Category: Exclusive Interviews

You are about to discover the best video on how to buy precious metals.

Please share this interview: https://provenandprobable.com/how-the-1-invest-in-precious-metals/

In this interview, I share the 3 groups of precious metals investors, their habits, and results. 1 of the 3 groups has results that are unmatched compared to the other 2. This is an absolute must watch before you invest in precious metals. Is silver investment the best move for you? Which type of precious metals investor are you?

Concerned about the effects of inflation? Want to learn about some of the biggest silver stacking mistakes? Are you interested in owning gold, silver, platinum, palladium, and or rhodium; and how to spot a buying opportunity and sell precious metals like the pro’s? At Miles Franklin we offer all of the above physical delivery directly to you, along with Precious Metals IRA’s, storage with BRINKS. To place an order: 855.505.1900 or email: maurice@milesfranklin.com

Contact me:

Maurice Jackson

855.505.1900

Maurice@MilesFranklin.com

Proven and Probable

Where we deliver Mining Insights & Bullion Sales. I’m a licensed broker for Miles Franklin Precious Metals Investments under our President Andy Schectman. Where we provide unlimited options to expand your precious metals portfolio, from physical deliver, offshore depositories, precious metals IRA’s, and private blockchain distributed ledger technology. Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com.

https://soundcloud.com/proven-and-probable/andrew-hecht-copper-fundamentals-and-stock-pick

Nevada Copper As We Head Into 2022

- Copper reached a new high in 2021

- Higher highs are on the horizon in 2022 for three critical reasons

- A favorable jurisdiction in Nevada- Momentum build and the value proposition is improving

- Two groups in the know have made significant investments

- The shares continue to offer value, risk-reward favors the upside for Nevada Copper

The leading stock market indices have been bumpy over the past weeks. The prospects for higher interest rates and taxes in 2022, new COVID-19 variants, inflation at the highest level in decades, and other factors have created uncertainty, which tends to cause indigestion in the stock market. However, many leading stocks remain near or at record highs.

Copper is a bellwether commodity that many market participants look to for clues about the health and wellbeing of the global economy. Copper’s nickname is Dr. Copper because it tends to move higher during economic expansion and lower when the global economy contracts. In May 2021, copper rose to its highest price in history when nearby COMEX futures rose to just shy of $4.90 per pound, and LME forwards moved to over $10,700 per ton for the first time. Over the past year, copper has taken on a new role, increasing the demand side of its fundamental equation. The red nonferrous metal is a critical requirement for decarbonization, leading Goldman Sachs to call copper “the new oil.”

In the world of commodities, higher prices and growing demand lead to more production. However, the global copper market faces a challenge as it will take years for new supplies to come to market, creating deficits that push the price higher. While copper corrected since the May high, the price remained around $4.40 per pound level as of December 24.

Locating value in the US stock market is not easy these days. Nevada Copper Corp. (NEVDF) is a promising emerging US producer. Two seasoned commodity groups recently invested in NEVDF, seeing tremendous value in the burgeoning producer.

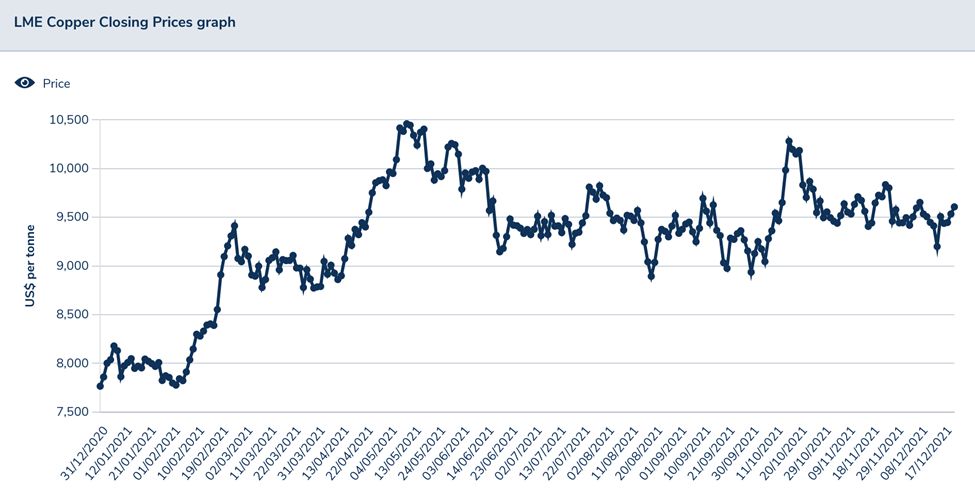

Copper reached a new high in 2021 Copper closed 2020 at the $3.52 per pound level on the nearby COMEX futures contract and $7,757 per ton on the three-month LME forwards.

Source: CQG

The chart highlights COMEX copper futures move to a high of $4.8985 in May. With the active month March contract at the $4.40 level on December 24, the price moved 25% higher in 2021 with only one week until 2022.

Source: LME

Three-month copper forwards rose to a high of $10,724.50 in 2021 and was at the $9,568 level on December 24, 23.35% higher than at the end of 2020.

While copper is closing 2021 below the year’s high, the trend remains bullish with impressive gains since the end of last year.

Higher highs are on the horizon in 2022 for three critical reasons

Three reasons support higher highs and new all-time peaks in the copper market in 2022 and beyond:

- Copper is critical for electric vehicles (EVs), wind turbines, and other clean energy initiatives. The red metal is a crucial ingredient for decarbonization, making the fundamental equation’s demand-side grow.

- It takes eight to ten years to bring new copper production online from exploration to output. Copper is still in the early phases of expanding global production, with the leading mining companies scrambling to find new ore deposits. As demand increases, supplies will struggle to keep pace over the coming years.

- Inflationary pressures will continue to rise, putting upward pressure on all commodities, and copper is no exception. At the latest December FOMC meeting, the US central bank forecast a 0.90% Fed funds rate for 2022 and a 1.60% rate for 2023. Even if inflationary pressures recede, real interest rates are likely to remain negative, which is bullish for raw material prices in the coming years.

