Vancouver, British Columbia–(Newsfile Corp. – September 24, 2025) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) (“Riverside” or the “Company”) is pleased to announce that drilling at the Union Project in Sonora, Mexico, is progressing on track and on budget, with three of the five main targets now having some initial drilling and work continuing toward completion of the current program. This update follows the Company’s July 7, 2025 announcement outlining preparations for drilling and the August 6, 2025 news release marking the start of the program.

Powered by Money.com – Yahoo may earn commission from the links above.

“We are pleased to see the Union Project drill program advancing on schedule and on budget, with key targets now being tested,” commented John-Mark Staude, President and CEO of Riverside Resources. “The geological information we’re gathering, the mineralization indicators, particularly the structural and stratigraphic details, is already refining our exploration model and setting us up for the next stages as the program moves ahead. We look forward to drilling the high-potential Famosa target and to receiving the assay results from the work completed so far as the Riverside team operates working with the drill company.”

The first hole at the Union Mine target was drilled southeast beneath historic workings, cutting through the Clemente and Caborca formations, both key host units for past mining at Union as described in the NI 43-101 report on SEDAR+ filed on May 7, 2025, by Questcorp Mining (QQQ). The hole ended in the Caborca Formation, encountering the distinctive microconglomeratic carbonate unit that historically hosted mineralization at the bottom of the Union Mine. Samples from this hole have been delivered to Bureau Veritas in Hermosillo, Sonora, for gold fire assay, with pulps to be sent to Vancouver, Canada, for ICP-MS analysis with 4-acid digestion to determine silver, base metal, and multi-element values. This consistent analytical approach has been applied since the outset of the Union program to ensure comparability across results.

Drilling then moved to the northern part of the project, testing two target areas: the El Cobre Mine area and the North Union Mine area. Here, holes were oriented perpendicular to stratigraphy and toward interpreted feeder zones along pre-mineral fault structures, primarily within the Clemente Formation. Drilling in these areas has intersected more quartzite than initially modeled, with extensive hematitic oxides, an encouraging sign for potential gold mineralization, possibly linked to sulfides that have been oxidized through supergene weathering. Historic mining in the district targeted oxides only, leaving sulfide zones untested. Riverside plans to evaluate this potential beneath past workings across four target areas: Union Mine, El Cobre, North Union, and Famosa.

The program has now moved south to the Famosa target, where two initial holes are planned to test beneath and along strike from historic workings toward a steeply west-dipping, north-south-trending fault structure, as well as into host rocks on either side of this major structural feature. Famosa produced gold historically, with reported grades exceeding ½ oz/ton Au in archived records referenced in the NI 43-101 report. The Company is encouraged by the target’s potential and is eager to advance drilling here.

Once this initial campaign is completed, follow-up work will integrate assay results, ongoing surface programs, additional induced polarization (IP) surveys, and refined geological interpretations based on stratigraphy and structure observed in drilling. The greater-than-expected quartzite content in the Clemente Formation supports the evolving model of fracture- and quartz-pyrite veinlet-hosted gold mineralization, which will help sharpen targeting at the Union Project. Core from all drilling has been logged, saw-cut, and half-core samples sent for assay, with remaining halves retained for reference and cataloging.

The Company looks forward to completing the Famosa drilling, receiving the pending assay results, and providing further updates as this program progresses.

