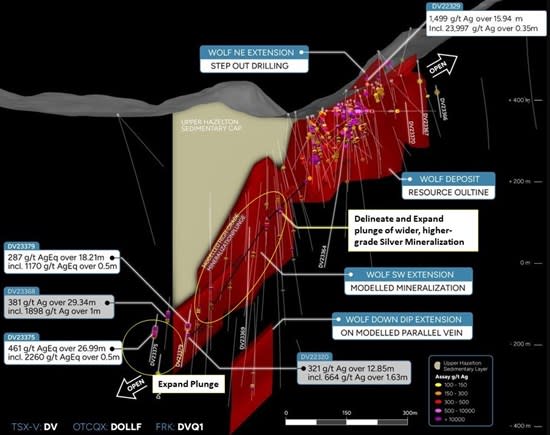

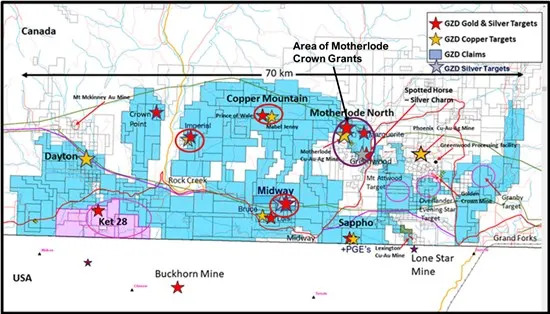

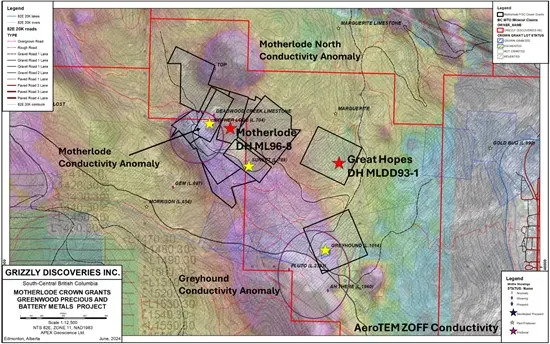

Edmonton, Alberta–(Newsfile Corp. – June 25, 2024) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to provide some highlights of historical information on the Motherlode Crown Grants for which the Company entered a purchase agreement with First Majestic Silver Corp on June 12, 2024, host to the historical Motherlode, Sunset, Sunrise and Greyhound mines that, at various times during the early and middle 1900’s, produced copper (Cu), gold (Au) and silver (Ag) from both open pit and underground workings (Figures 1 & 2). The Motherlode Crown Grants comprise 13 Crown Grants for a total of 300 acres (121.4 ha) that all retain the subsurface mineral rights and date back to the late 1800’s when they were granted. The Crown Grants take precedence over normal mineral titles mineral claims. The Crown Grants cover a number of historical mines, including the Motherlode that produced 76,975,111 pounds of Cu, 173,319 ounces (oz) of Au and 688,203 oz of Ag during the active periods of mining from 1900 to 1920 and from 1957 to 1962. The Motherlode skarn mineralization is developed in Triassic Brooklyn Formation sediments (BC Minfile 082ESE034). The Motherlode Mine is road accessible approximately 2.5 km northwest of the town of Greenwood (Figure 1).