Copper faces an almost perfect bullish storm for the coming years. Goldman Sachs’s forecast of $15,000 per ton by 2025 would put nearly COMEX futures over the $6.80 per pound level. While higher prices will encourage more production, existing mines cannot keep pace with the rising demand.

Chile is the world’s leading copper producer. The recent election of Gabriel Boric, a 35-year-old former student activist who carries a new generation’s socialist dreams to the presidential palace, threatens Chile’s capitalist economy fueled by copper output. Taxes are likely to rise along with wages and addressing climate change could cause a new wave of regulations that weigh on copper output over the coming years. Moreover, the new Chilean government could move to nationalize copper mines, which would impact output and efficiency. The bottom line is that a supply-demand deficit in the global copper market is likely to widen over the coming years, putting upward pressure on the red nonferrous metal’s price.

A favorable jurisdiction in Nevada- Momentum build and the value proposition is improving

The world’s leading copper producers are searching the globe for new reserves and output. Australian mining giant BHP recently said it is considering a challenging Democratic Republic of Congo copper project. The DRC is notorious for political and regulatory issues.

Meanwhile, the US remains a friendly mining environment, and Nevada is a state that supports the industry and is mineral-rich.

Nevada Copper (NEVDF) is an emerging producer with a lot going for it these days. The company mines copper in Nevada in the USA, and the Canadian Fraser Institute ranks the state as the world’s #1 mining jurisdiction. In 2021, momentum has been building for NEVDF:

- Underground mine operation improvements have resulted in 100% growth in development rates.

- New equipment in the second half of 2021 has accelerated development.

- An operational efficiency plan took effect in the second half of 2021 and is forecasted to increase output in H1, 2022.

To put more meat on the bone, in a December 21 press release, the company provided updates on its Pumpkin Hollow underground mine project:

- Nevada Copper is on track to advance over 1,100 lateral equivalent feet of development in December 2021.

- Development is running at the highest rate for 2021, with December nearly 50% higher than November and almost 100% above the level in August 2021.

- New equipment should enhance further development and growth in January 2022.

- Ventilation fan infrastructure should be completed in Q1 2022.

- Mining of the Sugar Cube, the first high-grade area in the East North Zone of the underground mine, is on schedule for Q1 2022.

In December, CEO Randy Buffington said, “We are on track to complete 1,100 feet of lateral development this month, which puts the Company in a position to mine the first stope of high-grade Sugar Cube as planned next month.”

Accelerated development increases NEVDF’s value proposition:

- The current enterprise value is less than the value of the company’s machinery and equipment.

- NPV at current prices is close to the US $3 billion level.

- The company will be cash-flow positive in 2022.

- Open-pit mining development will accelerate in 2022.

The company’s prospects are compelling, leading two influential groups to invest in NEVDF.

Two groups in the know have made significant investments

Solway Investment Group is a private international mining and metals group with headquarters in Switzerland. Solway specializes in nickel production with mines and smelting plants in Guatemala, Ukraine, Russia, Indonesia, and Macedonia. The group has over 5,000 employees, is expanding its focus in battery metals, and recently invested US$30 million for a 10% stake in Nevada Copper.

Mercuria Energy Group Ltd. is a multinational commodity trading company active in global energy, metals, and agricultural markets. The company dates back to 2004 when two ex-Phibro executives, Marco Dunard and Daniel Jaeggi departed after Citigroup sold Phibro to Occidental Petroleum. The company recently closed an oversubscribed $2.2 billion multi-year secured borrowing base credit facility with a collection of international financial institutions. Mercuria is one of the world’s leading and growing commodities trading companies, with core exposure in energy. Mercuria’s goal is a 50% portfolio in renewable energy over the coming five years and invested US$30 million for a 10% stake in Nevada Copper.

Solway and Mercuria are top organizations in the international commodities business, with tentacles reaching across the globe. Both companies put their capital up as they see the compelling potential for Nevada Copper’s properties and business plan.

The shares continue to offer value, risk-reward favors the upside for Nevada Copper

Nevada Copper shares remain inexpensive at the end of December 2021. Aside from the Solway and Mercuria investments, insider buying is another bullish sign for the company. After a recent blackout period, CEO Randy Buffington purchased 200,000 shares, and the company’s directors have been buyers of the shares. Nevada Copper shares (NEVDF) peaked at $2.40 value in May when copper prices reached the high at nearly $4.90 per pound. Copper closed around the $4.40 level on December 23, and NEVDF shares having fallen dramatically in early December hitting yearly lows, could be a golden opportunity for investors that see the same potential as Solway and Mercuria.

Source: Barchart

The chart shows that NEVDF shares corrected to a low of 38.78 cents on October 1 as nearby copper futures moved to test the $4 per pound level. At 53.0 cents per share on December 23, Nevada Copper had a $236.328 million market cap.

Development companies are risky businesses as their future depends on delivering from their mines. The backing of two well-established commodities trading and investment companies, insider buying, and accelerated progress are positive signs for the company as we head into 2022.

New copper production is scarce, and mining companies are scouring the globe for new reserves. Nevada copper’s location, proven and probable reserves, management, progress, and investors bode well for the company’s future. Further progress could transform NEVDF from an emerging producer to a takeover candidate or established producer as the world’s leading miners are hungry for output. Risk is always a function of reward with any investment. At 53.0 cents per share, NEVDF’s potential compensates for the risk.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

TORONTO, Dec. 29, 2021 (GLOBE NEWSWIRE) — Labrador Gold Corp. (TSX.V:LAB | OTCQX:NKOSF | FNR: 2N6) (“LabGold” or the “Company”) is pleased to review its 2021 exploration success along the Appleton Fault Zone and to give an update on plans for 2022 at its 100% controlled Kingsway project near Gander, Newfoundland. The Kingsway project is located in the highly prospective central Newfoundland gold belt.

Drilling

In early April, 2021 LabGold began a 10,000-metre diamond drilling program began at Kingsway, testing the Big Vein target where visible gold in quartz vein boulders was found in late 2020. The drilling program was increased to 50,000 metres in June following completion of two private placements.

Between the start of drilling in April and the break for the festive season in December, a total of 26,767 metres were drilled in 116 holes primarily at Big Vein. Drilling at the new “Pristine” target began in November and nine holes totalling 2,229 metres have been drilled to date. Assays have been received for 56% of samples submitted to the laboratory or approximately 15,000 metres of core.

