 6179693 | 952 | 230 | -68 | 450.00 |

| HR23-374 | 463166 | 6179562 | 895 | 232 | -53 | 441.00 |

| HR23-375 | 462771 | 6179849 | 1091 | 200 | -62 | 582.00 |

| HR23-376 | 462897 | 6179729 | 964 | 140 | -65 | 609.00 |

| HR23-377 | 463166 | 6179562 | 895 | 232 | -71 | 552.00 |

| HR23-378 | 462771 | 6179849 | 1091 | 200 | -73 | 609.00 |

| HR23-379 | 463015 | 6179634 | 918 | 210 | -59 | 450.00 |

| HR23-380 | 463132 | 6179539 | 914 | 221 | -70 | 501.00 |

| HR23-381 | 462794 | 6179271 | 1116 | 106 | -45 | 402.00 |

| HR23-382 | 463075 | 6179672 | 902 | 212 | -55 | 450.00 |

| HR23-383 | 463129 | 6179330 | 986 | 220 | -53 | 285.00 |

| HR23-384 | 463132 | 6179539 | 914 | 205 | -66 | 501.00 |

| HR23-385 | 462897 | 6179729 | 964 | 240 | -74 | 600.00 |

| HR23-386 | 463120 | 6179391 | 969 | 223 | -57 | 300.00 |

| HR23-387 | 463120 | 6179391 | 969 | 231 | -52 | 306.00 |

| HR23-388 | 463133 | 6179500 | 925 | 223 | -47 | 399.00 |

| HR23-390 | 463120 | 6179391 | 969 | 205 | -62 | 354.00 |

| HR23-391 | 463133 | 6179500 | 925 | 218 | -61 | 439.00 |

| HR23-392 | 462794 | 6179271 | 1116 | 116 | -45 | 354.00 |

| HR23-389 | 463590 | 6179193 | 825 | 228 | -46 | 603.00 |

| HR23-394 | 463590 | 6179193 | 825 | 228 | -53 | 654.00 |

| HR23-399 | 463590 | 6179193 | 825 | 232 | -48 | 621.00 |

| HR23-410 | 463560 | 6179124 | 834 | 220 | -50 | 600.00 |

| HR23-417exp | 463182 | 6178630 | 1070 | 240 | -50 | 283.00 |

| HR23-420exp | 463482 | 6178246 | 1014 | 240 | -50 | 279.00 |

| HR23-421exp | 463295 | 6177829 | 1200 | 282 | -46 | 222.00 |

| HR23-422exp | 463305 | 6177143 | 1117 | 166 | -46 | 261.00 |

| HR23-423exp | 463713 | 6176389 | 1038 | 315 | -50 | 255.00 |

| HR23-424exp | 463318 | 6178059 | 1169 | 230 | -46 | 327.00 |

Dolly Varden Exploration Drilling

Result for twelve drill holes competed at the end of the 2023 season on the Dolly Varden property come from three main areas: Red Point, North Star and Wolf (Figure 6).

Red Point Drilling

Three holes were drilled in the Red Point area, located at the southern end of the western gold belt, approximately 10 kilometers southeast along the trend from the Homestake Ridge deposits. Styles of mineralization encountered including varying degrees of quartz and quartz-carbonate veining in a QSP alteration halo, similar to what is seen at the Homestake Ridge deposits. Highlights from the 2023 exploration drilling include: (intervals shown are core length**)

- HR23-360: 1.92 g/t Au over 13.10 meters including 7.25 g/t Au and 1.12% Cu over 2.30 meters near surface all within a broad mineralized halo grading 0.44 g/t Au over 120.62 meters.

**Estimated true widths vary depending on intersection angles and range from 70% to 90% of core lengths.

North Star Drilling

Two drill holes intersected the stratabound mineralization of the North Star deposit, part of the Torbrit Horizon, approximately 50 meters down dip from historic underground drilling in the 1960s. The surface drill holes collars were moved further back to intercept the horizon at a better angle and test for continuity. The North Star deposit has higher lead (Pb) and zinc (Zn) values than the Torbrit deposit located across the Kitsault Valley. The Current Mineral Resource Estimate for North Star does not include any credits for the significant base metals in the mineralized horizon.

