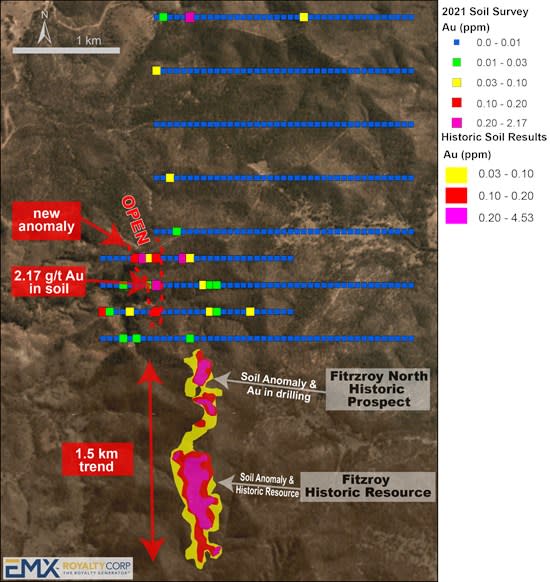

Figure 1

Big Vein Plan Map

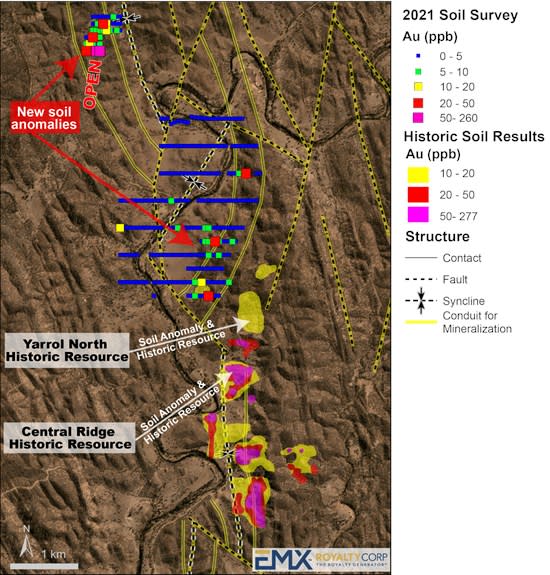

Figure 2

Long section of the HTC Zone

TORONTO, Jan. 12, 2022 (GLOBE NEWSWIRE) — Labrador Gold Corp. (TSX.V:LAB | OTCQX:NKOSF | FNR: 2N6) (“LabGold” or the “Company”) is pleased to announce further high-grade intercepts of near surface gold mineralization along the Appleton Fault Zone at its 100% controlled Kingsway project near Gander, Newfoundland. These holes were drilled as part of the Company’s ongoing 50,000 metre drill program. The Kingsway project is located in the highly prospective central Newfoundland gold belt.

High grade gold continues to be found at Big Vein including intercepts of 50.52 g/t Au over 2m in hole K-21-76 from the HTC Footwall Zone. A deeper (200m to 201m) intercept of 15.86 g/t Au over 1 m from the same hole appears to be from a new zone. Approximately 135 metres along strike to the southwest, Hole K-21-74 intersected 2.86 g/t Au over 25m including 16.21g/t Au over 1m and 5.7g/t over 7m in a possible new zone in the immediate footwall to the Big Vein Zone. Testing further to the Southwest along Big Vein indicates consistent increased width of mineralization in the Big Vein zone as shown here by Hole K-21-75, that intersected 3.33 g/t Au over 4m within a larger intercept of 12m grading 1.62 g/t Au from 28m.

“Drilling at Big Vein continues to turn up high grade gold mineralization both down plunge and along strike. Two potential new zones are indicated by these results and grade 15.86 g/t Au over 1m in Hole K-21-76 and 16.21 g/t Au over 1m within a larger 29m interval in hole K-21-74 located 135m along strike to the southwest,” said Roger Moss, President and CEO of the Company. “We are very encouraged by the thickening of the Big Vein Zone to the southwest and look forward to results from many more holes drilled in this area. Drilling continues along strike to the southwest and down plunge at Big Vein. Drilling is also ongoing at the Pristine Target from which we are still awaiting the first assays.”

| Hole ID | From (m) | To (m) | Width (m) | Au (g/t) | Zone |

| K-21-76 | 24 | 25 | 1 | 1.1 | Big Vein |

| 132 | 143 | 11 | 1.44 | ||

| 175 | 177 | 2 | 50.52 | HTC Footwall | |

| 183 | 192 | 9 | 1.28 | ||

| 199 | 201 | 2 | 8.91 | ||

| including | 200 | 201 | 1 | 15.86 | New Zone |

| K-21-75 | 13 | 14 | 1 | 3.15 | Big Vein |

| 28 | 40 | 12 | 1.62 | ||

| including | 28 | 32 | 4 | 3.33 | |

| K-21-74 | 68 | 69 | 1 | 8.98 | Big Vein |

| 202 | 227 | 25 | 2.86 | New Zone | |

| including | 202 | 203 | 1 | 16.21 | |

| and | 207 | 211 | 4 | 2.63 | |

| and | 214 | 221 | 7 | 5.7 | |

| K-21-73 | 76 | 88 | 12 | 1.09 | Big Vein |

| K-21-68 | 67 | 68 | 1 | 1.72 | Big Vein |

| 211 | 215 | 4 | 3.4 | HTC | |

| K-21-66 | 7 | 9 | 2 | 1.16 | Big Vein |

| 14 | 16 | 2 | 1.45 | ||

| 18 | 19 | 1 | 1.3 | ||

| 38 | 48 | 10 | 1.65 | ||

| 81 | 82 | 1 | 1.5 | ||

| 210 | 211 | 1 | 4.43 | HTC |

Table 1. Summary of Assay Results

All intersections are downhole length as there is insufficient Information to calculate true width.