Highlights from the drilling program include high grade intersections of 276.56 g/t Au over 0.5m in hole K-21-31 and 75.86 g/t Au over 1m in hole K-21-49 from the Big Vein zone and 44.08 g/t Au over 4.28m in hole K-21-39, and 128.51 over 1.12g/t Au in hole K-21-47 from the HTC Zone.

Regional Exploration

LabGold continued its systematic exploration along the Appleton Fault Zone during 2021, using prospecting, mapping, geophysics, soil and till sampling to great effect with two significant results.

Prospecting following up coincident structures and geochemical anomalies led to the discovery of the Golden Glove occurrence on the east side of the Appleton Fault Zone approximately 3.4km southwest of Big Vein. The occurrence consists of an outcrop of quartz vein containing visible gold that assayed from 2.99 g/t Au to 338.08 g/t Au. Soil sampling, ground magnetics and VLF-EM have been carried out in the Golden Glove area to assist in drill targeting with results expected early in the new year.

Two till samples taken approximately 700 metres northeast (down ice) of Big Vein returned 165 and 311 gold grains of which 96% and 83%, respectively were pristine. The large number of pristine grains in these samples indicates a short transport distance suggesting a source other than Big Vein closer to the sample locations. Follow up work in the area immediately up ice of these samples found quartz veins containing pyrite and arsenopyrite. Diamond drilling at this “Pristine” target began in November and assays from the first holes are pending.

Numerous other gold anomalies were uncovered along the Appleton Fault Zone that will be aggressively followed up during 2022 to define additional targets for drilling.

Financings

During the year, the Company raised $24.8 million at an average price of $0.81 in two private placements with Mr. Eric Sprott and New Found Gold. As at December 24,2021, the Company had $30.8 million in cash and a market cap of $124.5 million.

Outlook for 2022

LabGold will continue to explore the entire 12km strike length of the Appleton Fault Zone during 2022 including:

- Continued diamond drilling at Big Vein and the “Pristine” target testing along strike and at depth.

- Initial drilling at Golden Glove following receipt of survey results and drill permit.

- Upgrading of gold anomalies and generation of new targets using the same techniques that produced discoveries during 2020 and 2021.

“2021 was an exciting year for us as the LabGold team built on the exploration success achieved in 2020. The drilling at Big Vein demonstrated the presence of high grade epizonal style gold mineralization at Kingsway and the discovery of visible gold at Golden Glove and pristine gold grains at the “Pristine” target reinforces the prospectivity of the Appleton Fault Zone,” said Roger Moss, President and CEO of Labrador Gold. “Given the number of gold anomalies we have uncovered along the 12km length of the Appleton Fault Zone 2022 is shaping up to be another year of discovery for LabGold. Many assays remain outstanding from 2021 which, together with our continued drilling, will result in a steady flow of news next year. With over $30 million in cash and no debt the Company is well capitalized for its planned exploration programs. I would like to express my thanks to the LabGold exploration team for their commitment to the project and to the Newfoundland government for their continued support and assistance. Finally, to our shareholders, we wouldn’t be here without you, and we look forward to sharing with you what we expect to be another year of discovery in 2022.”

QA/QC

True widths of the reported intersections have yet to be calculated. Assays are uncut. Samples of HQ and NQ split core are securely stored prior to shipping to Eastern Analytical Laboratory in Springdale, Newfoundland for assay. Eastern Analytical is an ISO/IEC17025 accredited laboratory. Samples are routinely analyzed for gold by standard 30g fire assay with ICP (inductively coupled plasma) finish with samples containing visible gold assayed by metallic screen/fire assay. The company submits blanks and certified reference standards at a rate of approximately 5% of the total samples in each batch.

Qualified Person

Roger Moss, PhD., P.Geo., President and CEO of LabGold, a Qualified Person in accordance with Canadian regulatory requirements as set out in NI 43-101, has read and approved the scientific and technical information that forms the basis for the disclosure contained in this release.

The Company gratefully acknowledges the Newfoundland and Labrador Ministry of Natural Resources’ Junior Exploration Assistance (JEA) Program for its financial support for exploration of the Kingsway property.

About Labrador Gold

Labrador Gold is a Canadian based mineral exploration company focused on the acquisition and exploration of prospective gold projects in Eastern Canada.

In early 2020, Labrador Gold acquired the option to earn a 100% interest in the Kingsway project in the Gander area of Newfoundland. The three licenses comprising the Kingsway project cover approximately 12km of the Appleton Fault Zone which is associated with gold occurrences in the region, including those of New Found Gold immediately to the south of Kingsway. Infrastructure in the area is excellent located just 18km from the town of Gander with road access to the project, nearby electricity and abundant local water. LabGold is drilling a projected 50,000 metres targeting high-grade epizonal gold mineralization along the Appleton Fault Zone following encouraging early results. The Company has approximately $32 million in working capital and is well funded to carry out the planned program.

The Hopedale property covers much of the Florence Lake greenstone belts that stretches over 60 km. The belt is typical of greenstone belts around the world but has been underexplored by comparison. Work to date by Labrador Gold show gold anomalies in rocks, soils and lake sediments over a 3-kilometre section of the northern portion of the Florence Lake greenstone belt in the vicinity of the known Thurber Dog gold showing where grab samples assayed up to 7.8g/t gold. In addition, anomalous gold in soil and lake sediment samples occur over approximately 40 km along the southern section of the greenstone belt (see news release dated January 25th 2018 for more details). Labrador Gold now controls approximately 40km strike length of the Florence Lake Greenstone Belt.

The Company has 153,711,033 common shares issued and outstanding and trades on the TSX Venture Exchange under the symbol LAB.

For more information please contact:

Roger Moss, President and CEO Tel: 416-704-8291

Or visit our website at: www.labradorgold.com

Twitter @LabGoldCorp

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This news release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such as actual results of current exploration programs, the general risks associated with the mining industry, the price of gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. Shareholders are cautioned not to put undue reliance on such forward-looking statements.