Highlights from North Star Area include: (intervals shown are core length**)

- HR23-358: west step out, entire horizon: 199 g/t Ag with 1.28% Pb and 1.21% Zn (292 g/t AgEq) over 18.10 meters including 1,510 g/t Ag, 1.23% Pb and 5.34% Zn (1,755 g/t AgEq) over 0.58 meters and 753 g/t Ag, 0.51 g/t Au, 15.20% Pb and 4.32% Zn (1,430 g/t AgEq) over 1.00 meters.

**Estimated true widths vary depending on intersection angles and range from 80% to 95% of core lengths.

The North Star deposit (along the Torbrit Horizon) remains open to the west down dip along the Torbrit Horizon for follow up in the 2024 drill program.

Wolf Drilling

The five drill holes reported in this release for Wolf were part of an end of season follow up to test below the plunge of the wide, higher-grade zone. The Wolf structure was intersected with low silver grades and increased lead and zinc values, typical of below and outside of the plunge of high-grade silver zone (Figure 8).

Figure 6. Drill hole location map for Dolly Varden Property holes reported in this release.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_007full.jpg

Figure 7. Wolf Long Section with 2023 drill holes in this release highlighted in white. The 2023 result highlights shown from step-outs along the wide, high-grade plunge are from previous releases (Sept 11th and Nov 06th, 2023).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1728/197571_d1b03db9d4f00b27_008full.jpg

Table 5. Completed Drill Hole Assays from the Dolly Varden Property Exploration Drilling in this release.

| Hole ID | From (m) | To (m) | Length (m)** | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | AgEq (g/t) |

| DV23-353 North Star | 251.05 | 254.50 | 3.45 | 138 | 0.07 | 3.50 | 7.69 | 543 |

| including | 252.50 | 254.50 | 2.00 | 211 | 0.10 | 5.74 | 9.82 | 769 |

| and | 266.45 | 267.10 | 0.65 | 426 | 0.39 | 0.59 | 0.24 | 485 |

| and | 291.50 | 292.50 | 1.00 | 219 | 0.47 | 0.05 | 1.29 | 308 |

| DV23-358 North Star | 278.96 | 280.80 | 1.84 | 52 | 0.03 | 0.80 | 11.10 | 500 |