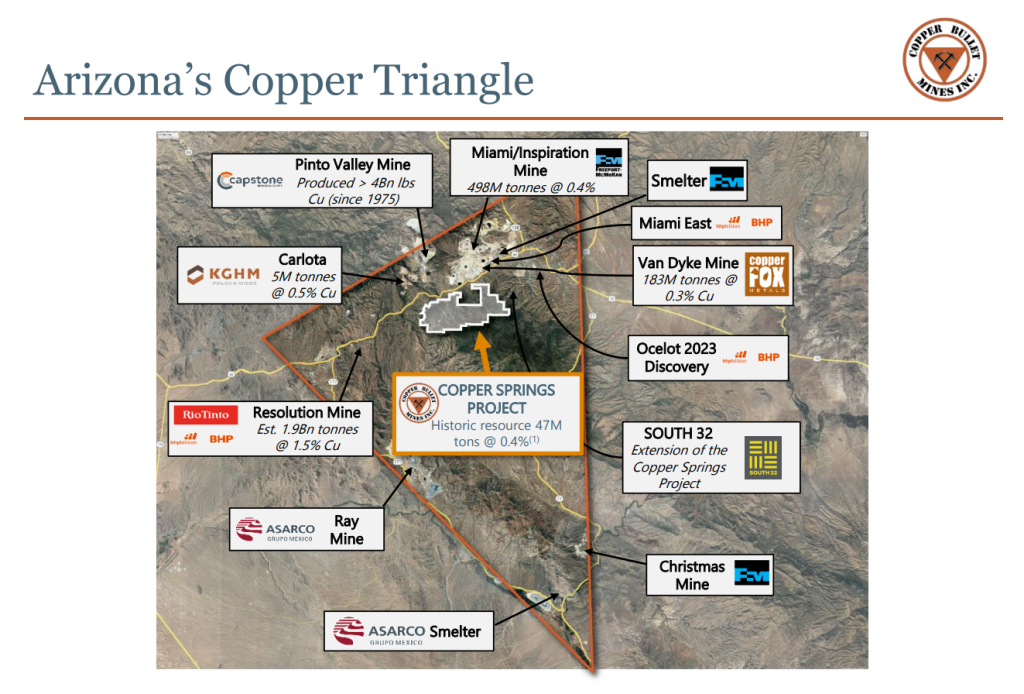

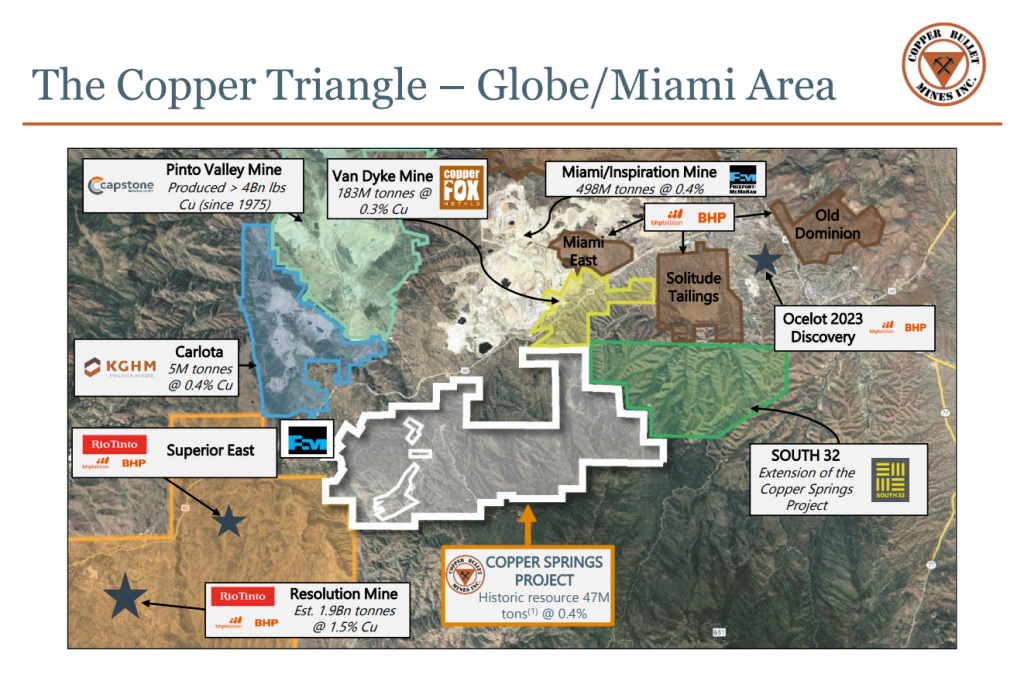

Figure 1. Geologic map with the tenure of the Union internal concession shown in pink. Manto and chimney type CRD targets are shown as red polygons. Riverside now controls all mineral tenures on this map. The drill program will focus on the Union Mine and areas north of the Union Mine with the initial drill work.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/267702_3d2170133406b9a6_002full.jpg