TRANSCRIPT PENDING

TRANSCRIPT PENDING

Maurice Jackson:

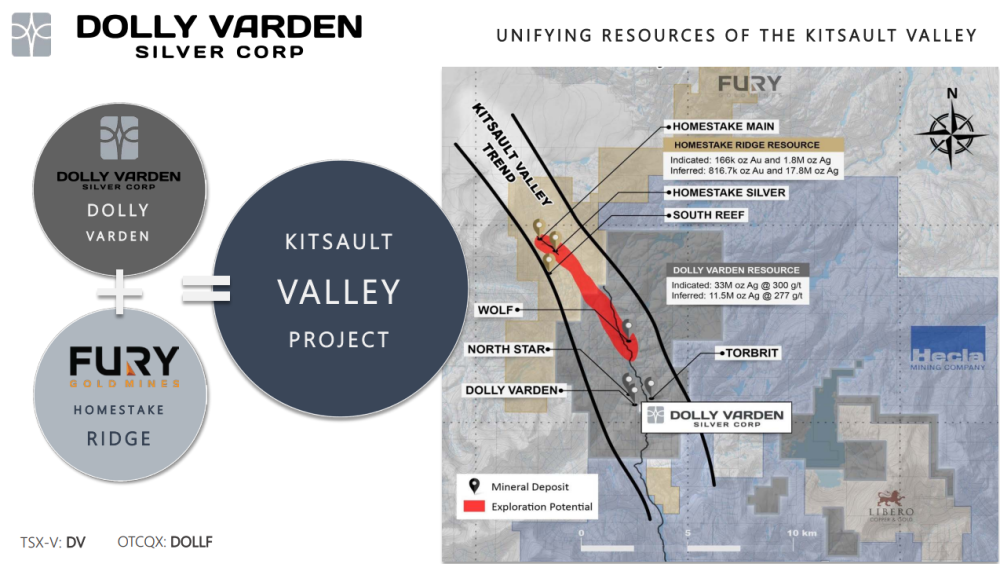

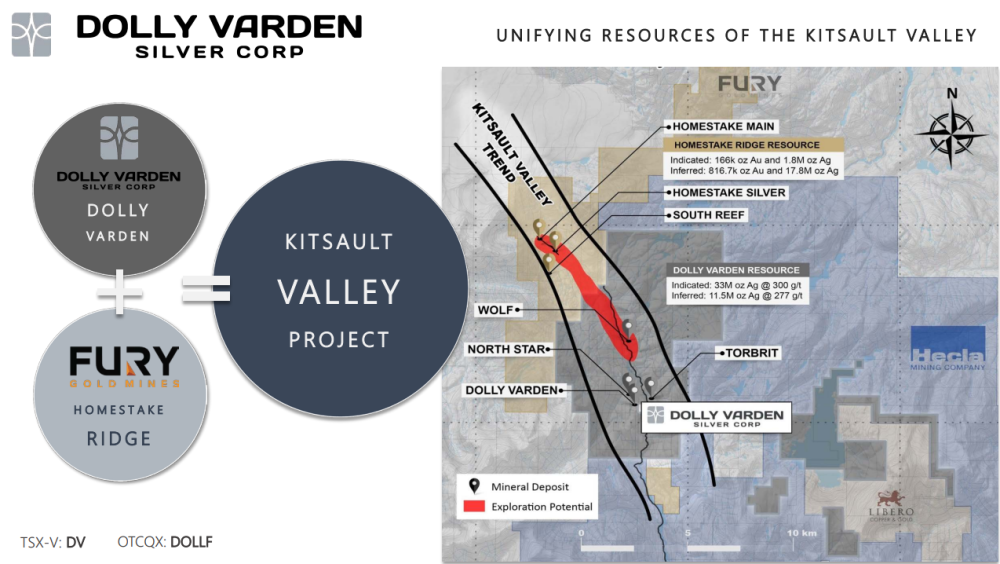

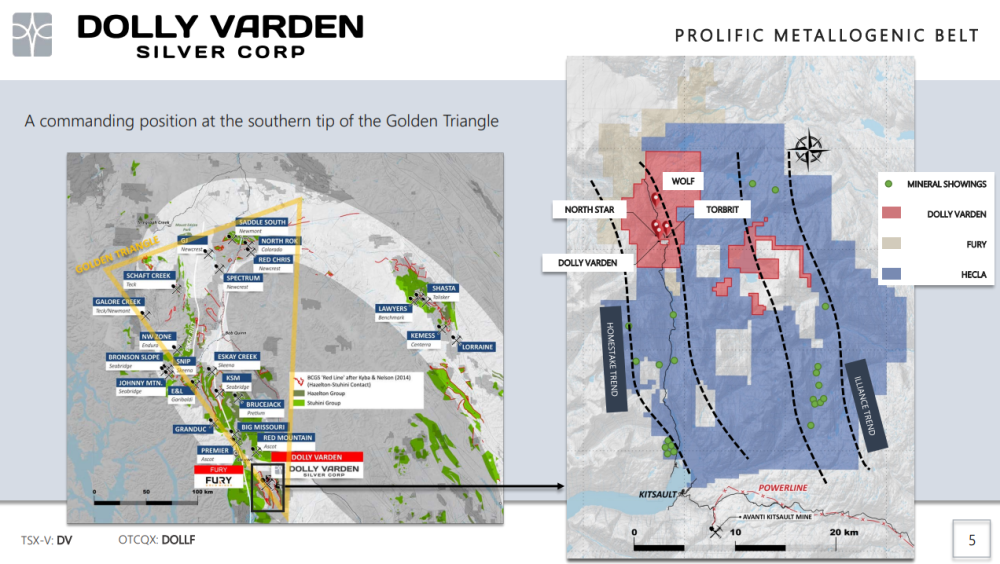

Joining us for a conversation is Shawn Khunkhun, the CEO of Dolly Varden Silver Corp. It’s a great time to be speaking with you as Dolly Varden Silver has just expanded their footprint in the highly prospective Kitsault Valley trend located in the prolific Golden Triangle of British Columbia. Before we begin, Mr. Khunkhun, please introduce us to Dolly Varden Silver and the opportunity the company presents to shareholders.