Highlights

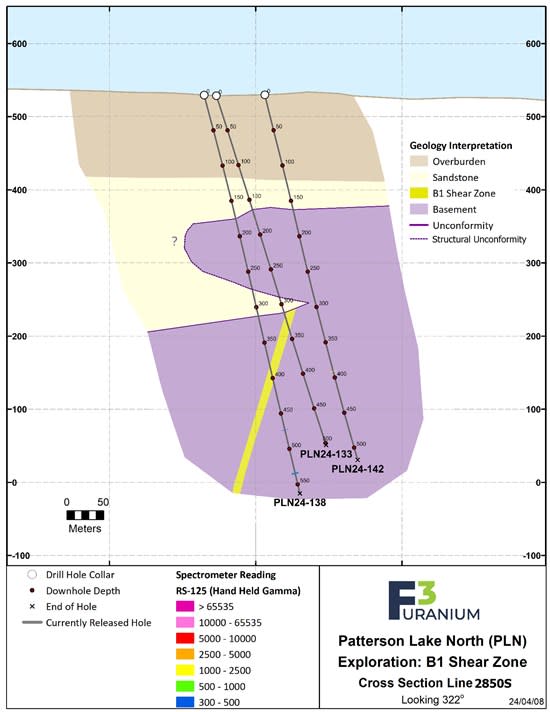

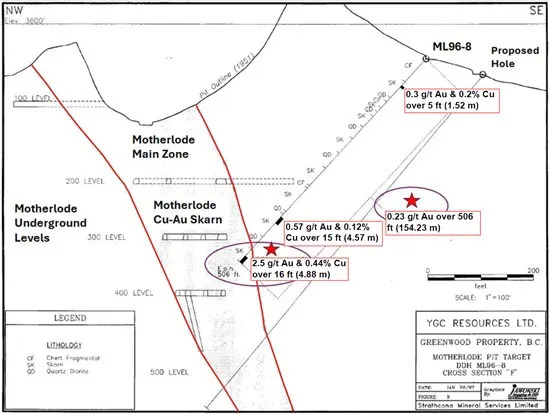

- Drilling in 1996 by Strathcona Mineral Services on behalf of YGC Resources intersected several zones of Cu-Au mineralization targeting the gold bearing halo to the Motherlode Skarn along the east side of the pit in the vicinity of the historical underground workings (Figures 2 and 3).

- Drillhole 96-8 encountered gold in almost every sample including a weighted average grade of 0.23 grams per tonne (g/t) Au over the entire 154.23 m (506 ft) length drillhole with a number of higher grade zones in proper skarn towards the bottom of the hole (Figure 3).

- The Main Motherlode skarn was intersected at the bottom of the drillhole and returned 2.5 g/t (0.073 oz per ton [opt]) over 4.88 m (16 ft) at the end of the drillhole from skarnified Brooklyn limestone, that is associated with a strong AeroTEM conductivity anomaly (Figure 2).

- The drillhole collared in Brooklyn Sharpstone conglomerate and drilled through alternating skarn an altered diorites along the length of the drillhole, with the main zone at the end of the hole characterized by increased quartz-carbonate-chalcopyrite veining and volumetric chalcopyrite.

- The hole was ended due to technical difficulties. Strathcona Mineral Services recommended follow-up drilling which has never been completed.

- A drillhole completed on the Great Hopes Crown Grant in 1993 by Orvana Minerals intersected 3.30 g/t (0.096 opt) Au over 25 ft (7.62 m) near surface in faulted sediments beside the Greyhound fault zone with a core zone of 6.69 g/t (0.195 opt) Au over 10 ft (3.05 m) (Figure 2).

- Follow-up drilling in 1996 was focused on IP chargeability anomalies and struggled with core recovery in the fault zone – so the zone intersected has not been properly follow-up tested.

Brian Testo, President and CEO of Grizzly Discoveries, stated, “We are excited to complete the acquisition of the historical Motherlode Crown Grants and the targets that they provide. We look forward to aggressive 2024 drilling at the Motherlode area and other high grade Au-Ag-Cu showings and historical mines along with additional exploration for battery metals in our current 170,000+ acre holdings in the Greenwood District.“

Figure 1: Land position and targets of interest for future exploration, Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/214278_973f5d9534c88b70_002full.jpg

Figure 2: Motherlode Crown Grants, Historical Drilling and AeroTEM Survey Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/214278_973f5d9534c88b70_003full.jpg

Figure 3: Motherlode Historical Drillhole ML96-8 Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/214278_973f5d9534c88b70_004full.jpg

Summary of the Motherlode Crown Grant Purchase Terms

- The Company will cover all costs related to the transfer of the Crown Grants from First Majestic to the Company.