| and | 293.32 | 311.42 | 18.10 | 199 | 0.08 | 1.28 | 1.21 | 292 |

| including | 293.32 | 300.75 | 7.43 | 345 | 5.92 | 2.75 | 1.6 | 491 |

| including | 293.32 | 293.90 | 0.58 | 1510 | 0.06 | 1.23 | 5.34 | 1755 |

| including | 296.00 | 297.00 | 1.00 | 753 | 0.51 | 15.20 | 4.32 | 1430 |

| DV23-360 Red Point | 1.85 | 122.47 | 120.62 | 3 | 0.44 | 0.02 | 0.05 | 42 |

| including | 34.90 | 48.00 | 13.10 | 6 | 1.92 | 0.03 | 0.08 | 169 |

| including | 44.00 | 46.30 | 2.30 | 15 | 7.25 | 0.03 | 0.07 | 619 |

| DV23-363 Red Point | 29.00 | 109.00 | 80.00 | NSV | 0.38 | |||

| including | 51.00 | 54.10 | 3.10 | 12 | 3.45 | 298 | ||

| DV23-384 Red Point | 724.20 | 783.00 | 58.80 | 1 | 0.28 | 0.01 | 0.03 | 26 |

| including | 737.50 | 761.81 | 24.31 | 1 | 0.45 | 0.00 | 0.02 | 39 |

| DV23-377 Surprise | NSV | |||||||

| DV23-378 Surprise | NSV | |||||||

| DV23-380 Wolf | 575.60 | 584.28 | 8.68 | 2 | NSV | 0.12 | 0.55 | 26 |

| DV23-381 Wolf | 593.13 | 594.10 | 0.97 | 115 | 0.03 | 1.60 | 1.73 | 233 |

| and | 669.20 | 670.20 | 1.00 | 184 | 0.04 | 0.52 | 2.44 | 295 |

| and | 671.92 | 673.90 | 1.98 | 215 | 0.01 | 0.23 | 3.17 | 343 |

| and | 675.40 | 676.40 | 1.00 | 138 | 0.03 | 15.04 | 3.12 | 725 |

| DV23-382 Wolf | 549.83 | 570.70 | 20.87 | 39 | 0.18 | 1.25 | 0.70 | 119 |

| including | 551.00 | 552.30 | 1.30 | 250 | 0.28 | 15.38 | 3.80 | 895 |

| DV23-383 Wolf | 274.00 | 276.72 | 2.72 | 6 | 0.03 | 0.06 | 1.14 | 53 |

| DV23-385 Wolf | 369.02 | 384.62 | 15.60 | 21 | 0.05 | 0.77 | 0.61 | 72 |

| including | 372.10 | 372.92 | 0.82 | 131 | 0.28 | 0.34 | 0.55 | 185 |

*AgEq is calculated using $US20/oz Ag, $US0.90/lb Pb and $US1.10/lb Zn

**Estimated true widths vary depending on intersection angles and range from 70% to 95% of core lengths

Table 6. Drill Hole Collar Locations for 2023 Dolly Varden Property drill holes in this release.

| Hole ID | Easting UTM83 (m) | Northing UTM83 (m) | Elev. (m) | Azimuth | Dip | Length (m) |

| DV23-353 North Star | 467575 | 6171329 | 533 | 115 | -60 | 431.00 |

| DV23-358 North Star | 467575 | 6171329 | 533 | 155 | -58 | 413.00 |

| DV23-360 Red Point | 467026 | 6172064 | 618 | 205 | -50 | 384.00 |

| DV23-363 Red Point | 466782 | 6172288 | 707 | 220 | -63 | 378.00 |

| DV23-384 Red Point | 466500 | 6171968 | 759 | 260 | -60 | 912.00 |

| DV23-377 Surprise | 466815 | 6173693 | 446 | 232 | -46 | 300.00 |

| DV23-378 Surprise | 466815 | 6173693 | 446 | 340 | -60 | 618.00 |

| DV23-380 Wolf | 467013 | 6173643 | 383 | 140 | -71 | 803.00 |

| DV23-381 Wolf | 467013 | 6173643 | 383 | 140 | -74 | 824.00 |

| DV23-382 Wolf | 467013 | 6173643 | 383 | 142 | -65 | 648.00 |

| DV23-383 Wolf | 467265 | 6172994 | 372 | 305 | -55 | 762.00 |

| DV23-385 Wolf | 467127 | 6173757 | 364 | 138 | -57 | 498.00 |

Quality Assurance and Quality Control

The Company adheres to CIM Best Practices Guidelines for exploration related activities conducted on its property. Quality Assurance and Quality Control (QA/QC) procedures are overseen by the Qualified Person.

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed to 70% minus 2mm (10 mesh), of which a 500 gram split is pulverized to minus 200 mesh. Multi-element analyses were determined by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) for 48 elements following a 4-acid digestion process. High grade silver testing was determined by Fire Assay with either an atomic absorption, or a gravimetric finish, depending on grade range. Gold is determined by Fire Assay on a 30g split with and AA finish and over limits determined by Fire Assay with a gravimetric finish. Metallic screen fire assay analysis on 1kg sample +106umis carried out when determined to be necessary on higher grade samples.

Qualified Person

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Forward-Looking Statements

This release may contain forward-looking statements or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “potential”, and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Dolly Varden to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward-looking statements or information in this release relates to, among other things, the 2022 drill program at the Kitsault Valley Project, the results of previous field work and programs and the continued operations of the current exploration program, interpretation of the nature of the mineralization at the project and that that the mineralization on the project is similar to Eskay and Brucejack, results of the mineral resource estimate on the project, the potential to grow the project, the potential to expand the mineralization and our beliefs about the unexplored portion of the property.

These forward-looking statements are based on management’s current expectations and beliefs and assume, among other things, the ability of the Company to successfully pursue its current development plans, that future sources of funding will be available to the company, that relevant commodity prices will remain at levels that are economically viable for the Company and that the Company will receive relevant permits in a timely manner in order to enable its operations, but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward-looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

For additional information on risks and uncertainties, see the Company’s most recently filed annual management discussion & analysis (“MD&A“) and management information circular dated January 21, 2022 (the “Circular“), both of which are available on SEDAR at www.sedar.com. The risk factors identified in the MD&A and the Circular are not intended to represent a complete list of factors that could affect the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

For further information: Shawn Khunkhun, CEO & Director, 1-604-609-5137, www.dollyvardensilver.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/197571