Shawn Khunkhun:

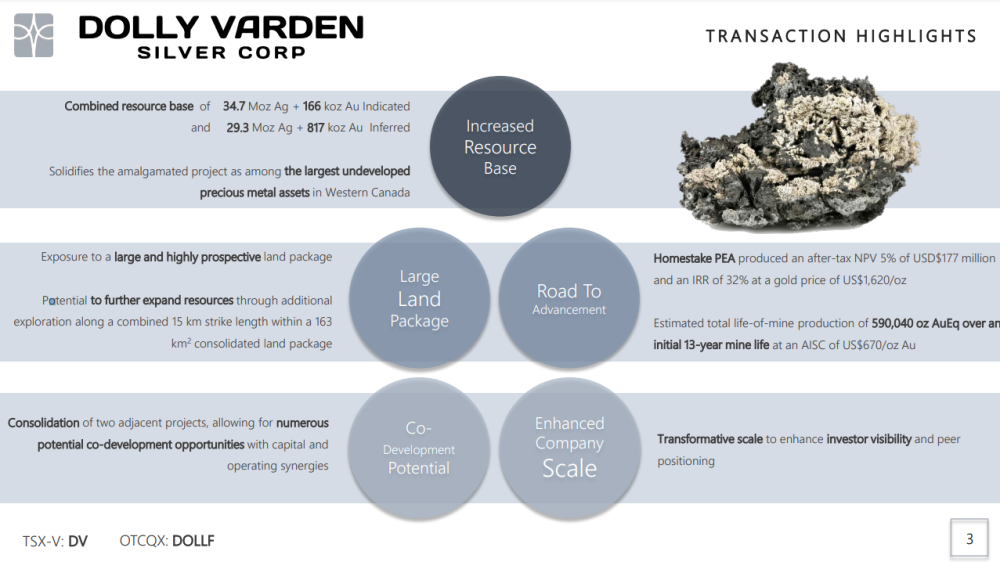

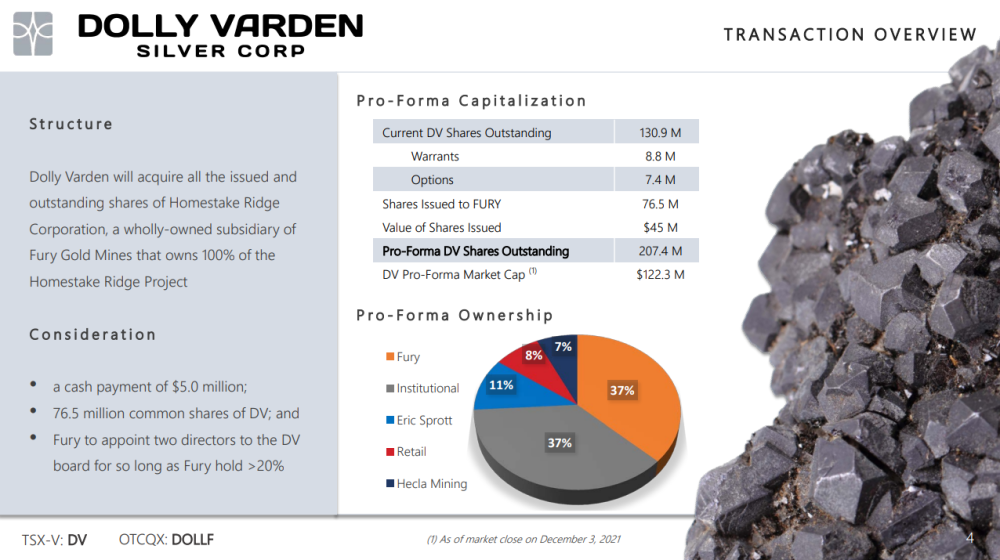

Dolly Varden has just announced today that we are set to acquire Homestake Ridge from Fury. Up until this moment, Dolly Varden was a silver-focused company in the Golden Triangle with a mineral endowment of 44 million ounces of high-grade silver. What today’s announcement proposes, is Dolly Varden is going to have a shareholder vote. We’ve got support from one our larger shareholders, Eric Sprott, who has not only publicly given his support, but he’s actually signed up support and lockup agreements for this transaction.

Shawn Khunkhun:

Shawn Khunkhun:

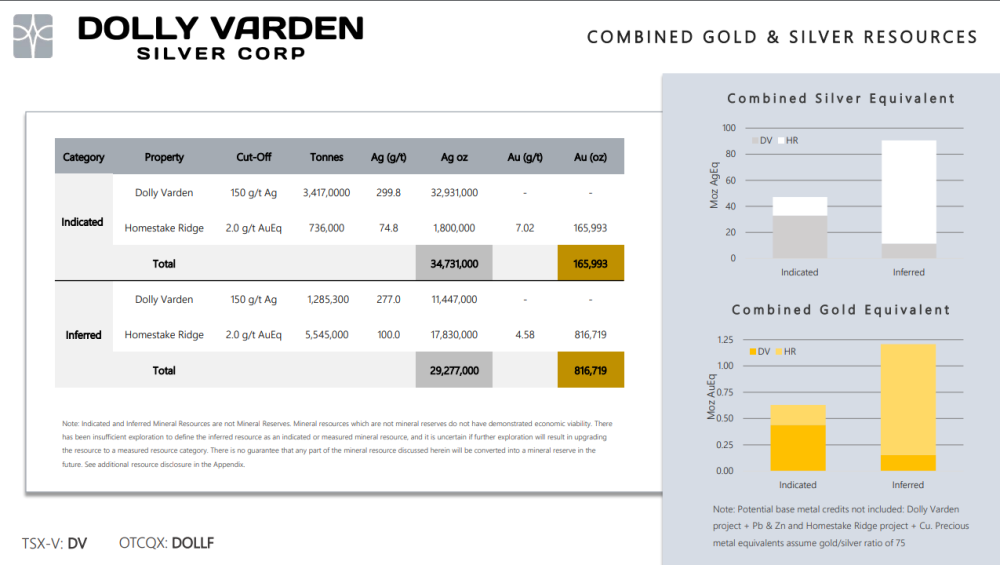

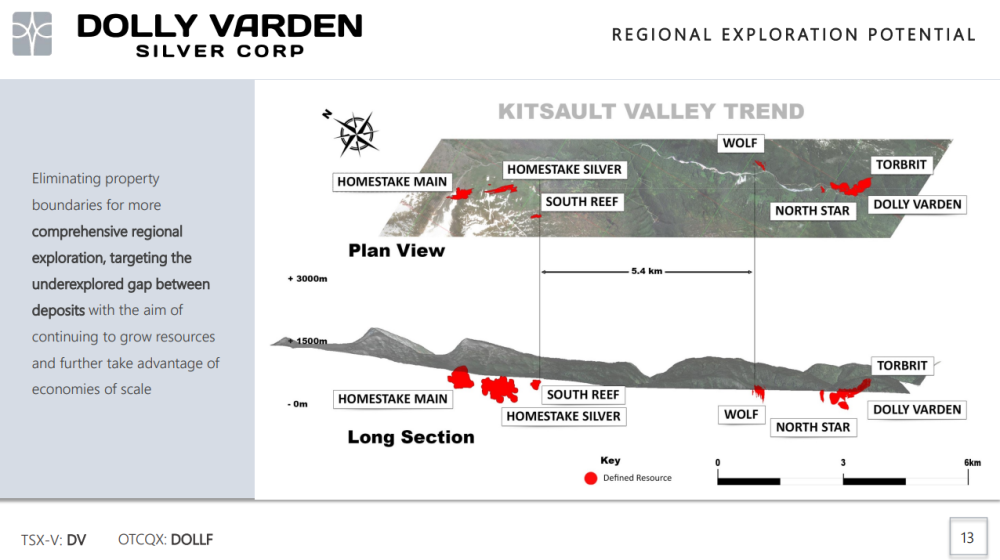

We are looking to unify the Kitsault Valley trend, which is comprised of 7 known deposits along 15 kilometers of Hazleton Rocks in the Golden Triangle, of which 4 of these deposits are on the Dolly Varden side and 3 are on the Homestake Ridge side. The amalgamation would also dramatically increase our mineral inventory taking us from 44 million ounces of high-grade silver to 137 million ounces of high-grade silver equivalent. To look at it through a gold lens, we would be at over 1.8 million ounces of high-grade gold.

Maurice Jackson:

Now before we get into the details of the transaction, please acquaint us with the Homestake Ridge Project, which hosts a resource in the inferred and indicated category of both gold and silver, along with a PEA.

Shawn Khunkhun:

Shawn Khunkhun:

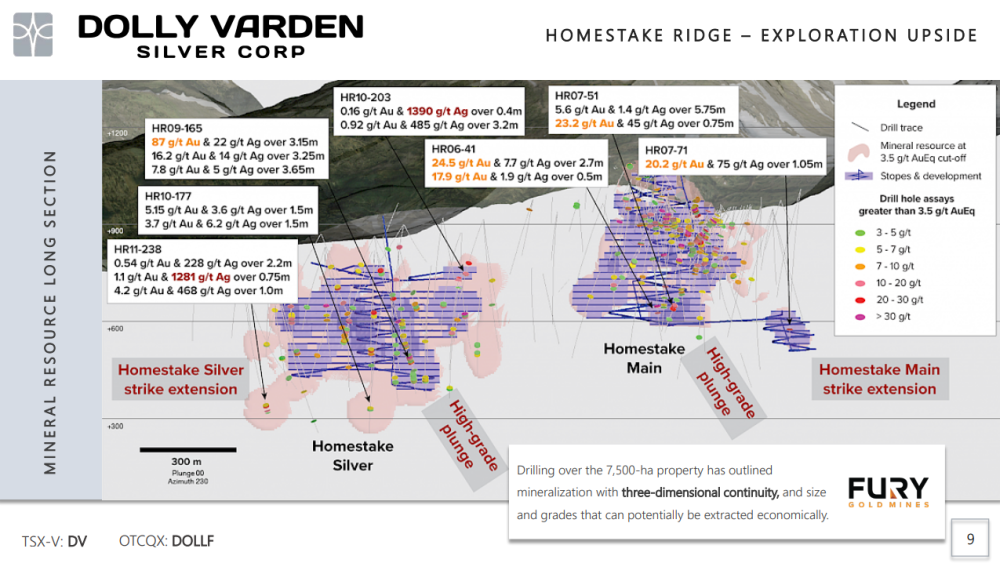

Homestake Ridge, looking at it based on their gold ounces, has about 900,000 ounces of gold, about 18 million ounces silver, or one could look at it through a gold lens of 1.2 million ounces gold equivalent or 93 million ounces silver equivalent. It’s a project that is situated in the Golden Triangle. It’s a project that is open at depth and along strike. And it’s a project that hosts some very, very impressive grades.

And some of the opportunities at Homestake Ridge are there are some high-grade areas that not only do you have 20, 30 gram per ton gold material, but you have it over wide intervals. There are some tremendous opportunities to take some of the inferred resources and move them along into the indicated category. But you’re probably going to have some big surprises there in that just as Dolly Varden saw last year at our Torbrit Mine, which is a silver-rich mine, there is a tremendous opportunity when you vector into the high-grade.

Shawn Khunkhun:

For example, our resource on our side of the property is 300-gram silver. We did some infill drilling last year and we were finding that the resources were understated, as we were finding 450 gram material over big wide intervals. I suspect those same opportunities are going to persist on the Homestake side of the trend.

But the real story here, is that there are 5.5 kilometers in between the two projects that have never been explored. And both companies independently had done some geophysical work that has both concluded in three large geophysical anomalies in between, so I suspect we’ll move from seven deposits potentially to 10 and counting. We feel confident that there’s a huge, huge exploration upside before us.

Shawn Khunkhun:

I came into Dolly Varden in February 2020. This was a company that had $3 million in the bank. It had 44 million ounces in the ground and it had a $20 million market cap. Post this transaction, this is a $125 million company with 140 million ounces of silver equivalent in the ground, boasting an impressive treasury and with an experienced technical team that will continue to unlock discovery opportunities.

Maurice Jackson:

Now I have to ask you, sir, how were you able to acquire the Homestake Ridge? Could you walk us through the details of the transaction?