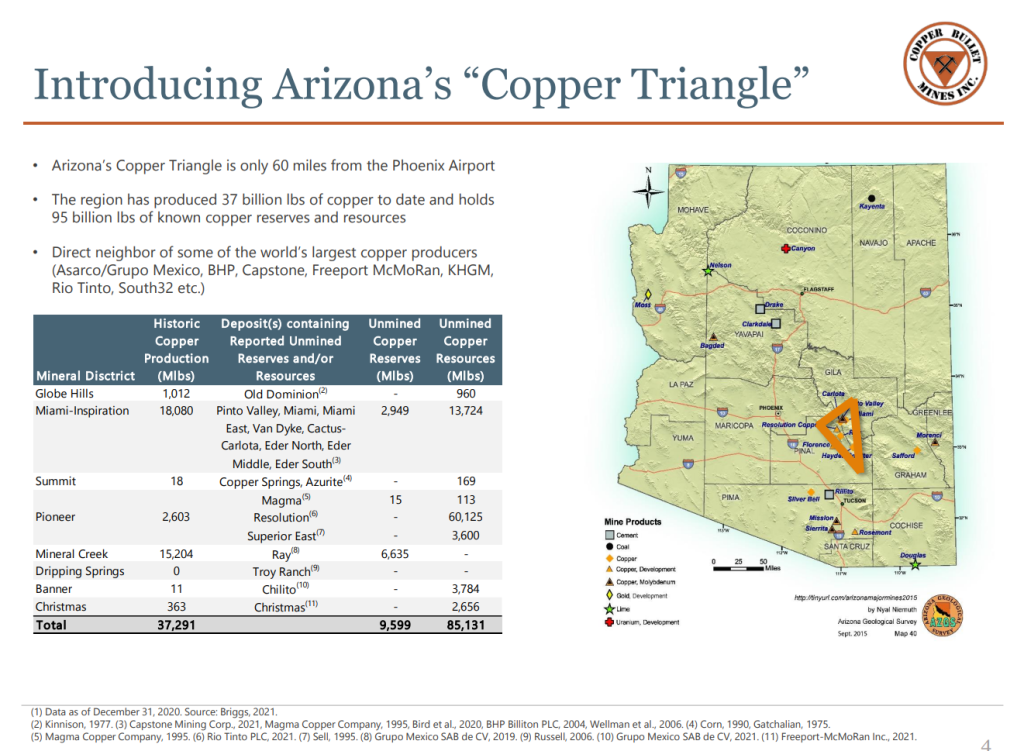

Figure 2. Cross section looking west with conceptual drill targets and schematic drillhole traces. Assays from Riverside’s sampling of rock dump materials from the two mine areas are labeled in black. Red areas are interpreted as manto and chimney target bodies that are now well defined and drill ready. Assays shown on figures 1 and 2 have been previously released and disclosed as summarized below the geochemical QA/QC and in published NI 43-101 Report that Questcorp published 2025 on Sedar+.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/267702_3d2170133406b9a6_003full.jpg

Qualified Person & QA/QC:

The scientific and technical data contained in this news release pertaining to the Project was reviewed and approved by Freeman Smith, P.Geo, a non-independent qualified person to Riverside Resources Inc., who is responsible for ensuring that the information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Rock samples from previous exploration programs discussed above at the Project were taken to the Bureau Veritas Laboratories in Hermosillo, Mexico for fire assaying for gold. The rejects remained with Bureau Veritas in Mexico while the pulps were transported to Bureau Veritas laboratory in Vancouver, BC, Canada for 45 element ICP/ES-MS analysis using 4-acid digestion methods. A QA/QC program was implemented as part of the sampling procedures for the exploration program. Standards were randomly inserted into the sample stream prior to being sent to the laboratory.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has a solid balance sheet with no debt and less than 75M shares outstanding with a strong portfolio of gold-silver and copper assets and royalties in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. Riverside has properties available for option, with information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information, contact:

| John-Mark Staude President, CEO Riverside Resources Inc. info@rivres.com Phone: (778) 327-6671 Fax: (778) 327-6675 Web: www.rivres.com | Eric Negraeff Corporate Communications Riverside Resources Inc. Eric@rivres.com Phone: (778) 327-6671 TF: (877) RIV-RES1 Web: www.rivres.com |

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the risk that the Transaction will not be completed as contemplates, or at all, availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267702