- As consideration, Grizzly will issue First Majestic 250,000 common shares of the Company (the “Compensation Shares”) upon closing of the transaction.

- At closing, the Company will grant a 1% Net Smelter Return (NSR) Royalty on the Crown Grants to First Majestic and retains an option to purchase the NSR Royalty for $250,000 at any time.

The issuance of the Compensation Shares is subject to the acceptance of the TSX Venture Exchange.

The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Michael B. Dufresne, M. Sc., P. Geol., P.Geo., who is a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT GRIZZLY DISCOVERIES INC.

Grizzly is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange focused on developing its approximately 72,700 ha (approximately 180,000 acres) of precious and base metals properties in southeastern British Columbia. Grizzly is run by a highly experienced junior resource sector management team, who have a track record of advancing exploration projects from early exploration stage through to feasibility stage.

On behalf of the Board,

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

Suite 363-9768 170 Street NW

Edmonton, Alberta T5T 5L4

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Nancy Massicotte

Corporate Development

Tel: 604-507-3377

Email: nancy@grizzlydiscoveries.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as “may,” “will,” “should,” “anticipate,” “plan,” “expect,” “believe,” “estimate,” “intend” and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly’s actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management’s Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available under the Company’s SEDAR+ profile at www.sedarplus.ca. Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/214278

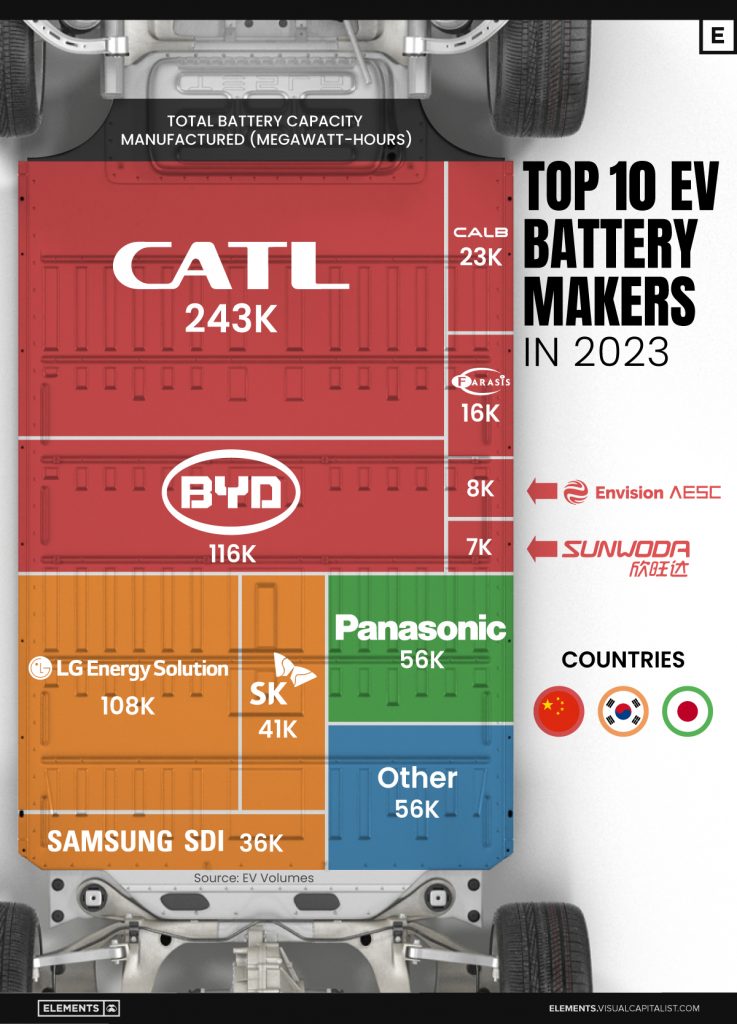

China

China Korea

Korea Japan

Japan