Shawn Khunkhun:

I think it was just one of these situations where when an M&A deal works for both parties, it’s the best. I really believe in business, how do you create win-win-win opportunities, whether it’s with our first nations partners, the Nisga’a, where we bring employment opportunities and they give us social license to do our exploration work.

Or whether it’s in the case of this M&A transaction where Fury is undervalued based on the incredible mineral endowment they have. And they’ve got 3 great projects in Canada, but the challenge with 3 great projects is how do you advance them all? Therefore, what Fury Gold Mines will be doing is they’re partnering with us. Ivan Bebek, Fury’s chairman, wants to ride the upside in Dolly Varden stock. So we structured a deal where we allowed him to ride the upside by becoming a 37% shareholder.

Shawn Khunkhun:

Now that’s a lot of trust to place in an outside party. They signed escrow agreements so that their stock is held up longer than the traditional hold periods. And there are all sorts of other parts of the investor rights agreement that are quite favorable for Dolly Varden shareholders, but they’re able to ride in the upside. As this project gets re-rated because it’s now got scale and there are the obvious synergies when his shares become re-rated and as we move into the latter stages of a precious metals bull market, these shares are going to be worth a lot more than 60 cents a share. And there was a pretty meaningful cash component to the deal as well. Dolly Varden is parting with $5 million worth of cash that Fury now can then take to advance either Eau Claire or Committee Bay.

Maurice Jackson:

Now we’ve covered the current resources. What can you tell us about further exploration upside potential?

Shawn Khunkhun:

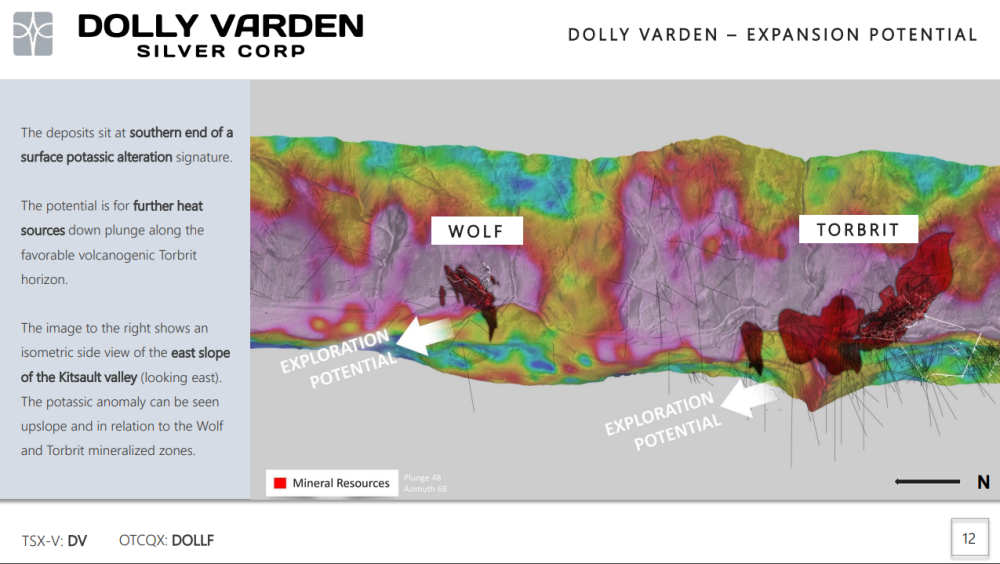

The key is, so we have a northern property, northern deposit called Wolf, which is nearby Torbrit, which is the big granddaddy, 50 million ounce silver discovery on our property. Two kilometers away you have the Wolf and there’s a tremendous two-kilometer opportunity between Torbrit and Wolf.

Now going north from Wolf, you’ve got South Reef, which is Fury’s southern-most project. The big exploration opportunity is in the five and a half kilometers that lie in between South Reef and Wolf. I haven’t had the incentive to drill north. I’m not going to be positioning my drill rigs going on to Fury’s ground, defining mineral inventory on their side of the property. Likewise, Tim Clark and the team at Fury weren’t going to be drilling south. Now that we’ve unified, now that there’s 100% interest in one entity, that is going to be a huge area of focus going forward.

Maurice Jackson:

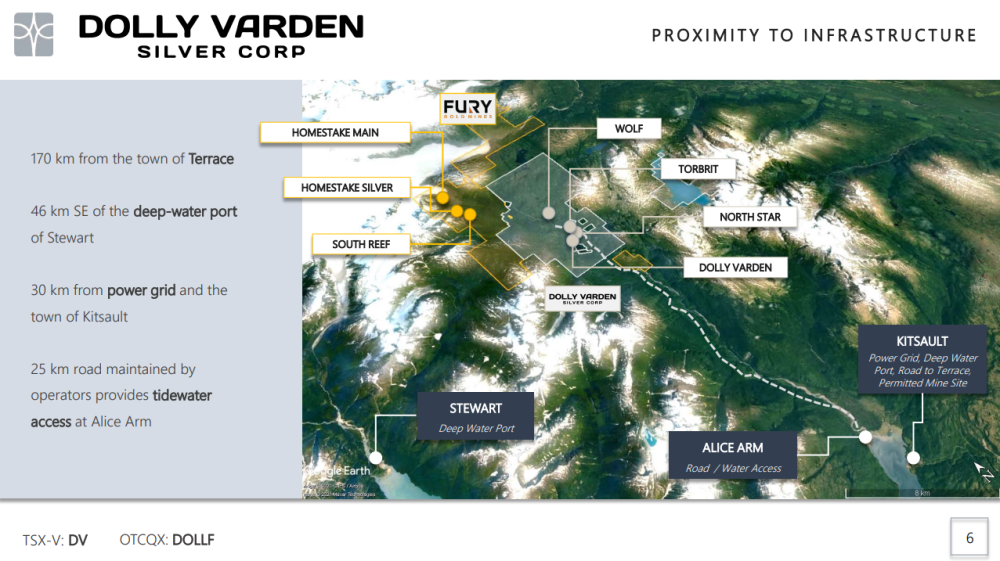

Now to coincide with this upside potential. How will the addition of the Homestake Ridge Project impact infrastructure?