Photos accompanying this announcement are available at:

| Hole ID | Easting | Northing | Elevation | Azimuth | Inclination | Depth (m) | |

| K-21-76 | 661574.3 | 5435213.9 | 40.3 | 102 | 64 | 225.66 | |

| K-21-75 | 661435.5 | 5435096.1 | 40.0 | 145 | 45 | 185 | |

| K-21-74 | 661442.4 | 5435186.6 | 50.5 | 130 | 50 | 329 | |

| K-21-73 | 661436.2 | 5435096.7 | 39.9 | 165 | 72 | 272 | |

| K-21-68 | 661442.0 | 5435186.7 | 50.5 | 130 | 55 | 377 | |

| K-21-66 | 661435.5 | 5435096.1 | 40.0 | 165 | 55 | 305 |

Table 2. Drill hole collar details

Big Vein target

The Big Vein target is an auriferous quartz vein exposed at surface that has been traced over 400 metres along the Appleton Fault Zone. It lies within a larger northeast-southwest trending “quartz vein corridor” that stretches for over 7.5 kilometres as currently outlined, with potential for expansion along the 12km strike length of the Appleton Fault Zone in both directions. Gold mineralization observed at Big Vein includes visible gold in quartz veins, assays of samples from which range from 1.87g/t to 1,065g/t gold. The visible gold is typically hosted in annealed and vuggy gray quartz, that is locally stylolitic with vugs often containing euhedral quartz infilling features characteristic of epizonal gold deposits. Drilling has produced high grade intercepts as well as wide areas of gold mineralization associated with significant quartz veining and sulphide mineralization including arsenopyrite, pyrite and possible boulangerite noted along vein margins and as strong disseminations in the surrounding wall rocks.

The ongoing 50,000 metre drill program has now tested Big Vein over approximately 250 metres of strike length and to vertical depths of 200 metres. A total of 26,767 metres of the 50,000 metres have been completed in 116 holes primarily at Big Vein. Drilling at the new “Pristine” target began in November and nine holes totaling 2,229 metres have been drilled to date. Assays have been received for 59% of samples submitted to the laboratory or approximately 15,800 metres of core.

QA/QC

True widths of the reported intersections have yet to be calculated. Assays are uncut. Samples of HQ and NQ split core are securely stored prior to shipping to Eastern Analytical Laboratory in Springdale, Newfoundland for assay. Eastern Analytical is an ISO/IEC17025 accredited laboratory. Samples are routinely analyzed for gold by standard 30g fire assay with ICP (inductively coupled plasma) finish with samples containing visible gold assayed by metallic screen/fire assay. The company submits blanks and certified reference standards at a rate of approximately 5% of the total samples in each batch.

Qualified Person

Roger Moss, PhD., P.Geo., President and CEO of LabGold, a Qualified Person in accordance with Canadian regulatory requirements as set out in NI 43-101, has read and approved the scientific and technical information that forms the basis for the disclosure contained in this release.

The Company gratefully acknowledges the Newfoundland and Labrador Ministry of Natural Resources’ Junior Exploration Assistance (JEA) Program for its financial support for exploration of the Kingsway property.

About Labrador Gold

Labrador Gold is a Canadian based mineral exploration company focused on the acquisition and exploration of prospective gold projects in Eastern Canada.

In early 2020, Labrador Gold acquired the option to earn a 100% interest in the Kingsway project in the Gander area of Newfoundland. The three licenses comprising the Kingsway project cover approximately 12km of the Appleton Fault Zone which is associated with gold occurrences in the region, including those of New Found Gold immediately to the south of Kingsway. Infrastructure in the area is excellent located just 18km from the town of Gander with road access to the project, nearby electricity and abundant local water. LabGold is drilling a projected 50,000 metres targeting high-grade epizonal gold mineralization along the Appleton Fault Zone following encouraging early results. The Company has approximately $30 million in working capital and is well funded to carry out the planned program.

The Hopedale property covers much of the Florence Lake greenstone belts that stretches over 60 km. The belt is typical of greenstone belts around the world but has been underexplored by comparison. Work to date by Labrador Gold show gold anomalies in rocks, soils and lake sediments over a 3 kilometre section of the northern portion of the Florence Lake greenstone belt in the vicinity of the known Thurber Dog gold showing where grab samples assayed up to 7.8g/t gold. In addition, anomalous gold in soil and lake sediment samples occur over approximately 40 km along the southern section of the greenstone belt (see news release dated January 25th 2018 for more details). Labrador Gold now controls approximately 40km strike length of the Florence Lake Greenstone Belt.

The Company has 153,711,033 common shares issued and outstanding and trades on the TSX Venture Exchange under the symbol LAB.

For more information please contact:

Roger Moss, President and CEO Tel: 416-704-8291

Or visit our website at: www.labradorgold.com

Twitter @LabGoldCorp

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This news release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such as actual results of current exploration programs, the general risks associated with the mining industry, the price of gold and other metals, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. Shareholders are cautioned not to put undue reliance on such forward-looking statements.