Shawn Khunkhun:

There was a PEA that was produced that looked at one mill to develop the project at Homestake Ridge. The obvious synergy is for the company to release a PEA where you’ve got one mill, two projects. So from CAPEX to exploration to development, there are tremendous synergies by having one entity. And then I think as we are demonstrating that we are the lead consolidator in the area and if we have the hub, the mill will attract other projects that are in the area that don’t have the capital, or maybe not large enough as a standalone operation, they will be coming into the Dolly Varden Mill.

Maurice Jackson:

By consolidating the region Dolly Varden Silver now has a commanding land position at the southern tip of the Golden Triangle. But there’s more to the transaction. You’ve added some icing on the cake by merging the synergies and expertise from Fury Gold Mine’s technical team as well.

Shawn Khunkhun:

Thank you. No, and it’s not just technical, you’re absolutely right. But you know, Tim Clark, his capital markets and his banking contacts, Tim, as a CEO of Fury, he spent a career in the precious metals business. He’s got a Rolodex of contacts. Tim’s rolling up his sleeves, he’s coming on the board. In addition to having Michael Hendrickson, who is a very, very talented exploration geologist joining our board and working together as a group to unlock the true potential with the capital market’s expertise, with the technical expertise, we already had a lot of depth on the technical side, right from the top with Rob McLeod, Rob van Egmond, Jodie Gibson, Ryan Weymark, Andrew Hamilton’s just joined the team. And then we’ve got this new generation of project managers, Amanda Bennett. We’ve got a new gentleman joining our team here imminently, Joaquin.

Shawn Khunkhun:

We’ve just got, this is not going to be set out to consultants. This is in-house where the incentives are aligned with shareholders. And I’ve been through projects in the past where you have strong teams where the incentives are aligned with shareholders and it produces the best results. And we’ve got first-class people from even looking at this transaction, how it was put together from our banking advisors at Haywood to our legal counsel at Stikeman, I’m just floored and honored to work with just a high caliber of people. I’ve got a tremendous partner in our CFO, Ann Fehr. We’ve got a supportive, active board. I’m not going to mention every board member, but I want to thank our chairman, Darren Devine. We’ve just got a tremendous opportunity. It’s a great culture. It’s a culture that wants to grow, that wants to win. And now we have a platform and with size and scale that is going to attract larger investors.

I’ve listened to investors, I’ve gone out into the world. They told me to consolidate. They told me to get bigger. I’ve done it. And we’re just getting started.

Maurice Jackson:

Now before we leave the Golden Triangle, let’s visit the Dolly Varden Silver Project, which conducted a 10,000-meter drill program, which was a 50/50 split between infill and expansion drilling on the high-grade Torbrit Deposit. Any updates for us and when we might expect to see some results?

Shawn Khunkhun:

The labs have been extremely backed up in this part of the world. I’m anticipating results imminently and will continue to report results going into Q1. We allocated about 35% of our meters to exploration and we allocated about 65% of those meters in and around known resources. I would envision putting out two result-oriented press releases, one on exploration drilling, and one on resource expansion and extension drilling. Last year, we were extremely successful. A year hasn’t gone by where Dolly Varden hasn’t had dual success. I anticipate that to be the case, but what we’ve done here with this transaction is a material change to our mineral inventory definitively. And so I look forward to following up on exciting discoveries and drilling them out. But this is a real shot in the arm in terms of going from 44 million ounces to 140 million ounces. It’s quite a feat.

Maurice Jackson:

It certainly is. All right, switching gears, sir. Let’s look at some numbers. Please provide us with the capital structure for Dolly Varden Silver.

Shawn Khunkhun:

We currently have 130 million shares. Assuming our shareholders vote for this transaction, we’re going to issue 76 million shares to Fury. Again, they’re an insider. They’re locking up that stock. They’re riding this precious metals market with us, and they’re going to help us extract maximum value from this opportunity. If the transaction is supported, Dolly Varden Silver Corp will go to 207 million shares. But again, that’s 37% held by Fury. That’s 37% held by precious metal institutional investors, some of them are 9.9% shareholders, that’s 11% Eric Sprott, 8% retail. In addition, Hecla, which is a 10% shareholder has an opportunity to do a top-up. So they have a participation right. If Hecla exercises their participation right, they will come in for 9 million shares and they will resume having a 10.5 % percent ownership. Which coincidentally nets out the cash component of the transaction.

Maurice:

Now, before we close Mr. Khunkhun, what would you like to say to shareholders?

Shawn Khunkhun:

I came in in year one in 2020. We had a great market and we raised $27 million in a non-dilutive way. We put money in the ground. We started growing the deposit and saw an opportunity to transform the company. There were opportunities to transform the company outside of our region, we chose to expand our footprint next door, which now gives us a commanding position at the southern tip of the Golden Triangle. We’re a prominent player in the area now.

And we shouldn’t ignore the catalysts’ In the region such as Pretium being subject to a takeover bid from Newmont. We saw the big takeout last year with GT Gold. This is an area that the majors want to be and we’ve positioned our shareholders with a commanding position at the southern tip of the Golden Triangle.

Shawn Khunkhun:

But beyond that, this is what I want to leave the readers with. There are a lot of gold projects that have ounces in the ground in North America. There are a few projects that have ounces in the ground in North America that are silver. There are only 14 companies that have both gold and silver of this size. None of them have it at this grade. We are number one. We are number one for size meets grade in precious metals.

Shawn Khunkhun:

You missed nothing Maurice. You got it all covered.

Maurice:

Mr. Khunkhun, for someone that wants to learn more about Dolly Varden Silver, please share the contact details.

Shawn Khunkhun:

Please visit our website, www.dollyvardensilver.com. You can follow us on Twitter @silvervarden, or you can call us toll-free at +1 800-321-8564.

Maurice:

Mr. Khunkhun, it’s been a pleasure speaking with you. Wishing you and Dolly Varden Silver the absolute best, sir.

And as a reminder, I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide several options to expand your precious metals portfolio from physical delivery directly to your home, off-shore depositories secured by Brinks, and precious metal IRAs. Call me directly at 855-505-1900 or you may email, maurice@milesfranklin.com. And finally, please subscribe to provenandprobable.com, where we provide mining insights and bullion sales.